If you’re thinking about entering into the world of Life Insurance in Canada, you might have wondered, “Is there a perfect age to make the move?” Well, the truth is, there’s no perfect answer that will be applicable to everyone, but picture it like this: choosing when to get Life Insurance is a bit like going to a sale – the earlier, the better! It’s like getting a discount on protection for your loved ones when you’re young and healthy. But hold on, if you wait too long, it’s a bit like trying to buy winter jackets in the middle of summer, which would be tricky and maybe even impossible, especially if your health is already not in the best of condition. Let’s figure out when the best time to buy Life Insurance is and why you should start thinking about it right away.

Let’s Understand Life Insurance

First, it’s important to know what Life Insurance is before talking about the best age to buy it. Life Insurance is a financial product that provides a lump sum payment, known as a death benefit, to beneficiaries upon the policyholder’s demise. This financial support system can help pay for things like funeral costs, outstanding debts, and the ongoing financial needs of people who depend on you.

Factors Influencing the Decision

Age and Health:

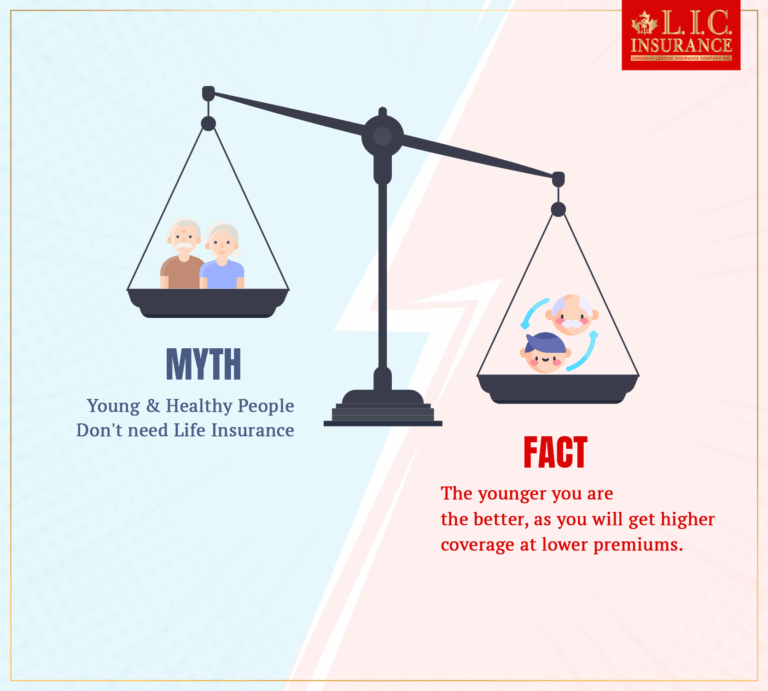

Life Insurance premiums are often more affordable when you buy them at a younger age. This is because younger individuals typically pose a lower risk to insurance providers.

Health is a significant factor influencing both eligibility and premiums. Generally, individuals in good health can secure more favourable rates.

Financial Responsibilities:

The best time to buy Life Insurance may coincide with significant life events, such as marriage, the birth of a child, or the purchase of a home. These milestones often bring about increased financial responsibilities, making Life Insurance coverage even more important.

Income Stability:

Having a stable income is another important thing to be considered. Life Insurance makes sure that your loved ones are protected financially if the unexpected were to happen, offering peace of mind during times of uncertainty.

