- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Limited Vs. Comprehensive Visitor Insurance In Canada: Key Differences & Which Plan To Choose

By Harpreet Puri

CEO & Founder

- 10 min read

- November 12th, 2025

SUMMARY

Limited vs. Comprehensive Visitor Insurance in Canada is explained with clear comparisons of benefits, costs, and coverage limits. Readers gain insight into choosing the best Visitor Insurance Plan in Canada, understanding Visitor Insurance Coverage for pre-existing medical conditions, and comparing Limited Visitor Insurance Plans with Comprehensive Visitor Insurance Plans through a Visitor Visa Insurance quote online before travel.

Introduction

Stepping into Canada for a visit is exciting — but it also comes with the quiet reality that one medical emergency can cost thousands. According to the Canadian Institute for Health Information, the average cost of an emergency hospital stay for non-residents in 2024 was over $6,000 per day, and provincial plans do not extend health insurance to visitors to Canada. This is exactly why our team spends so much time helping newcomers and visitors compare the best Visitor Insurance Plan in Canada before they travel. It isn’t just about ticking a box for visa paperwork; it’s about shielding yourself from unexpected medical expenses that can derail your trip.

We see travellers making the same choice every week: should they save a few dollars with Limited Visitor Insurance Plans or invest more for Comprehensive Visitor Insurance Plans? This isn’t a trivial decision. Both kinds of plans fall under the umbrella of Visitor Insurance Coverage, but the structure of the benefits is radically different. Knowing the mechanics before you buy gives you the power to choose the right protection for your health, budget, and peace of mind.

Understanding Comprehensive Coverage For Visitors To Canada

When our advisors explain comprehensive coverage to a client, we use the same straightforward language we’ve honed over 14+ years. Think of it as percentage-based protection. These Comprehensive Visitor Insurance Plans typically cover 75 % to 100 % of eligible medical expenses after the deductible is met, up to the coverage amount you selected when you purchased the policy. That can include Emergency Medical Insurance, hospitalization, doctor visits, diagnostic tests, and even some prescription medications or emergency dental treatment, depending on the plan you choose.

Because many of these plans work like a PPO network, you’re rewarded for using providers inside the network: higher acceptance, discounted rates, and faster claims turnaround. But unlike a limited plan, the benefit isn’t a fixed dollar amount per service. Instead, your plan pays a large percentage of medical expenses, which dramatically reduces your out-of-pocket risk if you need medical care. For travellers worried about pre-existing medical conditions or who simply want the strongest Health Insurance Plan possible, comprehensive coverage usually represents the best value.

Another under-appreciated point: most of the best Visitor Insurance Plans in the comprehensive category include Travel Insurance extras built into the bundle. Trip interruption, lost baggage, and even limited emergency medical evacuation are often part of the package. This isn’t fluff; we’ve had clients save thousands on non-refundable flights because their comprehensive plan included travel benefits.

Yes, premiums are higher. But when you’re facing a $5,000 hospital bill for one night in an emergency room — which is common in Ontario or British Columbia for non-residents — the slightly higher upfront cost of comprehensive coverage looks very small compared to what you’d pay with a limited plan.

How Limited Coverage Plans Really Work

We meet a lot of travellers who are on a tight budget or simply think they’re healthy enough to “get by.” They’re drawn to Limited Visitor Insurance Plans because the premiums are low. But as we tell our clients, limited coverage is built on a fixed-benefit model: every type of medical service you might need abroad has a pre-set payout limit.

Say your policy lists $75 for a doctor visit. If you see a physician and the bill comes to $180, you’ll be covering the remaining $105 from your own pocket — plus any deductible. Hospital stays, diagnostic tests, and emergency room care are all subject to the same kind of ceiling. That’s why limited plans can leave people with huge medical bills in the event of a serious medical emergency.

Limited coverage also rarely includes extras like trip cancellation, lost baggage, or emergency medical evacuation. There’s usually no PPO network, so while you can go to any doctor, you’re not benefiting from negotiated rates and your reimbursement is always capped at the schedule of benefits. For travellers with pre-existing conditions or who might need ongoing medical treatment, that gap in protection can be dangerous and expensive.

The upside is obvious: lower premiums and simple terms. For short trips where you’re willing to self-insure most risks, a limited plan can serve as a basic safety net. But from our experience advising thousands of Visitors to Canada, the cost difference between a limited plan and a comprehensive plan often looks trivial once you’ve seen one large hospital bill.

