- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Universal Vs Variable Universal Life Insurance In Canada: Which Policy Fits You Best

By Harpreet Puri

CEO & Founder

- 10 min read

- November 18th, 2025

SUMMARY

Universal Life Insurance Canada and Variable Universal Life Insurance Policy are compared to highlight benefits, flexibility, cash value growth, and lifelong coverage. The content explains how Universal Life Insurance works with guaranteed minimums, while Variable Universal Life offers investment options and higher risk. Key differences, premium payments, tax-free death benefit, and estate planning advantages are outlined to help assess which Permanent Life Insurance Policy fits financial goals.

Introduction

Money decisions… they creep up on families. Not the daily ones about coffee runs or skipping takeout. The real weight comes later — when someone isn’t here anymore. The mortgage. Tuition bills. Credit cards. Those obligations don’t disappear. They land on the people left behind.

That’s why life insurance matters. It isn’t just another product; it’s a safeguard. The difference between a family scrambling and a family staying secure.

In Canada, there isn’t just one choice on the shelf. Term life insurance works for short-term needs. Whole life insurance appeals to those who want fixed costs and predictable growth. But when clients sit with us, the conversation often shifts toward Universal Life Insurance Canada and the Variable Universal Life Insurance Policy.

Both are permanent. Both carry a death benefit. Both give you a chance to build cash value. But they don’t operate the same way, and choosing which one to fund is where the real decision happens.

Universal Life Insurance

A Universal Life Policy is designed to adjust with you, not against you. Premium payments are flexible. Pay more when income allows, reduce them if life gets tight.

Part of those payments goes toward the cost of insurance. The rest builds inside the cash value component.

Here’s what that means in practice:

- The insurance company credits interest. Rates can shift with markets, but there’s almost always a guaranteed minimum. It cushions the policy from extreme swings.

- That cash value portion isn’t locked away. You can use it. Withdraw. Take a policy loan. It’s there for financial hardship or future expenses.

- And the death benefit? It stays intact, tax-free, supporting family members with funeral costs, estate taxes, or outstanding debt.

It’s Permanent Life Insurance, but more adaptable than whole life. We often see it as a middle ground — steady enough to provide security, yet flexible enough to work in real-world financial planning.

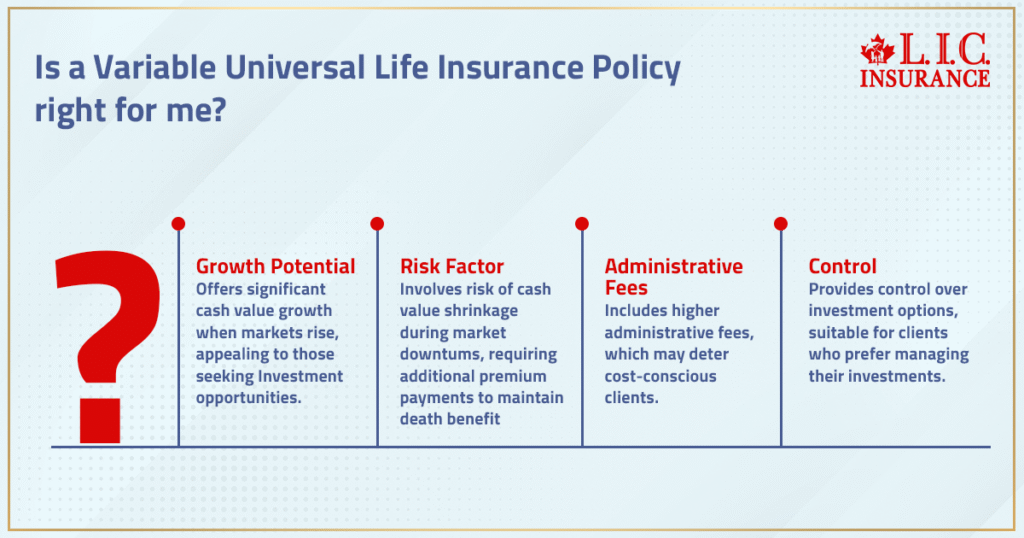

Variable Universal Life Insurance

A Variable Universal Life Insurance Policy takes the same foundation but adds an investment component.

