- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Total Permanent Disability Insurance In Canada: What It Covers, Costs, And Who Should Get It

By Harpreet Puri

CEO & Founder

- 13 min read

- August 27th, 2025

SUMMARY

Permanent Disability Insurance in Canada protects income when illness or injury prevents work for life. Coverage ensures financial stability, helps pay medical expenses, and secures children’s education. Using a Disability Insurance Calculator and Long Term Disability Insurance Quote Online, families can assess premiums, benefits, and coverage to maintain stability during permanent disability.

Introduction

Facing Reality

We’ve met too many families caught off guard. One accident. One illness. Suddenly, the breadwinner cannot work, and the bills keep coming. Rent. Mortgage. Car loans. School fees. The government doesn’t cover it all, and employers don’t either. That’s when Permanent Disability Insurance in Canada becomes more than a concept. It’s protection, not theory.

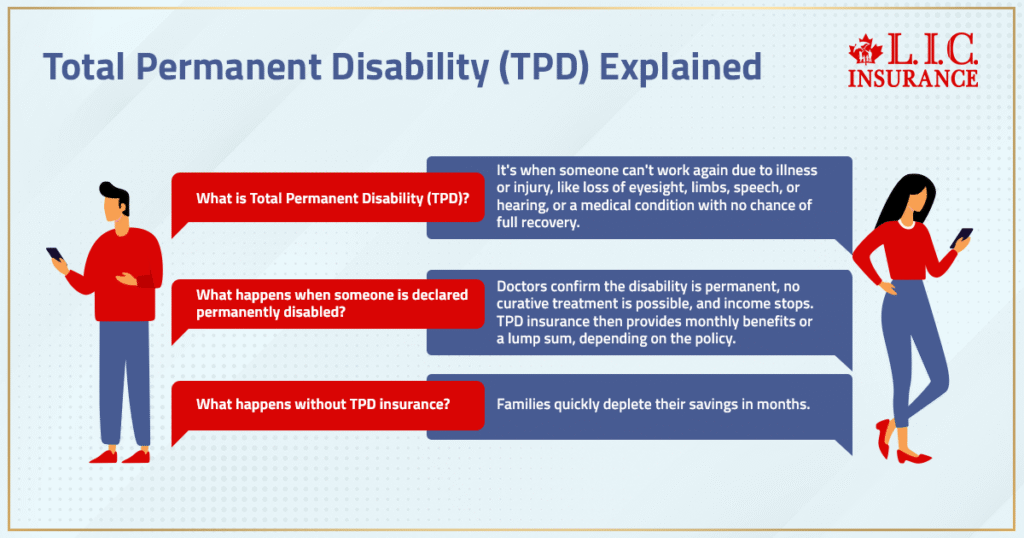

What Is Total Permanent Disability?

Total Permanent Disability, often called TPD, is when a person cannot work again because of illness or injury. It could be loss of eyesight. Loss of limbs. Loss of speech or hearing. It could be a medical condition that leaves no chance of full recovery.

We’ve seen clients where a doctor confirmed the disability was permanent. At that point, no curative treatment is possible, and income stops. That’s when TPD insurance coverage steps in, giving monthly benefits or a lump sum, depending on the policy. Without it, families burn through savings in months.

Benefits Of Choosing Permanent Disability Insurance

Insurance companies divide disability into temporary or permanent. Benefits are only paid if the condition meets the definition of permanent disability. Here are the real advantages of having coverage:

Financial Security For A Standard Lifestyle

Income loss changes everything. Permanent Disability Insurance in Canada gives financial security by replacing a fixed percentage of your wage. That’s what lets your family keep a standard lifestyle. Not luxury, but stability. Bills paid. No sudden drop into debt.

Compensation Of Medical Bills

When you are permanently disabled, medical expenses don’t stop. Hospital visits, treatment, and rehabilitation. The benefits help cover these costs. We’ve seen families relieved when payments covered expensive therapy sessions. Without coverage, they would have cut treatment short.

No Hindrance In Children’s Education

Children are often the most affected. Tuition fees, school trips, and higher education savings — these continue whether you work or not. Disability Insurance Coverage makes sure your children’s education doesn’t break down because income has disappeared. We tell clients: protecting kids’ futures is one of the strongest reasons to secure coverage early.

How To Buy Permanent Disability Insurance

Buying permanent Disability Insurance is not about finding the cheapest premium. It’s about broad coverage. Some plans are limited, some are more comprehensive. Broad coverage costs more, but it covers both illness and accident. Limited plans might cover only accidents.

Premiums depend on age, salary, health, and occupation. The terms vary between insurers. That changes both the premium and the assured benefit. Reading the fine print is not optional. We guide clients line by line so they know what is included and what is not.

How Does It Work?

In permanent disability, the policyholder receives benefits based on conditions listed in the contract. Sometimes it is the entire sum assured. Sometimes a percentage. In temporary disability, insurers may pay part of the sum for a short time until recovery.

Here are examples of conditions that often qualify as TPD:

- Irrecoverable loss of sight in both eyes.

- Total loss of hearing in both ears combined with loss of speech.

- Loss of one eye and one limb.

- Loss of use of both hands or both feet.

- Permanent inability to speak and loss of one limb.

These are not rare scenarios. We’ve seen people in their 30s and 40s face such outcomes. That’s why having Disability Insurance Coverage in place early is critical.

Temporary Vs Permanent Disability

Temporary disability is short-term. Permanent disability is lifelong. Both matter, but they are not the same.

Temporary disability means:

- Short-term loss of work ability, lasting weeks, months, or up to two years.

- Benefits stop once you recover.

