- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

What Happens If You Don’t Have Student Insurance Abroad?

By Pushpinder Puri

CEO & Founder

- 11 min read

- July 30th, 2025

SUMMARY

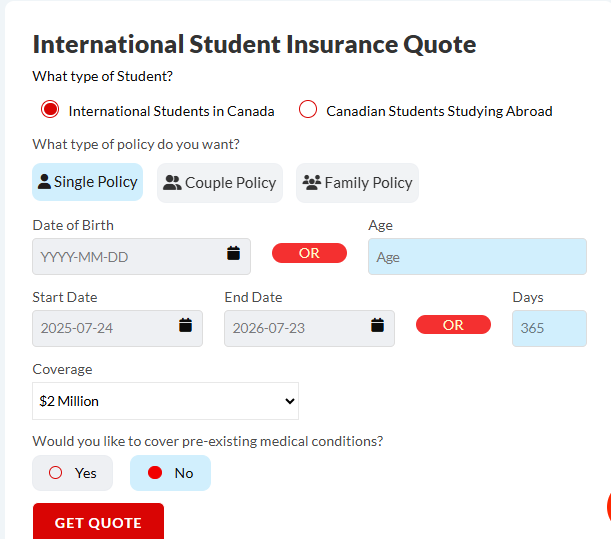

Many international students face serious financial risks when studying abroad without proper coverage. The content highlights why Student Insurance Plans in Canada are essential, the limitations of school-issued policies, and the dangers of relying solely on a Registered Education Savings Plan. It also explains how the best International Student Insurance Plans offer broader protection and how to get a personalized International Student Insurance Quote.

Introduction

At first, everything feels exciting.

A new country. New friends. A new campus to explore.

But then one cough turns into chest pain.

Or a bike accident leaves you in urgent care.

And that’s when it hits—your student life abroad has no safety net.

We’ve seen too many students and families suffer financially and emotionally because they skipped the one thing that could have saved them: proper student insurance. Whether you’re comparing the best International Student Insurance Plans or are still figuring out your budget, this guide explains what really happens when you study abroad without coverage—and how you can avoid costly mistakes.

The Hidden Costs Of Studying Abroad Without Insurance

Every year, we get calls from parents across India, the Philippines, Nigeria, and the Middle East. Their child, who is studying in Canada, was suddenly hospitalized and is facing medical bills they cannot pay. All because they didn’t realize that a Student Insurance Plan in Canada is not just helpful—it’s critical.

Here’s what typically happens when there’s no coverage in place:

- Emergency room visits cost between $2,000 $10,000

- A simple surgery like an appendectomy may run $20,000 or more

- There is no access to provincial healthcare (like OHIP in Ontario) in the first year

- Chronic conditions go untreated due to out-of-pocket costs

- Prescriptions, therapy, and mental health care are often unaffordable

Without insurance, students delay care. They avoid going to the doctor. And the situation gets worse.

Real Cases We’ve Helped Resolve

We once assisted a student from India who had just arrived in Toronto. Within a month, he developed a kidney infection. With no International Student Insurance Quote secured, he was denied non-emergency care until he could pre-pay thousands of dollars. By the time his family arranged the money, his condition had worsened.

In another case, a student from the UAE contacted us after being diagnosed with clinical depression. Her basic college plan didn’t cover counselling beyond four sessions per year. Her academic performance suffered, and she nearly had to withdraw from her program. These aren’t rare cases. They’re weekly realities.

The Misconception About Registered Education Savings Plans

Parents often assume that having a Registered Education Savings Plan (RESP) means their child is financially protected. It’s not the case.

RESPs are designed for tuition, books, and living expenses—not medical emergencies.

If your child gets injured, falls seriously ill, or needs ongoing care, RESP funds cannot offer the same protection as health insurance. Worse, we’ve seen families pull from RESP savings to pay unexpected medical bills, compromising their child’s ability to continue their education.

The Visa Risks Of Having No Student Insurance

Many families also don’t realize that having valid insurance is often required as part of maintaining your student visa or study permit.

Without it, students may face:

- Delays or rejections during visa application or renewal

- Denial of admission into certain educational programs

- Lack of access to school-based health services

- Challenges in obtaining post-graduate work permits

Some provinces in Canada require students to show proof of insurance if they are not yet eligible for provincial plans. Without proper coverage, your stay in the country could be cut short—not because of academics, but because of administrative failure.

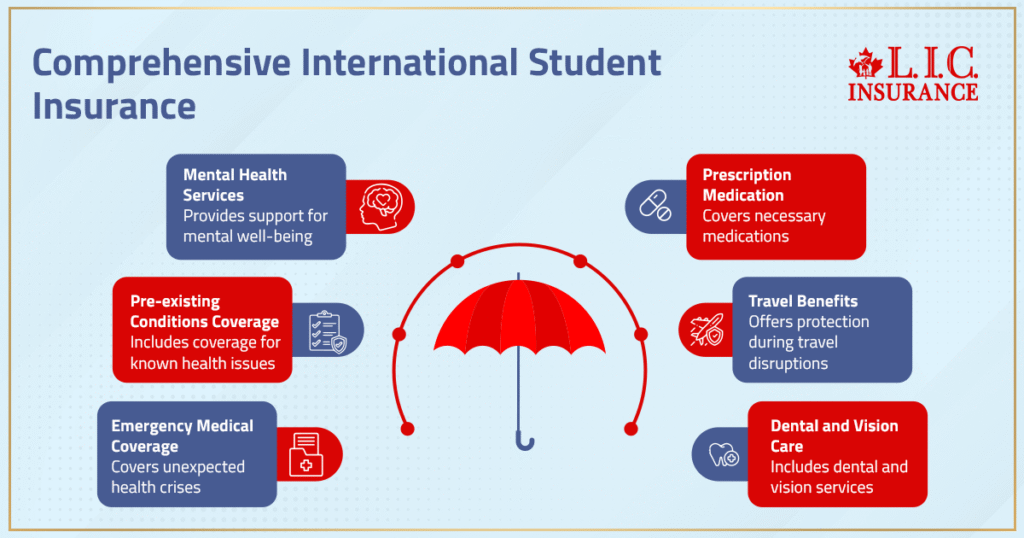

What Makes The Best International Student Insurance Plans?

The best International Student Insurance Plans don’t just cover hospital visits. They also include benefits you don’t realize you need—until you do.

- Full emergency medical coverage

- Coverage for pre-existing conditions, if declared

- Mental health and counselling services

- Prescription medication

- Travel benefits (trip interruption, lost passport, repatriation)

- Dental and vision care (in some plans)

We don’t push one-size-fits-all plans. We listen to your situation, your visa requirements, your program length, and your medical history, and then guide you toward the right protection. One that doesn’t leave you or your parents stranded.

School Plans Are Often Not Enough

We’ve reviewed dozens of college and university-provided insurance plans. Some are comprehensive, but most are not. Here’s what many school-based plans leave out:

- Limited therapist sessions

- No support for dependents

- Low annual coverage caps

- No coverage during breaks or holidays

- No emergency evacuation or return of remains

This is why we always advise students to compare their existing coverage with independent policies. You’d be surprised how much more you can get with just a few dollars more per month.

Already Abroad Without Insurance? Act Fast

If you’re already in Canada and don’t have a policy in place, don’t panic—but don’t delay either.

Many plans can be started even after arrival, although they won’t cover pre-existing conditions that appear before enrollment. That means the sooner you apply, the better.

We can help you secure a Student Insurance Plan in Canada or advise on short-term options while you explore longer-term coverage. Every day, being uninsured is a financial risk you don’t need to take.

Why Are We Different

We’re not a faceless website. We’re real advisors who’ve been helping international students and families across the world for over 14 years.

When you speak to us:

- You get advice tailored to your child’s exact school, visa status, and medical needs

- You receive a free International Student Insurance Quote with transparent comparisons

- You avoid plans that are too cheap to work or too expensive for what they offer

- You protect both your child’s health and your family’s finances

We’ve helped students avoid medical debt. We’ve prevented study permit delays. We’ve helped students complete their education, even after unexpected illnesses or accidents. And we’ll do the same for you.

