- Connect with our licensed Canadian insurance advisors

- Shedule a Call

Basics

Common Inquiries

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Disability Tax Credits & Deductions In Canada: Smart Ways To Save More

By Harpreet Puri

CEO & Founder

- 10 min read

- October 17th, 2025

SUMMARY

Canadians can lower income tax costs by combining the Disability Tax Credit with other tax credits, deductions, and programs. The article highlights Canada’s disability savings benefits, Disability Insurance Coverage, medical expenses, and non-refundable tax credit options while explaining how the Canada Revenue Agency and provincial supports work together to help families maximize benefits.

Introduction

Families coping with disability soon learn the costs of daily living. Medications. Equipment. Travel to specialists. Missed work hours. And then April comes, and with it the tax bill falls like a hammer. For years and years, we’ve sat with parents, caregivers, and persons who just knew there was “nothing out there” for them. And every year, we see people pass up thousands of dollars, all because the paperwork looked too difficult.

In Edmonton, a father explained to me that he was effectively working part-time after a back injury took him out of construction, but had been having full income tax deducted from his paycheque. He believed credits were “just for wheelchairs.” He was wrong. Applying for the Disability Tax Credit not only cut his taxes going forward, but also resulted in a reassessment of the past several years. That cheque was for a van lift for his daughter. It is stories like his that are why this subject matters.

Disability Tax Credit

Is the Disability Tax Credit (DTC) refundable? Succinctly, it doesn’t give you cash directly; rather, it reduces the amount of income tax that you owe. One approved form can pave the way to years of reconciliation savings as well as other federal and provincial programs, automatically.

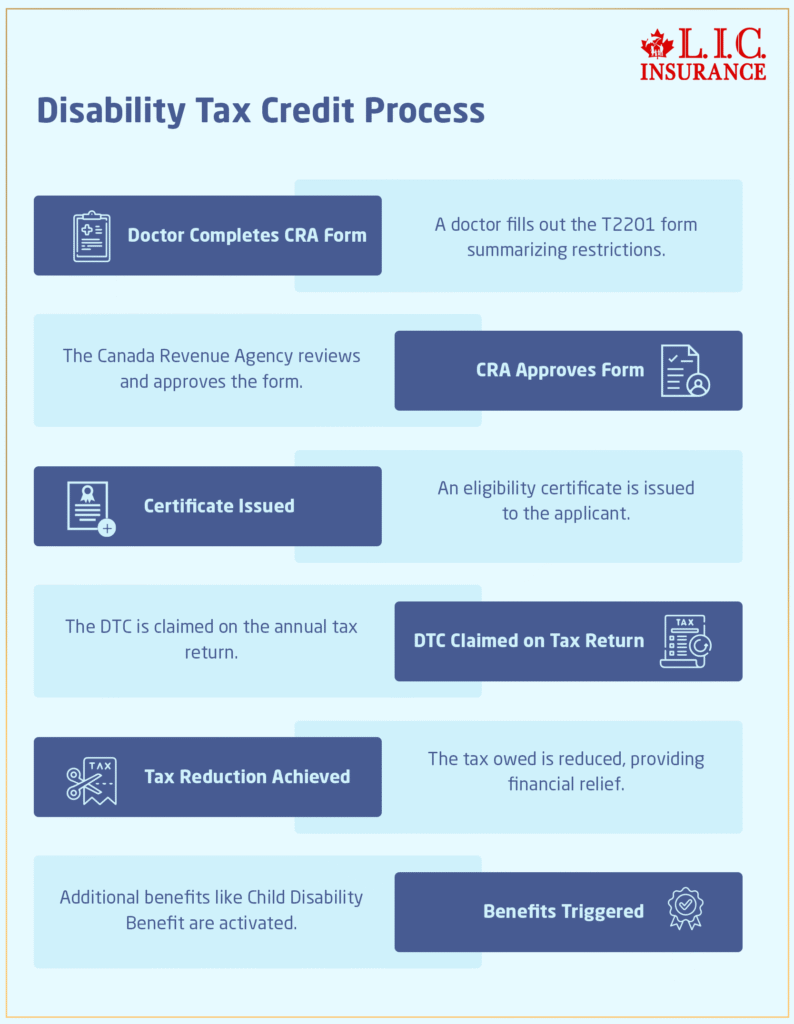

How it works: a doctor completes a CRA form (known as T2201) summarizing your restrictions. The Canada Revenue Agency approves it, and if you’re eligible, you receive a certificate. You can then take the DTC on your tax return each year. Under some circumstances, if your taxable income is low enough for a given year, then a spouse or common-law partner might be able to claim the unused portion — the chunk of contribution still left over after you got through with it — in order to reduce their own bill.

