- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Self-Employed Canadians Lack Disability Insurance Coverage: Why It Matters More Than Ever in 2025

By Pushpinder Puri

CEO & Founder

- 12 min read

- April 25th, 2025

SUMMARY

The blog discusses how most self-employed Canadians lack disability insurance coverage, based on Statistics Canada’s March 2025 data. It highlights why many freelancers and small business owners remain uninsured, the risks they face, and how affordable, personalized disability insurance plans can protect their income. It shares real client experiences from Canadian LIC to explain the importance of taking action before an illness or injury disrupts work and finances.

Introduction

A Growing Concern for Self-Employed Canadians

If you find yourself as a self-employed individual in Canada, you know well what freedom and responsibility look like when running your own show. You create your own schedule, determine your rate, pursue contracts, and service clients. But a lot of our clients at Canadian LIC ask us, “What happens in the event I become injured or sick and cannot work?

That silence following the question speaks volumes.

Many self-employed professionals we talk to — graphic designers, realtors, contractors, consultants, and small business owners — have invested their all in their ventures. However, they tend to forget one important layer of financial protection: disability insurance.

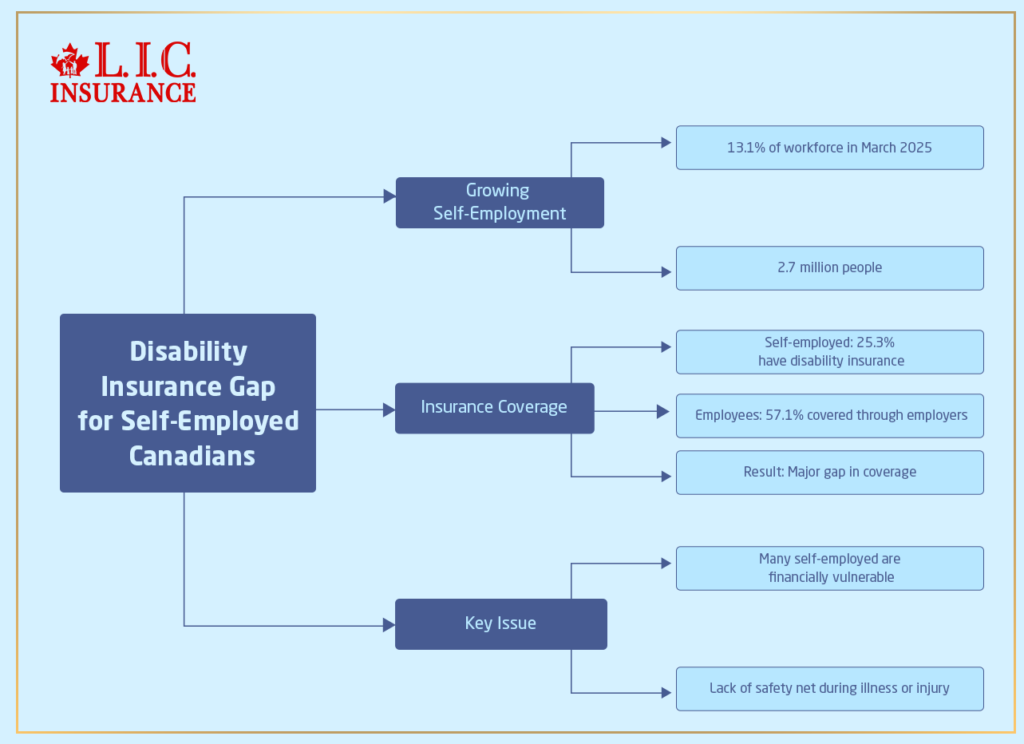

The latest Labour Force Survey from Statistics Canada for March 2025 lays the problem bare. Among all 2.7 million self-employed Canadians, only 25.3% said they had any kind of disability insurance coverage. That still leaves nearly three-quarters at serious financial risk if sickness or injury strikes.

Let’s take a look at why that’s happening, what we hear every day from self-employed Canadians like yourself, and what you can do to address it before it’s too late.

The Numbers Speak Loudly: Who Is Left Uncovered?

We’re working with a growing population of self-employed workers. After flatlining in 2022 and 2023, the number of self-employed Canadians grew in the second half of 2024. As of March 2025, they make up 13.1% of the workforce — that’s 2.7 million people.

But here’s the issue:

- Only 25.3% of them have disability insurance.

