IN THIS ARTICLE

- At What Age Should You Stop Buying Term Life Insurance

- When Should You Consider Stopping Term Life Insurance?

- Weighing The Pros And Cons Of Term Life Insurance In Later Life

- Age-Specific Guidance on Term Life Insurance

- Life Insurance In Canada: When Term Coverage Stops Making Sense

- The Final Verdict

SUMMARY

Explore the right time to stop buying Term Life Insurance, weighing the pros and cons of continuing coverage as you age. It covers when to consider stopping, especially as financial obligations decrease, and provides age-specific guidance. Using real-life examples, the blog offers practical advice on balancing the rising costs of premiums with the benefits of coverage. It also discusses the importance of reviewing your Term Life Insurance as your needs change over time, ensuring a tailored approach to financial security.

INTRODUCTION

Have you ever been at a family gathering, a cousin sipping coffee with you, and he proudly tells you about this new Term Life Insurance Policy that he just bought, though you realize you still don’t know what your Term Life Insurance needs are? You are possibly in your late 40s, then. That triggered a small worry in your head: “Am I already old enough to consider buying Term Insurance? What if I pay for something that I don’t actually need?” Yes, these are some of the very common questions and concerns that one goes through as one ages and decides at what age Term Life Insurance should be continued, renewed, or stopped. Buying Term Insurance isn’t just about opting for a policy—it goes way beyond that. It includes knowing how Term Life Insurance fits into your whole strategy, knowing the pros and cons of Term Life Insurance, and, most importantly, the right point in time to reevaluate your needs. This blog will help you make such decisions with practical advice, relevant stories, and a very clear breakdown of such important considerations. Let’s go through it together to understand if there is a right age to stop spending money on Term Life Insurance and how you can make that decision with confidence.

When Should You Consider Stopping Term Life Insurance?

Term Life Insurance: The Basics

Just to have a clear understanding of what a Term Life Insurance Policy actually is, let’s review. Term Life Insurance provides coverage for a fixed period of time (such as 10, 20, or 30 years). You pay premiums during that term, and if the insured passes away during the policy term, the death benefit is paid to the beneficiary. Term Life Insurance is one of the Life Insurance products designed to cover you for a set number of years, normally ending in a set number of years. Insurance policies usually end at the end of this time, but they can be renewed for another term. That’s why Term Insurance is so popular; it delivers a significant death benefit for relatively low premiums, particularly when you’re young.

The Aging Factor in Term Life Insurance

As you get older, the cost of new Term Life Insurance Policies increases dramatically. This is because insurance companies assess the risk of insuring older individuals as higher.

Consider John, the 50-year-old accountant. He found that the premiums for a new twenty-year term policy were nearly two to four times higher (depending on health, smoking status, and insurer pricing) than what he had to pay when he was in his 30s, all for the exact same amount of coverage.

Of course, increasing premium prices does bring us to the main question: at what age does Term Life Insurance end, and when does it make sense to renew versus let coverage expire or take out a brand-new Term Life Insurance Policy?

