- Why Buy Life Insurance For Kids?

- Understanding Life Insurance For Kids

- Exploring The Benefits: Why Life Insurance For Kids Is A Smart Investment

- Factors To Keep In Mind When Purchasing Life Insurance For Kids

- Exploring The Canadian Market: Finding The Perfect Life Insurance Policy For Your Child

- Conclusion: Securing Your Child’s Future

In financial planning, Life Insurance is often associated with adults who have dependents relying on their income. However, a growing number of parents in Canada are considering the benefits of buying Life Insurance for their children. Despite initial hesitations, understanding the rationale behind such a decision can shed light on the value it brings to a family’s financial security.

Understanding Life Insurance for Kids

Life Insurance for kids operates on a similar premise as policies for adults. It offers financial security, providing a lump sum payout in the unfortunate time of a child’s passing. While it may seem morbid to consider such scenarios, the reality is that unexpected tragedies can occur, and having the appropriate coverage can alleviate financial burdens during an already challenging time.

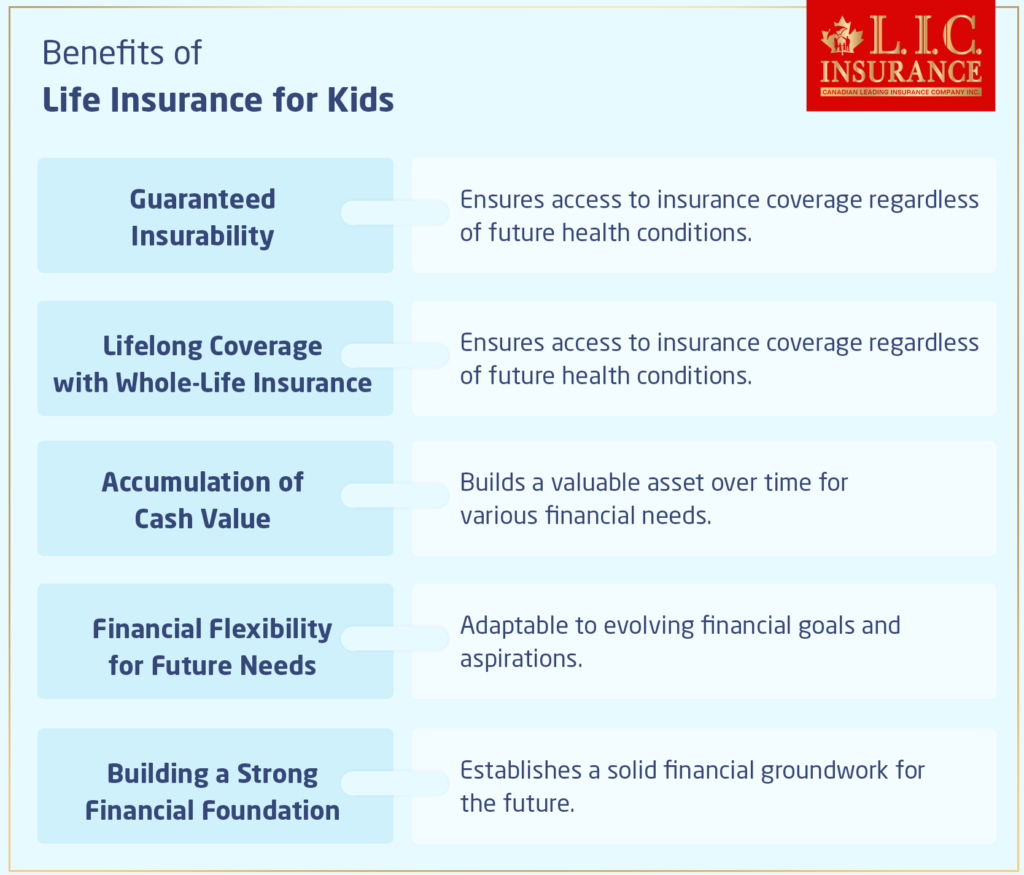

Exploring the Benefits: Why Life Insurance for Kids is a Smart Investment

When it comes to securing your family’s financial future, considering Life Insurance for kids can offer a range of advantages. Here’s a closer look at why this investment is worth considering:

Guaranteed Insurability: If you buy Life Insurance plans for kids early in their lives, parents can guarantee their insurability, irrespective of any future health conditions that may arise. This is particularly vital for families with a history of medical issues or genetic predispositions. With Life Insurance for kids, you’re essentially locking in their ability to access insurance coverage regardless of what the future holds.

Lifelong Coverage with Whole-Life Insurance: Life Insurance for kids often takes the form of Whole-Life Insurance, providing coverage for the entirety of their lives as long as premiums are consistently paid. Unlike Term Life Insurance Policies that have expiration dates, Whole Life Insurance offers the peace of mind of continuous protection. This means your child will always have a safety net, ensuring their financial security well into adulthood.

