- Best Term Life Insurance Companies in Canada: In-Depth Reviews & Essential Insights (2026)

- What is Term Life Insurance, and Why Does It Matter?

- Key Factors to Consider When Choosing a Term Life Insurance Provider

- List of 11 Best Term Life Insurance Companies in Canada – 2026

- Top Term Life Insurance Providers in Canada: Reviews & Ratings

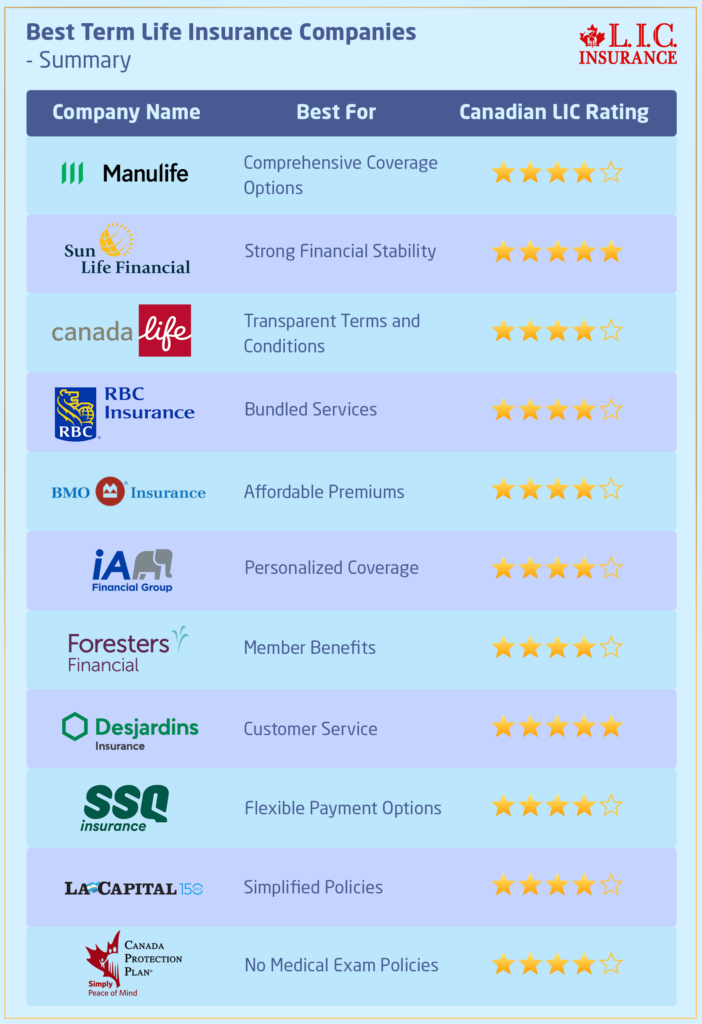

- Best Term Life Insurance Companies- Summary

- Our Client Stories: Making the Right Choice

- The Importance of Getting the Right Term Life Insurance Quotes

- How to Buy Term Life Insurance Online: A Step-by-Step Guide

- Conclusion: Why Canadian LIC is Your Best Bet for Term Life Insurance

SUMMARY

This blog provides a comprehensive guide to the best term life insurance companies in Canada for 2026. It highlights key factors to consider when choosing a provider, including coverage options, premiums, financial stability, and customer service. The blog reviews top companies like Manulife, Sun Life, and Canada Life, offering detailed insights into their offerings. It also emphasizes the importance of comparing quotes and provides guidance on how to select the right policy based on individual needs and preferences.

INTRODUCTION

Most people do not understand the world of term life insurance. In order to protect your family’s future, you have decided to take matters into your own hands and get a term life insurance policy. Just as you start reading up on it, a host of options hits you in the face: which company to entrust your decision with; how you can be sure that you have the best Term Life Insurance in Canada; and then, of course, there’s the endless searching for term life quotes within your budget.

These are the very things most Canadians struggle with daily. At Canadian LIC, we’ve dealt with a lot of people drowning in insurance mumbo-jumbo, unsure of where to turn next. They don’t want just any policy; they want the very Best Term Life Insurance Providers out there who are able to provide protection in times of need, offering peace of mind at a price they can afford. If this sounds familiar, you’re not alone. Keep reading as we talk about the best Term Life Insurance Companies in Canada for 2026, and share in-depth reviews along with key insights to make an informed decision without the headache.

