- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

REVIEWS

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Who Benefits From Limited Pay Term Insurance, And How It Works

By Hrapreet Puri

CEO & Founder

- 10 min read

- September 3rd, 2025

SUMMARY

Limited Term Life Insurance is explained through real situations in Canada, focusing on how a Term Life Insurance Policy works, steps to buy Term Life Insurance online, ways to compare Term Life Insurance quotes, insights into Canadian Term Life Insurance, support from Term Life Insurance agents, and details on Term Life Insurance cost. Readers gain a clear view of how affordable Term Life Insurance Plans protect families while offering flexibility for future needs.

Introduction

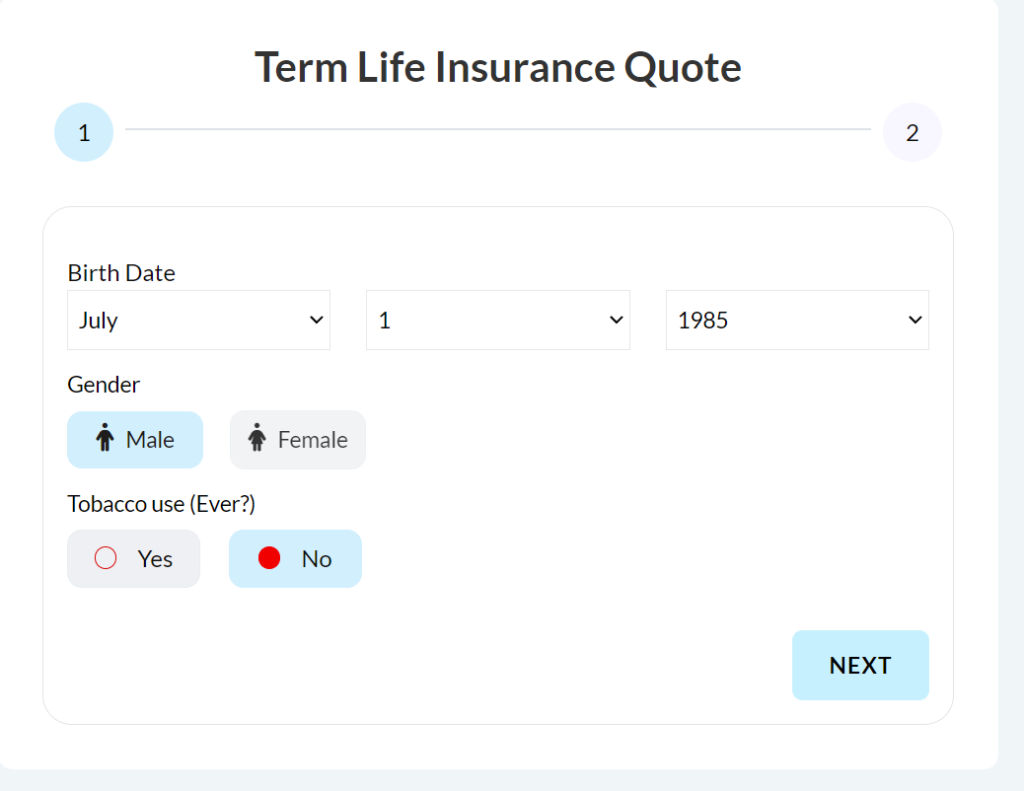

We frequently hear from customers who pose a straightforward question: Can I pay for insurance ahead of time and still maintain protection for my family? The answer is a resounding yes. That’s the value of a Limited Term Life Insurance Policy. You pay for a certain number of years, and then you’re done. Your Term Life Insurance Coverage remains in effect until the end of the selected period.

This plan suits individuals who desire control over premium payments. It suits best with families with a mortgage, professionals with loans, and anyone who wishes for a clean end date for paying premiums. However, it’s not for everybody. To realize whether it’s suitable for you, you should know how it operates, its cost, and who benefits most.

Life Insurance Coverage With Limited Pay

A Limited Pay Term Life Insurance Plan is unlike a standard pay arrangement. Standard pay stretches payments out over the entire coverage. Limited pay condenses them into a shorter time. After you finish making payments, the policy becomes fully paid, and you will no longer receive bills.

Illustration: You opt for a 20-year policy with a 10-year payment period. You pay premiums at a higher rate in the first 10 years. After the 10 years are completed, you do not pay premiums. The cover will continue until the 20th year.

