- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

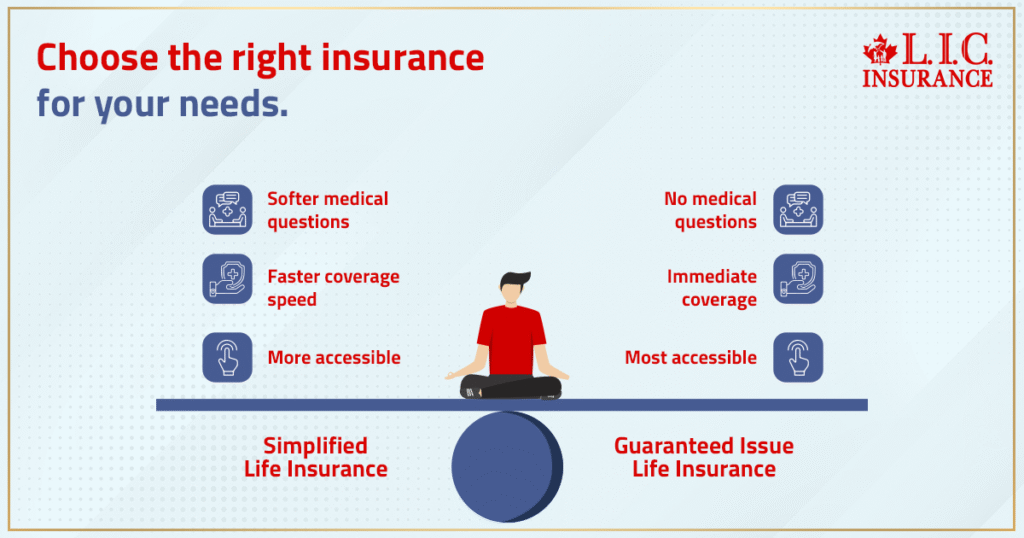

Simplified Vs. Guaranteed Issue Life Insurance: Choosing What Truly Fits You

By Harpreet Puri

CEO & Founder

- 12 min read

- August 21th, 2025

SUMMARY

This comparison between a Simplified Life Insurance Plan and a Guaranteed Life Insurance Policy outlines key aspects, including eligibility, application process, coverage, and costs. It explains how Canadian Life Insurance companies assess health factors, medical exam requirements, and benefit payouts, while also detailing how each option addresses different needs, budgets, and long-term goals for individuals seeking reliable Life Insurance coverage.

Introduction

There’s a moment that hits you — maybe it’s while sorting through a drawer of old documents, or sitting at the kitchen table with a cup of coffee — when you realize you can’t keep putting off Life Insurance.

For some people, it’s a passing thought. For others, especially if health issues have crept in over the years, it’s a quiet weight on the shoulders. You’re not just buying a policy; you’re buying a promise your family can rely on when you’re no longer here to keep things steady.

That’s when the two names start showing up again and again: Simplified Life Insurance and Guaranteed Life Insurance Policy.

Both seem simple. Both promise coverage without endless forms or invasive medical exams. But the truth? They’re different in ways that matter — and those differences can mean the world when the time comes for your family to make a claim.

Why These Two Types Exist At All

In a perfect world, we’d all apply for fully underwritten Life Insurance, breeze through the medical exam, and get the best Life Insurance rates possible. But life isn’t that neat.

Some people have serious health issues. Others have time-sensitive needs — a divorce settlement requiring Life Insurance coverage, a mortgage renewal, or simply the urge to get coverage in place quickly after a scare.

This is where Simplified Life Insurance Plans and Guaranteed Issue Life Insurance come in. They’re designed for people who don’t fit the mould of the traditional underwriting process. The Life Insurance companies offering them know they’re serving a group that values speed, accessibility, and a softer approach to medical questions.

Let’s Start With Guaranteed Issue Life Insurance

Imagine you’ve had more than one major health diagnosis in recent years. A Life Insurance policy provider in Canada has already declined you for Term Life Insurance and Whole Life Insurance after a medical history review. That’s when a Guaranteed Life Insurance Policy becomes your lifeline.

