- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Money Back Vs Endowment Policy In Canada 2025: Key Differences Explained

By Pushpinder Puri

CEO & Founder

- 10 min read

- November 05th, 2025

SUMMARY

Compare Money Back Life Insurance Policies and Endowment Plans based on returns, maturity benefits, and flexibility in Canada. Learn how Money Back Insurance Plans can offer periodic payouts, while Endowment Policies focus on lump-sum returns. Understand long-term advantages, tax implications, and premium costs tied to each option to align your goals with the right protection strategy.

Introduction

Have you ever sat there staring at your bank app and thought, “Where’s all my money going?”

Yeah. Same. Especially when we talk about Life Insurance. Paying in year after year… and for what? If nothing happens to you, you get nothing?

That’s the part that doesn’t sit right with most people. Which is why this question comes up constantly:

“Do I get my money back if I don’t die?”

And honestly, it’s a fair question.

So let’s talk about the two options that actually do something for you while you’re still here: Money Back Life Insurance Plans and Endowment Policies. They sound similar. They’re not. I’ve seen families win and lose financially just because they picked the wrong one for their lifestyle. You’re smart for digging deeper.

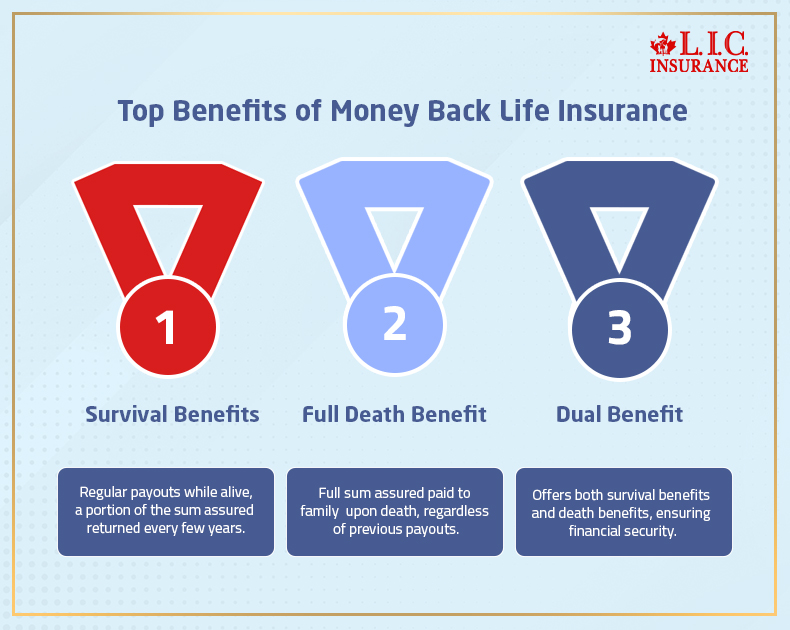

What Is A Money Back Life Insurance Plan?

This one’s got a rhythm to it.

You pay your premium payments like any other Life Insurance Policy, but instead of waiting till the end of time, your policy starts giving back a portion of the sum assured every few years. These are called survival benefits. Think 15%, 20%, maybe more — depends on your insurance provider.

You’re alive? You get money back.

But here’s the kicker — if the life insured dies during the policy term, the full death benefit is still paid out to the family. It doesn’t matter how many payouts were already given. That’s built in.

So you’re alive? You win.

You’re not? Your loved ones win.

That’s what people call a dual benefit.

What Is An Endowment Policy?

Completely different energy.

You’re still paying premiums, sure. But there are no mid-way payouts. No bells. No confetti.

You stay put. The policy grows quietly.

And when it ends — whether it’s 15, 20, 30 years — you get a lump sum. That includes the sum assured plus accumulated bonuses, if any.

If you die before that? Your nominee still gets the full Life Insurance Coverage.

This is for people who don’t want temptation. You’re letting the savings component mature in peace. No interruptions. Just quiet growth.

It’s like planting a tree and not picking at it every season. You wait. It gives you shade when you need it most.

Comparing The Two: Which One Makes Sense?

It’s not a battle. It’s a compatibility test.

The difference in insurance coverage matters most when you think about liquidity. Endowment Plans give you access at the end. Money Back Life Insurance Plans let you enjoy the ride a little.

Who Should Consider A Money Back Policy?

Let’s keep it simple:

- Young parents pay for daycare or tuition.

- Business owners with irregular income who want access to cash value without waiting decades.

- Retirees who don’t want to wait till they’re 80 for their policy to finally pay them.

- Anyone who wants more control.

You’ll still get the death benefit, but you also get a kind of living benefit. It’s a popular choice because it’s visible. Tangible.

Who Should Go For An Endowment Plan?

This one’s more traditional.

It works beautifully for people who want a forced saving mechanism. You don’t touch it. It grows.

It’s for:

- Long-term planners saving for retirement

- Parents saving for a future wedding or home

- Professionals who already have Term Insurance Plans but want something that builds slow, steady wealth

And don’t forget, a good Endowment Policy from a trusted insurance company might include investment components with tax-free growth, provided it stays under the exempt rules in the Income Tax Act.

Do These Plans Offer Tax Benefits?

Yes — both do.

Under the Income Tax Act, policies structured properly usually provide:

- Tax-free maturity benefit under Section 10(10D)

- Tax benefits on the premium paid under Section 80C

- And no tax on the cash surrender value if you keep the plan intact

But — and this is important — if you start messing with the plan, surrendering early, or borrowing against it, the tax laws get a bit less friendly.

This is where most people get blindsided. Talk to a real financial advisor (we know a few) before tweaking anything.

The Role Of Insurance Companies

Don’t just pick any insurance company offering the lowest Term Life Insurance Premiums.

Look at things like:

- Policy guarantees

- Historical bonus performance (for Endowment Plans)

- Flexibility with payout structures

- Claim settlement ratios

We compare across multiple insurance providers to get you a plan that actually matches your timeline, goals, and even your risk profile.

You’d be shocked at how much the details differ between policies that look identical on the surface.

When Money Back Feels Like A Better Fit

You want structure, but flexibility too.

You want to fund short-term goals while staying covered.

You want to buy Life Insurance, but still see something come back.

We’ve seen Money Back Plans work great for:

- Families with kids entering college in 5–10 years

- Self-employed folks who want to keep some liquidity

- People are trying to meet multiple financial goals at once

Just make sure the premium payment term matches your cash flow reality. You don’t want to miss a premium and risk the whole thing.

When Endowment Wins The Race

You’re disciplined. You want something you don’t have to check every quarter.

You don’t need cash now. You want it later, when you’ll need it more.

You’re thinking 15, 20, 25 years ahead.

Endowment Policies offer Life Insurance Protection, wealth-building, and a simple yes/no structure. You pay. You wait. It pays back. Easy.

They work beautifully for future financial goals like:

- Retirement security

- Home down payment

- Structured generational wealth

Especially if you want to accumulate wealth without worrying about taxable income year to year.

The Final Word

Here’s the truth.

Both Money Back and Endowment options can be incredible.

And both can be a total mismatch — if you don’t choose based on your actual life.

We’ve had clients come in asking for Money Back Policy quotes online and end up choosing a hybrid product that gave them more flexibility. We’ve also had parents walk in thinking endowment is too slow… and 30 minutes later, they’re sold on it after we break it down.

You need:

✔️ A plan that fits your real life

✔️ Clear, honest info about insurance coverage

✔️ Flexibility for where you are now — and where you’re going

We do that every day, not just because we sell policies. But because most people don’t get to learn this stuff anywhere else.

No pressure. No jargon. No empty promises. Just what makes sense.

Let’s build the right path together — one you’ll actually be proud you picked.

FAQs

Technically? Sure. But it’s not like swapping a phone plan.

You’ll probably lose cash value or even take a hit on the sum assured.

Most insurance companies don’t let you “flip” policies mid-term just like that.

We’ve seen people try. It usually doesn’t go well. Ask before you leap.

Honestly, don’t. Just don’t miss it.

Some insurance providers give you a grace period, but after that? Trouble.

You might lose your Life Insurance Coverage, or worse, wreck the payout schedule.

And you’d be mad if that happened the same year you were due a payout.

Yeah, some riders can be bolted on — Critical Illness Cover is one.

But don’t just add stuff to feel fancy. It affects your Term Life Insurance Premiums.

Make sure you’re not just inflating your policy with things you won’t use.

Protect your blind spots. Not your ego.

Short-term? Not really.

These aren’t fast-money machines — they’re for the patient people.

You don’t buy an Endowment Insurance plan hoping to use it next year.

That’s what Money Back Life Insurance Plans are for.

Yeah, but early on, don’t expect much.

You’d barely cover a weekend grocery run if you exit too soon.

That said, if you hang on long enough, the cash surrender value builds up.

Let it simmer. Or it’s not worth it.

Mostly, yeah.

They’re under the Permanent Life Insurance umbrella, but not as extreme as Whole Life.

They’ve got structure. A start and an end. Not for your entire life.

It’s like semi-permanent paint. Still does the job.

If you just let it be? Nope.