The Ideal Age for Life Insurance

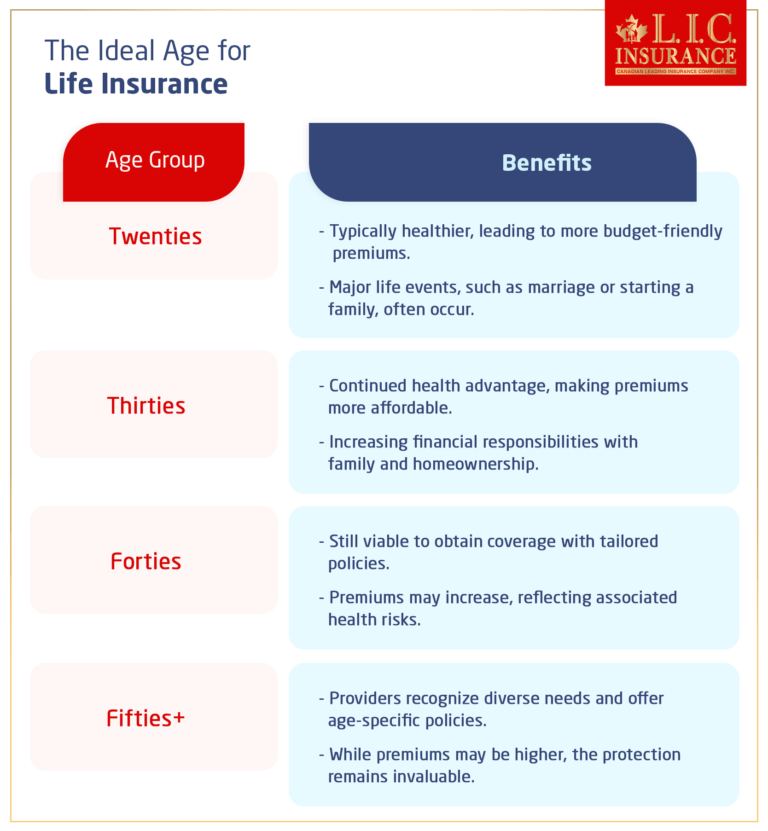

Determining the ideal age to buy Life Insurance in Canada is a decision that is dependent on various factors, each playing an extremely crucial role in securing peace mentally. While no universal answer applies to everyone, many financial experts lean towards recommending Life Insurance acquisition in one’s twenties or thirties. Let’s explore the rationale behind this advice and why it’s never too late to consider Life Insurance coverage per different age groups.

The Twenties and Thirties Advantage:

In your twenties and thirties, life often gives you a mix of big moments and the feeling that you can do anything. Financial responsibilities may include rent or mortgage payments, student loans, and perhaps the joyous chaos of starting a family. At this stage, Life Insurance premiums are often more pocket-friendly.

One key factor contributing to the affordability of premiums during this time is the general good health that tends to accompany youth. Insurance companies typically view younger individuals as presenting a lower risk, leading to lower premiums. Going for Life Insurance during this period ensures that you get more favourable rates, providing a cost-effective means to protect your loved ones’ financial future.

Moreover, acquiring Life Insurance in your twenties or thirties aligns with major life events, such as your marriage or the birth of your child. These significant milestones often trigger a heightened awareness of financial responsibilities, making Life Insurance a sensible consideration. By doing so, you lay the foundation for a safe and secure place that can support and protect your family’s financial stability during unforeseen circumstances.

It’s Never Too Late:

The common misconception is that getting Life Insurance becomes harder as you get older. This is not true. The reality is that Life Insurance providers recognize the diverse needs of individuals at every stage of life. Therefore, it’s never too late to obtain coverage, and many providers offer policies designed to cater to different age groups.

Whether you’re in your forties, fifties, or beyond, securing Life Insurance remains a feasible and important step toward financial security. While premiums may increase with age due to associated health risks, the protection and mental peace offered by Life Insurance are immeasurable. Providers know how each age group’s circumstances are different, and they know how to adjust policies to suit different demands.

Going through the Process:

Obtaining a Life Insurance quote in Canada has become more accessible than ever. Many reputable insurance companies offer online tools that simplify the process. By entering basic information such as age, health status, and coverage preferences, individuals can receive instant quotes, enabling them to make intelligent choices about their Life Insurance needs.

For those unfamiliar with the difficulties that come with Life Insurance, seeking guidance from licensed insurance brokers can be immensely beneficial. These professionals possess the expertise to review the huge number of options, ensuring you find coverage that is perfect as per your specific needs and budget.

So, even though the twenties and thirties present a great time to secure Life Insurance in Canada, the door to coverage remains wide open at any age. The main thing is to understand the unique factors influencing your life and financial situation. By exploring Life Insurance options and obtaining quotes tailored to your needs, you take a significant step towards providing lasting financial protection for your loved ones, regardless of your age.

When You Should Never Buy Life Insurance?

Life Insurance is a great way to protect your loved ones who count on your income in case you die. However, there are instances when purchasing Life Insurance might not be the most practical or necessary decision. Read the following points to know when you should hold off on buying Life Insurance:

Zero Dependents, Zero Need:

If you currently have no dependents and foresee a future where this situation remains unchanged, Life Insurance may not be a priority. The primary aim of Life Insurance is to protect those who rely on your financial support.

Exception: Financially Independent Loved Ones:

An exception to the rule exists if obtaining a Life Insurance policy brings mental peace, even for financially independent loved ones. While having no dependents may not necessitate coverage, it’s worth considering if the thought of providing extra security for a loved one is important to you and fits your budget.

Affordability Matters:

Life Insurance can contribute to inner peace, but it should never be a financial burden. It becomes a practical option if you can afford a policy without compromising your overall financial well-being.

