- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How Much Does Personal Health Insurance Cost In Canada? A 2025 Guide

By Harpreet Puri

CEO & Founder

- 12 min read

- October 07th, 2025

SUMMARY

Personal Health Insurance cost in Canada varies widely in 2025, from about $61 for basic private Health Insurance to $300+ for seniors. Factors like dental coverage, prescription drug coverage, and pre-existing conditions drive premiums higher. The piece also looks at provincial differences, monthly premium ranges, and why options like Critical Illness Insurance in Canada and Disability Insurance for the self-employed add extra financial protection.

Introduction

We get asked this question every day- “So what’s a realistic Medical Insurance cost in Canada for me?” The cynical answer: it depends on your age, provincial jurisdiction, current health, and how much you really want the insurance plan you’re buying to cover. You’re going to see starter Health Insurance premiums in the low-$60s for a healthy young adult, but a family that adds richer drug, dental, vision, and paramedical service coverage may find premiums in the few-hundred-dollar-a-month range. Prices change — and so should your plan.

We’re going to dive into the actual ranges, the factors that drive up or down your Health Insurance cost, how Health Insurance in Canada shares the burden with provinces, and the smart add-ons (like Critical Illness Insurance in Canada, Disability Insurance for self-employed) that help protect your income while your health plan protects your bills.

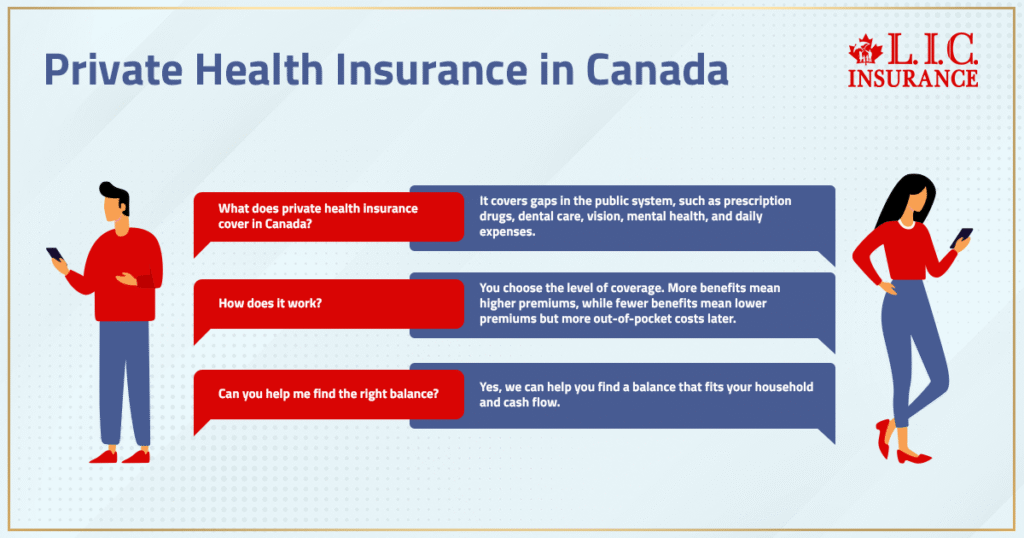

Private Health Insurance: What It Does (And What It Doesn’t)

Canada’s public system is robust, but not universal. Basic medical services — physician and hospital services — are covered by the provinces, but significant gaps remain for prescription drug coverage, routine dental care, vision coverage, many mental health services, and indeed day-to-day expenses. This is where private Health Insurance comes in.

Your top-up is a personal or Personal Health Insurance Policy. You choose how much protection you’d like. More benefits = higher premium; leaner benefits = lower premium, but more for you to pay later. Our role as a licensed insurance advisor team is to help you find a balance that works for your household and your cash flow.

Health Insurance Premiums: The Benchmarks We Use With Clients

You asked for numbers. Here are the practical anchors we use in conversations every day:

- Individuals: entry plans often start near $61.32/month for a healthy 20s–30s profile on a basic plan.

- Couples: young couple benchmarks frequently begin around $110.38/month for minimal coverage.

- Family of Four: a lean starter bundle sits in the $175.89/month zone (coverage scaled for two adults, two children).

For older applicants—and for anyone choosing richer health plans (higher drug maximums, full dental and vision care, travel)—the monthly premium rises accordingly. A 70s profile on comprehensive benefits can reach several hundred dollars, which tracks with the increased claims risk and breadth of the benefits package.

These are starting points. Real quotes depend on underwriting, province, and the exact mix of benefits you pick.

Health Insurance In Canada: Province First, Private Second

Public Health Insurance is provincial. Provincial plans cover the essentials, then private plans fill the gaps. Coverage differences across provinces affect how much private Health Insurance costs you’ll face:

- Ontario: abundant plan choice; pricing spreads sharply as you add drugs + dental + vision.

