- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Is It Time To Improve Long Term Disability Insurance For Older Workers?

By Harpreet Puri

CEO & Founder

- 10 min read

- August 19th, 2025

SUMMARY

This blog addresses the need to improve Long Term Disability Insurance for older workers in Canada, focusing on fair disability coverage, removing strict age cutoff rules, and ensuring sustainable LTD insurance benefits. It highlights the role of insurance providers, updating benefit formulas, adjusting pre-disability earnings, and offering better income protection to meet the needs of Canada’s aging workforce.

Introduction

Every week, we meet Canadians in their late 50s, 60s, and even early 70s who are still contributing to their workplaces with skill, dedication, and passion. Yet many of them have no idea that their Long Term Disability Insurance for older workers could stop — or be drastically reduced — at a moment when they might need it the most.

The truth is, our workforce has changed. People are living longer, staying healthier, and delaying retirement. But our Disability Insurance benefits for seniors have not caught up. For too many Canadians, the age cutoff baked into their insurance plan could mean a sudden loss of protection during their most vulnerable years.

We’ve seen how this plays out in real life. Someone who has paid into their group insurance program for decades suddenly learns that if they’re injured or develop a chronic illness after age 65, their LTD benefits will shrink — or vanish — just when income protection is most important. That’s not just a policy flaw; it’s a human problem that needs fixing.

Why Disability Insurance Needs Modern Thinking

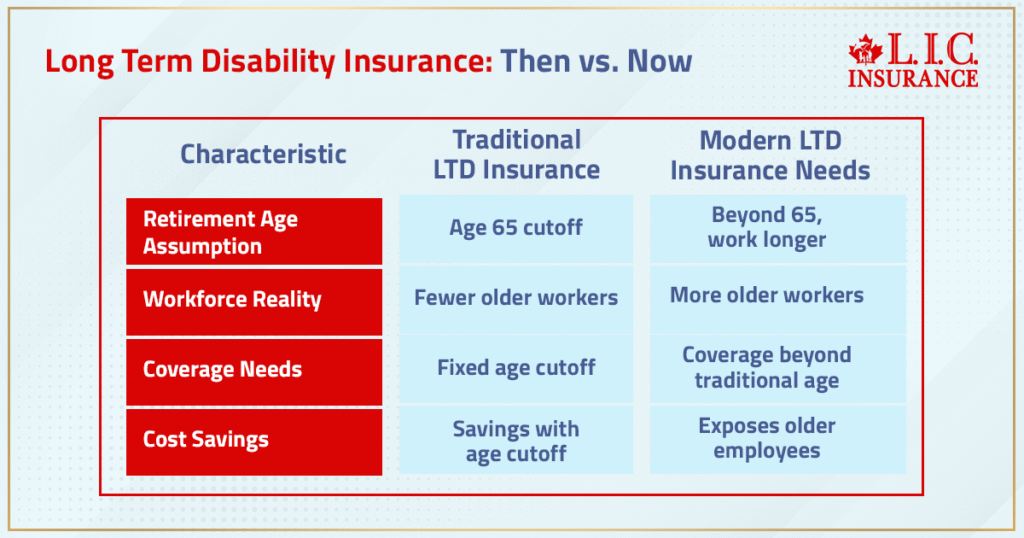

Disability Insurance is not simply a payout when you can’t work — it’s a financial lifeline that helps replace lost income, protect savings, and maintain stability. But many LTD Insurance policies were designed in a different era, when the so-called reasonable retirement age was 65, and Statistics Canada reported far fewer older employees in the workforce.

Now, the data tells a different story. The Canadian Institute confirms that participation rates for older workers are climbing, particularly in sectors where experience is an asset. The aging workforce is real, yet many LTD Insurance Plans have not been adapted to fit this reality. As a result, employees who remain in their jobs past traditional retirement age face reduced Disability Coverage, even though their risk of needing it may be higher.

The assumption that a fixed age cutoff saves money might look good on paper, but in practice, it leaves people exposed. Chronic conditions, significant accidents, and even mental health challenges don’t stop at 65. Neither should our safety nets.

The Financial Risks Of Current Long Term Disability Coverage

The Long Term Disability Coverage in Canada that we see in many workplaces still follows outdated templates. Benefits often end at 65 — or are sharply reduced — regardless of whether the employee can still work. For older employees who haven’t yet reached pension eligibility, this creates a dangerous gap between lost income and any government benefits like the Canada Pension Plan disability program, which rarely replaces a full salary.

