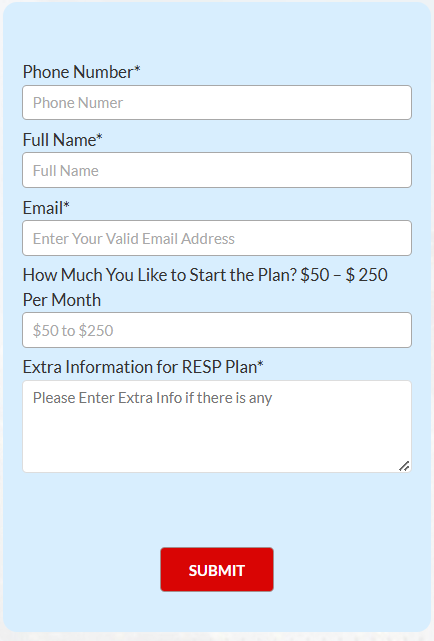

- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How To Include RESPs In Your Estate Plan For Maximum Benefit In 2025

By Pushpinder Puri

CEO & Founder

- 9 min read

- July 11th, 2025

SUMMARY

Including a Registered Education Savings Plan in your estate planning helps preserve RESP funds, transfer benefits to a replacement beneficiary, and ensure education savings continue after the original subscriber’s death. Topics covered include RESP contribution limits, government grants, registered accounts, and how to align your plan with your child’s post-secondary education goals.

Introduction

There was a grandmother in Brampton on a mission. And she wanted her own grandchildren to have the education she never had. So, she set up a Registered Education Savings Plan (RESP) and then contributed regularly to it. But when she died, her family didn’t understand how to get to the RESP money. The coronavirus caught them without clear estate planning in place, and what should have been a simple gift became a complicated legal puzzle. This isn’t rare. It’s a common story in Canadian homes every day.

At Canadian LIC, we have experienced this far too often. Clients believe that naming a beneficiary is all that is necessary. But there’s more to estate planning with a RESP Canada than just saving money: It’s about holding it in a certain form so that what you want gets out to you, even when you’re no longer walking among us.

Here is where families either protect their opportunities or throw away thousands on misunderstandings, delays and tax hit-and-runs. If your aim is to leave a legacy of learning, you need to start thinking about that RESP as carefully as your will.

Why Estate Planning with Registered Education Savings is Not Optional Anymore

You are already investing in your family’s future if you have an RESP. But what few subscribers understand is just how tenuous that plan becomes when you, the subscriber, die without a plan.

In the absence of a designated beneficiary under the RESP contract, the plan belongs to the subscriber’s estate. This sets off delays, legal costs and potentially tax consequences. RESP funds could even be paid out according to the will, not your desired RESP beneficiaries.

That means your RESP could be:

- Closed prematurely

- Taxed unnecessarily

- Denied access by your child or grandchild at the time of need

We’ve helped families clean up these messes. And we always say: a few proactive steps now can avoid a dozen headaches later.

Choosing the Right Successor Subscriber or Joint Subscribers

A successor subscriber is someone who takes over managing the RESP upon your death. This person must be named within the RESP contract.

You can also designate a joint subscriber (such as your spouse), ensuring uninterrupted control over the education savings plan, RESP.

Best practices include:

- Naming a successor subscriber in writing with your RESP provider

- Matching this designation in your will to avoid conflicting documents

- Consulting a financial advisor to confirm eligibility and tax effects

By clearly naming a successor, you ensure RESP funds continue growing and stay available for post-secondary education costs.

RESP Beneficiaries: Keeping the Education Pathway Clear

Whether you’re saving for a son, daughter, or even a grandchild, naming RESP beneficiaries isn’t enough. You need to consider what happens if a beneficiary doesn’t pursue post-secondary education.

RESPs allow for:

- Replacement beneficiaries within the same family plan

- Reallocation of accumulated income to other children

- Transfer of up to $50,000 to a Registered Education Savings Plan Canada if unused

We once worked with a couple in Mississauga whose child became a professional athlete at 18. No university. No college. But they had $48,000 in RESP funds.

Because they planned ahead and set up proper replacement beneficiary language, they transferred the money to a younger sibling without penalty.

RESP Clauses to Include in Your Will

To keep everything aligned, your will should include an RESP clause that:

- Clearly confirms your intention to maintain the RESP

- Names the successor subscriber

- Designates any unused funds for other beneficiaries

This avoids confusion where the estate trustee or court could mistakenly wind down the RESP.