What is Term Life Insurance, and Why Does It Matter?

Key Factors to Consider When Choosing a Term Life Insurance Provider

Although it may sound a little tempting to go with the least premium, there are better ways to select a Term Life Insurance company. The following are some features that you should critically analyze so that you can make the best selection for your unique situation. Often, Canadian LIC helps clients to break down the major areas of differences, which will make things easy for one to decide:

- Amount of Coverage and Term: Consider the amount of coverage you need to purchase and the term length of time it will last. You can purchase a policy to cover everything from your mortgage to your children’s education to your final expenses.

- Premiums: Look at the premiums and how they fall under your budget. Do not forget that the cheapest policy might not be the best.

- Financial Strength of Company: The insurance company’s financial standing is a critical item. You’ll need to make sure the company is around to pay that death benefit when it comes time.

- Customer Services and Claims Processing: The ease of working with the insurer, especially concerning claim processing, may be a world of difference.

- Additional Features and Riders: Most policies come with added benefits in the form of Critical Illness Insurance Coverage or conversion into a Permanent Life Insurance Policy from a term policy.

- (Conversion is typically subject to policy conversion windows and age limits—always confirm the exact contract rules.)

With this in mind, let’s continue our review of the best-Term Life Insurance Companies in Canada for 2026.

List of 11 Best Term Life Insurance Companies in Canada – 2026

- Manulife: Best for Comprehensive Coverage Options

- Sun Life Financial: Best for Strong Financial Stability

- Canada Life: Best for Transparent Terms and Conditions

- RBC Insurance: Best for Bundled Services

- BMO Insurance: Best for Affordable Premiums

- Industrial Alliance (iA Financial Group): Best for Personalized Coverage

- Foresters Financial: Best for Member Benefits

- Desjardins Insurance: Best for Customer Service

- SSQ Insurance: Best for Flexible Payment Options

- La Capitale: Best for Simplified Policies

- Canada Protection Plan: Best for No Medical Exam Policies

Top Term Life Insurance Providers in Canada: Reviews & Ratings

Manulife

Canada’s Best Term Life Insurance for Comprehensive Coverage Options:

For a reason, Manulife stands out as one of the most recognizable names in insurance across Canada. Their Term Life Insurance Policies are designed to be as flexible as your life requires. Manulife can offer a variety of term lengths, from 10- to 20- to 30-to 50-year coverage, to make sure you will be able to find the right fit for your stage in life. They know life changes, so they give you the ability to convert your Term Life Insurance to permanent without you having to take a medical examination. (Conversion is subject to eligibility rules, including deadlines and age limits—confirm your specific policy.) This in itself will attract many who would like to have it for their whole lives but are not ready to commit to permanence from the start.

Manulife also enjoys the benefit of having strong financial stability, which will guarantee that your loved ones actually get death benefits when they need them most. Their Term Life Insurance Quotes are very competitive, more so considering the extent of their available Term Life Insurance options. However, many customers indicate that the premiums can be on the higher side for older people, and if you choose to opt for riders, you will gain extra coverage. Although Manulife’s management tools are not that comprehensive, you’ll never be without guidance since customer support is part of its broad offer.

Pros and Cons of Choosing Manulife

| Pros | Cons |

|---|---|

| Flexible term lengths and coverage options | Premiums can be higher for older individuals |

| Option to convert to permanent insurance | Limited online tools for managing policies |

| Strong financial stability and reputation | Some riders may come with additional costs |

| Competitive Term Life Insurance Quotes |

Sun Life Financial

Canada’s Best Term Life Insurance for Strong Financial Stability:

Sun Life Financial, with Term Life Insurance Policies, has been the most trusted name in Canada for quite some time now, as it has been able to offer reliable and secure policies to meet all the needs of the people. One of the major reasons people go for Sun Life is its high financial stability. This purchase from Sun Life ensures that when Term Life Insurance Policies are bought from them, this company will still be in existence and able to back the policy, ensuring peace of mind for you and your beneficiaries.