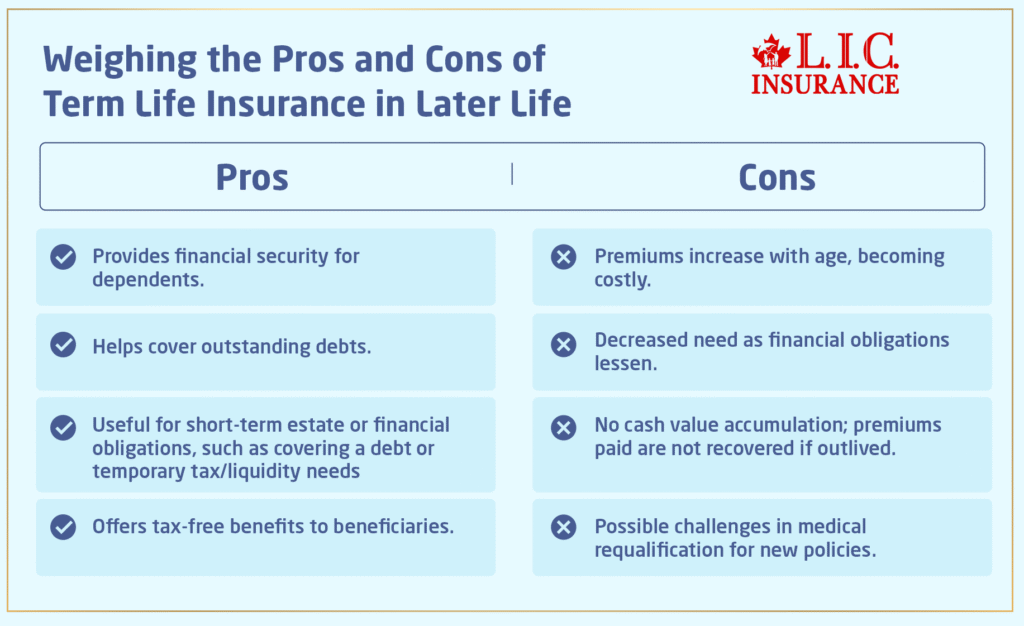

Weighing the Pros and Cons of Term Life Insurance in Later Life

Pros

- Dependents’ Financial Security: If you still have dependents, such as young children or a spouse who relies on your salary, your early death will not hurt them financially.

- Mortgages and Debts: Coverage can provide peace of mind if you have significant debts or a mortgage that would be burdensome to your family if it were left unpaid.

Cons

- Premiums Are Prohibitively Expensive: The cost of new policies may be high.

- Dependents are Financially Independent: Your grown children are succeeding on their own and are not financially dependent on you.

Strategic Considerations

Consider Lisa’s story. At 65, she’s a retired nurse with grown, financially independent children. She has a small mortgage left on her home and a healthy retirement fund. Lisa questioned whether renewing her Term Life Insurance Policy made sense. Her scenario illustrates a common situation many older adults find themselves in—evaluating the necessity of extending Term Life Insurance against its increasing cost and decreasing financial obligations.

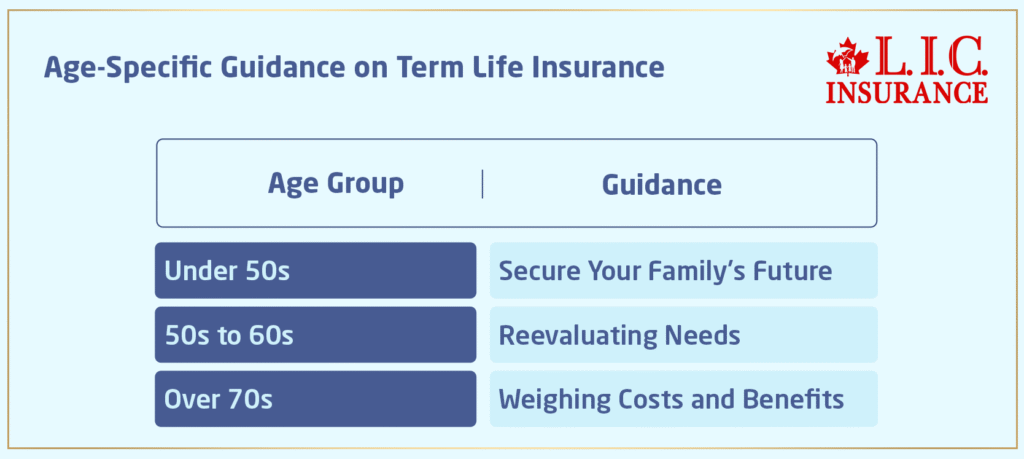

Age-Specific Guidance on Term Life Insurance

Under 50s: Securing Your Family’s Future

If you are below 50, then the benefits that come with taking up a Term Life Insurance Policy are immense, more so if you have dependents or major debt. At this point in life, you are most probably supporting young children, paying for a mortgage, and even striving to climb the career ladder, which makes Term Life Insurance quite invaluable at this stage, premiums generally being pocket-friendly, yet offering a way through which you can ensure financial security for your family without you having to alter your current lifestyle.

For instance, let’s take Marina, a 38-year-old graphic designer and mother of two. Marina recently found out that if something unexpected happened to her, then her family would never be able to cover the mortgage payments, children’s education, and any other living expenses from the income of her husband alone. This gave her a great deal of peace of mind, knowing that her children and spouse would be financially secure. The takeaway from the above is that Term Life Insurance is, therefore, an insurance policy that is essential to act as a safety net, giving huge coverage during the period when the financial liabilities are high and continuous.

