- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

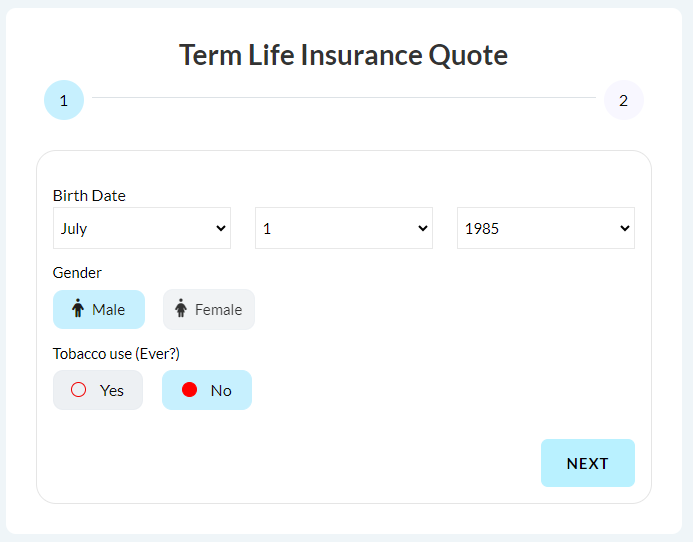

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How To Pay Off Your Mortgage Faster?

By Harpreet Puri

CEO & Founder

- 11 min read

- February 05th, 2026

SUMMARY

Canadians can pay off their mortgage faster through smart strategies like lump sum payments, accelerated payment schedules, and prepayment privileges. The article explains how adjusting payment amounts, reviewing the mortgage term, and choosing the right Mortgage Insurance Canada plan with affordable premiums and policy coverage can reduce interest costs and protect families from financial uncertainty.

Introduction

Understanding The Urge To Become Mortgage-Free

Owning a home in Canada has always been associated with financial stability, and a rapid increase in mortgage would not change the belief. However, inflation and rising interest rates have resulted in larger mortgage payments, burdening thousands of families. The Bank of Canada claimed that the average mortgage balance had recently exceeded $360,000 due to a nominal high. 35% of borrowers are concerned about being able to afford their debt. This prompted even more homeowners to look for ways to pay off their mortgage sooner without compromising other objectives.

Canadian LIC, a nationally recognized brokerage that helps Canadians design insurance and financial solutions, regularly guides clients through mortgage-related decisions. Whether comparing a mortgage insurance Canada option, planning a lump sum payment, or restructuring a payment schedule, homeowners often find that even small changes can cut years off their amortization period.

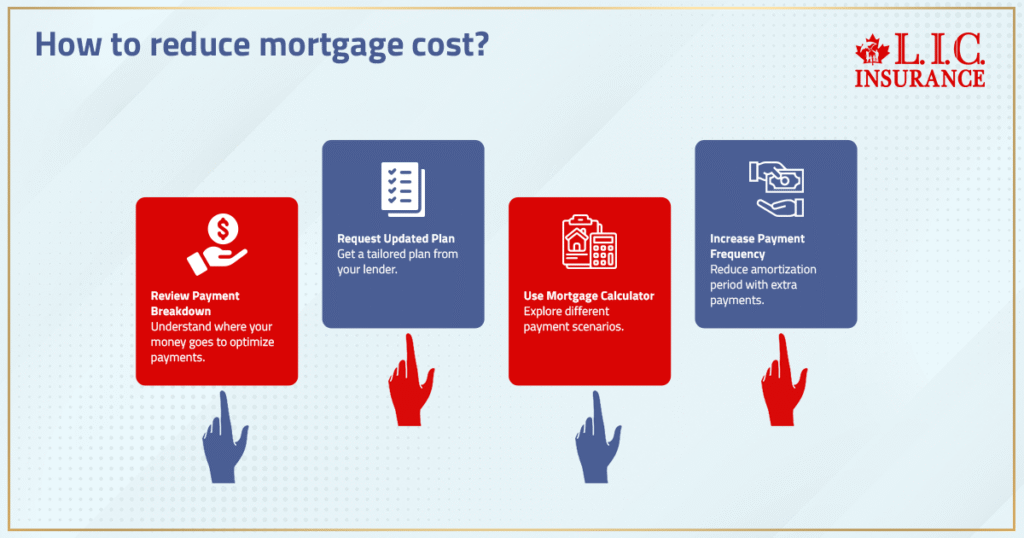

Mortgage Payments: Your Starting Point

Every path to life without a mortgage starts by reviewing the breakdown of your mortgage payment. The principal and interest. Initially, much more of it goes to interest since the principal amount is still large. As time passes, the ratio reverses, and more of your monthly spend goes to repaying your mortgage. Homeowners may ask their lender for an updated mortgage payment plan, or they may use a mortgage calculator to determine how changing the payment frequency or payment amount affects the total mortgage cost. That framework will allow you to see how even just one extra monthly wage cut into your yearly payments reduces the amortization period by many years.

