- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Choosing The Right Visitor Insurance Deductible: Pros, Cons, And Smart Tips For Travellers 2025

By Harpreet Puri

CEO & Founder

- 13 min read

- September 19th, 2025

SUMMARY

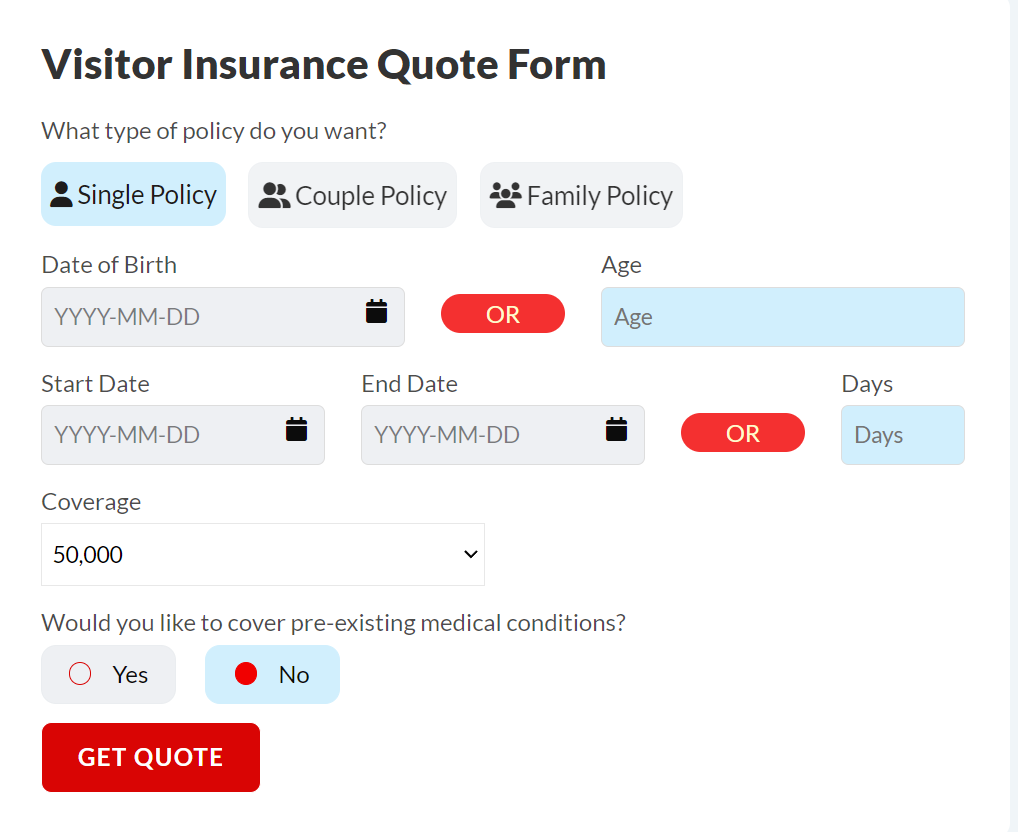

Visitor Insurance Plans in Canada often hinge on the deductible you select, directly shaping Visitor Insurance Costs and coverage. Travellers weighing Visitor Insurance Quotes Online face a trade-off between lower premiums with higher deductibles and stronger protection with smaller deductibles. The discussion highlights how medical expenses, budget, trip length, destination, and family health needs influence choices. Practical travel tips help travellers and parents make informed decisions for a safe travel experience in 2025.

Introduction

Choosing The Right Visitor Insurance

Most people think the deductible is a small line buried in the Visitor Insurance paperwork. I’ve watched it change entire travel experiences. Let me tell you why.

When families call Canadian LIC, the conversation often starts with flight dates, then quickly shifts to costs. “We found a plan for $550, but if we raise the deductible, it drops to $420. Should we?” It’s the same debate over and over. And it matters more than most people realize.

Deductible: Pros

So now let us introduce you to Gurpreet, a 69-year-old man from Punjab. Two Visitor Insurance Quotes Online had already been obtained by his daughter in Brampton. One had a $0 deductible at $640. The other had $1,000 at $470. She leaned across the desk and asked us, “Which one makes sense, Harpreet? Dad’s healthy. He’s never been in a hospital. But what if something happens?”

