- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How To Financially Prepare For A Sudden Job Loss In Canada

By Pushpinder Puri

CEO & Founder

- 20 min read

- June 2nd, 2025

SUMMARY

Sudden job loss can derail your finances without a plan. The content covers how to build an emergency fund, manage essential expenses, maintain key insurance policies like life insurance for job loss, evaluate coverage, and understand available benefits in Canada. It also highlights real stories, debt strategies, and actionable steps to protect income, credit, and long-term goals before and after employment ends.

Introduction

“They let me go — just like that.”

This is the moment it gets real. One minute, you’re checking your email and scheduling next week’s meetings. Next, HR is on Zoom, and your access badge is revoked. Your heart races. Your mind loops:

“What now? What about my mortgage? My family?”

At Canadian LIC, we’ve sat across from professionals, new immigrants, and small business owners asking these very questions — stunned, confused, and scared. Most didn’t see it coming. Few had a plan.

Here’s the hard truth:

Job loss can hit anyone, anytime. Even top performers. Even senior executives. And especially now, in a post-pandemic economy where restructures, layoffs, and hiring freezes are more common than ever.

But the difference between panic and preparedness?

A financial safety net that you built while things were stable.

This article walks you through exactly how to financially prepare for sudden job loss in Canada, so you’re not caught off guard — and so your income, insurance, and long-term goals stay protected.

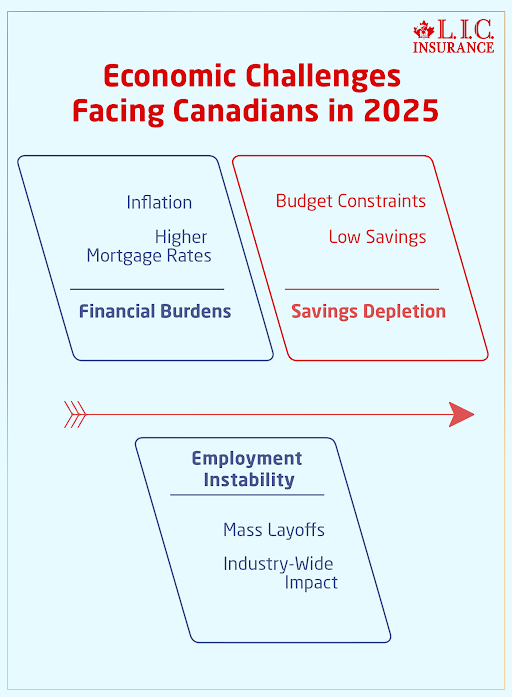

Why Canadians Should Be Concerned in 2025

We’re not trying to scare you, but the indicators are real:

- Mortgage renewals are happening at higher interest rates

- Inflation has stretched most household budgets thin

- Many Canadians have less than 3 months of savings

- Mass layoffs have touched nearly every industry: tech, healthcare, retail, education

Even if you feel safe today, your financial security should not depend entirely on a single paycheck.

Step 1: Know Your Financial Baseline

Before you can protect your finances, you have to know them.

Create a “Job Loss Budget” today — not when it’s too late.

Start with these three columns:

| Category | Amount (Monthly) | Must-Have or Optional? |

|---|---|---|

| Rent / Mortgage | Must-Have | |

| Utilities & Internet | Must-Have | |

| Groceries | Must-Have | |

| Subscriptions | Optional | |

| Transportation | Must-Have | |

| Childcare / Tuition | Must-Have / Optional | |

| Insurance Premiums | Must-Have | |

| Minimum Loan Payments | Must-Have | |

| Entertainment | Optional |

Tally up only the “Must-Have” items.

That’s your bare-minimum survival number per month. Multiply by 3 or 6 for your emergency fund target.

Step 2: Build or Replenish Your Emergency Fund

No, this isn’t just a personal finance buzzword. An emergency fund is your financial parachute.

