- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Expat Vs Immigrant In Canada: How Super Visa Insurance Covers Visiting Family In 2025

By Harpreet Puri

CEO & Founder

- 11 min read

- December 01st 2025

SUMMARY

Understand the difference between an expat and an immigrant in Canada and how each status affects access to a government health insurance plan. It outlines Super Visa Insurance for parents and grandparents, its coverage requirements, rates, and benefits. Key details include medical expenses, emergency medical coverage, pre-existing conditions, and how a proper health insurance plan protects visitors to Canada and their families.

Introduction

Canada is still one of the most sought-after countries to migrate to for a higher standard of living, with safety and more opportunities. More than 500,000 immigrants settled in Canada in 2024 — an all-time high — while nearly 100,000 temporary residents, such as expats and international workers, chose to make the country their second home for work or study, as per Statistics Canada reports. Families are more spread out across borders than ever before, and that has its own set of challenges when it comes to maintaining contact, securing safety and being financially protected.

We commonly find clients who come and say, “My parents want to stay with us for a year, but they’re concerned about health costs.” It’s a common question — and one that frequently leads to confusion between expats and immigrants. Both groups reside outside their own country, and vary markedly in legal status, access to government health insurance programs, and health insurance coverage.

It’s more than just terminology when it comes to knowing the difference between an expat and immigrant: It can influence your eligibility for medical coverage, what type of Super Visa Insurance you’ll need and how much you’ll be paying in Super Visa Insurance rates in Canada.

For family members of Canadian citizens and permanent residents, the Super Visa program makes it possible for parents and grandparents to visit Canada for up to five years at a stretch. But here’s the rub: they have to buy Super Visa Insurance online before arriving in Canada — a private health insurance policy that covers emergency medical expenses, diagnostic services, hospital stays and other costs.

Here, we’ll cover: What is an expat vs. an immigrant? How Super Visa Insurance works. Why getting it through quality Canadian insurance providers is crucial. That way, you won’t have a medical emergency spiral into a financial nightmare… and be forced to sell your home for one more (last) goodbye visit. The registered education savings plan and the registered disability savings plan are both excellent products available in Canada’s financial system. Where the RESP’s goal is to finance education, the RDSP provides long-term security for people living with a disability. All have their own unique tax benefits, subsidies and freedom which can be used to enhance financial results.

Knowing the rules around contribution room, maximizing government incentives and using sound tax strategies can help families and individuals get the most out of these registered savings opportunities in 2025.

