- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Top Group Insurance Companies In Canada 2026: Ratings, Reviews & Coverage Options

By Pushpinder Puri

CEO & Founder

- 11 min read

- December 11th 2025

SUMMARY

This blog reviews the top Group Insurance companies in Canada for 2026, comparing Group Insurance Plans, costs, employee benefits, and coverage options. It highlights Sun Life, Canada Life, Manulife, Desjardins, Green Shield, Medavie Blue Cross, Equitable Life, and Empire Life, outlining their strengths in digital tools, health insurance, disability insurance, and financial protection for businesses and employees.

Introduction

The reality is this: in Canada, most people still get their extended health, dental and disability coverage through an employer or group plan.

Recent federal labour data also shows that about eight in ten full-time permanent workers in Canada have access to employer-provided medical or dental benefits, reinforcing how essential group plans remain in 2026.

Historical national data showed that roughly 90% of private health-insurance dollars were paid through group arrangements, and more recent surveys confirm that the majority of Canadians with supplemental health or dental coverage still receive it through workplace or other group plans.

And, when owners inquire about budgeting, we offer the (actual) range: about $1,500–$4,000 per employee per year for mainstream small-to-mid-market plans, depending primarily on design, demographics and headcount.

Quick Ratings Snapshot

- Sun Life — 4.5/5

- Canada Life — 4.5/5

- Manulife — 4.5/5

- Desjardins — 4.5/5

- Empire Life — 4.5/5

Sun Life: Digital Experience And Virtual Care Depth

Why Employers Pick Sun Life: A huge suite of Group Insurance Plans with strong digital rails and virtual care baked in. Lumino Health Virtual Care gives plan members 24/7 access to clinicians, plus Sun Life has layered in EAP and care navigation.

Standout Tools & Programs

- Lumino Health Virtual Care (on-demand care; EAP integration).

- Robust online claims through my Sun Life (fast reimbursements).

Best For: Employers prioritizing online services and scalable coverage options with strong medication-management add-ons.

Canada Life: Small-Business Flex With “Freedom At Work”

Why Employers Pick Canada Life: Long Canadian track record, big provider network, and small-business bundles under Freedom At Work. It’s built to help companies with ~2–75 employees stand up group benefits quickly.

Standout Tools & Programs

- Freedom At Work — curated benefits and savings plan menus; Canada Life claims costs “as little as 1–5% of payroll” for some small setups.

- Clean employer/admin dashboards for enrollment and billing.

Best For: Employee benefits, Group Insurance for Canadian buyers seeking straightforward administration and flexible plans.

Manulife: Data-Driven Care, Pharmacogenomics, And App Polish

Why Employers Pick Manulife: A tech-forward carrier with Health by Design, drug-plan tools, and a Personalized Medicine (pharmacogenomics) program that uses a one-time genetic test to help match members to more effective medications.

Standout Tools & Programs

- Personalized Medicine Program (for qualifying EHC plans).

- DrugWatch, My Drug Plan, and specialty-drug care paths to control the trend. (Program pages reference Manulife’s pharmacy and plan tools.)

Best For: Employers focused on claims service consistency, drug-trend control, and modern app experiences.

Desjardins: Pharmacy Strategy, Virtual Care, And Manager Support

Why Employers Pick Desjardins: Strong cost-containment strategy (biosimilar adoption), comprehensive wellness platforms, and unique manager support.

Standout Tools & Programs

- Health Is Cool 360° (member health navigation and resources).

- Biosimilar switching strategies with reported 15%–50% savings depending on drug/class in Canadian markets.

- Preferred pharmacy arrangements (Costco) can reduce out-of-pocket costs in some plans.

Best For: Employers serious about insurance coverage sustainability and proactive cost management.

Equitable Life: Small-Group Friendly, Clean Onboarding

Why Employers Pick Equitable: Flexible Bronze/Silver/Gold/Platinum plan tiers, low minimum participation, and stand-out onboarding with Online Plan Member Enrolment (OPME) and EZClaim.

Standout Tools & Programs

- OPME (email reminders, quick digital enrollment).

EZClaim mobile claims (fast reimbursements).

Best For: Smaller employers wanting simple admin and stable pricing for Health Insurance and dental.

Empire Life: Mental Health Navigator, Telemedicine, And Fast Claims

Why Employers Pick Empire Life: Practical mental-health supports and telemedicine, with Mental Health Navigator (via Teladoc) included on many plans.

Standout Tools & Programs

- Mental Health Navigator and Teladoc Medical Experts.

- Telemedicine with referrals into Navigator as needed; quick e-claims.

Best For: Employers prioritizing mental wellness access with a streamlined pathway to specialists.

Health Insurance, Disability Insurance, And Other Coverage Options

Most Canadian Group Insurance Coverage options we design include a mix of:

- Extended Health Insurance (drugs, paramedicals, hospital, out-of-country care).

- Dental Coverage (basic/major/orthodontics).

- Disability Insurance (short- and long-term income replacement).

- Life Insurance and Accidental Death Benefits (core protection; optional Critical Illness Insurance riders are common).

- Healthcare Spending Accounts (HSA) or Taxable Spending Accounts for extra flexibility.

- Optional Travel Insurance benefits (notably strong with Blue Cross).

What Does Group Insurance Cost In Canada?

Plan math primarily involves coverage amounts, demographics, claims patterns, and funding methods. For 2026 planning, a realistic range for mainstream small-to-mid-market health and dental programs is about $1,500–$4,000 per employee per year. When employers add richer disability, wellness or retirement components, total benefits costs can rise into the $3,000–$7,500 range depending on plan design and workforce makeup.

Ways carriers help you save money without gutting benefits:

- Biosimilar strategies (Desjardins reports 15%–50% savings on targeted drugs).

- Specialty pharmacy integration (GreenShield/NKS Health) to improve adherence and control trend.

- Preferred pharmacy networks (various carriers) to lower dispensing fees/prices.

How To Choose Your Group Insurance Provider (No Guesswork)

- Begin with Employee Needs: First, prioritize the mix (drugs, paramedicals, mental health, vision/dental).

- Choose Funding Style: Fully insured vs. ASO (administrative services only) can alter the math for predictable vs. catastrophic claims. (The Honeybee/GreenShield fly modern ASO programs for SMBs.)

- Demand Real Digital Usability: Play around in the member app (claims, eligibility lookups, drug search) and employer admin portal before you sign.

- Probe Drug Cost Controls: Inquire about biosimilars, specialty-drug case management and tiered formularies.

- Compare Rate Guaranties & Renewal Caps: Many carriers now include “riders” such as Guaranteed Rates/Caps …use these tools to help keep your first-term group benefits rates more predictable. (Terms of the programs vary by company; contact us for current terms.)

The Canadian LIC Take: Who’s “Best” In 2026?

- Best Digital Care Bundle: Sun Life (Lumino Virtual Care + EAP depth).

- Best For Small Teams Wanting Simplicity: Canada Life (Freedom At Work).

- Best For Drug-Trend Innovation: Manulife (Personalized Medicine + plan tools).

- Best Cost-Management Play: Desjardins (biosimilars + pharmacy cost controls).

- Best Small-Group Onboarding: Equitable Life (OPME + EZClaim simplicity).

- Best Mental-Health Pathways: Empire Life (Mental Health Navigator + Teladoc).

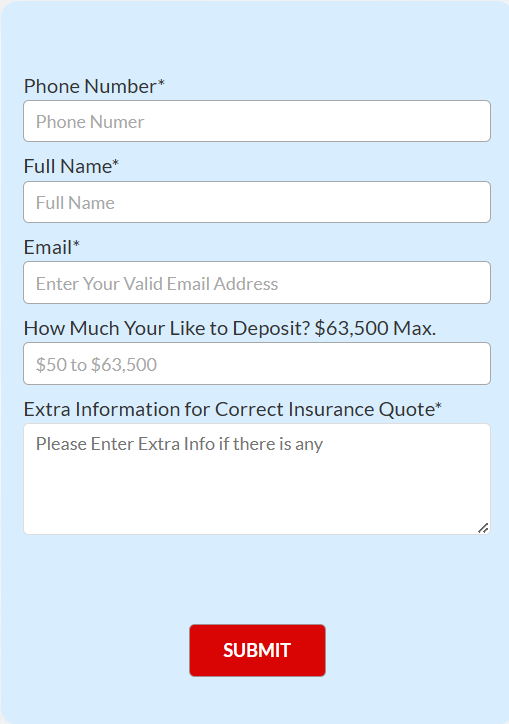

Ready For A Group Insurance Quote Online?

Let us know how many employees you have, the province breakdown and your “must have” coverage (drug, dental, paramedicals, disability insurance, critical illness, travel). We’ll pull apples-to-apples quotes from the carriers above, pressure-test the insurance policy fine print, and negotiate rate guarantees where possible.

We have a tie-up with a lot of insurance companies in Canada. Want us to map group insurance cost in Canada to three plan tiers (Essential / Standard / Enhanced) and show the trade-offs? We’ve got you.

Call 1-888-601-9980 or text “QUOTE” and your employee number — we’ll take a brief intake and start curating your shortlist today.

FAQs

Most SMBs land between $1,500–$4,000 per employee annually; larger groups trend lower per capita with scale.

Many carriers will quote starting at 3–5 employees; some will consider two unrelated full-timers with minimum hours. (Carrier rules vary.)

In general, yes—premiums are a business expense for employers (confirm with your tax pro/CRA based on your mix of benefits). (General industry guidance; carriers highlight write-off advantages.)

Yes—most carriers support class-based plan design (e.g., Bronze/Silver/Gold or custom tiers).

Both health and Life Insurance are cheaper when they’re part of a Group Policy, because the costs — often paid in full by employers — are spread across multiple workers’ premiums. Coverage remains in effect even while you are working, and most plans automatically renew from year to year. It’s not a paper safety net, but one worked out statistically.

Yes, small groups can form a group policy. Insurers such as Equitable Life or Green Shield typically accept plans for two to five full-time employees, meaning that smaller businesses can have the same access to health insurance and disability insurance enjoyed by larger employers — without paying corporate-size rates.

Current insurers create a range of choices — basic, standard, enhanced — with an eye to allowing employers to tailor benefits to match their budgets. You can combine health insurance, critical illness coverage, dental or life under one roof, and amend those limits later as revenue or headcount fluctuates.

Most Group Insurance Plans terminate when work ends, but workers, in many cases, can convert Life Insurance or health benefits into individual policies within 30 days. It is a bridge to keep people insured between group protection and individual ownership, negotiating directly with the insurer.

Disability insurance provided through a group plan kicks in to replace income lost if you are unable to work due to sickness or injury. The employer and the employee pay the premiums, and payouts cushion everyday expenses so that financial stability doesn’t collapse with a diagnosis.

Absolutely. The best insurance companies in Canada incorporate virtual counselling, mindfulness apps or EAP sessions into their Group Insurance cost offering. Carriers such as Manulife and Empire Life bake these into health insurance, they said, aimed at fostering mental wellness long before burnout hits.

A qualified insurance broker compares actual quotes from dozens of Canadian insurance companies, deciphers renewal terms and hunts for reasonable premiums. Rather than run around after each insurer, you have a single advocate who ensures your coverage amounts and rates are staying in line with your company’s needs.

Yes, lots of employers add optional permanent Life Insurance or critical illness insurance for execs or key staff. The extras offer long-term financial protection and are frequently less expensive than buying personal coverage outright because insurance sold to groups is underwritten.

Rising medical inflation, new specialty drugs and longer paramedical claims are driving up premiums. The right insurance company tackles this by using data analytics, digital claim controls and preventive health programs to keep claims — and premiums — sustainable.

Each coverage decision — whether you are insuring life, disability or health risk — comes down to protecting cash flow. The correct mix provides employees and owners with both the financial protection needed when life takes a sideways turn, and avoids payroll suck. Such is the thumb on Smart Group Insurance Planning: It’s all about balance, not overkill.

Key Takeaways

- Group Insurance Dominates Canada’s Benefits Market

Nearly 90% of all health and Life Insurance coverage in Canada is sold through Group Insurance Plans, helping employers protect teams with affordable, pooled benefits. - Sun Life Leads in Digital Benefits and Virtual Care

Sun Life stands out for its strong digital onboarding tools, mobile claims app, and Lumino Health Virtual Care, making benefits easy to manage for both employers and employees. - Canada Life Offers Small-Business Flexibility

With its Freedom at Work™ program, Canada Life provides tailored coverage for smaller companies, integrating health, dental, life, and disability insurance under one efficient plan. - Manulife Excels in Personalized Health Management

Manulife’s Group Insurance Coverage options include data-driven tools like the Personalized Medicine Program, DrugWatch, and Mental Health Plus—bridging employee wellness with cost control. - Desjardins Delivers Robust Wellness and Cost Savings

Desjardins Insurance focuses on comprehensive wellness support and biosimilar drug strategies that can cut prescription costs by 15–50%, helping maintain long-term financial protection for employers. - Equitable Life Simplifies Benefits for Growing Teams

Equitable Life of Canada provides easy digital enrollment, flexible benefit tiers, and stable rates—ideal for startups or expanding organizations seeking simple administration and predictable pricing. - Empire Life Prioritizes Mental Health and Fast Claims

Empire Life integrates telemedicine, the Mental Health Navigator, and quick e-claims, ensuring employees can access professional support and receive reimbursements within 24 hours. - Balanced Cost Range Across Canada

Employers typically spend $1,500–$4,000 per employee annually on group benefits, depending on plan design, workforce demographics, and the mix of life, health, and disability insurance. - Tax Efficiency and Employee Retention

Group benefits remain one of Canada’s most tax-efficient ways for businesses to boost loyalty and morale while reducing turnover through comprehensive employee benefits Group Insurance offerings. - Choosing the Right Partner Matters

The best results come from pairing the right insurance provider with the right funding model—balancing affordability, flexibility, and long-term employee well-being.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA) – 2024 Canadian Life & Health Insurance Facts.

https://www.clhia.ca

(Provides national data on group benefits participation, claims volume, and market share across insurers.) - Statistics Canada – Employer-Sponsored Health and Dental Benefits in Canada, 2024.

https://www.statcan.gc.ca

(Outlines participation rates, average employer spending, and workforce coverage trends.) - Sun Life Financial – Group Benefits Insights 2024 Report.

https://www.sunlife.ca

(Industry insights on digital healthcare, virtual mental-health support, and drug plan cost control.) - Canada Life – Group Benefits and Workplace Solutions Resources.

https://www.canadalife.com

(Comprehensive overview of small-business benefit structures and wellness programs.) - Desjardins Insurance – Group and Business Health Solutions.

https://www.desjardinslifeinsurance.com

(Explains flexible plan design, biosimilar adoption, and health-tech integration for employers.) - GreenShield – Employer Health & Benefits Programs.

https://www.greenshield.ca

(Details on the not-for-profit model, specialty pharmacy integration, and mental-health initiatives.) - Medavie Blue Cross – Group Benefits Overview.

https://www.medaviebc.ca

(Outlines group benefit customization, travel coverage, and digital health innovation.) - Equitable Life of Canada – Group Benefits Resources.

https://www.equitable.ca

(Information on small-business plans, flexible tiers, and administrative support tools.) - Empire Life – Workplace Health and Benefits Hub.

https://www.empire.ca

(Covers group plan design, telemedicine partnerships, and mental-health programs.) - Canadian Chamber of Commerce – Benefits and Total Rewards Trends 2024.

https://chamber.ca

(Summarizes employer sentiment, cost projections, and benefits modernization trends across provinces.)

Feedback Questionnaire:

Your thoughts help us understand what employers and professionals like you face when choosing Group Insurance Plans in Canada. Please take a minute to share your experience below.

IN THIS ARTICLE

- Top Group Insurance Companies In Canada 2026: Ratings, Reviews & Coverage Options

- Quick Ratings Snapshot

- Sun Life: Digital Experience And Virtual Care Depth

- Canada Life: Small-Business Flex With “Freedom At Work”

- Manulife: Data-Driven Care, Pharmacogenomics, And App Polish

- Desjardins: Pharmacy Strategy, Virtual Care, And Manager Support

- Equitable Life: Small-Group Friendly, Clean Onboarding

- Empire Life: Mental Health Navigator, Telemedicine, And Fast Claims

- Health Insurance, Disability Insurance, And Other Coverage Options

- What Does Group Insurance Cost In Canada?

- How To Choose Your Group Insurance Provider (No Guesswork)

- The Canadian LIC Take: Who’s “Best” In 2026?

- Ready For A Group Insurance Quote Online?

Sign-in to CanadianLIC

Verify OTP