- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Common Visitor Insurance Exclusions In Canada For 2025

By Pushpinder Puri

CEO & Founder

- 13 min read

- July 3rd, 2025

SUMMARY

Common visitor insurance exclusions in Canada for 2025 include issues tied to pre-existing conditions, non-emergency procedures, and high-risk activities. Visitor insurance policies often have strict rules, so reviewing visitor insurance quotes, understanding medical needs, and choosing trusted insurance providers is essential for the right visitor insurance coverage.

Introduction

It hits harder than you expect. Your parents are here on a Super Visa, enjoying time with their grandkids, when something goes wrong. A sudden chest pain, a fall, a hospital visit. You rush to make sure they’re okay, only to be told their visitor insurance policy won’t cover the treatment.

This isn’t a rare story. At Canadian LIC, we’ve worked with thousands of clients over the years who thought they were prepared—until they realized their visitor insurance in Canada came with common exclusions that left them exposed when it mattered most.

We’re writing this not as a pitch but as a warning. Because 2025’s healthcare costs for visitors to Canada are higher than ever, and if your visitor insurance coverage doesn’t align with your medical needs, you or your loved ones could face thousands in emergency medical expenses.

What Are Common Visitor Insurance Exclusions in Canada?

We get this question a lot, usually after someone has already paid a large medical bill out of pocket.

Put simply, common visitor insurance exclusions in Canada refer to the medical services, treatments, or conditions that visitor insurance policies typically do not cover. These exclusions vary slightly across insurance providers, but the patterns are largely the same.

Let’s break them down clearly.

- Pre-Existing Conditions

Pre-existing conditions are by far the number one reason claims are denied.

This can include any diagnosed medical condition that existed before the insurance coverage started, such as:

- High blood pressure

- Diabetes

- COPD (chronic obstructive pulmonary disease)

- Kidney disease

Even if the condition was stable for a long time, many visitor insurance policies still exclude them unless specific coverage is added in advance.

At Canadian LIC, we often recommend going over the medical questionnaire thoroughly and checking the insurer’s definition of “stable pre-existing conditions.” Some define stability as 90 days, others 180 days, without any change in medication or symptoms.

- Medical Treatment Related to Undeclared Medical History

You’d be shocked how many visitors assume “I feel fine” is good enough when filling out insurance paperwork.

But if there’s a medical history not declared—even a single prescription for heartburn or high cholesterol—and later that issue resurfaces? The claim may be denied.

Some insurance companies will request access to previous healthcare services in the home country, so honesty is essential.

- Routine Medical Services and Diagnostic Tests

Visitor insurance in Canada is designed for emergency medical situations only.

That means diagnostic tests, checkups, or prescription medication for minor ailments are generally excluded unless linked directly to an emergency. You cannot use visitor insurance like regular Canadian health insurance or private health insurance.

And yes, even if a doctor ordered the test in an emergency setting, coverage limits may apply. Always review the coverage options and read the fine print.

- High-Risk Activities and Sports Injuries

Planning to ski in Whistler? Go whitewater rafting in Alberta?

Think again.

Most visitor insurance coverage excludes injuries from extreme sports or any activity the provider considers high-risk. This includes:

- Rock climbing

- Skydiving

- Motor racing

- Scuba diving (unless certified)

One of our clients learned this the hard way when their nephew dislocated a shoulder snowboarding. Does the hospital stay? Covered. The ambulance and follow-up physiotherapy? Denied due to “high-risk” classification.

- Mental Health and Substance Abuse-Related Care

Unfortunately, most insurance policies exclude treatment for mental health crises, addictions, or rehabilitation care. That includes hospital visits tied to alcohol or drug use.

This can be devastating, especially for younger visitors to Canada who may be dealing with adjustment issues, anxiety, or depression.

Some private medical insurance plans offer partial mental health support, but these are rare and expensive.

- Care During the Waiting Period

Most visitor insurance has a waiting period of 5 to 8 days if the policy is purchased after arrival. That means any medical emergencies during this time will not be covered.