The benefit formula in some LTD insurance programs also hasn’t evolved with rising costs. Pre-disability earnings are often replaced at percentages that no longer cover today’s expenses. And because benefit payments may be tied to fixed age limits, employees can face financial stress, forced early retirement, or dipping into retirement savings long before planned.

As an insurance company partner, we believe in finding actuarial solutions that balance costs while still offering the income replacement workers truly need. That’s the essence of a fair and sustainable insurance plan.

Health Benefits And Chronic Conditions: Why Older Workers Need More, Not Less

Health benefits and LTD coverage become even more important with age. Older employees are more likely to experience chronic conditions — from arthritis to heart issues — that may reduce their capacity to work full-time but don’t necessarily mean they’re ready to stop altogether.

With the right Term Disability Insurance or long-term plan, workers can maintain partial income, continue contributing to their workplace, and avoid draining personal savings. But if the benefit period ends too soon because of a fixed age cutoff, that safety net disappears.

Medical evidence is clear — recovery times for injuries or illnesses are often longer in later years. That means cutting benefits short can create lasting hardship, particularly when the goal of Disability Insurance is to provide stability.

Why Age Cutoff Rules Create Inequality

The age cutoff in many LTD insurance benefit structures is one of the most pressing issues in the aging workforce discussion. While some employers and insurance providers use these cutoffs to limit unnecessary costs and maintain program sustainability, they can also unintentionally create inequity.

Picture this: a 67-year-old employee in excellent health suffers a significant accident on the job. Under a typical Group Insurance Policy, their LTD benefits might end after just two years, long before they’re physically able to return to work. That forces them to rely on lower government benefits or personal savings, all because of a birth date.

A better approach is to tailor coverage based on an employee’s actual role, health, and risk factors, rather than applying a one-size-fits-all rule. That’s how we avoid discrimination claims while still limiting costs.

Updating Group Insurance For Today’s Workforce

Traditional group insurance programs were built around an older idea of the reasonable retirement age. But with people living longer and longer, life expectancy becoming the norm, employers should be proactively reviewing plan designs.

This means:

- Extending benefit eligibility beyond the traditional fixed age cutoff

- Adjusting the benefit formula to ensure fair income replacement levels

- Considering pre-disability earnings in a way that accounts for inflation

- Building a more defined legislative framework for fair coverage

By doing this, employers not only support employees but also protect themselves from age discrimination challenges.

The Balance Between Cost And Coverage

The main challenge for employers is balancing costs with adequate protection. Cutting benefits for older workers might seem like an easy way to save, but it damages loyalty, morale, and retention. Instead, actuarial solutions — like gradually reducing benefits rather than stopping them outright — can maintain a safety net while controlling expenses.

It’s about designing LTD insurance plans that address the needs of all employees, from new hires to those past age 65. This approach helps avoid discrimination claims and keeps insurance programs both fair and financially stable.

Addressing Age Discrimination Proactively

From our perspective, addressing age discrimination in LTD insurance isn’t just a legal requirement — it’s the right thing to do. People who have spent decades contributing to a company deserve to feel supported at every stage.

When benefits end abruptly because of an arbitrary age cutoff, it sends the wrong message. Employers can avoid this by working with insurance providers who understand the complexities of an aging workforce and can design insurance plans that protect without creating unnecessary costs.

Canadian LIC’s Approach To Improving Disability Coverage

We specialize in Disability Coverage that works for everyone — not just those in the early or middle stages of their career. We consider factors like chronic conditions, mental health, and delayed retirement to make sure benefits remain realistic and valuable.

We’ve helped employers replace outdated LTD insurance programs with solutions that extend the benefit period, redefine pre-disability earnings, and adjust income protection to reflect the real cost of living in Canada.

The Call To Action For Employers And Workers

For employers, now is the time to review and modernize your LTD insurance benefit structures. For employees, it’s time to check your insurance plan and see exactly what happens if you become disabled after a certain age.

Too many people assume their coverage continues at the same level until they choose to retire. The reality is often different — and knowing now gives you the chance to act before it’s too late.

Final Word: Age Shouldn’t End Protection

Improving Long Term Disability Insurance for older workers isn’t just a policy tweak — it’s a reflection of how we value experience, loyalty, and human dignity in the workplace.

By eliminating rigid age cutoff rules, updating benefit formulas, and building insurance plans that adapt to real-life needs, we can protect every member of the workforce — regardless of birth date. And that’s a future we are committed to building.