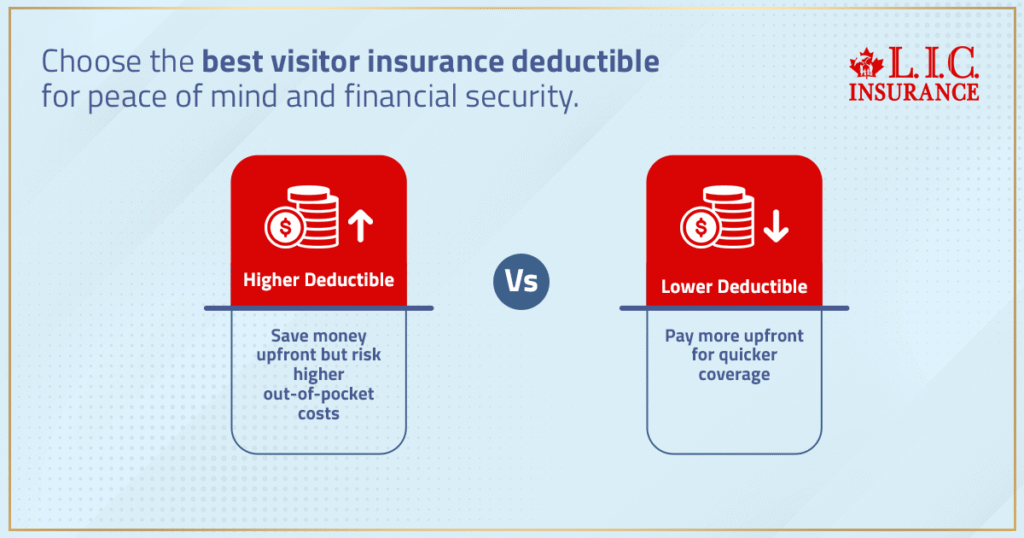

That’s the reality. The higher the deductible, the lower the premium. You save money immediately, which is nice when you’ve already dropped thousands on flights and hotels. But when a medical emergency hits, you have to cover the deductible in cash before coverage kicks in. An ordeal if unprepared.

A lower deductible means you pay more upfront, but the safety net activates quickly. One of our clients, age 72, had a sudden chest pain while visiting relatives in Mississauga. His hospital bill was over $8,000. Because he had chosen the $100 deductible, he paid only that amount. He told me later, “That was the best $50 extra I spent on the premium.”

So, the pros line up like this:

- Higher deductible = lower upfront costs but more risk later.

- Lower deductible = more coverage and less stress when emergencies happen.

Travel Insurance And Real Numbers

Visitor Insurance Plans in Canada are a form of Travel Insurance built for non-residents. Hospitals charge visitors full costs. No discounts. No public coverage.

Take this example:

- A 40-year-old traveller from Europe buys coverage for four weeks.

- With $0 deductible, the premium is around $240.

- With $500 deductible, about $180.

- With $1,000 deductible, it is closer to $150.

Now compare that with an older parent, say age 68, visiting for six months. Premiums jump:

- $0 deductible, about $1,100.

- $500 deductible, around $850.

- $1,000 deductible, $720.

The numbers show the trade-off clearly. You either save money up front or reduce financial risk during the journey. Canadian LIC advisors walk through these comparisons with every family.

Medical Expenses And Coverage

Here’s what travellers often forget: medical expenses in Canada are high. One night in the hospital can cost $3,000 to $4,000. A three-day stay, over $10,000. An MRI alone can cost $1,200.

Without Visitor Insurance, you pay cash. With Visitor Insurance, coverage begins after the deductible. That’s why choosing the deductible carefully is essential.

When you review plans, always check:

- Coverage limits. Ranges from $50,000 to $300,000.

- Deductible options. From $0 up to $5,000.

- Free extras. Some plans include telemedicine or prescription discounts.

Families buying Visitor Insurance for parents and family usually prefer lower deductibles. The chance of a medical emergency increases with age. Better to pay a little more premium and sleep peacefully than face stress later.

Travel Tips From Canadian LIC

Here are lessons we’ve learned after guiding thousands of travellers:

- Budget check. If paying $1,000 in cash would hurt, avoid high deductibles.

- Age factor. Lower deductibles fit older travellers better.

- Destination cities. Toronto, Vancouver, Calgary—big cities mean bigger hospital bills.

- Trip length. A six-month visit carries a higher risk than a two-week stay.