- Compare that to 57.1% of employees who are covered through their employers.

That gap is dangerous.

A freelance photographer we recently worked with from Mississauga shared her story. She broke her leg on a shoot, which meant she couldn’t walk, let alone work. With no disability coverage in place, she had to rely on her savings and credit card to keep her bills paid — a financial setback that took her months to recover from. And sadly, this isn’t rare.

Why Self-Employed Workers Miss Out on Disability Insurance

From what we hear every day, there are three main reasons self-employed Canadians lack disability coverage:

1. They Think It’s Too Expensive

Many assume disability insurance plans are beyond their means, particularly if no employer is subsidizing them. But the reality is there are plans specifically for entrepreneurs, gig workers and freelancers — and they can be adapted to fit your income and budget.

One client was a self-employed plumber in Brampton who thought disability insurance would cost him hundreds of dollars a month. When we presented him with a plan based off his monthly income, it was less than $75/month. “It’s less than I pay for my truck insurance,” he told us — and he signed up on the spot.

2. They Don’t Know It Exists for Them

When most people think of disability insurance, they think about workplace benefits. If you’re self-employed, you may not even know that private coverage exists. This gap in awareness is something we put in the work daily to fill.

We are often approached by small business owners who assume, “If it is not on my bank’s website or the programs CRA offers, it’s probably not for me.” But disability insurance policies for self-employed workers do exist — and are more important than ever.

3. They Think It Won’t Happen to Them

They are not in great company: Let’s face it, humans don’t prepare for the worst. They’re healthy now, so they expect that to always be the case. But accidents and illnesses do not discriminate based on your employment status.

One of our clients, a young software developer living in Vancouver, found himself hospitalized with a viral illness that kept him away from work for four months. And with no income protection in place, his growing tech consulting business nearly went under. He came to us after recovering, prepared to keep it from happening again.

The Financial Risk Is Real and Often Underestimated

By not having disability insurance, you’re risking your income and all that it provides for. Mortgage or rent. Groceries. Childcare. Your business expenses. All of these remain, even if you can’t work.

Like a financial net, disability insurance catches you when you fall. If you’re unable to work because of an injury or illness, it replaces part of your income. This way, you aren’t faced with bending into savings, incurring debt, or ending your business.”

So, for example, if your income is $5,000/month and you had disability insurance that replaces 60% of your income, you’d have $3,000/month to live off of while you were recovering.

How Canadian LIC Helps Self-Employed Workers Every Day

Every week, we meet self-employed Canadians who realize that it is too late and that they should’ve protected their income. That’s why our team takes a proactive approach.

Here’s what we do differently:

- We assess your specific job risks and income flow.

- We build disability insurance plans that match your monthly income and expenses.

- We help you understand benefit periods, elimination periods, and policy options in plain language.

One of our success stories came from a Hamilton-based contractor who initially declined coverage. A year later, a ladder fall kept him away from job sites for three months. Because he chose to revisit the policy with us six months before the accident, he received income payments that helped cover both personal and crew-related business costs.

What Does a Disability Insurance Plan Typically Cover?

When we help self-employed professionals choose a plan, they often ask: “What does this actually cover?” Great question.

A standard disability insurance policy can offer coverage for:

- Accidents at work or outside of work

- Illnesses that keep you from performing your job

- Short-term disabilities (e.g., surgery recovery)

- Long-term disabilities (e.g., cancer, chronic conditions)

There are flexible options for how soon benefits kick in (called the elimination period) and how long they last (the benefit period). You can decide what works best for your situation and budget.

Your Income Is Your Business. Protect It.

As someone self-employed, your income relies on your ability to get up and show up. If you’re not there, neither is the money. Your tools, your truck, your office equipment — you insure those things, but what about the one thing that makes it all happen? You.

A disability can appear suddenly and unknowingly. Planning ahead is not fear-mongering — it is smart business.

At Canadian LIC, we work with so many people navigating the day-to-day,help we see how quickly the tides can change. One accident. One diagnosis. Then, all of a sudden, your ability to earn is put on hold — but your bills are not. Every self-employed Canadian deserves to have options, and for those options to be affordable and effective.

Disability Insurance Isn’t Just for the “Dangerous Jobs”

The biggest misconception we hear from self-employed professionals: “My job isn’t risky — why would I need disability insurance?