Comparing Comprehensive Coverage Plans And Limited Coverage Plans

Here’s how we guide our clients through the comparison:

- Coverage Amount and Liability: With a comprehensive plan, you’re dealing with co-insurance and a deductible, but the insurer is paying 75–100 % of eligible expenses after that point, up to the policy maximum. With a limited plan, you’re dealing with hard dollar caps on each type of expense, so your liability is unpredictable in a real emergency.

- Network and Flexibility: Comprehensive plans often resemble PPO networks, which means better acceptance, faster claims, and discounted rates. Limited plans may not have a network; you can see any doctor, but you’re reimbursed only up to the fixed benefit.

- Travel Benefits: Many Comprehensive Coverage Plans include built-in Travel Medical Insurance features such as emergency dental care, trip interruption, or baggage loss. Limited plans generally exclude these extras.

- Pre-Existing Conditions and Health Status: If you have stable pre-existing medical conditions, comprehensive plans are far more likely to offer some form of coverage or at least an upgrade option. Limited plans generally exclude them outright.

- Cost Structure: Comprehensive plans have higher premiums but can save thousands on medical expenses. Limited plans have lower premiums but shift most of the risk to you.

When you lay these facts out next to each other, it becomes clear why so many of our clients ultimately choose a comprehensive plan even if it means paying more upfront.

Why Comprehensive Coverage Can Actually Save You Money

We’ve watched travellers make the same painful mistake: picking a limited plan to save $60–$80 and then being crushed by a hospital bill. Imagine this real scenario from one of our clients. She purchased a limited plan at $80 because she was young and healthy. Two weeks into her trip, she slipped on ice in Toronto, was taken to the emergency room, and needed a two-day hospital stay plus imaging. Her plan paid only the fixed $2,000 per day for hospitalization, but her bill was more than $5,000 per day. She ended up owing nearly $6,000 personally.

Contrast that with a client who had purchased one of the best Visitor Insurance Plans in the comprehensive category at $150. After the deductible, his plan covered 100 % of eligible expenses up to his coverage amount. He walked away without any out-of-pocket medical bills. In our 14+ years of working with visitors to Canada, these stories repeat themselves constantly. The slightly higher premium of a comprehensive plan frequently turns into thousands of dollars saved on medical expenses and unexpected medical expenses.

Another point: comprehensive plans are much more likely to include Emergency Medical Insurance for prescription medications, diagnostic tests, doctor visits, or even emergency dental care. They also have clearer paths for limited pre-existing condition coverage if your health status is stable, something almost unheard of in limited coverage plans.

How To Choose The Right Plan

When a client sits down with us, we don’t just hand them a brochure. We go through a short medical questionnaire to understand their health status, travel dates, and risk tolerance. Then we show them, side-by-side, the difference in coverage limits, premiums, and out-of-pocket exposure between Limited Visitor Insurance Plans and Comprehensive Coverage Plans.

We ask simple but powerful questions:

- Can you invest a little more upfront to avoid potentially catastrophic medical bills later?

- Do you want some form of pre-existing medical conditions coverage or at least flexibility if your health changes?

- Are you travelling with family members who might need doctor visits or emergency treatment?

- Are you interested in extras like lost baggage or trip cancellation protection built into your insurance plan?

Most of our clients say yes to at least two of these, which is why the vast majority end up with a Comprehensive Plan.

Provincial Coverage And Why It Doesn’t Apply To Visitors

One of the biggest misconceptions we clear up is the idea that provincial health systems will cover non-residents. They won’t. Provincial Coverage is reserved for Canadian citizens and permanent residents who meet eligibility rules. A visitor, even a parent on a Super Visa, is not entitled to those benefits. That’s why Health Insurance for visitors to Canada is so critical.

We regularly see people arriving with no plan or with bare-bones, limited coverage, assuming they’ll be treated for free like residents. Then a single emergency medical care incident – an ambulance ride, an overnight stay, a few prescription drugs – generates thousands of dollars in medical expenses. A properly structured Health Insurance Plan closes that gap.

