- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Pension Vs. Group Rrsp In Canada: Which One Will Maximize Your Retirement Income?

By Pushpinder Puri

CEO & Founder

- 12 min read

- August 26th, 2025

SUMMARY

The comparison between Pension Plans and Group Registered Retirement Savings Plans highlights how each impacts retirement income, tax savings, and flexibility. It examines RRSP Withdrawal Rules, contribution limits, and other benefits while considering super visa insurance eligibility and RRSP quote online options. Readers gain insights into maximizing long-term retirement savings and selecting the most affordable Registered Retirement Savings Plans in Canada for their needs.

Introduction

There does not have to be much digging to identify the problem — around 46% of working Canadians are said not to be saving enough capital for living in retirement. That’s not a scary headline. That is what is revealed by many of the retirement income surveys that have run recently. This is more than just a factor of how much people save, but where that saving goes after the fact. Canadians are eligible for pensions for some. Some of us have RSP group plans with our employers. And more than a few are juggling both, but remain terrified of outliving their $80,000 in retirement savings — not just the immediate bills or deep into some day-after-tomorrow scenario that involves travel and hobbies and an extra pillow of money for family.

It is a delicate, yet constant, war of attrition on your finances. It is discussed less often around dinner tables, but the questions are very similar: “If my company offers a pension, should I put money into the group RRSP at all?” or “Will RRSP withdrawals get me harder on my T1 than I think?” These aren’t abstract issues — they turn up in paycheques, annual contribution-room statements, and even arguments over whether it’s OK to splurge on a vacation instead of stuffing extra money into your nest egg.

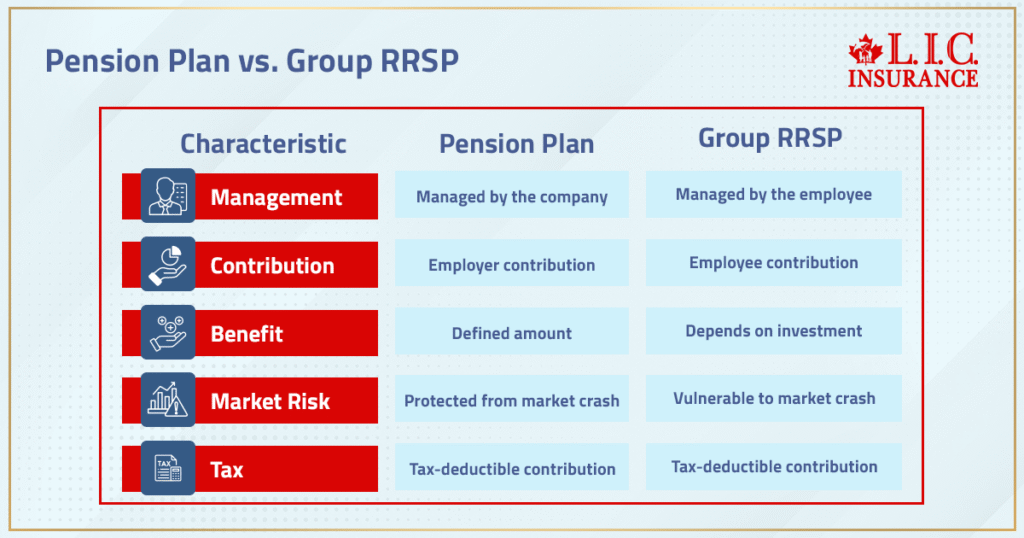

The Real Difference Isn’t Always About Rates or Fees

That is, other than return, you may be thinking that the major difference between a Pension Plan and a Group Registered Retirement Savings Plan is. In reality, though, the form work and tax treatment are important than performance numbers. Basically, a group RRSP is a bunch of individual RRSPs in Canada that are pooled at work via your employer and managed by you. You make a tax-deductible contribution out of each paycheck (or in some cases an equivalent match from your employer), which reduces the amount of taxable income you report that year. While it is easy to get an RRSP quote online and compare fees, where the entire thing really begins to work its magic is in how it relates back to your RRSP contribution room and long-term retirement income strategy.

By contrast, there are two primary types of pensions — defined benefit and defined contribution. Your retirement earnings are set as a dollar amount in the defined benefit plan based on salary and years of service. You need not worry about the market crashing just before you are ready to retire. On the other hand, it operates similarly to an RRSP in that your future income will depend on how well those investments perform rather than a defined benefit plan.

How Taxes and Withdrawals Affect Your Choice

This is where it separates the boys from the men — when RRSP Withdrawal Rules in Canada come into play. If and when you withdraw from your group RRSP, those withdrawals are, in fact, taxed as income for the tax year. That is, the most important question may be what your marginal tax bracket will look like when you retire — after all, if you opt for a lower income and therefore a lower tax rate, that bite could be nearly nothing. However, suppose you are also supplementing with rental property income, non-registered investment or a business for which you still receive investment income. In that case, you may push yourself into a higher tax bracket and end up paying more than expected.

More often than not, pension income is also taxable. Here is the catch: some types of pension income can be split with your spouse in order to create income splitting that reduces your household tax bill once you turn 65. Unlike RRSPs, your pension payments are regular monthly amounts, and you do not have to decide how much, if anything, to withdraw each year. While this predictability can be a blessing for some, it takes away the flexibility that others would otherwise prefer to control better when they would take these withdrawals (and hopefully have them taxed more advantageously).

Why The Order of Decision-Making Matters

In fact, there are even a few people who try to equate pensions with group RRSPs as if they were trying to compare two menus of investment options available on a website. But it’s not quite apples-to-apples. For most companies, you never really made a choice — your employment automatically meant enrolling in a company Pension Plan or group RRSP. Usually, the decision involves whether to contribute something to the plan, more than that to a TFSA outside the plan, or save it in your RRSP, where contribution room may be unused from previous years.

And this is how financial advisors can struggle to justify their existence. A good financial advisor will not only say which plan seems to be better — they will calculate it in your income tax return, with your RRSP contribution, and how much more money you actually have after tax. They will take into account the effect on your combined retirement income of Canada Pension Plan benefits, entitlement to a guaranteed income supplement, and old age security clawbacks down the road.

The Emotional Side Nobody Puts in a Chart

Money decisions aren’t just spreadsheets. I have observed clients — one in a de facto relationship, another single parent — each with comparable earned income but very different risk preferences. The first was content spinning the fact that they had a DB pension, comfortable in their expectation of full OAS and a reliable income for life. The second option felt restrictive due to the lack of flexibility, leading him to opt for a group RRSP over the permanent savings plan. Additionally, he invested some funds in a tax-free savings account for quick access to cash in emergencies.

This is why retirement planning isn’t just about “which pays better”. The peace of a fixed income stream might matter more for the select few than chasing capital gains or creating their own portfolio of mutual funds. For others, control outweighs predictability.

Shuffling the Comparisons — Thinking Beyond the Usual Order

Rather than just start with pensions, let’s go right to what a group RRSP offers, and in cases where flexibility is top priority. Suppose you want to retire early and push off collecting Old Age Security pension or Canada Pension Plan benefits until later for a larger payout. A group RRSP allows you to take out any amount of money each year to help minimize your income tax and avoid getting booted from other benefits, i.e., guaranteed income supplement.

For the pensionist, on the other hand, it is as plain as a nested bean soy as someone can forget something. Your pension adjustment appears on your T4, so this amount gets subtracted from your overall RRSP contribution room, although you do not have to worry about investing or deciding when markets are oversold. And if your employer includes indexing in a defined benefit plan, you have automatic inflation protection, which an RRSP does not.

Contribution Limits and Overlap

Both options are subject to a contribution limit. Your group RRSP and personal RRSP both have a limit called the RRSP contribution limit, so if one of these accounts is already maxed out, it leaves less room for the other. This is not so with pensions (work-related) — your contribution and any employer contributions are assessed via a pension adjustment that decreases your RRSP room. Some workers with strong Registered Pension Plans often find that their RRSP contribution room is very limited.

And remember — if you do contribute more to your RRSP than that buffer of $2,000, you might end up having to pay a tax on the excess.

How Age Security and Tax-Free Accounts Fit In

Regardless of which main course you select, adding a TFSA can be a sauce. It would not be considered taxable income upon your withdrawal, thereby removing any age security implication that you are earning enough money to cause an old age security clawback. And as such, it’s also a great way to store cash for rainy-day or income smoothing needs in years when your pensions and RRSP withdrawals would otherwise push you into a higher tax bracket.

Pension Plan vs. Group Registered Retirement Savings Plan

| Feature | Pension Plan | Group RRSP |

|---|---|---|

| Definition | An employer-sponsored plan that promises a set retirement income, often through a defined benefit or defined contribution model. | An employer-sponsored registered retirement savings plan where contributions are invested and grow tax-deferred until withdrawn. |

| Contribution Limit | Determined by pension rules and the pension adjustment reported on your income tax return. | Follows the RRSP contribution limit set by the Canada Revenue Agency, reduced by any pension adjustment. |

| Investment Choices | Limited; managed by the pension fund administrator with less personal control. | A wide range of investment options, like mutual funds and ETFs, offers more flexibility. |

| Funding Source | Funded by employee contributions and employer contributions, the employer often covers a significant portion. | Funded by employee contributions, often with employer matching up to a certain percentage. |

| Retirement Income | Provides guaranteed income (for defined benefit plans) or income based on contributions and investment performance (for defined contribution plans). | Retirement income depends entirely on contributions and investment growth; no guarantee of lifetime payments. |

| Tax Treatment | Contributions reduce taxable income; pension income is considered taxable income when received in retirement. | Contributions reduce taxable income; withdrawals follow RRSP withdrawal rules and are taxed as income. |

| Flexibility | Low flexibility — payouts often structured as monthly payments for life. | High flexibility — funds can be withdrawn anytime (subject to taxes), and can be converted to a registered retirement income fund at retirement. |

| Risk | For defined benefit plans, the employer bears the investment and longevity risk. | Individual bears all investment risk; returns vary based on market performance. |

| Portability | Less portable; may need to be transferred to a locked-in retirement account if you leave your job. | Highly portable; can transfer to a personal RRSP without tax penalty. |

| Other Benefits | May include survivor benefits, inflation protection, and eligibility for a guaranteed income supplement. | Allows greater control, more potential tax savings, and the ability to align with your own portfolio strategy. |

Where Canadian LIC Often Sees Clients Trip Up

When it comes to the math and helping clients compare Group RRSPs vs. Pensions, we have seen many mistakes as well — but that’s not where the vast majority are: they’re in the impacts of how withdrawals from an RRSP will affect projections for filing an income tax return or how much more (or less) purchasing power someone can expect over a 30-year life expectancy with indexing (or lack thereof) on their company pension. Though, as many retirees also forget, a pension terminates when you die (unless you are paying for survivor benefits), while RRSPs live on for the heirs and likely create capital gains or non-registered account problems.

FAQs

Yes — some employers provide a registered Pension Plan while also allowing voluntary contributions to a group registered retirement savings plan. The catch is that your pension creates a pension adjustment that lowers your available RRSP contribution room, so the two need to be coordinated carefully.

Withdrawals from a group RRSP can raise your taxable income, which may reduce your Old Age Security or guaranteed income supplement eligibility. Strategic withdrawal timing can help you keep more of these other benefits, especially when balancing with Canada Pension Plan income.

A group RRSP typically lets you select from a range of mutual funds and other investment options, so you can tailor your portfolio based on risk tolerance. In contrast, most company Pension Plans pool contributions into a standard fund, limiting your investment choices but simplifying management.

If you leave a job with a group RRSP, you can transfer the balance to your own registered retirement savings plan without triggering tax. With a Pension Plan, your options may include a lump-sum transfer to a locked-in account or leaving it in the company pension until retirement age.

Withdrawals from a group registered retirement savings plan follow the same RRSP Withdrawal Rules in Canada as individual plans. The amount withdrawn is considered taxable income in the year you take it out, and your marginal tax rate determines how much you’ll owe.

Yes — a tax-free savings account can complement your group RRSP by offering flexibility for short-term needs without affecting your income tax return. This pairing helps balance long-term retirement income goals with accessible tax-free savings.

Not always. While group RRSPs provide tax deductions and employer contributions, non-registered investments offer no withdrawal restrictions. The choice depends on your tax bracket, investment income strategy, and desired retirement savings timeline.

The RRSP contribution limit for a group RRSP is combined with your personal RRSP room. You can check your available contribution room each year on your tax return or through the Canada Revenue Agency’s online account.

A financial advisor can assess your retirement savings plans, company pension benefits, and RRSP contribution strategy. They help align your retirement planning with tax efficiency, income security, and lifestyle goals in retirement.

Key Takeaways

- Both Pension Plans and Group Registered Retirement Savings Plans can grow your retirement savings, but each offers different tax and withdrawal flexibility.

- Affordable Registered Retirement Savings Plans in Canada provide portability if you change jobs, while pensions offer predictable income but less control.

- Understanding RRSP Withdrawal Rules helps you avoid unnecessary taxes and keep more of your money in retirement.

- Comparing options with a qualified advisor ensures you choose the structure that supports long-term retirement income stability.

Sources and Further Reading

- Government of Canada – Registered Retirement Savings Plan (RRSP)

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans.html - Government of Canada – Pensions and Retirement Income

https://www.canada.ca/en/services/benefits/publicpensions.htm l - Financial Consumer Agency of Canada – Pensions and Retirement Savings Plans

https://www.canada.ca/en/financial-consumer-agency/services/retirement-planning.html - Canada Life – Understanding Group RRSPs and Pension Plans

https://www.canadalife.com/ - Sun Life – Comparing Retirement Savings Options in Canada

https://www.sunlife.ca/

Feedback Questionnaire:

Help us understand your challenges so we can provide better guidance.

IN THIS ARTICLE

- Pension Vs. Group RRSP In Canada: Which One Will Maximize Your Retirement Income?

- The Real Difference Isn’t Always About Rates or Fees

- How Taxes and Withdrawals Affect Your Choice

- Why The Order of Decision-Making Matters

- The Emotional Side Nobody Puts in a Chart

- Shuffling the Comparisons — Thinking Beyond the Usual Order

- Contribution Limits and Overlap

- How Age Security and Tax-Free Accounts Fit In

- Where Canadian LIC Often Sees Clients Trip Up

Sign-in to CanadianLIC

Verify OTP