- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Universal Life Insurance Plan Vs. Indexed Universal Life: Which One Fits Your Financial Goals

By Harpreet Puri

CEO & Founder

- 10 min read

- September 12th, 2025

SUMMARY

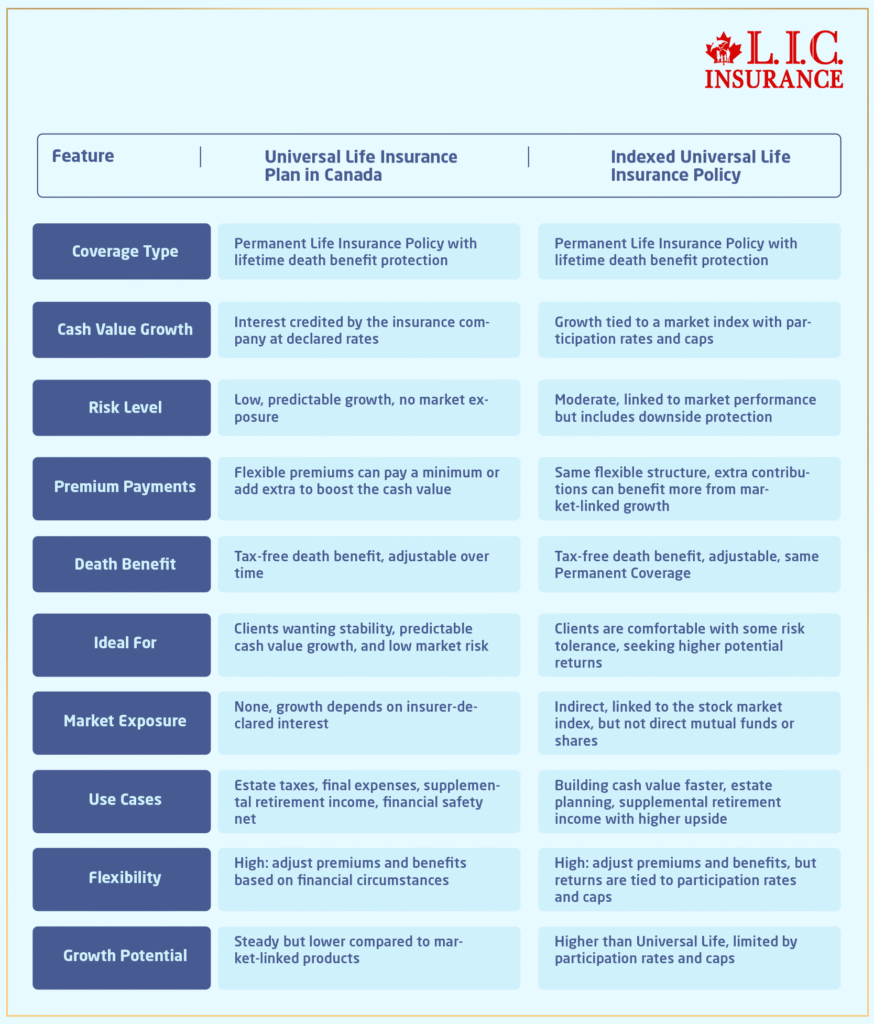

Universal Life Insurance Plan in Canada and Indexed Universal Life Insurance Policy both offer Permanent Coverage, flexible premium payments, and cash value growth. Universal Life Insurance benefits include steady accumulation with insurer-declared rates, while Indexed Universal Life links growth to a market index with downside protection. The comparison highlights how each policy fits different financial goals and levels of risk tolerance.

Introduction

We will be upfront. Most families we meet don’t wake up thinking about Universal Life Insurance benefits. They come in asking about term Life Insurance because it’s cheap and easy. But once we start talking about financial goals, about building something for the future, about protecting children and covering estate taxes, the conversation shifts. That’s when Universal Life and Indexed Universal Life Policies enter the picture.

Both are Permanent Life Insurance. Both last your entire life if you keep up with premium payments. Both give you a death benefit. But how they grow your cash value component, and how much risk you’re willing to accept, that’s where the decision gets personal.

Life Insurance Policy: Getting The Basics Right

Let’s slow down. A Life Insurance Policy is either temporary or permanent. The Term is temporary. Universal, indexed universal, whole life, variable Universal Life—those are Permanent Life Insurance options. Permanent means coverage stays in force until you pass away, not until a set year.

Permanent Life Insurance Policies do more than just pay out a tax-free death benefit. They also build a cash value. That cash value account is what sets these Life Insurance types apart from plain Term Life Insurance. Some clients use it as supplemental retirement income. Others let it sit to cover estate taxes. A few draw from it during emergencies.

