- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

$1 Million Dollar Whole Life Insurance In Canada: 5 Key Factors That Impact Cost In 2025

By Harpreet Puri

CEO & Founder

- 10 min read

- November 07th, 2025

SUMMARY

A $1 Million Dollar Whole Life Insurance Policy in Canada offers Permanent Life Insurance Coverage, guaranteed cash value growth, and financial protection for families. The cost depends on factors like age, health issues, smoking status, coverage amount, Life Insurance premiums, and policy type. The blog highlights how Life Insurance costs in Canada vary and what impacts long-term value and monthly premiums.

Introduction

We’ve spent more than 14 years assisting Canadians in grappling with this very question: “How much is a million-dollar whole life policy?” It’s not a straightforward table lookup. The Whole Life Insurance Premium for that amount of coverage in 2025 is made up of dozens of minute underwriting decisions, and each one of them can push your numbers higher or lower.

There’s also an industry data point to support why this is important. All-time high for new Canadian Whole Life Premiums: New Canadian Whole Life Premiums exceeded $1.4 billion in 2024, according to LIMRA. That’s a lot of families counting on Whole Life Insurance Policies as a long-term financial safety net. And with a Million Dollar Life Insurance Policy, the levers are also amplified — tens of thousands, if not hundreds, of dollars per month can separate a clean application from a dirty one.

We’ll take you through the five determinants we encounter commonly in day-to-day life that establish what the real Whole Life Insurance Costs in Canada are. This is not some tidy brochure spiel; it’s the inside view from a team that has viewed literally thousands of quotes.

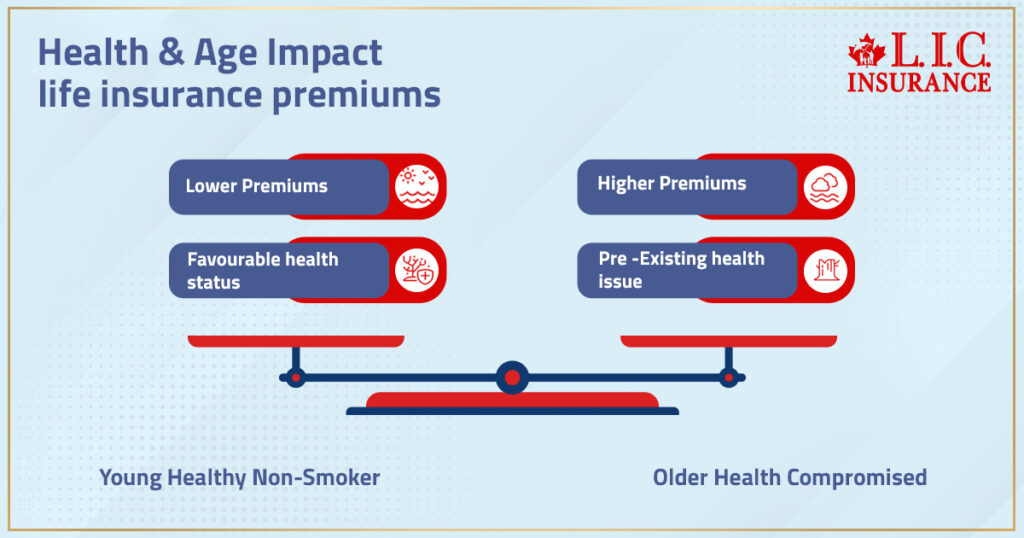

Life Insurance Premiums Start With Age And Health Status

When you apply for a million-dollar Whole Life Insurance Policy, the insurance underwriters want to know how probable it is they’ll have to pay out that death benefit in short order. That’s right, your age, your medical history, current health conditions, and even the medical history of other members of your family are being put under a microscope.

Young, healthy non-smokers will almost always secure lower Life Insurance premiums. An individual in their early 30s with average labs may receive a remarkably affordable quote, while another individual in their 50s who has pre-existing health issues will see the cost of Whole Life Insurance spike quite significantly. Every carrier will require a medical exam at this level of coverage — blood, urine, vitals, often an EKG — because $1 million is not chump change.

We’ve had clients surprised to learn that only one ticker-tape “Elevated Cholesterol” reading has pushed them out of the or- should I say ‘pre’-? Preferred class. That one line item can tack on hundreds to the monthly premium. It’s not personal; it’s math.

Life Insurance Costs Differ By Gender And Longevity

We don’t like to acknowledge this, but the statistics show that women tend to live longer. Insurers’ price for that. A healthy 40-year-old woman might pay an appreciably different amount for a one Million Dollar Policy per month than a healthy 40-year-old man. That spread is small on a $100k plan, but magnified when it comes to $1 million.

It’s why two people under the same roof can receive wildly different quotes from the same Life Insurance company. It’s mortality tables, not favouritism..