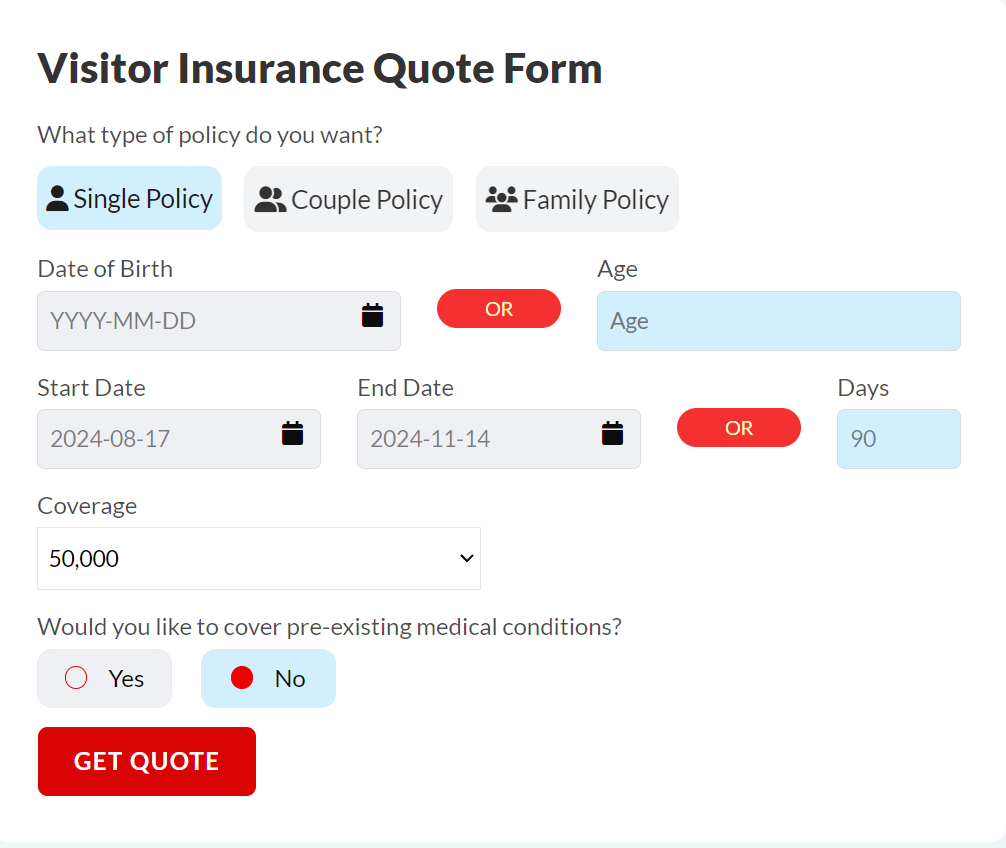

If you want full protection, you must buy visitor insurance online before your loved ones land in Canada. At Canadian LIC, we help clients schedule coverage start dates based on exact arrival times using the super visa insurance cost calculator.

- Pregnancy, Maternity, and Infant Care

Pregnancy and childbirth are almost always excluded from visitor insurance plans.

Even complications arising from a known or undiagnosed pregnancy are typically not covered. And if your baby is born in Canada, their medical expenses also won’t be covered unless a separate Canada insurance policy is taken out in their name.

This has caused heartbreak for many young visiting families who were unaware.

- Experimental or Elective Procedures

If your loved one needs elective surgery, cosmetic procedures, or any unapproved treatments, don’t expect insurance providers to foot the bill.

Coverage applies strictly to emergency medical care deemed necessary by a licensed physician and within Canada insurance plan limits.

Why Exclusions Matter More in 2025

In 2025, high healthcare costs and stricter insurance terms mean purchasing visitor insurance blindly is no longer an option.

Canada’s hospitals now charge higher rates for non-residents. A simple ER visit can cost over $1,500. Add diagnostic tests or overnight stays? You’re looking at bills over $10,000.

That’s why we advise clients to:

- Use a super visa insurance cost calculator to find a realistic premium-to-coverage value.

- Speak to insurance brokers who understand medical condition disclosures

- Always ask about coverage limits and common exclusions before committing

Canadian Citizens Inviting Family Must Step In

If you’re a Canadian citizen sponsoring your parents or grandparents, you must ensure they have proper visitor insurance coverage.

Please don’t assume your Canadian health insurance extends to them. It doesn’t.

You should:

- Get quotes from multiple insurance providers

- Compare visitor insurance policies using a professional

- Ensure pre-existing conditions are discussed and documented

At Canadian LIC, we customize plans specifically for families looking to buy visitor insurance online with full transparency. We also show them how to minimize out-of-pocket expenses by avoiding surprise denials.

Summary Table: Common Visitor Insurance Exclusions

| Exclusion Category | Typical Examples |

|---|---|

| Pre-existing Conditions | Chronic illnesses, heart disease, and diabetes |

| Non-Emergency Procedures | Elective surgeries, routine check-ups, preventive care |

| Pregnancy/Maternity | Routine pregnancy care, childbirth |

| Mental Health | Therapy, psychiatric care |

| High-Risk Activities | Extreme sports, adventure activities |

| Self-Inflicted/Substance | Injuries from self-harm, drug/alcohol abuse |

| Travel Advisory/Illegal | Travel to restricted areas, illegal acts |

| Diagnostic/Non-Emergency | MRIs, CAT scans (unless emergency) |

Travellers should always review their policy documents carefully to understand what is and isn’t covered, and consult with Canadian LIC if they have specific needs or concerns.

Final Advice from Canadian LIC

Don’t rely on guesswork when choosing visitor insurance in Canada. A simple oversight in the application form, an unchecked condition, or a misunderstood insurance policy term could result in major financial loss.

Every exclusion matters.

If you’re planning for your parents’ or grandparents’ visit, use a super visa travel insurance plan that doesn’t just meet IRCC requirements, but protects your family when it truly counts.

And if you’re unsure? That’s okay. Reach out. We’ve helped thousands of families across Canada make smart, safe choices that protect both visitors and sponsors.

Because insurance should offer protection, not surprises.

More on Visitor Visa and Visitor Insurance

FAQs

Most visitor insurance in Canada doesn’t cover everything, and that’s where the fine print matters. The common visitor insurance exclusions in Canada for 2025 include any pre-existing conditions that weren’t declared or considered stable, non-emergency medical treatment, routine check-ups, mental health therapy, and preventive care. If you were hoping for coverage on things like annual physicals or elective procedures, this is where many policies fall short.

A major factor in visitor insurance policies is the applicant’s medical history. If you’ve got pre-existing medical conditions, especially chronic ones like diabetes or hypertension, most plans either exclude them outright or require them to be stable for 90 to 180 days before your trip. This means no recent changes in medication, no hospital visits, and no new symptoms. Insurance providers are strict because they’re trying to avoid covering ongoing or anticipated medical treatment.

Visitor insurance is designed for emergency medical coverage, not for long-term or non-urgent care. So, diagnostic tests for things that aren’t deemed urgent or elective surgeries often fall under common exclusions. Insurance companies expect visitors to Canada to return to their home country for ongoing care. That’s why non-emergency medical procedures are generally left out of most visitor insurance coverage.

Adrenaline junkies, listen up. Activities like bungee jumping, skydiving, paragliding, and even off-trail skiing are often excluded from your visitor insurance policy. If you’re participating in anything considered an extreme sport, many insurance providers will classify it as high-risk and won’t offer emergency medical coverage for any related injuries. Always check your policy’s section on coverage limits before booking anything adventurous.

If you’re travelling from a country under a Level 3 or 4 advisory from the Canadian government, your insurance coverage might be impacted. Some insurance providers could void your visitor insurance if the advisory is tied to medical emergencies, civil unrest, or infectious disease outbreaks. When visiting Canada, it’s not just about having a policy—it’s about making sure it’s still valid under the current Canadian insurance policy regulations.

Pre-existing conditions increase insurance companies’ financial risk. When someone applies with a medical condition, especially one with recent symptoms or medical treatment, it signals a higher chance of claims. This is why most visitor insurance in Canada excludes pre-existing medical conditions or charges a premium to cover them. It’s all about risk assessment, and unfortunately, even stable conditions don’t always make the cut.

Pregnancy is one of the most commonly excluded items in visitor insurance policies. That includes prenatal check-ups, childbirth, and complications arising in the third trimester. Why? Because the cost of medical services for delivery and newborn care in Canada can run into tens of thousands of dollars. Most visitor insurance coverage treats pregnancy as a foreseeable medical need, and therefore, not eligible for emergency medical expenses.

Aside from adventure sports like rock climbing or snowboarding in uncontrolled terrain, even volunteer medical missions, working on farms, or operating machinery can be excluded. Insurance for visitors often doesn’t cover any occupation or activity that increases the likelihood of an accident. If it’s not something you’d do on a casual holiday, assume it might be excluded—and check with your insurance provider for exact definitions.

Most visitor insurance policies exclude mental health treatments. This includes counselling, psychiatric medication, and therapy for conditions like anxiety or depression. Unless it’s an emergency medical situation involving severe mental distress or hospitalization, don’t count on coverage. Mental health care falls under non-emergency medical treatment, and that’s typically not covered under most visitor insurance coverage.

If you cancel your trip for personal reasons, you’re usually on your own. Most visitor insurance plans don’t include trip cancellation unless you purchase an add-on. Non-emergency procedures—like cosmetic surgeries or physiotherapy—are generally excluded. Visitor insurance in Canada is built around emergency medical, not lifestyle or preference-based treatment. Always ask your insurance broker if you’re unsure about what qualifies.

Key Takeaways

- Common visitor insurance exclusions in Canada include pre-existing conditions, routine check-ups, maternity care, and high-risk activities such as adventure sports.

- Many visitor insurance policies will not cover medical services unless they are tied directly to emergency medical situations, making it crucial to understand coverage limits.

- Pre-existing conditions are a major reason claims get denied. Only stable pre-existing conditions with clear medical history might be considered for partial coverage.

- Non-emergency procedures, like diagnostic tests or prescription refills, are generally excluded from most visitor insurance coverage plans in Canada.

- Canadian citizens hosting visitors must help them compare visitor insurance quotes and read the exclusions to avoid paying high medical expenses out of pocket.

- Insurance providers often exclude care related to pregnancy, mental health, or chronic conditions unless specified in the insurance coverage agreement.

- Activities like skiing, snowboarding, or scuba diving are usually excluded unless special riders or emergency medical coverage options are added to the insurance policies.

- Travel advisories or visiting a destination against government warnings can void the visitor insurance in Canada, impacting eligibility for reimbursement of medical treatment.

- Coverage for emergency medical care usually does not include treatment for ongoing medical needs or conditions that were symptomatic before arrival.

- Being aware of the common exclusions helps visitors to Canada make better decisions when purchasing visitor insurance and comparing insurance plans.

Sources and Further Reading

- Official & Provider Resources

CoverMe (Manulife) has a detailed guide outlining exclusions and what typical visitor insurance policies cover, including pre-existing conditions and emergency-only services travelinsurance.ca+7coverme.com+7policyadvisor.com+7.

Blue Cross Ontario explains side-trip eligibility and the importance of visitor insurance coverage meeting Super Visa requirements.

- Wiki & Analytical Context

The Visitor health insurance Wikipedia article lists standard exclusions—pre‑existing conditions, maternity, prescription glasses, and cosmetic procedures coverme.com+13en.wikipedia.org+13visitorsinsurance.com+13.

The Travel insurance entry adds context around exclusions for wars, pandemics, or travel advisories—critical considerations for travellers.

- Medical Condition Definitions

The Wikipedia page on Pre-existing condition clarifies the general definition used widely by insurers; specifically, conditions present before the policy starts en.wikipedia.org+1americanvisitorinsurance.com+1.

Feedback Questionnaire:

Sign-in to CanadianLIC

Verify OTP