- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Whole Life Insurance Vs. Endowment Life Plans In 2025: Which One Is Right For Canadians?

By Pushpinder Puri

CEO & Founder

- 12 min read

- October 03rd, 2025

SUMMARY

Canadians often weigh a Whole Life Insurance Policy Canada against Endowment Life Insurance Plans when planning for family protection and savings. Whole life offers lifelong coverage, steady cash value growth, and lasting financial protection, while endowments combine savings with structured payouts. Comparing Life Insurance costs, benefits, and flexibility helps families choose the best Life Insurance Policies in Canada for 2025.

Introduction

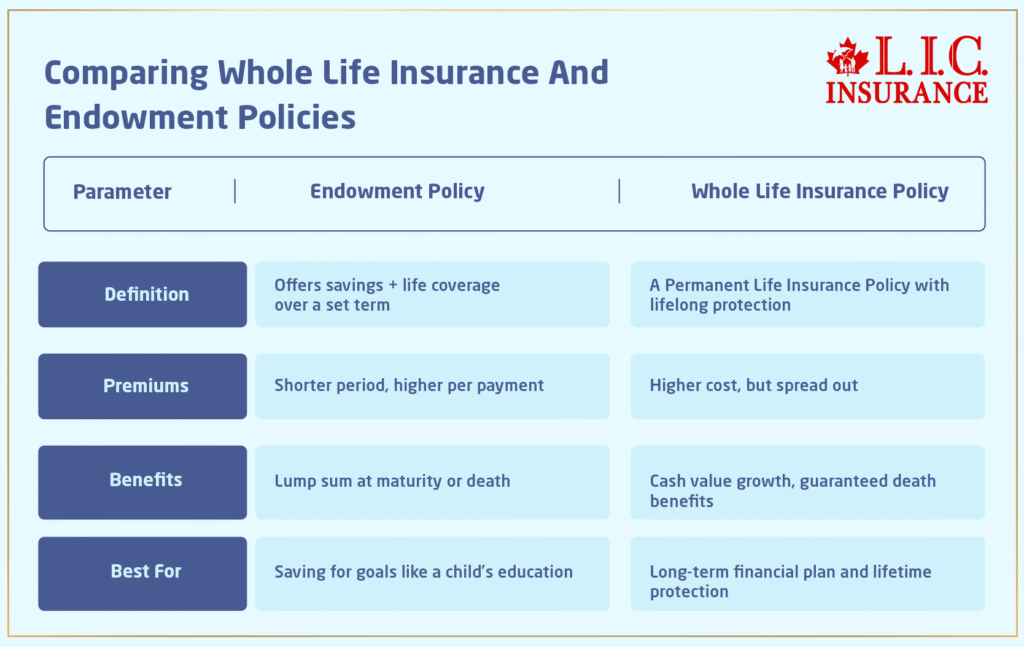

We meet families every day who are caught between choices. Should they go with a Whole Life Insurance Policy in Canada, knowing it promises lifelong coverage and a growing cash value, or lean toward Endowment Life Insurance Plans, which wrap savings and protection into one? Both are considered among the best Life Insurance Policies in Canada, but they’re not built for the same purpose.

What Is Whole Life Insurance?

When clients ask us about a Whole Life Insurance Policy, we tell them straight—it’s protection that never expires. You keep the insurance policy active by paying your premium payments, and in return, the life policy lasts as long as you do. Unlike a term Life Insurance Policy, it doesn’t stop after 10, 20, or 30 years.

But here’s the twist: it doesn’t just give a death benefit. A portion of your premium payments builds a cash value component. That cash value grows quietly, tax-deferred, year after year. Some of our clients borrow against it later, sometimes for retirement income, sometimes for emergencies, sometimes even to help with a child’s university fees.

Features And Benefits Of A Whole Life Insurance Policy

Why do Canadians choose Whole Life? Here’s what stands out:

- Permanent coverage: Your family gets guaranteed death benefits, no matter when you pass.

- Financial protection: It covers debts, funeral costs, and other ongoing financial obligations.

- Cash surrender value: Over time, your policy’s cash builds into an accumulated cash value that you can access.

- Guaranteed premiums: The Whole Life Insurance premiums don’t suddenly spike.

- Loan options: Once enough cash value growth has accumulated, borrowing is possible.