Life Insurance Cost Changes With Coverage Amount And Policy Design

The easy part: more coverage = more premium. But beyond the $1 million mark, underwriters impose “large case” rules — more financial justification, and sometimes more medical review.

The less visible piece: how your whole life policy is constructed. A conventional Whole Life Plan has level premiums and slow, steady cash value growth. A plan that is overfunded or supercharged from the start takes in more monthly premiums up front but accumulates more cash value (and possibly death benefit) along the way.

We run side-by-side comparisons detailing the difference in performance between Whole Life Insurance Policies. It may surprise you how much the interior design of Long Term Life Insurance costs in Canada.

Coverage Amount, Payment Pattern, And Duration All Interlock

Another lever that doesn’t receive enough attention is how you pay. One annual payment generally has the cheapest effective insurance premiums; a monthly payment comes with higher costs because of processing fees.

Then there’s limited-pay vs life-pay. With limited-pay, you compress premiums into 10 or 20 years — higher Life Insurance prices now, but you’re done sooner and own the policy outright. With life-pay, your monthly premium is lower, but you continue to pay for 10 or 20 years.

Here is where people get tripped up by online calculators. A quote for a “Million Dollar Life Insurance Plan per month” could seem very inexpensive because that is on the assumption of life-pay at age 30. Ages 50 and over. With a 20-pay design, run the same package at age 50 with your client, and that number triples.

Permanent Life Insurance Depends On Dividends And Company Strength

The vast majority of the big Permanent Life Insurance Plans in Canada participate. That allows your policy to receive dividends from the company’s profits. Dividends can be applied to lower your premium, purchase more coverage, or increase your cash value. But they’re not guaranteed.

The insurer’s track record matters. Strong mutuals with consistent decades-long records of large dividend payouts will typically charge a little more upfront, but have far better net results down the road. “It’s the weak insurers that may be cheaper today but disappoint later.”

That is why we think beyond the headline Life Insurance pricing and delve deeper into the insurer’s financial statements, credit ratings, and dividend track record. And for a Million Dollar Whole Life Insurance Policy, those details will make or break the financial future for your family for the next 30 years.

How Much Does It Really Cost?

There’s no public table for “$1 million whole life at age 40, non-smoker” because it’s so profile-specific. But scaling from published data:

- Healthy mid-30s non-smoker: could see something in the CAD $1,200–$1,800/month range.

- Healthy 50-year-old: often CAD $2,500–$3,500/month or more.

- Add smoking status, high-risk hobbies, or poor health, and it can shoot much higher.

That’s why “how much Life Insurance” you buy and how you structure it matters. Online quote engines can give you a Whole Life Insurance quote online, but for this size of coverage, you almost always need a human advisor to shop multiple Life Insurance companies and model the differences.

Whole Life Is Not Just Insurance, It’s Strategy

A million-dollar Whole Life Insurance Policy is actually two things: a guaranteed death benefit plus a long-term cash value asset. Used properly, it can shield your family, buttress a buy-sell agreement, or be used as part of an estate plan. Done wrong, it can be a cash-flow vampire.

This is where our licensed advisors prove their mettle — ensuring that your coverage amount corresponds to your financial responsibilities and you’re not overpaying for the wrong design. We also look at your health history, how you live, and even how much money you make to substantiate the coverage for underwriting.

Quick Recap Of The 5 Key Factors

- Age and health status (medical exam, medical history, non-smoker vs smoker).

- Gender (mortality differences reflected in premiums).

- Coverage amount and policy design (traditional vs overfunded, riders, dividend options).

- Payment frequency and duration (annual vs monthly, limited pay vs life pay).

- Insurer strength and dividend history (affects long-term net cost).

Get those right, and your Life Insurance premiums for a Million Dollar Plan become a predictable line item rather than a surprise.

What Canadian LIC Can Do For You

We’re not just quoting numbers; we’re competing on designs, passing multiple carriers, and showing how divergent assumptions change your cost over the decades. This is how you protect your family’s financial future, not with any ol’ whole life plan, but the right one.

If you’re interested in a Million Dollar Policy, start the conversation while you’re young and healthy. Clean up lifestyle risks. Then let us do the shopping for you. The amount of that gap between the “average” quote and the “best” quote at this size is thousands of dollars a year.

FAQs

Yes, most term policies in Canada come with a built-in conversion option.

This lets you switch to Permanent Life Insurance without another medical exam.

Timing is key — most insurers allow this only within specific age ranges.

It’s a smart move if your long-term goals now include lifetime coverage.

Absolutely. A Million Dollar Policy can cover capital gains tax and more.

It ensures your beneficiaries get the full value of your estate — tax-free.

Some policies also allow you to build an accumulated cash value for future use.

For many Canadians, it’s a foundational piece of intergenerational wealth transfer.

It depends on how your policy is structured at the time of purchase.

Certain participating policies offer premium flexibility using built-up cash value.

