- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Money Back Insurance for NRIs in Canada: What You Need to Know in 2025

By Harpreet Puri

CEO & Founder

- 11 min read

- August 06th, 2025

SUMMARY

The blog explains how Money Back Life Insurance Policies work for NRIs in Canada, highlighting guaranteed payouts, flexible coverage, and long-term benefits. It outlines who should consider Money Back Insurance Plans for NRIs, compares them with term plans, and explains how to buy a Money Back Life Insurance Policy online. Readers also gain insights into Money Back Life Insurance quotes, eligibility, payment options, and how these policies support both protection and wealth planning.

Introduction

We have dealt with many NRIs who manage international careers or run businesses, and one of the most frequent questions that arises now is, “How can I protect as well as get tax-free money out from my insurance policy.

The answer is yes. When considering your financial situation, Canadian LIC realizes that the optimal money-back life insurance policy offers an advantageous position for Canada-based nonresident individuals. Protection with structure. Financial discipline with returns. Reassurance without the sensation of a “pay and pray”

This isn’t just another plan. This is a strategy we have helped many clients put into action in their cross-border financial planning, and it has been successful.

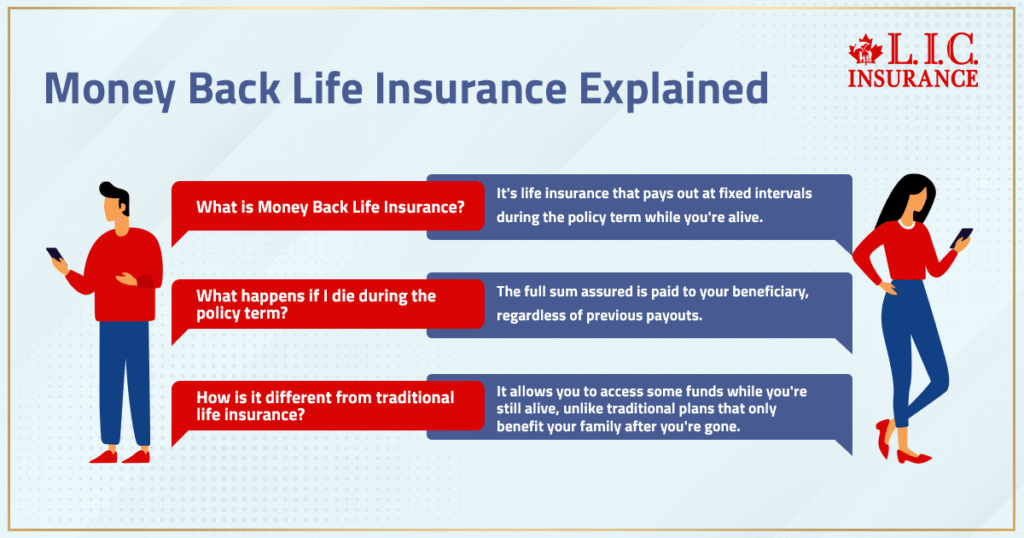

What Exactly Is A Money Back Life Insurance Policy?

It’s insurance—but with cash in hand along the way.

A Money Back Life Insurance Policy is a type of life insurance where the policyholder receives payouts at fixed intervals during the term of the plan. These payouts are a percentage of the total sum assured and are paid while the insured is alive.

And if something happens during the policy term? The full sum assured is paid to the beneficiary, regardless of how many payouts the client has already received.

That’s what makes it different. While most traditional plans only benefit your family after you’re gone, Money Back Insurance Plans for NRIs let you access some of those funds while you’re still here, still working, still building.

Why More NRIs Are Asking About These Policies In 2025

There has been a clear change in the comments we get on our daily consultations.

An increasing number of non-residents are seeking insurance with benefits that cover unexpected events. They are not looking for a safety net — they want an exit, but not just at the end, on all exits.

This is where Money Back Insurance Plans for NRIs excel. It’s what many of our clients say matters most, and we agree!

- Structured payouts allow for long-term planning.

- It makes you feel like the premium price is ‘worth it’, because you actually get something back

- In a volatile and unpredictable global economy, the assured returns guarantee provides peace of mind.

- Full death benefit is payable to you even if you have received several installments.

- It’s just protection and power under the same plan.

How Does Money Back Insurance Work In Real Life?

Let’s simplify it.

Such an individual in their mid-30 gets a policy for 25 years with $250,000 sum assured. They receive 15–20% of that amount as a survival benefit every 5 years. If they die at the end, then there is a final payout, or if disaster strikes in the time period, all $250k still goes to the beneficiaries of their choice.

You aren’t choosing return at the expense of (or in exchange for) protection. You’re getting both.