Accumulation of Cash Value: One of the standout features of Whole-Life Insurance for kids is the accumulation of cash value over time. As premiums are paid, a portion of the payments goes to build cash value within the policy. This cash value can serve as a very meaningful asset that can be tapped into for a lot of reasons in the future. Whether it’s funding educational expenses, making a down payment on a home, or even supplementing retirement savings, the cash value offers flexibility and security.

Financial Flexibility for Future Needs: As your child grows, their financial needs and aspirations may evolve. Life Insurance plans for kids provide the flexibility to adapt to these changing circumstances. Whether it’s helping them pursue higher education, starting a business, or providing a financial cushion during unexpected challenges, the benefits of a well-chosen Life Insurance policy extend far beyond just protection.

Building a Strong Financial Foundation: Investing in the best Life Insurance policy for your kids isn’t just about protecting against the unforeseen—it’s also about laying the groundwork for their financial future. By instilling the importance of financial planning from a young age, you’re setting them up for success and empowering them to make one of the best financial decisions as they mature.

So, Life Insurance for kids offers a blend of protection, flexibility, and long-term growth potential. It’s a strategic investment in your child’s future that provides both immediate benefits and lasting financial security. As you explore your options, it is best to take advice from a trusted financial advisor to ensure you select the best

Life Insurance plan that aligns with your family’s goals and priorities. After all, securing your child’s future is one of the most important decisions you can make as a parent.

Factors to Keep in Mind When Purchasing Life Insurance for Kids

Assessing Financial Capacity:

Before going into the world of Life Insurance for kids, parents must thoroughly assess their financial situation. While rates for children’s policies may be lower compared to those for adults, it’s essential to ensure that the premiums suit the family’s budget. By evaluating income, expenses, and other financial obligations, parents can determine whether investing in Life Insurance for kids is a feasible option within their means.

Finding the Balance:

When selecting a Life Insurance policy for their children, parents often face the dilemma of choosing the right coverage amount. While the temptation may be to opt for minimal coverage to keep premiums low, it’s crucial to balance between affordability and adequate protection. Considering factors such as future needs, potential expenses, and the long-term financial security of the family can help determine the appropriate coverage level. By finding the right balance, parents can make sure that their children are adequately protected while staying within their budget constraints.

Anticipating Future Expenses:

Life Insurance for kids is not just about providing financial protection at the time of an untimely death; it’s also about planning for the future. Parents should consider potential expenses that may arise as their children grow older, such as education costs, medical expenses, or even a down payment on a home. By anticipating these future expenses, parents can choose a coverage amount that offers enough protection and mental peace for their children’s future.

Evaluating Long-Term Benefits:

While the immediate focus may be on securing coverage for their children, parents should also take into account the long-term benefits of investing in Life Insurance. Whole Life Insurance, which is commonly used for children’s insurance, offers lifelong coverage and accumulates cash value over time. This cash value offered can serve as a valuable asset for their children in the future, providing financial flexibility and opportunities for growth. By evaluating the long-term benefits of Life Insurance for kids, parents can make smart decisions that are similar to the family’s financial goals.

Comparing Policy Options:

In the Canadian market, there are various insurance providers offering Life Insurance policies tailored specifically for children. It’s essential for parents to research and compare different policy options to find the best Life Insurance plans that meet their needs and choices. Factors such as coverage benefits, premium rates, and additional features should be carefully considered when evaluating policy options. By conducting thorough research and comparing policy options, parents can ensure that they select the most suitable coverage for their children’s financial security.

By carefully considering these factors, parents can make the best decisions possible when they decide to purchase Life Insurance for their children.

Exploring the Canadian Market: Finding the Perfect Life Insurance Policy for Your Child

There are a lot of different types of Life Insurance for kids in Canada. This gives parents the chance to protect their child’s financial future with coverage that fits their needs. The best way to find the best Life Insurance for your child is to follow these below-stated points:

Research Different Providers

Start your journey by researching the various insurance providers offering Life Insurance for kids in Canada. Take the time to explore their offerings, coverage options, and reputation within the industry. Look for providers that specialize in policies for children, as they may offer more tailored solutions to meet your family’s needs.

Compare Quotes

Once you’ve identified a few potential providers, it’s time to compare quotes. Request quotes from each provider, taking into account the coverage amount, premiums, and any additional benefits or features offered. Comparing quotes will help you determine which provider offers the best value for your money and also fit your budget.

Consider Online Options

In today’s digital age, many insurance providers offer online quotes and streamlined application processes for Life Insurance for kids. Take advantage of these online platforms to obtain quotes quickly and conveniently from the comfort of your home. Online options can save you time and hassle, making it easier to explore your options and make wiser decisions.

Assess Your Needs and Preferences

As you compare quotes and explore different providers, consider your family’s specific needs and preferences. Think about the coverage amount you require, as well as any additional features or benefits that are important to you. Whether you’re looking for a policy with flexible payment options, guaranteed insurability, or cash value accumulation, make sure to prioritize what matters most to you and your family.

Seek Expert Advice

If you need clarification on which Life Insurance policy is best for your child, feel free to seek expert advice. Insurance brokers and financial advisors can offer valuable insights and guidance to help you go through the complexities of Life Insurance for kids. They can figure out about your unique situation, provide personalized recommendations, and solve any questions you may have along the way.

Review and Revise Regularly

Once you’ve purchased a Life Insurance policy for your child, it’s essential to review and revise it regularly to make sure it meets your family’s needs. Life circumstances can change over time, so adjusting your coverage is important. Whether you experience changes in income, family size, or financial goals, make sure to revisit your policy periodically to keep it up to date.

By following these steps and exploring the Canadian market with care, you can find the perfect Life Insurance policy for your child that offers peace and financial security for years to come. Remember, investing in the best Life Insurance policy for your child is an investment in their future and well-being.

Conclusion: Securing Your Child’s Future

In conclusion, while the idea of buying Life Insurance for kids may initially seem unconventional, understanding the benefits and considerations can illuminate its significance in safeguarding a family’s financial well-being. By guaranteeing insurability, providing lifelong coverage, and accumulating cash value, Life Insurance for kids offers mental satisfaction along with financial security for parents.

As you contemplate your family’s financial future, consider taking action to secure the best Life Insurance policy for your children. Whether it’s providing for their future education, protecting against unforeseen circumstances, or building a financial legacy, investing in Life Insurance for kids can be a proactive step toward securing your child’s future.

Please don’t wait until it’s too late. Take the first step towards financial comforts by exploring your options and selecting a Life Insurance policy that best fits your family’s needs. Your children’s future is worth protecting, and Life Insurance for kids can be very valuable in achieving that goal.

Find Out: Is Life Insurance Worth it After 70?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

As parents consider the idea of purchasing Life Insurance for their children, it’s natural for questions to arise. Here are some frequently asked questions related to Life Insurance for kids to help guide your decision-making process:

In Canada, Life Insurance proceeds are typically not taxable. The death benefit paid out to the beneficiaries of a Life Insurance policy is generally considered tax-free. This means that beneficiaries receive the full amount of the policy without having to pay income tax on it. However, there are some exceptions, such as when the policy has been assigned to a creditor or when the policyholder has made withdrawals from a Permanent Life Insurance Policy that exceed the premiums paid. In such cases, a portion of the proceeds may be subject to taxation. It’s recommended to consult with a tax advisor or financial expert for personalized advice regarding the tax implications of Life Insurance proceeds.

Yes, in many cases, Life Insurance policies can be cashed out or surrendered for their cash value. This option is typically available with permanent Life Insurance policies. These policies include Whole Life or Universal Life Insurance. By surrendering the policy, the policyholder can receive the cash value accumulated within the policy minus any applicable fees or penalties. However, cashing out a Life Insurance policy means forfeiting the death benefit provided by the policy, so it’s imperative to carefully consider the implications before making a decision.

Additionally, cashing out a policy may have tax implications, so it’s advisable to consult with an insurance agent or financial advisor for guidance.

Life Insurance for kids offers several benefits, including guaranteed insurability, providing lifelong coverage, and accumulating cash value over time. By securing a policy early in your child’s life, you can ensure their financial security and mental peace for the future.

The best Life Insurance policy for children depends on your family’s specific needs and preferences. It’s essential to research different providers, compare quotes, and take into account factors such as coverage amount, premiums, and additional benefits. Tailoring the policy to suit your family’s financial goals and circumstances will help you find the best fit.

Yes, many insurance providers offer customizable Life Insurance options for kids. You can tailor the policy to meet your family’s specific needs and preferences by adjusting factors such as the coverage amount, payment schedule, and additional benefits or features. The guidance of an insurance agent or financial advisor can help you customize the policy to fit your family’s goals.

Investing in Life Insurance for your child can provide valuable financial security and peace for your family’s future. By guaranteeing insurability, providing lifelong coverage, and accumulating cash value over time, a Life Insurance policy for kids offers numerous benefits that can support your family’s financial well-being for years to come.

Yes, a Life Insurance plan can be denied under specific situations. Insurance companies have the full right to not accept coverage based on factors such as the applicant’s health, lifestyle, occupation, and medical history. If an applicant poses too high of a risk to insure, the insurance company may choose to deny coverage altogether or offer coverage at a higher premium rate. Additionally, the insurance company may deny coverage or cancel the policy if an applicant provides false or misleading information on their insurance application. It’s essential to be honest and transparent when applying for Life Insurance to avoid potential denial of coverage. If coverage is denied, applicants may explore alternative options or work with an insurance broker to find a suitable solution.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]