- Compare multiple Visitor Insurance Quotes Online. Free comparisons reveal how deductibles shift costs.

These travel tips help save money, reduce stress, and protect your health.

Travel Experience Matters

The Visitor Insurance is not mere paperwork. It’s about your travel experience. You’re coming to Canada to visit family, see attractions and have a good time. Hey, you don’t want memories to be ruined by medical bills.

One family brought their parents from India for six months. They chose a $1,000 deductible to cut the cost. There was a $1,000 cash fee when the father had a fall and required hospital care, before his coverage kicked in. They later said they wished they had gone with $100. The few bucks saved on the premium weren’t worth it versus the headache they went through.

A good trip requires tranquillity, not fretting about your bill. Deductible choice determines which side of that line you’re on.

Advice From Canadian LIC

Here’s the advice we repeat:

- Don’t chase the cheapest plan blindly.

- Look beyond premiums. Balance costs and coverage.

- Ask about exclusions, policy details, and free benefits.

- Discuss deductible choice with your family. Everyone should know what to expect if something happens.

We have worked with travellers for over 14 years. Our role is to give advice that keeps your travel safe.

Factors That Determine Deductible Choice

Several factors matter:

- Age: Higher age, lower deductible recommended.

- Health: If medical history is complicated, protect yourself with stronger coverage.

- Budget: Can you pay cash in an emergency? If not, lower deductibles help.

- Trip length: Longer trips mean a greater chance of medical emergencies.

- Destination: Healthcare charges differ by city.

Responsible planning means looking at these factors before buying.

Saving Money Without Losing Coverage

Everyone wants to save money. Nobody wants to lose protection. You can do both.

- Buy early. Purchasing in advance of your flight locks in better rates.

- Compare plans. Always check at least two or three.

- Join family under one plan if possible.

- Select deductibles wisely. A $500 deductible often lowers premiums without leaving you too exposed.

Simple steps like these keep Visitor Insurance Costs manageable while ensuring coverage.

Smart Travel Tips For 2025

Here are practical reminders for 2025:

- Double-check the policy start date matches your flight date.

- Keep passport and insurance details together. Do not forget them at home.

- Contact Canadian LIC if anything happens. We guide travellers through claims.

- Save all receipts and records for faster processing.

- Expect higher premiums as age increases. Don’t delay buying.

These travel tips are essential for travellers who want an enjoyable experience in Canada.

Final Word From Canadian LIC

Deductibles determine how you will pay for your Visitor Insurance. The bigger the deductible, the lower the premiums and the higher the risk. A lower deductible increases premiums, but lowers your stress levels. The right answer can vary depending on your health, your budget, your age and what you hope to get out of your trip.

We’ve assisted thousands of families in the purchase of a Visitor Insurance Canada plan. We link travellers with free quotes, impartial guidance and help if things do go wrong. If your parents or other family members are coming to Canada to visit, you have come to the right place. With the right deductible decision, you safeguard your money, your health and your life, and you build memories that matter.

FAQs

Quotes fluctuate because deductibles change the cost and coverage of both Visitor Insurance policies. With larger premiums, a higher deductible may be set in order to lower the cost, but with smaller ones, a lower deductible might add the needed protection. Putting quotes alongside each other online allows travellers to line up real numbers. It makes the decision clearer before the bikepacking trip starts.

Emergencies don’t tend to wait, and visitors to Canada pay the full shot for any treatment. Considering medical emergencies when choosing your deductible means never having to scramble for cash as the orderlies cheer you into an ambulance. A well-thought-out plan readies travellers for the unexpected.

Yes, because the second number can impact how smooth an emergency feels. Lower deductibles mean less stress and more time to focus on family, attractions and fun. Higher deductibles save money but carry more risk. The right balance ensures a safe and pleasant journey.

Budget sets the limits. Lean toward lower deductibles if a fat deductible is going to be a strain on your budget. Travellers must weigh premiums, health risks and the length of their trip against how much they are willing to pay. Responsible planning reduces stress later.

Yes, families typically select lower deductibles for parents because advanced age is associated with greater health risk. This limits the cost to out-of-pocket emergencies. Visitor Insurance Plans in Canada provide a range of deductible levels to allow families to tailor them to their budget and health.

Aging leads to more medical emergencies that parents must contend with. Lower deductible in Visitor Insurance for parents and family translates to lower cash stress in times of protection need. In Canada, your policy allows you to customize deductibles based on your comfort level. The right choices promote health and the budget.