It is what we explain to applicants at Canadian LIC: “This is the type of policy in which you can put your money and not have it vanish — it says hello every once in a while along the way.”

Who Are These Plans Best Suited For?

Not all our client profiles should buy Whole Life, but if we are crafting a ton of strategies for people like you, then these Money Back Life Insurance Policies make more sense than others.

- Residential aspirations in Canada with global Residents, non-Canadians

- People who, instead of flex, choose fixed returns

- Our thinking about children’s education, marriage, or business expansion in future

- Individuals looking to make regular and consistent savings using life insurance.

We’ve had some clients who started with term plans, but after five or six years into their income, they hear the horror stories and realize they don’t want to be one of them. Anything that has to do with cash flow and coverage.

What's The Difference Between Term Insurance And Money Back Insurance?

We explain this every day—and it’s an important comparison.

| Feature | Term Insurance | Money Back Insurance |

|---|---|---|

| Cost | Lower | Higher |

| Returns | None | Yes (periodic payouts) |

| Coverage Duration | Fixed term | Fixed term with survival benefits |

| Maturity Benefit | No | Yes |

| Investment Element | No | Yes |

| Ideal For | Pure risk coverage | Coverage + returns |

Ideal For Pure risk coverage Coverage + returns

Term insurance is great for affordability and simplicity. But if you’re looking for more than just coverage and want your premiums to work for you along the way, Money Back Insurance Plans for NRIs are built for that purpose.

Can You Buy Money Back Life Insurance Policy Online?

Yes. And we’ve made it easier than ever at Canadian LIC.

Most of our clients today prefer remote consultations. Many don’t even visit our offices in person anymore. With digital tools and licensed guidance, we’ve made it seamless to buy Money Back Life Insurance Policy online from anywhere in Canada.

The steps are usually:

- Schedule a call with one of our licensed advisors

- Share basic personal and financial details

- Review customized plan illustrations (payouts, premium, term)

- Upload identification and relevant documentation

- Complete payment securely

- Receive policy confirmation digitally

The key is working with someone who understands both the insurance rules and the NRI documentation requirements. That’s where our experience comes in. We walk every client through the process ourselves—no third-party call centers or automation.

How Are Money Back Life Insurance Quotes Calculated?

Your Money Back Life Insurance Quotes depend on:

- Your age and health

- The total sum assured

- Policy term (often 15–25 years)

- Frequency of payouts (every 5 years, 10 years, etc.)

- Optional riders (accident, critical illness, waiver of premium)

These plans provide periodical payouts, but the insurance companies offer shorter-term policies (yes, higher premiums than Term), however, with an added advantage of fixed periodical maturity pay-out. But you are receiving a return on a slice of that investment. That changes the math.

We always compare premiums paid to payout, etc, against the final maturity amount side next.

No guesswork. They are just all numbers at the end of the day.

What Do Our NRI Clients Say After Choosing These Plans?

We’ve asked. They’ve told us.

Some immediate takeaways from the people we’ve assisted:

I didn’t want to throw away my hard-earned money, never to be seen again. This plan felt real. I am reminded that I made the right choice every five years.

“The returns help me plan. No need to liquidate investments with every milestone.

My biggest fear was that I would overpay for something and never use it. Well, I am setting the value now but also leaving the protection ·tour alone.

These aren’t just policies. These are background financial tools that support your higher-level goals.

Why Canadian LIC Recommends These Plans To NRI Clients

We don’t push products. We provide solutions. Time and time again, Money Back Life Insurance Policies have delivered the optimal mix of flexibility, return, and protection for our NRI clients over the years, which term policies can not deliver on their own.

What makes us different?

- Plans tailored to the NRI status, not merely age and income

- Cross-border Asset Compliance Documentation Support

- We partner with the best providers in all of Canada to offer you more competitive rates

- We monitor how your strategy works once it has been released

Assist in filing claims, changing beneficiaries, and dealing with renewals

We understand your life crosses borders, money, and responsibilities: Welcome to Canadian LIC. The truth is that life changes, so we build your insurance to change with it.

What You Should Watch Out For Before Signing Anything

Not all plans are created equal. Here’s what we review closely with every client before recommending a policy:

- Industry jargon: Tell us what you really mean by everything on the invoice. No surprises.

- Stress-free claims: How to get paid, plain and simple.

- Policy flexibility: A few plans offer mid-term changes in the sum assured.

- Coverage riders: We hold you accountable and only compromise on riders that really do match your objectives.

- Mini-Course on Tax Reporting Considerations: Contingent upon the number of benefits and other tax facts, we work with advisors to coordinate.

Insurance should not be confusing. If it does, something’s wrong.

The Bottom Line: Is It Worth It?

So, is it worth a policy that protects your family and provides value back to you while you are still here to utilize it? The answer is YES! It’s absolutely worth it.