Final Thoughts—This Is Too Important To Ignore

You wouldn’t send your child on a plane without a seatbelt.

You shouldn’t send them abroad without insurance.

Studying overseas is a dream built on years of sacrifice. Don’t let one medical emergency turn it into a financial nightmare.

We make this simple.

We help you compare, choose, and activate your policy—often within 24 hours.

FAQs

If your policy expires and isn’t renewed on time, you may be left without coverage until a new plan takes effect. Any medical expenses during the gap must be paid out-of-pocket. Renewing before expiry helps avoid disruptions and keeps your status compliant.

Yes, many plans allow coverage for pre-existing conditions if disclosed upfront. Some may impose waiting periods or exclusions. Always compare the best International Student Insurance Plans to find one that fits your medical history.

Some Student Insurance Plans include travel-related benefits like trip interruption, flight delays, or lost baggage. It depends on the provider and policy type. Request a detailed International Student Insurance Quote to confirm what’s included.

Top-tier plans often include emergency evacuation to your home country or a nearby facility with appropriate care. It’s a critical benefit to check for when evaluating Student Insurance Plans in Canada, especially for serious injuries or illnesses.

Basic student plans rarely include dental coverage unless it’s for emergency dental treatment. However, some premium options do offer it. Always ask for a breakdown when reviewing your International Student Insurance Quote.

Key Takeaways

- Studying abroad without insurance can result in overwhelming medical bills, visa issues, or academic disruption.

- School-issued insurance plans may not offer complete coverage for emergency care, mental health, or travel-related risks.

- A Registered Education Savings Plan helps with tuition but does not protect against unexpected healthcare costs.

- The best International Student Insurance Plans cover hospitalization, prescriptions, therapy, evacuation, and more.

- Securing a personalized International Student Insurance Quote early prevents coverage gaps and protects your status.

- Canadian LIC provides trusted guidance to compare, select, and activate the right Student Insurance Plan in Canada.

Sources and Further Reading

- Government of Canada – Studying in Canada: Health Insurance Requirements

https://www.canada.ca/en/immigration-refugees-citizenship/services/study-canada/health-insurance.html - Canadian Life and Health Insurance Association (CLHIA) – Consumer Information on Health and Travel Insurance

https://www.clhia.ca/web/CLHIA_LP4W_LND_Webstation.nsf/page/Consumer_Info_Home - Universities Canada – Information for International Students

https://www.univcan.ca/universities/facts-and-stats/international-students-in-canada/ - Canadian Bureau for International Education (CBIE) – International Student Data and Insights

https://cbie.ca/what-we-do/research/ - Ontario Ministry of Health – OHIP Eligibility for International Students

https://www.ontario.ca/page/apply-ohip - International Education Financial Aid (IEFA) – Insurance Resources for Students Studying Abroad

https://www.iefa.org/international-student-health-insurance - Alberta Health – Health Care Insurance for Temporary Residents

https://www.alberta.ca/ahcip-temporary-residents.aspx - British Columbia MSP – Coverage for International Students

https://www2.gov.bc.ca/gov/content/health/health-drug-coverage/msp/bc-residents/eligibility/international-students

Feedback Questionnaire:

We’d love to understand the challenges you or your family faced when dealing with student insurance. Your responses help us serve international students better and provide the support you truly need.

Thank you for sharing your experience. A licensed advisor may follow up to help you or someone you care about stay fully protected while studying abroad.

IN THIS ARTICLE

- What Happens If You Don't Have Student Insurance Abroad?

- The Hidden Costs Of Studying Abroad Without Insurance

- Real Cases We’ve Helped Resolve

- The Misconception About Registered Education Savings Plans

- The Visa Risks Of Having No Student Insurance

- What Makes The Best International Student Insurance Plans?

- School Plans Are Often Not Enough

- Already Abroad Without Insurance? Act Fast

- Why Are We Different

- Final Thoughts—This Is Too Important To Ignore

Sign-in to CanadianLIC

Verify OTP