Why it matters: approval can also trigger the Child Disability Benefit, a Registered Disability Savings Plan, and provincial credits such as the Ontario Trillium Benefit. In plainer English, that’s potentially one scribble from a doctor and one form with the CRA in exchange for relief to a family’s budget that will last and last.

Non-Refundable Vs. Refundable Credits

One of the biggest shockers to newbies is that not all “credits” are created equal. In the case of a non-refundable tax credit, such as the Disability Tax Credit, for example, or a home accessibility tax credit or donation credits, it can’t have anything to do but be applied towards your payable taxes; otherwise, it is wasted because you cannot get a refund on something that is not refundable! A refundable tax credit is closer to a cash rebate — even if you don’t owe a penny, it can still put money back in your pocket.

The single parent in Saskatoon whose child has a serious allergy, for example. Her income was so small that she didn’t pay much income tax, and her DTC seemed fairly pointless. Posted by Thu, Apr 30th, 2020. Once she did understand the refundable GST/HST credit and refundable medical expense supplement, she began to receive quarterly payments that actually went towards some of the grocery bill. By layering those two kinds of credits, she adjusted her cash flow without altering her job.

Medical Expenses: More Than Prescriptions And Receipts

The medical expenses credit is a sleeper, too. People think of prescriptions, but the list is much longer — travel for treatment, special diets, mobility aids, and part of the cost of attendant care at day camps, to name a few. Your claim can be based on any 12-month period ending with the same tax year. If your expenses spike irregularly, that small rule makes a big difference.

A British Columbia couple with a teenage son in a therapy program did just that: they batched 18 months of receipts into a single claim period and hacked away at the sum from their taxable income. They didn’t know the Canada Revenue Agency permitted that timing flexibility until a volunteer at a free tax clinic told them about it.

A few tips we’ve learned watching families do this well:

- Keep every receipt matched to the person it’s for.

- If your medical practitioner prescribed a renovation, you might also tap the home accessibility tax credit on top of the medical credit.

- If you’re self-employed, check whether you should deduct allowable items as business costs or claim them personally as credits.

By combining the Disability Tax Credit, the right mix of non-refundable tax credit items, and properly timed medical expenses, many Canadians quietly reduce their income taxes year after year without elaborate schemes – just by using the rules already in place.

Canada Caregiver Credit: Recognizing Family Support

Somewhere behind every line on a tax form resides a beleaguered caregiver. Maybe it’s a son assisting his mother to dress after a stroke, or a wife overseeing medication for her partner with mental health issues. The Canada Caregiver Credit is there to relieve that burden somewhat. It is a non-refundable tax credit that you can claim if you need to support your spouse, common-law partner, child, or other dependent who has a prolonged impairment.

A teacher in Regina who was caring for her adult brother with a profound disability didn’t even know she could claim it. Then, when she claimed the caregiver amount on her return and transferred her brother’s unused Disability Tax Credit to herself, her taxable income fell and her refund increased. That is the real-world impact of a single line, overlooked, on a return.

Canada Revenue Agency Services

To be certain, the CRA is a labyrinth, but it does provide services for those with impairments. Video relay service interpreters, TTY lines, large-type and e-text forms, even special sign language interpreters at meetings if you request them in advance — all meant to help smooth out the process of filing.

Filing your tax return in a timely fashion also keeps other payments flowing on autopilot. The GST/HST sales tax credit, the Ontario Trillium Benefit, provincial supplements for families with children — they all rely on being fed up-to-date information from your return. File anyway — even if you don’t owe any income tax. The arrival back is the signal for those programs.