Clients often compare it with Term Life. The key difference? Whole Life Policies stick with you for your entire life, while Term Insurance is temporary.

What Is Endowment Life Insurance?

An Endowment Life Policy is different. It mixes Life Insurance Coverage with structured savings. Here’s how it works:

If you live until the end of the term, you get a lump sum. If you pass away during the policy term, your family gets the Life Insurance coverage payout. Either way, money is coming back to someone.

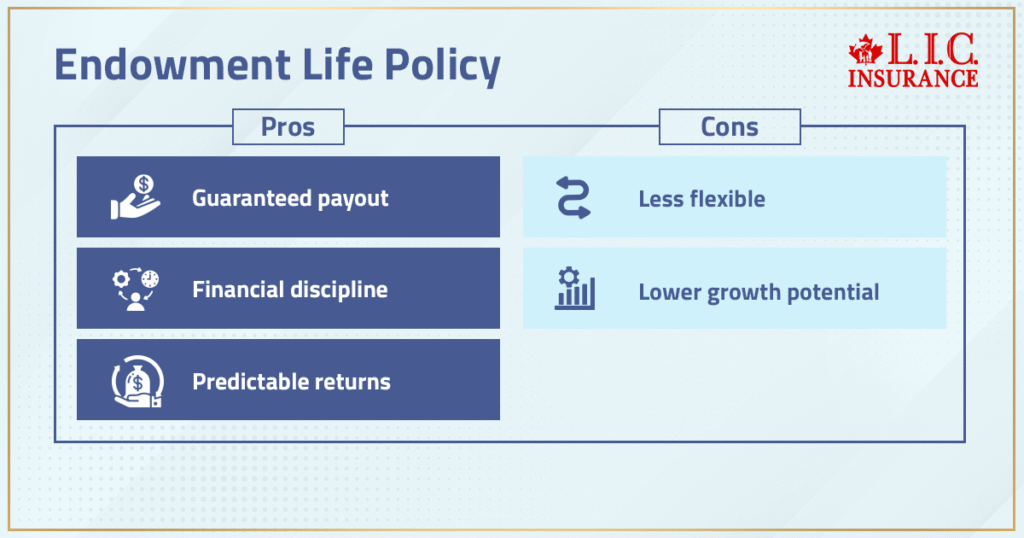

For Canadians who want discipline in saving—maybe for a child’s education or long-term financial goals—this feels reassuring. It’s not as flexible as a Whole Life Insurance Policy, but it’s more predictable than market-linked products.

Features And Benefits Of Endowment Life Insurance Plans

- Death and survival benefits: If you pass, your family receives the payout. If you live, you still get money back.

- Higher returns than term life: The savings portion grows, unlike plain term Life Insurance.

- Low-risk investment component: Safer than stock-linked funds.

- Flexible add-ons: Riders can expand insurance coverage to include disability or accident.

- Maturity payout: A big reason Canadians pick endowments—they like knowing there’s a final lump sum.

We see families choosing endowments when they want both a Life Insurance Policy and disciplined savings in one place.

Factors Canadians Should Consider Before Choosing

When helping clients pick between Whole Life and endowment, we always talk through:

- Budget and overall Life Insurance cost.

- Whether they want Temporary Coverage or Permanent Coverage.

- The importance of building retirement income.

- Comfort with premium payments.

- Tax perks like tax-deferred growth and sometimes tax-free withdrawals.

- The role of a medical exam in qualifying.

No two families are the same, and neither is the right answer.

The Reality Of Life Insurance Cost

We often get asked: Which one is cheaper? The truth is, Edowment Life Insurance Plans usually have shorter, more intense premium payments. Whole Life Policies spread payments out, but because they last your entire life, the higher premiums add up.

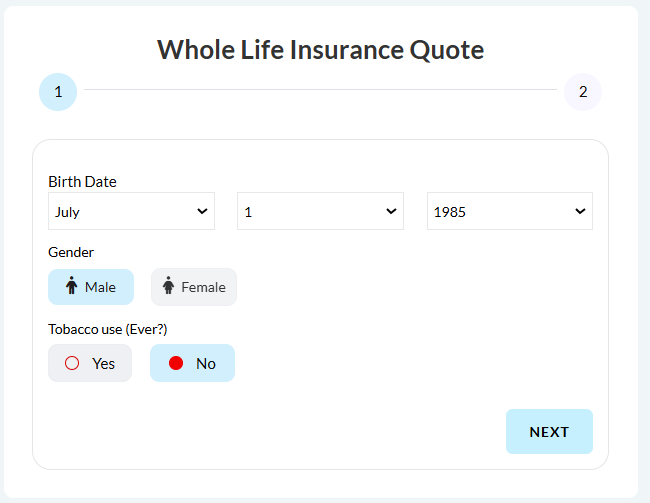

We make this easy by giving clients a Whole Life Insurance Quote Online so they can see the math clearly.

