- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Should You Use Your TFSA To Pay For A Super Visa Insurance Plan In Canada?

By Pushpinder Puri

CEO & Founder

- 10 min read

- August 20th, 2025

SUMMARY

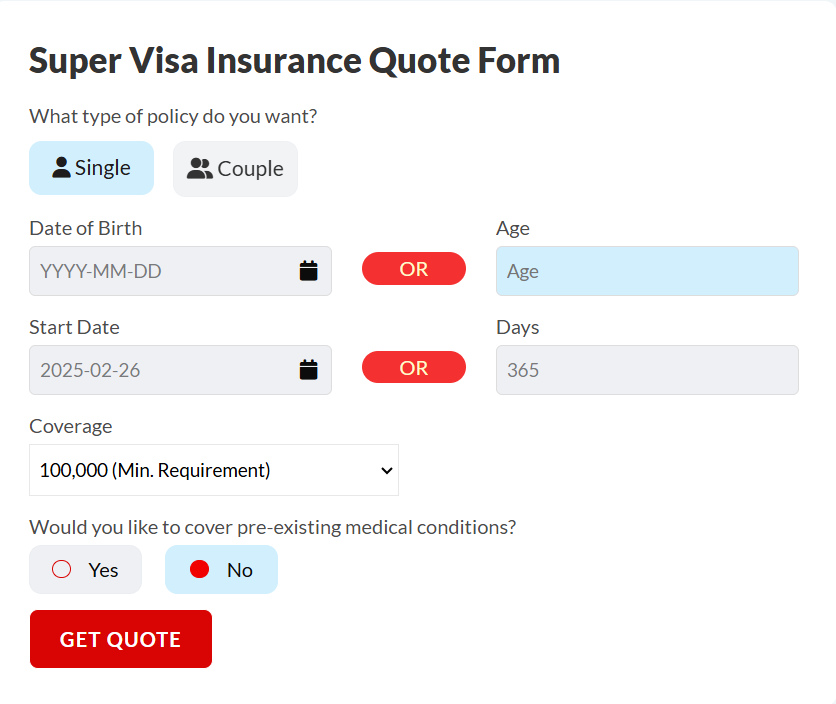

This blog explores the impact of using a TFSA for Super Visa Insurance on monthly costs, coverage options, and tax implications. It explains TFSA withdrawal rules, benefits, and limits while comparing them with other investment accounts. The discussion includes how Canadian citizens and permanent residents supporting parents and grandparents can manage savings efficiently, address emergency medical expenses, and meet super visa application requirements.

Introduction

Some choices in life don’t just affect your bank balance — they ripple through your family’s security, your travel timelines, and even the way you sleep at night. If you’re a Canadian citizen preparing to welcome your parents or grandparents under the Super Visa Program, you already know that Super Visa Insurance is not a “nice-to-have.” It’s required. It’s strict. And yes — it can be costly. Which is why more and more people are quietly asking: Should I use my Tax-Free Savings Account (TFSA) to help pay for it?

The question isn’t just about pulling money from an account. It’s about weighing the Super Visa Insurance Monthly Cost, understanding Super Visa Insurance Coverage, calculating Super Visa Insurance tax implications, and knowing exactly how TFSA withdrawal rules will affect your bigger financial goals.

And while there’s no one-size-fits- all answer, there’s a way to walk through the decision so you see all the moving parts — and choose with confidence.

Super Visa Basics And Why The Insurance Matters

The super visa allows parents and grandparents of Canadian citizens or permanent residents to stay for up to five years at a time, with multiple entries for up to ten years. It sounds generous — and it is — but the Canadian government attaches one very clear condition: before your loved ones can arrive, you must purchase medical insurance from approved insurance providers that meet strict Super Visa Insurance Coverage rules.

That coverage isn’t symbolic. It’s there to protect your family from the kind of emergency medical expenses that can crush savings and derail financial stability. We’re talking hospital care, medical emergencies that require immediate treatment, and even certain pre-existing medical conditions if your chosen insurance company offers that option.

But here’s the sticking point — the Super Visa Insurance Monthly Cost isn’t pocket change. For older applicants or those with health concerns, the cost can be substantial. Which is where some people start thinking about using their TFSA.

Why The TFSA Comes Into The Conversation

Your tax-free savings account isn’t just for retirement. It’s a flexible investment account that lets your income earned inside the account grow free from income tax — and, crucially, you can withdraw it tax-free.