Your cash value isn’t just credited interest. It’s allocated to subaccounts — mutual funds, equities, and bonds. You choose from the investment options your insurance company provides.

When markets rise, your cash value growth can be significant. When markets fall, your accumulated cash value may shrink. And if it shrinks too far, the death benefit could be at risk unless additional premium payments are made.

It’s a higher-risk design, and yes, there are more administrative fees. But for clients who want growth potential and control, it can be the right fit.

Death Benefit: Why It Matters

All the charts and numbers eventually circle back to one question: what does your family receive when you’re gone?

That’s the death benefit. The payment provides financial protection when your income disappears. The cheque can cover outstanding debt, credit card balances, even basic groceries and household costs.

Both universal and Variable Universal Life provide a death benefit payout. Both are designed to deliver that payout tax-free. But with variable policies, markets can influence how stable that protection feels.

Cash Value: The Secondary Strength

The cash value is often the overlooked part of Permanent Life Insurance Policies. It builds slowly with a universal life policy, more aggressively — but less predictably — with Variable Universal Life.

Either way, it’s there. It can be borrowed against for personal loans, car loans, or education costs. It can provide financial support when other resources aren’t enough. Just remember: using it reduces the total death benefit if it’s not repaid.

Indexed Universal Life Insurance

There’s also a hybrid — Indexed Universal Life Insurance.

Here, the cash value is linked to a market index like the S&P 500. Growth is tied to performance, but there’s still a guaranteed minimum. For Canadians who want some market exposure without taking on full investment risk, it can be a practical middle ground.

How Much Life Insurance Do You Need?

There isn’t one answer.

For some families, enough coverage means paying off the mortgage and leaving room for estate taxes. For others, it’s about funeral costs, smaller debts, or providing a cushion for children’s education.

We don’t hand out one-size-fits-all figures. We run projections. We factor in personal loans, credit card balances, and future expenses. Then we help decide whether an affordable life insurance policy, like term insurance, works, or if Permanent Life Insurance with lifelong coverage makes more sense.

Comparing Life Insurance Types

To keep the options clear:

- Term Life Insurance Policy – Lower premiums, temporary coverage, no cash surrender value.

- Whole Life Insurance – Fixed premiums, guaranteed cash value accumulation, lifelong coverage, possible dividends.

- Universal Life Policy – Flexible premiums, adjustable death benefit, interest-based cash value growth.

- Variable Universal Life Insurance – Flexible premiums, investment options, higher risk, higher reward.

Every policy type supports a different set of financial goals.

The Role Of The Insurance Company

The insurance company behind your policy matters as much as the policy itself.

Different providers apply different rules on cash surrender value, surrender charges, policy loans, and administrative fees. Choosing poorly can mean higher premiums compared to other options, or not enough cash value to keep lifelong protection in place.

That’s why we compare policies across multiple insurance companies. We deliver a Universal Life Insurance quote online right alongside a variable illustration, so you see the differences clearly.

