- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How To Continue Your Critical Illness Insurance After Leaving A Job In Canada

By Harpreet Puri

CEO & Founder

- 10 min read

- October 23rd, 2025

SUMMARY

Canadian LIC explains how to continue Critical Illness Insurance after leaving a job in Canada, outlining options for seamless Critical Illness Insurance Coverage, using a Critical Illness Insurance costs calculator to compare premiums, and securing a Critical Illness Insurance Quote Online. The article highlights timelines, personal health insurance choices, and ways to protect finances during employment transitions.

Introduction

You’ve built your career, you’ve earned your employee benefits, and then one day you hand in your notice or your employer hands you a package. Suddenly, the paycheque isn’t the only thing at risk. Your Critical Illness Insurance after leaving a job may be ending, too. We see this every week when people walk into our Brampton office clutching their termination papers, worried about keeping the coverage that once felt automatic.

This guide is from our team’s lived experience helping Canadians preserve their protection. We’ll show you how to continue or replace Critical Illness Insurance Coverage so you’re not left exposed just when life might throw a curveball. We’ll also talk about costs, timelines, and how to get a Critical Illness Insurance Quote Online that fits your new reality.

Why Critical Illness Insurance Matters More Than Ever

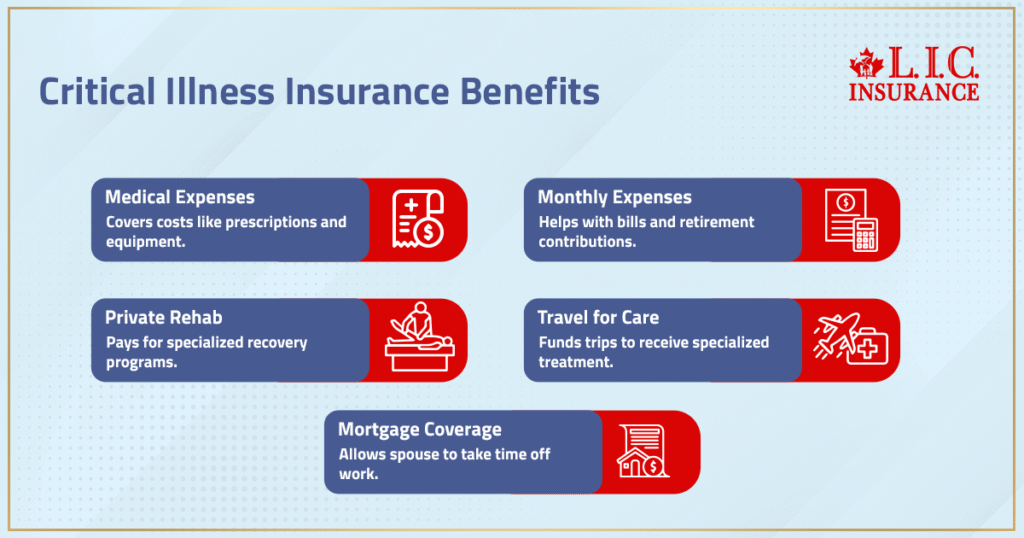

It’s tempting to cut expenses during a transition, but the risk of a serious illness doesn’t take a break just because your job did. A solid Critical Illness Insurance Policy pays a lump sum if you’re diagnosed with a covered condition like a heart attack, stroke, or life-threatening cancer. That lump sum can help with medical expenses, prescription drugs, medical equipment, or even your monthly expenses and retirement savings contributions while you recover.

We’ve watched clients use their Critical Illness benefit to pay for private rehab, travel for specialized care, or simply cover the mortgage so their spouse could take time off work. That’s why keeping some form of Critical Illness Insurance — even if your workplace coverage ends — is one of the smartest moves you can make for financial protection.

Understanding What Happens When Workplace Coverage Ends

Most Canadians first get Critical Illness Insurance through a Group Plan tied to their employer. It’s bundled with Health and Dental Coverage, Disability Insurance, and sometimes life insurance. But once you leave, the workplace benefits and Group Insurance don’t automatically follow you out the door.

Insurers generally give a short notice period — typically 31 days for guaranteed issue life coverage and up to 60 days for other plans — to apply for a conversion or continuation plan. Miss that window, and you may need a full medical exam and health questions to qualify for new coverage. We see too many people assume their health benefits or Provincial Health Plan will take care of everything. In reality, Provincial Coverage or Provincial Health Insurance covers only basic hospital and doctor services, not the lump-sum protection of a Critical Illness Plan.

Your Main Options When Coverage Ends

We break the choices into three pathways. Each one can keep you insured against a covered critical illness while fitting your budget and health status.