The way that cash value grows is what separates a Universal Life Insurance Plan in Canada from an Indexed Universal Life Insurance Policy.

Universal Life Insurance Coverage Benefits In Simple Words

Universal Life Insurance is flexible. That’s the word we use most often. Flexibility in premium payments, flexibility in how your death benefit is structured, and flexibility in how you use your policy’s cash.

Here’s how it works:

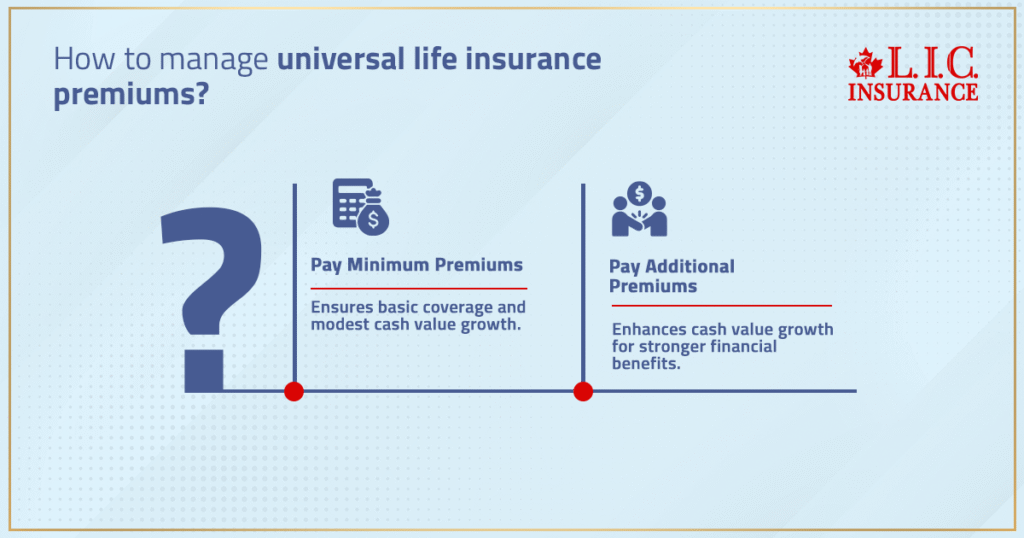

- You pay premiums on a monthly or annual basis.

- Part of that money goes toward insurance costs, and the rest builds cash value.

- You can add more than the minimum if you want your cash value growth to be stronger.

- The insurance company declares the interest rate, so you know where you stand.

People like this because it’s predictable. You are not watching stock market index numbers every night. You’re not worried about market performance cutting into your savings. You’re building steady cash value growth on a tax-deferred basis.

And of course, the permanent death benefit protection is always there. Your beneficiaries receive it tax-free. It handles final expenses, it can cover estate taxes, and it makes sure your family isn’t stuck with debt.

Some clients see the cash value as a backup fund. Others use it as part of a broader financial strategy for retirement. That’s the beauty of Universal Life Policies—you have room to adapt.

Indexed Universal Life Insurance: A Different Angle

Indexed Universal Life, often shortened to IUL, changes the way your cash value grows. Instead of being tied to rates declared by the insurance company, the cash value component is linked to a market index. Not direct market exposure—you’re not buying mutual funds. The insurance company simply credits your growth based on how the market index performs.

Think S&P 500 or another index. If the market index goes up, your cash value growth is stronger. If the index drops, you don’t lose money. That’s called downside protection. But growth is capped, so you never get the full upside either.

Here’s what clients usually care about:

- You still have Permanent Coverage and tax-free death benefit protection.

- Premium payments remain flexible.

- Growth potential is higher than that of traditional Universal Life.

- Market risk is limited by downside protection.

Indexed Universal Life Insurance is for someone comfortable with a bit more risk tolerance. They want cash value accumulation that outpaces what an insurance company credits on traditional Universal Life. But they don’t want to risk losing everything in a bad year, like with variable Universal Life Insurance.

Death Benefit: The Core That Never Changes

No matter what you choose—Universal Life or Indexed Universal Life—the death benefit is the non-negotiable piece. It’s Permanent Coverage. It’s a financial safety net. It pays out on a tax-free basis.

We have seen families use it to cover final expenses. We have seen it settle estate taxes. Sometimes it simply creates a legacy, money for the next generation. This is the part that makes Permanent Life Insurance coverage so valuable. Term Life Insurance runs out—permanent stays.