Lump Sum Payment Strategies That Make A Difference

When it comes to paying off the mortgage with term insurance, a lump-sum prepayment on the mortgage principal is one of the strongest steps you could have taken. According to CMHC, 42% of borrowers who reported using annual bonuses or income tax refunds as a lump-sum payment saved $10,000 to $25,000 in interest payments. Most Canadian lenders allow annual prepayments, which can range between 10% and 25% of your remaining balance. If you have a $220,000 balance and a 15% annual prepayment allowance, you could pay an extra $33,000 without penalty. However, even a one-time $5,000 payment could cut months off your mortgage term and save you tens of thousands in interest. Our advisors frequently tell their customers to “make a lump sum of the nearest thousand.” This practice helps clean up your numbers and saves money with less money in play, powered by lower interest rates in the long run.

Accelerated Payments To Shorten Your Amortization Period

If you want a more regular approach with less impact than sporadic large payments, you can opt for an accelerated payment schedule. Instead of one regular payment a month, you divide it into half and make it every two weeks, resulting in 26 half-payments a year. This extra half-payment results in one additional monthly payment a year and significantly accelerates the payoff. For instance, a homeowner with a C$400,000 mortgage at a 5.5% rate on a 25-year term will save over $40,000 in interest payments on an accelerated biweekly payment schedule. It shrinks the amortization period to just 21 years. However, Canadian LIC points out to its client that sometimes, a lender may give variations of the accelerated schedule–accelerated weekly, semi-monthly, or bi-weekly payments–impacting cash flow differently. They encourage reviewing one’s financial situation beforehand to make sure that an accelerated payment schedule will be easier on your budget.

Prepayment Options And How They Work

Most lenders provide prepayment options that let you go beyond minimum regular payments without penalty. These additional payments directly reduce your principal amount, lowering future interest payments.

Common features include:

- Annual prepayment privileges (10–25%)

- Increase-your-payment option (up to 15% extra per regular payment)

- Double-up payments (some closed mortgages permit this once per year)

Before you take advantage, confirm the fine print in your mortgage agreement. Exceeding limits may cause prepayment charges, reducing the benefit. Our specialists emphasize that understanding these clauses protects you from unexpected fees — particularly if you plan to renew your mortgage or make a lump sum payment after selling an asset.

Prepayment Privileges You Should Leverage

Your prepayment privileges are essentially your permission slip to pay down debt faster. These differ across lenders and loan products.

If your mortgage contract includes generous prepayment privileges, use them strategically:

- Apply extra cash from a bonus, inheritance, or side income.

- Target a specific calendar year for annual prepayment charges allowances.

- Always verify the exact amount permitted under your mortgage contract.

Our Mortgage Insurance experts advise reviewing prepayment privileges before renewing or refinancing a closed mortgage, since newer contracts sometimes adjust or reduce them.

Payment Amount And Frequency Adjustments

Even small increases in your payment amounts can make a significant financial difference. For example, a $50 incremental monthly payment on a 25-year loan can shave two years off your amortization period and thousands off your interest bill. Similarly, payment frequency matters. For example, moving to accelerated payments with two additional payments each year converts your payment schedule from a liability to a wealth-generating asset. Most people include their monthly mortgage payment cycle with their payday schedule to simplify budgeting. We frequently recommend regular payment with your income cycle to ensure timely payments without compromising other financial objectives.

Review Your Mortgage Term And Interest Rates

People should also ensure they compare interest rates and look at shorter terms when they have to renew their mortgages. A shorter mortgage term generally comes with a lower interest rate, while also having more significant monthly payments, which will help people become mortgage-free more rapidly. If individuals are stuck in a fixed-rate mortgage, prepayment charges should once more be evaluated before reconsidering. Prepayment charges may be the equivalent of 90 days’ interest, or they can be the interest rate advantage or IRD, more or less often than another interest-rate differential, the fee that is the penalty for three months of interest, or the remaining cost of interest. Lastly, with variable-rate mortgages, they could utilize the reductions with every drop to add to extra monthly installments and never decrease their transaction size. This guarantees the willingness of the principal more rapidly and reduces exposure to additional growth.