If you’ve been using your TFSA for years, it might already hold investments like mutual funds, stocks, bonds, or even just cash from previous savings. So when the super visa application is moving forward and the insurance policy document is sitting in your inbox with the annual premium staring back at you, it’s natural to think: Why not just take it from my TFSA?

The short answer: you can. The real question is whether you should — given the TFSA withdrawal rules, your financial goals, and the trade-offs.

Looking At The Super Visa Insurance Monthly Cost Through The TFSA Lens

Let’s start with the numbers. The Super Visa Insurance Monthly Cost will vary depending on age, health, and the level of medical insurance you choose. Some parents and grandparents may qualify for rates in the lower range, but others, especially over a certain age, might face premiums that push into thousands annually.

If you’re covering extended stay protection with broad emergency medical coverage, the cost increases. Add optional coverage for pre-existing medical conditions, and you’ll see why many households feel the squeeze.

Here’s where the TFSA’s role gets interesting. If you pull from your TFSA to cover that monthly cost, you avoid triggering additional taxable income. Unlike dipping into certain Registered Retirement Savings Plan (RRSP) withdrawals — which are taxed as income — your TFSA withdrawals are tax-free. That means no pushing yourself into a lower tax bracket or affecting other government benefits.

But the benefit today has to be weighed against the opportunity cost tomorrow.

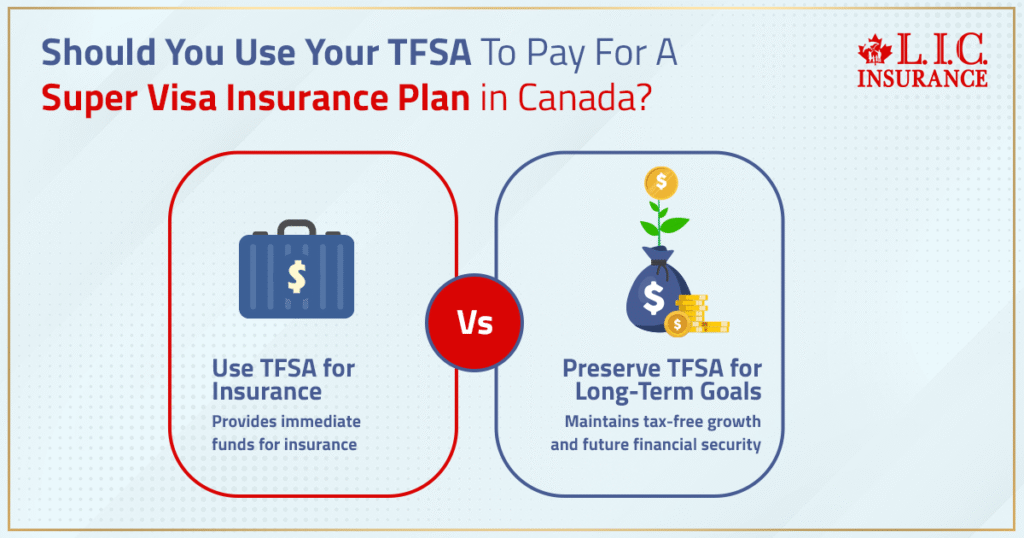

The Real Trade-Off: Growth Potential Versus Immediate Relief

The tax-free savings feature of the TFSA means every dollar you take out could have been a dollar continuing to grow — compounding year after year. If your TFSA is invested in mutual funds, equities, or other growth-oriented assets, that withdrawal isn’t just subtracting the premium amount; it’s interrupting years of potential gains.

So while paying your Super Visa Insurance Monthly Cost from the TFSA can ease the cash flow strain now, it might slow down your retirement planning progress or delay other financial goals like post-secondary education savings for a child, contributions to a home savings account, or building a cushion for your own medical care in later years.

It’s the classic short-term relief versus long-term growth dilemma.

Super Visa Insurance Coverage And TFSA Withdrawal Rules In Practice

A complete Super Visa Insurance Coverage package usually includes hospitalization, surgery, diagnostics, prescription drugs, and medical care after accidents or illness. Suppose your loved ones face emergency medical expenses while visiting. In that case, this coverage prevents you from dipping further into your own assets or scrambling to pay tax-triggering withdrawals from other accounts.

Now, how do TFSA withdrawal rules fit in? When you take money out of a TFSA, that TFSA contribution room is restored — but only in the following calendar year. So if you pull out a large sum today to cover the Super Visa Insurance Monthly Cost, you can’t replace it until next year without impacting your tax-free growth space.

For some, that delay is fine. For others — especially those using their TFSA aggressively for investments — that lost year of compounding can be significant.

Tax Implications You Can’t Ignore

One of the biggest points in favour of using a TFSA for Super Visa Insurance is the lack of Super Visa Insurance tax implications. Pulling from non-registered investment accounts may trigger capital gains if you sell assets, increasing your taxable income. Taking from RRSPs is worse because the withdrawal is fully taxed as income, potentially affecting age security benefits or other government programs.

With the TFSA, there’s no added tax burden. You don’t pay tax on withdrawals. You don’t bump yourself into a higher bracket. Your income for the year remains unchanged in the eyes of the Canadian government.

But — and this is important — just because there’s no immediate tax hit doesn’t mean the choice is free from cost.

Balancing Emotional And Financial Security

Many clients we work with aren’t just looking at numbers. They’re weighing the relief of having the insurance policy document sorted against the discomfort of seeing their TFSA balance drop. There’s also the emotional reassurance of knowing parents and grandparents are protected during their stay, with medical insurance ready to step in if unexpected medical expenses hit.

For families who’ve already earmarked their TFSA for retirement or future financial support of a child, pulling from it for super visa purposes can feel like crossing wires in the financial plan. But for others, especially those with surplus savings or less aggressive investments, the TFSA offers a clean, no-penalty way to fund the coverage.

When Using Your TFSA Makes The Most Sense

From what we’ve seen, using your TFSA for Super Visa Insurance Monthly Cost tends to work best when:

- You have excess account value beyond your short-term and long-term financial goals.

- Your investments inside the TFSA are conservative, so the lost growth potential is minimal.

- You’re in a situation where other sources, like RRSPs or taxable investment accounts, would cause a bigger tax hit or erode government benefits.

- The application process for the super visa is time-sensitive, and using TFSA funds avoids delays in the purchase of required coverage.

When To Think Twice

You may want to avoid tapping your TFSA if:

- The withdrawal would significantly reduce your long-term savings for retirement or other major financial obligations.

- Your TFSA is heavily invested in growth assets, and you’d be missing out on substantial future income earned.

- You’re close to your TFSA contribution room limit and won’t be able to replace the withdrawn funds for at least one year.

A Quick Word On Eligibility And Access

Remember, to open a TFSA, you must be a Canadian resident with a valid social insurance number, and to qualify for the super visa program, your visiting family must meet specific criteria, including being eligible for entry to Canada and proving financial support. That includes meeting the minimum income requirement for the super visa application and securing the right medical insurance.

The Bigger Picture

Ultimately, the decision to use your TFSA for Super Visa Insurance Coverage isn’t just about this year’s premium. It’s about the rhythm of your savings, the shape of your investments, and the timeline for your financial goals. It’s about choosing whether short-term convenience aligns with long-term security.

For some, the TFSA is the perfect bridge — avoiding tax issues, smoothing cash flow, and delivering peace of mind. For others, it’s a tool better left to grow untouched, while coverage is funded through other channels.

More on Super Visa Insurance, TFSA And Super Visa

- A Guide to the Rules of Trading Stocks within Your TFSA: Avoiding Pitfalls and Maximizing Your Benefits

- Why Investors Prefer Tax-Free Savings Accounts To Registered Retirement Savings Plans In Canada

- How Can You Use Deductibles to Reduce the Premium of Super Visa Insurance?

- What is a Deductible in Super Visa Insurance?

- Can I Choose My Own Doctor or Hospital with Super Visa Insurance?

- Are Psychological or Psychiatric Services Covered Under Super Visa Insurance?

FAQs

It’s doable. So the story is some of us reach into that tax-free savings account when we start to feel the pinch of this, and, while paying off the Super Visa Insurance Monthly Cost, right? Herein lies the catch — given that the withdrawal is done, your TFSA contribution room only reopens in the next year. You have today’s insurance payments to make with tomorrow’s investment account growth.

The money, having come from a TFSA for Super Visa Insurance, doesn’t change the coverage itself. What changes is how it makes you feel — You are withdrawing from funds meant to grow tax-free. You pay for the ability to cover emergency medical expenses now, but you also give your longer-term goals room to breathe.

You also do not get any direct tax bill when using TFSA withdrawals for Super Visa Insurance Coverage. While the true price is lost TFSA space for that year, to a retiree and someone building an investment portfolio, a skimpy tax shelter can mean less growth later on.

The TFSA rules will continue as is, whether you are assisting with Super Visa Insurance for parents and grandparents or helping them open a new bank account. Money can go out in a day, but the space to replenish it waits for the calendar page turnover. It is a nuance that you should consider before you begin deducting from your savings account every month to pay for their insurance.

Additionally, there are people who do not want all of their TFSA for Super Visa Insurance to disappear in one shot. Call less from your regular account and more from your tax-free savings account. It’s a bridge over the high-priced world of today, Super Visa Insurance, with a monthly cost without draining all those hard-earned savings you have built up.

Other than that, the TFSA withdrawal rules take effect when you pay a full year of Super Visa Insurance Coverage instead of going month to month. The space you create only returns the following calendar year, so do some planning to avoid robbing your longer-term savings.

How do we all know this? When the date for the insurance company payment is approaching, you make mutual funds sheltered inside the TFSA with your money. It allows you to put your money in some sort of growth and yet have it instantly available when the Super Visa Insurance Coverage bill arrives.

Gifting TFSA money to cover the cost of Super Visa Insurance for parents and grandparents comes without a tax hit. The only catch, and it’s the same TFSA quirk, is that you can only get that money back inside next year. That is where a bit of retirement planning knowledge comes in handy, though, so this way you should not lose out at another time.

Key Takeaways

- Super Visa Insurance Monthly Cost Can Be Easier to Manage with TFSA Withdrawals – Using a TFSA for Super Visa Insurance payments allows you to access funds tax-free, while keeping the flexibility to cover premiums without increasing taxable income.

- Super Visa Insurance Coverage Goes Beyond Emergency Care – Many policies include benefits for medical emergencies, pre-existing medical conditions (if stable), and other essential medical care, giving parents and grandparents financial protection during extended stays in Canada.

- Understand the Super Visa Insurance Tax Implications Before You Buy – Premiums are not tax-deductible, but using a TFSA for Super Visa Insurance can help avoid pushing your taxable income into a higher bracket.

- TFSA Withdrawal Rules Support Flexible Planning – Because TFSA withdrawals restore contribution room the following year, families can plan for future premium payments or unexpected medical expenses without losing investment growth potential.

- Pairing Insurance and Savings Protects Both Health and Wealth – Combining super visa coverage with a well-funded TFSA ensures financial support for parents during their extended stay, while preserving long-term savings and investments.

Sources and Further Reading

- A clear explanation of updated Super Visa Insurance requirements from Immigration, Refugees and Citizenship Canada (IRCC), highlighting flexibility in accepting valid private health insurance—even from foreign companies approved by OSFI. IRCC Canada+6Canada.ca+6Canada.ca+6

- Official IRCC overview of the Super Visa program, including who can apply, eligibility criteria, and the insurance requirement of at least one year and $100,000 coverage. Canada.ca+1

- Canada Revenue Agency’s TFSA Guide, offering authoritative details on eligibility, contribution limits, withdrawal rules, and tax treatment for TFSAs. canadianlic.com+4Canada.ca+4moving2canada.com+4

- Insights on using TFSAs as accessible, tax-free savings vehicles, ideal for short- or medium-term goals like covering Super Visa Insurance premiums. Canada.ca+5thinkinsurance.ca+5Sun Life+5

Feedback Questionnaire:

We’d love to understand your challenges so we can create better resources to help you make confident decisions.

Please fill in your details and share your experience below.

IN THIS ARTICLE

- Should You Use Your TFSA To Pay For A Super Visa Insurance Plan In Canada?

- Super Visa Basics And Why The Insurance Matters

- Why The TFSA Comes Into The Conversation

- Looking At The Super Visa Insurance Monthly Cost Through The TFSA Lens

- The Real Trade-Off: Growth Potential Versus Immediate Relief

- Super Visa Insurance Coverage And TFSA Withdrawal Rules In Practice

- Tax Implications You Can’t Ignore

- Balancing Emotional And Financial Security

- When Using Your TFSA Makes The Most Sense

- When To Think Twice

- A Quick Word On Eligibility And Access

- The Bigger Picture

Sign-in to CanadianLIC

Verify OTP