Sun Life offers competitive premiums on term insurance, particularly for the healthiest. You can even choose flexible lengths of terms that best suit your financial and personal objectives. Most importantly, Sun Life’s Term Life Insurance Policy is uniquely designed to enable a conversion from a term policy to a permanent one without requiring a medical examination (Conversion is subject to eligibility rules, including deadlines and age limits—confirm your specific policy.).This flexibility is highly appropriate for people who may wish to change to a plan that covers them for life, according to their changing conditions.

While Sun Life might be noted for its easy and transparent application process, premiums tend to increase by large amounts at renewal, which should be factored in if you’re looking for long-term coverage. Another minor disadvantage is that although their term policies are solid, not as many options for customization are available when compared to some other carriers, which can limit the capability to tune the policy to exact needs.

Pros and Cons of Choosing Sun Life Financial

| Pros | Cons |

|---|---|

| Strong financial stability | Premiums may increase significantly upon renewal |

| Option to convert to permanent insurance | Limited customization of term policies |

| Competitive pricing for healthy individuals | |

| Simple and transparent application process |

Canada Life

Canada’s Best Term Life Insurance for Transparent Terms and Conditions:

They are Canada Life, expertly founded providers who take pride in selling Term Life Insurance Policies with very plain and transparent agreement terms. If you prefer no-nonsense insurance policies, then Canada Life can be the company for you. The policies for Term Life Insurance are designed to be simple and without any hidden fees or complicated terms, easily understood; thus, it is easier for a person to know exactly what they are paying for.

Canada Life will offer a host of varied term lengths to select from, thereby giving you coverage that aligns with your financial goals—protection for your family until they are grown or cover for your mortgage up until it’s paid off. In addition, they have become known to have some of the best customer service, with customer representatives always at the helm and ready to clarify any question you might have regarding your policy. It’s in this light that concentrated endeavours on transparency and client support have made Canada Life dear to many who want to shun the typical confusion usually associated with insurance.

While Canada Life’s policies are no-nonsense, they provide fewer options online for policy management compared with some other Term Life Insurance Providers. Furthermore, premiums can be a little higher in some age groups, especially for those a little older or with health-related issues. At the very least, with minor drawbacks like this, Canada Life still proves to be a very sound option for someone who is looking for a Term Life Insurance Policy that is not only reliable but transparent.

Pros and Cons of Choosing Canada Life

| Pros | Cons |

|---|---|

| Transparent terms and conditions | Fewer options for online policy management |

| Wide range of term lengths | Premiums may be higher for certain age groups |

| Excellent customer service | |

| No hidden fees or complicated terms |

RBC Insurance

Canada’s Best Term Life Insurance for Bundled Services:

If one wants to manage their banking and insurance needs seamlessly, then their experience would be par excellence with RBC Insurance. Getting a Term Life Insurance Policy added to your portfolio can be easy and hassle-free if you happen to be an RBC customer. For its part, RBC Insurance has competitively priced a lot of Term Life Insurance Policies that offer flexible coverage to suit the myriad requirements of Canadians.

Probably the greatest benefit RBC Insurance has over many other Term Life Insurance Providers is being able to manage your insurance along with other financial products. It allows you to keep track of all of your finances in one place while at the same time ensuring that your insurance coverage is aligned perfectly with your overall financial plan. RBC also allows easy online access to a variety of features, from getting your Term Life Insurance Quotes and managing your policy to making your payments online.

Though very convenient and competitively priced, RBC Insurance tends to be pricier for people with some health conditions or at a senior’s age. Another possible drawback is that their term policies are not so customizable; therefore, you might not get too much of a tailor-made policy. Even with these drawbacks, RBC Insurance is a strong choice for those who value convenience and want to manage all their financial needs in one place.

Pros and Cons of Choosing RBC Insurance

| Pros | Cons |

|---|---|

| Convenience of bundling banking and insurance | Premiums can be higher for certain health conditions |

| Seamless online experience | Limited customization options |

| Competitive pricing for term policies | |

| Flexible coverage options |

BMO Insurance

Canada’s Best Term Life Insurance for Affordable Premiums:

BMO Insurance provides hassle-free, inexpensive Term Life Insurance Policies designed to help individuals and families on a budget to protect loved ones. Their Term Life Insurance is designed to provide essential coverage at an affordable price to help you take care of your loved ones without compromising your financial stability.