50s to 60s: Reevaluating Needs

Getting into your 50s and 60s would mean looking at your Term Life Insurance needs differently. This is a time when you need to review your situation specifically. Are your children already out of the nest and financially independent? How close are you to paying off your debt?

Please pay close attention to these things because they will have a big impact on whether you need to renew, change, or even cancel your Term Life Insurance Policy.

Robert is 57 years old, and his Term Life Insurance is almost up. Let’s talk about him. His kids were now grown up, and the debt was almost paid off. Robert had to decide whether to renew the policy with a much higher payment or let the policy expire. One problem with Term Insurance at this age is that you may have to pay higher and higher costs even though the returns are usually very low. For most people like Robert, this is the time to weigh the costs of a new policy against falling obligations.

Over 70s: Weighing the Costs and Benefits

For individuals in their 70s, purchasing new Term Life Insurance often becomes less feasible. Premiums skyrocket at this age due to the increased risk insurers take on. Unless you have pressing financial responsibilities, such as dependent family members or significant outstanding debts, the high costs might outweigh the benefits of a new Term Life Insurance Policy.

Take Eleanor, for example. At 72, she considered buying a new Term Life Insurance Policy after her previous one expired. However, upon reviewing her financial situation—no dependents, a comfortable retirement fund, and her home fully paid off—Eleanor decided against renewing.

The costs simply did not justify the benefits, illustrating a common situation for many seniors. Her story emphasizes a critical point: the cons of Term Life Insurance at this age, where the financial burden of high-paying premiums may not match the practical need for coverage. Each age group usually has distinct challenges when dealing with Term Insurance. Whether you are like Marina, working to secure a future for a young family, Robert, who has needs that change with new financial obligations, or Eleanor, who simply does not renew because they have a nice cushion in the bank account, your decision has to fit where you are in life.

So, as you read through these stories and thinkabout how they could possibly relate to your own life situation, consider opening up a discussion about your own needs and options with an advisor you trust on insurance matters. Just remember, though: the properly aligned Term Life Insurance Policy can be there for peace of mind and protection, but it must be kept tailor-made to fit the unique chapters of life.

Life Insurance In Canada: When Term Coverage Stops Making Sense

If you’re reviewing Life Insurance Canada options in 2026, one question comes up again and again: when do you not need Life Insurance anymore?

In simple terms, you may not need term coverage if your biggest responsibilities are already handled. For example, if your mortgage is fully paid, your children are financially independent, and your retirement income can support your spouse, you may be at the stage when to stop Term Life Insurance becomes a real and smart discussion—not an emotional one.

At the same time, many people keep coverage because they fear rising costs later. That’s why looking at Term Life Insurance rates by age is important. As you move from your 40s into your 50s and 60s, Term Life Insurance rates by age typically rise sharply, especially at renewal. This is one of the biggest reasons people start comparing different term insurance plans to see if renewing is still worth the premium jump.

Now let’s talk about the big question seniors ask: Is Life Insurance worth it after 60?

The answer depends on what you still need protection for. For some families, Life Insurance for seniors still matters because they want to protect a spouse, cover final expenses, or leave money behind without forcing loved ones to use savings. But for others, the cost is simply too high compared to the real benefit.

In fact, for seniors who want smaller coverage amounts and simplified options, some providers promote products like seniors’ choice Life Insurance, which can be useful in specific situations—but only if the pricing and conditions actually fit your goals.

So if you’re asking yourself is Life Insurance worth it after 60, the smartest move is not to renew blindly. Instead, match the policy to your current financial responsibilities and choose coverage only where it still protects something meaningful.

The Final Verdict

Deciding whether to continue investing in term coverage as you age is a nuanced decision that depends heavily on personal and financial circumstances. It’s about balancing the security it offers with its rising costs. As we’ve explored through various scenarios, there is no universal right age to stop buying Term Life Insurance. But as you go through this, you might want to talk to experts who can give you help that is tailored to your specific situation.

If you are more inclined to secure or update your Term Life Insurance, then get in touch with Canadian LIC, one of the best insurance brokerages. They have a professional team that can provide you with solutions tailor-made for your life stage, budget, and coverage goals.

Instead of renewing out of habit, it’s smarter to review whether Term Life Insurance still matches your real financial responsibilities today.