- No medical questions

- No medical exam

- Guaranteed acceptance if you’re within the eligible age range

It sounds perfect — and for many, it is. But here’s the part that often surprises people: the death benefit is usually modest, often $5,000 to $25,000, designed to cover funeral and burial costs or final expenses. And most policies have a waiting period (often two years) before the full benefit is paid for death from natural causes.

Still, for someone shut out from other Life Insurance options, this type of policy delivers something invaluable: certainty.

The Emotional Side Of Choosing

This isn’t just about policy terms. I’ve sat with families where a parent’s declining health made traditional coverage impossible. The sense of relief they felt after securing a Guaranteed Issue Life Insurance Plan wasn’t about the numbers — it was about knowing they’d left something behind to ease the strain.

And in those moments, no one talks about premiums paid or cash value growth. They talk about dignity

Switching Gears: Simplified Life Insurance Plans

Now let’s flip the situation. Suppose you’ve got a few health concerns — maybe controlled high blood pressure, or you had surgery a few years ago — but nothing life-threatening right now. A Simplified Issue Life Insurance plan could work in your favour.

You’ll answer a short list of medical questions (often a dozen or fewer). If you can honestly answer “no” to most of them, you could qualify for higher coverage amounts, sometimes up to $500,000, without a medical exam.

This means you get more protection and sometimes better Life Insurance rates than a guaranteed plan. The trade-off? If your health issues are serious enough to answer “yes” to certain key questions, you might be declined and have to fall back on a guaranteed issue policy.

Where Permanent Life Insurance Fits

Many Canadian Life Insurance companies also offer both simplified and guaranteed options as permanent Life Insurance policies. That means your coverage won’t expire as long as you pay premiums, and in some cases, a cash value component can grow over time.

Permanent policies — whether Whole Life, Universal Life Insurance Policies, or Variable Life Insurance — are more expensive than term coverage, but they give you lifetime protection. For people who want to ensure their Life Insurance claim will be honoured no matter when they pass, this is a crucial advantage.

Whole Life vs. Universal Life — And Where Simplified & Guaranteed Fit

If you go the permanent route, you’ll also have to choose between Whole Life Insurance (steady premiums, guaranteed growth in cash value) and Universal Life Insurance (more flexibility in premiums and investment options). Both can be issued under simplified or guaranteed rules, though the coverage amount and Life Insurance cost will vary.

For example:

- Whole life might appeal to someone who wants predictable premiums and a clear, steady path to building cash value.

- Universal life could attract someone more comfortable with investment risk who likes the idea of adjusting how much they pay.

Common Misconceptions That Trip People Up

Here’s one I hear all the time: “If it’s a guaranteed issue, it must be the best for everyone.” Not so. If you can qualify for Simplified Issue Life Insurance, you’ll usually get more Life Insurance protection for the same or lower cost.

Another myth? That guaranteed acceptance means instant full payout. As mentioned, most Guaranteed Life Insurance Policies have a waiting period for natural causes. If you pass away during that time, your beneficiaries might receive only the premiums paid plus interest.

Canada Protection Plan And Similar Providers

Some names keep popping up in this space — Canada Protection Plan is one of the most recognized. They’ve built a strong reputation for no Medical Life Insurance, with both simplified and guaranteed options. But they’re not the only game in town. Other insurance companies also compete with the best Life Insurance Companies, offering similar products.

It’s worth comparing Life Insurance rates across multiple providers, even if you’ve already been sold on one. The underwriting process (even in simplified form) can differ slightly, and that can affect your approval and premiums.

How Medical Life Insurance Differs

There’s also a category called Medical Life Insurance — not to be confused with medical insurance for health expenses. In Life Insurance terms, it usually means fully underwritten coverage, where you take a medical exam and answer a detailed questionnaire. This is where you’ll get the most competitive rates, but again, it’s not an option for everyone.

