- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Renewing Vs. Converting Your Term Life Policy: A Simple Guide To Protecting Your Future

By Harpreet Puri

CEO & Founder

- 12 min read

- September 26th, 2025

SUMMARY

Families weighing renewing vs. converting a Term Life Insurance Policy gain clarity on coverage duration, premium changes, medical exam rules, and cash value growth. The discussion highlights how converting Term Life Insurance to Whole Life Insurance or Universal Life Insurance offers lifetime protection, tax-advantaged cash value, and estate planning benefits, while renewals suit short-term needs but lead to sharply rising premiums over time.

Introduction

Purchasing a home when you are self-employed takes planning, a plan, and good help. We witness every day how the power of insurance and planning allows business owners to make that leap to homeownership.

Fulfilling mortgage insurance coverage requirements may seem like an additional obstacle, but in fact, it is the proverbial golden key to unlocking approvals. “Self-employed workers can purchase homes with just as much confidence as employed (salaried) workers by providing the right documents, a clear down payment source, and working with a professional,” he adds.

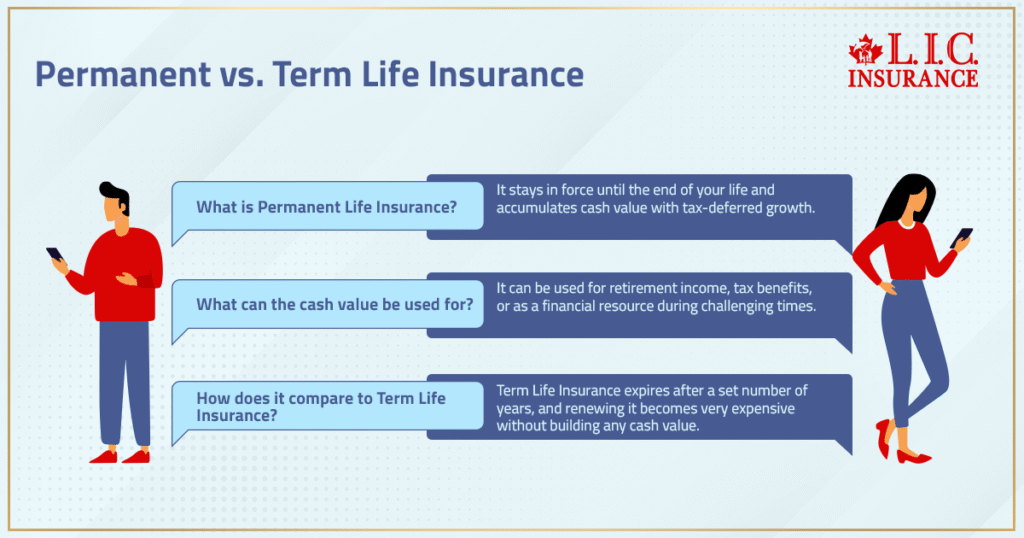

Permanent Life Insurance Isn’t As Complicated As It Sounds

When most people hear the phrase Permanent Life Insurance, they think: expensive, complex, possibly not even necessary. But the basics are simple. Rather than running out after a set number of years, as a 20-year Term Life Insurance Policy would, Permanent Coverage stays in force until the end of your life.

And here’s the kicker: it doesn’t lie there. With Permanent Life Insurance, a cash value component is accumulated. That cash value increases with tax-deferred growth. Slowly, yes. However, over time, it becomes a pool of money that families can tap into. Retirement income is a source of income that provides tax benefits to an estate or serves as a financial resource during challenging times.

To contrast that with renewing Term Life Insurance. The coverage remains, of course, but the price explodes. And it doesn’t build anything. No savings, no cash value benefits. Just higher bills.