The short premium payment period works because it aligns with the years when earnings are higher and financial burdens are more certain. Subsequently, when earnings decrease or you retire, the life insurance cover continues in effect without additional payments.

Death Benefit And Why It Matters

The death benefit is the sum your loved ones get if you die while covered. It’s the major purpose individuals purchase coverage for. In a low-pay plan, the death benefit operates just like in an ordinary plan.

- It clears your home loan amount.

- It pays for the tuition of your children.

- It substitutes your income for a fixed period of years.

- It maintains long-term family requirements.

We calculate the death benefit from your obligations, not speculation. We examine your mortgage, educational goals, other financial responsibilities, and present savings. We then match the life policy to those figures so the coverage is useful, but not too much or inadequate.

Insurance Coverage Structure

A Limited Pay Life Insurance structure is easy but rigid.

- Select a coverage duration like 10, 20, or 30 years.

- Choose the premium payment duration within that coverage. Ten years is typical.

- Pay premiums that are higher every year within that funding period.

- At the end of the term, the life policy is paid in full.

If you fall behind in payments prior to completion, you lose coverage. We monitor premiums paid and remind you so that you can make payments in a timely manner. After completion, you have life coverage worry-free.

How Much Life Insurance Do You Need

Your actual figures determine the correct coverage amount. We apply data, not general estimates.

- Income replacement: typically 10–15 times your annual income.

- Mortgage balance: total outstanding debt and interest.

- Tuition requirements: typical Canadian university fees are 20,000 to 30,000 annually for Canadian students, and more for international programs.

- Business commitments: loans, shareholder agreements, or expansion loans.

- Already existing savings: group insurance plans, RRSPs, and TFSAs.

We add all these numbers together and calculate how much life insurance will make sense. We then determine whether a limited pay term or regular pay term insurance type will suit your budget and schedule.

Cash Value And Permanent Coverage

A limited pay term policy doesn’t accumulate cash value. It is purely protection. If you desire policy’s cash benefits, you must have permanent life insurance.

- Whole life insurance comes with a guaranteed death benefit, growth of cash values, and dividends from certain life insurance providers.

- Universal life policies mix permanent coverage with versatile investments and tax advantages.

- Conventional whole life policy designs tend to employ a limited premium payment duration, for instance, 10-pay or 20-pay.

Most families do both: purchase a limited pay term for income protection during the mortgage years, and supplement with a whole life policy for estate purposes and cash accumulation.

Financial Obligations And Limited Pay

The optimal way to look at a limited pay life policy is as a planning instrument. It succeeds when you wish to synchronize insurance financing with your financial life cycle.

- Parents make payments before the tuition year.

- Business proprietors should align the premium payment period with the loan repayment or buy-sell arrangements.

- Professionals pay during strong earning years and avoid bills later.

- Retirees retire with a paid-up policy and no bills.

By tying the higher premiums up front, you minimize the chances of payment issues later, when your retirement income is no longer adjustable.

Cost-Effective Or Not

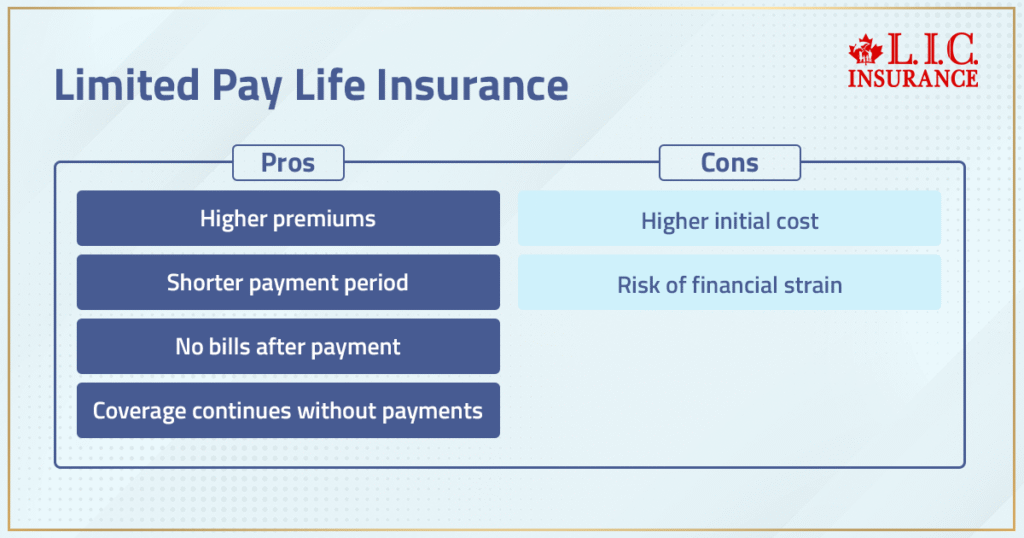

The word “cost-effective” depends on perspective. Yearly costs are higher under limited pay. But the total premium cost is often lower than a long-term regular pay structure.