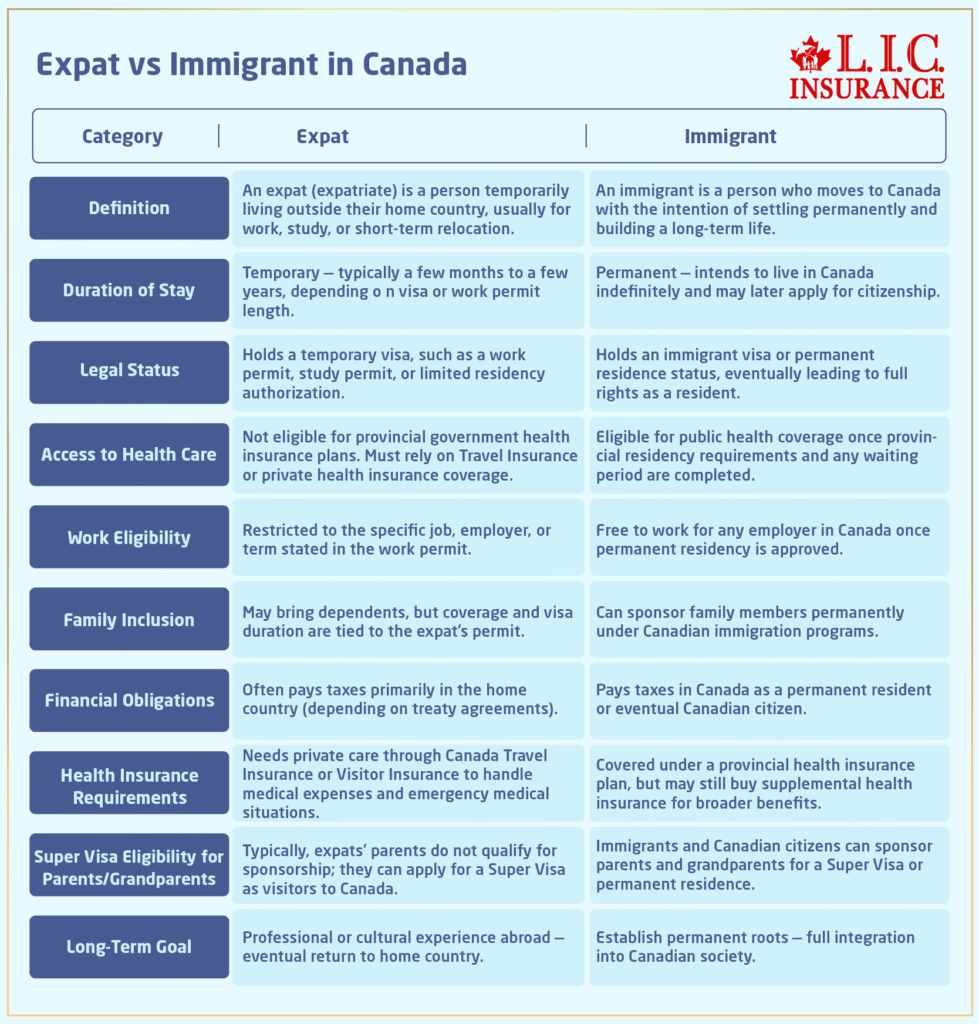

Understanding Expats And Immigrants — What Sets Them Apart?

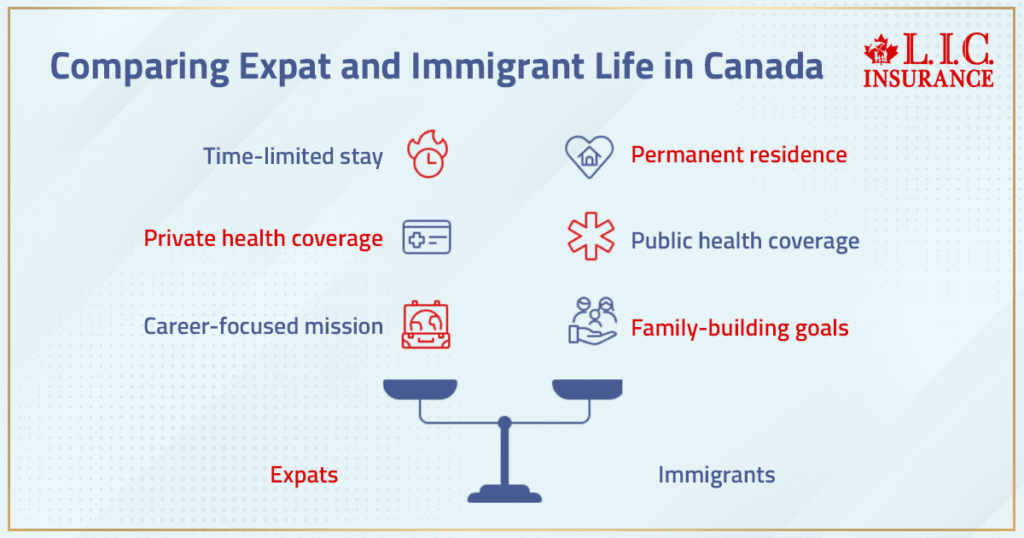

Expat or immigrant? Most people hear expat and think it’s the same as immigrant. Moving countries. Packing up. Starting fresh. Only it’s not so simple, is it?

An expat —short for expatriate —tends to arrive on a mission. Perhaps a project, a stretch term, a career leap. They have one foot home, one foot here. Their stay is time-limited, even if they don’t express it. They discuss flights back, visa expirations, and whatever the next country in line might be. For health stuff: they aren’t normally covered under any government health insurance plans, so they tend to get Travel Insurance, buy private health insurance or use a company plan that covers medical emergencies. The goal? Keep yourself covered without depleting your savings if something goes wrong.

Then you’ve got immigrants. Different mindset entirely. They come to Canada to build something solid. Families who don’t make us give up after two years. They get permanent residence, dream of Canadian citizenship, start paying taxes, enroll kids in school and open accounts. And yes — they are granted public health coverage through their province. But here is what nobody tells you: It doesn’t really kick in right away. There’s frequently a wait, sometimes of several months. For that in-between slot, you’ll still want insurance for travel to Canada or temporary medical coverage.