- Examples: bronchitis, cancer under treatment, and minor injuries.

Permanent Disability means:

- Lifelong impairment, no chance of recovery.

- Benefits continue as long as the policy allows.

- Examples: loss of limbs, eyesight, or incurable injury.

We remind clients: Employment Insurance may help in temporary disability, but permanent disability needs long-term coverage.

Things To Remember

You can buy TPD coverage as a stand-alone policy or as an add-on to personal accident insurance. An add-on only pays for disability caused by an accident. A stand-alone covers both illness and accident. The broader the coverage, the higher the premiums.

Insurance company terms differ. Some cover more conditions, others less. That affects cost. Always check definitions, exclusions, and waiting periods. Waiting periods usually range from 30 to 120 days before benefits begin.

One exception worth noting: if you leave the workforce voluntarily or retire, you are not eligible for benefits. Permanent Disability Insurance is meant for illness or injury only.

The Canadian LIC Perspective

We’ve worked with thousands of clients, and we know patterns. Families who prepare early stay financially safe. Families who wait face denied claims, limited employer benefits, or heavy We use a Disability Insurance Calculator to show real numbers. We run Long Term Disability Insurance Quote Online so you can see how age, income, and occupation change costs. Then we explain options clearly, without hidden details.

The decision is not about whether you want coverage. The real decision is whether you want your family to be secure if you can’t work again. That’s the moment where Permanent Disability Insurance in Canada proves its value.

Final Word

Total Permanent Disability Insurance is not abstract. It’s real protection against real risks. If illness or injury ends your career tomorrow, the question is simple: how will your family pay bills and keep their life stable?

Our advice is always the same. Request a quote. Review the terms. Decide early, not later. Because once you are already affected, no insurer will approve coverage. The best time to act is before. That’s how you secure income, protect children’s education, and keep your family safe.

FAQs

There isn’t one timeline. We’ve seen claims transfer in a couple of weeks when the paperwork is clean, and we’ve seen others drag on for months. Delays most often occur when the insurer requests additional medical reports. That’s where you and we need to come in to push the request along and make sure the period is shorter.

Premiums are the easy part, but that’s not all. Some clients tack on riders to inflate the payment, and some want protection if they try to return to work. The extras, some of which can raise costs, are worth it for some households. We talk through choices line by line so you’re not surprised.

Well, indirectly, because the benefits go to the person who paid the premium, not the survivors, but we’ve seen families where the big emotional blow was to the children. There were still school bills to be paid, and food still had to be on the table. That lump-sum payment helps keep their life stable even when they’re out of work.

It is more common than people realize. We’ve seen instances in which a single piece of missing information, or one exception somewhere in the fine print, sank an appeal. Clients then appeal or have hearings. We have helped families navigate this process and have seen approvals after stronger evidence was submitted.”

That is a function of who is paying premiums. If you pay them yourself, the money is tax-free. Benefits are taxable if your employer pays the tab. Numbers are always run with our clients, as what might be cheaper upfront might not be the best deal after taxes come into play with the payment.

Yes, but it’s not simple. You may want more coverage if your salary has increased. The insurance company will also re-evaluate all of it — how old you are, how healthy you are, how much you earn. We advise our clients that it’s better to play strong very early than update later because the price of doing so is higher, and approval is harder.

The dispute revolves around doctors. Their reports, their treatment notes, their opinions — absent that, claims come to a standstill. We have seen hearings at which the court heavily, if not entirely, relied on what the doctor wrote. That’s why we talk to our clients about keeping appointments and getting the right documents in order.

Key Takeaways

- Permanent Disability Insurance in Canada protects income when illness or injury prevents work for life.

- Coverage supports financial stability, helps pay medical expenses, and keeps children’s education on track.

- Broad plans cost more but provide stronger Disability Insurance Coverage for both illness and accident.

- A Disability Insurance Calculator and Long Term Disability Insurance Quote Online help assess premiums.

- Temporary disability is short-term, while permanent disability means lifelong impairment with long-term benefits.

- Terms vary by insurance company, so definitions, exclusions, and waiting periods must be reviewed carefully.

- Acting early ensures eligibility, lower premiums, and reliable long-term disability coverage for your family.

Sources and Further Reading

- Government of Canada – Employment Insurance (EI) Sickness Benefits

https://www.canada.ca/en/services/benefits/ei/ei-sickness.html - Government of Canada – Disability Benefits

https://www.canada.ca/en/services/benefits/disability.html - Financial Consumer Agency of Canada – Insurance

https://www.canada.ca/en/financial-consumer-agency/services/insurance.html - Canadian Life and Health Insurance Association (CLHIA) – Disability Insurance

https://www.clhia.ca/web/CLHIA_LP4W_LND_Webstation.nsf/page/Disability+Insurance - Sun Life Canada – Disability Insurance Overview

https://www.sunlife.ca/en/insurance/disability-insurance/ - Manulife Canada – Disability Insurance

https://www.manulife.ca/personal/insurance/disability-insurance.html - Canada Life – Long Term Disability Insurance Quote Online

https://www.canadalife.com/insurance/disability-insurance/long-term-disability.html

Feedback Questionnaire:

IN THIS ARTICLE

- Total Permanent Disability Insurance In Canada: What It Covers, Costs, And Who Should Get It

- What Is Total Permanent Disability?

- Benefits Of Choosing Permanent Disability Insurance

- How To Buy Permanent Disability Insurance

- How Does It Work?

- Temporary Vs Permanent Disability

- Things To Remember

- The Canadian LIC Perspective

- Final Word

Sign-in to CanadianLIC

Verify OTP