- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

PSHCP Travel & Emergency Medical Insurance In Canada 2025: What You Need To Know

By Pushpinder Puri

CEO & Founder

- 10 min read

- November 24th 2025

SUMMARY

The content outlines how PSHCP travel and Emergency Medical Insurance Coverage work in 2025 for federal employees and pensioners. It explains the role of Canada Life, eligibility for emergency travel assistance, the importance of positive enrolment, how to handle medical expenses abroad, and what eligible expenses are reimbursed. It also covers benefit card use, extended health provision limits, and claim submission details for International Travel Insurance Plans.

Introduction

You don’t always see the moment coming — but you can be ready for it.

Whether it’s a minor accident on a European tour or an unexpected health issue while visiting family abroad, travel can bring surprises. And when those surprises come with medical bills, your PSHCP Travel and Emergency Medical Insurance steps in.

In 2025, the Public Service Health Care Plan (PSHCP) isn’t just another formality in your benefits package. It’s a practical, built-in layer of Emergency Medical Insurance Coverage for travel — especially if you’re a federal employee, pensioner, or PSHCP member who’s completed positive enrolment.

And yet… most members don’t realize what’s covered — and what’s not — until they really need it. We’ve had calls that prove just how important it is to understand your plan before boarding that plane.

The $1 Million Lifeline (But with Limits)

The Travel Emergency Medical Insurance Plan offered through the PSHCP provides up to $1 million per person for eligible expenses during travel outside your province. Sounds generous, right?

It is. But… here comes the fine print.

The entire period of that coverage maxes out at 40 days — and that’s excluding official travel status (like a business trip approved by your department).

So let’s say you take your family on a summer road trip across the U.S., or plan a 6-week trip to India to visit family — if you’re still away on day 41, you’re exposed.

No emergency treatment. No emergency travel assistance. Nothing.

It’s painful watching PSHCP members assume they’re fully covered, only to get stuck with tens of thousands in medical expenses because they stayed one week too long.

Who Actually Provides the Help?

Let’s be real — when people hear “Canada Life,” they assume it’s the one helping them during an emergency abroad. But that’s not the case here.

In this health care plan, the PSHCP structure, Canada Life is the current plan administrator, but is it the real on-the-ground help?

That comes from MSH International, through the Emergency Travel Assistance Benefit.

These are the folks who manage:

- 24-hour toll-free emergency helpline

- Medical referrals and monitoring

- Medical evacuation if you’re in an area without suitable care

- Even transportation arrangements, if you’re hospitalized and your children are left alone

If you’ve never called a 24-hour PSHCP member services line in the middle of a panic attack or heart event abroad — trust me — having assistance services that actually answer makes all the difference.

What If You’re Hospitalized Abroad?

We’ve seen this one happen — and it’s brutal.

You’re out of the country. Something serious happens. Maybe it’s you, maybe it’s your spouse. You’re rushed to a hospital. Your local insurance card? Useless.

This is where the Emergency Travel Assistance Benefit steps in like a paramedic for your wallet.

Here’s what most plan members don’t realize:

If you’re admitted, you must call the 24-hour help line. Immediately. Don’t wait.

Why? Because advance payment assistance is only triggered when you connect with the team.

They’ll verify your PSHCP benefit card details and certificate number, and they’ll speak directly with the hospital to pay eligible medical expenses upfront.

No calling your bank. No maxing your credit card to post a $15,000 guarantee. They do it for you.

But if you delay — if you try to sort things on your own — the burden can come back to you. That’s real.

Family Left Behind — Or Worse, Stranded

This next part isn’t talked about enough.

We had a case last year where a PSHCP member was hospitalized in the Caribbean. His two kids, both under 12, were left sitting in a hotel lobby, terrified, while his wife was taken into emergency surgery.

That’s where the Family Assistance feature becomes life-changing.