We see it all the time. People say, “I thought I was covered,” and one day receive a bill for an emergency-room visit or diagnostic tests. It isn’t fun to explain that difference after the fact.

So, something like this: Expats borrow time; immigrants build a life. The one requires flexibility; the other requires permanency. Both need to stay protected.

Legal Status, Residency, And Access To A Government Health Insurance Plan

Status drives access. Canadian citizens and permanent residents are eligible to be covered by a provincial government health insurance plan (OHIP in Ontario, AHCIP in Alberta, MSP for British Columbia, etc.). New permanent residents may wait until a government health insurance plan from Canada becomes effective (3 months in some provinces). In the meantime, private medical coverage is available for Canadian health care and emergency medical expenses.

Public coverage does not extend to parents or grandparents who are in Canada on the Super Visa. As part of the entry requirements for super visa applicants, there is a requirement to have private medical insurance purchased before arriving in Canada with coverage of at least $100,000. It must be valid for no less than 1 year from the date of entry and must cover health care, hospitalization and repatriation. Payment confirmation (Not a quote) will be required.

This is where having a purpose-built visitors to Canada insurance becomes a non-negotiable. It covers emergency medical treatment while in Canada and has the family seeking care if parents are in Canada as visitors.

Super Visa: Insurance Policy Essentials (What IRCC Actually Requires)

From a compliance standpoint, here’s what your insurance policy must include for the super visa:

- Valid 1 year from the date of entry (no gaps or “trip break” at the start).

- Minimum coverage $100,000.

- Coverage for health care, hospitalization, and repatriation.

- Paid (in full or in instalments with a deposit). Quotes aren’t accepted.

IRCC Retention of Super Visa for 10 Years (Bill C-242) The IRCC will retain the longer super visa allowed to stay, which is currently up to five years per entry, with the possibility of multiple entries within a ten-year period. Families can arrange for lengthier visits free of exit-and-re-entry logistics.

As your advisor, we ensure that proof of purchase aligns with the wording used by IRCC, the effective date matches your travel plans, and the covered person (each family member who will travel) is accurately named. Rejected requests are a frequent response that arises due to misaligned dates.

Health Insurance: What’s Typically Covered (And Where Limits Hide)

A Robust Health Insurance Plan for the Super Visa typically covers:

- Emergency medical and emergency treatment

- Physician fees and hospital services (often a semi-private room)

- Diagnostic services (lab tests, X-rays), medical appliances (e.g., crutches)

- Ambulance service and prescription medications during emergencies

- Dental emergencies due to accidental injury (benefit caps apply)

- Repatriation to the home country when medically required

Canadian carriers (e.g., Blue Cross, GMS, others) publicly list these inclusions; policy booklets spell out caps, exclusions, and claim procedures. Always review the wording for waiting period rules, purchased prior conditions, and any per-incident maximums tied to emergency medical expenses.

Pre-Existing Conditions: Stability Rules, Medical Questionnaire, And Eligibility

Coverage for pre-existing medical conditions (or a single medical condition) depends on stability periods and—at certain ages—answers to a medical questionnaire. Many plans:

- Cover pre-existing conditions if stable for a set period (e.g., 90–180 days).

- Impose waiting period clauses if you purchase after arrival (e.g., 2–7 days before illness coverage starts).

- May offer optional riders for pre-existing conditions coverage with specific underwriting.

Sample citations: Blue Cross mentions optional pre-existing coverage limits; GMS quotes waiting period provisions if you purchase in Canada after arriving. We assist you in matching the medical history to the wording so there are no surprises at claim time.

Bottom line: Answer a medical questionnaire honestly, and match the dates to the effective date of coverage, being aware that “stable” as you know it in real life needs to meet reasonable stability in the policy. Stability is a defined term.

Medical Care: How Claims Actually Work (Step-By-Step In A Real Emergency)

If a medical emergency happens:

- Call the toll-free assistance number on the wallet card (24/7). This opens the file and authorizes care, including ambulance service if needed.

- Go to the recommended facility. The assistance team coordinates with the attending physician and the hospital.

- Most providers bill directly. If you pay out-of-pocket, keep itemized bills—diagnostic services, physician fees, pharmacy receipts, and discharge notes.