- Alberta: competitive entry pricing; comprehensive tiers climb with broader medical services and drug caps.

- British Columbia: midrange starters, noticeable jumps as you add major dental/drug protection.

This is why two similar families living in different provinces can get very different Health Insurance quotes.

Health Insurance Plan: What “Good” Actually Looks Like

When we design a Health Insurance Plan, we’re aiming for:

- Prescription drug benefits with a clear formulary and annual maximum that reflect your real needs.

- Dental coverage in tiers: preventive/basic now; major later if budget is tight.

- Vision care allowance every 12–24 months; consider separate Vision Coverage for families with multiple glasses wearers.

- Paramedical services (physio, chiro, massage) with realistic per-visit and annual caps.

- Optional Travel Medical Insurance or broader Travel Insurance Coverage for out-of-province/country emergencies.

- Straightforward claims process (ideally direct-pay at pharmacy and clear app submissions).

If a plan looks cheap but hides tiny annual maximums, that’s not savings—that’s a future bill.

Private Health Insurance Cost: What Moves Your Price

Here’s the levers you can actually adjust:

- Coverage Level: Drug, dental, vision, paramedical, and durable medical equipment—each add-on moves the insurance cost in Canada needle. Start with basic coverage and scale up at renewal if you need to.

- Deductibles & Co-Pays: Higher deductible = lower premium, but you’ll pay more when using benefits. Find a number you won’t resent at claim time.

- Underwriting & Health Status: Healthy applicants generally get better pricing on underwritten plans. With pre-existing conditions or pre-existing medical conditions, look at guaranteed or replacement options (expect a waiting period and tighter early-year caps).

- Province / Postal Code: Pricing reflects regional utilization, provider fees, and market competition.

- Insurance Company & Plan Design: Different Health Insurance companies and insurance providers excel in different benefit buckets. We place you with the carrier that aligns with your usage pattern—not just the lowest sticker price.

Health Insurance Companies: How We Compare Apples To Apples

When comparing Health Insurance Quotes, align the specs:

- Drug: annual maximums, brand/generic rules, prior authorization.

- Dental: fee guide (province-specific), preventive vs basic vs major percentages, and annual caps.

- Vision: frequency and dollar limit.

- Paramedical: per-visit cap and combined annual maximum.

- Admin: digital claims, direct-pay pharmacy, turnaround time.

- Contract: waiting period, exclusions, and how the insurance plan covers your exact meds/treatments.

Once specs match, the best value—not necessarily the lowest price—usually pops out.

Health Insurance Tax Deductible & Medical Expense Tax Credit

Two tax angles that routinely help clients:

- Medical expense tax credit: tally eligible medical expenses and premiums; credits reduce tax payable (federal + provincial).

- Self-employed and incorporated Canadians may have additional routes for deductibility depending on structure (ask your tax pro—Health Insurance tax deductible rules are nuanced).

Keep every receipt. Future-you will thank current-you.

Dental Coverage: Why Everyone Wants It (And Why It Costs)

Dental Insurance hikes premiums because claims are frequent and predictable. To keep costs sensible:

- Start with preventive/basic.

- Add major services later or pick a plan that ramps up caps over the first 2–3 policy years.

- Time big work (crowns, root canals) against annual maximums to stretch benefits.

For families, dental is often the difference between “annoying bills” and “manageable maintenance.”

Disability Insurance: Protect Your Paycheque Too

Your health plan covers bills. Who covers your income if you can’t work?

- Disability Insurance for the self-employed is essential if you don’t have Group Insurance.

- Brand preference? Many clients ask about Canada Life Disability Insurance; we also compare across carriers.

- Price a Disability Insurance Quote alongside your health quote; seeing both side-by-side clarifies priorities.

A tight budget? Insure the biggest risk first—usually your income—then add health extras as cash flow allows.