Every Life Insurance Policy Has Rules

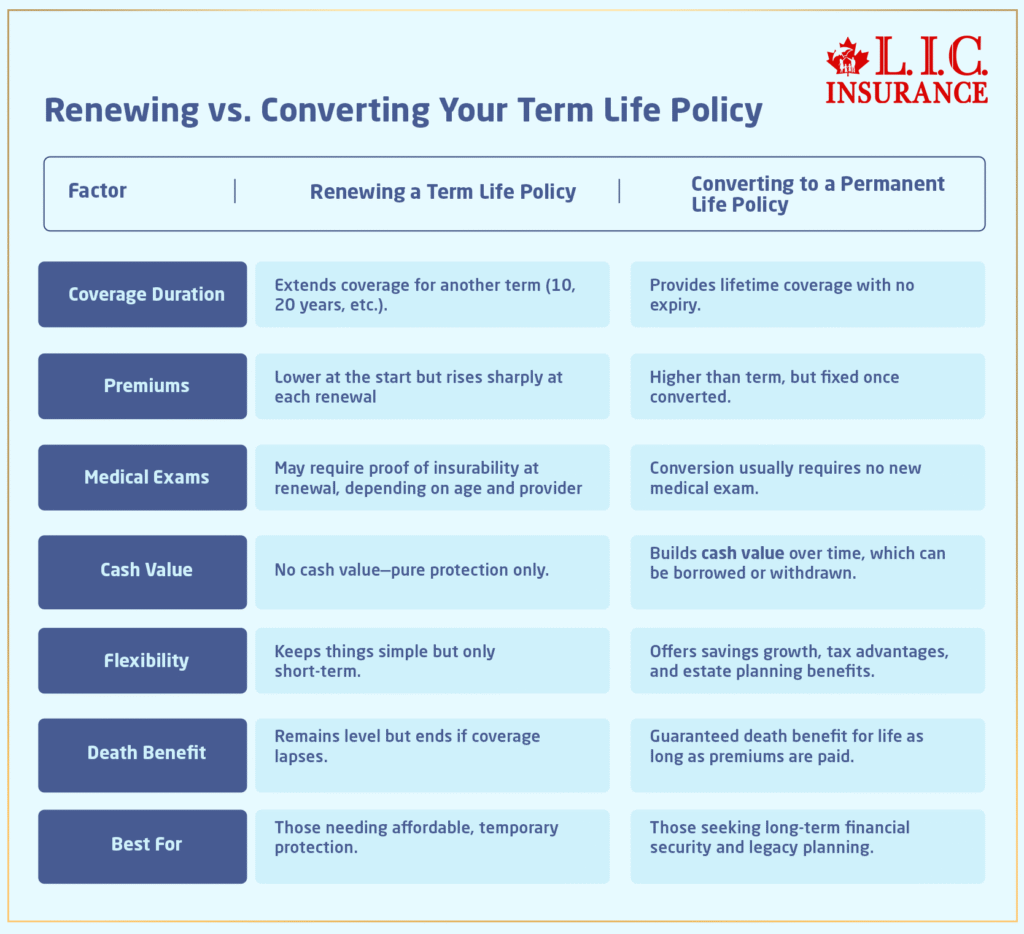

Ultimately, a Life Insurance policy is a legally binding contract. It doesn’t care about feelings. It has timelines, fine print, and options that matter. When the term ends, you usually face two choices:

- Renew: Keep the same Term Life Insurance Policy, but now with higher premiums. Age and health status drive the numbers.

- Convert: Skip the new medical exam, switch into a permanent policy like Whole Life Insurance or universal Life Insurance, and secure lifelong protection.

Both mean continued coverage. One ends again down the road. The other gives long-term benefits.

Medical Exam Anxiety

Let’s be honest. No one enjoys a medical exam. The criminal side of the video illustrates why, for many people, it can be the insurance equivalent of a wall. So, a fresh physical exam after 15 years of aging? That can be brutal. Elevated blood pressure, diabetes, increased weight — reality strikes.

Life Insurance conversion is like a life preserver. In most cases, most companies will let you skip the exam when you convert your term. The same coverage, but in the form of a permanent policy. For families affected by a health curveball, this is the lifeline.

Converting Your Term Policy Isn’t Complicated

The idea of converting your Term Policy sounds like a big leap. But in practice? Often, it is a straightforward process. The insurance provider sets a window — usually before the term ends. You sign papers, pick between whole life or universal life, and you’re set.

Why do people do it?

- They want lifelong coverage.

- They like the idea of cash value growth.

- They see the need to cover estate taxes.

- They don’t want a new medical exam because their current health status isn’t great.

It’s not just paperwork. It’s a mindset shift. From “temporary coverage” to “I’m locking in stability for the rest of my life.”

Lifetime Coverage Hits Different

There is something different about lifetime coverage. No scrambling every decade. Gone are the late-night Google searches for a Term Life Insurance Quote Online, quoting jaw-dropping numbers. In fact, a Life Insurance company ensures a death benefit while quietly accumulating cash value under the surface.