Make that call today to take the first step toward a secure financial future for you and your loved ones by understanding your needs, being informed about the pros and cons of Term Life Insurance, and carefully assessing your personal situation.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQs

Yes, you can own more than one Term Life Insurance Policy at a time. Layering of Term Insurance can be arranged so that coverage diminishes in size over time for various financial obligations. For instance, John has a policy on his mortgage, which will expire when he pays off his mortgage, and another policy to fund his kids’ education.

Death benefits paid from a Term Life Insurance Policy to a beneficiary are usually received tax-free. It is a major pro in Term Life Insurance, as it is one of the powerful instruments in financial planning. Sheeba was relieved to hear that ‘the benefit her children would derive from her policy would not be eroded by taxes’, ensuring her objective of providing complete financial security for her children.

Term Life Insurance should be reviewed every five years or sooner with significant life events, such as marriage, childbirth, home purchase, or when one’s financial situation changes. Reviewing the policy at regular intervals ensures that the coverage still meets the criteria. After the birth of his second child, David reviewed his policy and realized he had to increase his coverage to protect his growing family.

No, term life insurance premiums typically increase as you age due to the higher risk associated with older individuals.

The Term Life Insurance age limit varies by insurer, but most policies offer coverage up to age 75 or 80 through renewals, while new term policies are commonly available until around age 70 to 75, depending on the insurance company and term length.

After this age, it may be difficult to secure a new Term Life Insurance Policy. Premiums tend to increase as you age, so it’s advisable to purchase Term Life Insurance early. Always check with your insurer to understand their specific age restrictions.

It’s generally recommended to stop Term Life Insurance once you no longer have financial dependents, such as after paying off your mortgage or when your children are financially independent. However, some choose to keep it longer for additional peace of mind. Evaluate your financial situation to make the best decision.

Yes, Term Life Insurance is often considered worth it because it offers affordable coverage for a set period, making it ideal for protecting your loved ones while you have financial responsibilities. It provides a high death benefit for a low premium, making it a great choice for many.

Yes, Term Life Insurance premiums typically increase with age. As you get older, the risk to the insurer rises, leading to higher premiums when you renew or purchase a new policy. It’s usually cheaper to buy term life insurance at a younger age.

You should consider getting Term Life Insurance as early as possible, ideally when you’re young and healthy, to lock in lower premiums. It’s particularly important if you have dependents or financial obligations like a mortgage that need protection in case of your passing.

The length of time you should keep Term Life Insurance depends on your financial needs. It’s typically recommended to keep it until your financial obligations, such as mortgages or children’s education, are fulfilled. Most people choose terms between 10 and 30 years.

Sources and Further Reading

For readers looking to delve deeper into the topic of Term Life Insurance and making informed decisions about when to stop buying it, here are several sources and further reading suggestions:

- “Life Insurance Basics” by Investopedia

- An extensive resource that covers all aspects of Life Insurance, including Term Life Insurance, with detailed explanations about how policies work, what you should consider before buying, and how to choose the right type for your needs.

- Investopedia Life Insurance Basics

- NerdWallet Life Insurance Blogs

- These articles discuss critical life events that should trigger a review of your Life Insurance needs, helping you decide whether to continue, adjust, or end your Term Life Insurance Policy.

- NerdWallet on Life Insurance

- Policygenius Life Insurance Blogs

- An informative piece that explains how your age impacts Life Insurance rates, with a focus on the increasing cost of premiums as you age and how that affects the decision to buy or renew Term Life Insurance Policies.

- Policygenius on Age and Insurance Rates

- “How to Choose the Right Amount of Life Insurance” by Consumer Reports

- Consumer Reports provides a critical look at Term Life Insurance, discussing who it is best for and highlighting the pros and cons of these policies.

- Consumer Reports on Term Life Insurance

These resources will provide comprehensive insights and help you navigate the complexities of Term Life Insurance, ensuring you make the most informed decision about when to stop purchasing such policies.

Key Takeaways

- As you age, Term Life Insurance premiums increase significantly, warranting a cost versus benefit evaluation.

- The need for Term Life Insurance often decreases as major financial obligations are fulfilled.

- If your health has declined or if you still have dependents, maintaining or purchasing Term Life Insurance could be beneficial.

- Weigh the pros and cons of Term Life Insurance, especially the financial strain of higher premiums against the benefits.

- Seeking advice from financial advisors or insurance professionals can provide personalized insights.

- If concerned about future insurability, consider conversion options to a whole or universal life policy.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com