- Submit forms promptly. If the policy mentions a subsistence allowance for a bedside companion, ask the adjuster how to document it.

Canadian carriers emphasize using their assistance network; it speeds up approvals for emergency medical care and avoids paperwork gaps that can slow reimbursement.

Canada Insurance: Picking The Right Coverage Options (So You Don’t Overpay)

When we calculate Super Visa Insurance for parents and grandparents visiting Canada, several key factors directly impact Super Visa Insurance rates in Canada:

- Age band (older age → higher cost)

- Coverage limit (e.g., $100k vs $250k vs $500k)

- Deductible chosen (higher deductible → lower premium)

- Stability of pre-existing conditions

- Trip length and side trips outside Canada

- Number of dependent children added as covered travellers

We compare coverage options across top Canadian insurance companies, making sure the pricing aligns with the quality of policy wording. It’s important to pay attention to exclusions — such as self-inflicted injury clauses or “external injury only” conditions — because a lower price tag can sometimes hide weaker protection.

Travel Insurance: Side Trips, Trip Breaks, And Country Rules

Most visitors to Canada’s Insurance Plans allow some side trips to other countries (so long as the travel starts and ends in Canada, and most of the time is spent here). Some plans pause Canada-only benefits during the side trip; others continue to provide emergency medical coverage worldwide (emergency-only). Always review the side-trip rule and any trip break (short return home) language before you make your travel plans. For example, Blue Cross allows certain side trips within prescribed limits, while other carriers declare their own guidelines.

From the files of things we’ve learned: Keep itineraries simple. If parents anticipate U.S. shopping weekends or a brief trip to Mexico, let us know in advance so we can put them on one of the Canada Travel Insurance plans that accepts those moves.

Medical Expenses: Realistic Ranges (Why $100,000 Is The Floor, Not The Ceiling)

Why does IRCC ask for a minimum of $100,000 in coverage? Because, as previously noted, Canadian acute care is top-notch—and very costly for uninsured visitors. One heart attack or difficult fracture with surgery, diagnostics and a semi-private room can easily consume five figures rapidly; expect six in multi-day ICU cases. The $100k rule is to be considered a minimum, and you probably notice that not everything fits under the cap, also. We frequently suggest $250k or $500k with parents who are older or who have a history of medical conditions.

For some perspective on the big picture of migration: 2024 saw 483,591 gaining PR status, and temporary residents continued to change demand for private coverage in a significant way—another reason why we encourage taking out policies early during peak seasons.

Emergency Medical Expenses: Common Exclusions You Should Know

Policies typically won’t cover:

- Non-emergency visits or routine check-ups

- Undeclared or unstable pre-existing medical conditions

- Treatment during a waiting period if you purchase after arrival

- Elective procedures or ongoing care beyond stabilization

- Specific exclusions (e.g., self-inflicted injury) are listed in the booklet

Waiting-period rules and after-arrival purchases are frequent sources of claim friction. For instance, some plans waive waiting periods if you purchase insurance before arrival or continue from another Canadian policy; if you buy late, a waiting period for illness (but not injury) can apply.

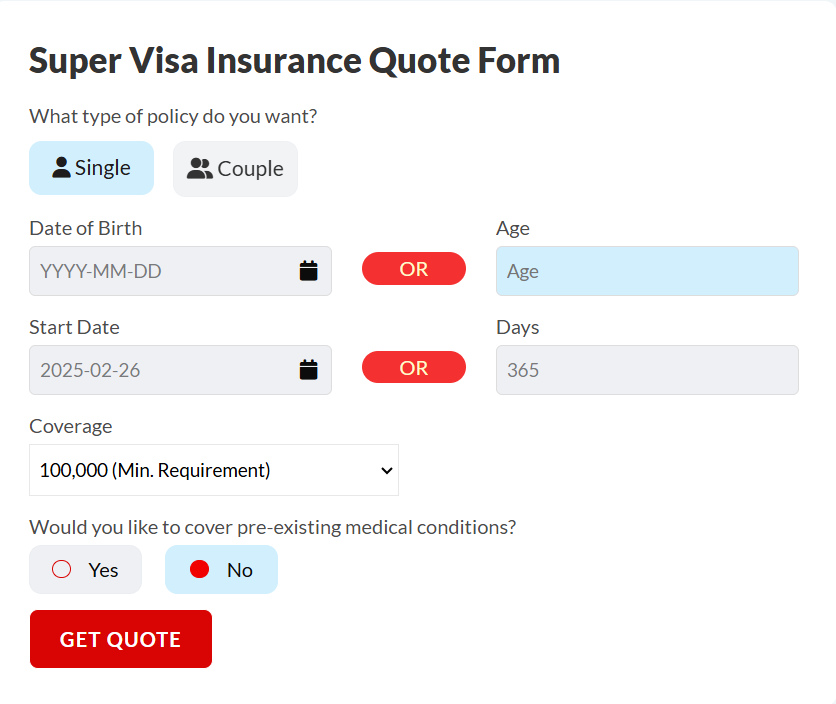

Canada Travel Insurance: Rates, Discounts, And How To Get A Super Visa Insurance Quote Online

To manage cost without weakening protection:

- Choose the right coverage limit (don’t under-insure; think worst-case).

- Use deductibles strategically.

- Confirm pre-existing conditions stability dates with us before you submit any medical questionnaire.

- Align the effective date with arrival in Canada and any side trips.

- Ask us to price multi-month vs 1-year blocks; some carriers price aggressively at the 365-day mark.

We’ll shop major carriers and provide a Super Visa Insurance quote online with side-by-side comparisons (benefits, deductibles, coverage options, stability periods). As brokers, our role is to protect families first and simplify the paperwork.

Blue Cross And Comparable Options: What To Look For Beyond The Brand

Names you recognize—Blue Cross included—offer strong Visitor Insurance benefits. But policies evolve. Look beyond the logo:

- Stability definitions for pre-existing conditions

- Clarity on emergency medical benefits and maximums

- Side trips, allowances, and trip break rules

- Prescription medications and dental emergencies caps

- How ambulance service and medical appliances are handled

- Assistance network quality (real-time case management matters)

Example: public pages outline Blue Cross side-trip parameters and emergency benefits; GMS discloses waiting period mechanics if purchased after arrival. We’ll translate these into plain English before you pay.

Health Insurance Plan: Putting It All Together For Parents And Grandparents

Here’s our standard checklist when we place Super Visa Insurance for parent and grandparent visitors:

- Confirm legal status and travel window; position the effective date to match flights.

- Select a Health Insurance Plan that meets IRCC’s insurance policy rules (1-year validity, minimum coverage $100,000, hospitalization + repatriation).

- Address pre-existing conditions via stability review; if a medical questionnaire is required, we go line-by-line together.

- Decide on coverage limits and a deductible, mindful of potential emergency medical expenses.

- Add riders if needed (e.g., coverage during side trips).

- Issue proof of purchase (paid policy, not a quote) for the visa file.

When families rely on us for this process, we align visas, Travel Insurance, and real-world risk—so parents focus on time with loved ones, not paperwork.

Final Guidance From Canadian LIC

This is not just a checkbox tick for IRCC. It’s about ensuring that parents and grandparents are protected the moment they touch down. Give us the age, travel date and any pre-existing conditions that you may know. We will take care of the wording, medical questionnaire (if required), a quote for clean Super Visa Insurance online and an evidence-backed insurance policy – designed for real emergencies, not just paperwork.

FAQs

As they have longer terms of stay in mind—up to 5 years per entry—the design of a Super Visa Insurance is different from the regular Visitors to Canada insurance, the latter typically only covers you for 6-12 months. Super Visa Policies need to have higher minimum coverage amounts, be prepaid in full and must extend protection for emergency medical purposes. They’re designed for IRCC requirements, not travel convenience.

Some employers offer limited Private Health Insurance, but coverage rarely equals a provincial Health Insurance Plan. It might exclude pre-existing conditions or stop once a work contract ends. Expats often add Canada Travel Insurance for consistent protection against gaps in medical care between jobs or permit renewals.

The majority of Canadian insurance companies offer just partial emergency medical coverage for side trips to other countries, as long as the trip begins and ends in Canada. But benefit limits shrink fast. Remember to check the coverage warm-up in your insurance policy — and call now on the toll-free assistance line before seeking treatment overseas.

They’re only covered when tied to a treated medical emergency. When a physician writes prescriptions for short-term drugs, during hospital confinement or diagnostic services, the insurer pays covered expenses. Routine refills or long-term therapies do not apply — such are not covered under emergency definitions in most health insurance plans.