One of the greatest features of BMO Insurance is just how easy and open it is to apply. Apply online or through an advisor—it does not matter; BMO will help make it very easy to know your options and get your coverage quite quickly. For those who love the efficiency brought about by digital tools, there is also an online platform at BMO, whereby getting Term Life Insurance Quotes is easy, management of policies is easy, and the payment of premiums is easy.

However, BMO Insurance’s focus on affordability means that its policies may be less flexible in terms of customization options. You can choose different term lengths, but you have fewer options when it comes to riders and other ways to make the policy really specific to you. Some customers said that the customer service side of BMO was less responsive than some of the other providers. Even with these few shortcomings, BMO Insurance continues to stand in the leading position in providing people who need protection at an affordable price with a truly reasonable Term Life Insurance offer.

Pros and Cons of Choosing BMO Insurance

| Pros | Cons |

|---|---|

| Affordable premiums | Limited flexibility in policy options |

| Simple and clear application process | Customer service can be less responsive |

| User-friendly online toolss | |

| Multiple term lengths available |

Industrial Alliance (iA Financial Group)

Canada’s Best Term Life Insurance for Personalized Coverage:

Industrial Alliance, also known as iA Financial Group, excels in offering personalized Term Life Insurance Policies that can be tailored to meet your unique needs. If you want more than basic risks covered, then iA Financial Group provides a bouquet of riders and additional benefits whereby you can personalize your policy. Whether it is the inclusion of Critical Illness Insurance Coverage or child protection, iA Financial Group can easily tailor-make a policy based on your lifestyle and financial goals.

iA Financial Group is also known for its flexible term lengths and coverage amounts, ensuring that you find a policy that aligns best with your current and future needs. It brings a very personalized way of approaching insurance with the involvement of advisors who take the time to understand your situation and recommend the best possible options for you. This consideration of individuals’ needs makes iA Financial Group one of the top choices if you are looking for a highly customized insurance solution.

However, such a high level of customization and personalization with iA Financial Group does come at a few costs. Their online policy management tools aren’t as robust as some other providers, so you may have to lean on your advisor a bit more in regard to policy changes. In addition, premiums may be a little pricier for several riders, especially if you’re adding on quite a few really extensive coverage options. Despite the factors to the contrary, iA Financial Group remains very competitive for anyone seeking tailored-term Life Insurance.

Pros and Cons of Choosing iA Financial Group

| Pros | Cons |

|---|---|

| Highly customizable policies | Fewer options for online self-service |

| Wide range of riders available | Premiums may be higher for certain riders |

| Flexible term lengths and coverage amounts | |

| Focus on personalized service |

Foresters Financial

Canada’s Best Term Life Insurance for Member Benefits:

Foresters Financial, on the other hand, is a unique Term Life Insurance offering in the sense that its policies offer other benefits to members. From scholarships to community grants to other modes of financial backing, Foresters Financial would be the right answer in case you consider your needs to be anything other than life cover. Their term life assurance premiums are priced for competitiveness and developed with families and community welfare in mind, alongside Foresters Financial’s mission to make a difference.

Foresters Financial provides flexibility at diverse lengths in terms of requirements, as well as coverage options that ensure you get a policy that suits your needs. The other great value in choosing Foresters Financial is the value-added member benefits that are available to provide substantial financial support for your family over and above the regular death benefit. These benefits, without a doubt, make Foresters Financial one of the more attractive options, particularly for families with children or those otherwise engaged with their communities.

Although Foresters Financial has some excellent membership benefits, its online tools for policy handling could be stronger. One cannot easily make policy changes or deal with his or her account online, so that’s possibly a downfall for those looking to handle mostly digitally on a first-instance basis. Additionally, Foresters Financial has less variety in high coverage amounts; this may be insufficient for persons with large financial obligations. However, in spite of this, Foresters Financial is actually a very good insurer to opt for, especially if you want the extra perks that you get with their Term Life Insurance Policies, which focus more on a community effort.

Pros and Cons of Choosing Foresters Financial

| Pros | Cons |

|---|---|

| Additional member benefits like scholarships | Limited online policy management tools |

| Competitive premiums for families | Fewer options for high coverage amounts |

| Community-focused approach | |

| Strong support for policyholders |

Desjardins Insurance

Canada’s Best Term Life Insurance for Customer Service:

It is through exceptional customer service that Desjardins Insurance places itself at the forefront for customers who value personalized support and guidance throughout the journey of insurance. Desjardins offers various Term Life Insurance Policies that are simple and easy to manage and designed to provide the essential protection your loved ones may need. Whether you want to ensure financial protection in the event of an unexpected death for a short period of time or over a longer period, Desjardins has options that will suit your individual needs.