Protect Your Home With Mortgage Insurance Canada

Paying off your loan faster is only half the battle — protecting it is just as important. A Mortgage Life Insurance Plan ensures your family isn’t left struggling to cover mortgage payments if you pass unexpectedly or become critically ill.

There are two main protection routes in Canada:

- Mortgage Insurance Policy Coverage From Your Lender

– Premiums are added to your monthly mortgage payment.

– The payout goes to the lender to clear the loan.

– Coverage decreases as the mortgage amount declines, but the Mortgage Insurance premium usually stays the same.

- Independent Mortgage Life Insurance Plan (through brokers like Canadian LIC)

– Flexible coverage that protects your family directly, not the bank.

– The benefit can be used for any purpose — paying off your mortgage, medical expenses, or income replacement.

– Options to bundle with critical illness or disability coverage.

Independent plans tend to offer better value over time and clear ownership of the policy. A qualified advisor can help you compare a Mortgage Insurance quote with a traditional life policy to see which fits your financial goals.

Understanding Mortgage Insurance Premium And Monthly Cost

How much does Mortgage Insurance pay a month? Mortgage Insurance premiums vary with age, health, and loan size. For the majority of borrowers, the Mortgage Insurance monthly cost is approximately an extra $25 to $75 a month. That might not seem to be a significant amount, but in the event of an emergency, the difference could be considerable. In many scenarios, the decision between Mortgage Insurance and a regular Life Insurance Policy comes down to versatility. Regular Life Insurance can be a more economical option over time and offers more comprehensive coverage, but it comes with a lengthy exercise shadow. Lender-issued plans include minimal underwriting and start-up coverage right now. Canadian LIC can help its clients strike a good balance between spending enough money and doing this early enough.

Balancing Paying Off Your Mortgage And Building Home Equity

Aggressively paying off your mortgage is appealing, but it’s wise to balance debt reduction with investment growth. Extra payments build home equity — a form of forced savings — yet may limit liquid extra cash for other opportunities.

We often recommend splitting your tax refund or bonus: half toward a lump sum payment, half into retirement or education plans. This approach keeps your financial situation diversified while still working toward a mortgage-free future.

Avoiding Prepayment Charges And Maximizing Savings

However, you should be wary of one pitfall: a prepayment charge for closed mortgages. The point is, this charge is intended to compensate lenders for lost interest if you repay the loan before the end of the term. Make sure you are familiar with your mortgage agreement. If you plan to make a lump sum payment or sell your property before the end of the term, you need to find out how to do it with minimal penalties. Thus, there is a type of open mortgage that implies full repayment without additional payments at a slightly increased rate. The experts will help you compare open versus closed terms to prevent you from paying for prepayments.

Smart Mortgage Solutions For Changing Times

When the economic landscape changes, it is worth revisiting your mortgage solutions. If the interest decreases, it may be a prime chance to refinance – you will keep up the same payment, continuing to allocate additional money towards your principal. If the interest increases, accelerated payments and a minor lump sum can assist you in retaining your edge over the increase. Our advisors usually go through the client’s mortgage contract to apply custom strategies suited to their salary, expenses, and targets. It allows you to safely lower your debt and ensure your household budget stays healthy.

Essential Insights For Homeowners

- Increase your regular payments or make additional monthly payments whenever possible.

- Use prepayment options and prepayment privileges without exceeding limits.

- Choose an accelerated payment schedule to add one extra installment each year.

- Make strategic lump sum payments from bonuses or refunds.

- Compare your Mortgage Insurance Policy Coverage to ensure protection for your family.

- Seek guidance from licensed advisors before altering your mortgage contract or switching terms.

The Bottom Line

The dream of mortgage freedom can become a reality sooner than many Canadians think. Regular payments, one-off payments from time to time, and the right Mortgage Life Insurance Policy help homeowners save thousands on interest payments over the years and create lasting financial security. While financial markets remain subject to change, trust needs trustworthy partners. For years, we have provided Canadians with the equal support and experience to secure their families while allowing them to morph their mortgage debt into mortgage-free homes.

More on Mortgage Insurance

FAQs

Mortgage Insurance Canada helps borrowers keep their homes safe even if income stops due to illness or death. It covers mortgage payments directly or provides funds to clear the mortgage balance. This protection ensures families don’t lose stability while still working toward their goal to pay off the mortgage faster.