FAQs

Because sometimes it is not about spending more $$. It can reshape benefit periods, ensure a more gradual taper for income protection, or restructure LTD insurance programs so they are financially sustainable and provide the necessary safety net. The numbers aren’t all that interesting, except for the fact that they do something good for people´s lives.

The best are staying away from a set age cutoff. They examine the actual time it is taking to recover, how the aging workforce is doing and working in today’s labour market and shape Disability Coverage that meets people where they are. These types of policies are not so much a contract as they are a promise.

As the cost of living changes and benefit payments lose their purchasing power, Long Term Disability Insurance for older workers can start to erode over time if it’s not updated regularly. However, periodic review ensures coverage is fresh when it is needed.

It should be. A desk job is not the same as a construction site — neither should their coverage be the same. Sound group insurance can enhance income protection, eliminate draconian age-based limits and ensure the long-term disability benefit remains relevant at all stages in a career.

Admit that 65 is not the end. Longer working lives, living with chronic disease and injured survivors mean people need to keep working. The earnings of a person who was already disabled when he or she earned that income should be addressed. For example, benefit periods should not require that sick time taken sometime during the employment period be used to recover the same kind of illness.

It’s not just a no-paycheque missing. They take from their retirement accounts early, they push out retirement dates, and they even sell off real estate just to get by. The minute that income replacement disappears, the financial hole will appear promptly.

The smart ones do. Term Disability Insurance covers short-term rehabilitation; long-term benefits are for gradual changes that persist. True coverage will provide both, so no one is kicked to the curb before they successfully recover.

They ignore individual circumstances. Whether or not you have chosen to continue working, learn the hard way by trying to navigate Social Security at 68 (or due to an injury, 62) and all benefits are cut off. LTD benefits tailored to people, not birthdays. Fortunately for us all, some forward-thinking insurance providers design LTD benefits that work with the person in mind, not their birth date.

It comes down to a smarter plan. Adjusting benefit formulas, redefining pre-disability earnings, and phasing coverage changes over time can limit unnecessary costs while still giving older workers dependable income protection. The goal is to protect people without breaking the program.

End blanket age limits on benefits that are much too low to support Canadians experiencing financial difficulty. Replace them with coverage adjusted to true job requirements, health conditions, and recovery timelines. This route continues to keep short-term disability coverage equitable, and it helps prevent employers from facing even more expensive discrimination claims.

Key Takeaways

- Long Term Disability Insurance for older workers in Canada often needs updates to match today’s longer careers and shifting retirement patterns.

- Removing rigid age cutoff rules and adjusting benefit formulas can make disability coverage fairer without increasing unnecessary costs.

- Regular reviews of LTD insurance plans ensure income protection and benefit payments remain meaningful for Canada’s aging workforce.

- Employers and insurance providers can balance program sustainability with fair coverage through tailored plan designs and flexible benefit periods.

- Addressing age discrimination in LTD benefits strengthens trust, supports older employees, and reduces legal and reputational risks.

Sources and Further Reading

- Government of Canada – Canada Pension Plan Disability Benefit Overview: https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-disability-benefit.htm

- Statistics Canada – Labour Force Characteristics by Age Group: https://www150.statcan.gc.ca

- Canadian Life and Health Insurance Association (CLHIA) – Guidelines on Disability Insurance: https://www.clhia.ca

- Canadian Human Rights Commission – Age Discrimination and Employment: https://www.chrc-ccdp.gc.ca

- Actuarial Solutions Inc. – Insights on LTD Plan Sustainability: https://www.actuarialsolutionsinc.com

- Conference Board of Canada – The Aging Workforce in Canada: https://www.conferenceboard.ca

Feedback Questionnaire:

IN THIS ARTICLE

- Is It Time To Improve Long Term Disability Insurance For Older Workers?

- Why Disability Insurance Needs Modern Thinking

- The Financial Risks Of Current Long Term Disability Coverage

- Health Benefits And Chronic Conditions: Why Older Workers Need More, Not Less

- Why Age Cutoff Rules Create Inequality

- Updating Group Insurance For Today’s Workforce

- The Balance Between Cost And Coverage

- Addressing Age Discrimination Proactively

- Canadian LIC’s Approach To Improving Disability Coverage

- The Call To Action For Employers And Workers

- Final Word: Age Shouldn’t End Protection

Sign-in to CanadianLIC

Verify OTP