- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

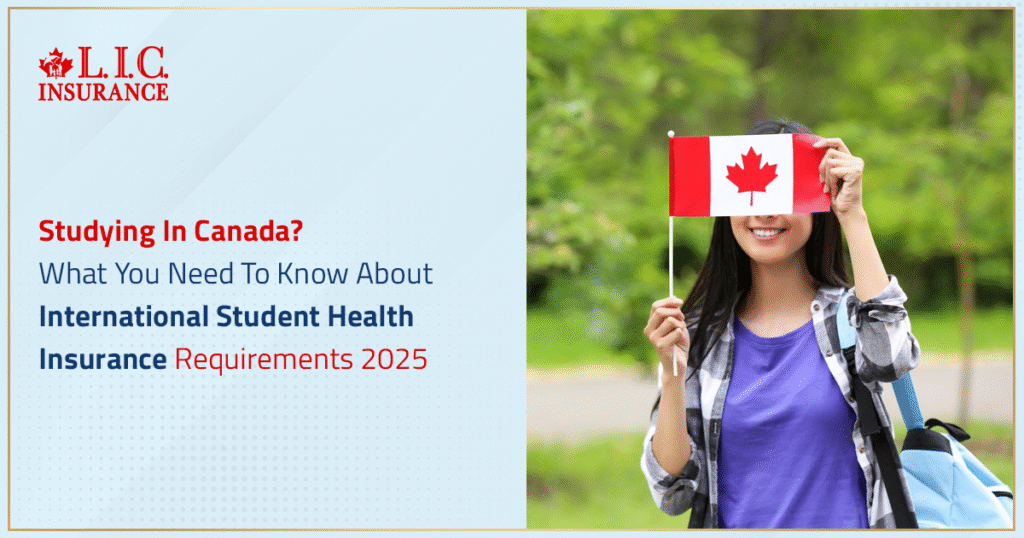

Studying In Canada? What You Need To Know About International Student Health Insurance Requirements 2025

By Harpreet Puri

CEO & Founder

- 12 min read

- October 02nd, 2025

SUMMARY

International Student Health Insurance in Canada is essential for anyone with a valid study permit. Provincial health coverage varies, so many students are automatically enrolled in a university health insurance plan or must purchase private health insurance. Options differ across provinces like British Columbia, Ontario, and Nova Scotia. Families can compare International Student Insurance Coverage and request an International Student Insurance Quote Online to manage medical expenses and protect against financial burden.

Introduction

Stepping off the plane into a new country is exciting. The energy of a new culture, a new school, and new opportunities fills the air. But one thing that international students in Canada cannot overlook is health insurance. We meet families and students every single week who are confused about International Student Health Insurance Canada, and the consequences of misunderstanding the rules can be financially devastating.

Health care in Canada is often praised worldwide, but the truth is that the free Canadian health care system is only for Canadian citizens and permanent residents. If you are arriving with a study permit, you must arrange proper coverage for the entire duration of your studies.

Understanding Canadian Health Care

Canada’s system is built on fairness. Citizens and permanent residents have access to medically necessary hospital services and medical services without paying directly out of pocket. But for an international student in Canada, that protection does not apply automatically.

Every province and territory operates its own program. Some offer provincial health coverage to students who study long enough. Others leave you with the responsibility to purchase private health insurance. The difference between provinces is huge, and it is the reason why we spend so much time advising students on the right health insurance plan before they leave their home country.

If you are planning to study in Ontario, for example, you will not qualify for the Ontario Health Insurance Plan (OHIP). Instead, you will be automatically enrolled in UHIP, the university health insurance plan that covers international students. But in British Columbia, things work differently—you can apply for the province’s MSP after three months, and in the meantime, you are covered by iMED.

The main point: don’t assume “Canada’s free health care” will protect you. It doesn’t, unless you are a permanent resident or citizen.