Here’s what’s included:

- Return of dependent children under 16 (plus an escort if needed)

- Return of other family members if their flight was missed due to hospitalization

- Visit of a relative if someone’s hospitalized for more than 7 days while travelling alone

- Meals and accommodation reimbursement up to $200/day if your trip is extended due to hospitalization

And yeah — it even includes up to $5,000 in total coverage for these family support services.

But again, only if you know the rules. Only if you call and use the right services through PSHCP member services or the emergency travel assistance hotline.

Death Abroad — The Costs You Never Consider

Nobody likes talking about this part.

But here, we plan for everything — even the darkest possibilities.

If a covered family member dies while travelling, the coordinators will handle the worst of the logistics:

- Return of the deceased to Canada

- Up to $3,000 reimbursed for preparation and transportation of the body

You don’t want to deal with paperwork while grieving. You don’t want to negotiate with airlines or morgues in a foreign country.

You want it handled — and this benefit does that.

But this is why we tell our clients:

Make sure you have all your details ready — plan number, PSHCP contract info, your benefit card, and completed positive enrolment records. If you’re not fully registered, you might not be eligible.

The Part Nobody Reads — Until It’s Too Late

You know that fine print everyone scrolls past? Yeah… that’s the stuff that burns you.

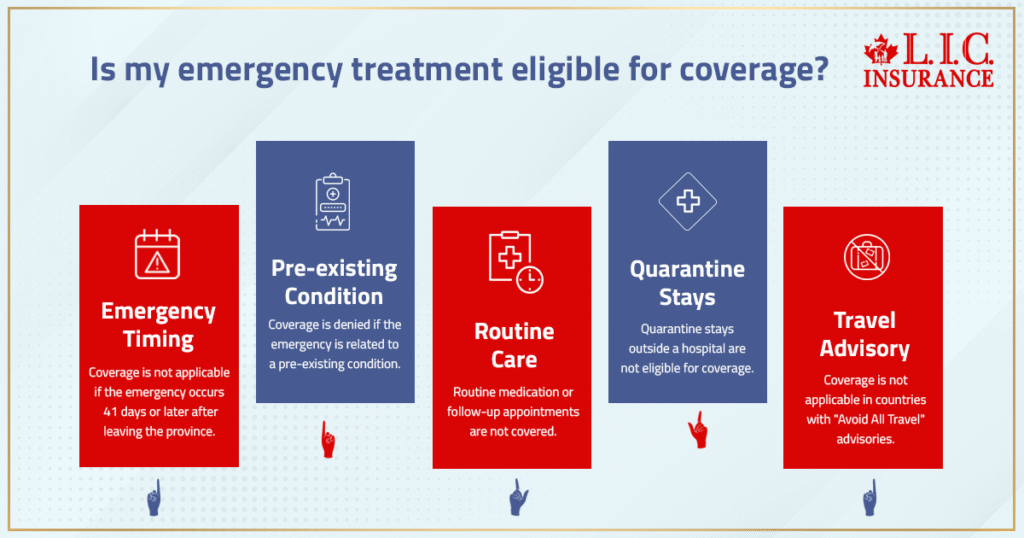

Here’s the cold truth: PSHCP Emergency Medical Insurance Coverage for travel isn’t bulletproof.

There’s a long list of exclusions, and we’ve seen too many people shocked when their claim gets denied.

Here’s what’s not covered:

- If your emergency happens on day 41 or later after you’ve left your province, you’re out.

- If you were already sick and left anyway, and it wasn’t a new emergency treatment, the claim was denied.

- If you’re just getting routine medication or a follow-up appointment, it doesn’t count.

- Quarantine stays, like COVID isolation outside a hospital? Also not eligible.

- And if you’re in a country flagged as “Avoid All Travel” by Canada’s advisory, your comprehensive coverage doesn’t apply.

This is where we get real with our clients.

Don’t rely on PSHCP alone.

We often pair clients with International Travel Insurance Plans that bridge the gap — especially for longer trips, or those with pre-existing medical conditions.

Submitting A Claim – It’s Not Instant Gratification

Okay, let’s say you did everything right. You got help, you kept your receipts, and now you want to get your money back.