Customer satisfaction is one of the most remarkable things about Desjardins Insurance’s insurance offerings. Its team of advisors is always at hand for queries, advisory work, and even solving complex problems regarding Term Life Insurance. One would say it is very helpful, especially if you are new to this kind of life insurance or have some special concerns related to the coverage.

While Desjardins Insurance is very strong regarding customer service, it offers fewer customization options than some other providers. The policies are created to be very simple and straightforward; this is quite perfect for those seeking a hassle-free experience but pretty limiting for those requiring more tailored coverage. On the other side, while Desjardins offers competitive pricing for individuals in good health, there is a limited array of online tools for policy management; therefore, you may have to rely more on your advisor when making any changes or updating the policy. With those minor drawbacks aside, Desjardins Insurance stands as a robust competitor to those people who really value customer service and easy-to-understand policies.

Pros and Cons of Choosing Desjardins Insurance

| Pros | Cons |

|---|---|

| Exceptional customer service | Fewer customization options |

| Competitive pricing for healthy individuals | Limited online tools for policy management |

| Simple and straightforward policies | |

| Strong financial stability |

Canada Protection Plan

Canada’s Best Term Life Insurance for No Medical Exam Policies:

If you would rather have a simplified application process, then Canada Protection Plan is your best bet; it’s been one of the market-leading specialists in no medical exam requiring Term Life Insurance Policies. Whether you have pre-existing health conditions or simply want to avoid the hassle of medical exams, the Canada Protection Plan offers accessible Term Life Insurance Policies with a variety of term lengths and coverage amounts. Their policies are especially appealing to people who would not qualify for regular insurance for health reasons or want something very quick and easy.

Canada Protection Plan’s Term Life Insurance Policies are designed with a simple view of the terms and conditions; no hidden fees are here. The premiums they offer are competitive, especially when one thinks of the no-medical exam requirement, making Canada Protection Plan policies accessible to a wider range of applicants. A quick and easy application means one can get covered right away without those in-person meetings and tons of paperwork.

Canada Protection Plan does offer a no-medical-exam convenience, but their premiums are often higher than for traditional policies that do have requirements for medical underwriting. (Also, coverage amounts and product features can be more limited than fully underwritten term plans—confirm maximums and eligibility.) Also, their policies have less room for customization since there is the likelihood of fewer riders available for those who want to customize their coverage. That being said, the Canada Protection Plan remains an excellent choice for those seeking no-medical-exam Term Life Insurance Policies with simple coverage.

Pros and Cons of Choosing Canada Protection Plan

| Pros | Cons |

|---|---|

| No medical exam required | Higher premiums compared to traditional policies |

| Accessible to those with health conditions | Limited customization options |

| Wide range of term lengths and coverage amounts | |

| Simple and fast application process |

These reviews and tables should give you a clear understanding of what each Term Life Insurance provider offers and help you make an informed decision based on your specific needs and preferences.

Best Term Life Insurance Companies- Summary

This table provides a quick overview of each company, highlighting what they are best known for and how Canadian LIC rates them.

Our Client Stories: Making the Right Choice

After all, the importance of the right choice of provider of Term Life Insurance is best revealed through the stories of people. Here are two examples where the right life insurance policy made all the difference for our clients:

Story 1: The Young Family in Need of Long-Term Coverage

A young Vancouver couple, John and Sarah, came to us overwhelmed by the vast number of options for Term Life Insurance available. They had just bought a home and were expecting their first child, so they thought a 10-year term policy would be adequate to pay off their mortgage in the event of tragedy. However, we reckoned that a 30-year policy would be more appropriate after making a proper needs analysis, also covering their child’s education and other long-term expenses.

We recommended Manulife’s 30-year term policy for the flexibility and option to change coverage with changing needs. John and Sarah felt relieved that they now had a policy which would protect their growing family for decades to come.

Story 2: Transitioning to Permanent Coverage with Ease

This is Manoj, an entrepreneur from Toronto, 45, who came to us initially for a Sun Life 20-year term policy. His business started to boom, and so did his financial responsibilities. Now, about 10 years into his policy, Manoj has decided he wants to have lifelong coverage to make sure he’s got his estate protected, and his children will have a legacy.