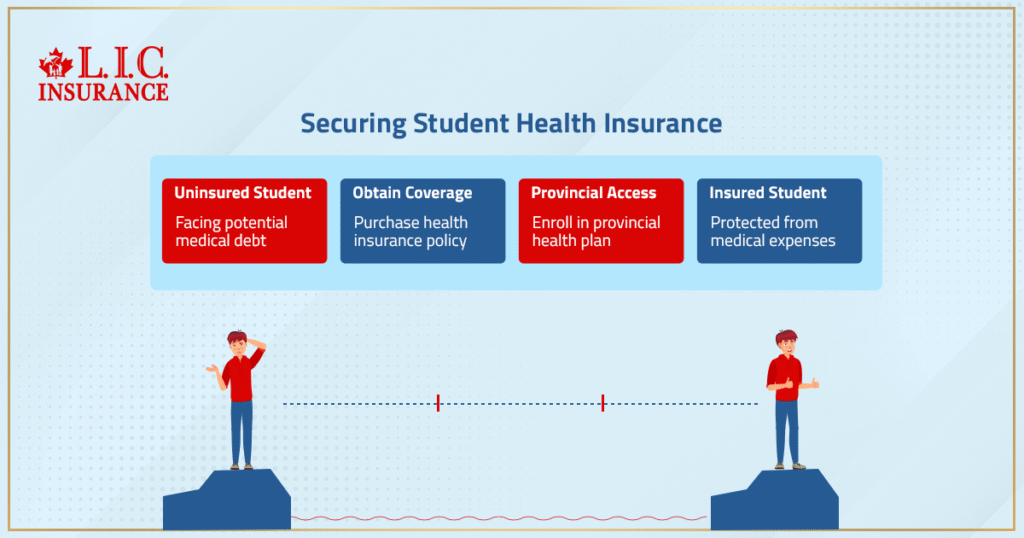

Why Health Insurance Is Mandatory For International Students

The Canadian government is strict. A valid study permit requires proof that you will not become a financial burden on the health care system. That means you must obtain health insurance for the entire duration of your stay.

Without coverage, the risks are severe. A single medical emergency—a broken leg, a sudden illness, or unexpected hospital stays—could cost thousands of dollars. We’ve seen students face bills for medical expenses that climb higher than their tuition fees.

That’s why every province either provides access to provincial health plans or requires private health insurance purchased through an insurance company or directly from your school.

Health Insurance Plans Offered By Canadian Universities

Most Canadian universities know international students will need coverage. To protect students and ensure compliance, they create group plans. We often get calls from parents asking, “Why was my child’s account charged automatically for insurance?” The answer is simple: most schools require all registered international students to be enrolled, and they are automatically enrolled unless they show proof of equivalent private coverage.

These insurance policies often cover:

- Doctor visits and hospital services

- Prescription drugs

- Emergency transportation

- Diagnostic tests and medical exams

But keep in mind: most don’t cover dental care or vision. If you want that, you need to purchase private insurance separately.

Provincial Health Coverage For International Students

Here is a breakdown of how health care coverage works by province in 2025.

Alberta

International students with a six-month study permit minimum are eligible for the Alberta Health Care Insurance Plan (AHCIP). It provides basic health care coverage, but not extras like prescription drugs. If you don’t qualify, you must purchase private health insurance.

British Columbia

If you study in British Columbia, you can apply for MSP if your program lasts more than six months. While you wait for approval, iMED covers you. Many schools bundle extended coverage on top of MSP to reduce the financial burden on students.

Manitoba

Here, there is no free provincial health coverage for international students studying. You will be enrolled in the Manitoba International Student Health Plan, which covers emergencies like hospital stays and X-rays.

New Brunswick

Students with at least one academic year of studies qualify for Medicare. It provides basic health insurance coverage, but extended benefits may still require private options.

Newfoundland And Labrador

If you study full-time for at least 12 months, you qualify for MCP, the province’s basic plan. Graduate students and undergraduate students who are not eligible must buy a private insurance plan.

Northwest Territories

If your program lasts longer than 12 months, you may apply for Northwest Territories Health Care. Again, only basic coverage—extras need to be arranged.

Nova Scotia

International students are not covered automatically. They must buy private health insurance policies, often through their university. After 12 months of residency, you may apply for a Nova Scotia Health Card, but until then, you pay around $650 annually.

Ontario

International students are not covered under OHIP. Instead, UHIP coverage is required, and you are automatically enrolled by your school.

Prince Edward Island

If you stay longer than six months, you may apply for a PEI Health Card. Until then, you must buy a health insurance plan through your school or a private provider.

Quebec

Unique rules apply here. Quebec has reciprocity agreements with some countries, allowing free RAMQ coverage. Others must rely on a university health insurance plan or buy private insurance.