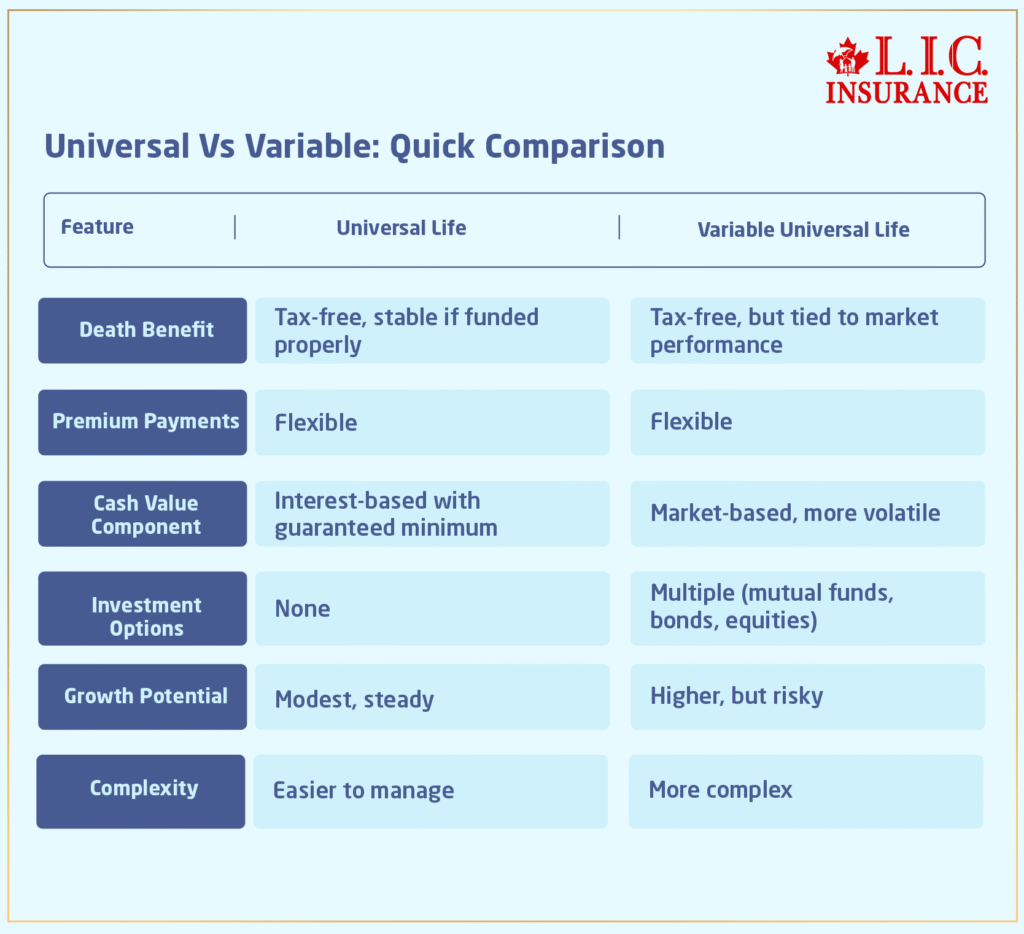

Universal Vs Variable: Quick Comparison

Choosing The Right Policy

If you value predictability — modest cash value, guaranteed minimums, fewer surprises — Universal Life Insurance Canada is the likely fit.

If you value control — the ability to select investments, pursue higher growth, and accept higher risk — then a Variable Universal Life Insurance Policy may suit you better.

And if neither seems right? Whole life may provide security. Term insurance may handle a specific period. That’s why conversations with experienced insurance advisors matter more than sales brochures.

Canadian LIC’s Perspective

We’ve seen both sides. Clients who were unsettled when their policy’s cash value declined in weak markets. Others benefited when their Variable Universal Life policy grew significantly. The difference? They understood what they were signing up for.

We walk clients through how Universal Life Insurance works. We compare Universal Life Insurance quote online options, explain the benefits of Universal Life Insurance, and highlight the risks in variable policies.

Because in the end, this isn’t just about buying insurance. It’s about financial security for your family, managing future expenses, and building a financial future that lasts.

More on Universal Life Insurance

FAQs

Here’s what we typically tell clients: Whole life insurance is inflexible. Fixed premiums. Guaranteed growth. No surprises. Universal life policy is felt differently — it flexes throughout your life. Payments are not set; the cash value portion changes with it, and yet you still have a death benefit that covers you for your entire life.

It can, but it’s going to be bumpy. The investment aspect enables your cash value to pursue greater growth. Mutual Funds, stocks or other features offered by the insurance company. And if the market does well, it’s fine. If it doesn’t? The risk is yours. Some people love the control. Others find it stressful.

Yes, that’s the promise — but it’s not merely a payout. It’s the death benefit that keeps family members afloat when income has ceased. It’s tax-free, so money goes directly to cover funeral expenses, unpaid debts, or estate taxes. We’ve witnessed families depend on this support when everything else felt uncertain.

There isn’t a magic number. Some homeowners are only interested in making mortgage payments. Others require sufficient life insurance to tackle car loans, credit card balances or future bills for something like kids’ tuition. We do real numbers with clients — not just “how much life insurance” in theory (plugging a figure out of thin air), but also what makes sense to their financial future.

Cash surrender value is what you would get if you cancelled the policy. It’s not the equivalent of cash value growth over time, but it is there if you need to access cash. Just remember this: Go too soon and you could end up paying surrender charges. That’s why we say to people: Universal policies are most effective when you give them a chance.