1. Conversion Or Continuation Plans

Many insurance providers offer the ability to convert your Group Benefits Coverage into an individual plan without a new medical exam. You may get similar health and dental benefits, Dental Coverage, and even Critical Illness Insurance at retail rates. These plans are for people whose workplace coverage ends but who still want continuity.

The catch: coverage limits can be lower than your group plan, and premiums will be higher because the employer is no longer subsidizing. Still, for clients with pre-existing conditions or recent health issues, this can be a lifesaver because there’s no waiting period or medical underwriting.

2. Personal Health Insurance And Standalone Critical Illness Policies

If you’re healthy and want more flexibility, applying for new Personal Health Insurance or a standalone Critical Illness Policy can be a good move. This lets you choose the coverage amount, optional riders, and add-ons like Dental Insurance, paramedical services, or routine eye exams and contact lenses.

You’ll answer health questions and possibly undergo a medical exam, but the upside is potentially higher Critical Illness Insurance payout limits and the chance to tailor your coverage options. For clients who left a job to start a business, this approach can mesh better with fluctuating income and monthly expenses.

3. Layering Protection With Other Products

We also help clients blend Critical Illness Insurance with other tools like Disability Insurance, Private Health Insurance, or even tapping their workplace pension savings to fund premiums temporarily. It’s about keeping financial stress low while you navigate your next chapter. Sometimes, a modest lump sum benefit combined with a strong retirement savings cushion is all a family needs to weather a covered illness.

Cost Considerations: Using A Critical Illness Insurance Costs Calculator

One question we hear constantly: “How much will this cost me?” The answer depends on your age, health, and coverage level. Using a Critical Illness Insurance costs calculator can give you a rough estimate, but a licensed advisor will refine it to your situation.

We run comparisons across multiple insurance companies so you see the real market. We’ll look at your existing coverage, any new coverage you’re considering, and how much you actually need. For many clients, the sweet spot is enough to cover lost income for a year or two, plus major out-of-pocket expenses like medical bills or medical equipment.

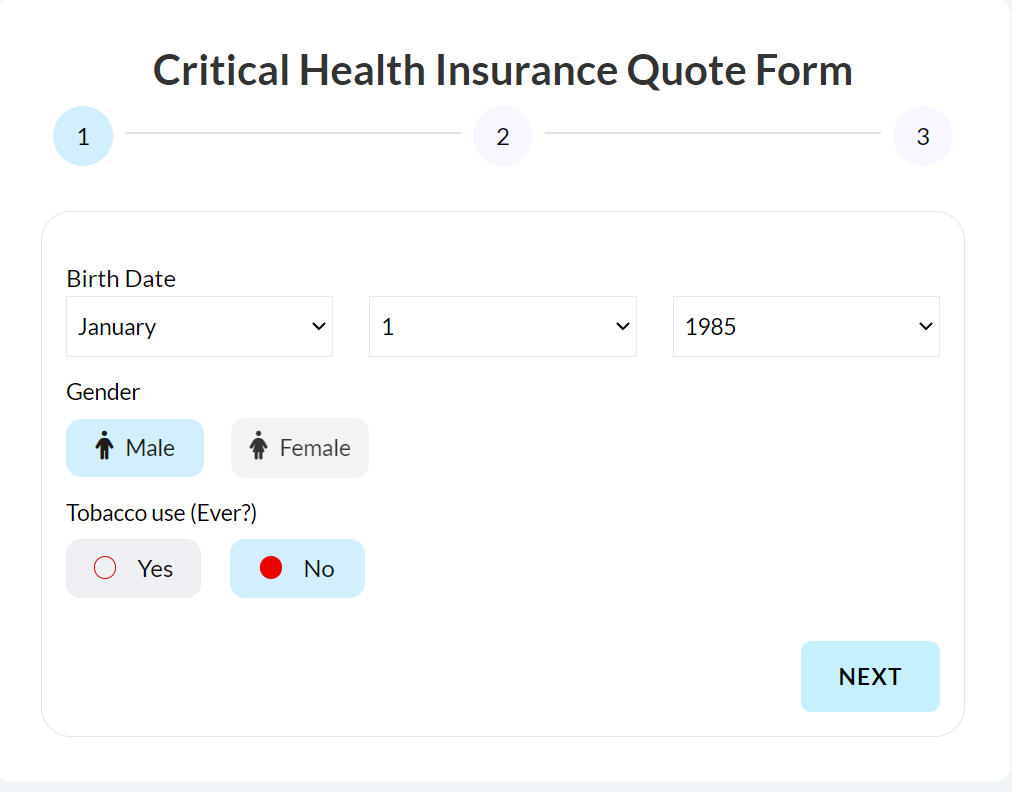

Getting A Critical Illness Insurance Quote Online

Shopping for insurance used to mean endless paper forms. Today, you can start with a Critical Illness Insurance Quote Online, answer a few questions, and then have one of our advisors follow up to refine the details. We’ll explain terms like insured person, coverage ends, individual coverage, individual plan, and coverage options so you know exactly what you’re buying.

