- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Top Whole Life Insurance Policies In Canada With The Highest Dividends

By Pushpinder Puri

CEO & Founder

- 10 min read

- June 16th, 2025

SUMMARY

Top Whole Life Insurance Policies in Canada with the highest dividends are compared based on performance, rates, and long-term value. The content explains how Whole Life Insurance Coverage works, what to expect from Whole Life Insurance Rates in 2025, and how policyholders use dividends to build cash value, fund education, or support retirement. It highlights real-life client stories and expert advice from Canadian LIC.

Introduction

Every time someone walks through our doors at Canadian LIC and says, “I want a policy that takes care of my family—and maybe grows something for them,” we know exactly where to start. In 2025, the focus isn’t just on protection; it’s about building guaranteed value. Whole Life Insurance isn’t just a safety net. It’s an asset. And for Canadians looking to lock in financial growth while safeguarding their legacy, Whole Life Insurance Policies with high dividends are proving to be one of the strongest financial tools available.

We’ve seen firsthand how families benefit from policies that not only offer lifelong coverage but also deliver increasing cash value through reliable dividend payouts. But not all plans are created equal. So today, we’re bringing you an insider view of the top Whole Life Insurance Policies in Canada with the highest dividend performance, backed by over 14 years of our experience, client stories, and hands-on results.

Why Dividends Matter in Whole Life Insurance Coverage

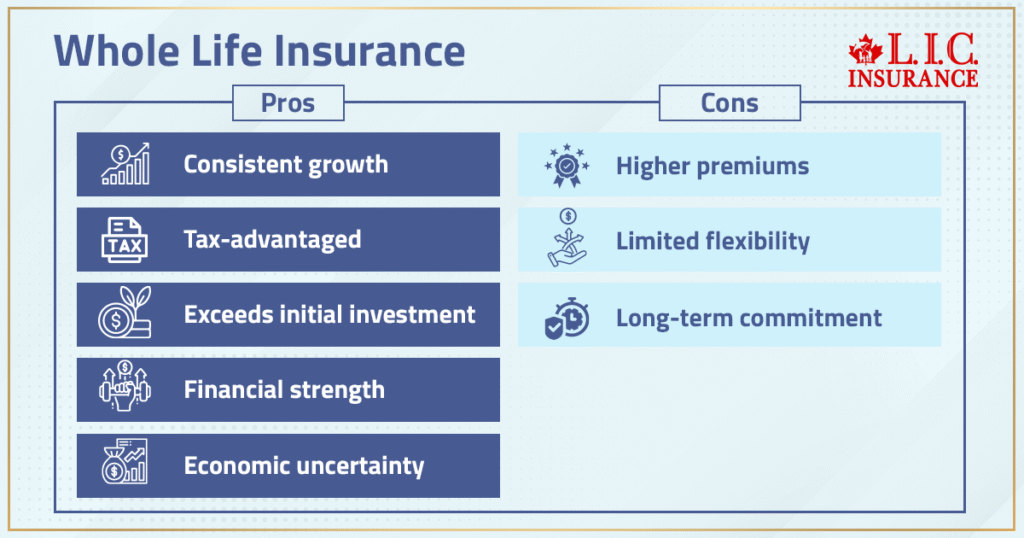

Too many people think Whole Life Insurance is just about death benefits. What they miss is how powerful dividend-paying policies can be in building long-term financial strength.

Let’s take the example of one of our clients from Brampton. She started a whole life policy for her 7-year-old son. By the time he turns 30, the cash value projected from dividends alone will exceed what she put into the policy. No stock market volatility. No guesswork. Just consistent growth, tax-advantaged.

This is the kind of Whole Life Insurance Coverage smart Canadians are leaning into—especially now, with economic uncertainty making fixed growth more attractive than ever.

How Whole Life Insurance Dividends Work

Dividends are not guaranteed, but some Canadian insurers have consistently paid them for over a century. Here’s how they typically work:

Issued annually based on the insurer’s performance

Reflect profits from investment returns, expense control, and claims experience

It can be used to:

- Buy additional paid-up insurance

- Reduce premiums

- Earn interest

- Accumulate as cash

At Canadian LIC, we walk every client through these dividend options to help them align the policy with their financial goals. Whether you’re saving for a child’s future, building an estate, or supplementing retirement income, dividends help you grow while staying protected.

Key Factors to Compare Dividend-Paying Whole Life Insurance Policies

Choosing the best Whole Life Insurance Policy with strong dividends means looking at more than just rates. We consider:

- Historical dividend track record

- Participating in account performance

- Policy flexibility

- Cash value growth projections

- Premium structure (limited pay or life pay)

- Conversion options and riders

We don’t believe in one-size-fits-all. What worked for your neighbour may not suit your goals. That’s why we match policies with your needs, not just market hype.

Top Dividend-Paying Whole Life Insurance Policies in Canada – 2025 Review

Here’s our professional ranking based on client outcomes, insurer financial strength, and dividend performance:

- Canada Life – Participating Life

- Dividend History: Paid consecutively for 175+ years

- Dividend Scale Interest Rate (2025): ~5.2%

- Why It Works: Strong balance sheet, flexible paid-up options, solid for wealth transfer

- Best For: Estate planning, intergenerational wealth, corporate clients

- Sun Life – Sun Par Protector / Sun Par Accumulator

- Dividend History: Highly consistent

- Dividend Scale Interest Rate (2025): ~5.0%

- Why It Works: Accumulator plan offers high early cash values, strong for retirement planning

- Best For: Retirement income, long-term cash value access, family banking

- Manulife – Par Whole Life

- Dividend History: Excellent across decades

- Dividend Scale Interest Rate (2025): ~5.05%

- Why It Works: Strong digital access, options for premium offset, smooth claims process

- Best For: Professionals, business owners, high-net-worth individuals

- Equitable Life – Equimax Estate Builder / Wealth Accumulator

- Dividend History: Consistent with member-owned advantage

- Dividend Scale Interest Rate (2025): ~6.05% (one of the highest)

- Why It Works: Flexible design, high early cash values

- Best For: Young families, parents buying for kids, cash-rich clients

- Foresters Financial – Advantage Plus Whole Life

- Dividend History: Reliable and focused on mutual benefit

- Dividend Scale Interest Rate (2025): ~6.00%

- Why It Works: Includes membership benefits, community grants, and an orphan scholarship fund.

- Best For: Clients who value impact, long-term giving, and legacy building

Whole Life Insurance Rates – What to Expect in 2025

Whole Life Insurance isn’t “cheap,” but it’s dependable. It builds guaranteed value, which term insurance cannot do. That said, here’s a rough guide to 2025 Whole Life Insurance Rates:

| Age | $100,000 Coverage (Life Pay) | $100,000 Coverage (20-Pay) |

|---|---|---|

| Age 25 | $65–$80/month | $105–$130/month |

| Age 35 | $90–$110/month | $150–$180/month |

| Age 45 | $130–$160/month | $210–$260/month |

| Age 55 | $190–$240/month | $310–$370/month |

Rates vary based on smoking status, gender, riders added, and policy design. At Canadian LIC, we work to structure plans that maximize value based on your goals.

How Families Use Dividends From Whole Life Policies

Our clients use dividends in powerful ways. Here’s how:

- Build a Tax-Free Retirement Buffer – One Toronto couple used their policy’s accumulated dividends to supplement their RRSP withdrawals.

- Fund a Child’s Education – A Mississauga father bought a limited-pay plan, and by age 18, his son had enough cash value to cover tuition.

- Create a Family Bank – Families borrow from their policy cash value to finance cars, weddings, and even home renovations—repaying themselves, not a bank.

These strategies are not theory—they are real, practical, and used by our advisors every day.

Common Mistakes People Make With Whole Life Insurance Policies

- Choosing Based on Premium Alone: The lowest premium ≠ is the best policy.

- Not Reviewing Dividend Options Annually: You need to adjust based on current financial goals.

- Ignoring Riders That Add Flexibility: Critical illness, waiver of premium, and guaranteed insurability riders can make a big difference

- Delaying Start: Premiums increase with age; starting earlier builds more value.

Our role at Canadian LIC is to help you avoid these traps.

Why Canadian LIC Is the Trusted Source for Whole Life Insurance in Canada

Harpreet Puri, our CEO, brings over 14 years of experience in designing personalized Whole Life Plans that balance protection, growth, and legacy. Whether you’re a young parent, a mid-career professional, or preparing your estate, we know how to build policies that work for you.

We do more than quote policies. We educate, guide, and stay with you throughout the life of your plan.

More on Whole Life Insurance

FAQs – Whole Life Insurance Policies With Dividends

No, as long as they remain within the policy. Withdrawals or loans may have tax implications.

Yes. Most participating policies allow you to apply dividends toward reducing or offsetting premiums.

No. Rates and policies vary widely. That’s why expert guidance is key.

It depends on your goals. Whole life offers guarantees and stability; universal life provides more flexibility but requires active management.

You can start with policies as low as $25/month, but meaningful dividend growth usually begins around $75–$100/month, depending on age.

Need help choosing the right Whole Life Insurance Policy in Canada with high dividends? Speak to a licensed advisor at Canadian LIC today. We’re here to help you protect, grow, and pass on your wealth the smart way.

Yes. That’s one of the biggest advantages of Whole Life Insurance Policies. You can borrow against the accumulated cash value or withdraw it, depending on the insurer’s rules. Many of our clients use it for retirement income, emergencies, or family needs like education or business startup funds.

Unused dividends can accumulate within the policy to earn interest, purchase additional paid-up insurance, or be held as cash value. At Canadian LIC, we often recommend reinvesting them into the policy to grow your coverage and wealth tax-efficiently, especially if you don’t need the cash immediately.

We recommend reviewing your policy annually. Dividends, personal finances, and life goals change. A quick review helps you adjust how dividends are used, whether to reduce premiums, increase coverage, or boost cash value. Our advisors handle these reviews regularly for our clients to make sure the policy continues working in their best interest.

Not at all. While many high-net-worth clients use them for estate planning, we work with young professionals, new parents, and small business owners every day who start small and grow over time. You can start with a manageable monthly premium and still benefit from long-term value.

Absolutely. In fact, it’s one of the smartest financial moves parents and grandparents make. Buying early locks at the lowest possible rates allows decades of cash value to be built. We’ve helped many families use this strategy to create a financial foundation that supports education, marriage, or even home ownership down the road.

Many Whole Life Insurance Policies come with built-in safety nets like automatic premium loans or cash value used to keep the policy active. But consistent payment is important. If something happens, contact us immediately—we’ve helped clients resolve missed payments and reinstate policies without losing coverage.

Yes, many term policies come with a conversion option that allows you to switch to a whole life policy without medical underwriting, usually within a specific time window. If you’re unsure whether your policy qualifies, reach out. We’ll walk you through the details and timing.

Key Takeaways

- Whole Life Insurance Policies offer more than just coverage — they build guaranteed cash value and can pay dividends annually, depending on insurer performance.

- Top providers in Canada for 2025 include Canada Life, Sun Life, Manulife, Equitable Life, and Foresters Financial, all offering strong dividend-paying whole life plans.

- Dividend payouts can be used in several ways, such as buying additional paid-up insurance, reducing premiums, accumulating interest, or withdrawing as cash.

- Dividend scale interest rates for 2025 range from ~5.0% to over 6.4%, with Equitable Life and Foresters Financial offering some of the highest rates.

- Whole Life Insurance Rates vary by age, gender, smoking status, and plan type, but provide stable, long-term value, unlike term insurance.

- Families use dividend-rich policies to fund retirement, education, or create a personal family bank — building wealth while staying protected.

- Common mistakes include choosing the lowest premium instead of the best long-term value, skipping annual policy reviews, or delaying policy start dates.

- Starting early gives more time for dividends to compound, especially when buying for children or young adults.

- Canadian LIC helps clients match the right Whole Life Insurance Coverage to their goals, using real experience, product knowledge, and a client-first approach.

- Whole Life Insurance with dividends is ideal for those seeking long-term financial security, tax-sheltered growth, and legacy planning.

Sources and Further Reading

- Canada Life – Participating Whole Life Insurance

Discusses dividend uses such as buying paid-up additions, paying premiums, or withdrawing cash suncentral.sunlife.ca+15canadalife.com+15advisor.equitable.ca+15foresters.com+6foresters.com+6foresters.com+6. - Sun Life – Participating Whole Life Dividend Scale History

Shows consistent dividend scale with ~6.25% interest rate suncentral.sunlife.ca+12sunlife.ca+12manulife.ca+12. - Manulife – Dividends for Par Whole Life

Dividend scale interest rate of ~6.35% as of September 1, 2024 centralesunlife.sunlife.ca+15manulife.ca+15manulife.ca+15. - Equitable Life – Equimax Participating Whole Life Dividend Info

Current dividend scale is 6.40% from July 1, 2025, bluesky.foresters.com+9equitable.ca+9advisor.equitable.ca+9equitable.ca+5equitable.ca+5advisor.equitable.ca+5. - Foresters Financial – Advantage Plus Whole Life

Describes dividend options like paid-up additions, cash deposits, or premium reduction canadalife.com+15foresters.com+15foresters.com+15. - Canada Life – 2024 Participating Policyholder Dividend Policy PDF

Details on dividend scale and its non-guaranteed nature canadalife.com+15canadalife.com+15canadalife.com+15.

Feedback Questionnaire:

We’re here to support your financial journey. Your feedback helps us understand where people get stuck, what’s confusing, and how we can serve you better.

Thank you for taking a moment to share your feedback. One of our experienced advisors at Canadian LIC may follow up (if requested) to help you make a confident decision. You’re never alone in this process.

IN THIS ARTICLE

- Top Whole Life Insurance Policies In Canada With The Highest Dividends

- Why Dividends Matter in Whole Life Insurance Coverage

- How Whole Life Insurance Dividends Work

- Key Factors to Compare Dividend-Paying Whole Life Insurance Policies

- Top Dividend-Paying Whole Life Insurance Policies in Canada – 2025 Review

- Whole Life Insurance Rates – What to Expect in 2025

- How Families Use Dividends From Whole Life Policies

- Common Mistakes People Make With Whole Life Insurance Policies

- Why Canadian LIC Is the Trusted Source for Whole Life Insurance in Canada

Sign-in to CanadianLIC

Verify OTP