Saskatchewan

If you study for more than six months, you can apply for a Saskatchewan Health Card. Some schools also automatically enroll you in private plans.

Yukon

Yukon does not provide coverage. The sole designated learning institution automatically enrolls students into its own insurance plan.

What Is Included In International Student Insurance Coverage

A typical International Student Insurance Coverage package includes:

- Doctor visits

- Emergency hospital services

- Diagnostic tests and medical exams

- Prescription drugs (basic level)

- Emergency transportation

- Repatriation in case of death

But it’s not unlimited. Students often assume the plan will cover everything, only to learn later that it won’t cover dental care, vision, or elective services. That’s why we encourage families to apply online for supplemental options before arrival.

Exchange Students And Short-Term Programs

If you are an exchange student coming for one or two terms, the rules can be even stricter. Most provinces require even short-term students to purchase private health insurance for the entire duration of their stay.

The Role Of Private Insurance Companies

When provincial plans don’t apply, the gap is filled by an insurance company offering health insurance policies designed for students. These plans are structured to manage medical costs for emergencies, hospital stays, and prescription drugs.

Parents often ask us whether it’s smarter to rely on a university health insurance plan or to purchase private health insurance separately. The answer depends on the province, the school, and the student’s own needs. We review options and help families get the best balance of coverage and cost.

Graduate Students, Work Permits, And Life After Graduation

Coverage doesn’t end when studies finish. Many graduate students transition to a post-graduation work permit. Some provinces allow students on a work permit to join provincial health plans if they have a month residency requirement fulfilled.

Others need to purchase private insurance until employer benefits begin. Families often overlook this stage, but it’s crucial—going without insurance between study and work could expose you to catastrophic medical costs.

Why Canadian LIC Guides Students Through The Process

Health care in Canada is not a one-size-fits-all program. For international students studying here, the rules shift between provinces, universities, and even different academic statuses (full-time vs. part-time, undergraduate vs. graduate).

We don’t just hand you a policy. We review:

- Your province of study

- Your study permit length and expiry date

- Whether your school automatically enrolls you

- Whether you need to provide proof of alternate coverage to opt out

- The balance between tuition, living expenses, and insurance plan costs

This is how we protect students and families from unexpected bills, reduce their financial burden, and give them confidence in their health insurance coverage.

Key Takeaway

International students in Canada cannot rely on the universal Canadian health care offered to citizens and permanent residents. Rules vary by province, and every student with a valid study permit must arrange a health insurance plan that protects them for the entire duration of their stay.

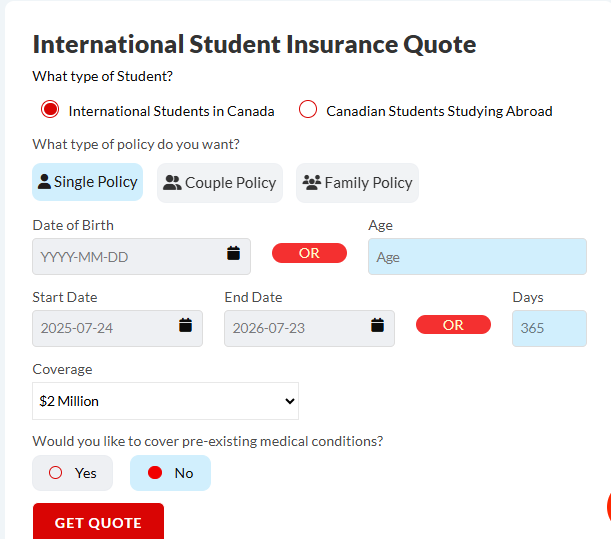

Whether it’s provincial health coverage, a university health insurance plan, or private insurance, what matters is that you are covered. We help families purchase private health insurance, compare International Student Insurance Quote Online options, and secure the right insurance plan before arrival.

Your education is a major investment. Protect it with proper International Student Insurance Coverage.

FAQs

International Student Health Insurance in Canada usually comes through your university, offering a group plan that meets study permit requirements. Private health insurance is purchased directly from an insurance company and can include extra benefits like dental care, vision, or extended prescription drugs. Families often use private options to reduce financial burden and expand coverage beyond medical services.

Yes, most Canadian universities allow you to apply online and compare an International Student Insurance Quote Online before travelling. Doing this early helps ensure your insurance plan starts on the expiry date of your current coverage or upon entry. This step protects you from gaps in health coverage that may create unexpected medical costs.

Graduate students often remain automatically enrolled in their school’s health insurance plan, while exchange students usually purchase private insurance for the entire duration of their stay. Some graduate students transition to work permit status and then join provincial health coverage later. The path depends on enrollment type and province.

If you travel outside Canada, your university health insurance plan or private insurance may not automatically cover you. Students need additional Travel Insurance for medical emergency costs outside Canada. Always review health insurance policies closely to confirm if out-of-province or outside Canada coverage is included.

Yes, most provinces require students to carry a Canadian health insurance plan even if they hold coverage from their home country. The reason is that Canadian health care providers and hospitals only accept health insurance policies that settle claims in Canada. This ensures medical expenses are paid directly without delays or out-of-pocket costs.

Once students move to a work permit, they may become eligible for provincial health coverage, but eligibility rules differ by province. Until provincial access begins, it’s often safer to purchase private health insurance to bridge the gap. This step avoids exposure to large medical expenses during the transition.

Yes, both undergraduate students and graduate students are often automatically enrolled, though the fees and plan options may differ. Some graduate students choose to purchase private insurance if they require extended benefits like family coverage. Universities guide students through the process to make sure health care coverage remains continuous.

Private insurance becomes essential when provincial health plans do not include certain medical services or prescription drugs. Students use private options to enhance protection, cover dental care, and handle costs that are not part of provincial programs. This flexibility gives international students broader health coverage throughout the entire duration of their studies.

Key Takeaways

- International Student Health Insurance in Canada is mandatory for anyone with a valid study permit, as Canadian health care is only for citizens and permanent residents.

- Rules vary across provinces: some provide provincial health coverage, while others require students to purchase private health insurance or join a university health insurance plan.

- Many students are automatically enrolled in their school’s insurance plan, but private health insurance can expand protection to cover dental care, vision, or extended prescription drugs.

- Students can compare an International Student Insurance Quote Online to manage costs, ensure adequate International Student Insurance Coverage, and avoid large medical expenses.

- Graduate students, exchange students, and those moving to a post-graduation work permit must review eligibility carefully, as health coverage changes with status.

Sources and Further Reading

Government and Provincial Health Coverage

- Government of Canada – Studying in Canada: Health Insurance

https://www.canada.ca/en/immigration-refugees-citizenship/services/study-canada/health-insurance.html - Ontario – University Health Insurance Plan (UHIP)

https://uhip.ca/ - British Columbia – Medical Services Plan (MSP)

https://www2.gov.bc.ca/gov/content/health/health-drug-coverage/msp - Alberta Health Care Insurance Plan (AHCIP) for International Students

https://www.alberta.ca/ahcip-apply.aspx - Saskatchewan Health Coverage for International Students

https://www.ehealthsask.ca/residents/health-cards - Nova Scotia Medical Services Insurance (MSI)

https://novascotia.ca/dhw/msi/ - Quebec – Régie de l’assurance maladie du Québec (RAMQ)

https://www.ramq.gouv.qc.ca/en/citizens/health-insurance/registration/foreign-student

University and Educational Resources

- University of Toronto – Health Insurance for International Students

https://studentlife.utoronto.ca/task/health-insurance-for-international-students/ - University of British Columbia – Health Insurance for International Students

https://students.ubc.ca/health/health-insurance - McGill University – Health Insurance for International Students

https://www.mcgill.ca/internationalstudents/health

Feedback Questionnaire:

IN THIS ARTICLE

- Studying In Canada? What You Need To Know About International Student Health Insurance Requirements 2025

- Understanding Canadian Health Care

- Why Health Insurance Is Mandatory For International Students

- Health Insurance Plans Offered By Canadian Universities

- Provincial Health Coverage For International Students

- What Is Included In International Student Insurance Coverage

- Exchange Students And Short-Term Programs

- The Role Of Private Insurance Companies

- Graduate Students, Work Permits, And Life After Graduation

- Why Canadian LIC Guides Students Through The Process

- Key Takeaway

Sign-in to CanadianLIC

Verify OTP