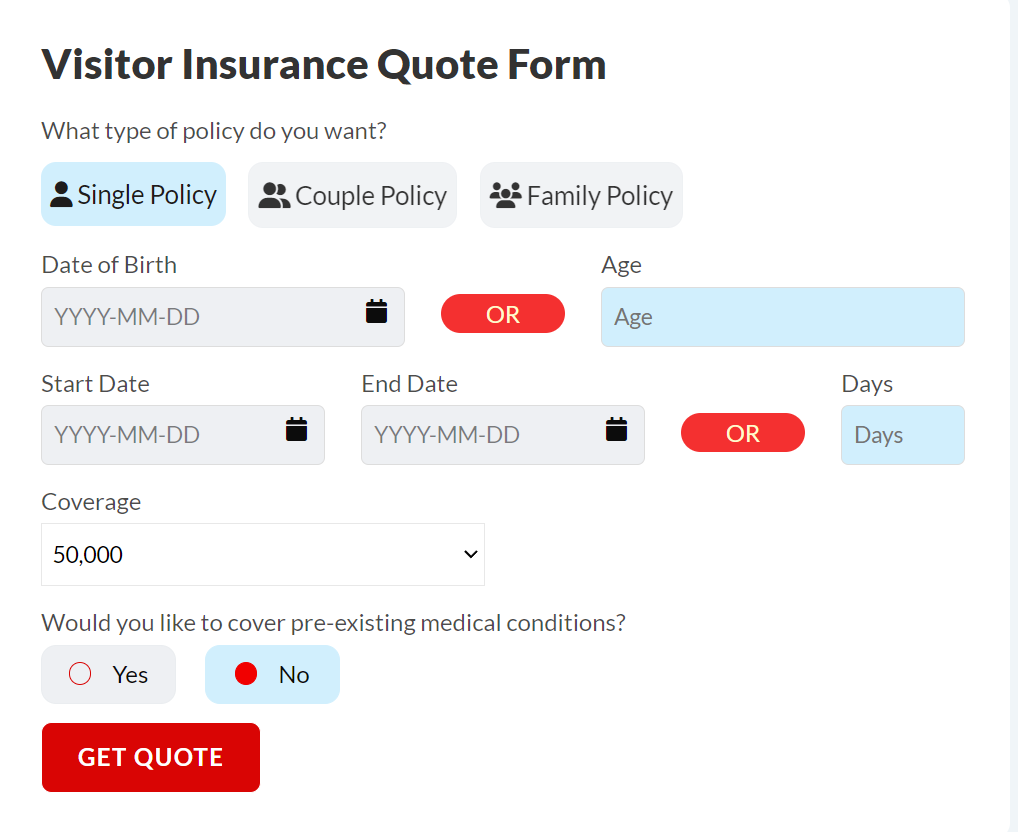

Buying The Right Comprehensive Travel Insurance

When it’s time to actually buy, our advisors help you use a Vistor Visa Insurance quote online tool to compare multiple insurance plans side by side. We filter for Comprehensive Travel Insurance options that meet your trip length, your budget, and any relevant pre-existing medical conditions. We check the coverage limits, deductible, and how the plan handles doctor visits, emergency room care, and emergency medical evacuation.

Because we’re a broker, not a single insurance provider, we can also help you switch from a limited plan to a comprehensive plan before your travel dates if you change your mind. And we’ll walk you through the medical questionnaire so you know exactly what’s covered and what isn’t before your coverage begins.

Canadian Citizens, Permanent Residents And Returning Travellers

For Canadian citizens or permanent residents returning after a long absence, the rules can be tricky. Some provinces have waiting periods before your provincial plan resumes. In those gaps, you’re effectively treated like a visitor. That’s when a Short Term Health Insurance Plan that mirrors Visitor Insurance Coverage can save you from high medical costs during the waiting period.

| Feature | Limited Visitor Insurance Plans | Comprehensive Visitor Insurance Plans |

|---|---|---|

| Coverage Model | Fixed benefit per service (pre-set dollar limits for each doctor visit, hospital stay, or test). | Percentage-based coverage (typically 75–100 % of eligible medical expenses up to the policy maximum after deductible). |

| Out-of-Pocket Risk | High and unpredictable — anything over the fixed limit is paid by you. | Lower and more predictable — insurer covers most eligible expenses after the deductible. |

| Premiums | Lower cost premiums for basic protection. | Higher premiums but usually lower total cost in a medical emergency. |

| Pre-Existing Medical Conditions | Generally excluded, no upgrade options. | Some plans may offer stable pre-existing medical conditions coverage or upgrades. |

| Doctor and Hospital Choice | You can see any doctor; reimbursement is capped at a fixed benefit per visit. | PPO-style networks are available; higher acceptance and discounted rates for in-network care. |

| Travel Benefits | Rarely includes extras such as trip interruption, baggage loss or emergency medical evacuation. | Often includes extras such as trip interruption, lost baggage, emergency medical evacuation, or emergency dental care. |

| Best For | Short trips, very tight budgets, or travellers willing to self-insure major risks. | Travellers seeking strong protection, families, or anyone concerned about medical bills or unexpected medical expenses. |

Bottom Line

For over 14 years, we’ve helped thousands of visitors to Canada pick between Limited Visitor Insurance Plans and Comprehensive Visitor Insurance Plans. The pattern is clear: comprehensive coverage costs more upfront but usually saves far more in out-of-pocket medical expenses and stress. Limited Plans can work for very short trips and very tight budgets, but they leave you exposed to unpredictable medical costs and gaps in protection.