Our team also checks how a Critical Illness Insurance Policy interacts with your provincial healthcare and any Group Plan you may still have temporarily. We’ll even estimate how your notice period affects your ability to lock in a Critical Illness Plan without a medical exam.

Timing Is Everything

The single biggest mistake is waiting too long. Once your workplace coverage ends, the clock starts ticking. Those 31- and 60-day windows are real. Apply within them, and you may secure coverage with no medical exam. Miss them and you’re treated as a new applicant — which means underwriting, possible surcharges for health issues, or even decline if you’ve had a heart attack, prostate cancer, or other covered condition.

We had a client who left a job with great employee benefits, assumed his Critical Illness Insurance would roll over, and then suffered a heart attack three months later. Without coverage, he faced massive healthcare costs and dipped into his retirement savings. Don’t let that happen.

How Canadian LIC Helps

We’re not tied to one carrier. We act as your licensed insurance advisor, guiding you through options from multiple insurance providers. We check your group plan booklet, your workplace coverage, and your Personal Coverage, and then design a roadmap that keeps you protected.

Sometimes that means taking a conversion option now and applying for a bigger Critical Illness Policy later, once your new job’s benefits kick in. Sometimes it’s layering a small Critical Illness Plan with Disability Insurance and health and dental benefits to replicate what you had at work. Either way, our goal is to protect you from financial stress while you rebuild.

The Role Of Provincial Coverage And Other Gaps

It’s worth stressing again: provincial health care or provincial coverage is not a substitute for a private Critical Illness Insurance Policy. It won’t pay a lump sum benefit or cover out-of-pocket expenses like travel, experimental treatments, or prescription drugs not on the provincial formulary.

And don’t forget about other gaps. Dental benefits, Dental Plan Coverage, Health and Dental Coverage, and health and dental benefits often disappear with your job, too. We help clients piece together individual coverage so you’re not blindsided by medical expenses or Dental Coverage gaps at the worst time.

Building A Sustainable Plan

Leaving a job can also be a chance to rethink your insurance strategy. Maybe your old employer had a one-size-fits-all Group Plan. Now you can build your own blend of Critical Illness Insurance, Personal Health Insurance, Disability Insurance, and even retirement savings contributions that fit your family’s real needs.

We’ll walk through how much coverage you actually require, how to handle waiting periods, and how to keep premiums affordable even if you’re between jobs. Sometimes that means a temporary Critical Illness Policy with a lower lump sum benefit while you stabilize your income. Other times, it’s locking in a comprehensive Critical Illness Insurance work replacement package right away.

Action Steps For Canadians Leaving A Job

- Act fast. You typically have 31 days for Guaranteed Life and 60 days for other coverages after workplace coverage ends.

- Know your gaps. Provincial Health Insurance does not pay a Critical Illness Insurance payout or cover illness costs.

- Compare smartly. Use a Critical Illness Insurance costs calculator and get a Critical Illness Insurance Quote Online to benchmark, then let a licensed insurance advisor refine it.

- Blend products. Consider combining Critical Illness Insurance, Private Health Insurance, Disability Insurance, and health benefits to mirror your old workplace plan.

- Think long term. Protect your retirement savings, avoid financial stress, and plan for new coverage that grows with you.

Your Next Step

If you’ve just left a job or are about to, this is the time to secure your future. We sit down with you (or meet virtually) to map out your coverage options. We’ll review your insurance policy documents, check your Group Plan, estimate your lump sum benefit needs, and help you transition smoothly.

We know the market. We know the timelines. And we know how to speak to underwriters to get your Critical Illness Insurance approved without unnecessary hurdles. Whether you’re an insured person with pre-existing conditions or someone who’s never bought individual insurance before, we’ll guide you.

Because when your job ends, your health risks don’t. Keeping your Critical Illness Insurance Coverage isn’t just a checkbox — it’s a lifeline. And with the right help, you don’t have to lose it.

More on Critical Illness Insurance

FAQs

Yes. Most insurers permit you to adjust your Critical Illness Insurance after you quit a job with optional riders that include family coverage or higher lump-sum amounts. This can increase your Critical Illness Insurance over and above what a workplace plan provides without having to begin from scratch.