For a rest-of-life plan, Sun Life’s convertible term policy meant that Manoj could move to a Permanent Life Insurance Policy without the need for a medical exam. He would be able to have a seamless move—thanks to a convertible term policy—giving him peace of mind, knowing very well that his long-term goals have been secured.

The Importance of Getting the Right Term Life Insurance Quotes

Probably the most common mistake that people make when buying Term Life Insurance is not comparing the various quotes of providers. We at Canadian LIC can’t stress enough the importance of shopping around. Term Life Insurance Quotes can vary significantly between companies, even for similar coverage amounts.

Imagine that you want to buy a new car. Will you rush and buy the first one which crosses your way without comparing the prices and features? We guess not, right? It is the same with Term Life Insurance Policies—when you compare quotes, you can ensure that you are getting real value for money.

We have many clients who came to us with a quote from another provider that seemed reasonable. When we compare the quotes, we find a policy that gives them better coverage for less premium. These are reasons alone that show why you need to shop around.

How to Buy Term Life Insurance Online: A Step-by-Step Guide

Today, buying Term Life Insurance Online is easier than ever. Many of our clients appreciate the ease of applying for a policy from their very own home. Here is an online application step-by-step guide to walk you through how to apply:

- Research Providers: Research the Best Term Life Insurance Providers in Canada. Look for the best Term Life Insurance Companies in Canada that have a strong financial rating, good customer reviews, and policies that suit your needs.

- Get Quotes: Make use of online tools to get several Term Life Insurance Quotes from different providers. This will give you an idea of what you can expect to pay based on your age, health and sum assured.

- Compare Policies: With your quotes in hand, compare the details of each policy. Review coverage amounts, duration of terms, and any additional features or riders offered.

- Apply Online: Once you have chosen a policy, you can often fill out an application online. You will need to provide some basic information, such as your health history and habits.

- Medical Examination: Depending on the policy, you may be asked to go through a medical checkup. Some providers offer no medical exam policies, but these are quite expensive.

- Review and Sign: After your application is approved, you will need to go through the policy documents carefully. Read the terms and conditions of the policy before signing it.

- Pay for Your Premium: Once you have signed the policy, you will have to pay your first premium so that the coverage can be activated.

Follow these steps to purchase Term Life Insurance Online quickly and effectively so that you can be appropriately covered without hassle.

Conclusion: Why Canadian LIC is Your Best Bet for Term Life Insurance

Deciding on the best Term Life Insurance Policy is one of the greatest financial decisions you’ll ever make. It goes far beyond looking for the most inexpensive premium; it’s about making sure your loved ones are secured in the event of the unforeseen. We understand the challenge that goes along with such decisions at every step.

We’ve seen countless clients come through our doors, each with their own unique needs and concerns. Our seasoned insurance professionals will help you get the best term life policy from a well-reputed provider.

Do not wait another moment. The peace of mind in knowing your family is safeguarded is immeasurable, so don’t put it off any longer. Reach out to Canadian LIC for your valuable, specifically customized Term Life Insurance Quotes and get started on the journey to protect the future of your family. Make no mistake. This is an important decision. Let us help you decide on the best Term Life Insurance Policy for your peace of mind and well-being that fits your needs and budget.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

A Term Life Insurance Policy is one that pays out for a specified period, usually varying from 10 to 50 years. Should the policyholder die within that term, a death benefit—ordinarily income tax-free—is payable to the beneficiaries.

At Canadian LIC, there are many clients who come in, fresh-faced with life insurance matters, who get confused about the exact difference between Term Life Insurance and other policies. One of our clients, Sandra, reached out to us in a dilemma about which way to go. She had initially been interested in the Term Life Insurance option because the premiums were less, but she didn’t fully understand how it worked. After explaining that Term Life Insurance offers very straightforward, temporary coverage—perfect for covering things like a mortgage or a child’s education—she was confident in choosing the right 20-year term policy that suited her financial goals.

Getting Term Life Insurance Quotes is no big deal, and it is literally the best manner in which you can ascertain that you have the best value. You can start by using online tools or simply going straight to the providers. Here at Canadian LIC, we would advise comparing quotes with some of the very Best Term Life Insurance Providers to make sure you pick up a policy that falls within your set budget and is enough for your coverage needs.