Consider Alternative Safety Nets:

For individuals with zero dependents, exploring alternative financial protection options is advisable. Instead of investing in Life Insurance, focus on building an emergency fund. A high-yield savings account can be a practical means of slowly accumulating three to six months’ worth of income for unexpected financial challenges.

Remember, the decision to purchase Life Insurance is highly individual. It’s essential to understand your unique circumstances and financial goals very well. While Life Insurance is a valuable financial safety choice, knowing when it may not be necessary makes it possible for you to allocate your resources effectively and make aware and intelligent financial decisions.

Concluding Thoughts

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

With Life Insurance, if the insured dies, their beneficiaries will get a lump sum payment, which is called a death benefit. It protects your finances by paying for things like funeral costs, debts, and the financial needs of people who count on you. Without Life Insurance, the people you care about would not have enough money if you died suddenly.

There is no one right answer, but many financial experts say you should get Life Insurance when you are in your twenties or thirties. People are usually in better health at this point, and rates are more affordable. But it’s never too late to get insurance, and many Life Insurance companies have Life Insurance plans that are specific to age groups.

People are usually in good health during these years, which means that rates are lower. Also, big events in people’s lives, like getting married, having a child, or buying a house, often happen during this time, making it even more important to protect their finances. When you decide to buy Life Insurance in your twenties or thirties, you can get better rates and take care of your growing financial responsibilities.

No, it’s never too late to obtain Life Insurance. Providers understand the diverse needs of individuals at every age and offer policies that cater to different age groups. While premiums may increase with age due to associated health risks, the protection and mental peace offered by Life Insurance are invaluable at any stage of life.

It’s very easy to get a quote for Life Insurance in Canada. A lot of good insurance companies have online tools that let you get instant quotes by entering basic information like your age, health, and coverage choices. Working with licensed insurance brokers can also give you personalized help and help you learn about your choices.

Several factors impact Life Insurance premiums, including age, health, lifestyle, coverage amount, and the type of policy. Younger, healthier individuals often enjoy lower premiums. Lifestyle choices, such as smoking, may increase costs. The coverage amount and policy type (term or whole life) also play a role in determining premiums.

Absolutely, a lot of Life Insurance plans provide flexibility. When your situation changes, like when you engage in marriage, have your first baby, or go through other big events in your life, you can usually change the amount of coverage you have or look into getting extra riders. It’s wise to examine your policy and make any necessary revisions frequently.

To find the right Life Insurance policy, you need to think about your budget, financial goals, and specific desires. Working with a qualified insurance broker can be helpful because they can give you expert advice and help you sort through the different policies to find one that fits your needs.

Yes, many insurance providers in Canada offer online tools that allow you to input basic information and receive a Life Insurance quote instantly. These tools are user-friendly and provide a convenient way to explore coverage options.

No, Life Insurance is valuable for anyone with financial responsibilities. It provides financial protection for dependents, covering various expenses, regardless of whether the individual is the primary breadwinner or a contributing member of the family.

Yes, it’s possible to obtain Life Insurance with pre-existing health conditions. However, the type of coverage and premiums may vary. It’s advisable to disclose all health information accurately when applying for coverage.

Yes, there are various types, including term life, whole life, and universal Life Insurance. The choice depends on factors like your budget, coverage needs, and preferences. Consulting with an insurance professional can help you make an informed decision.

Some Life Insurance policies, such as whole life and universal life, have a cash value component that can grow over time. However, it’s essential to weigh the pros and cons, as these policies may have higher premiums compared to term Life Insurance.

Yes, many Life Insurance policies allow you to adjust coverage. This can involve increasing or decreasing the coverage amount, changing the policy duration, or adding additional riders to meet evolving needs. Contacting your insurance provider can help facilitate these adjustments.

If you miss a premium payment, there is often a grace period during which you can make the payment without any negative consequences. However, it’s crucial to understand the terms of your policy and the grace period specifics to avoid lapses in coverage.

Yes, you can name multiple beneficiaries, and you can specify the percentage of the death benefit each will receive. This flexibility allows you to tailor your policy to the needs of your loved ones.

While Life Insurance is often associated with providing for dependents, single individuals may still benefit from coverage. It can help cover debts and funeral expenses, preventing a financial burden for family members or beneficiaries.

In Canada, Life Insurance payouts are generally tax-free. The beneficiary receives the death benefit without having to pay income tax on the proceeds.

Yes, it’s possible to have multiple Life Insurance policies. This might be beneficial if your needs change over time, allowing you to tailor coverage to different aspects of your life.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]