Plans vary not only in premium, but also in what protection looks and feels like when an emergency hits. “When people can compare options, they can see things like how the deductible impacts their Visitor Insurance Costs and coverage,” Rodrigues said. This comparison should be done before you book. It helps make informed decisions.

Yes, a lower deductible is linked to earlier insurance coverage. Travellers who have lower deductibles are less concerned about having to pay cash upfront when they visit, say, a hospital. In Canada, with its high costs, that speed is crucial. This makes the travel experience safer and less traumatizing.

Many online quotes will let you adjust your level of deductible at the same time. “The individual traveller will be able to see how premiums change and what his or her coverage looks like,” they wrote. This tool exposes the trade-off. It saves you money without the exposure to risk you actually need.

Deductibles determine the extent of financial risk a person will bear during a trip. They are directly linked to the budget, health and the safety of the family. A judicious choice reduces stress when something goes wrong abroad. Canadian LIC recommends balancing savings with solid coverage.

Key Takeaways

- Deductibles directly affect Visitor Insurance Costs and coverage in Canada. Higher deductibles lower premiums, but increase financial risk.

- Parents and older travellers benefit from lower deductibles, as medical expenses from emergencies can be high.

- Budget, age, trip length, and destination are the main factors that shape deductible choice for visitors and family members.

- Visitor Insurance Quotes Online allows travellers to compare plans quickly, showing how different deductible levels change premiums.

- Responsible planning means balancing savings with protection so travellers can focus on their travel experience instead of hospital bills.

Sources and Further Reading

Government and Official Resources

- Government of Canada – Visitors to Canada Insurance Requirements

https://www.canada.ca/en/immigration-refugees-citizenship/services/visit-canada/insurance.html

(Explains why visitors are not covered by provincial health insurance and need private Visitor Insurance.) - Ontario Ministry of Health – Health Care for Visitors

https://www.health.gov.on.ca/en/public/publications/ohip/ohip_visitors.aspx

(Details on how visitors to Ontario must pay for medical care, reinforcing why coverage matters.)

Insurance Providers and Associations

- Manulife – Visitors to Canada Emergency Medical Insurance

https://www.manulife.ca/personal/insurance/health-insurance/visitors-to-canada.html

(Plan details, deductible options, and emergency coverage limits directly from a leading provider.) - Sun Life Financial – Health Coverage for Visitors

https://www.sunlife.ca/en/insurance/health-insurance/visitors-to-canada-insurance/

(Information on Visitor Insurance options, plan features, and deductible choices.) - Allianz Global Assistance – Visitors to Canada

https://www.allianz-assistance.ca/en_CA/travel-insurance/visitors-to-canada.htm l

(Explains protection for travellers, deductible levels, and examples of medical expenses in Canada.) - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca/

(Industry-level insights on travel and Visitor Insurance, coverage basics, and consumer protection.)

Health Cost References

- Canadian Institute for Health Information (CIHI) – Hospital Cost Data

https://www.cihi.ca/en/hospital-spending

(Provides average costs of hospital stays in Canada, useful to highlight why deductibles matter.)

- Fraser Health – Hospital Services for Non-Residents

https://www.fraserhealth.ca/patients-and-visitors/billing

(Real-world cost ranges for non-residents seeking care in British Columbia.)

Educational and Consumer Guidance

- Insurance Bureau of Canada – Travel Insurance Tips

https://www.ibc.ca/on/insurance/travel

(Gives practical advice to travellers on what to check in policies, including deductibles.) - CIC News – Visitor Insurance for Parents and Family in Canada

https://www.cicnews.com/

(Articles discussing super visa and Visitor Insurance requirements, helpful for context.)

Feedback Questionnaire:

IN THIS ARTICLE

- Choosing The Right Visitor Insurance Deductible: Pros, Cons, And Smart Tips For Travellers 2025

- Deductible: Pros

- Travel Insurance And Real Numbers

- Medical Expenses And Coverage

- Travel Tips From Canadian LIC

- Travel Experience Matters

- Advice From Canadian LIC

- Factors That Determine Deductible Choice

- Saving Money Without Losing Coverage

- Smart Travel Tips For 2025

- Final Word From Canadian LIC

Sign-in to CanadianLIC

Verify OTP