We recently assisted a client whose name was David; he was in a rush to get life insurance after his first child was born. Indeed, he had visited us with another provider’s quotation, which looked reasonable. Yet, after we compared it with quotes from other companies, we could find him a policy that gave better coverage with lower premiums. David compared the prices of Term Life Insurance, eventually giving his family peace of mind without breaking the bank.

The best Term Life Insurance in Canada may be challenging to choose because what is best will depend on the different strengths of each company. Providers like Manulife, Sun Life, and Canada Life are among the top in Canada because of the rating for financial stability, customer service, and flexibility of policies for the clients.

We often guide our clients based on their needs. For example, one of our recent clients from Ottawa, Emily, was seeking a provider that offered flexible term lengths and the capability to convert her policy to Permanent Coverage in the future. Based on her needs, we recommended Sun Life since they were able to provide her flexibility and a competitive premium. Knowing what you want from a term life policy will go a long way in helping you identify the correct provider to help meet your financial goals.

Yes, you can buy Term Life Insurance Online. It’s quite convenient to protect yourself without having to meet in person. When purchasing online Term Life Insurance, the close attention of a policyholder is needed regarding the policy details, understanding the terms used, and more about a company’s reputation.

We’ve guided people like Tim, who enjoy the ease and convenience to buy Term Life Insurance Online. Tim was tech-savvy and wanted a quick and easy way to get covered. However, he was unsure about the reliability of some online providers. We helped him sort the wheat from the chaff and use only top providers with credible, user-friendly online platforms so Tom could buy Term Life Insurance Online with complete confidence that he would have the best possible coverage.

If you outlive your Term Life Insurance Policy, the coverage simply ends, and no benefit is going to be paid. Nevertheless, some policies allow for the option of renewing or converting to Permanent Life Insurance.

We’ve seen people like Shibra, who contacted us when her 20-year term policy was up. She was healthy and still in need of coverage, so we talked about her potential options. Shibra made her term policy permanent, giving her life coverage. Knowing beforehand what your choices are about your Term Life Insurance Policy can help you prepare for the future concerning your coverage.

If you find that the premiums for your term life policy are unaffordable, you have a few choices to make: lower the coverage amount, switch to a shorter term, or sometimes pause the policy. It’s important to communicate with your provider about your best options.

We had a client, Mahesh, who lost his job and was concerned about how he would be able to pay his premiums. Instead of cancelling the policy, we took him down to what he could afford to pay. Now, Mahesh can go on with his term life policy without straining his pocket. Discussing the situation with your provider or insurance broker may help in arriving at some solution to keep you covered while keeping your premium payments within your capacity.

Almost all Term Life Insurance Policies are renewable, meaning you can extend the coverage for another term, usually at a higher premium. Whether you renew depends on your current needs and financial situation.

We recently helped a client named Laura, whose 15-year term was coming to an end. She wasn’t sure if she should renew or investigate alternative options. Based on her situation, we recommended renewing for another ten years since she still had small children and had a mortgage. However, we also addressed the higher premium by talking through alternatives. Be sure to review your needs before the end of your term to determine if it’s right to renew.

Yes, most term life policies do provide for additional riders that offer extra coverage, such as critical illness, accidental death, or protection for children.

We had a client, Anna, who wanted to feel protected in case something was severely wrong with her health. We helped her add a Critical Illness Rider to her Term Life Insurance Policy so that she had peace of mind about being covered for much more than just life insurance. Policy additions are additional coverage added to your policy to provide extra security and tailored protection.

The appropriate amount of coverage in a Term Life Insurance Policy would consider your income, outstanding debts, mortgage, and other future expenses like the education of your children.

We had a client named James who really had no idea how much insurance he should carry. Following a detailed analysis of his financial commitments and aspirations for the future, we recommended a cover amount that he felt would enable his family to continue their way of life in case of his death. Hence, taking the time to calculate your needs can help you choose a Term Life Insurance Policy that provides adequate protection for the ones you love.

Canadian LIC knows how overwhelming Term Life Insurance Policies can be for an individual due to the various options that overpopulate the market. We assist you in finding the Best Term Life Insurance Providers for you according to your needs and budget. Personalized service is given to you at every step, from Term Life Insurance Quotes to buying Term Life Insurance Online.