We remind clients that while we spend time analyzing cash value growth, the death benefit is why you buy Life Insurance in the first place. Everything else is additional.

How A Life Insurance Company Shapes These Policies

Every insurance company designs their policies a little differently. They set participation rates for Indexed Universal Life. They decide on caps for market performance. They declare interest rates for traditional Universal Life Insurance Policies.

That’s why you can’t just go by product names. Universal Life from one Life Insurance company may look different than another. Same with Indexed Universal Life Insurance.

We always pull Universal Life Insurance Quotes Online and compare them against indexed universal illustrations. You see the numbers side by side. Premium payments, policy’s cash growth, and long-term death benefit values. Only then can you see which Life Insurance Plan supports your financial goals.

Financial Goals: Decide Which One Fits

It always comes back to this: what are your financial goals?

- If you want stable growth, low stress, and predictable cash value accumulation, a Universal Life Insurance Plan in Canada is the fit.

- If you want higher potential returns, are okay with caps, and have personal risk tolerance for index-linked growth, Indexed Universal Life works better.

Ask yourself:

- Do I want Permanent Coverage, mostly for estate planning?

- Will I use cash value as supplemental retirement income?

- How important is downside protection compared to guaranteed steady growth?

- What does my broader financial strategy look like?

There’s no best Life Insurance Policy in general. There’s only what fits your financial circumstances and your family.

Life Insurance Types Worth Mentioning

We’ve focused on Universal Life and Indexed Universal Life. But clients often ask about whole Life Insurance. Whole life is permanent, with fixed premiums and guaranteed cash value. Some people prefer the certainty, even if it comes with higher premiums.

Variable Universal Life Insurance, or variable Life Insurance, is another option. It ties cash value growth directly to investment options, like mutual funds. That means higher upside, but also the real chance to lose money. For some, that level of market risk is too much.

These Life Insurance types exist because not everyone shares the same goals or risk tolerance. Universal Life Policies sit in the middle: more flexible than whole life, less volatile than variable Life Insurance. Indexed Universal Life sits between as well, adding growth potential while protecting against losses.

Talking Through Real Choices With Clients

Here’s what happens in practice. A family comes in with a mortgage, young kids, and a need for Permanent Coverage. They’re not focused on market index charts. We lean toward Universal Life Insurance benefits—predictable, stable, with room to add premiums later when income rises.

Then we meet professionals who already max out retirement accounts. They want Permanent Coverage but also a way to push cash value growth harder. An Indexed Universal Life Insurance Policy fits them better. They like the idea of tying growth to market performance without direct market exposure.

This is how Life Insurance Policies work in real life: not as abstract concepts but as tools matched to financial goals and personal risk tolerance.

The Role Of An Insurance Professional

Honestly, these decisions are not easy without help. An insurance professional runs projections. We explain how participation rates change indexed universal returns. We walk you through tax-deferred growth. We show what happens if you pay premiums at minimum levels versus adding extra each year.

We don’t say “this is the only answer.” We compare Universal Life Policies against Indexed Universal Life. We explain Life Insurance costs, cash value growth, and the long-term picture. That’s how you choose a policy that aligns with your financial plan.

Our Closing View

Universal Life and Indexed Universal Life are both Permanent Life Insurance Policies. Both provide tax-free death benefit protection, both let you build a cash value component, and both give you flexibility with premium payments.

Universal Life is the choice if you want predictable growth and simple management. Indexed Universal Life is the choice if you want more upside, are okay with caps, and value downside protection.

Your financial goals, personal risk tolerance, and broader financial strategy determine the most sensible path.

We’ll run the numbers, request a Universal Life Insurance Quotes Online, and match it against Indexed Universal Life illustrations. That way, you see how the policies look in your real financial circumstances. No pressure, no generic advice—just clarity about which Life Insurance Plan fits your future.

More on Universal Life Insurance

FAQs

Here’s what happens. Cash value inside a Universal Life Insurance Policy grows on a tax-deferred basis, so you’re not reporting it every year the way you would with investment income. Later on, if you want extra retirement income, you can access the policy through withdrawals or loans. That flexibility can mean less income tax than if you were to withdraw from RRSPs directly.

Consider Indexed Universal Life as a middle-of-the-road option. Your cash value growth is based on a market index, but you are not actually invested in it. You have downside protection, so you don’t lose money in a bad year. Variable Universal Life, also known as VUL or variable Life Insurance, puts you directly into the market with investments, including mutual funds, so the risk level will be higher.

Yes, and we see this a lot with entrepreneurs. Permanent Life Insurance Policy structures that they use to fund buy-sell agreements or pay estate taxes at death by transferring shares. Some even use its cash value to secure loans. It’s not just something to keep from getting sick; it could help form part of an overall financial strategy.