Provincial And Territorial Payments

In addition to federal programs, such as the Disability Tax Credit or the Canada Caregiver Credit, provinces have their own programs. In British Columbia, affordable credit for senior and disabled homeowners is available for home renovations. Ontario has the Ontario Trillium Benefit. A number of provinces top up those payments with their own child supplements or energy rebates.

A retired Thunder Bay couple used the federal DTC, the home accessibility tax credit, and Ontario’s provincial housing grant in tandem when they renovated their bathroom. Efforts by both the federal and provincial governments meant the after-tax cost of the renovation was cut nearly in half.

This isn’t about memorizing every program in all those layers, of course; it’s knowing that they are there so you know to ask the right questions come tax time. Along with your return, also review the notice of assessment and CRA “My Account” for credits you have been automatically enrolled in, but more importantly, ones still needing to be applied for separately.

Disability Insurance Coverage And Savings Plans: Protecting Income And Building Security

Tax credits and deductions can be potent, but they won’t pay the rent if your paycheque stops. This is where Disability Insurance comes into play. A modest policy can act as a surrogate for some of your income if disease or injury sidelines you. Premiums vary, definitions of disability vary, and so do after-tax benefits — which is why people often ask us to run a Disability Insurance Quote Online before they buy.

A self-employed hairstylist in Halifax fractured her wrist and lost weeks of work. Her private plan paid the bills while her CRA paperwork lagged. She also accessed Canada disability savings benefits and provincial programs, which provided her with breathing room while she got back on her feet.

If you are already approved for the Disability Tax Credit, look into opening a Registered Disability Savings Plan (RDSP). Contributions accumulate tax-deferred, and the federal government can contribute generous grants. It’s a turbocharged RESP for long-term disability savings.

Using Other Savings Tools With Disability Benefits

Don’t overlook mainstream accounts. If you expect very high-spending years, an RRSP deduction can still reduce your taxable income. You can withdraw from an RRSP to purchase or build a qualifying home for yourself, or a related person with a disability, and make repayments over time under the Home Buyers’ Plan.

A British Columbia family used RRSP withdrawals under the Home Buyers’ Plan in conjunction with a provincial housing grant and home accessibility tax credit to renovate a bungalow for their adult son, who has mobility issues. Layering federal and provincial initiatives made a daunting renovation affordable.

Newer accounts, such as the First Home Savings Account (FHSA) and home savings accounts (HAMs), can also provide a boost when a reachable move becomes inevitable. They are a blend of TFSA-type growth with RRSP-type deductions— both useful as an offset against future expenses when you’re still using disability-related credits.

Wrapping Up: Small Steps, Big Difference

When it comes to disability tax planning in Canada, memorizing every rule isn’t the point; having in your back pocket an understanding of what’s available to you is what will ultimately serve you best. The Disability Tax Credit, of course, lowers what you owe in taxes. The Canada Caregiver Credit acknowledges family caregiving. The home accessibility tax credit reimburses hidden costs, as do medical expenses. Services from Canada Revenue Agency and provincial programs, such as the Ontario Trillium Benefit, keep the system running in the background. And personal tools — including Disability Insurance, Canada Disability Savings Grants, RRSPs, and RDSPs — protect income and build security.

We have seen families go from anxious to stable just by filing on time, applying for the right credits, and layering in insurance and savings. The distinction is not a loophole; it is consciousness. The more you know about your choices, the more likely you are to keep your money working for you — not just at tax time, but throughout the year.

FAQs

Canada Disability Savings Benefits can be stacked on other credits and administered through provincial supplements and private plans. And if families can coordinate them with a registered disability savings plan or home-saving account, they will be able to stretch federal dollars even further. It comes down to when to contribute so that your government matching funds hit before you need them for future expenses.

Yes. When someone is approved for the Disability Tax Credit, some insurance companies will permit you to consider additional Disability Insurance protection or an extended benefit period without full medical underwriting. That can reduce the cost of Disability Insurance or offer up more protection so that your after-tax income remains level while you are claiming new credits.

Begin by obtaining a Disability Insurance Quote Online. It won’t simply display premiums — it frequently incorporates projected after-tax benefits, waiting periods, and optional riders. Side-by-side numbers can help families determine whether to pay for more coverage or keep premiums lean, and couple it with Canada’s disability savings benefits.