Others let you offset payments with dividends from the insurer.

This is why reviewing premium terms before committing is crucial.

Whole life comes with guaranteed premiums and a fixed death benefit.

Universal life, on the other hand, offers adjustable coverage and flexible payments.

But that flexibility can come with higher insurance costs long-term if unmanaged.

It really comes down to your risk tolerance and financial discipline.

Cash value in a whole life plan grows at a guaranteed rate set by the insurer.

Participating policies may also earn annual dividends that accelerate growth.

This value can be accessed through policy loans or withdrawals if needed.

Think of it as a financial cushion inside your Life Insurance policy.

Most whole life policies include a grace period and built-in safety features.

Your accumulated cash value can sometimes cover missed premiums temporarily.

Failing that, your policy may convert to reduced coverage or lapse altogether.

It’s best to review payment flexibility when choosing your insurer.

Not always — some insurers offer simplified issue Whole Life Insurance Policies.

But most standard policies at this coverage level do ask for medical underwriting.

Applicants with complex health issues may require additional screening.

A clean medical record can often unlock preferred Life Insurance premiums.

Yes, many lenders accept a policy’s cash value as collateral for personal loans.

It’s a low-risk asset with predictable value, especially after the first 10 years.

This strategy can preserve other investments or income during tough times.

It’s an underrated financial benefit of Permanent Life Insurance Plans.

Yes — the cash value growth inside a whole life policy grows tax-sheltered.

The death benefit is paid out tax-free to your beneficiaries.

And policy loans don’t trigger immediate tax liabilities if structured right.

It’s often used alongside RRSPs and TFSAs for long-term financial planning.

Some whole life policies include guaranteed insurability riders for this reason.

They allow you to increase your coverage amount without another exam.

Other times, you’ll need to apply for a new policy or convert term coverage.

Always check the policy’s built-in options when you first apply.

Key Takeaways

- Age and health status play a major role in determining the Whole Life Insurance Premium. Younger, healthier applicants usually receive lower rates.

- Gender influences the cost of Life Insurance due to differences in life expectancy. Women generally pay less for the same Life Insurance coverage.

- The coverage amount and type of Permanent Life Insurance Policy chosen — such as traditional vs. overfunded — directly affect monthly premiums and cash value growth.

- Payment frequency and structure matter. Opting for annual payments or limited-pay options may reduce Life Insurance costs over time.

- The performance of the Life Insurance company, especially regarding dividends and policy options, can impact the long-term value of a Million Dollar Whole Life Insurance Policy.

- Pre-existing health conditions, medical history, and smoking status can lead to higher Life Insurance premiums, affecting both affordability and eligibility.

- Requesting a Whole Life Insurance quote online gives personalized insight into how your lifestyle, age, and policy structure affect the final Whole Life Insurance Costs in Canada.

Sources and Further Reading

Canadian Life and Health Insurance Association (CLHIA)

Industry statistics, coverage trends, and policy data across Canada

🔗 https://www.clhia.ca/facts

Canada Revenue Agency (CRA) – Life Insurance & Taxation Guidelines

How Life Insurance death benefits and cash values are taxed in Canada

🔗 https://www.canada.ca/en/revenue-agency.html

Office of the Superintendent of Financial Institutions (OSFI)

Regulatory framework and oversight of Life Insurance companies in Canada

🔗 https://www.osfi-bsif.gc.ca/

Life Happens Canada (via LIMRA/Canadian-specific data)

Insights on Life Insurance needs, ownership gaps, and policy usage

🔗 https://lifehappens.org/

Equitable Life of Canada – Participating Whole Life Insurance Guide

Details on dividends, cash value, and permanent coverage features

🔗 https://www.equitable.ca/

Sun Life Canada – Life Insurance Cost Estimator Tool

Helps estimate Life Insurance costs based on age, health, and amount

🔗 https://www.sunlife.ca/

Canadian Life Insurance Consumer Guide – Insurance Bureau of Canada (IBC)

Independent overview of term vs. whole life policies and what to expect

🔗 https://www.ibc.ca/on/home/insurance/life-insurance

Feedback Questionnaire:

We’d love your input. Help us improve and serve you better. Your answers will remain confidential.

IN THIS ARTICLE

- $1 Million Dollar Whole Life Insurance In Canada: 5 Key Factors That Impact Cost In 2025

- Life Insurance Premiums Start With Age And Health Status

- Life Insurance Costs Differ By Gender And Longevity

- Life Insurance Cost Changes With Coverage Amount And Policy Design

- Coverage Amount, Payment Pattern, And Duration All Interlock

- Permanent Life Insurance Depends On Dividends And Company Strength

- How Much Does It Really Cost?

- Whole Life Is Not Just Insurance, It’s Strategy

- Quick Recap Of The 5 Key Factors

- What Canadian LIC Can Do For You

Sign-in to CanadianLIC

Verify OTP