If you’re comparing options today, ask yourself: how much risk can you comfortably carry? Are you prepared to cover thousands in medical bills from your own wallet, or would you rather pay a bit more for a plan that covers 75 % to 100 % of your eligible expenses? Our advisors can walk you through every major insurance plan on the market, show you real Vistor Visa Insurance Quotes Online, and help you make an informed decision that protects both your trip and your finances.

More on Visitor Visa Insurance

FAQs

Limited plans cost less because they offer limited coverage – fixed benefits per service, no percentage-based protection, and usually no extras like trip interruption or emergency medical services.

Yes. Unforeseen illnesses and injuries happen to everyone. A Comprehensive Plan can spare you from huge medical bills in the event of a medical emergency.

Usually, you can cancel a limited plan before your travel dates and purchase a comprehensive one instead. Terms vary, and our team will guide you through the process to ensure continuous Health Coverage.

Key Takeaways

- Comprehensive Visitor Insurance Plans Cover More: They typically pay 75 – 100 % of eligible medical expenses after the deductible, including Emergency Medical Insurance, doctor visits, prescription medications, and sometimes emergency dental care or evacuation.

- Limited Visitor Insurance Plans Have Fixed Benefits: Each medical service has a pre-set payout limit. Anything above that limit comes out of your pocket, making large medical bills likely in a true medical emergency.

- Provincial Coverage Does Not Apply To Visitors To Canada: Visitors cannot rely on provincial health plans. A proper health insurance plan is essential to avoid unexpected medical expenses.

- Higher Premiums Usually Mean Lower Out-Of-Pocket Costs: While comprehensive coverage costs more upfront, it can save thousands on hospital stays, emergency treatment, and other medical services.

- Use Vistor Visa Insurance Quote Online Tools Wisely: Comparing multiple insurance plans through a trusted broker ensures the right coverage amount, pre-existing conditions options, and travel extras.

- Best Visitor Insurance Plans Balance Protection And Budget: The right plan depends on your health status, trip length, and risk tolerance, but comprehensive Travel Insurance generally provides stronger financial protection than limited coverage.

Sources and Further Reading

Government and Regulatory Sources

- Immigration, Refugees and Citizenship Canada (IRCC) – Super Visa and Visitor Insurance requirements: https://www.canada.ca/en/immigration-refugees-citizenship.html

- Canadian Institute for Health Information (CIHI) – Data on hospital costs and health system spending: https://www.cihi.ca

- Ontario Health Insurance Plan (OHIP) – Coverage for Visitors: https://www.ontario.ca/page/health-care-visitors-ontario

- British Columbia Medical Services Plan (MSP) – Residency and waiting periods: https://www2.gov.bc.ca/gov/content/health/health-drug-coverage/msp

Consumer and Information Sites

- Canadian Life and Health Insurance Association (CLHIA) – Industry guidelines and consumer information on travel and Visitor Insurance: https://www.clhia.ca

- Insurance Bureau of Canada (IBC) – Understanding travel and visitor health insurance in Canada: https://www.ibc.ca

- Travel Health Insurance Association of Canada (THIA) – Standards and best practices for Travel Medical Insurance: https://www.thiaonline.com

Health and Travel Safety References

- Public Health Agency of Canada – Travel Health Notices: https://travel.gc.ca/travelling/health-safety

- World Health Organization (WHO) – International Travel and Health: https://www.who.int/ith

Feedback Questionnaire:

Help Us Improve – Share Your Experience

We’re always looking to make our guidance on Visitor Insurance more helpful. Please take a minute to tell us about your experience.

IN THIS ARTICLE

- Limited Vs. Comprehensive Visitor Insurance In Canada: Key Differences & Which Plan To Choose

- Understanding Comprehensive Coverage For Visitors To Canada

- How Limited Coverage Plans Really Work

- Comparing Comprehensive Coverage Plans And Limited Coverage Plans

- Why Comprehensive Coverage Can Actually Save You Money

- How To Choose The Right Plan

- Provincial Coverage And Why It Doesn’t Apply To Visitors

- Buying The Right Comprehensive Travel Insurance

- Canadian Citizens, Permanent Residents And Returning Travellers

- Bottom Line

Sign-in to CanadianLIC

Verify OTP