Sure — we witness it every day. Universal Life Insurance Canada Universal Life Insurance offers coverage for life and a tax-free payout at death. Families frequently use it to pay for estate taxes so their children don’t have to sell property or tap savings. It’s one way to leave financial security rather than just not coming right out of a crisis.

Variable Universal Life Insurance puts you right in the stock market. Subaccounts rise and decline, and so does the cash value in your policy. Indexed Universal Life Insurance is distinct — it’s connected to a market index but with a guaranteed minimum. One is high control, high risk.’ The other rebalances growth with a safety net.

Yes — and clients do. Some use the policy loan feature to borrow money for personal loans or car loans. Some take the withdrawals to finance a cash crunch or even large future purchases. Just remember: Removing dollars brings down the overall death benefit received by your family. That’s the tradeoff.

Premium payments are the fuel. They pay insurance charges and feed the cash value component. Skip too many times and the policy starts draining itself, potentially jeopardizing lifelong coverage. We always have to remind people: universal life is flexible, but in ‘flexible’ it doesn’t mean optional.

Don’t just ask about the shiny features. Ask about administrative fees. Inquire about how the insurance company treats policy loans, cash surrender value, or a lapse in making premium payments if you have financial trouble and can’t pay premiums for several months. Clients regret not having asked those questions in the beginning, we’ve seen. Clarity now avoids problems later.

Key Takeaways

- Universal Life Insurance Canada gives stability — flexible premium payments, steady cash value growth with a guaranteed minimum, and a tax-free death benefit your family can count on.

- Variable Universal Life Insurance Policy puts growth in your hands — investment options, higher upside, but also higher risk if markets fall.

- Both are Permanent Life Insurance Policies: they last your entire life and build a cash value portion you can tap into for future expenses, loans, or emergencies.

- Universal life = predictable. Variable Universal Life = more control, but more volatility. Neither is “better,” it depends on your financial goals and comfort with risk.

- For estate planning, covering future expenses, or leaving a stable death benefit, Permanent Life Insurance Policies (universal, variable, or even indexed Universal Life Insurance) can provide financial security that term life insurance alone cannot.

- The right choice comes down to how much life insurance you need, your appetite for investment growth, and whether lifelong coverage or temporary coverage fits your family’s financial future.

Sources and Further Reading

- Canadian Life & Health Insurance Association — CLHIA Factbook

Detailed statistics on life insurance penetration, claims paid, and market trends in Canada. clhia.ca+2clhia.ca+2 - Government of Canada – Life Insurance (Financial Consumer Agency)

Official overview: how universal life, whole life, term life insurance work in Canada; rights & rules. Canada.ca - Office of the Superintendent of Financial Institutions — Life Insurance Regulatory Framework

Regulatory rules, capital adequacy, and risk-based oversight for life insurers in Canada. osfi-bsif.gc.ca+1 - NerdWallet — What Is Universal Life Insurance?

A consumer-friendly breakdown of universal life vs other types, pros and cons, and cash value behaviour. NerdWallet - Equitable Life of Canada — What Is Universal Life Insurance?

A Canadian insurer’s explanation of how the policy works, its flexibility, and its savings feature. equitable.ca - Assuris – Protection For Policyholders

Info on what happens if a life insurer becomes insolvent, and how your policy is protected in Canada. Wikipedia - “A Guide To Life Insurance” — CLHIA Consumer Brochure

A neutral, educative guide for consumers: types of life insurance, how to choose, and legal promises. clhia.ca

Feedback Questionnaire:

IN THIS ARTICLE

- Universal Vs Variable Universal Life Insurance In Canada: Which Policy Fits You Best?

- Universal Life Insurance

- Variable Universal Life Insurance

- Death Benefit: Why It Matters

- Cash Value: The Secondary Strength

- Indexed Universal Life Insurance

- How Much Life Insurance Do You Need?

- Comparing Life Insurance Types

- The Role Of The Insurance Company

- Universal Vs Variable: Quick Comparison

- Choosing The Right Policy

- Canadian LIC’s Perspective

Sign-in to CanadianLIC

Verify OTP