But start pulling money out or surrendering it, and… now the Income Tax Act cares.

Most maturity benefits are tax-free if you stay within the rules.

Key word: if. Don’t wing this part.

Start with someone who doesn’t treat you like a number.

Then look at how their insurance products are actually built.

Some focus more on investment components, others on cheaper premiums.

We’ve seen the cheapest plan cost people way more in the end. Ask questions.

You can, but not everyone should.

Stacking Term Life Insurance on top of a Money Back Plan can work if you’re under-covered.

Just don’t assume more policies = better plan. Sometimes it’s just more confusion.

If you’re gonna do it, keep one for financial protection, one for flexibility.

Sometimes? Not at all. Depends on how the insurance company performs.

Bonuses aren’t guaranteed, even if your buddy got one last year.

If your plan is “with profits,” you might get accumulated bonuses. No promises.

Best to plan for the sum assured alone. Treat bonuses like surprise money.

Not really the main tool for that, no.

You’d be better off with Whole Life Insurance for estate or financial legacy planning.

Money Back Plans are more for mid-term goals and liquidity, not end-of-life transfers.

But yeah, it still counts toward total Life Insurance Coverage if you’re doing the math.

Shorter term = heavier payments. Longer term = more manageable.

But longer doesn’t always mean better — you might end up paying more over time.

Also, some plans let you pay early and still keep Life Coverage going after that.

It’s about pacing. Not just price.

Key Takeaways

- Both money back and Endowment Policies offer savings + insurance, but Money Back Plans provide periodic payouts, while Endowment Policies pay a lump sum at maturity.

- Money Back Insurance is ideal for short-term liquidity needs, such as children’s education or loan EMIs, due to its survival benefits every few years.

- Endowment Policies are better for long-term financial planning, offering disciplined savings with guaranteed lump-sum benefits on maturity or death.

- Premiums for Money Back Life Insurance Policies are usually higher than Endowment Plans because of the periodic payouts during the policy term.

- Tax advantages apply to both policy types in Canada, depending on how the plan is structured, especially if it’s participating or comes with investment components.

- Riders like critical illness, accidental death, or waiver of premium can enhance protection in both policy types, but may affect the cost structure.

- Neither is “better” universally—your choice depends on your financial goals, liquidity needs, and risk tolerance.

- Both policies help build disciplined savings, provide Life Insurance protection, and support legacy or milestone planning in Canada.

Sources and Further Reading

- Government of Canada – Life Insurance Basics

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life-insurance.html

(A reliable primer on Life Insurance types and how they function in Canada.) - Financial Services Regulatory Authority of Ontario (FSRA)

https://www.fsrao.ca/

(Covers regulation of Life Insurance agents and product oversight in Ontario.) - Canada Revenue Agency – Life Insurance and Taxation

https://www.canada.ca/en/revenue-agency.html

(Search “Life Insurance and tax implications” for CRA treatment of policy payouts.)

Financial Institutions (Non-Competitive)

- Manulife Financial – Insurance Planning

https://www.manulife.ca/personal/insurance.html

(Explore various Life Insurance solutions, including participating policies.) - Sun Life Canada – Participating Insurance Overview

https://www.sunlife.ca/en/tools-and-resources/money-and-finances/insurance

(Good background on long-term protection products and wealth strategies.) - Canada Life – Whole Life & Savings Strategies

https://www.canadalife.com/insurance/life-insurance.html

(Provides high-level insights on how cash value and endowment features function.)

Educational & Consumer Literacy

- Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

(Comprehensive resources on policy types, how Life Insurance works, and consumer rights.) - Investopedia – Canada Section

https://www.investopedia.com/canadian-personal-finance-4689745

(Articles on Money Back Plans, endowment insurance, and investment-linked options.)

Canadian Securities Administrators (CSA)

https://www.securities-administrators.ca/

(Check their investor education section for wealth management and savings tools.)

Feedback Questionnaire:

We’d love your input! Please take a moment to answer the following questions so we can better serve Canadians exploring money back and endowment Life Insurance options.

IN THIS ARTICLE

- Money Back Vs Endowment Policy In Canada 2025: Key Differences Explained

- What Is A Money Back Life Insurance Plan?

- What Is An Endowment Policy?

- Comparing The Two: Which One Makes Sense?

- Who Should Consider A Money Back Policy?

- Who Should Go For An Endowment Plan?

- Do These Plans Offer Tax Benefits?

- The Role Of Insurance Companies

- When Money Back Feels Like A Better Fit

- When Endowment Wins The Race

- The Final Word

Sign-in to CanadianLIC

Verify OTP