And that’s what gives the people peace of mind. Parents can trust that their kids will have support if they need income replacement. Heirs will no longer have to sell property just to pay taxes, retirees point out. Husbands and wives know there is a plan in place, not just hope.

Life Insurance Conversion In Plain Language

Let’s strip it down. Life Insurance conversion means:

- The current term life policy is about to expire.

- Instead of facing higher premiums, roll into a Permanent Life Insurance Policy.

- No new medical exam.

- Start building a cash value component.

- Guarantee a death benefit for the future.

It’s taking something temporary and making it permanent. Simple as that.

The Ugly Side Of Term Life Renewals

Here’s what nobody tells you. The renewal process for Life Insurance term is extremely harsh. The rates don’t just inch up — they pop. Sometimes double, sometimes triple. Families regularly bring in renewal letters to the Canadian LIC, and the horror is on their faces.

Insurance companies aren’t being cruel. They’re calculating risk. Increased age, worse health status, and a greater probability of receiving a payout. That’s why renewal is so costly.” Which is precisely why so many Canadians begin to wonder about converting to Term life instead.

Different Life Insurance Options Work For Different People

Not everyone needs the same path. Canadian LIC has seen families go both ways:

- Renewal works if you only need short-term insurance coverage while raising children or paying down debts.

- Conversion makes sense if you’re focused on financial goals, want cash value benefits, and need lifelong coverage.

- Sometimes both happen. Renew part of the term insurance and convert only a portion. Balance affordability with long-term benefits.

There isn’t one correct answer. It depends on your financial situation and what future protection actually looks like for you.

Life Insurance Offers Keep Changing

Insurance markets don’t stand still. RBC Life Insurance and others update their products and design Life Insurance offerings for individuals who need to convert their Term Policy. Some refine Universal Life Policies for better cash value growth; others reinvent whole life for stability.

This is not about chasing shiny deals. It ensures that whatever choice is made helps meet today’s and tomorrow’s needs.

Converting Term Life Builds More Than Protection

Here’s the thing. When families decide to convert Term Life, they aren’t just purchasing insurance. They’re building a financial resource.

That expanding policy’s cash isn’t simply a number. It’s a backup for retirement. It’s the funds to help heirs pay taxes without selling the family farm. It’s flexibility. And for many families, that flexibility can be worth more than anything.

Picking The Right Insurance Provider

The right insurance provider matters. Compare plans across companies, you pull quotes, and you figure out the dirty details. Life Insurance is not one size fits all. What’s going to work for a family that’s heavily financially obligated is not necessarily going to work for a family that’s nearly financially independent.

That’s why guidance matters. Without it, people are likely to pay for the wrong type of coverage — too much, too little, or simply mismatched with their financial objectives.

Renewing vs. Converting Your Term Life Policy

Final Thoughts

So here’s the bottom line. Renewing or converting your term isn’t just paperwork. It’s about deciding how much financial protection you want for your family.

Renewals make the lights stay on, but renewals are stuck with pricier premiums and another deadline. Conversions are more expensive upfront, but they ensure coverage to the end, growth of cash value, and a death benefit that cannot be taxed and remains in effect.

The smartest move? Don’t wait for that renewal notice to arrive in your mailbox. Narrow down your options early on, take a glance at the numbers, and then pick out what aligns with your budget. Whether that’s deciding how Whole Life Insurance works for a short renewal term, or about converting Term Life Insurance to Whole Life Insurance, the decision we make today will somehow impact our tomorrow.

FAQs

When a Permanent Life Insurance Policy ends early, the built-up cash value doesn’t disappear. Families usually get a payout, known as the surrender value. That pool reflects the growth earned through tax-deferred growth and past Life Insurance premiums. It won’t equal the full benefit, but it acts as a backup fund.

Yes. Some families keep a small Term Life Insurance Policy for short-term needs and add other insurance coverage for stability. This could mean layering with Whole Life Insurance or even a Universal Life contract. The mix creates protection for financial responsibilities without losing flexibility.

Choosing to convert Term Life Insurance to Whole Life Insurance can prepare heirs for estate costs. A guaranteed death benefit provides liquidity when taxes or debts must be handled quickly. It prevents the need to sell assets. For many households, this step secures both legacy and financial security.

An insurance provider often stresses early action because it protects eligibility. Once a Life Insurance term ends, a new medical exam could be required for a new Life Insurance policy. Conversion sidesteps that risk, locking in lifetime coverage while health remains unpredictable.

Some Term Life Insurance Policies let you convert only a portion. This means part becomes a permanent policy, while the rest stays term. It’s a way to control costs, keep insurance coverage affordable, and still begin building cash value growth.

For a Term Insurance renewal, health status doesn’t usually matter because rates are based mainly on age. But if you apply for a new Life Insurance Policy, your current health comes into play. That’s why Life Insurance conversion is attractive — it avoids fresh medical hurdles.

A Whole Life Insurance Policy isn’t just about protection. It builds cash value accumulation that grows steadily over decades. Families use it to back up retirement income, support financial goals, or even provide a cushion for future financial obligations.

When a Term Life contract ends, higher premiums often jump much more than expected. The Life Insurance company adjusts based on age and risk. That’s why families feel blindsided and start comparing a Term Life Insurance Quote Online against options like conversion.

Yes. Universal Life Insurance can be chosen instead of converting term life into whole life. It still offers Permanent Coverage, but adds flexibility to adjust Life Insurance premiums and grow cash value benefits. For some, this flexibility fits better into a changing financial plan.

Key Takeaways

- Term Life Insurance renewal keeps coverage active, but premiums rise steeply with age and can overwhelm budgets.

- Converting your Term Policy into a Permanent Life Insurance Policy locks in lifetime coverage, avoids a new medical exam, and adds a cash value component.

- Life Insurance conversion turns temporary protection into a tool for financial goals, tax-deferred growth, and financial security for family needs.

- Whole Life Insurance or universal Life Insurance options provide a guaranteed death benefit, flexibility, and long-term benefits compared to repeating renewals.

- Working with the right insurance provider ensures the decision—renewal or conversion—matches both short-term needs and future financial responsibilities.

Sources and Further Reading

- “Term and Whole Life Insurance: Which Is Better?” — The Times

This recent UK-based article breaks down the pros and cons of term versus Whole Life Insurance, including decreasing term and investment-linked options. It’s a quick, practical read to help you understand how permanent coverage works in legacy and planning contexts.

MyChoice+11The Times+11canadianlic.com+11 - Convertible Insurance: Meaning, Pros and Cons, Example — Investopedia

A clear explainer of what convertible Term Life Insurance entails, including its benefits like avoiding medical requalification and ensuring long-term coverage, along with cost considerations and examples.

Investopedia+4Investopedia+4canadianlic.com+4 - What Happens If You Outlive Your Term Life Insurance Policy? — Investopedia

Walks through real options when a Term Policy expires—renewing, converting, or getting new coverage—plus tips on planning ahead to avoid gaps in protection.

canadianlic.com+15Investopedia+15canadianlic.com+15Investopedia - Your Life Insurance Might Expire Before You Do. Here’s How to Fill the Gap — Investopedia

Details on partial conversions, what to do if financial or coverage needs change, and the importance of acting before the policy ends.

Investopedia - Term vs. Whole Life Insurance: What’s the Difference? — Investopedia

A timeless, well-rounded comparison emphasizing how term life offers affordable, temporary coverage, while whole life provides lifelong protection and builds cash value.

canadianlic.com+15Investopedia+15meetfabric.com+15 - Term vs. Permanent Life Insurance – Should You Convert? — CWB Wealth

Even though published in 2021, this Canadian-specific article explains how conversion to permanent policies may or may not include cash value and highlights scenarios like premium suspension possibilities.

Canada Life+4cwbwealth.com+4Canada Life+4

Feedback Questionnaire:

IN THIS ARTICLE

- Renewing Vs. Converting Your Term Life Policy: A Simple Guide To Protecting Your Future

- Permanent Life Insurance Isn’t As Complicated As It Sounds

- Every Life Insurance Policy Has Rules

- Medical Exam Anxiety

- Converting Your Term Policy Isn’t Complicated

- Lifetime Coverage Hits Different

- Life Insurance Conversion In Plain Language

- The Ugly Side Of Term Life Renewals

- Different Life Insurance Options Work For Different People

- Life Insurance Offers Keep Changing

- Converting Term Life Builds More Than Protection

- Picking The Right Insurance Provider

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP