To protect one’s financial future in the unpredictable Canadian setting, getting Life Insurance went from being a choice to an absolute must. Going through all the different insurance choices is like trying to find your way through a thick forest without a map. An important thing for many is to find out what kind of Life Insurance is most popular among these tons of options. This blog goes into that search in great detail, focusing on the popularity and, more importantly, the usefulness of Money-Back Life Insurance and Term Insurance with money-back policies. This blog will really help the reader sort through all the choices and make a decision.

Understanding the Struggle

Just imagine yourself standing at a crossroads with paths going in different directions, all having signs reading “Term Life Insurance Policy,” “Whole Life Insurance,” “Universal Life Insurance,” etc. Your work wouldn’t only be choosing a way but choosing a path through which one gets peace of mind and is assured of being secured financially for loved ones in your absence.

Heavy responsibility on your shoulders, right? The struggle to make an informed decision is real, compounded by the fear of choosing a path that might lead to regret. This is what many Canadians are grappling with today: where to find an insurance policy that not only promises them protection but, in the course of their lifetime, offers financial benefits to them. This is where Money-Back Life Insurance policies and Term Insurance with money-back policies can really show the way.

Money Back Life Insurance Policy: A Smart Choice

Money-Back Life Insurance is no less than security coverage for the uncertain life of a human being; in fact, it is a plan that provides financial benefits. The easy premiums that you pay are such that part of your money comes back to you at stipulated regular intervals. It is an insurance policy and a sound financial strategy through which you can secure your family’s future, covering your present and any unwanted loss. It’s now very easy to get a Money-Back Life Insurance Policy Quote in Canada. This is a popular way to protect yourself and save money.

The Practical Choice: Term Insurance with Money Back Policy

Term Insurance with Money Back Policy swings at the other end, providing a simple and non-complex insurance option that offers the best of both worlds. In essence, it is as if you rented a safety deposit box to put your valuable things in. You even pay lots of money like the one in the first example, so much time as you are going to occupy it, and if at the end of the term, you take some of your things out, you can even get some of the money back.

This is really a compromise for those who for lack of a better term, this “hybrid solution” solves the main problem that most Canadians have with insurance: they want a safety net but don’t want that safety net to make them feel like they are throwing money into a black hole.

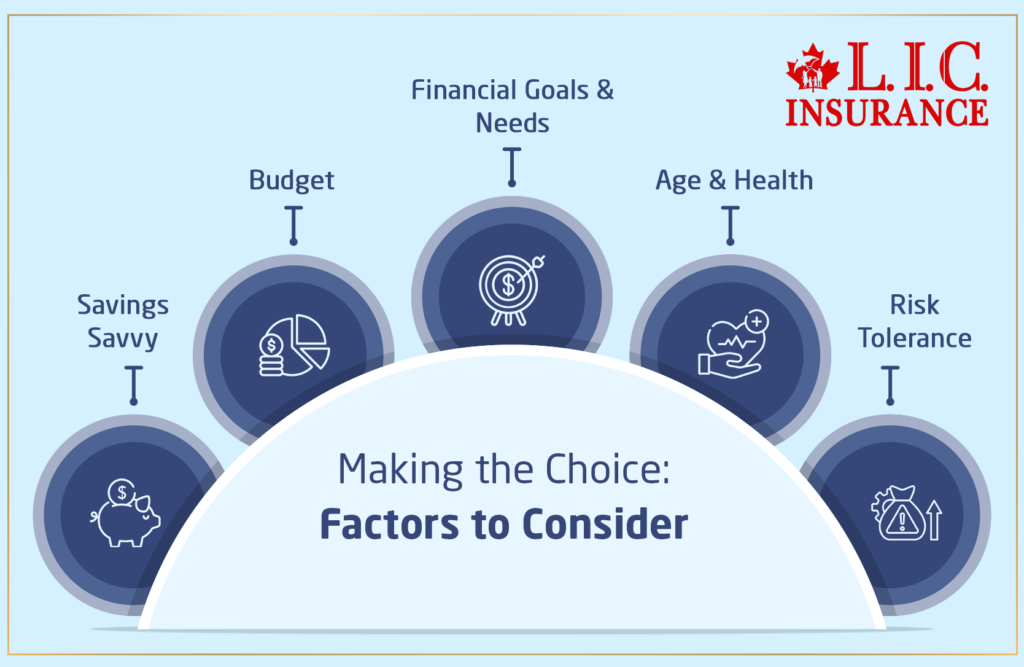

Making the Choice: Factors to Consider

- Financial Goals and Needs: Your choice should be based on what complements your financial goals. Are you looking for a safety net in emergencies, a savings plan, or both?

- Budget: Take into consideration the amount of money you can part with in terms of premiums without affecting your current way of life.

- Age and Health: Another major factor that influences your decision is your age and the health conditions prevailing at the time of taking the policy.

Risk Tolerance: The degree of your comfort in taking risks. Whole Life and Money-Back Policies contain an element of investment that every individual may not like.

Savings Savvy: A Universal Life Policy could allow some flexibility if you’re comfortable with investments.

Real-Life Solutions

Take, for example, John and Maria, a young couple just starting to build their family. So, in the maze of Life Insurance products out there, John and Maria are looking to, of course, take care of their child and figure out how they’ll do their mortgage and their retirement. This is where Term Insurance with a money-back policy comes in to meet them halfway: protection for a term, with some assurance of the return of money if the policy is not claimed.

Then comes Amina, a professional singleton in her thirties who cares deeply about her financial independence and security. A Money-Back Life Insurance Policy ensures not only peace of mind over her family’s future but is also a perfect fit for building a strong financial portfolio.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Conclusion: The Call to Action

The journey through the forest of Life Insurance coverage options is challenging but not impossible. Be it the temptation to get some money back with a Money-Back Life Insurance Policy or the practical thing to do with Term Insurance that has a money-back policy, the point is to take that plunge. Never fear; your decision to take Life Insurance coverage or not is your own. Ask for a money-back policy on your Life Insurance today or discuss the matter with a financial advisor about money-back Term Insurance. Secure your family’s future with a money-back policy. The right time to act is now.

For sure, navigating through the intricate maze of Life Insurance in Canada does take insight into the respective financial goals, needs, and circumstances. Money-back and Term Insurance with money-back schemes are the policies that dominate, mainly due to the way they blend security with a money return. Engaging with these choices in light of your own insurance needs can help you make the best decision for you and your own long-term financial well-being. After all, the best time to plant a tree was twenty years ago; the second best time is now. Act now and secure your future. Let your Life Insurance policy be the stepping stone towards financial security not only for your lifetime but also for that of your family.

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

FAQ'S

The Money-Back Life Insurance is a type of Life Insurance in which coverage is given at the death of the policyholder, along with returning some portion of the premiums paid if the policyholder survives during the policy term.

A Term Insurance policy with a money-back policy works the same as a normal Term Insurance policy, wherein coverage for a certain span of time is provided. However, this is different from traditional Term Insurance in that if the policyholder’s term exists, then he or she gets certain parts of the paid premiums back.

Yes, generally, the Money-Back Life Insurance policies and Term Insurance with money-back policies are costlier than the standard Term Life Insurance policies as they offer a return of premium features.

You will probably get access to the quote of Money-Back Life Insurance policies from most of Canada’s Life Insurance companies online. You will only have to click a few buttons, and from your home, you will be able to compare several policies with their characteristics.

The main benefit is the return of premium features. This means if one outlives the policy term, a part of the premiums is given back to him; therefore, it is financially appealing to persons in need of coverage but at the same time wanting to be sure that their monies are not “wasted” if the coverage goes unused.

The Money Back Life Insurance Policy is suitable for those who seek the double benefit of Life Insurance protection along with the opportunity to earn some returns on the outgoing premium. This makes it very appealing to those who want to bundle their insurance premiums with wider financial planning strategies.

Yes, that is generally accepted, with age limits variably dependent on the insurer. Usually, the younger and healthier you are, the better terms you’ll get for your policies, but do check with each individual insurer, as they might have age limits and terms applied to them.

Although the money-back feature can be an added financial benefit, serious consideration of its terms and the return rate compared to other options should be given. In other words, Life Insurance with a money-back feature should be considered essential protection.