But here’s the truth — it’s not only construction workers, electricians, or delivery drivers who are at risk. Even if you are desk-bound, there are dangers, too. Chronic illnesses, repetitive strain injuries, mental health challenges, and unexpected surgeries can take a writer, therapist or IT consultant out of commission for weeks or months.

We used a wedding planner in Ottawa who developed really bad tendonitis from doing a lot of logistics setup work and using her laptop. She didn’t tumble off a ladder or die in a car accident. But her earnings came to a halt while her hands healed. Had she not purchased a disability insurance policy six months before, after a consultation with us, the bills would have piled up quickly.

The point is: It’s not the danger of your job. This has to do with your ability to earn. If that’s compromised, everything is compromised.”

How Much Does Disability Insurance Cost for the Self-Employed?

This is the question that always comes up next: “Okay, but what does it cost?”

It depends on a few key factors:

- Your age

- Your occupation

- Your monthly income

- Whether you choose short-term or long-term coverage

- Your elimination and benefit period preferences

- Smoking status and medical history

But here’s the good news — it’s cheaper than most people think. We help self-employed Canadians establish policies regularly. Our rates vary from $40-$120/month.

One of the freelance makeup artists we worked with, based in Toronto, was shocked when her personalized plan totalled $58/month. Her response? “That’s less than my phone bill — and this protects my income!”

And if you’re operating your business through a corporation, there could be tax-efficient ways to structure your premiums as well. With our clients, we run through that step by step.

Why This Matters More Than Ever in 2025

With self-employment numbers rising — now at 2.7 million across Canada — and economic volatility still looming post-pandemic, the stakes are getting higher.

Unlike salaried workers, self-employed individuals:

- Don’t qualify for employer health or disability plans

- Can’t rely on the employer’s sick leave policies

- Often lack emergency savings

- Must handle both personal and business expenses, even when income stops

Statistics Canada has made clear that self-employed Canadians are at greater financial risk than salaried employees. So why remain unprotected?

This is where Canadian LIC comes into play. We’ve helped thousands of clients too, across multiple industries — like yoga instructors to real estate agents — get the disability coverage they need to safeguard their hustle.

Your Business Plan Should Include Disability Insurance

We often ask this in our conversations with clients: “If you couldn’t work for three months, what’s your plan?”

If the answer is silence, or dipping into credit, or depending on a spouse or parent, it’s time to rethink the strategy.

Your business plan likely includes:

- How do you acquire clients

- How do you manage projects

- How do you scale your revenue

Now it’s time to include how you protect that income source. Disability insurance acts like a backup generator for your business. You hope you never need it, but if the lights go out — it keeps you running.

How to Get Started With the Right Disability Insurance

Getting started doesn’t have to be complicated. Here’s the simple process we follow when we help self-employed Canadians:

Step 1: Review Your Income

We help calculate a realistic monthly income baseline. This number doesn’t have to be perfect — we’re here to guide you.

Step 2: Understand Your Options

We explain short-term vs. long-term disability insurance, elimination periods (the waiting time before benefits start), and benefit durations. All in plain language.

Step 3: Personalize Your Plan

No two self-employed workers are alike. A dog groomer needs coverage that is different from that of a freelance accountant. We personalize everything to your work and your risks.

Step 4: Compare and Apply

We shop across Canada’s top insurance providers to compare policies, premiums, and features. Then, we walk you through the application step by step.

Step 5: You’re Covered

Once approved, your disability coverage starts, and your income is protected. You can focus on your business, knowing you’ve covered one of the biggest risks.

It’s Time to Treat Your Income Like the Asset It Is

You’ve spent years developing your career, your brand, and your client base. But none of that works if you’re suddenly forced to stop working without a financial cushion.

At Canadian LIC, we meet with self-employed Canadians every day, and we’ve seen both sides of the coin: the ones who waited too long and the ones who were covered just in time. We tell their stories because we want others to get ready, not freak out.

Disability insurance isn’t a nice-to-have. It’s a key component of your financial plan. It gives you breathing space, not just in the moment of crisis, but every day you show up to work, knowing you have a safety net behind your income.

And the best part? You don’t need to sort it out on your own. We’re here to help you make sense of the policies, the premiums and the protection that works for your life and your business goals.

Self-Employed, But Not Alone

If you are self-employed, battling the unknowns is the plywood road you’ve already committed yourself to. You’ve left behind the regular salary and company perks for the flexibility to forge your own way.