We have guided many clients in the process of life insurance, empowering them with confidence and security about their decisions. You’re not just buying a policy when you choose Canadian LIC; you’re choosing a company that cares about families like yours as much as you do.

These FAQs should help in solving many of the common queries that one might have regarding Term Life Insurance Policies. If you still have doubts or maybe you have more questions, please do not hesitate to contact us at Canadian LIC. We’re here to help you make the best decision for your family’s future.

Sources and Further Reading

- Insurance Bureau of Canada (IBC)

- Website: www.ibc.ca

- The IBC provides comprehensive information about the insurance industry in Canada, including consumer guides and insurance company ratings.

- Canadian Life and Health Insurance Association (CLHIA)

- Website: www.clhia.ca

- CLHIA offers valuable resources about life insurance policies, including Term Life Insurance, and insights into the Canadian insurance market.

- Manulife Financial Corporation

- Website: www.manulife.ca

- Explore Manulife’s official site for detailed information on their Term Life Insurance Policies, coverage options, and customer support.

- Sun Life Financial

- Website: www.sunlife.ca

- Sun Life’s website provides in-depth information about their life insurance offerings, including term and Permanent Life Insurance Policies.

- Canada Life

- Website: www.canadalife.com

- Visit Canada Life’s official site for details on their Term Life Insurance options, financial stability, and customer service.

- RBC Insurance

- Website: www.rbcinsurance.com

- RBC Insurance’s website offers comprehensive details on their Term Life Insurance products, bundled services, and online tools.

- BMO Insurance

- Website: www.bmo.com

- Learn more about BMO Insurance’s affordable Term Life Insurance Policies and their application process on their official site.

- Industrial Alliance (iA Financial Group)

- Website: www.ia.ca

- iA Financial Group’s website provides detailed information on their customizable Term Life Insurance Policies and additional riders.

- Foresters Financial

- Website: www.foresters.com

- Explore Foresters Financial’s unique approach to life insurance, including member benefits and Term Life Insurance options.

- Desjardins Insurance

- Website: www.desjardins.com

- Desjardins Insurance’s site offers insights into their Term Life Insurance Policies, customer service excellence, and flexible coverage.

- SSQ Insurance

- Website: www.ssq.ca

- Visit SSQ Insurance’s website for information on their Term Life Insurance products, flexible payment options, and application process.

- La Capitale

- Website: www.lacapitale.com

- La Capitale’s site provides details on their simplified Term Life Insurance Policies, competitive pricing, and transparent terms.

- Canada Protection Plan

- Website: www.cpp.ca

- Canada Protection Plan’s website offers comprehensive information on their no-medical-exam Term Life Insurance Policies and accessible coverage options.

Additional Resources

- Government of Canada – Financial Consumer Agency of Canada (FCAC)

- Website: www.canada.ca/en/financial-consumer-agency.html

- The FCAC provides guidance on choosing the right life insurance and understanding your financial options in Canada.

- Financial Post – Insurance Section

- Website: www.financialpost.com/personal-finance/insurance

- Read articles and expert analyses on life insurance trends, including Term Life Insurance in Canada, from the Financial Post.

These sources and further reading materials should help you gain deeper insights into Term Life Insurance in Canada and guide you in making informed decisions.

Key Takeaways

- Choosing the right provider depends on your specific needs, like coverage and term length.

- Flexibility and customization are crucial for tailoring policies to your unique requirements.

- Affordable premiums from providers like BMO Insurance offer essential coverage on a budget.

- Simplified applications, like those from Canada Protection Plan, make securing coverage easier.

- Exceptional customer service, as offered by Desjardins Insurance, enhances the insurance experience.

- User-friendly online tools from providers like RBC Insurance simplify policy management.

- Consider long-term needs with options to convert term policies to Permanent Coverage.

- Foresters Financial offers member benefits, adding value beyond standard insurance coverage.

Your Feedback Is Very Important To Us

Thank you for taking the time to participate in this questionnaire. We aim to understand the challenges Canadians face when searching for the best Term Life Insurance companies. Your feedback will help us improve our services and provide better guidance to others in their insurance journey.

Thank you for your feedback!

Your input is invaluable in helping us improve our services and provide better support for Canadians searching for Term Life Insurance.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com