- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Personal Loan Protection In Canada 2025: How Insurance Can Safeguard Your Borrowing

By Pushpinder Puri

CEO & Founder

- 10 min read

- November 20th, 2025

SUMMARY

Personal Loan Protection Insurance in Canada offers a safety net for borrowers facing disability, critical illness, job loss, or premature death. Coverage can help with regular loan payments, reduce an outstanding balance, and protect credit when an unexpected event disrupts income. With options like credit insurance, Disability Insurance, and Critical Illness Insurance, families can secure their financial future while managing insurance premiums effectively.

Introduction

The 2025 reality is harsh and unforgiving: Canadian households currently carry an average debt-to-income ratio of more than 178 per cent, according to Statistics Canada. That works out to $1.78 in credit and loans held by Canadians for every dollar they earn. Families are still weighed down by lines of credit, balances on credit cards, loans for cars and mortgages. It’s not just numbers — it’s late-night stress about how to make your loan payments on time, the anxious pit in your stomach about missing a credit card payment, the terrifying thought of what happens if illness or disability or early death occurs.

Here’s where Personal Loan Protection Insurance in Canada comes into play. For over 14 years, we have been sitting across the table from families who thought they were doing fine — until something hit that no one could have predicted. A father who was laid off and had no way to pay the balance on his car loan. Young women who are diagnosed with critical illnesses in the middle of their mortgage term. A self-employed client who never thought he would ever be in an accident that could disable him for six months.

These aren’t abstract examples. They’re also the reasons we at Canadian LIC do everything possible to help consumers understand how Loan Protection Insurance works in reality, not just on paper. Let’s strip this down the way families should expect to hear it — with clarity, with honesty and from the perspective of your financial future as our focus. Indexed Universal Life and Variable Universal are two specialized avenues in the permanent Life Insurance universe. And in 2025, when the markets are volatile and the interest rates aren’t guaranteed, the downside buffering protection of an IUL is attractive. But VUL remains — for those willing to tilt into market risk for potentially higher upside.

We refuse to take sides. We build comparisons, we model universal Life Insurance quote online scenarios for each, and we advise clients on trade-offs: cost, risk, flexibility and legacy goals.” The “best Life Insurance plan” is not one-size-fits-all — it’s the one designed around your life.

Understanding Loan Protection Insurance

Boiled down, Loan Protection Insurance is a safeguard. It provides you a safety net in case life throws an unforeseen event—disability, critical illness, job loss or death — and the outstanding balance and your regular loan payments do not fall back on your family.

From borrowing for your personal line of credit, to paying off a loan to mitigate risk or an insured credit card balance, this type of insurance coverage is meant to offer protection for yourself, the lender and ultimately, your spouse.

These policies, frequently underwritten by major insurers like Canada Life Assurance Company, are available from Banks and credit unions across the country — including RBC, TD and Desjardins. They’re not always sold well, but when structured properly, these benefits can be the difference between financial planning that remains on solid ground and a catastrophic fall.

Credit Insurance: Covering Loans When Life Gets Hard

Credit insurance is one of the largest products in this space. This coverage is directly related to the money you’re borrowing — be it for that car loan, personal loan or lines of credit. Unlike Traditional Life Insurance, which pays your family, credit insurance is intended to ensure that the lender receives payment and that your loan balance is either paid off or reduced.

That may seem as if it’s only protecting the bank, but in a practical sense, it protects your family from inheriting unpaid debt. It spares your spouse the need to scramble to make regular loan payments once income stops suddenly. It also safeguards your credit score, something that is much longer-lasting in Canada and affects everything from mortgage approvals to interest rates.

Insurance Premiums: What Drives The Cost

Every borrower asks the same question: how much will this added cost set me back? The insurance premiums for loan protection depend on several factors:

- Age: Younger borrowers often pay less.

- Loan balance: Higher outstanding balances lead to higher premiums.

- Coverage type: Choosing between life, disability, or Critical Illness Insurance alters the cost.

- Term length: The duration of your loan agreement affects premiums.

- Overall health: For some products, your health may determine whether you’re automatically approved or asked to complete a questionnaire.