Super Visa Insurance, if purchased online in advance, locks you into current pricing and eliminates the post-arrival waiting period that may hold up emergency medical coverage. It also provides proof of purchase at the border in order to be able to meet Super Visa Insurance requirements. Early purchase buys peace of mind — and compliance — from Day One in Canada.

Key Takeaways

- Expats live in Canada temporarily for work or study, while immigrants move permanently to gain residency and long-term access to public health coverage.

- Super Visa Insurance for parents and grandparents is mandatory for up to five-year stays and must include at least $100,000 in emergency medical coverage.

- Visitors to Canada are not eligible for provincial government health insurance plans, making private health insurance essential from the date of arrival.

- Policies cover medical expenses, hospitalization, diagnostic services, and emergency medical treatment, but exclusions may apply for unstable pre-existing conditions.

- Buying a Super Visa Insurance policy early—before arrival—ensures compliance with IRCC rules, removes waiting periods, and protects families from high medical care costs.

- Reputable providers like Blue Cross and GMS offer coverage options with varying Super Visa Insurance rates in Canada, deductible choices, and side-trip benefits.

- Canadian LIC helps families compare Super Visa Insurance quote online options, match coverage to IRCC standards, and secure reliable protection for visiting loved ones.

Sources and Further Reading

Immigration, Refugees and Citizenship Canada (IRCC) – Official Super Visa Insurance requirements, eligibility rules, and application details.

🔗 https://www.canada.ca/en/immigration-refugees-citizenship/services/visit-canada/super-visa.htm

Statistics Canada (StatCan) – Latest data on immigration, population growth, and permanent residency trends in 2024–2025.

🔗 https://www.statcan.gc.ca/

Government of Canada – Provincial Health Coverage Information – Details on waiting periods, public health eligibility, and coverage for new immigrants.

🔗 https://www.canada.ca/en/health-canada/services/health-care-system.html

Blue Cross Canada – Official overview of Visitors to Canada and Super Visa health insurance coverage, including emergency medical benefits.

🔗 https://www.bluecross.ca/travel-insurance/visitors-to-canada

GMS (Group Medical Services) – Comprehensive plan details for Visitors & Immigrants to Canada insurance, including pre-existing conditions and waiting periods.

🔗 https://www.gms.ca/

Canadian Life and Health Insurance Association (CLHIA) – Consumer resources on private health insurance, travel medical coverage, and claims protection.

🔗 https://www.clhia.ca/

CanadaVisa.com – Immigration insights and up-to-date analysis on Super Visa requirements and parental sponsorship programs.

🔗 https://www.canadavisa.com/

Canadian Institute for Health Information (CIHI) – Data on healthcare costs, hospital expenses, and emergency medical care in Canada.

🔗 https://www.cihi.ca/

Feedback Questionnaire:

We’d love to understand your experience better. Please take 2 minutes to share your feedback — it helps us improve future guides and support visitors like you.

IN THIS ARTICLE

- Expat Vs Immigrant In Canada: How Super Visa Insurance Covers Visiting Family In 2025

- Understanding Expats And Immigrants — What Sets Them Apart?

- Legal Status, Residency, And Access To A Government Health Insurance Plan

- Super Visa: Insurance Policy Essentials (What IRCC Actually Requires)

- Health Insurance: What’s Typically Covered (And Where Limits Hide)

- Pre-Existing Conditions: Stability Rules, Medical Questionnaire, And Eligibility

- Medical Care: How Claims Actually Work (Step-By-Step In A Real Emergency)

- Canada Insurance: Picking The Right Coverage Options (So You Don’t Overpay)

- Travel Insurance: Side Trips, Trip Breaks, And Country Rules

- Medical Expenses: Realistic Ranges (Why $100,000 Is The Floor, Not The Ceiling)

- Emergency Medical Expenses: Common Exclusions You Should Know

- Canada Travel Insurance: Rates, Discounts, And How To Get A Super Visa Insurance Quote Online

- Blue Cross And Comparable Options: What To Look For Beyond The Brand

- Health Insurance Plan: Putting It All Together For Parents And Grandparents

- Final Guidance From Canadian LIC

Sign-in to CanadianLIC

Verify OTP