How Life Insurance Providers In Canada Approach It

Every Life Insurance company has its own spin. Some skip the medical exam. Others demand one. Some allow smaller Life Insurance premiums, but with less Life Insurance coverage.

Because we work with multiple Life Insurance providers, we can compare them side-by-side. That way, our clients don’t overpay for insurance coverage they don’t need.

Whole Life Policies Vs. Term Life Insurance Policy

Many people think a Term Life Insurance Policy is enough. And for some, it is. It gives affordable coverage for a fixed period. But remember, Term doesn’t build cash value. It’s protection only.

Whole Life Policies are different. They add an investment component, creating a pool of accumulated cash you can borrow from. Yes, it’s a higher cost upfront, but it’s also lifelong protection.

Where Universal Life Insurance Fits In

Sometimes Canadians ask about Universal Life Insurance. It’s another Permanent Policy, but with more flexibility. You can adjust premiums and tie them to investment performance. It’s not for everyone, but it’s worth mentioning when reviewing all Life Insurance types.

Using Insurance For Retirement Income

A big part of this conversation is retirement income. Whole Life Insurance Coverage builds a pool of value, on a tax-deferred basis, that can support an emergency fund or even act like a financial plan in retirement.

Endowment Policies also help, since the payout at maturity can go toward savings or supplementing financial security later in life.

Medical Exams And Eligibility

Most insurance companies still use a medical exam to decide eligibility and pricing. Healthy applicants often get lower Life Insurance premiums. Others may face higher costs or stricter rules.

We help clients prepare for the process so there are no surprises.

Canadian LIC’s Closing Guidance

So, which should you pick in 2025—a Whole Life Insurance Policy Canada or an Endowment Life Insurance Plan?

If your goal is lifelong coverage with a growing cash value component, Whole Life is the answer.

If you want disciplined saving with a lump sum payout, an endowment is attractive. Both protect families, both offer financial protection, and both can be part of a smart financial plan.

We don’t push one over the other. We look at your financial situation, your dependents, your age, and your goals. Then we show you the numbers with a Whole Life Insurance Quote Online and options from trusted insurance companies.

The right choice is the one that protects your family while fitting your life. That’s what matters.

More on Whole Life Insurance

FAQs

Depends. Some insurance companies will let you switch, but usually with strings attached. A medical exam might be required, or the premiums jump. Sometimes, instead of switching, our clients keep the endowment and add a small whole life policy on top.

Not at all. We’ve seen clients use the maturity payout for a child’s education, funding a wedding, or even kicking off a side business. It’s still Life Insurance coverage, but the savings side gives flexibility. That’s why it appeals to people who don’t like taking market risks.

Yes, and it’s quiet but powerful. The cash value component inside a Whole Life Insurance Policy grows on a tax-deferred basis. Later in life, it can help with retirement income or cover unexpected expenses without pulling from other investments.

Here’s the thing: with an endowment, you may walk away with a reduced cash surrender value. With Whole Life Policies, if there’s enough accumulated cash value, it can keep the coverage alive for a bit. But if you keep missing, eventually the safety net vanishes.

They can be, yes. The maturity payout often lands right when retirement needs grow. On their own, they’re not a full plan. But paired with RRSPs or Whole Life Policies, they add a nice buffer for financial security.

Every Life Policy does build it, but patience is key. In the first few years, it may feel like nothing’s there. As the premium payments stack up, the cash surrender value becomes real money you can access if needed.

Riders are extras. Each Life Insurance company sets its own list, but they often cover disability, critical illness, or accidents. Adding one to a Whole Life Insurance Policy or an Endowment Life Policy stretches the insurance coverage further.