The key here is balance. The premiums should never outweigh the peace of mind or protection they provide. As a professional advisor, my role is to walk clients through the math, compare options, and ensure their insurance coverage aligns with both budget and financial health.

Disability Insurance And Loan Protection

Now let’s take up the situation that most frightens Canadians: disability. The numbers speak volumes: Approximately 1 in 3 Canadians becomes disabled for a period of at least 90 days before the age of 65. That’s not small talk—that’s reality.

Similarly, a Personal Loan Disability Insurance Plan will benefit you by having the insurer make your regular periodic loan payments when illness or injury prevents you from working until recovery or the coverage expires. These disability benefits don’t eliminate your entire loan balance, but they provide you with breathing space.

I have personally known self-employed contractors and professionals who, when they had a serious accident, saved their homes from bankruptcy because Loan Protection Insurance Canada payments automatically jumped in to make these payments. That’s the difference between piling up debt and having a fighting chance to rebuild your income.

Critical Illness: The Silent Threat To Borrowers

Critical illness is the one that most people underestimate. It’s not only being sick that is at stake, but what costs accrue when serious illness strikes. A cancer diagnosis, a stroke or a heart attack can upend income streams for months if not years.

Under Critical Illness Insurance, some lenders will pay all or some of your insured loans or lines of credit once you receive a diagnosis for a covered critical illness. It won’t just save your credit — it saves you from having a financial future eaten alive by debt repayments while you’re fighting for your life.

Back when I was working, there was a family where the breadwinner had a covered critical illness. All of their home and vehicle loans were insured, and within weeks, the claims form process cancelled thousands in overdue balances. Without it, their family would have been left with not just hospital bills but foreclosure.

Why Loan Protection Matters For Financial Planning

It’s easy to believe one can “self-insure” — that savings will be enough in an unexpected event. But the reality is this: A 2024 survey found that most Canadians have less than $5,000 in liquid savings. That won’t last long if you have to cover loan payments for months.

Loan protection is an underutilized but powerful wealth tool in planning your finances. It prevents any cash devotee from being nibbled away at by debt, or eaten away at investments, retirement savings and children’s education funds. It allows families to keep their financial health intact when life throws them a curveball.

Unlike traditional Life Insurance or disability, the benefits of a Loan Protection Insurance Policy are laser-focused: keep your loans current, keep your credit in good shape and protect your family.

Insurance Coverage Options: Tailoring To Your Needs

When clients sit down with me, we often ask them bluntly: “If you couldn’t pay your loan tomorrow, who would?”

Here’s how insurance coverage breaks down:

- Life Insurance Coverage: Pays down or pays off your insured loans if you die prematurely.

- Critical Illness Insurance Coverage: Pays off all or part of your insured lines of credit or loans if diagnosed with a covered critical illness.

- Disability Insurance Coverage: Keeps your loan payments current if you can’t work due to disability.

The best solution is often layered—combining types of protection depending on your age, loan type, and family responsibilities.

Life Insurance And Loan Protection: What’s The Difference?

Some clients ask: “I already have a Life Insurance Policy—why add loan protection?”

Here’s the answer: Traditional Life Insurance pays a lump sum to your loved ones. Loan Protection Insurance ensures specific loans are covered, no matter what. This reduces stress during probate and prevents lenders from clawing at your estate.

Both have roles. Life Insurance secures your family’s future, while Loan Protection Insurance works to ensure that lenders don’t take away the roof over their heads.

Lines Of Credit: Why They Deserve Protection Too

Lines of credit — a flexible form of borrowing that many Canadians use — often carry larger amounts than their personal loan balances. So, how does missing or being late on line of credit payments, which don’t have fixed loan payments, spiral quickly into ruined credit and collections?

The addition of insurance to protect against unexpected loan repayment within lines of credit means that things can continue even amidst job loss, disability or illness. It’s not just a matter of covering debt — it’s about maintaining the flexibility and sense of confidence that lines of credit provide borrowers.

Disability Benefits And The Claim Form Process

Families’ most difficult task, when the time comes, is often filling out a claim form. We shepherd each step: documentation gathering, insurer negotiations and making sure benefits are paid promptly.

Disability Insurance Coverage usually pays loan installment payments directly to the lender so the borrower can focus on getting better without incurring financial hardship. Death/Critical illness claims may pay off the entire balance. Either way, how quickly and straightforwardly the claims process works is as important as what’s in the policy.

The Role Of Credit Card Balance Protection

There’s also the stealth debt that often creeps up on Canadians: The balance on the credit card. At interest rates that can top 19% in some cases, falling behind even a month can put you in a rut that’s hard to escape.

You have credit card balance protection (Loan iInsurance), which will cover the minimum payment in the event of disability, sickness, or death. It’s not sexy, but it keeps credit from collapsing at the worst possible time.

Insurance Plans And Enrollment Process

It’s typically easy to enroll in insurance plans associated with loans. And many add premiums right into your loan agreement. And some provide independent Personal Loan Insurance Policies direct from financial institutions.

Enrollment itself usually entails just a few health questions. Many banks approve coverage automatically for balances under $100,000. Larger numbers might call for greater detail. But the convenience is real: A single policy tangled up with the loan and there to protect you without any additional questions or complexity.

Protecting Your Financial Future

Ultimately, Loan Protection Insurance Canada is more than just protecting banks — it’s about ensuring your financial future.

It’s so that your family won’t lose a home as a result of missed mortgage or personal loan payments. It means your children will not see savings for education drained to meet debt. It means your spouse will not be kept up at night trying to figure out how you’re going to pay the credit card bill on top of medical bills.

Life is fragile. Work is uncertain. But if you have the right insurance plans, debt doesn’t need to be your family’s storyline.

Protecting Your Financial Future

Ultimately, Loan Protection Insurance Canada is more than just protecting banks — it’s about ensuring your financial future.

It’s so that your family won’t lose a home as a result of missed mortgage or personal loan payments. It means your children will not see savings for education drained to meet debt. It means your spouse will not be kept up at night trying to figure out how you’re going to pay the credit card bill on top of medical bills.

Life is fragile. Work is uncertain. But if you have the right insurance plans, debt doesn’t need to be your family’s storyline.

Final Word From Canadian LIC

We have seen that debt protection has been underestimated by clients for 14 years now. They think they’ll “figure it out” if illness or disability strikes. Still, week after week, I counsel new families who are blindsided when reality hits.

The Loan Protection Insurance Policy benefits aren’t hypothetical — they’re lifelines. And in a Canada where debt levels are rocketing, that would be a gamble nobody can afford to make.

We don’t peddle fear. We sell preparedness. We guide customers to compare a Loan Protection Insurance quote online – help them understand the coverage options – and make sure they’re not just borrowing money, they’re protecting their borrowing.

In 2025, debt is a given. Protection should be too.

FAQs

Not at all. Even smaller borrowing, like car financing or a credit card balance, can be tied to loan protection. What matters is keeping your credit clean and your lender calm when an unexpected event shakes your income.

Life Insurance supports your family, but loan protection clears insured loans directly. It’s a separate safety layer, keeping savings and payouts intact instead of being drained by credit payments.

Most don’t make it mandatory. Banks and credit unions usually offer it as an option. But many borrowers choose it to avoid stress about an outstanding balance if disability or critical illness ever strikes.

Policies are usually tied to the specific loan agreement, not the borrower’s whole financial future. If you refinance or close the loan, the protection ends, and you stop paying insurance premiums automatically.

Yes, many insurance plans allow coverage on multiple insured loans at once. Each lender may have its own enrollment process, so you’d often need separate protection tied to each loan balance or line of credit.

Most financial institutions calculate premiums based on the current balance and your age at enrollment. That means as you pay down the loan, your cost may shrink too, unlike regular Life Insurance, where premiums usually stay level.

Some lenders include job loss as an extra option, but it’s not always standard. You’d need to check if involuntary job loss is listed in your coverage details before assuming loan payments would be covered.

It depends on the claim form and how quickly documents are provided, but insurers usually try to step in before missed payments damage your credit. The goal is to keep credit payments current while you recover.

Eligibility varies. Certain conditions may limit how much insurance coverage you qualify for, but many banks still approve insured loans up to a set limit without deep medical underwriting.

Not all, but many Loan Protection Policies in Canada are underwritten by Canada Life Assurance Company. Other insurers and credit unions may use different providers depending on the product.

Key Takeaways

- Personal Loan Protection Insurance in Canada keeps loan payments going when disability, critical illness, or death stops income.

- Coverage like credit insurance, Disability Insurance, and Critical Illness Insurance ensures lenders are paid without draining family savings.

- Insurance premiums are usually tied to the loan balance and added to regular payments, making protection simple to manage.

- Protection prevents an outstanding balance from damaging credit and gives families breathing room during an unexpected event.

- Loan protection isn’t just for banks—it safeguards the borrower’s financial future when health, income, or stability collapse.

Sources and Further Reading

- Statistics Canada – Household Debt & Debt Service Ratios

Debt service ratio in Canada (interest + principal payments / disposable income) hovered around 14.40 % in Q1 2025. Statistics Canada

Household debt-to-disposable income ratio in Q1 2025: ~176.4 %. search.open.canada.ca+1 - Canada Life – Creditor / Credit Protection Insurance

Provides information on how creditor insurance (loan protection) helps pay down or maintain payments if death, critical illness, or disability strikes. Canada Life

Their “Protection For Your Personal Loan” certificate outlines the life & disability cover amounts and conditions. Canada Life - Canada Life – RBC LoanProtector Insurance

RBC’s LoanProtector product offers life, disability, and critical illness options to protect personal loans or lines of credit, underwritten by Canada Life. RBC Royal Bank

The certificate shows eligibility, benefit structure, and how disability & Life Insurance components work together. Canada Life - Government of Canada – Credit / Loan Insurance Overview

The Financial Consumer Agency of Canada explains how credit or Loan Insurance helps with loan repayment in events like job loss, critical illness, death, or accident. Canada.ca - TD / Canada Life – Personal Loan & Line Of Credit Protection

TD’s product guides describe how their creditor insurance covers death, disability, accidental dismemberment, and critical illness for loans and lines of credit. Canada Life

Their line-of-credit product guide includes specifics of maximum coverage, eligibility, and how payout is calculated. TD Canada Trust - CIBC – Creditor Insurance On Personal Loans

CIBC’s site explains protection options for their personal loans: disability, death, and involuntary job loss to maintain or pay off loan balances. cibc.com

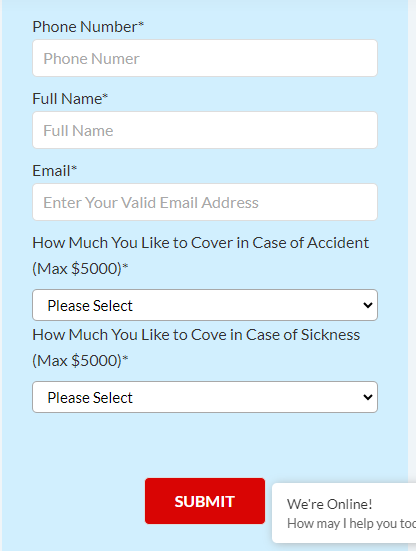

Feedback Questionnaire:

We’d love to hear your thoughts. Your answers will help us understand the real challenges Canadians face when it comes to Personal Loan Protection Insurance.

IN THIS ARTICLE

- Personal Loan Protection In Canada 2025: How Insurance Can Safeguard Your Borrowing

- Understanding Loan Protection Insurance

- Credit Insurance: Covering Loans When Life Gets Hard

- Insurance Premiums: What Drives The Cost

- Disability Insurance And Loan Protection

- Critical Illness: The Silent Threat To Borrowers

- Why Loan Protection Matters For Financial Planning

- Insurance Coverage Options: Tailoring To Your Needs

- Life Insurance And Loan Protection: What’s The Difference?

- Lines Of Credit: Why They Deserve Protection Too

- Disability Benefits And The Claim Form Process

- The Role Of Credit Card Balance Protection

- Insurance Plans And Enrollment Process

- Protecting Your Financial Future

- Final Word From Canadian LIC

Sign-in to CanadianLIC

Verify OTP