- What happens if I never claim my Critical Illness Insurance?

- Understanding Your Critical Illness Insurance Policy

- Premiums: A Waste or a Worthy Safety Net?

- The Role of Insurance: Security in Uncertainty

- Benefits Beyond Claims: The Hidden Advantages of Critical Illness Insurance

- Wrapping Everything Up

You pay for Critical Illness Insurance year after year, hoping never to use it. As you approach retirement, you wonder, what would happen if I never made a claim on my Critical Illness Insurance in Canada? This is a common question asked by many of our clients. They come to us feeling uncertain about the value of their ongoing premiums if they remain healthy. Today, we’ll get into what happens if you never claim your Critical Illness Insurance and why you should keep your policy even if you’re lucky enough never to use it.

Understanding Your Critical Illness Insurance Policy

In its essence, a Critical Illness Insurance Policy in Canada is protection. It’s meant to put less pressure on one’s wallet by issuing a lump sum if you have been diagnosed with a covered critical illness under your policy. Stories of our clients at Canadian LIC who have received a diagnosis out of nowhere and are so grateful for the support that a policy can provide are not uncommon. But what if that day never comes?

First, let us define what “never making a claim” means. This occurs when you stay well throughout the term of your policy and do not suffer from any of the covered critical illnesses under your contract. While this is undeniably the best-case scenario, it does leave some policyholders with the feeling that their investment in premiums might go to waste.

Premiums: A Waste or a Worthy Safety Net?

Paying for Critical Illness Insurance Coverage can sometimes feel like money down the drain—especially if you’re like Ram, an old client with Canadian LIC who, in the past 15 years since he signed up, has never had to make a critical illness claim. Every year, Ram gets online to compare Critical Illness Insurance Quotes and reassess if his continued investment in his policy is justified. His good health all this time is something to be grateful for, but it really does question his mind when he looks back upon the premium paid all these years. Let us understand why these are not costs or expenses but necessary investments in your future security.

Understanding the True Value of Insurance

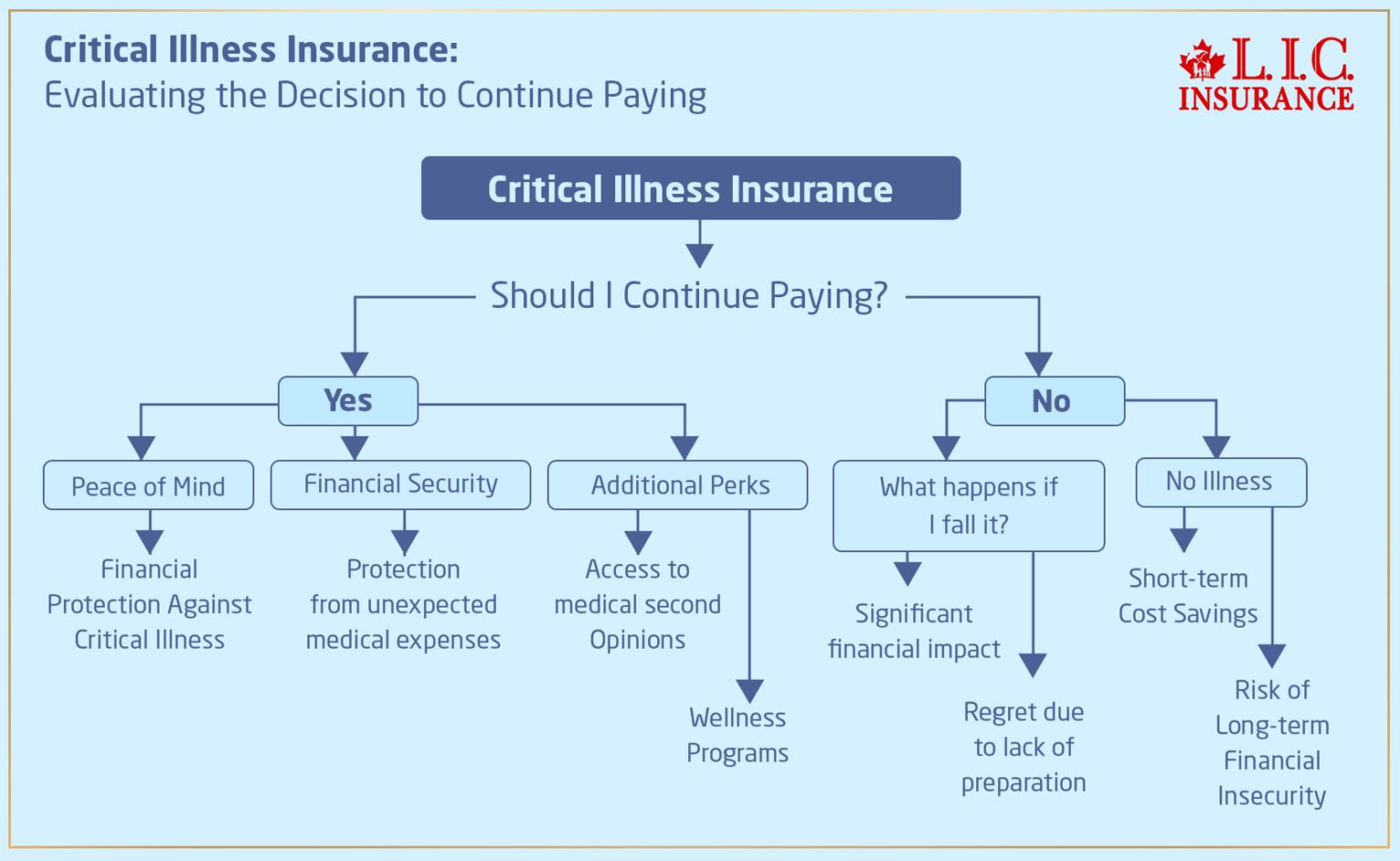

Insurance as Peace of Mind: Think of your Critical Illness Insurance Policy in Canada not just as a financial tool but as emotional and psychological protection. You insure your car and your home not because you expect them to be damaged but because the peace of mind it offers is priceless. Similarly, while you may never claim your Critical Illness Insurance, the reassurance it provides—that you and your family will be secure in the face of life-altering illnesses—is invaluable.

The Cost of Complacency

The Price of Being Unprepared: Consider the story of Meena, another Canadian LIC client, who opted out of Critical Illness Insurance because she felt it was an unnecessary expense. Unfortunately, she was later diagnosed with an illness covered by such Critical Illness Policies. The financial impact was significant, forcing her to reconsider the earlier decision to save on premiums. This scenario is precisely what Critical Illness Insurance aims to prevent, ensuring you aren’t caught off-guard by unexpected medical expenses.

Comparing Costs and Benefits

Long-term vs. Short-term Financial Planning: When reviewing Critical Illness Insurance Quotes Online, it’s crucial to think long-term. The premiums you pay now can safeguard against potential financial disasters that could otherwise deplete your savings or retirement funds. It’s not just about the money you spend but about the money you save in scenarios where the Critical Illness Plan becomes necessary.

Leveraging Insurance for Comprehensive Health Planning

An Integrated Approach to Health Security: Your Critical Illness Insurance Policy is a component of a broader health and wellness strategy. It complements your health insurance by covering costs that traditional plans might not, such as travel for treatment, specialized medications, and non-medical expenses that accrue during recovery periods. This coverage ensures that a medical diagnosis does not derail your financial stability.

The Benefit of Added Features

Additional Perks and Supports: Many critical illness plans in Canada come with extras that policyholders can benefit from even without making a claim. These might include access to medical second opinions, health monitoring services, or wellness programs. These features enhance the value of your insurance, contributing to your overall well-being.

Return of Premium Options

Getting Your Money Back: Some policies offer a return of premium feature, either upon the policy’s expiration or the policyholder’s death. This means that all the premiums paid (minus any claims) can be returned to you or your estate. This transforms your premiums into a savings plan, where either your health wins or your wallet does.

So, when the time comes that you feel like you are just being taken for granted with your Critical Illness Insurance premium, consider Ram and Meena’s stories. Ram sleeps better, knowing that with his good health, he has financial protection from a debilitating illness. On the other side of the coin is the story of Meena, which shows what a lack of preparation can cost. At Canadian LIC, we see these stories unfold every day, reinforcing the value of maintaining your Critical Illness Insurance Policy. Please do not wait until you need the safety net to appreciate its worth. Reach out to the Canadian LIC today for a policy that has security and peace of mind, knowing that you are covered no matter what.

The Role of Insurance: Security in Uncertainty

Insurance is a product protecting from uncertainty. When clients do come to us with apprehension about carrying on their Critical Illness Insurance in Canada, purchased but not yet used, we like to share some life-altering stories. These stories will serve more than just illustrate the palpable benefits of carrying on with insurance coverage; they give a reassurance value to our clients. Here are a few insights illustrating why Critical Illness Insurance isn’t just a Plan B—it’s really how you plan ahead for life’s unpredictabilities.

An Anchor in Stormy Seas:

Anita has seen how Critical Illness Insurance helps close friends when things get tough. She hasn’t had to file a claim yet; however, having that safety net in place for her personally gives her peace of mind and the ability to focus on other areas of life without constant worry. This peace of mind is invaluable, especially if medical issues can be so unpredictable and change financial stability into chaos in an instant. She is a living example of the protective umbrella that every Critical Illness Insurance Policy in Canada has.

Financial Flexibility in Times of Need:

David is another valued client at Canadian LIC who found solace in his Critical Illness Insurance when he learned of his sister’s serious illness diagnosis. While he himself wasn’t the one with the serious illness, watching the relief such a policy gave her during her recovery was enough motivation to continue his policy. This coverage ensured she could afford the best care without draining her savings, highlighting the policy’s role in preserving not just health but financial autonomy.

Transforming Insurance from Cost to Investment:

Of course, many clients first look at the premium as an ongoing expense that yields no immediate return. Our advice to our clients is to consider online quotes of Critical Illness Insurance as an investment for security in the future. It is the equivalent of investing in a life jacket: you hope that you will never need it, but when the moment comes, you can’t assign value to it—describing it as an investment moves the perception from a grudge purchase to a strategic part of a financial plan.

Enhancing Estate Planning:

When discussing estate planning, Emily learned how her Critical Illness Insurance Policy in Canada could play a crucial role. Not only does it provide for direct health-related needs, but in cases where the policy includes a return of premium on death, it also contributes to the legacy she wishes to leave her family. This dual purpose truly underlines insurance as a future planning tool, ensuring that no matter what happens with respect to health, the family will benefit.

Empowering Through Education:

We regularly organize workshops to help our clients understand the features and benefits that accrue from different policies. We essentially take our clients through what Critical Illness Insurance Coverage really means and what it entails, together with the benefits attached. Such sessions have been imperative for clients like Anita and David to learn about the details of their policies and, more importantly, the broader implications of the insurance choices they make.

Building a Community of Support:

We believe in a supportive community where customers can make contributions regarding their experience and insight into living with Critical Illness Insurance. It is the community approach that can help demystify the process, showing prospective and existing policyholders how Critical Illness Insurance work in real life to bring the value of their investment into clearer focus.

Benefits Beyond Claims: The Hidden Advantages of Critical Illness Insurance

When one considers Critical Illness Insurance Coverage, the very first thing that probably comes to mind is the financial support one receives upon being diagnosed with a serious illness. However, there are more benefits to having a Critical Illness Insurance Policy in Canada than the immediate real monetary relief brought about by claiming a policy payout. Listed here are some of the lesser-known benefits of your policy, proving that its value does not end there, even if you do not make a claim.

Access to Counseling and Support Services

Most Critical Illness Insurance will have access to specialized psychosocial counselling and psychological support services. Their benefits are specially designed to help you, together with your loved ones, cope with the most challenging of times, either under claim or not.

Take the example of Sheeba, one of our clients whose spouse was diagnosed with a dreadful disease. Though it was not her who was an insured person, she availed of the free counselling that the policy offered when her loved one was undergoing treatment. So, this feature of their Critical Illness Insurance offered them comfort and a guiding light, further adding to the value of the policy, which is already designed to do more than just help a family financially.

Preventive Health Services

Some even provide preventive health services, including health screenings and medical check-ups, which are very instrumental in early disease detection and prevention.

Michael, another valued customer, learned through a health screening covered under his Critical Illness Policy that he was at risk for a condition covered under his Critical Illness Insurance. Because it was early detection, he could seek preventive care that may avoid a much more serious health issue later. This proactive benefit helped Michael appreciate the broader protective umbrella his insurance provided.

Return of Premium Options

Return-of-premium options are especially attractive features of some Critical Illness Insurance policies. In case you never file a claim, some or all of the premiums paid can be returned, or it can be returned upon maturity of the policy to the policyholder or his beneficiaries. This provision works much like any other forced savings scheme, assuring that if your health investment goes unused, it will not be a pure loss.

Take the case of Linda: She has been paying for her Critical Illness Insurance for 20 years and has never made a claim. Now that the policy’s term is up, she gets back a nice fat sum, which she will use to fund her retirement travels. This return of premium changed what had been, up until then, ‘unused’ insurance into a very profitable long-term investment.

Waiver of Premium Benefits

Some policies have included, in the case of diagnosis of a critical illness, a waiver-of-premium benefit that holds back an individual’s obligation to pay further premiums while ill. This means you are able to focus all your energy on recovery and not worry about ongoing insurance costs.

When Jaideep was diagnosed with a covered illness, his Critical Illness Insurance Policy came into play—not only with a lump sum payout but also by waiving his future premiums. This certainly provided relief for him, allowing him to focus on recovery without the stress of financial burdens.

Peace of Mind

This is, at the last count, another of the biggest advantages of having Critical Illness Insurance Coverage: it gives peace of mind. The knowledge that you and your family are financially protected against life’s uncertainties can be a huge psychological comfort.

Eera, who thankfully has remained healthy, often shares how her Critical Illness Insurance gives her a sense of security, allowing her to enjoy her daily life with one less worry. Her policy acts as a safety net, ensuring that she can face the future with confidence.

It’s more than just preparing for the worst—your Critical Illness Insurance actively enhances your quality of life and well-being, even if you never make a claim. Canadian LIC knows each feature of your Critical Illness Insurance Policy serves some purpose. Every benefit, whether it is financial support, peace of mind, or health services, underscores our commitment to your health and happiness.

Equally important to the comparison of online Critical Illness Insurance Quotes is the hidden benefits when you choose between options. Your policy is invested in your future; make sure it is with a brokerage that truly cares about your well-being. Connect with Canadian LIC today at +1 416 543 9000 to find out more about how we can help protect what matters most to you.

Long-Term Policy Psychology: How Return of Premium Shapes Behaviour and Decision-Making

One of the lesser-discussed aspects of critical illness insurance return of premium options in Canada is their psychological impact on long-term policyholder behaviour. At Canadian LIC, we’ve observed a unique pattern among clients who opt for return of premium riders: they’re more likely to maintain their policies for the full term and perceive their insurance as an asset, not an expense.

Here’s why that matters.

Many individuals cancel their critical illness insurance mid-way, especially if they remain healthy for several years. This is often rooted in a perception that premiums are being “lost.” However, clients who choose the return of premium feature are more committed, knowing that even if they never claim, their investment isn’t wasted. This mindset transforms insurance into a hybrid product—part protection, part financial planning tool. It helps clients stay consistent with their long-term coverage, which statistically increases the chances of receiving the policy’s full value either through a claim or a premium return.

Moreover, this shift in perception changes how families talk about insurance. It becomes part of legacy planning, not just risk mitigation. This behaviour-based insight, rooted in real policyholder interactions, is a powerful indicator that insurance, when structured correctly, has benefits far beyond monetary payouts.

Using Critical Illness Insurance as a Bridge to Self-Insurance in Retirement

A powerful but underutilized strategy among financially disciplined Canadians is using critical illness insurance return of premium options as a bridge to eventual self-insurance. This approach is best suited for those with strong long-term savings habits, yet who recognize the financial shock a critical illness can still cause during their working years or early retirement.

Here’s the core idea: Many clients don’t plan to carry insurance coverage forever. Their goal is to build enough assets over time to “self-insure” against large health-related expenses. However, this takes decades—and that’s where critical illness insurance steps in as a safeguard. With a return of premium rider, the policy acts as temporary protection and future capital. If no claim is made, the refunded premiums can become part of the client’s retirement nest egg.

This turns critical illness insurance from a “just-in-case” expense into a “wealth recycling mechanism.” You’re not giving up on protection as you age—you’re transitioning smartly toward financial independence, with premiums that come back to you if unused.

This hybrid purpose of risk protection and capital recovery sets policies with return of premium apart as a key financial planning bridge—an insight often missed in conventional insurance discussions.

Wrapping Everything Up

So, what happens if you never make a claim on your Critical Illness Insurance? In essence, you’ve purchased peace of mind, a financial safety net that has stood guard over your most valuable asset—your health. At Canadian LIC, we want you to consider not looking at your Critical Illness Insurance as something that may end up being a regret but rather as one of the cornerstones of prudent financial planning.

If you have been putting off purchasing Critical Illness Insurance Coverage, remember that the best time to insure against the unknown is when the unexpected seems least likely. Please do not wait until you need the coverage to realize its value. Contact Canadian LIC today to get your Critical Illness Insurance Quotes Online and secure a policy that is with you through thick and thin, rain or shine. It doesn’t stop at insurance; it’s about planning for life’s twists and turns with the best in the business

More on Critical Illness Insurance

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions About Critical Illness Insurance

Critical Illness Insurance provides for the payment of a lump sum upon diagnosis of any of the illnesses specified in your policy. This type of coverage goes a step higher to protect you by offering financial support during your recovery so you can focus on your health and not worry about the financial burdens.

Jennifer, a client of Canadian LIC, used her critical illness payout to cover her living expenses when she could not work, which really proves that this insurance acts like a financial lifeline in times of distress.

Just log on to the Canadian LIC website to get Critical Illness Insurance Quotes Online. You will be guided through easy steps to fill in personal details and health information to customize quotes for your needs.

The process was quite simple for Mohan when he set out to compare various plans. He liked the transparency and ease of access, which allowed him to make an informed decision from the comfort of his home.

Consider the range of illnesses covered, the lump-sum payment amount, and any other value-added benefits like the return of premiums or counselling services that come with any chosen Critical Illness Insurance Policy. In addition, the reputation and customer service of the insurer should also be taken into consideration.

When Sana was shopping for her policy, she focused on finding comprehensive coverage with a reputable provider. Our client-first approach and extensive support services reinforced her decision to choose Canadian LIC.

Yes, you can usually add more coverage to your existing policy.. This may require reassessing your health status and adjusting the premium that you pay. Contact your insurer to discuss your options.

After one of his family members was diagnosed with a serious illness, Alex really knew he needed more protection last year. He easily readjusted his policy with Canadian LIC to protect his future.

If you outlive your policy without making a Critical Illness Insurance claim, you could be due for a return of premium, depending on your policy terms. In effect, it would allow one to get back the premiums paid in, less some admin charges.

Emily chose a return-of-premium policy. She considers her premiums not just an expense to purchase the coverage but also an investment in the future that may well be returned to her if she doesn’t have claims.

Any lump sum payment under a Critical Illness Insurance Policy is normally tax-free, although the premiums you pay are not tax-deductible. You should always consult with a tax advisor to understand your case’s implications.

For Robert, who recently paid out, the knowledge that every cent he had received was tax-free maximized the financial benefit he received during his recovery.

Usually, a Critical Illness Insurance Policy will pay out shortly after the claim has been agreed to—typically within 30 days. It helps ensure that you will not have to be worried about money, only recovery.

When Tom, one of our loyal customers from Canada, submitted his claim following a critical diagnosis, he was really impressed with the speed at which the funds were returned to him, as he helped in managing expenses associated with treatment and thus ensured the maintenance of the quality of life.