Here’s how that works:

🧾 Online Claim

- Head to the MSH PSHCP Member Portal.

- Register using the same email and DOB on file with Canada Life.

- Heads up: If you just finished your positive enrolment, you might need to wait 48 hours before registering.

- Once in, you can upload receipts, submit claims, and track everything securely.

📮 By Mail

- Download the paper form from the MSH portal or call the PSHCP member contact centre.

- Mail it to:

- MSH International (Canada) Ltd

- PO Box 4903 STN A

- Toronto, ON, Canada, M5W 0B1

Oh — and don’t forget to keep copies of every single document.

If you lose those receipts or fail to submit your claim within the calendar year, you could be out of luck.

Reimbursement Rules That Catch People Off Guard

Let’s talk about reimbursement.

Because yes, sometimes MSH International will cover your costs upfront — but that doesn’t mean it’s free money.

If the medical expenses weren’t eligible under your provincial health plan or the extended health provision of the PSHCP, you can ask for the money back.

No joke. We’ve seen clients get slapped with repayment notices because they assumed it was fully covered.

That’s why it’s so important to:

- Know what counts as a medical reason

- Keep proof of prescription drugs covered

- Understand what a reasonable and customary charge is

- Follow the prior authorization process if needed

And again — don’t just rely on your benefit card. Back it up with policy numbers, contact Canada Life if needed, and know who the plan administrator is at every stage.

When Dependants Get Left Behind By The System

Let’s talk about the people you think are covered, but might not be.

It’s not always obvious who counts as a dependant under the PSHCP coverage umbrella.

Got a common law partner?

A child turning 21 this year?

A child living with a disability but over age 25?

If your dependant information verification reminder wasn’t updated or acknowledged through positive enrolment, your claim could be denied — even for something as serious as an emergency medical evacuation.

We’ve helped dozens of families who thought their health care plan, PSHCP, applied to everyone in the household. It didn’t — not until the paperwork caught up.

And let’s not forget: you can’t just slap a PSHCP benefit card down in another country and expect everything to be magically sorted.

Your completed positive enrolment determines whether your child, spouse, or dependent is eligible for emergency treatment or assistance services while abroad.

What Bargaining Agents and Legacy Rules Don’t Tell You

The PSHCP underwent some pretty serious plan changes in recent years.

There was a PSHCP directive, new contribution rates, and updated plan administrator responsibilities.

But here’s the thing:

Most members weren’t told what that actually meant for their real-world coverage.

If you’re still relying on Sun Life as the go-to name in this space, you’re living in the legacy period. The current admin? Canada Life — and its MSH International- is handling all things travel emergency.

Some bargaining agents pushed back against the switchover, but let’s be honest: politics aside, what matters is that you know who covers what, and how fast.

Even now, confusion around reimbursement, co-payment limits, or brand-name drug exclusions in foreign countries continues to leave members hanging.

Our job isn’t to lobby — it’s to educate and protect you before that plane takes off.

Final Wake-Up Call For Public Service Families Travelling in 2025

If you’re a PSHCP member — especially one with comprehensive coverage — this blog wasn’t just about the plan.

It’s about what can happen when the plan fails to protect you in the way you thought it would.

Because guess what?

- Most families still travel over 40 days without realizing the coverage window closes.

- They still forget to obtain a written referral or have their medication pre-approved.

- They still expect assistance services in countries where travel is banned.

- They assume prescription drugs are covered without checking the combined maximums or eligible expense categories.

And then they call us — after the damage is done.

We don’t just sell plans.

We fix broken assumptions.

We layer your PSHCP with smart, tailored, private Travel Medical Insurance benefits.

We fight for your claim statements to be paid fairly.

We double-check your plan number, walk you through the prior authorization program, and help you submit claims that actually go through.

Final Word

You’ve earned your pension.

You’ve done your time in service.

But that doesn’t mean you’re bulletproof once you leave the country.