But just because you’re self-employed doesn’t mean you are unprotected.

The numbers don’t lie: 74.7% of self-employed Canadians now do not have disability insurance. The risks are high. But it is easy, cheap and ready.

You have already put your time into your skills, your business and your future. It’s time to go out and invest in the one thing that shields all of it — your capacity to earn.

And we are here to walk with you all the way.

FAQs

Many self-employed people in Canada believe disability insurance is an option only for employees or that it’s simply too expensive. At Canadian LIC, we frequently encounter clients who have never learned that private plans are available specifically for the self-employed worker. When we explain how coverage works and customize it for their budget, they’re shocked at how affordable it actually is.

Yes, you can. If you’re a contractor, designer, consultant, personal trainer — whatever your trade — we find you the coverage that goes with it. Although one of our clients, a freelance wedding planner, assumed that she wouldn’t qualify, she provides a perfect example of a plan we built, which gave her income protection during a health setback.

Costs vary based on your age, income, job type and plan design. We have also successfully gotten some clients started on plans in the $40–$120/month range. One Brampton client said he thought coverage would be “crazy expensive” — yet his plan was cheaper than his mobile bill.

It includes income loss from illness or injury that prevents you from working. You can decide how soon benefits begin (the waiting period) and how long they last. We recently assisted a self-employed physiotherapist who was unable to work after undergoing surgery. It was her policy that provided her with a monthly income while she got back on her feet.

We walk you through the entire process. First, we review your income. We then simplify options, tailor your plan, and guide you through your application. It’s worry-free and structured around your timetable.” We’ve made it easy for artists and chefs, mechanics, whoever—you name it—to protect their income.

Key Takeaways

- Only 25.3% of self-employed Canadians have disability insurance, leaving nearly three-quarters financially exposed during illness or injury, according to the March 2025 Labour Force Survey by Statistics Canada.

- Most self-employed workers mistakenly believe disability insurance is only for employees, too expensive, or not available for their type of work. This lack of awareness leads to delayed or missed coverage.

- Disability insurance provides income replacement when illness or injury prevents you from working. Plans can be customized to fit your job, income, and budget—even for freelancers, contractors, and small business owners.

- Canadian LIC helps self-employed clients daily by designing personalized disability insurance plans, explaining all policy details in plain English, and comparing the best coverage options in Canada.

Sources and Further Reading

1. Labour Force Survey, March 2025 – Statistics Canada

This report highlights that only 25.3% of self-employed workers aged 15 to 69 have disability insurance, compared to 57.1% of employees.

2.Health-Related Insurance for the Self-Employed – Statistics Canada

Why it’s useful: It provides data on the average salary in Canada, job trends by province, and information on the fastest growing industries and wage changes across different Canadian job sectors.

3.Guide to the Labour Force Survey 2025 – Statistics Canada

Provides comprehensive information on the methodology and data collection processes of the Labour Force Survey.

Access the guideStatistics Canada

Additional Reading

- Business Ownership Among Persons with Disabilities in Canada

Examines the unique challenges and barriers faced by entrepreneurs with disabilities, including access to insurance and financial support.

Read the article - Employment Insurance Benefits for Adults with Disabilities

Provides data on the uptake of employment insurance benefits among adults with disabilities, highlighting gaps in support.

View the dataStatistics Canada+2Statistics Canada+2Statistics Canada+2

Your Feedback Is Very Important To Us

We’d love to understand your experience better. Your feedback helps us serve you and others like you more effectively

Thank you for your time! Someone from our team may reach out to help you explore solutions tailored to your situation.

IN THIS ARTICLE

- A Growing Concern for Self-Employed Canadians

- The Numbers Speak Loudly: Who Is Left Uncovered?

- Why Self-Employed Workers Miss Out on Disability Insurance

- The Financial Risk Is Real and Often Underestimated

- How Canadian LIC Helps Self-Employed Workers Every Day

- What Does a Disability Insurance Plan Typically Cover?

- Disability Insurance Isn’t Just for the “Dangerous Jobs”

- How Much Does Disability Insurance Cost for the Self-Employed?

- Why This Matters More Than Ever in 2025

- Your Business Plan Should Include Disability Insurance

- How to Get Started With the Right Disability Insurance

- It’s Time to Treat Your Income Like the Asset It Is

- Self-Employed, But Not Alone

Sign-in to CanadianLIC

Verify OTP