Balancing Budget And Coverage

Here’s where family conversations get tricky. You might be leaning toward a simplified issue because you want higher coverage, but your spouse is pushing for guaranteed issue for its certainty. Or maybe you’re weighing whether to put more into Group Life Insurance at work instead of buying individual coverage.

These are not just financial decisions — they’re emotional. Your choice affects not only how much your family will receive but also the kind of stability they’ll feel knowing the plan is in place.

Death Benefit Expectations

No matter which path you choose, keep your expectations realistic. If your primary goal is to cover end-of-life expenses, burial insurance or a small final expense insurance policy might be all you need. If you want to leave a meaningful inheritance, you’ll need to look for higher coverage amounts, possibly through Term Life Insurance Policies or permanent coverage.

Health History And Eligibility

Your medical history plays the biggest role in where you land on the spectrum from Traditional Life Insurance Policies to deferred Life Insurance to fully Guaranteed Acceptance Life Insurance. Even details like whether you’ve been hospitalized in the past year or have certain health concerns can move you from one category to another.

How To Decide — Without Regret

When you’re stuck between simplified and guaranteed, I suggest this approach:

- Start with the questions — See if you can pass the Simplified Term Life Insurance health questions.

- Compare costs — Get Life Insurance Policy Quotes for both.

- Think about the waiting period — Can your family manage without the full death benefit for the first two years if it’s guaranteed?

Match to your goals — Is this about income replacement, covering debt, or simply leaving enough to handle funeral and burial expenses?

Simplified Life Insurance V/s Guaranteed Issue Life Insurance

| Feature | Simplified Life Insurance Plan | Guaranteed Life Insurance Policy |

|---|---|---|

| Medical Exam | No medical exam required, but a few health questions are asked. | No medical exam and no health questions—approval is automatic. |

| Eligibility | May be denied if certain serious health issues are disclosed. | Approval for almost everyone meeting the age criteria, regardless of health. |

| Coverage Amount | Typically higher than guaranteed issue; can range from $50,000 to $500,000 depending on insurer. | Usually, lower coverage limits are often between $5,000 and $50,000. |

| Premiums | More affordable than guaranteed issue because of limited health screening. | Higher premiums due to no health screening and a higher risk to the insurer. |

| Waiting Period | Shorter waiting period before full death benefit applies (often 1–2 years). | Longer waiting period (usually 2 years) before full death benefit; accidental death may be covered immediately. |

| Best For | Those with manageable health issues who want higher coverage without a full medical exam. | Individuals with severe health problems or those who have been declined for other types of Life Insurance. |

| Death Benefit | Pays full death benefit after waiting period or immediately for accidental death. | Pays full death benefit after waiting period; if death occurs earlier, premiums paid may be refunded. |

| Underwriting Process | Simplified underwriting—few medical questions, no lab tests. | Guaranteed acceptance—no underwriting questions, no lab tests. |

| Example Use Case | A person with mild diabetes who wants moderate coverage without medical tests. | A person with multiple serious health issues needs guaranteed approval for final expenses. |

Final Thoughts

Choosing between Simplified Life Insurance and a Guaranteed Life Insurance Policy isn’t about which one is “better” in the abstract. It’s about which one meets your needs, health profile, and budget without creating more stress for your loved ones.

Some will lean toward the comfort of knowing they’re instantly accepted. Others will take the extra step to answer health questions for more robust coverage. Either way, the goal is the same: leave behind something meaningful, so that when the hardest days come, money is not the first thing your family has to think about.

FAQs

A few insurers will permit you to convert back to a fully underwritten Life Insurance policy if your health has improved. It just may allow you a higher face amount for Life Insurance or more affordable rates, all without sacrificing the coverage you currently have.

Certain Guaranteed Life Insurance Policies build up a small cash value slowly over time. This is not meant as an investment, but could be a small amount you might want to take out in later years that would not impact your death benefit for final expenses or funeral and burial costs.

