- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

RRSP Loans In Canada: Should You Borrow To Invest In Your Retirement?

By Harpreet Puri

CEO & Founder

- 11 min read

- October 10th, 2025

SUMMARY

The blog explains how an RRSP loan in Canada works, when borrowing from RRSP contributions makes sense, and how interest rates, cash flow, and RRSP Withdrawal Rules affect results. It also reviews the RRSP Contribution Limit, the impact on retirement savings, and how tools like an RRSP Quote Online can guide Canadians in deciding whether borrowing money helps or harms their long-term Registered Retirement Savings Plan.

Introduction

Retirement feels far away… until it doesn’t. Bills, mortgages, groceries, kids’ hockey fees — all of it keeps chewing up income while the idea of saving for the future keeps getting pushed to the “someday” list. But then tax season rolls around, and you remember the Registered Retirement Savings Plan (RRSP). You realize you’ve got unused contribution room just sitting there, and the clock is ticking on the deadline. That’s when someone whispers about an RRSP loan in Canada — a way to borrow money just to stuff it into your RRSP. Sounds clever. But is it? Let’s talk about it like real people, not just a bank pamphlet.

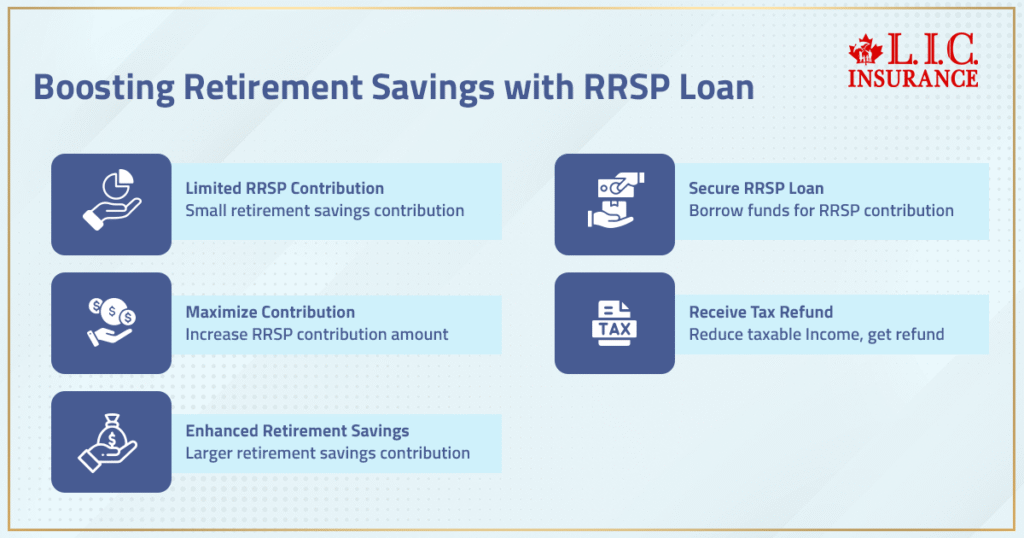

What Is An RRSP Loan?

An RRSP loan is exactly what it sounds like: the bank lends you money, but instead of spending it on a car or a trip, you throw it into your RRSP account. It’s not charity. You have to repay it, and you’ll pay interest too. But here’s why it’s tempting: making a bigger RRSP contribution before the deadline can shrink your taxable income and maybe score you a nice refund from the CRA.

Imagine this: you’ve got $4,000 saved up to put into your RRSP. But the deadline looms, and you realize your RRSP Contribution Limit is way higher. If you toss in another $3,000 using borrowed money, suddenly you’ve contributed $7,000 total. That pushes your refund higher. In some cases, the refund is almost the same size as the loan. You pay it back quickly, with minimal cost, and your retirement savings get a nice boost. On paper, it makes sense.

How Does An RRSP Loan Work In Real Life?

Let’s keep it human. You’re 35, decent job, juggling expenses. Tax bracket? Maybe around 40%. You can afford $4,500 cash into your RRSP. Then you borrow $3,000 from your bank. That’s $7,500 total. Multiply that by your marginal tax rate, and you’re looking at a tax refund of $3,000, which just happens to equal the loan you took. You turn around, pay off the loan, and boom: your debt is cleared, and your RRSP balance is higher.

This is the magic people talk about when they explain how an RRSP loan works. You use the refund to wipe out the debt. The cost? A little bit of interest, maybe a few weeks’ worth, depending on when you repay. But your retirement account is fatter, and time is on your side. Compound growth loves those extra dollars.

Interest Rates: The Deal Breaker Or Maker

Here’s the part banks don’t sugar-coat, but you still need to hear clearly: interest rates matter. Right now, prime rates aren’t exactly low. Let’s say your bank offers an RRSP line of credit or loan at prime + 1%. That’s what, 6.95% give or take? If your RRSP investments earn more than that over the long run — maybe 7%, 8%, or more — you’re fine. But if your portfolio is conservative and earns 4% or 5%, suddenly the cost of borrowing outweighs the gains.

