- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

RRSPs For Your Spouse In Canada: How You and Your Spouse Can Benefit

By Harpreet Puri

CEO & Founder

- 10 min read

- November 04th, 2025

SUMMARY

Spousal RRSPs in Canada offer a smart retirement planning strategy for couples. By allowing one partner to contribute to the other’s account, couples can lower taxable income, split retirement income, and maximize tax savings. The blog explains contribution rules, withdrawal timing, attribution rules, and estate planning benefits, while helping readers compare RRSP spousal contribution limits and get RRSP quotes online.

Introduction

It doesn’t matter whether you and your partner have been together for 3 years or 30—when it comes to retirement planning, the earlier you coordinate your income strategy, the better the outcome.

Let’s say one of you earns more. A lot more. And you’re starting to think about the long-term implications. Taxes. Withdrawals. Government benefits. You realize quickly that keeping everything in one name might not be the most efficient path forward.

Here’s where a Spousal RRSP comes into play—and believe me, it’s one of the most underused tools couples in Canada have at their disposal. We see this all the time: one spouse is carrying most of the income, while the other has little to no RRSP savings. The tax burden? Heavier than it needs to be.

But there’s a better way to plan.

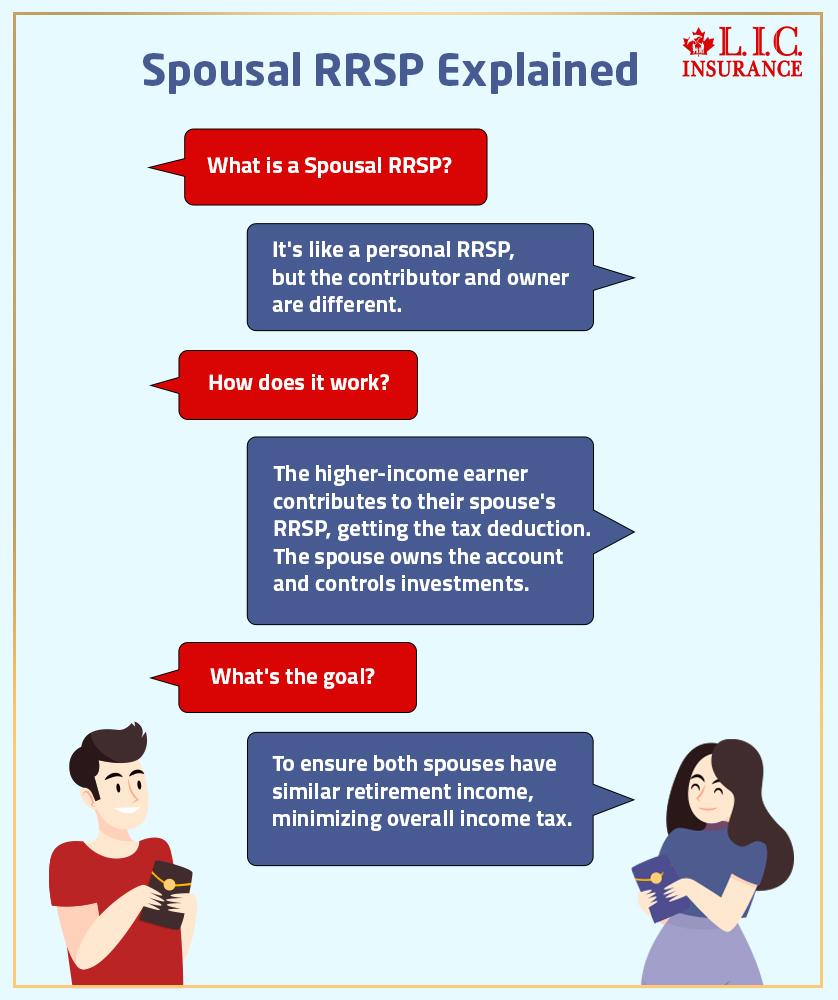

A Simple Definition That Goes A Long Way

A Spousal RRSP isn’t all that different from a personal one, except for one major detail: the contributor and the owner aren’t the same person.

If you’re the higher-income earner, you put money into a Registered Retirement Savings Plan that’s in your spouse or common-law partner’s name. They own the account. They control the investment decisions. But you get the tax deduction when you contribute.

It’s a form of income splitting before retirement even starts. The ultimate goal? Make sure both spouses retire with similar levels of retirement income, so that neither ends up paying more than necessary in income tax.

Let’s Talk Strategy — Not Just Saving, But Planning

Here’s what most people don’t realize: you don’t need to be close to retirement to open a spousal RRSP. You just need to have earned income and contribution room. That’s it.

You can contribute:

- While you’re working full-time.

- While your spouse is home raising children.

- While they’re between careers or in part-time work.

- Even after you turn 71, as long as your spouse is under 71 and you still have RRSP contribution room left.

We often see couples where one partner earns six figures and the other earns significantly less. Without careful planning, the higher income-earning spouse ends up withdrawing huge chunks in retirement—often pushing them into a higher tax bracket, losing money unnecessarily.

With a spousal RRSP in place, the lower-income-earning spouse can withdraw from their own RRSP in retirement, at a lower tax bracket.

That’s real-life tax savings. Not just theory.

Contribution Rules You Can’t Afford To Ignore

Let’s keep it clear.

- The contribution counts toward your RRSP limit, not your spouse’s.

- The maximum in 2025 is 18% of your income, up to $32,490.

- Any unused room from previous years? Still available.

- Don’t forget to check your CRA Notice of Assessment for your exact RRSP contribution room.

Now here’s where things get tricky—if you contribute too much, you’re looking at penalties. So if you’re putting money into your own RRSP, a spousal plan, or even a Group RRSP at work, you need to add everything up. You don’t get separate limits.

That’s something we guide our clients through step-by-step.

The Attribution Rule: Don’t Let It Surprise You

This one trips up more people than it should.

If you contribute to a spousal RRSP and your spouse withdraws funds within three calendar years of your last contribution, the Canada Revenue Agency can turn around and say: “Nice try, but the tax is on you, not them.”

It’s called the three-year attribution rule.

So what do we tell clients? Simple. If your goal is tax savings, make sure no withdrawals happen until at least three full calendar years have passed after your last contribution.

Otherwise, you’ll pay tax on the contributor’s taxable income instead of benefiting from your spouse’s lower taxable income.

Real Numbers, Real Results

Here’s a classic scenario.

- Spouse A earns $110,000/year.

- Spouse B earns $35,000/year.

- They want to withdraw $70,000/year during retirement.

Now—without a spousal RRSP?

- Spouse A takes the full $70,000.

- They get bumped into a higher tax bracket.

- They pay more than necessary.

With a spousal RRSP in place?

- Spouse A and B each withdraw $35,000.

- Both stay in lower-income brackets.

- Each benefits from the basic personal amount (which is $15,705 in 2024).

- The result? They keep more of their money.

Just that one adjustment alone can amount to thousands saved every year. Add that up over 25 years of retirement? That’s real wealth preservation.

What If You Both Already Have RRSPs?

You can still benefit from spousal contributions. Many clients we serve already have individual RRSPs, but the contribution levels aren’t equal.

For instance:

- You have $25,000 of unused contribution room.

- You use $15,000 for your own RRSP.

- You contribute $10,000 to your spouse’s RRSP.

Totally legal. Totally strategic.

We’ve also helped clients merge personal and spousal RRSPs. But remember: once merged, the entire account is treated as a Spousal Registered Retirement Savings Plan. So attribution rules would apply going forward.

Plan accordingly.

And What About Common-Law Couples?

Good news. If you’ve been living with your partner for 12 months or more in a conjugal relationship, CRA considers you common law.

Meaning:

- What are all the spousal RRSP rules Canada offers?

- You qualify for them.

You don’t need to be legally married to benefit from income splitting and tax savings through this method.

Separation And Spousal RRSPs: What Happens?

This is where things get more complex, but let’s break it down.

- In a divorce, RRSP accounts are considered family assets.

- That includes spousal RRSPs.

- In most provinces, the value of RRSPs accumulated during the relationship is split equally.

- A written agreement or court order can authorize a tax-free transfer of RRSPs from one spouse to the other.

That’s right—tax-deferred transfers during separation are possible. But only if done properly.

We always recommend speaking to a legal representative or tax advisor before moving RRSP assets during a breakup.

TFSA vs RRSP: Can I Do This With My Spouse’s TFSA?

Not exactly.

You can’t contribute directly to your spouse’s TFSA the way you do with a spousal RRSP. But there’s a loophole—and it’s legal.

You can gift your spouse money. They can then contribute it to their own TFSA. And here’s the twist: no attribution rule applies.

That means the growth is theirs—and it stays tax-free.

Another way to shift income and maximize joint retirement savings without triggering extra income tax.

Spousal RRSPs vs Pension Income Splitting

We get this a lot: “Why bother with a spousal RRSP if we can do pension income splitting when we retire?”

Here’s the difference:

- Pension income splitting kicks in at age 65.

- Spousal RRSPs? They work at any age.

- That makes them perfect for early retirement or for couples with inconsistent income levels.

You’re not choosing one over the other. You can use both for maximum tax efficiency.

Spousal RRSPs let you contribute now and split income later—long before the government allows formal pension splitting.

Why Couples Choose Canadian LIC

We don’t just “set up accounts.” We run the math. We analyze your income, your RRSP accounts, your unused contribution room, your age difference, and your goals.

We tell you when to withdraw money, how to avoid being retroactively taxed, and how to combine RRSPs with other strategies like registered retirement income funds, corporate insurance, and estate planning benefits.

We’ve helped couples recover overpaid taxes, protect pension income, and retire with confidence—all because of a well-structured spousal plan.

Final Thought

If you’re earning more than your spouse and planning to retire together, don’t ignore the Spousal RRSP. The earlier you start, the more flexibility you’ll have later.

The tax rules aren’t always intuitive. But with the right help, they can absolutely work in your favour.

Let’s Get You Started

- Call Canadian LIC to speak with an RRSP advisor

- Request RRSP quotes online today

- Ask us to map your contribution limit, income splitting options, and attribution window

- We’ll build a tax-smart retirement planning for couples strategy that’s built to last

Want to retire smarter together?

It’s not about who earns more. It’s about how you both keep more.

FAQs

They work, not waiting until 65. That’s the key. It allows you to carve out tax savings years before the formally allowed pension income splitting comes into effect, providing couples a longer time frame in which to withdraw retirement income on an equal footing basis and before CRA limitations come into play.

If you make too much income in retirement, that OAS benefit begins to decline. But by shifting some of that retirement savings into the name of a partner early on, you can do much to keep it under wraps and shield what you have earned.

It’s about control and continuity. If something should happen to the contributing spouse, those spousal RRSP assets can roll over into their partner’s registered retirement income fund without creating a tax event. That’s an estate strategy—not just savings.

Yes—and this one’s sneaky smart. Let’s say you have unused contribution room available. Rather than stuffing your own RRSP, channel some of that into a spousal plan, and you’re keeping your future retirement-income picture more balanced. It’s long-game planning.

Totally. We have heard this a lot — one partner diverged to raise kids or switched careers later in life. The higher-earning spouse can incorporate contributions, and that supports the couple in accumulating a more equal pool of retirement savings over time.

If all of the savings are in one person’s name, one partner bears the tax burden. That’s not efficient. And a spousal RRSP lets you spread things out — so that both spouses report income more smoothly and get less socked with high rates, later on.

They can, yes. Take the money out too fast, and you could see your GIS or other support pared down. With spousal RRSPs, you are playing the long game—managing taxable income into it gradually, across both of your names, to keep doors open for benefits.

Depends on what you’re aiming for. Prefer the tax deduction now, but smoother income splitting later? The second spouse teaches you that you can have both of those things. The sweet spot, perhaps, is somewhere in between — and that’s what we help couples sort out.”

Then CRA might shift the tax back to your lap. That’s the danger if you don’t time it properly. We steer clients away from setting off the three-year attribution rule — because tapping the funds early can undo all the good you hoped to accomplish.

Yes, and they should be. When dealing with incorporated clients, it is common for us to mix in spousal RRSPs along with holding company assets, corporate-owned life insurance and surplus strategies. It’s all a piece of the pie for retirement planning as a couple. Travelling in retirement isn’t about flying by the seat of your pants. It’s about preparation for adventure and the fight.

Key Takeaways

- Spousal RRSPs help couples split future retirement income by allowing the higher income-earning spouse to contribute to the lower income spouse’s account—leading to long-term tax savings and smarter retirement planning for couples.

- RRSP spousal contribution limits follow the contributor’s personal RRSP limit, not the recipient’s. You can contribute up to 18% of your earned income annually (to a max of $32,490 for 2024), including any unused RRSP contribution room from past years.

- The three-year attribution rule is critical: if the spouse withdraws funds within three calendar years of a contribution, the contributor may be taxed on it, so timing withdrawals is essential for keeping income tax low.

- Spousal RRSPs can reduce taxable income now and enable income splitting later, even before age 65—offering flexibility beyond traditional pension income splitting rules in Canada.

- These accounts also offer estate planning benefits, as they allow for tax-deferred transfers of retirement savings to the surviving spouse’s registered retirement income fund upon death.

- Spousal RRSPs complement personal RRSPs and corporate strategies, especially for self-employed professionals and incorporated individuals planning for retirement with uneven spousal income levels.

Sources and Further Reading

Official Government Resources

- Canada Revenue Agency (CRA) – RRSPs and related plans

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans.html

Explanation of contribution limits, spousal RRSPs, attribution rules, and income tax rules related to RRSP withdrawals. - Canada Revenue Agency (CRA) – Registered Retirement Savings Plans (RRSPs)

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4466.html

Detailed RRSP guide with spousal contribution and tax deduction scenarios. - Service Canada – Old Age Security (OAS) Clawback and Pension Rules

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security.html

Understanding how high income affects OAS and why income-splitting matters.

Financial Institution Guides

- RBC Royal Bank – Understanding Spousal RRSPs

https://www.rbcroyalbank.com/investments/retirement/spousal-rrsps.html

Accessible breakdown of who should use spousal RRSPs, examples, and attribution rule. - TD Canada Trust – RRSPs and Retirement Income Planning

https://www.td.com/ca/en/personal-banking/products/rrsp

Spousal RRSPs explained from a financial planning perspective, with eligibility and tax tips.

Trusted Financial Education Platforms

- Investor Education Fund (GetSmarterAboutMoney.ca) – RRSPs

https://www.getsmarteraboutmoney.ca/invest/investment-products/rrsps/

Ontario Securities Commission’s education platform for Canadian RRSPs and spousal RRSP strategies.

Feedback Questionnaire:

We’d love to hear your thoughts! Your answers will help us better understand how Canadians like you are planning their retirement together — and where you’re feeling stuck.

IN THIS ARTICLE

- RRSPs For Your Spouse In Canada: How You and Your Spouse Can Benefit

- A Simple Definition That Goes A Long Way

- Let’s Talk Strategy — Not Just Saving, But Planning

- Contribution Rules You Can’t Afford To Ignore

- The Attribution Rule: Don’t Let It Surprise You

- Real Numbers, Real Results

- What If You Both Already Have RRSPs?

- And What About Common-Law Couples?

- Separation And Spousal RRSPs: What Happens?

- TFSA vs RRSP: Can I Do This With My Spouse’s TFSA?

- Spousal RRSPs vs Pension Income Splitting

- Why Couples Choose Canadian LIC

- Final Thought

Sign-in to CanadianLIC

Verify OTP