You still can have both if your budget permits, the coverage of simplified Life Insurance and the guaranteed acceptance Life Insurance. This can help fill in the gaps when you need Life Insurance at various points throughout your lifetime.

Group Life Insurance does not reduce the amount of coverage you can qualify for by way of your own personal Life Insurance policies. No ideas. Many Canadians keep both for added Life Insurance coverage, as well as because they want continued coverage regardless of whether they may stop working or lose workplace benefits.

Simplified Issue Life Insurance typically consists of a small set of medical questions, as opposed to an entire physical exam. This enables people with select health conditions to qualify and allows them to secure Life Insurance coverage that is substantive enough for their family.

Whole Life Insurance offers lifelong protection and has a cash value, while Guaranteed Issue Life Insurance is all about getting you a death benefit — no matter what. It all comes down to whether you would like simple protection of final expenses, or the life-long security with cash value that could be saved.

With Guaranteed Issue Life Insurance that is offered by most companies in Canada, anyone can be approved regardless of medical history. But if the death is from natural causes in the first two years, there may be a waiting period before there is full payment of the death benefit.

The fact that Variable Life Insurance policies carry an investment component (with the concomitant risk of losing money) and permitted flexibility will help such a policy build cash value, but also means the policyholder may need to be a bit more hands-on with respect to managing the various aspects. Variable Life Insurance also almost always requires a medical exam, whereas Level Term insurance does not. If you apply for a Simplified Life Insurance Plan, it usually comes with an expedited approval process, and it will require fewer health questions, thus making this option ideal for someone who is on the go.

Key Takeaways

- Simplified Life Insurance Plans and Guaranteed Life Insurance Policies are designed for people who want coverage without the full medical exam process, but each has different eligibility, costs, and benefits.

- Simplified Issue Life Insurance usually asks a few medical questions and can offer higher coverage amounts than guaranteed options, making it a better fit for those with manageable health issues.

- Guaranteed Issue Life Insurance skips medical questions entirely, offering near-automatic approval, but premiums are higher, and death benefits are often limited in the first two years.

- Choosing between the two depends on age, health, budget, and your priorities for Life Insurance coverage, whether it’s replacing income, covering final expenses, or leaving a small legacy.

- Comparing offers from multiple Life Insurance policy providers in Canada can help you secure the right balance of cost, benefits, and coverage amount.

Sources and Further Reading

Government and Regulatory Resources

- Financial Consumer Agency of Canada (FCAC) – Life Insurance Basics and Consumer Rights

https://www.canada.ca/en/financial-consumer-agency.html - Canadian Life and Health Insurance Association (CLHIA) – Guidelines on Life Insurance Policies and Consumer Protections

https://www.clhia.ca

Educational and Financial Literacy Resources

- Investopedia – Simplified Issue Life Insurance vs. Guaranteed Issue Life Insurance

https://www.investopedia.com - Canadian Encyclopedia of Financial Planning – Life Insurance Types and Coverage Options

https://www.fpcanada.ca

Consumer and Industry Insights

- Insurance Bureau of Canada (IBC) – Consumer Guides on Life and Health Insurance

https://www.ibc.ca - Life Happens (Nonprofit) – Life Insurance Policy Comparisons and Decision-Making Tips

https://www.lifehappens.org

Feedback Questionnaire:

IN THIS ARTICLE

- Simplified Vs. Guaranteed Issue Life Insurance: Choosing What Truly Fits You

- Why These Two Types Exist At All

- Let’s Start With Guaranteed Issue Life Insurance

- The Emotional Side Of Choosing

- Switching Gears: Simplified Life Insurance Plans

- Where Permanent Life Insurance Fits

- Whole Life vs. Universal Life — And Where Simplified & Guaranteed Fit

- Common Misconceptions That Trip People Up

- Canada Protection Plan And Similar Providers

- How Medical Life Insurance Differs

- Balancing Budget And Coverage

- Death Benefit Expectations

- Health History And Eligibility

- How To Decide — Without Regret

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP