- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

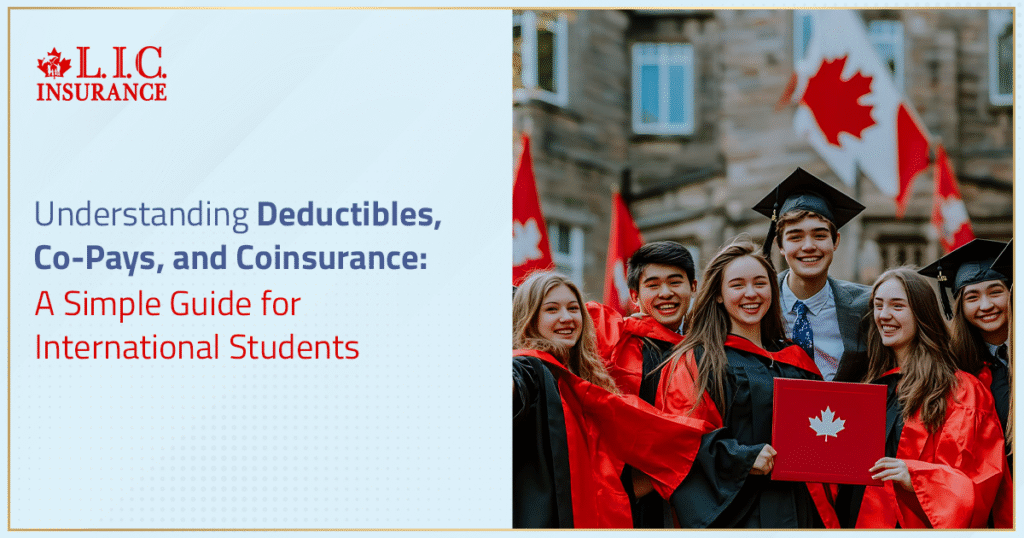

Understanding Deductibles, Co-Pays, And Coinsurance: A Simple Guide For International Students

By Harpreet Puri

CEO & Founder

- 10 min read

- July 24th, 2025

SUMMARY

International students often face confusion around health insurance terms like deductibles, co-pays, and coinsurance. The content explains how International Student Insurance Plans work, what to expect from an International Student Insurance Quote, and how to avoid surprise medical expenses. It also highlights how Canadian LIC supports students in choosing the right International Student Health Insurance and managing healthcare costs effectively.

Introduction

She had no clue what to say. The nurse at the desk repeated the number. $245. For a quick visit. Just a sore throat. Just a basic check.

And the girl simply… stood there.” Eyes wide. Shoulders tight. Her insurance card was already in the nurse’s hand. But now she was fumbling with her phone again, trying to call someone back home.

She wasn’t the first. Won’t be the last either.

We’ve seen it too many times. At Canadian LIC, those students arrive at our doors more afraid of medical bills than disease. And not because they were uninsured. But this was only because they didn’t understand it.

What’s a deductible? What’s a co-pay? What is coinsurance even for? And why didn’t somebody tell me that before I made the first doctor visit?

For more than 14 years, Harpreet Puri has assisted international students in managing it. He has been on the late-night panic calls. He has assisted students who had been two months into their program before they learned they did not actually have adequate insurance.

You think it never will. Then it does. And all it takes is one night when you need medical care, and suddenly your “covered services” have secret stipulations. Fine print. Percentages. Unexpected charges.

You’re in Canada to study, not to get lost in a labyrinth of health insurance terms you didn’t even know existed. So let’s walk through it. Just as we do for every student who looks up at us across the desk, confused, stressed, and uncertain, they are going to be all right.

Health Insurance In Canada: The Missing Chapter In Every Student's Welcome Package

Nobody tells you how fast things get real.

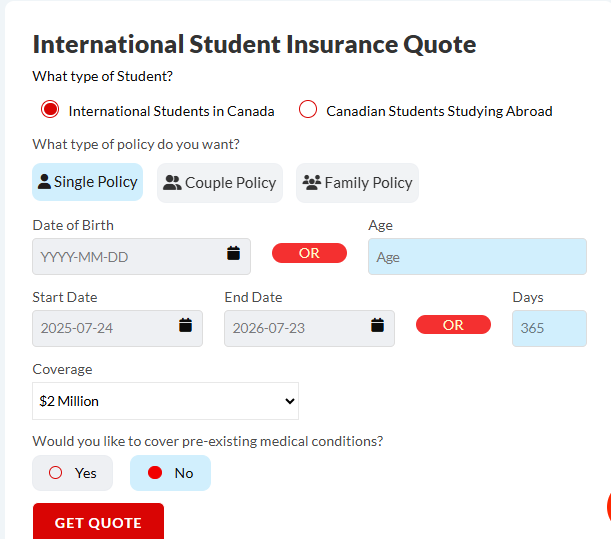

You arrive. Settle in. Sign up for classes. Maybe find a part-time job. You hear something about needing insurance, so you click, compare a few International Student Insurance Quotes, and pick what looks cheapest.

And that’s it. You assume you’re covered.

Until one evening, you feel dizzy. Or someone in your dorm cuts their hand on a broken glass and needs stitches. The hospital asks for a credit card. You say, “But I have insurance.” They say, “That doesn’t matter until your deductible is paid.”

That’s the moment it clicks. You weren’t ready for this part.

We’ve helped students through all of it. The confused calls. The panic after a denied claim. The worry about how to pay rent and a medical bill in the same month. All of it.

Some plans come with higher premiums but cover more. Others look affordable—but they hide a higher deductible or don’t explain what your co-insurance share will be.

It’s not fair. It’s not clear. And it’s definitely not simple.

But we’re going to make it make sense.

Deductible. What Do You Pay First? Even If It's An Emergency.

Forget what the websites say.

A deductible isn’t just a number. It’s a barrier. One that stands between you and your coverage.

Let’s say your annual deductible is $500. That means, before your insurance company pays anything, you need to pay $500 out of your own money. Doesn’t matter if it’s urgent. Doesn’t matter if it’s your first visit.

And yes, most students don’t know that when they sign up.

One guy from Nigeria—we’ll call him O—called us after getting charged full price at the ER. His health insurance plan? Looked great on paper. But that $700 deductible? No one explained it. And he didn’t read the part buried on page six of his insurance policy.

He thought his coverage had failed him. It hadn’t. But the way it was explained definitely did.

We walked him through it, helped him file paperwork, and made sure the rest of his year was better protected.

But that first shock? He’ll never forget it.

Co-Pays. The Fixed Amounts That Quietly Drain Your Wallet

You feel fine. Not amazing. But not sick enough for a full emergency room trip. So, you go to a walk-in clinic. Maybe just for a cough that won’t go away.

The receptionist says, “That’ll be $35.”

You blink. You already pay monthly premiums. You thought your insurance would take care of this.

But that co-pay? It’s not optional. It’s a fixed amount—you must pay it every time you access covered services like doctor visits, prescriptions, or urgent care.

And it adds up. Quietly. $35 here. $40 there. Before you know it, you’ve spent more than your textbook budget for the term.

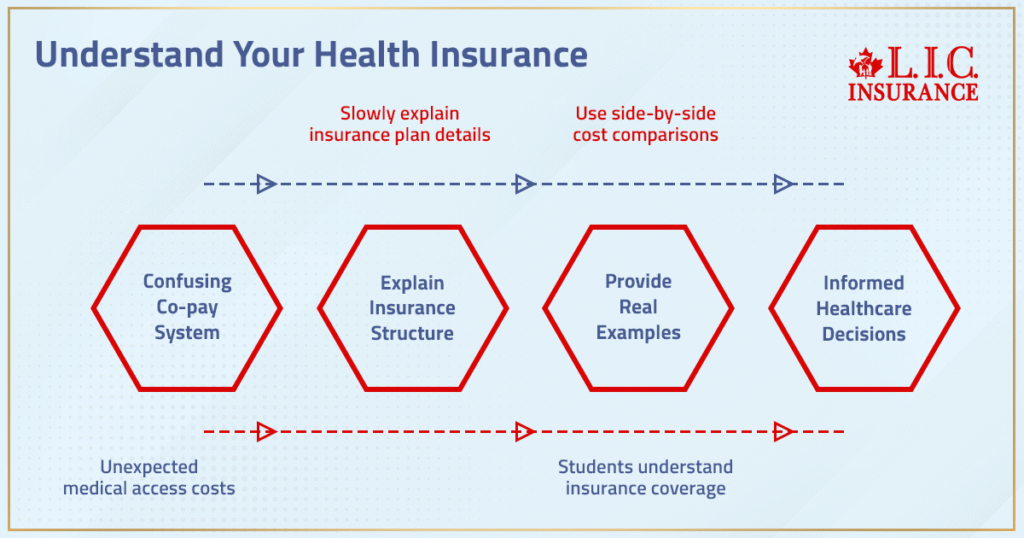

We met a student from Dhaka once who went in for counselling support. He didn’t realize his plan had a higher copay for mental health services. And no one told him that upfront. The guy skipped his next three sessions just to afford food for the week. That’s not how this should work.

If you don’t understand your health insurance provider’s structure—if you don’t read how your co pay works—you end up avoiding medical services when you need them most. That’s where the system fails you.

We don’t want that for you. Ever.

When we walk students through their International Student Insurance Plans, we explain this part slowly. With real examples. With side-by-side numbers. Because your health is not something you should gamble with.

Coinsurance: The Percentage Nobody Tells You About

This one gets almost everyone.

You’ve paid your deductible. You’ve already handed over co-pays. So your coverage should be the rest of it, right?

Not exactly.

Here’s where coinsurance comes in. You share costs with your insurer, however, even once you reach your deductible. That’s coinsurance.

Imagine if you had a $1,000 note. Your coinsurance is 20%. You still owe $200 even after everything else.

And the worst part? You find out only when the bill arrives. Last winter, it put us in touch with a student from Brazil. For an injured ankle, she would have to go back to a doctor. Her scam covered part of the medical expenses. But the rest? 25% coinsurance. And it was hidden in the verbiage of her plan. Right under the part nobody ever reads.

She was angry. And scared. And confused. She didn’t even know she’d signed up for it. That’s just how insurance companies organize these things, the point is. It’s legal. It’s normal. But it’s not clear. Certainly not to someone who’s recently arrived and still hasn’t quite figured out what “coinsurance” means.

Once you have paid the deductible, coinsurance applies. And it can escalate from there, especially in cases of hospitalization, ongoing care (or anything that will cost even more than it takes for a single visit to a clinic).

And here is what we say to every student: Always ask what your coinsurance is. Don’t guess. Don’t assume it’s zero.

We’ve seen students pay 10%. Some pay 30%. It makes a huge difference.

Deductibles vs. Co-Pays vs. Coinsurance

| Feature | Deductible | Co-Pay | Coinsurance |

|---|---|---|---|

| What it is | The amount you must pay first before your insurance starts covering costs. | A fixed fee you pay every time you access a covered service. | A percentage of the cost you share with your insurer after deductible. |

| When it applies | Typically, once per year, it resets annually (e.g., every January). | Every visit or service, like a clinic or prescription. | After your deductible is met, for most medical services. |

| Example from student life | You pay the first $500 of medical bills before insurance helps. | You pay $25 every time you see a doctor. | Insurance covers 80%, you pay 20% of a $1,000 bill = $200 out of pocket. |

| Common confusion point | Students think coverage starts right away—it doesn’t. | Costs seem small but add up quickly over time. | Students don’t realize it’s ongoing—even after deductible is paid. |

| Why it matters | Impacts how much you pay upfront in an emergency. | Affects day-to-day access to care, like walk-ins or prescriptions. | Determines your share of big bills like ER visits or hospital stays. |

| How to prepare | Know the amount and budget for it each calendar year. | Check each service’s copay rules before appointments. | Ask your provider for the exact percentage you’re responsible for. |

What Students Really Need: A Plan That Actually Fits

There’s no such thing as “one-size-fits-all” insurance for international students.

Some barely need care. Others have chronic conditions. Some come with meds from back home, unsure if they’ll be covered here. And many—far too many—just go for the cheapest option.

We get it. Budgets are tight. School is expensive. Rent is worse.

But this isn’t the area to guess. A low monthly premium might mean a higher deductible, higher coinsurance, or stricter limits on covered services. You save now. But you pay more later.

We sit down with students and ask the hard questions.

“How often do you usually need care?”

“Can your family support a $500 emergency expense?”

“Would you rather pay more monthly or risk paying more all at once?”

The answers vary. But the relief when someone finally explains it all? That never changes.

At Canadian LIC, we help you compare real International Student Health Insurance Quotes side by side. We decode the fine print. We call the insurance providers on your behalf. We make sure the insurance plan you pick won’t fail you when you need it most.

That’s the point, isn’t it? Knowing someone’s got your back.

Managing Costs Before They Spiral Out Of Control

By the time most students realize they’re overpaying, it’s too late.

We have worked with students who never knew they were offered a lower premium, because their insurance plan had so many strings attached — a higher deductible, high coinsurance, and an extensive list of in-network clinic requirements. And what, every time they did see a doctor outside that network? Surprise charges.

What’s wise isn’t necessarily the least expensive plan. It’s the one that’s honest about what you’ll have to pay out of pocket, which services are completely covered, and when you’ll cross your out-of-pocket maximum — if your plan even has one.

We had this guy from Dubai who came to us after being billed $1,200 for a procedure. His insurer said it was not a “covered service.” But there was no list. No document. Nothing that said it would not be part of the plan. It just wasn’t.

We intervened. Called the provider. I spent hours fighting for him. Ultimately assisted in recovering approximately 60% of medical expenses. But that other 40%? It stuck. And it shook him.

“Don’t matter to me if I pay $20 more a month. I just don’t want that surprise ever again.”

And that’s the crux of it. Control expenses before the bills come. Understand what you’re paying for. What’s covered? What’s not? And how much you might still owe, even with insurance.

Because being sick when you’re in a new country… is never fun… and neither is being broke.

How To Avoid Insurance Surprises — For Good

There are things you can do. Small steps. Big difference.

- Read everything. Especially the ugly parts — the fine print, the exclusions, the section about when coinsurance kicks in.

- Call the insurance company. Ask dumb questions. The "how much will I really pay?" type. You're not being annoying. You're being smart.

- Know your deductible. Write it down. Set a reminder. Know if it resets each calendar year or academic term. Some students forget and get charged again in January, even though they paid last September.

- Double check co-pays. Every clinic visit? Every prescription? You should know what that fixed amount is.

- Save receipts. All of them. Some insurance providers ask for proof to reimburse. If you don't have it? You don't get the money back.

- Ask about networks. Some insurance companies only cover certain clinics or hospitals. Others might give partial coverage outside the network. Know before you go.

- Never assume full coverage. Always check if something's a covered service. Don't wait until after treatment.

Too many students skip these steps. Then get hit with bills they can’t pay. Or worse, stop seeking medical care because they’re scared of the cost.

You deserve better. And with the right support, you can get it.

How Canadian Lic Makes It Easier For International Students

We’re not just selling insurance plans. That’s never been the point.

What do we really do? We listen. We explain. We’re there for you when things go wrong.

We’ve had students who were alone in this country, no parents to call, no Plan B. They simply required someone who could read their insurance contract, put it into plain English, and say, “Here’s what this really means for you.”

We help fit you with the appropriate International Student Insurance plan specifically for you, based on your real needs. Not what sounds good on a brochure. Not what a comparison site decides to push to the top of the page.

We assist you in making your budget match your risk. We describe the difference between higher premiums and lower deductibles. We walk through coinsurance if we have to go line by line. And when things go wrong? We fight for you.

Cause you are worth more than just a number. You won’t believe the difference in buying something from a company that actually gives a rip what happens after you click “buy.”

That, after all, is why Harpreet and the others began doing this work in the first place. It was never just insurance. It was always how it protects those people.

Final Thoughts: Your Health Isn't A Risk You Can Afford To Guess On

You didn’t hustle halfway across the world just to wrestle with fine print.

You came here for something larger — for education, for opportunity, for a future. And yes, insurance for international students is part of that narrative. Quietly. In the background. But when it lets you down, it is the entire story all of a sudden.

Don’t let confusion or crummy plans leave you in a lurch.

Know your deductible. Know your co-pay. Be aware of when coinsurance kicks in, or what your percentage is. And if you’re not sure?

At Canadian LIC, we’ll demystify all of it for you. With heart. With patience. With answers that aren’t open to interpretation.

FAQs — Straight Talk for International Students

Yes. The January 1st start date applies for all of these and for most plans students return to, regardless of what time in the school year you need it. So even if you maxed out in December, it begins again in January. It’s cold timing, especially for winter semesters. We always caution students about that so they don’t schedule care too close to year-end without any sense of what comes next.”

In some cases, yes. But it’s tricky. Some insurers do permit mid-term changes, but only in certain circumstances, such as losing other coverage or experiencing a life-altering event. You can’t usually jump ship just because you’re unhappy. That and “read everything, compare everything” — monthly premiums, coverage, limits — before signing anything, she said. Switching later can be costly or put you at risk of a gap.

You’ll probably pay more. Maybe a lot more. You also have some insurance companies that won’t pay them anything if it’s not in their provider network. Others only give partial coverage. A few require pre-approval. “One kid we helped wound up spending $380 in cash for a five-minute walk-in appointment just because his clinic was off the list for his plan. Always check with your health insurance company to ensure that an HAE CENTERS provider is considered in network, because assumptions should never be made.

Often, yes. Some plans impose higher coinsurance for certain services — like an ambulance ride or a hospital stay — even after the deductible is reached. Others waive coinsurance completely for life-threatening emergencies, and then charge a bigger percentage for continuing care thereafter. It all depends on one’s insurance policy. We have had students get hit with surprise percentages that have been granted after recovery, not during the emergency, but after the follow-ups began.”

Start by reviewing your habits. If you seldom see doctors and have no health conditions, you might get by with a plan that has a higher deductible and lower premiums. But don’t guess. Some do predict that they’ll remain healthy, and then are slammed by the flu. At Canadian LIC, we assist students in finding that perfect middle – overseas student insurance plans that provide you with what you need and not leave you paying thousands of dollars unnecessarily. Instead of focusing just on the price, we’re trying to get at how much you can actually afford if something goes wrong.

Usually no. That is the whole idea of the maximum out-of-pocket limit: You hit it, and then the insurance starts covering 100 percent of covered services. But there’s a catch: Not all insurance plans have a cap. And not all services are included in it. If your plan specifies no maximum or excludes certain treatments from the tally, you could be on the hook for a tiny share even after many months of expenses. We help students sort this out before they’re enrolled, not after the bills arrive.

No. In most cases, you’ll be sold special insurance for international students, which is not the same as public health insurance, such as OHIP (Ontario) or MSP (British Columbia). Such plans that focus on students may include restrictions on certain types of medical services or prohibit access to public hospitals. Some don’t include dental, vision, or pre-existing conditions, unless they are added on separately. That’s why it’s important to run International Student Insurance Quotes by someone who can tell you what they include — and maybe more importantly — what they’re leaving out.

You don’t—unless you ask. Far too many students are taking for granted that counseling or therapy is covered, only to find out later that their insurance carrier excluded it or tacked on a prohibitive co-pay. One client we helped had to spend 60% of her therapy costs out of pocket because coinsurance applied only to “physical” care. If your plan doesn’t discuss mental health, don’t assume — you’re likely not covered.