When income fluctuates, a Critical Illness Insurance cost calculator provides a dynamic perspective of costs and benefits for business owners. It also firms up Critical Illness Cover levels to your varying earnings, so that you don’t have to pay a fortune for your safety net as a self-employed person.

Absolutely. When you leave your job, you can also construct a hybrid package combining Critical Illness Insurance with Private Health Insurance or Dental Insurance to cover gaps. This option also ensures you’ll have continuous medical coverage and financial support, even if you go a few weeks or months between group plans.

A handful offer simplified underwriting so you can get a quote for Critical Illness Insurance online, even if you have pre-existing conditions. We weigh these alternative options for each insured and choose the most feasible route to coverage.

You can be vulnerable for a tiny gap. Some insurers will allow you to obtain temporary Critical Illness Insurance Coverage or a limited Critical Illness Policy until long-term protection kicks in, minimizing exposure to uninsured periods.

Yes. A Critical Illness Insurance Policy pays a tax-free lump sum to use for expenses you might incur beyond treatment, such as childcare or travel. That provides you with greater financial protection as you rebuild your income.

No, Provincial health care includes hospital and doctor visits, but not lump-sum payments for a qualifying critical illness. Although last time he won, this time it will be different because you’ll both have insurance to keep your family’s monthly bills and recovery needs in order.

They complement each other. Disability Insurance makes up for lost income monthly, while Critical Illness Insurance, after you leave a job, delivers payment as a lump sum. Having both can help shield retirement savings during the recovery.”

Yes. “Insureds can adjust the waiting period, choose a lower lump-sum benefit, or combine with insured health and dental benefits to help manage costs.” Canadian Critical Illness Life Insurance helps offset the cost of Critical Illness Coverage.

It’s often possible. With a coverable condition such as a history of heart attack or prostate cancer, many insurance companies have guaranteed issue options. We shepherd each individual insured through these two paths of continuation.

Key Takeaways

- Acting quickly after leaving a job in Canada helps you keep Critical Illness Insurance Coverage without new medical underwriting or long waiting periods.

- Using a Critical Illness Insurance costs calculator and getting a Critical Illness Insurance Quote Online gives a clear picture of realistic premiums and benefits before committing.

- Building a flexible mix of Critical Illness Insurance, personal health insurance, and other protections can shield your family from medical expenses and lost income.

- A licensed advisor at Canadian LIC can compare Critical Illness Insurance after leaving a job from multiple providers and design a plan that protects savings and lifestyle during transitions.

Sources and Further Reading

- Government of Canada – Health Coverage Outside Employment

https://www.canada.ca/en/services/health/health-care-system.html

(Explains what provincial health insurance covers and what it doesn’t, helping readers see why private Critical Illness Insurance is important.) - Financial Consumer Agency of Canada – Insurance and Employee Benefits

https://www.canada.ca/en/financial-consumer-agency/services/insurance.html

(Outlines the basics of insurance in Canada, including workplace benefits and individual coverage.) - Canadian Life and Health Insurance Association (CLHIA) – Critical Illness Insurance

https://www.clhia.ca

(Provides consumer information and statistics on Critical Illness Insurance and how it works in Canada.) - Sun Life – Individual Health and Critical Illness Plans

https://www.sunlife.ca/en/insurance/health-insurance/

(Shows an example of individual health and Critical Illness Insurance options available after leaving a group plan.) - Manulife – Critical Illness Insurance

https://www.manulife.ca/personal/insurance/health-insurance/critical-illness.html

(Provides details on stand-alone Critical Illness Insurance and continuation options.) - Ontario Securities Commission – Financial Planning After Job Changes

https://www.getsmarteraboutmoney.ca/plan-manage/job-loss/

(Offers tips on handling benefits and insurance when changing or losing a job.) - Canadian Cancer Society – Financial Assistance and Insurance

https://cancer.ca/en/living-with-cancer/practical-supports/financial-help

(Discusses the role of insurance payouts in managing the costs of serious illness.)

Feedback Questionnaire:

Help Us Improve – Share Your Experience

(We respect your privacy and only use your details to respond to your inquiry.)

IN THIS ARTICLE

- How To Continue Your Critical Illness Insurance After Leaving A Job In Canada

- Why Critical Illness Insurance Matters More Than Ever

- Understanding What Happens When Workplace Coverage Ends

- Your Main Options When Coverage Ends

- Cost Considerations: Using A Critical Illness Insurance Costs Calculator

- Getting A Critical Illness Insurance Quote Online

- Timing Is Everything

- How Canadian LIC Helps

- The Role Of Provincial Coverage And Other Gaps

- Building A Sustainable Plan

- Action Steps For Canadians Leaving A Job

- Your Next Step

Sign-in to CanadianLIC

Verify OTP