- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Self-Employed Insurance Guide: Key Coverage For Entrepreneurs

By Harpeet Puri

CEO & Founder

- 14 min read

- May 6th, 2025

SUMMARY

This blog helps Canadian entrepreneurs understand essential insurance coverage for self-employed freelancers. It discusses affordable insurance plans for self-employed individuals, highlights critical coverage like health, disability, life, liability, and business overhead insurance, and provides practical tips to select the best insurance policies for self-employed entrepreneurs without overspending.

Introduction

Self-employment in Canada must sound like freedom, right? But the truth is often otherwise. You run your business, chase clients, pay your taxes, and somehow, you still forget to protect your most important asset—yourself. Entrepreneurs have visited our office feeling exhausted, uncertain, and buried in “what if” situations they’ve never prepared for. And almost without fail, the question is, “What type of insurance do I really need — and what can I actually afford?”

This guide is for you. The freelancer is trying to keep the business afloat through flu season. The small business owner who went years without a dental checkup. The consultant knows their work is solid but fears getting sued over one misinterpretation. Today, we’re going to address the stuff that truly matters when it comes to insurance for self-employed freelancers and entrepreneurs, without the jargon or sales-driven fluff.

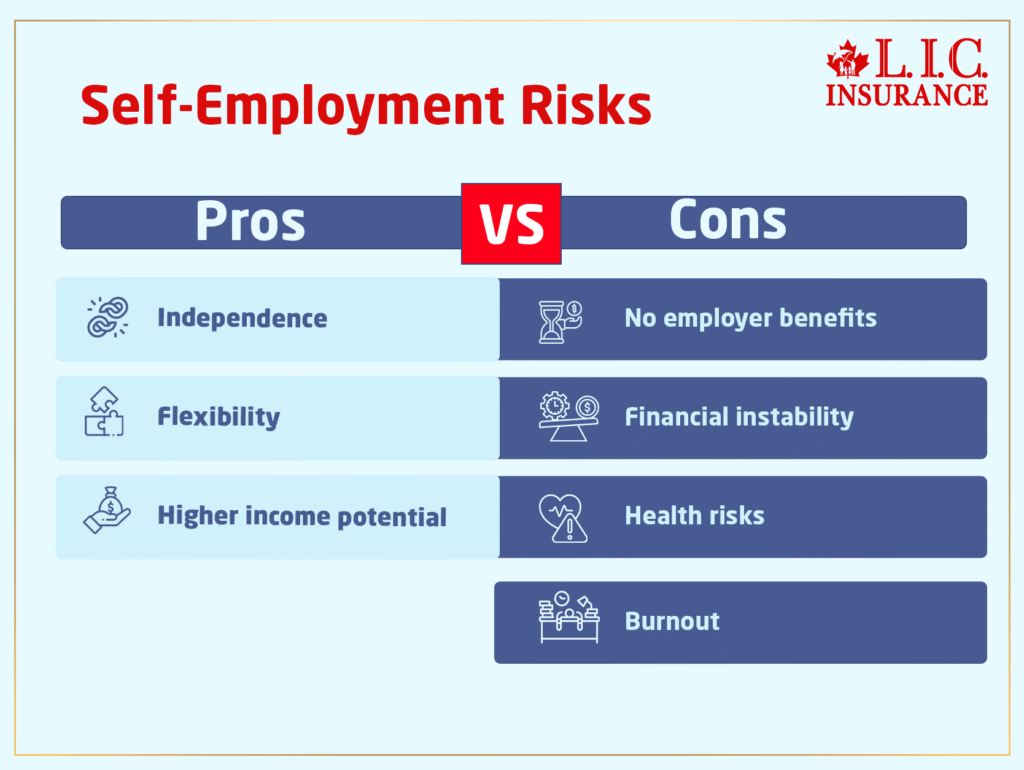

Why Insurance Matters When You're On Your Own

When you’re employed, your company backs you up with benefits. But when you’re on your own, everything rides on your ability to keep showing up. And if something stops you—illness, injury, burnout—then what?

Here’s what we often hear in our conversations with self-employed clients:

- “If I miss even a week of work, I’m in trouble.”

- “I thought public healthcare covered most things, but it doesn’t.”

- “I don’t have a team to take over if I’m out.”

You don’t need every insurance product on the market. You just need the right ones, structured to fit your lifestyle and income rhythm.

1. Health and Dental Insurance You Actually Use

A web designer from Mississauga once told us, “I haven’t been to a dentist in three years. I’m too scared of the bill.” And she’s not alone.

Provincial health care doesn’t cover dental, vision, or many prescription medications. For self-employed professionals, Health Insurance isn’t a perk- it’s damage control.

Smart options:

- Individual Health & Dental Plans – Basic coverage that handles everyday needs

- Health Spending Accounts (HSAS) – Great for incorporated professionals looking for tax efficiency

We helped that designer pick a plan where her cleanings, fillings, and even glasses were 80% reimbursed. Cost? Less than $100/month. Outcome? Peace of mind.

📎 Suggested Link: [Health Coverage in Canada – Canada.ca]

2. Disability Insurance- Because You Are the Paycheque

You can be careful and cautious and still get blindsided. That’s what happened to a solo mortgage broker we worked with in Brampton. One fall on the ice, one fractured hip, and two months with no income. Without Disability Insurance, her savings evaporated.

What you need to know:

- Short-term disability helps for a few weeks to months

- Long-term disability can protect you for years

This isn’t just another policy. It’s income continuity. Think of it as paying yourself, even when you can’t work.

📎 Reference: [Canadian Life and Health Insurance Association – CLHIA]

3. Life Insurance That Isn’t Complicated

You don’t have to be married with kids to think about life insurance. We’ve helped self-employed coaches, realtors, and startup founders who just wanted to ensure their debts didn’t become someone else’s burden.

Simple breakdown:

- Term Life – Affordable coverage for a set period (e.g., 20 years)

- Permanent Life – Costs more, but it builds cash value and never expires

A fitness trainer from Toronto chose a $500,000 term policy for under $35/month. She wanted to cover her mortgage, support her partner, and not think about it again. That’s smart planning.

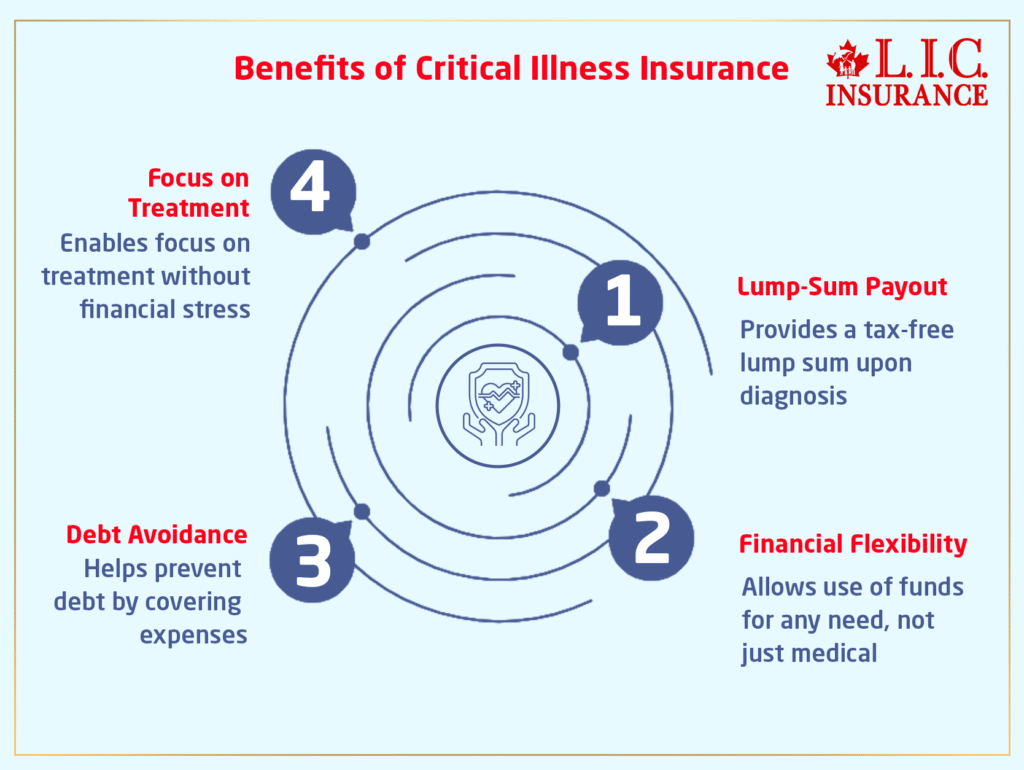

4. Critical Illness Insurance That Pays Out Fast

We had a videographer client, a healthy guy in his 30s diagnosed with lymphoma. The lump-sum payout from his Critical Illness Insurance Coverage helped him stop working, focus on treatment, and pay his rent without going into debt.

This type of plan gives you:

- A tax-free lump sum on diagnosis of a major illness

- Flexibility to use the money as you need (not just medical bills)

This isn’t just about survival. It’s about staying afloat when life turns upside down.

📎 Reference: [Canadian Cancer Society]

5. Business Overhead Insurance- Not Just for Big Firms

You may be small-scale, but your expenses aren’t. Business Overhead Expense insurance covers recurring business costs if you’re unable to work.

Think about it:

- Lease or co-working space rent

- Internet, utilities, and accounting software

- Virtual assistants or contractors

If you’re the only one bringing in revenue, this type of insurance keeps the lights on.

6. Liability Insurance- Because One Email Can Cost You Thousands

A freelance marketing consultant faced a $10,000 lawsuit when a client accused her of misrepresenting campaign results. The claim wasn’t even valid, but legal fees alone hurt.

What professional liability (E&O) insurance covers:

- Legal defence fees

- Settlements

- Client claims of negligence or breach of contract

It’s one of the most overlooked types of coverage and one of the most crucial if you give advice, offer services, or handle data.

7. Don’t Forget Home-Based Business Insurance

Many self-employed Canadians work from home. However, standard homeowners’ insurance often excludes business assets or client-related incidents.

What you need:

- A home office rider

- Or a separate small business insurance policy

You don’t want to find out your laptop or camera gear isn’t covered after a break-in.

What Do Affordable Insurance Plans for Self-Employed Professionals Look Like?

It’s not about buying every type of insurance. It’s about buying what fits the affordable insurance plans for self-employed.

Ways to keep your premiums low:

- Bundle policies with one provider

- Increase deductibles where feasible

- Start with essentials (health, disability, term life)

At Canadian LIC, we review dozens of plans from top insurers. A photographer client we helped had been quoted over $220/month by another broker. We brought that down to $139 with better dental, vision, and drug coverage.

Your Personalized Path: How to Pick the Best Insurance Policies for Self-Employed Entrepreneurs

Do this before you buy anything:

- Write down your monthly income and expenses

- List who depends on you—kids? Spouse? Business?

- Rank your risks: illness, injury, lawsuits, downtime

- Book a one-on-one conversation with a trusted broker

We don’t push products. We ask better questions. Because when coverage reflects your priorities, you’re not just insured—you’re protected.

What Our Clients Value Most

Self-employed people are some of the most resourceful people we meet. But they also take on too much. Having a proper insurance plan means you get to breathe, focus, and stop worrying about the ‘what ifs.

What you get when you work with us:

- Personalized recommendations, not one-size-fits-all products

- Transparent breakdowns of cost vs. coverage

- Support with claims and renewals

- Access to top Canadian insurers

A Few Final Words

If you are self-employed in Canada, insurance is not a luxury—it is your plan B. Whether you are a freelancer, a brand builder, or running a consultancy, if you feel it’s time to scale, there’s a process to organize low-cost and high-impact coverage.

The ideal insurance policies for self-employed entrepreneurs don’t make you work around them; they work around your reality. Let’s create something that protects you, your income, and those who depend on you.

Start with one conversation. We’ll take it from there.

FAQs For Self-Employed Canadians Looking at Insurance

That’s one of the first things we hear, and the answer is, yes, you can indeed, in many cases. If the insurance helps for your work as a self-employed professional, such as liability or business overhead coverage, it generally counts as a deductible business expense. Even health plans can count at times, particularly if you have a Health Spending Account. Make sure you go over it with a tax advisor before filing, but yes, there is typically a way to get your insurance to work for you at tax time.

If you’re on the move — whether it’s between provinces or beyond Canada — you’ll want to think bigger than basic health plans. The last thing you want to be worried about is unexpected medical bills if something goes wrong on the road. And if you’re hauling gear like cameras or tools, consider insuring that as well. We’ve assisted in crafting ”plans for the road,” and clients are covered whether they are in Toronto, Vancouver, or on location in Portugal.

Yes — just because you’re part-time doesn’t mean the risks disappear. If you depend on that income, a health issue covering only a short period could cause you disruption. The good news? You can size coverage to your condition. We have created insurance plans for self-employed clients who work weekends or after 5 pm. It’s not about how many hours — it’s about how much risk you are carrying completely unsupported.

You’ve got options. If you move to full-time employment with benefits, you can often end or suspend the private coverage. Just be certain that the employer plan will cover all you need. Some people even retain a piece of their private insurance, such as critical illness or life coverage, or both, that is not very good on the employer plan. We have guided many clients through such a transition smoothly, without having to pay twice or without losing coverage.

Indeed, very few people are aware of this. If you are a member of a professional association, union, co-op, or the like, those organizations might provide group rates that lower costs for you. And if we don’t, we are sometimes able to assist clients in joining a group-style plan through our networks. It’s a question worth asking — group coverage is no longer only for large employers.

That depends on the type of insurance, but usually, yes, you still have some choices. Some plans include medical questions, and others don’t. It may factor into your Health Insurance premiums or produce exclusions, but I can tell you we’ve had several clients who thought for sure they would never qualify, and they did. The key is to have that out front so that we can make sure that we’re matching you with the right provider and that we’re not wasting your time.

Not necessarily. Some plans allow scaling down or putting payments on hold temporarily rather than cancelling outright. If you cancel altogether, you might miss out on a good rate or need to reapply with fresh health questions in the future. We typically suggest hanging on to some kind of basic coverage — health, life, whatever — so you’re not starting completely from scratch the next time you’re at it. Every situation is different, but let’s talk it through first.

Yes, it can. A graphic designer and a roofer will not pay the same premiums. Insurance companies consider the risk level of what you do, how often you do it, and where you do it. But that doesn’t mean your job is “uninsurable.” We have a few to choose from, so we can always find one who understands what you do and won’t gouge you on the price.

Key Takeaways

- Health Insurance fills gaps not covered by public healthcare, like dental and vision.

- Disability Insurance protects your income if you’re unable to work.

- Life Insurance safeguards dependents and covers debts affordably.

- Critical Illness Insurance provides immediate support upon serious illness diagnosis.

- Business Overhead Expense Insurance ensures your business stays afloat during downtime.

- Professional Liability Insurance protects you from costly client lawsuits.

- Home-Based Business Insurance covers business assets your standard home policy doesn’t.

- You can keep insurance affordable by bundling, raising deductibles, and prioritizing essential coverage first.

- Reviewing your insurance annually ensures your coverage aligns with your changing needs.

Sources and Further Reading

- Health and Dental Insurance You Actually Use

- Provincial coverage limits and Canadian Dental Care Plan:

Canadian Dental Care Plan – What is covered (Canada.ca) - Health Insurance options for self-employed:

Health Insurance for self-employed – Canada Life - Health Spending Accounts (HSAs) explained:

Health Spending Account – Wikipedia

- Disability Insurance-Because You Are the Paycheque

- Why Disability Insurance matters and options in Canada:

Disability Insurance – Canada.ca - Industry insights from Canadian Life and Health Insurance Association:

Canadian Life and Health Insurance Association (CLHIA)

- Life Insurance That Isn’t Complicated

- Term life insurance basics and affordability:

Term Life Insurance Canada – RBC Insurance - Permanent life insurance overview and benefits:

Permanent life insurance | Sun Life Canada - Life insurance considerations for the self-employed:

7 Things Every Self-Employed Canadian Should Know About Life Insurance

- Critical Illness Insurance That Pays Out Fast

- Critical Illness Insurance explained and benefits:

Critical Illness Insurance | Sun Life Canada - Critical illness coverage details and statistics:

Critical Illness | Engineers Canada - Cancer statistics and financial impact:

Canadian Cancer Society

- Business Overhead Insurance- Not Just for Big Firms

- Business Overhead Expense Insurance details:

Business Overhead Insurance | Manulife

- Liability Insurance- Because One Email Can Cost You Thousands

- Professional liability insurance essentials:

Professional Liability Insurance – HRPA

- Don’t Forget Home-Based Business Insurance

- Home-based business insurance overview:

Insure your home-based business – Co-operators

Additional Resources on Choosing and Managing Insurance

- How to get affordable insurance plans for the self-employed:

Health Insurance for self-employed – Canada Life - Tax considerations for self-employed insurance:

Canada Revenue Agency – Medical Expenses and Private Health Services Plans

These links provide authoritative, detailed information on each insurance topic we have covered to deepen your understanding and make informed decisions.

Feedback Questionnaire:

We’d love to understand your struggles in finding suitable insurance coverage as a self-employed entrepreneur. Your feedback helps us provide better, more tailored support.

IN THIS ARTICLE

- Self-Employed Insurance Guide: Key Coverage For Entrepreneurs

- Why Insurance Matters When You're On Your Own

- What Do Affordable Insurance Plans for Self-Employed Professionals Look Like?

- Your Personalized Path: How to Pick the Best Insurance Policies for Self-Employed Entrepreneurs

- What Our Clients Value Most

- A Few Final Words

Sign-in to CanadianLIC

Verify OTP