Participation rates determine what percentage of the market performance you actually get to keep in your policy’s cash value account. If the index goes up by 8 percent but the participation rate is 60 percent, only some of that gain is credited. Throw in caps, and your cash value’s growth is more a function of how the insurance company builds the Indexed Universal Life contract than the index itself.

They do. A Universal Life Policy offers a tax-free death benefit, which means your family can have liquidity when they need it the most. Rather than liquidate assets or liquidate an investment, the Life Insurance proceeds pay estate taxes and final expenses.” It is for this reason that many wealthy families include Permanent Life Insurance in their estate plans.

Universal Life has some of the best U.L. benefits, with one of the most popular being premium payments. You are not bound to that particular number till the end of time. You pay the minimum to keep the Permanent Coverage for some years. In years other than the first, you dump more to help the cash value grow faster. This flexibility allows you to adjust as your financial situation changes.

It depends. Indexed Universal Life provides downside protection, which makes individuals who feel nervous about losing money feel better. However, the growth is still tied to a stock market index, so your cash value accumulation may be less predictable than with traditional Universal Life. For younger children, whole Life Insurance or traditional Universal Life (not IUL) is the safer route for the most risk-averse.

Yes, and it’s a tactic we recommend on occasion. A policyholder may hold a permanent policy — say in Canada, a Universal Life Policy, for lifetime coverage — while also purchasing a term life policy, many with high death benefits, for temporary protection. Universal Life Policies create a cash value that accumulates tax-deferred. By contrast, Term can keep insurance costs lower when you’re young or when your debts are at their highest.

Whole life is steady. Premiums are fixed, cash value growth is guaranteed, and you don’t have to follow participation rates or market index returns. Indexed Universal Life, however, provides greater upside linked directly to the market, with a safety net. So the trade-off is straightforward: dependability of whole life or the greater growth potential of Indexed Universal Life.

Yes, and people forget this. The policy’s cash becomes available later in life. That could be a combination of systematic distributions or loans. The key is not to disturb the tax-free death benefit. That’s why a Universal Life Insurance Policy is typically part of an overall financial plan, along with pensions and registered accounts.

Key Takeaways

- A Universal Life Insurance Plan in Canada gives steady cash value growth with interest rates set by the insurance company and flexible premium payments.

- An Indexed Universal Life Insurance Policy ties cash value growth to a market index, offers downside protection, and suits those with moderate risk tolerance.

- Both Permanent Life Insurance options provide lifetime death benefit protection and support broader financial goals like estate taxes or supplemental retirement income.

- The choice depends on financial goals, personal risk tolerance, and whether predictable accumulation or market-linked growth fits your financial circumstances best.

Sources and Further Reading

Government of Canada – Life Insurance Overview

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life-insurance.htm l

(Provides a neutral overview of Life Insurance Policy types, including Permanent Coverage options.)

Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

(Industry association resources explaining Universal Life, whole life, and other Life Insurance types offered in Canada.)

Investopedia – Indexed Universal Life Insurance

https://www.investopedia.com/indexed-universal-life-insurance-5209256

(Detailed breakdown of how Indexed Universal Life Policies work, including cash value growth and market index linkage.)

Insurance Bureau of Canada (IBC) – Understanding Life Insurance

https://www.ibc.ca/on/insurance-101/life-health-disability/life-insurance

(Explains Permanent Life Insurance options, including Universal Life Insurance benefits and death benefit protection.)

CFP Canada – Financial Planning with Insurance

https://www.fpcanada.ca

(Provides insights on how Life Insurance coverage fits into a broader financial plan and estate planning strategies.)

Investopedia – Universal Life Insurance

https://www.investopedia.com/terms/u/universallife.asp

(Clear explanation of Universal Life Policies, cash value components, and how flexible premiums work.)

Feedback Questionnaire:

IN THIS ARTICLE

- Universal Life Insurance Plan Vs. Indexed Universal Life: Which One Fits Your Financial Goals

- Life Insurance Policy: Getting The Basics Right

- Universal Life Insurance Coverage Benefits In Simple Words

- Indexed Universal Life Insurance: A Different Angle

- Death Benefit: The Core That Never Changes

- How A Life Insurance Company Shapes These Policies

- Financial Goals: Decide Which One Fits

- Life Insurance Types Worth Mentioning

- Talking Through Real Choices With Clients

- The Role Of An Insurance Professional

- Our Closing View

Sign-in to CanadianLIC

Verify OTP