Let us help you build coverage that moves with you, not against you.

Because when the moment hits, it’s not just about the policy.

It’s about whether someone picks up the phone, pays the hospital, and flies your child home.

That’s what we do.

And that’s why we stay ready — so you don’t have to scramble when life throws a left hook.

More on Emergency Medical Insurance

FAQs

Even a small mismatch between your positive enrolment information and your passport can delay access to Emergency Medical Insurance Canada for travel. We’ve seen it block assistance services in real-time emergencies. Always double-check your certificate number and enrolment details before flying.

While Canada Life is the current plan administrator, approvals for medically required travel services — like biologic drug access — often require a separate prior authorization process. Talk to a licensed advisor before departure to ensure you’re not left exposed mid-trip.

Yes, but coordination matters. We often help PSHCP members combine emergency travel assistance with International Travel Insurance Plans to boost protection beyond the PSHCP’s extended health provision. But if layered incorrectly, your claim statements can get delayed or denied.

Not always. Some comprehensive coverage providers overseas don’t accept it upfront — especially for high-cost medical expenses like hearing aids or specialized diagnostics. Keep backup documents and always call for advance payment instructions through official PSHCP member services.

Key Takeaways

- PSHCP Emergency Medical Insurance Coverage for travel provides up to $1 million per person, but only for trips up to 40 days unless you’re on official travel status.

- Canada Life is the current plan administrator, while MSH International handles emergency travel assistance, hospital coordination, and advance payments.

- Completing positive enrolment and keeping dependant information verification reminders up to date is essential to avoid denied claims during emergencies.

- Eligible expenses include emergency treatment, family assistance, evacuation, and return of remains — but routine care, pre-existing conditions, or extended quarantine are excluded.

- Submitting claims requires either online registration with the PSHCP member services website or mailing physical forms. Missing deadlines or incomplete documents may delay reimbursement.

- The benefit card isn’t accepted everywhere abroad, so keeping your certificate number and having secondary International Travel Insurance Plans is strongly recommended.

Sources and Further Reading

- Government of Canada – Public Service Health Care Plan (PSHCP)

https://www.canada.ca/en/treasury-board-secretariat/services/benefit-plans/health-care-plan.html - Canada Life – PSHCP Member Information

https://www.canadalife.com/pshcp.html - MSH International – PSHCP Emergency Travel Assistance Services

https://www.msh-intl.com/en - Government of Canada – Travel Advice and Advisories

https://travel.gc.ca/travelling/advisories - Canadian Life and Health Insurance Association (CLHIA) – Travel Insurance Guidelines

https://www.clhia.ca/web/CLHIA_LP4W_LND_Webstation.nsf/page/Travel_Insurance - Service Canada – Understanding Extended Health Coverage for Federal Employees

https://www.canada.ca/en/services/benefits/publicpensions/cpp.html - Financial Consumer Agency of Canada – Insurance Types and Responsibilities

https://www.canada.ca/en/financial-consumer-agency/services/insurance.html - Canadian Snowbirds Association – Out-of-Country Travel Insurance Insights

https://www.snowbirds.org/travel-insurance

Feedback Questionnaire:

We’d love to understand your experience with PSHCP travel coverage. Your insights help us build better solutions for public service families.

IN THIS ARTICLE

- PSHCP Travel & Emergency Medical Insurance In Canada 2025: What You Need To Know

- The $1 Million Lifeline (But with Limits)

- Who Actually Provides the Help?

- What If You’re Hospitalized Abroad?

- Family Left Behind — Or Worse, Stranded

- Death Abroad — The Costs You Never Consider

- The Part Nobody Reads — Until It’s Too Late

- Submitting A Claim – It’s Not Instant Gratification

- Reimbursement Rules That Catch People Off Guard

- When Dependants Get Left Behind By The System

- What Bargaining Agents and Legacy Rules Don’t Tell You

- Final Wake-Up Call For Public Service Families Travelling in 2025

- Final Word

Sign-in to CanadianLIC

Verify OTP