Renewing a Critical Illness Insurance Policy would entail reviewing your coverage needs and updating your personal information, perhaps. It provides an excellent opportunity to re-evaluate your policy’s terms and adjust accordingly as issues around you change.

The renewal process was quite smooth and was an eye-opener for Nancy, who had been with the Canadian LIC for several years. This helped her increase her coverage because of her increasing family and financial responsibilities.

Yes, you can get Critical Illness Insurance even for pre-existing health conditions. However, the exact terms and the premium rates may vary. Insurers may want a thorough medical evaluation or attach specific exclusions based on your medical history.

Dave was afraid that with his previous heart issues, he would not be able to obtain any type of coverage at all. After speaking with Canadian LIC and going through his case, though, he could get instant Critical Illness Insurance Quotes Online tailored to his requirements and get coverage that came with modified terms.

Comparing Critical Illness Insurance Quotes Online requires one to look at not just the premiums but also the scope of coverage, the list of covered conditions, the exclusions, and additional features such as the return of premiums or counselling services.

Lisa did her research by using the comparison tools on the Canadian LIC website to compare policies. She picked one which had comprehensive coverage at a reasonable rate and thus proved that the art of comparing options is a way to ensure getting the best policy.

One of the most common misbeliefs is that if a person has Health Insurance or Disability Insurance, then there is no need for Critical Illness Insurance. However, the fact is that Critical Illness Insurance supplements such policies for the costs that are further acquired, which might not be covered under normal Health Policy or Disability Policy, such as travelling to get the treatment or the cost incurred on developing your abode into a more comfortable stay.

Many clients, like Greg, hadn’t seen the need for more insurance in the beginning. After attending a workshop by Canadian LIC, he realized how critical illness coverage could fill gaps his other insurance didn’t cover, so he moved to secure a policy that would enhance his overall protection.

If you want to cancel the Critical Illness Insurance Policy, please inform your insurer to discuss the procedure and any possible implications that may arise, like losing premiums paid. It would be best if you talked to a financial advisor to make sure that this decision is aligned with your long-term financial plans.

When money became tight, Emma thought of cancelling her policy. After consulting with Canadian LIC, she decided it was better to reduce her policy features so that at least some level of coverage would be preserved while her premiums would be reduced.

Your questions are valuable to us here at Canadian LIC, and our effort is to make sure you get all the details you need to make your decisions regarding Critical Illness Insurance policies in Canada well-informed. Every client story shared is a testament to the practical benefits and peace that come with purchasing a Critical Illness Insurance Policy. No matter whether we buy a new policy or enhance the same, we are here to help at each level. Feel free to reach out to any of us for personalized recommendations and considerations as per your special needs.

Sources and Further Reading

- Canadian Life and Health Insurance Association (CLHIA) – Provides comprehensive guidelines and information on different types of insurance available in Canada, including Critical Illness Insurance.

- Website: CLHIA

- Insurance & Investment Journal – Articles and updates on Critical Illness Insurance products and industry trends in Canada.

- Website: Insurance & Investment Journal

- Financial Consumer Agency of Canada (FCAC) – Offers information on insurance products, consumer rights, and financial planning tools.

- Website: FCAC

- Canadian Insurance Top Broker – An online resource that provides news, insights, and advice on insurance policies, including Critical Illness Insurance.

- Website: Canadian Insurance Top Broker

These resources offer additional details and broader perspectives on Critical Illness Insurance, helping you make informed decisions and stay updated on industry standards and innovations.

Key Takeaways

- Unused benefits of Critical Illness Insurance include peace of mind, preventive health services, and counseling access.

- Critical Illness Insurance acts as a financial safety net and may return premiums if no claim is made.

- Real-life stories from Canadian LIC clients illustrate the practical value of Critical Illness Insurance.

- It’s crucial to understand all aspects of your Critical Illness Insurance Policy, including additional benefits.

- Readers are encouraged to actively engage with their insurance choices and reassess coverage as needed.

Your Feedback Is Very Important To Us

This questionnaire aims to gather insights into the concerns and perceptions of Canadians regarding their Critical Illness Insurance policies, particularly focusing on scenarios where the policy is never claimed.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com