Example 1

Age 35, non-smoker, 1,000,000 coverage, 20-year term:

- Regular pay: $650 per year for 20 years. Total about 13,000.

- Limited pay (10 years): $1,150 per year for 10 years. Total about 11,500.

Example 2

Age 45, non-smoker, 750,000 coverage, 20-year term:

- Regular pay: $1,050 per year for 20 years. Total about 21,000.

- Limited pay (10 years): $1,950 per year for 10 years. Total about 19,500.

The math shows that you pay higher premiums per year but complete payments faster. For disciplined clients, that’s cost-effective.

Home Loan And Protection

A mortgage is a very popular reason for individuals to purchase life coverage. Limited pay is easily compatible with this. You determine the term of the coverage to coincide with the mortgage. You pay premiums early, when income is good. In the event of death within the term of the coverage, the death benefit pays off the mortgage balance. Your family is able to maintain the home.

Insurance Policies And Key Differences

Here’s how it looks side by side:

- Regular Pay Term Insurance: lower yearly cost, continuous payments until the end.

- Limited Pay Term Insurance: higher yearly cost, payments stop earlier.

- Permanent Coverage: lifetime coverage, cash value features, and tax benefits.

- Whole Life Insurance Policy: guarantees, dividends, cash value growth.

Each design fits different financial goals. We explain policy benefits without jargon.

Tax Benefits To Remember

In Canada, the majority of life insurance policies have well-defined tax regulations.

- The death benefit is exempt from tax under the Income Tax Act.

- Premiums on personal coverage are not deductible.

- Tax-deferred growth of cash value is provided by permanent coverage.

- More than contribution levels can lead to a modified endowment contract, applicable in US policies.

- Creditor protection and shareholder agreements can be planned for by business owners using corporate-owned policies.

We usually recommend that clients engage a tax advisor in the case of corporate or cross-border matters.

Who Gains The Most From Limited Pay

Profiles that commonly gain:

- High-income individuals with stable cash flow.

- Mortgagor families and tuition plans.

- Early financial burdened professionals.

- Owner’s funding buy-sell arrangements.

- Retirees desire a paid policy prior to retirement.

For all, a limited pay life policy provides discipline, stability, and financial security over the long term.

Our Approach

We examine your requirements, shop around for quotations, and simulate alternatives. We verify:

- Regular pay versus limited pay.

- Premium payment schedules: monthly, quarterly, yearly.

- Total premiums paid throughout the policy’s lifetime.

- Riders such as critical illness, waiver of premium, or child protection.

- Conversion possibilities to permanent life insurance in the future.

We give you a side-by-side comparison. We use plain language. You view numbers, not pitch.

Extended Example: Family With Mortgage And Kids

Pair, both 32, both non-smokers.

Mortgage: $500,000 for 25 years.

Objective: save mortgage, pay income, and pay tuition.

They selected the 20-year Term Life Insurance Policy with 10-pay funding. The life cover is 1,200,000. Premiums are more expensive in the first 10 years and zero thereafter.

By the age of 12, their mortgage balance is reduced. They have paid their insurance policy in full. Their freed-up funds now contribute to RESP savings and RRSP investments.

At age 18, they exchanged some of their coverage for a whole life policy to meet estate requirements. The remaining one is allowed to lapse at age 20. They maintain their financial future equally.

Final Word

Limited pay is control. You pay off early. You maintain stable coverage. You align insurance with the financial objectives in your life.

We create policies that value your time, income, and family obligations. Get a Term Life Insurance Quote Online from us. We will present you with both regular pay and limited pay options. You decide the route that offers you the perfect combination of cost and protection.

More on Term Life Insurance

FAQs

Yes, it can stack up with existing coverage, such as whole life or critical illness. It’s like plugging gaps in income protection without holding premiums hostage forever. For older employees, limited pay term insurance means a smaller burden once you’ve finished paying. It coexists with other disability insurance or life coverage without standing on its own.