NRIs have not only zeroed in on the real purpose of Money Back Insurance Plans, but are a lot clearer about what they want from a product. They will always be about developing a roadmap that not only sees you through to everlasting life, but also the people you love after your time is up.

Your insurance shouldn’t sit still while the world around you changes. It has got to give you something back.

Ready To See What A Money Back Plan Looks Like For You?

Let’s make this easy.

- Compare Money Back Life Insurance Quotes with one of our licensed advisors

- Walk through payout timelines and premium options

- Understand exactly how to buy Money Back Life Insurance Policy online in your current residency status

- Ask anything—we're here to help

At Canadian LIC, we’re not just offering policies. We’re building plans that deliver—no matter what life throws at you.

FAQs

Most providers offer a grace period of around 30 days. If you miss the deadline, the policy could lapse or switch to a reduced-paid-up plan. Reinstatement may be possible, but it often requires interest payments or updated medical information. Always notify your advisor early if you’re facing payment issues.

Yes, you can surrender the policy early, but surrender charges and reduced payouts may apply. You may not receive the full premium value back. The earlier you cancel, the less you typically recover. It’s best to review the cancellation clause with your advisor beforehand.

Absolutely. Many business owners use them to structure future cash inflows while maintaining family protection. The scheduled payouts can assist with business reinvestment or funding annual expenses. They also work well in corporate tax planning with advisor guidance.

Usually, no—but some plans may allow top-up or rider options within a limited timeframe. If your financial needs change, a second policy might be more effective. It’s important to choose the right sum assured upfront. Consult your advisor if your life situation evolves.

It depends on the insurer and the severity of your condition. Some plans may require medical underwriting, while others offer simplified approval. You may still qualify, but premiums could be higher. Always disclose your full health history to avoid claim issues later.

Not always. Many insurers accept valid residential addresses where you’re currently residing or staying long-term. As an NRI, you may need to provide additional identification or residency documents. Your advisor can walk you through what’s acceptable in your case.

These plans build a predictable financial structure with guaranteed periodic returns. They’re often used to time payouts with future financial goals. Unlike volatile investments, returns are scheduled and risk-free. It’s like setting future money aside—with built-in protection.

Some policies may allow loans against the policy’s cash value. Others may offer partial withdrawal options, but this varies. These features can offer flexibility in case of unexpected needs. Review these provisions carefully during the plan selection process.

Yes, most money back plans pay the full sum assured to your beneficiaries—even if you’ve already received multiple survival payouts. That’s part of what makes them so valuable. The death benefit is typically not reduced by earlier returns unless stated otherwise.

Key Takeaways

- Money Back Life Insurance Policies provide periodic payouts during the policy term, along with full death benefits for added security.

- Money Back Insurance Plans for NRIs are ideal for those seeking both protection and guaranteed returns while living abroad.

- These plans support long-term financial planning, making them useful for milestone goals like education, retirement, or wealth transfer.

- You can buy Money Back Life Insurance Policy online through a simple, advisor-guided process with full digital documentation.

- Money Back Life Insurance quotes depend on factors like age, coverage amount, term length, and any optional riders.

- Canadian LIC specializes in helping NRIs choose flexible, return-based insurance options tailored to cross-border lifestyles.

Sources and Further Reading

- Explanation of return-of-premium life insurance (a similar concept), discussing its benefits and typical returns compared to term life: Wikipedia

- Industry-wide descriptions of NRI-specific life insurance options—covering money back, endowment, and term plans for non-residents abroad: bajajallianzlife.com+15SBNRI+15Liferay DXP+15

- Information on NRI payment protocols and premium modes for remote or foreign-based applicants: bajajallianzlife.com+1

Feedback Questionnaire:

We’d love to know what’s been difficult or confusing for you when it comes to Money Back Life Insurance Policies as an NRI in Canada. Your feedback helps us create better guidance and personalized support.

IN THIS ARTICLE

- Money Back Insurance for NRIs in Canada: What You Need to Know in 2025

- What Exactly Is A Money Back Life Insurance Policy?

- Why More NRIs Are Asking About These Policies In 2025

- How Does Money Back Insurance Work In Real Life?

- Who Are These Plans Best Suited For?

- What's The Difference Between Term Insurance And Money Back Insurance?

- Can You Buy Money Back Life Insurance Policy Online?

- How Are Money Back Life Insurance Quotes Calculated?

- What Do Our NRI Clients Say After Choosing These Plans?

- Why Canadian LIC Recommends These Plans To NRI Clients

- What You Should Watch Out For Before Signing Anything

- The Bottom Line: Is It Worth It?

- Ready To See What A Money Back Plan Looks Like For You?

Sign-in to CanadianLIC

Verify OTP