We’ve seen firsthand how a client with even $5,000–$10,000 in savings handled job loss with confidence, while another with a higher salary but no buffer fell apart within weeks.

How much is enough?

- Minimum: 3 months of essential expenses

- Ideal: 6 months, especially if you’re the sole earner or have dependents

- Where to keep it: High-interest savings account (HISA) or TFSA, not tied up in stocks or RRSPs

Pro Tip:

Use automation. Even $100/week builds up fast. If you receive a bonus or tax refund, treat your emergency fund like your future employer — pay it first.

Step 3: Understand What Government Benefits You Can Access

Canada provides a social safety net, but it’s not one-size-fits-all. And it’s not automatic.

Employment Insurance (EI)

- Covers up to 55% of your earnings, to a max of $668/week

- You must have worked enough insured hours

- Can take several weeks to receive your first payment

Severance Pay (If Applicable)

If you’re let go without cause and you’ve worked for the company long enough, you may be entitled to notice or pay in lieu of notice.

Understand your rights under Canadian labour law and review your employment contract carefully. Employers sometimes offer “packages” — but they’re not always the best you can get.

Get legal advice before signing anything.

Step 4: Keep Your Insurance Active — Especially During Unemployment

This is where most people make a dangerous mistake.

“I lost my job, so I guess I’ll cancel my life insurance and stop my critical illness plan to save money.”

Don’t do it.

The moment you become unemployed, your risk exposure increases, not decreases. You’re more vulnerable to:

- Mental health conditions

- Stress-related illness

- Inability to get new coverage later due to age or health

What You Should Do:

- Life Insurance

If you already have it, keep it. Even a small Term Policy can mean your family isn’t left with debt or unpaid taxes if something happens to you while job hunting.

- Critical Illness Insurance

Covers you with a lump-sum payout if you’re diagnosed with a major condition. We’ve seen families avoid bankruptcy because of this payout during unemployment.

- Disability Insurance

Even if you’re not working, private plans can sometimes cover part-time roles or new contracts. Look into personal policies if your group plan ended with your job.

Remember: Many of these policies are cheaper and easier to qualify for while you’re employed and healthy. If you’re reading this and still have your job, it’s time to act.

Step 5: Rethink Your Debt Strategy

Debt is manageable with income. But when that income disappears, it becomes a ticking clock.

What to do now:

- Call your mortgage lender: Ask about payment deferrals or temporary modifications

- Review your credit cards: Look into balance transfers or low-interest lines of credit

- Consider Loan Protection Insurance Plans, if not already in place

Understanding Loan Protection Insurance Coverage:

This type of insurance helps cover debt payments in the event of:

- Job loss

- Disability

- Death

Policies differ, so ask:

- Does it include involuntary job loss?

- What are the waiting periods and maximum payouts?

- How much are the Loan Protection Insurance costs monthly?

Even short-term coverage (6–12 months) can give you enough time to recover, find a new job, or restructure your payments.

Step 6: Network Before You Need a Job

The worst time to build your network? After you’re laid off.

You don’t need to pitch yourself today. Just stay active:

- Comment on LinkedIn posts

- Reconnect with past colleagues

- Join local industry groups or online events

When the time comes, it’ll be easier to say:

“Hey, I’m exploring new roles — would love to chat.”

Step 7: Diversify Your Income — Even While Employed

We’ve seen teachers tutor, marketers freelance, and engineers sell niche digital courses — all while holding down full-time roles.

Here’s why that matters:

- You’re building a backup income stream

- You gain confidence that your skills are still relevant

- If you’re laid off, you already have something to expand

No one’s saying work 24/7. But explore what you can offer, even for a couple of hours a week, because extra income today becomes financial freedom tomorrow.

Step 8: Make a Plan With Your Partner or Family

If you live alone, you can decide and act fast. But if you have dependents or a spouse, job loss affects everyone.