Self-employed individuals balance non-regular paychecks, so a faster payoff can be less risky. Limited pay term insurance provides stable expenses, in contrast to increasing Term Life Insurance Coverage. After paying premiums, the policy continues to run, releasing cash flow later. That flexibility is useful when business slows down or disability insurance is the safety net.

They don’t compete—they complement. Disability insurance replaces income if you can’t work, while Limited Term Life Insurance provides family protection in case life is cut short. Both deal with financial security in different ways. Having both offers a cushion—income replacement now, long-term protection without lifelong payments.

It does, for premiums cease prior to retirement—blank slate, no drag. RRSPs and retirement insurance plans then take the reins. The strategy is coordinated with pension planning, offering you protection early and freedom later. Limited pay term insurance is one component of the retirement insurance equation.

Not direct, such as RRSP contribution maximums or pension deductions. However, the indirect advantage is enormous—you protect savings and investments from being drained. It is like keeping tax-favoured accounts secure while your policy assumes the risk. It complements registered retirement savings plans in Canada very well.

It can. A Short-Term Life Insurance Policy allows you to settle premiums when cash flow is good, without having to worry about making payments afterwards. For commission workers or freelancers in Canada, it removes the anxiety of missing a premium when revenues are low. That brings it closer to an accessible Term Life Insurance Policy that accommodates their reality.

They have similar names, but they’re not the same. A shorter coverage period means your insurance ends sooner—no security blanket after expiration. Limited pay term insurance, conversely, maintains the protection for the entire contracted period, although you cease payment earlier. That compromise between long-term protection and condensed payment is what makes it attractive in relation to other Canadian Term Life Insurance products.

That’s more complicated. The majority of insurers in Canada won’t simply “flip a switch.” You might have to request a new Limited Term Life Insurance, which could involve new underwriting and potentially greater costs based on age and health. It’s why individuals will sometimes shop for Term Life Insurance quotes upfront, so they won’t regret passing up the limited-pay option down the line.

Yes. The higher upfront cost can stretch a budget thin. While it feels like freedom to stop paying after 10 or 15 years, some families struggle during those heavy payment years. It’s important to weigh whether an affordable Term Life Insurance Plan with smaller, ongoing premiums might feel safer for your household’s cash flow.

It cuts into the same dollars. To pay more into a limited pay term plan earlier might mean less to contribute to RRSPs or TFSAs in those years. But the catch is that with premiums stopping, future earnings are released. For Canadians weighing retirement savings against coverage, the timing of those premiums can make or break the choice.

Key Takeaways

- Limited Pay Term Insurance Plans allow you to pay premiums over a shorter period while enjoying coverage for a longer term, even for life.

- These plans offer flexibility to buy Term Life Insurance online, compare options, and lock in coverage that suits both short-term affordability and long-term needs.

- Premiums may be higher than regular Term Life Insurance quotes, but they reduce the risk of future financial strain.

- Canadian Term Life Insurance customers benefit from predictable payments, no future premium obligations after the limited pay period, and lifelong security.

- These plans suit those who want to complete payments early, avoid rising costs, or ensure family protection without ongoing expenses.

- Choosing the right option requires comparing Term Life Insurance agents, analyzing Term Life Insurance cost, and reviewing long-term financial goals.

Sources and Further Reading

- Government of Canada – Life Insurance Basics

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life-insurance.html

- Canadian Life and Health Insurance Association (CLHIA) – Industry overview and consumer guides

- Sun Life Canada – Term Life Insurance

https://www.sunlife.ca/en/insurance/life-insurance/term-life-insurance/

- Manulife Canada – Term Life Insurance Options

https://www.manulife.ca/personal/insurance/life-insurance/term-life-insurance.html

- Empire Life – Understanding Limited Pay Life Insurance

https://www.empire.ca/insurance/life-insurance

- Co-operators – Life Insurance in Canada

Feedback Questionnaire:

IN THIS ARTICLE

- Who Benefits From Limited Pay Term Insurance, And How It Works

- Life Insurance Coverage With Limited Pay

- Death Benefit And Why It Matters

- Insurance Coverage Structure

- How Much Life Insurance Do You Need

- Cash Value And Permanent Coverage

- Financial Obligations And Limited Pay

- Cost-Effective Or Not

- Home Loan And Protection

- Insurance Policies And Key Differences

- Tax Benefits To Remember

- Who Gains The Most From Limited Pay

- Our Approach

- Extended Example: Family With Mortgage And Kids

- Final Word

Sign-in to CanadianLIC

Verify OTP