Some families with a deep, long-term disability use RESP education grants and contribution deductions to offset RRSP deductions from income. And if they later withdraw the money under the Home Buyers’ Plan to buy or renovate a qualifying home, that can be added to Disability Tax Credits and provincial programs for more bang.

Yes. If the CRA grants you approval, in most cases, you can adjust up to ten previous years of tax returns. That means that families who did not even know about the Disability Tax Credit may still be entitled to recover substantial taxes already paid. An adjustment is free and will be without prejudice to current year claims.

They can. If the guddukazoom suffers low or no taxable income, it is often possible to transfer unused credits; certain non-refundable courses of a nature can be transferred to a spouse or common-law partner. This can reduce the family’s overall income tax bill and sometimes spur extra provincial benefits.

Provincial programs can supplement federal benefits with top-ups or matching funds. For instance, a province could offer someone a housing or energy rebate after an individual has already been approved for Canada disability savings benefits. That way, you won’t miss out on a life lesson: Be sure to check both federal and provincial websites every tax season.

A doctor’s contribution goes beyond the signature on a form. They can determine what medical expenses are eligible, verify the extent of impairments for CRA purposes, and support claims for credits like the home accessibility tax credit. Detailed notes from your practitioner can expedite approvals by CRA and avoid back-and-forth.

Yes. Individuals who are self-employed may be able to write off select support or equipment costs as business expenses rather than personal credits. This reduces taxable income even before credits, and coupled with Disability Insurance Coverage, makes cash flow more predictable.

Key Takeaways

- One Approval Can Open Many Doors. Applying for the Disability Tax Credit through the Canada Revenue Agency can reduce income tax and unlock other federal and provincial benefits automatically.

- Layer Credits For Bigger Impact. Combining non-refundable credits, such as the home accessibility tax credit, with refundable credits and medical expenses can create real cash flow relief for families.

- Keep Paperwork And Timing In Mind. Filing tax returns on time, batching medical expenses into one 12-month period, and coordinating with a medical practitioner can increase the size of your credits and deductions.

- Protection Beyond Tax Season. Disability Insurance Coverage, Canada disability savings benefits, registered retirement savings plans, and RDSPs help protect income and build long-term security alongside tax savings.

- Provincial Programs Add A Second Layer. Credits like the Ontario Trillium Benefit, British Columbia renovation credit, and other local supports can be stacked with federal programs to reduce overall costs.

Sources and Further Reading

- Government of Canada – Disability Tax Credit (DTC):

https://www.canada.ca/en/revenue-agency/services/tax/individuals/segments/tax-credits-deductions-persons-disabilities/disability-tax-credit.html - Canada Revenue Agency – Medical Expenses Tax Credit:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/lines-33099-33199-eligible-medical-expenses-you-claim-on-your-tax-return.html - Canada Revenue Agency – Canada Caregiver Credit:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/canada-caregiver-amount.html - Government of Canada – Home Accessibility Tax Credit:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-31285-home-accessibility-expenses.html - Employment and Social Development Canada – Canada Disability Benefit Updates:

https://www.canada.ca/en/employment-social-development/services/disabilities/canada-disability-benefit.html - Canada Revenue Agency – Registered Disability Savings Plan (RDSP):

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/registered-disability-savings-plan-rdsp.html - CRA Digital Services and Accessibility Options:

https://www.canada.ca/en/revenue-agency/services/e-services/e-services-individuals.html

Feedback Questionnaire:

IN THIS ARTICLE

- Disability Tax Credits & Deductions In Canada: Smart Ways To Save More

- Disability Tax Credit

- Non-Refundable Vs. Refundable Credits

- Medical Expenses: More Than Prescriptions And Receipts

- Canada Caregiver Credit: Recognizing Family Support

- Canada Revenue Agency Services

- Provincial And Territorial Payments

- Disability Insurance Coverage And Savings Plans: Protecting Income And Building Security

- Using Other Savings Tools With Disability Benefits

- Wrapping Up: Small Steps, Big Difference

Sign-in to CanadianLIC

Verify OTP