Talk about:

- Which expenses can be cut immediately

- How long can you last on savings

- Which assets you willing to liquidate (and which you aren’t)

We’ve seen clients hold onto brand-new cars they can’t afford just because “it would feel like failure.” But protecting your home, your credit, and your future is never a failure.

Real Client Scenario: Nina and Arjun

Nina worked in HR. Arjun was a consultant. She lost her job first; then his biggest client pulled out. In just 60 days, they lost 80% of their household income.

But here’s what they had in place:

- A $15,000 emergency fund

- Term life and Critical Illness Insurance

- Loan Protection Insurance on their mortgage and car loan

- Nina’s network got her three interviews within two weeks

They adjusted their spending, paused all non-essential expenses, and Arjun landed two new contracts within 90 days. They never touched their RRSPs or took on new debt.

Their secret?

Preparedness, not panic.

Final Thoughts: Don’t Wait for the Call

Financial emergencies don’t send calendar invites.

The best time to prepare for job loss is while you’re still employed — when you can still buy insurance, save with consistency, and explore side income on your own terms.

Here’s what to do now:

- Know your expenses

- Build your emergency fund

- Review your insurance coverage

- Learn about Loan Protection Insurance coverage

- Protect your credit

- Grow your network

- Diversify your income

You may never need any of it.

But if that day comes, you’ll be glad you didn’t leave your financial future to chance.

Frequently Asked Questions: Financial Preparation for Sudden Job Loss in Canada

We typically tell clients: aim for 3 to 6 months of essential living expenses. That means rent or mortgage, groceries, insurance premiums, loan payments — the must-haves.

If you’ve got a family or you’re the sole earner, aim closer to 6 months. And no, it doesn’t have to happen overnight. Start small. Even $100 a month into a high-interest savings account or TFSA can build momentum fast.

Yes — if you have the right plan.

Some Loan Protection Insurance Plans cover payments like your mortgage, car loan, or credit card minimums for a set number of months (usually 6 to 12) if you lose your job involuntarily.

But you’ve got to check the fine print:

- Is job loss included, or just disability/life coverage?

- Is there a waiting period before it kicks in?

- How much of your payment does it actually cover?

We’ve seen clients stay afloat just because they had this in place — and others stressed because they assumed they did, but didn’t.

Start with the essentials:

- Life insurance — especially if you have dependents or debts

- Critical illness insurance — it pays a lump sum if you’re diagnosed with a serious condition while unemployed

- Disability insurance — if you plan to freelance or consult post-layoff, this is your backup if you can’t work due to injury or illness

Most people cancel these, thinking they’re saving money — but we’ve seen that decision backfire too many times. The coverage you cancel today might cost double to replace later.

Severance is a lump sum or pay-in-lieu your employer may offer when they terminate your role. EI is a government benefit you must apply for. It pays up to 55% of your weekly earnings (to a max) if you qualify based on hours worked.

Heads up: EI won’t start paying out until after your severance period ends. So don’t count on immediate cash flow unless you plan for that gap.

Sometimes, yes. But you’ve got to ask before you fall behind.

Many lenders offer:

- Temporary deferrals

- Modified payment schedules

- Or even formal loan modifications

The sooner you call, the more options you’ll have. Waiting until collections start or you’ve missed a few payments? That’s when things get harder — and more expensive.

It depends on your:

- Age

- Loan amount

- Type of protection (life, disability, job loss)

For example:

- A $300,000 mortgage might cost $30–$60/month for life and job loss coverage

- A $20,000 car loan may add $10–$15/month for basic protection

Always ask:

“What are my current Loan Protection Insurance costs, and what exactly do they cover?”

It’s one of the most overlooked lines on your monthly statement.

Yes — if needed. These are smart, long-term tools, but they’re optional when cash is tight. Pause contributions, but don’t withdraw unless absolutely necessary (especially from your RRSP, which has tax consequences).

Use the pause to preserve cash flow, then plan a catch-up strategy once you’re back on your feet.

You can — but it gets harder.

Some insurance products (like Term Life or Disability Insurance) require you to have a stable income or employment to qualify. Others may allow coverage, but at a higher premium or with limited benefits.

That’s why we always say: get insured while you’re working. It’s faster, cheaper, and easier.

This happens more than people expect. Maybe you didn’t work enough insured hours, or you’ve just returned from maternity leave.

In that case, look into:

- Provincial assistance programs

- Community or nonprofit support for short-term needs

- Freelance or part-time gigs to bridge the gap

And revisit your emergency fund and insurance coverage to avoid slipping into credit dependency.

There’s no one-size-fits-all, but once your paperwork is sorted (severance, insurance, EI), it’s smart to start networking within the first 2 weeks.

That doesn’t mean you need to rush into the first offer, but staying visible keeps your momentum up. Many clients land roles through quiet conversations that started before they even posted “Open to Work” on LinkedIn.

Key Takeaways

- Emergency funds matter: Saving 3–6 months of essential expenses can soften the impact of unexpected income loss.

- Know your bare-minimum budget: Identify and prioritize must-have expenses like housing, insurance, food, and loan payments.

- Loan Protection Insurance coverage helps: These plans can cover debt payments in the event of job loss, illness, or death.

- Insurance should not be cancelled: Life, critical illness, and disability insurance become even more vital during unemployment.

- Government support takes time: Employment Insurance (EI) isn’t instant—prepare for a financial gap between severance and benefits.

- Debt strategies must shift: Contact lenders early for payment deferrals or modifications before falling behind.

- Networking is a long-term asset: Build relationships before you need them; it shortens the time between jobs.

- Income diversity builds resilience: Side gigs, freelancing, or contract work can cushion the blow and open new career paths.

- Stay covered post-layoff: Keep track of Loan Protection Insurance Plans and life insurance for job loss to avoid lapses in protection.

- Preparedness beats panic: The earlier you act, while employed, the more control you’ll have if job loss ever happens.

Sources and Further Reading

For additional information and practical guidance on financially preparing for sudden job loss in Canada, explore the following resources:

- How to Financially Prepare for a Sudden Job Loss in Canada (Canadian LIC)

A comprehensive guide covering emergency funds, budgeting, government benefits, insurance strategies, debt management, networking, and income diversification, tailored to the Canadian context1. - Staying Afloat Financially After a Job Loss (Scotiabank)

Practical advice on accessing Employment Insurance (EI), understanding eligibility, applying for benefits, and maintaining financial stability during unemployment.

Further Reading and Tools:

- Government of Canada – Employment Insurance (EI)

Official information about EI eligibility, application process, and benefit details. - Wage Earner Protection Program (WEPP)

Details on federal support if your job loss is due to employer bankruptcy or receivership. - Financial Consumer Agency of Canada – Managing Your Money

Resources and calculators for budgeting, emergency funds, and debt management. - Tips for Managing Debt (Credit Canada)

Guidance on debt relief options, communicating with creditors, and protecting your credit score. - Mental Health Support (CMHA)

Support services for managing the emotional impact of job loss.

These resources provide both immediate steps and long-term strategies to help you stay financially resilient through periods of unemployment.

Feedback Questionnaire:

IN THIS ARTICLE

- How To Financially Prepare For A Sudden Job Loss In Canada

- Why Canadians Should Be Concerned in 2025

- Step 1: Know Your Financial Baseline

- Step 2: Build or Replenish Your Emergency Fund

- Step 3: Understand What Government Benefits You Can Access

- Step 4: Keep Your Insurance Active — Especially During Unemployment

- Step 5: Rethink Your Debt Strategy

- Step 6: Network Before You Need a Job

- Step 7: Diversify Your Income — Even While Employed

- Step 8: Make a Plan With Your Partner or Family

- Real Client Scenario: Nina and Arjun

- Final Thoughts: Don’t Wait for the Call

Sign-in to CanadianLIC

Verify OTP