A Toronto family we worked with had conflicting wishes: the RESP said one thing, the will said another. That inconsistency created a freeze on the funds for over 8 months.

Avoid that. Make your documents speak the same language.

Tax Implications Most Canadians Don't Know About

Upon the death of the subscriber, any AIP not rolled over to a pursuing plan will be included in the estate’s income as taxable income. That’s on top of potential losses of government grants and Canada Education Savings Grant funds.

A well-conceived estate plan can shield your heirs from forfeiting such grants. It also secures that your RESP will not accidentally fall into the residuary estate beneficiaries’ category (which may not have been what you wanted).

And if you have to redirect any unused RESP money to a Registered Disability Savings Plan or tax-free savings account, nailing the wording and timing is crucial.

Coordinating RESP with Other Registered Accounts

Your RESP isn’t the only asset needing protection. You might also hold:

- A Registered Education Savings Plan (RESP)

- A Registered Disability Savings Plan (RDSP)

- A tax-free savings account (TFSA)

Each of these needs individual attention. But coordinating them as part of a single wealth planning strategy ensures you maximize your money tax-free for future generations.

Our team at Canadian LIC often conducts side-by-side reviews of registered accounts to prevent tax overlap and ensure each vehicle complements the other.

How to Transfer RESP Ownership Without Triggering Penalties

To transfer RESP ownership to a surviving subscriber or successor, you must:

- Submit documentation directly with your financial institution or RESP provider.

- Ensure your original subscriber’s death is recorded and acknowledged.

- Provide proper estate documentation and consent.

If these steps aren’t followed, the provider may default to closing the account and returning personal contributions to the estate, effectively undoing your entire education savings strategy.

Professional Advice for RESP Estate Planning in 2025

Laws change—tax codes update. RESP contribution limits and lifetime contribution limits can be adjusted accordingly under the new policy.

So, by partnering with financial professionals who concentrate on estate planning and Registered Education Savings Plan quotes, you won’t fall behind when the world’s financial and legal systems make even slight adjustments.

In one Calgary case, a family lost out on $7,200 of government grants still available to it because they didn’t understand their contribution room. Do not allow oversight to destroy years of careful saving.

Final Thought: Your Legacy Shouldn't Get Lost in Legal Loopholes

You’ve already done the hard part: saving regularly, dreaming big on behalf of your children or grandchildren. Don’t let your hard work be unpicked by a lack of clarity.

Protect your Registered Education Savings Plan, harmonize it with your estate plan and make sure your RESP transfers seamlessly to the ones for whom it was intended.

Our team at Canadian LIC is always here to help you through your options, from reviews of the RESP clause to setting up successor subscribers and reviewing each and every registered account you have.

Protect your legacy. Protect their future.

Let’s build your plan together.

FAQs

Yes, you can typically transfer an RESP to a sibling of the original beneficiary without losing government grants or facing tax penalties, as long as they meet the age and relationship criteria. Check your own plan for terms associated with your RESP provider.

If there is no eligible successor beneficiary, the income earned can be paid as an accumulated income payment (AIP). However, at that time, it becomes a taxable amount and may be subject to an additional 20% tax, unless transferred to the subscriber’s RRSP, if they have contribution room available.

A testamentary trust can be utilized to hold the RESP and appoint a trustee to facilitate withdrawals tied to the educational requirements of the child. This is particularly handy in the case of blended families, or for child beneficiaries who require supervision of their funds until they come of age.

Usually, successor subscribers are identified in the RESP contract. But unless specifically provided for, the estate trustee or residual beneficiaries may require court approval to obtain control, and these would be costly delays in providing education funds.

EAPs from an RESP count as student income and could affect eligibility for need-based financial aid or bursaries. Strategic exit timing may help alleviate the potential damage while maximizing student-aid money. Education Assistance Payments (EAPs) from RESPs are considered student income and may impact eligibility for needs-based financial aid or bursaries. Strategic withdrawal timing can help minimize this impact while maximizing educational funding.

Joint subscribers — typically spouses — are co-owners of the plan, with the survivor maintaining control of the RESP. A successor subscriber is named who can keep contributing and managing without legal obstacles when the sole subscriber passes away.

If money is pulled out of an RESP for reasons other than post-secondary education, then the contributions can be taken out tax-free, but the investment income and grants will be taxed, along with a possible grant repayment. Careful planning avoids such losses.

Yes — for example, if the recipient has a disability and is eligible for an RDSP, then RESP wind-up planning can be dovetailed with RDSP contributions in the interest of longer-term support, although note that these plans are legally separate.

An institution will provide a professional approach and continuity, particularly in more involved family compositions or where there’s just no one there that fits the bill,” he said. They ensure the proper handling of the RESP contract, contribution regulations and requirements governing the grant.

Some RESP providers that may accommodate custom “RESP clauses” can be established during setup, specifying how to deal with the subscriber’s death, appointing a successor and specifying what can be done with the funds. The addition of such clauses is clear and helps to avoid complexity and confusion with estates.

Key Takeaways

- Integrating a Registered Education Savings Plan (RESP) into estate planning ensures your child’s post-secondary education funding remains intact—even after the subscriber’s death.

- Designating a successor subscriber is vital. Without one, RESP funds may get tied up in probate, risking delays in education assistance payments.

- RESP rules allow transferring funds to a replacement beneficiary, like a sibling, under specific age and relationship conditions to avoid grant loss and tax penalties.

- If no eligible beneficiary exists, the accumulated income payment (AIP) can be withdrawn, though it may trigger taxes unless transferred to a Registered Education Savings Plan (RRSP) with available contribution room.

- Testamentary trusts offer a flexible way to manage RESP funds responsibly, especially in blended families or for minors needing financial oversight.

- RESP contracts should be reviewed to ensure provisions for joint subscribers or custom RESP clauses exist, reducing estate confusion or court delays.

- Government grants, including the Canada Education Savings Grant (CESG), must be repaid if funds are not used for post-secondary education—highlighting the need for clear planning.

- Coordination between registered accounts like RESP, Registered Disability Savings Plan (RDSP), and tax-free savings account (TFSA) can maximize tax efficiency across family wealth strategies.

- Naming a corporate trustee may be beneficial in complex cases, ensuring compliance with RESP rules and long-term continuity for the designated beneficiary.

- Seeking professional advice is essential to balance RESP contribution limits, tax implications, and intergenerational education savings plan RESP goals.

Sources and Further Reading

- Government of Canada – RESP Overview

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/registered-education-savings-plans-resps.html

A detailed explanation of RESP rules, contribution limits, withdrawals, and government grants. - Employment and Social Development Canada – Canada Education Savings Program (CESP)

https://www.canada.ca/en/employment-social-development/services/learning-bond.html

Information on CESG and CLB, two key government grants tied to RESPs. - Office of the Superintendent of Financial Institutions (OSFI)

https://www.osfi-bsif.gc.ca

Offers regulatory insight on financial institutions, especially relevant to RESP provider stability. - TaxTips.ca – RESPs and Estate Planning

https://www.taxtips.ca/resp/respandestateplanning.htm

A helpful breakdown of RESP estate planning strategies, tax considerations, and successor rules. - Legal Line – RESP and Inheritance

https://www.legalline.ca/legal-answers/resp-registered-education-savings-plan/

Guidance on how RESPs are handled legally after death, including contract terms and estate implications. - Canadian Bar Association – Planning for Children’s Education in Your Estate

https://www.cba.org (Search: “RESP estate planning”)

Provides legal insights on creating RESP clauses in wills and managing joint or successor subscribers. - CPA Canada – Tax Implications of RESPs

https://www.cpacanada.ca (Search: “RESP taxation” or “RESP AIP”)

Offers clarity on accumulated income payments, taxation, and RESP wind-down procedures.

Feedback Questionnaire:

We’d love to understand your challenges better so we can create more helpful content and guidance tailored to your situation. Please take a moment to answer a few quick questions.

Thank you for your time!

Your insights will help us create more valuable, personalized content to support families planning smarter for education and financial security.

IN THIS ARTICLE

- How To Include RESPs In Your Estate Plan For Maximum Benefit In 2025

- Why Estate Planning with Registered Education Savings is Not Optional Anymore

- Choosing the Right Successor Subscriber or Joint Subscribers

- RESP Beneficiaries: Keeping the Education Pathway Clear

- RESP Clauses to Include in Your Will

- Tax Implications Most Canadians Don't Know About

- Coordinating RESP with Other Registered Accounts

- How to Transfer RESP Ownership Without Triggering Penalties

- Professional Advice for RESP Estate Planning in 2025

- Final Thought: Your Legacy Shouldn't Get Lost in Legal Loopholes

Sign-in to CanadianLIC

Verify OTP