Your Mortgage Insurance premium depends on age, health, loan size, and term length. Higher-risk profiles or longer amortization periods usually increase costs. Reviewing quotes through trusted brokers lets homeowners compare every Mortgage Insurance Policy Coverage before committing.

A Mortgage Life Insurance Plan from an independent advisor offers flexibility the lender’s policy can’t match. The payout goes to your family, not the bank, and can cover lump sum payments or daily living costs. It also keeps protection intact even if you renew your mortgage or change lenders.

Tweaking your payment amount or switching to an accelerated payment schedule builds equity faster. It’s a proven way to make progress without major financial strain. Using mortgage calculators and analyzing regular payments help you measure exactly how these adjustments reduce interest payments over time.

While both secure your loved ones financially, Mortgage Insurance or Life Insurance differ in ownership and flexibility. Mortgage Insurance covers only the home loan; Life Insurance pays a broader benefit for any purpose. Many Canadians combine both for stronger Mortgage Protection and financial goals coverage.

Getting a Mortgage Insurance quote shows how protection fits into your monthly budget. It outlines the Mortgage Insurance monthly cost, coverage options, and renewal terms. Comparing several quotes with professional guidance can ensure your mortgage solutions remain affordable while you aim to become mortgage-free.

Key Takeaways

- Small adjustments such as accelerated payments or even one extra monthly payment each year can significantly reduce your amortization period.

- Making a lump sum payment from bonuses, tax refunds, or inheritance helps lower the mortgage balance and long-term interest payments.

- Reviewing prepayment privileges and prepayment options ensures you can pay off your mortgage faster without facing unexpected prepayment charges.

- Comparing Mortgage Insurance Canada plans, Mortgage Insurance premiums, and Mortgage Life Insurance Plans helps protect your family while maintaining affordability.

- Choosing the right payment amount and payment schedule aligned with your financial situation supports both debt reduction and wealth growth.

- Seeking expert advice allows homeowners to balance their Mortgage Insurance Policy Coverage with effective strategies to become mortgage-free faster.

Sources and Further Reading

Canada Mortgage and Housing Corporation (CMHC) – Official information on mortgage payments, prepayment privileges, and amortization options.

🔗 https://www.cmhc-schl.gc.ca

Bank of Canada – Current data and research on interest rates, inflation, and housing finance trends impacting mortgage affordability.

🔗 https://www.bankofcanada.ca

Financial Consumer Agency of Canada (FCAC) – Government resource explaining mortgage contracts, prepayment charges, and lender insurance options.

🔗 https://www.canada.ca/en/financial-consumer-agency.html

Statistics Canada – National statistics on household debt, homeownership rates, and average mortgage balances across provinces.

🔗 https://www.statcan.gc.ca

Canadian Life and Health Insurance Association (CLHIA) – Educational insights on life, mortgage, and critical illness insurance benefits in Canada.

🔗 https://www.clhia.ca

Financial Post – Mortgage & Real Estate Section – News and expert opinions on Canadian mortgage trends and interest rate impacts.

🔗 https://financialpost.com/real-estate/mortgages

Canadian Bankers Association (CBA) – Guidance on mortgage repayment flexibility, loan types, and consumer protection information.

🔗 https://www.cba.ca

Canadian LIC Official Website – Trusted source for personalized advice, Mortgage Insurance Canada options, and long-term financial planning strategies.

🔗 https://www.canadianlic.com

Feedback Questionnaire:

We’d love to hear from you! Your feedback helps Canadian LIC understand real homeowner challenges and design better mortgage and insurance strategies. Please take a minute to share your thoughts.

Thank you for sharing your thoughts! Your insights help Canadian LIC continue guiding Canadians toward smarter mortgage and insurance solutions.

IN THIS ARTICLE

- How To Pay Off Your Mortgage Faster

- Mortgage Payments: Your Starting Point

- Lump Sum Payment Strategies That Make A Difference

- Accelerated Payments To Shorten Your Amortization Period

- Prepayment Options And How They Work

- Prepayment Privileges You Should Leverage

- Payment Amount And Frequency Adjustments

- Review Your Mortgage Term And Interest Rates

- Protect Your Home With Mortgage Insurance Canada

- Understanding Mortgage Insurance Premium And Monthly Cost

- Balancing Paying Off Your Mortgage And Building Home Equity

- Avoiding Prepayment Charges And Maximizing Savings

- Smart Mortgage Solutions For Changing Times

- Essential Insights For Homeowners

- The Bottom Line

Sign-in to CanadianLIC

Verify OTP