Because it’s not just about picking the lowest Life Insurance cost, a financial advisor looks at your dependents, debts, long-term financial goals, and even your comfort with lifetime protection. That’s the part we focus on — fitting the policy to the person, not the other way around.

Yes, and it’s something Canadians often overlook. A Whole Life Insurance Policy allows you to leave part of the guaranteed death benefits to a cause you care about. It’s one of those quiet ways of creating impact while also protecting family.

Not really. They’re designed for longer timelines. If you want money back in a few years, this isn’t the right Life Insurance Policy. But for a decade-plus commitment, an Endowment Life Policy can serve both savings and Life Insurance coverage.

It’s there, but don’t think of it as an ATM. The cash surrender value in a Whole Life Policy takes time to build. Yes, it gives options if you’re stuck, but it works best as a long-term safety cushion, not for quick dips.

No. With Whole Life Policies, you usually get guaranteed premiums that stay steady. With a Term Life Insurance Policy, renewal often means a big jump in Life Insurance cost. That’s why planning ahead matters more than most people expect.

Not at all. One Life Insurance company may offer a disability rider, another may not. Some include accident coverage; others keep it separate. We line up options across insurance companies so clients see what’s actually worth paying for.

It can. A Whole Life Insurance Policy builds a cash value component on a tax-deferred basis. Over time, that pool of value can supplement pensions or savings. It’s not a silver bullet, but it’s a piece of the financial plan that often gets underestimated.

Key Takeaways

- A Whole Life Insurance Policy Canada provides lifelong protection, steady cash value growth, and predictable guaranteed premiums.

- Endowment Life Insurance Plans combine savings with Life Insurance coverage, paying out either at maturity or upon the insured’s death.

- Comparing Life Insurance costs, benefits, and flexibility helps families match policies to their real financial goals.

- Whole Life Policies are best for those seeking lifelong protection and an asset that builds over time, while endowment policies suit savings-focused Canadians.

- We guide clients with Whole Life Insurance Quote Online comparisons and access to top Life Insurance providers, ensuring families choose the policy that truly fits their needs.

Sources and Further Reading

- Gerber Life’s overview of endowment vs Whole Life Insurance, explaining how endowment builds value over a defined term and whole life remains active for a lifetime and builds cash value Gerber Life Insurance Company.

- WealthTrack’s recent Canadian-focused breakdown of endowment policies, detailing how they combine savings and a death benefit, plus an illustrative example of term versus maturity payouts WealthTrack.

- Diffen’s straightforward comparison of endowment vs whole life, highlighting that endowment matures sooner (10–20 years), whereas whole life is designed to last a lifetime Diffen.

- Investopedia’s authoritative explanation of how Whole Life Insurance works—level premiums, cash value growth, and tax-deferred savings Investopedia.

- Wikipedia’s entry on endowment policies, covering lump-sum payouts at maturity or death, typical maturity periods, and how bonuses are applied (reversionary and terminal) Wikipedia.

- Wikipedia’s overview of Whole Life Insurance, describing permanent coverage, fixed premiums, cash value, and policy maturity—great for foundational reading Wikipedia.

- SafePacific’s article on using Whole Life Insurance as a long-term investment for Canadians—emphasizing tax advantages, cash value, and legacy planning Safe Pacific Financial.

- Investopedia’s definition of an accelerative endowment—a handy add-on feature to some Whole Life Policies, providing early access to dividends in case of illness Investopedia.

- Wikipedia’s page on the Infinite Banking Concept, which illustrates how Whole Life Policies can essentially act as personal banks via the cash value component and policy loans Wikipedia.

Feedback Questionnaire:

IN THIS ARTICLE

- Whole Life Insurance Vs. Endowment Life Plans In 2025: Which One Is Right For Canadians?

- What Is Whole Life Insurance?

- Features And Benefits Of A Whole Life Insurance Policy

- What Is Endowment Life Insurance?

- Features And Benefits Of Endowment Life Insurance Plans

- Factors Canadians Should Consider Before Choosing

- The Reality Of Life Insurance Cost

- How Life Insurance Providers In Canada Approach It

- Whole Life Policies Vs. Term Life Insurance Policy

- Where Universal Life Insurance Fits In

- Using Insurance For Retirement Income

- Medical Exams And Eligibility

- Canadian LIC’s Closing Guidance

Sign-in to CanadianLIC

Verify OTP