Possibly. Most insurance companies will take claims 60 to 90 days — or more. But receipts, paperwork, perhaps even medical records, are required. We assisted a student from Kenya to recover over $700 for X-rays after they never knew the test was a covered service. It was time-consuming and paper-laden, but it worked. Keep all your documents. Every time.

A few plans include insurance cost calculators or 800 numbers you can call to find out potential costs. But they don’t all display everything, particularly not coinsurance, special rates for doctor visits, or off-network charges. That’s where Canadian LIC comes into play. We dissect real-world math based on your insurance, where you live, and the specific service you want. And cost shouldn’t be a mystery when you’re already sick.

Key Takeaways

- Many international students misunderstand what their health insurance plans actually cover until they face an unexpected bill during a medical visit.

- A deductible is the upfront amount students must pay before their insurance coverage begins, and it usually resets each calendar year—not each school term.

- A co-pay is a fixed amount paid at every clinic visit or prescription pickup—this can quietly add up over time if not anticipated.

- Coinsurance means paying a percentage of the total medical cost, even after meeting the deductible; this can lead to surprise expenses, especially for follow-up care.

- Choosing between higher premiums and lower deductibles depends on how often a student expects to need medical services—budget planning should be realistic, not optimistic.

- Students must always check if services are “in-network” and whether mental health care is included, as assumptions often lead to denied claims.

- Canadian LIC helps international students understand their options, compare International Student Insurance Quotes, and avoid getting trapped by confusing policy language or hidden costs.

Sources and Further Reading

- Government of Canada – Health Care for International Students

https://www.canada.ca/en/immigration-refugees-citizenship/services/study-canada/health-insurance.html

Provides official information on provincial healthcare availability and insurance expectations for international students in Canada. - Ontario Ministry of Health – OHIP Eligibility for Students

https://www.ontario.ca/page/apply-ohip

Details on who qualifies for Ontario’s public health insurance program and what services are covered or excluded. - British Columbia Ministry of Health – MSP for International Students

https://www2.gov.bc.ca/gov/content/health/health-drug-coverage/msp

Outlines how international students can register for the Medical Services Plan (MSP) and what’s included in their coverage. - Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

Provides foundational explanations of deductibles, coinsurance, premiums, and how private health insurance policies work in Canada. - Universities Canada – International Student Services

https://www.univcan.ca/universities/facts-and-stats/international-students-in-canada/

Covers institutional responsibilities around health insurance, advising, and financial services for international students. - International Centre – University of Toronto

https://www.studentlife.utoronto.ca/cie/health-insurance

Breaks down insurance options for international students attending Canadian universities, with real examples and case-specific advice. - McGill University – International Health Insurance FAQs

https://www.mcgill.ca/internationalstudents/health

FAQs and breakdowns of how premiums, co-pays, and provider networks affect students’ access to care. - Canadian Institute for Health Information (CIHI)

https://www.cihi.ca

National data source explaining average healthcare costs, system structure, and usage patterns — helpful for understanding out-of-pocket risks.

Feedback Questionnaire:

Understanding Student Insurance: Your Feedback Matters

At Canadian LIC, we meet students every day who struggle to make sense of health insurance terms like deductible, co-pay, and coinsurance. Your honest feedback helps us guide more students like you—clearly, respectfully, and with real solutions.

Please take 2 minutes to share your experience.

IN THIS ARTICLE

- Understanding Deductibles, Co-Pays, And Coinsurance: A Simple Guide For International Students

- Health Insurance In Canada: The Missing Chapter In Every Student's Welcome Package

- Deductible. What Do You Pay First? Even If It's An Emergency.

- Co-Pays. The Fixed Amounts That Quietly Drain Your Wallet

- Coinsurance: The Percentage Nobody Tells You About

- Deductibles vs. Co-Pays vs. Coinsurance

- What Students Really Need: A Plan That Actually Fits

- Managing Costs Before They Spiral Out Of Control

- How To Avoid Insurance Surprises — For Good

- How Canadian Lic Makes It Easier For International Students

- Final Thoughts: Your Health Isn't A Risk You Can Afford To Guess On

Sign-in to CanadianLIC

Verify OTP