It’s like running on a treadmill that’s going faster than your legs. You’re putting money in, but the interest keeps eating at the advantage. And no — unlike some types of investment loans — the interest you pay on an RRSP loan is not tax deductible. That kills the appeal for some folks.

Flexible Limits And Repayment Terms

Most banks, whether it’s RBC Royal Bank, TD, or others, offer flexible terms on these loans. Some let you borrow up to a certain cap based on your credit approval, your income, and how much contribution room you have left. Repayment can be stretched over 1 year, 5 years, or even 10 years. Some give you a deferred repayment period of 90 days — handy if you’re waiting on your tax refund to come in.

Here’s the kicker: you can often pay the loan faster if you want, without penalties. Extra payments? Allowed. Want to wipe it clean the moment your refund hits your chequing account? Go ahead. That’s why some Canadians treat it like a bridge loan — short-term debt, long-term gain.

The Impact On Cash Flow

This is the part that too many gloss over. Even with the best planning, debt is still debt. Adding another monthly payment to your budget affects your cash flow. If you’re already tight — mortgage, car, groceries, daycare — then squeezing in RRSP loan repayments might push you over the edge. Sure, you might have more money growing inside your RRSP, but if you’re stressing over day-to-day bills, was it worth it?

One of the things we tell clients: don’t chase the RRSP deadline at the expense of your sanity. You can also build your retirement savings slowly with regular RRSP contributions taken right off your paycheque. No borrowing, no interest rates, no stress. Just slow and steady growth.

When Borrowing Money For RRSPs Might Make Sense

Borrowing isn’t always bad. It can make sense if:

- You’re young enough that those dollars will invest and compound for decades.

- You’re in a higher tax bracket now and expect to be in a lower tax bracket when you retire, meaning the tax refund is sweeter today.

- You know you’ll get a big refund that can immediately pay off the loan.

In those cases, using an RRSP loan Canada strategy can really maximize your RRSP. Think of it as front-loading your retirement. You’re pulling future savings into the present so they can grow longer.

When It’s A Bad Idea

It’s a red flag if:

- You’re already juggling debt like credit cards or lines of credit with high interest rates. Adding more borrowing is risky.

- You can’t realistically repay the loan quickly. The longer you drag it out, the more you pay interest.

- You’re in a lower tax bracket, so the refund isn’t big enough to justify the move.

- Your income is unpredictable. Missing payments damages your credit and adds stress.

In these cases, it’s better to contribute at your own pace with smaller, consistent amounts.

What About Borrowing From Your RRSP?

Some Canadians confuse borrowing from RRSPs with taking an RRSP loan. Different thing. Borrowing directly from your RRSP is usually tied to the Home Buyers’ Plan or the Lifelong Learning Plan. Yes, you can withdraw funds without immediate tax penalties — but you must repay them over time, or they will be added to your taxable income. Different rules, different risks.

An RRSP loan, on the other hand, is outside money you borrow to contribute more. It’s not dipping into your savings — it’s adding to them. Big difference.

RBC Royal Bank And Other Financial Institutions

Big names like RBC Royal Bank and other financial institutions heavily market these loans in the weeks before the RRSP deadline. Ads everywhere. They highlight the benefits: bigger refund, bigger retirement balance. But remember, they make money off the interest rates you pay. Don’t take glossy brochures as financial gospel. Always crunch your own numbers, or better yet, sit with a financial planner who can lay out scenarios.

The Psychology Of Borrowing For Retirement

This part doesn’t get talked about enough. When you take a loan for a car or a house, you see and feel what you bought. When you borrow for an RRSP, it’s invisible. Your funds are tied up for decades. That lack of immediate payoff makes it harder for some people to stay motivated about repaying the debt. You’ve got to be disciplined — treating it like a real financial strategy, not a whim.

Should You Take The Leap?

At the end of the day, whether an RRSP loan makes sense comes down to three things:

- Your contribution room and how much you want to fill it.

- Your ability to repay quickly, ideally with a tax refund.

- Whether the expected growth of your investments will beat the interest rates on the loan.

If those align, then borrowing to invest in a Registered Retirement Savings Plan might be a smart move. If not, stick to regular contributions and avoid adding another line of credit to your life.

Final Thoughts

Saving for retirement isn’t easy in today’s world. Inflation, housing, kids — everything feels like it competes for your dollars. An RRSP loan work strategy can help you play catch-up and give your future a boost, but only if you approach it with eyes wide open. For some, it’s the right tool. For others, it’s a distraction.

We see both sides every tax season. Some families thrive using short-term borrowing to maximize their RRSPs. Others find peace of mind just making steady contributions, knowing their savings will grow at their own pace. Both paths lead to retirement — the real trick is choosing the one that fits your life, not your neighbour’s.