The ‘return of premium’ feature will mitigate the risk of ‘losing’ the premiums if the policy is not claimed by giving a partial refund at the end of the term. The disadvantage of this feature is, most often, policies that have it do not come with a policy premium when compared to policies without that option.

Moreover, a policy that gets cancelled in the early years could be subject to surrender charges, where one may not get all the paid premiums. Details will be as per the terms of your policy, so it’s always better for you to understand the cancellation terms before you finally buy the policy.

These FAQs will help to enhance understanding and help potential policyholders make informed decisions regarding their Life Insurance Coverage choices in Canada, especially when considering the nuanced options of Money Back Life Insurance policies and Term Insurance with money back policies.

Sources and Further Reading

For readers interested in exploring more about Money Back Life Insurance policies, Term Insurance with money back policies, and Life Insurance options in Canada, the following sources and resources offer valuable information. These references can provide deeper insights, help compare different insurance products, and guide personal financial planning decisions.

For readers interested in exploring more about Money Back Life Insurance policies, Term Insurance with money back policies, and Life Insurance options in Canada, the following sources and resources offer valuable information. These references can provide deeper insights, help compare different insurance products, and guide personal financial planning decisions.

Insurance Bureau of Canada (IBC): The IBC offers comprehensive guides on various types of Life Insurance available in Canada, including money back policies. Their resources are invaluable for understanding the basics of insurance, policy comparisons, and consumer rights. Visit IBC

Canadian Life and Health Insurance Association (CLHIA): CLHIA provides detailed publications and resources about Life Insurance products, including Term Life Insurance and money back policies. Their guides can help consumers make informed decisions about their insurance needs. Visit CLHIA

- Financial Consumer Agency of Canada (FCAC): The FCAC offers educational material on financial products, including Life Insurance. They provide tips on choosing insurance products, understanding insurance terms, and managing financial health. Visit FCAC

- Personal Finance Blogs and Websites: Websites like MoneySense and Canadian Finance Blog offer articles, comparisons, and personal advice on choosing the right Life Insurance policy in Canada. These platforms often share personal experiences and reviews about dealing with insurance companies and selecting policies.

- Insurance Company Websites: Major Canadian insurers such as Manulife, Sun Life, and Canada Life provide detailed descriptions of their Life Insurance products, including Money Back Life Insurance policies. Their websites also offer tools like premium calculators and quote generators to help potential policyholders estimate costs and benefits.

- Professional Financial Advisors: Consulting with a professional financial advisor can provide personalized advice tailored to individual financial situations and goals. They can offer insights into the advantages and disadvantages of different Life Insurance products and help navigate the complexities of selecting the right policy.

Further Reading:

- Books on Personal Finance and Insurance: Reading books like "The Wealthy Barber" by David Chilton or "Pound Foolish: Exposing the Dark Side of the Personal Finance Industry" by Helaine Olen can provide broader perspectives on personal finance management, including insurance decisions.

- Research Papers and Journals: Academic journals and research papers on insurance and financial planning can offer in-depth analyses and studies on consumer behavior, insurance trends, and the financial implications of various Life Insurance products.

- Online Forums and Community Discussions: Platforms like Reddit, particularly subreddits related to personal finance and insurance, can be valuable resources for real-life advice, questions, and discussions on insurance policies, including Money Back Life Insurance.

Remember, while these sources and resources can provide valuable information, it’s crucial to critically evaluate the advice and data presented, considering how it applies to your individual circumstances and financial goals.

Key Takeaways

- Money Back Life Insurance policies combine protection with the chance to recoup some premiums.

- Term Insurance with money back adds financial return to the security of term coverage.

- Align insurance choices with your financial goals and dependent needs.

- Perform a cost-benefit analysis on higher premium costs versus potential returns.

- Your age and health influence policy terms and premium costs significantly.

- Consider your comfort with investment aspects and risk when choosing a policy.

- Seeking professional advice and using educational resources aids in informed decision-making.

- Taking action to secure Life Insurance now is crucial for financial protection.

- Sharing and discussing experiences can lead to better insights and choices.

- Regularly review your Life Insurance as part of your financial planning to ensure it meets current needs.

Your Feedback Is Very Important To Us

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com