FAQs

Yes, but banks push them hardest around the RRSP deadline. You can apply anytime if you meet credit approval, but the big draw is using it to fill unused RRSP contribution room before tax season ends.

Most RRSP loans are tied to prime, so rising interest rates can make repayment more expensive. If you can repay faster, you’ll save on interest and keep your retirement savings strategy intact.

Absolutely. An RRSP loan shows up like any other debt. Making payments on time helps your credit, but missed payments can drag it down, even if the funds went straight into a Registered Retirement Savings Plan.

Not quite. RBC Royal Bank and other big players market RRSP line and loan products with different flexible limits, repayment schedules, and prime rate add-ons. Comparing options matters before signing.

Stretching repayment out is possible, but you’ll pay more interest over future years. If cash flow gets tight, talk to your bank about adjusting terms rather than risking missed payments on the loan.

Some do. RBC Royal Bank and other lenders may set flexible terms where the loan looks like a personal line of credit. The difference is that the funds must go directly into your RRSP account.

Yes, because you don’t have decades of compounding left. Borrowing late in life means the interest cost could outweigh the RRSP benefits, especially if you need to start repaying fast.

It can, but only if you manage cash flow carefully. A big early contribution grows longer, but if payments stretch your budget, you may not keep up with regular RRSP contributions in later years.

The faster, the better. If you clear it right after the tax refund comes in, you reduce interest charges. Letting debt drag on eats away at the retirement savings advantage you wanted in the first place.

Most financial institutions advertise flexible limits. You can usually repay extra without fees. That’s one of the hidden benefits — finish it off early and keep more money compounding.

Not always. The refund is smaller, which means less immediate cash to help repay. Some Canadians in a lower tax bracket prefer to contribute at their own pace instead of borrowing.

Key Takeaways

- RRSP loans in Canada can help boost contributions before the deadline, potentially creating a larger tax refund and more long-term retirement savings.

- Borrowing works best for those with steady cash flow, manageable debt, and an ability to repay quickly—especially when interest rates are low.

- Not all borrowers benefit equally. If carrying high-interest debt or lacking repayment stability, focusing on regular contributions may be wiser.

- Using an RRSP Quote Online and understanding RRSP Contribution Rules helps Canadians see if the numbers make sense before borrowing.

- While short-term borrowing can accelerate growth in a Registered Retirement Savings Plan, long-term success still depends on consistency and overall financial discipline.

Sources and Further Reading

Government & Regulatory Guidance

- Overview of RRSPs (Canada Revenue Agency)

Detailed official information on how RRSPs work, contribution rules, tax treatment, and withdrawals—straight from the CRA. Government of Canada - CRA Guide on RRSPs and Related Retirement Plans

A thorough guide covering technical definitions, contribution limits, and related registered plans like RRIFs and RPPs. Government of Canada

Financial Institution Insights

- TD’s RSP Loan Options and Features

Real-world details from TD Bank on RRSP loan products, including loan types (e.g., CarryForward, On-the-Spot), repayment terms, and interest rate options. TD Bank - RBC’s RRSP Loan Illustration

Example showing potential tax savings after accounting for interest and flex terms like deferred repayment. RBC Royal Bank - National Bank of Canada: RRSP Loans vs Lines of Credit

Breakdown of borrowing options, their ideal use cases, and typical loan structures—very practical comparison advice. National Bank

Independent Financial Commentary

- NerdWallet’s Analysis of RRSP Loans

Benefits and drawbacks in clear terms, with examples of when a loan can work—and when it might backfire. NerdWallet - Sun Life Canada on Borrowing to Contribute

Explains how borrowing for an RRSP can boost contributions and tax efficiency—while flagging risk. sunlife.ca

Expert Perspectives & Reader Questions

- “Should I Borrow to Invest?” (Boomer & Echo)

A personal finance blog that unpacks the psychology and practicalities of borrowing to invest, offering a cautionary viewpoint. Boomer & Echo - RBC Wealth Management PDF on RRSP Borrowing

Insight into how loan interest relates to after-tax investment returns, and why short repayment timelines matter. RBC Wealth Management

Together, these resources offer a well-rounded and trustworthy set of insights—from official guidelines to strategic analysis—that complement the guidance in your RRSP loan blog.

Let me know if you’d like help summarizing any of these into quick reference bullets for your readers!

Feedback Questionnaire:

IN THIS ARTICLE

- RRSP Loans In Canada: Should You Borrow To Invest In Your Retirement?

- What Is An RRSP Loan?

- How Does An RRSP Loan Work In Real Life?

- Interest Rates: The Deal Breaker Or Maker

- Flexible Limits And Repayment Terms

- The Impact On Cash Flow

- When Borrowing Money For RRSPs Might Make Sense

- When It’s A Bad Idea

- What About Borrowing From Your RRSP?

- RBC Royal Bank And Other Financial Institutions

- The Psychology Of Borrowing For Retirement

- Should You Take The Leap?

- Final Thoughts

Sign-in to CanadianLIC

Verify OTP