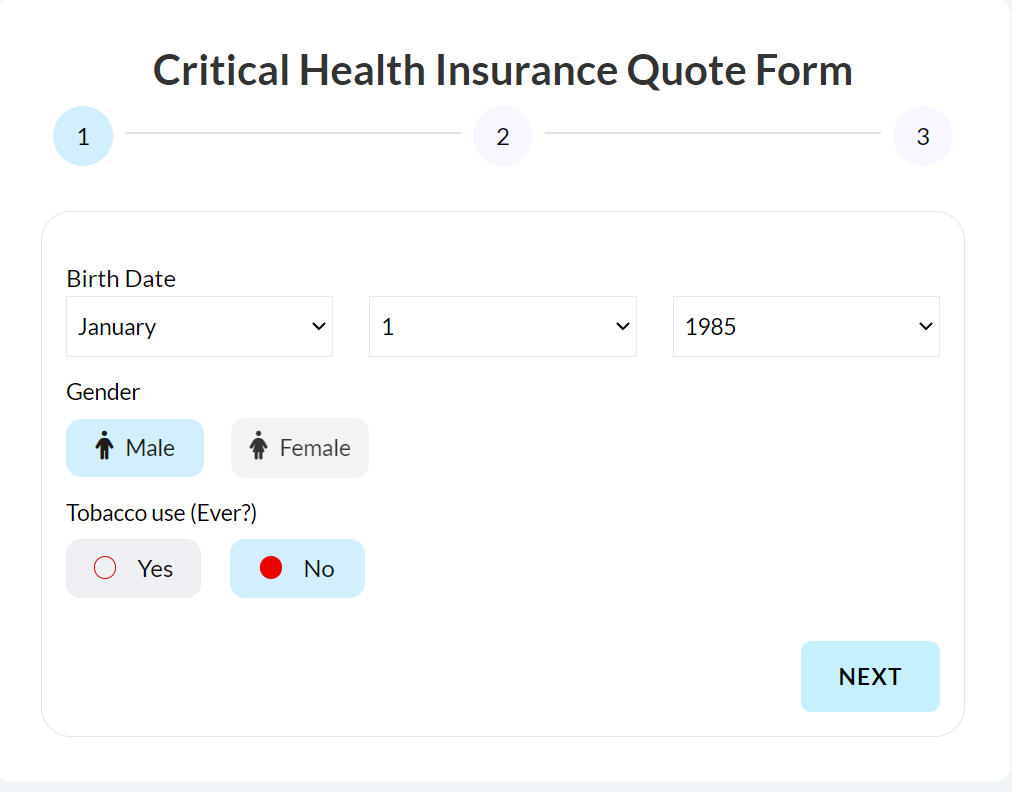

Critical Illness Insurance In Canada: A Lump Sum On Diagnosis

A serious diagnosis brings costs that the health plan doesn’t solve—time off work, travel to specialists, and home modifications. Critical Illness Insurance in Canada pays a tax-free lump sum on covered conditions (cancer, heart attack, stroke, etc.).

- Pair policies or consider Life Insurance with critical illness if you prefer one contract.

- Request a Critical Illness Insurance Quote while you’re gathering Health Insurance quotes; bundling decisions often reduce total gaps.

CI complements health coverage; it doesn’t replace it.

Public Health Insurance: The Foundation (Not The Finish Line)

Canada’s public healthcare system is excellent for emergencies and hospital care, but the everyday costs—prescription drugs, dental, therapy—live outside Provincial Health Insurance. That’s why private exists. Your Private Insurance Plan clears routine bills and gives you choices in non-urgent healthcare services without shredding savings.

Monthly Premium: Five Ways To Keep It Reasonable

- Pick a higher deductible you can genuinely afford.

- Don’t overbuy benefits you won’t use this year.

- Choose plans with ramp-up schedules to keep year-one costs tame.

- Re-shop at renewal if rates jump.

- Work with a licensed insurance advisor to pressure-test quotes and avoid traps in the fine print.

Pay for protection you’ll actually use. Skip the rest—for now.

Province Snapshots We Share Most Often

- Private Health Insurance Cost – Ontario

Basic from roughly the low-$100s for a single adult; comprehensive bundles with drug + dental + vision trend higher as you widen caps and add riders.

- Health Insurance Premiums – Alberta

Competitive entry pricing; comprehensive plan tiers climb with richer drug schedules and paramedical caps.

- Health Insurance In Canada – British Columbia

Starter pricing is often mid-range; fuller drug + dental + vision packages step up quickly with higher annual maximums.

Your reality = age + benefits + underwriting + postal code.

Pre-Existing Conditions: What To Expect

If you have a condition or notable medical history, expect one of these:

- Underwritten plan: best value when approved; may include ratings or exclusions tied to the condition.

- Guaranteed acceptance/replacement coverage: higher premiums and waiting period, but fast approval and immediate baseline protection.

- Blended approach: core plan now, add supplemental or extended Health Insurance later.

Full disclosure is non-negotiable. Non-disclosure risks claim denial when you need the plan most.

Travel Medical Insurance: Don’t Fly Without It

Even stellar Canadian coverage doesn’t cover out-of-country expenses by default. Add Travel Medical Insurance (single-trip or annual multi-trip) or confirm your plan’s Travel Insurance Coverage length and limits. Out-of-country emergencies can be five-figure events. Don’t chance it.

Best Health Insurance Companies: Picking A Partner, Not Just A Price

We match our clients to carriers that match their usage — strong drug formularies for families incurring high levels of prescription drug costs; robust dental schedules for families getting back up to date with their dental; good mental-health supports for those who focus on mental health care and mental health support. The best is the one that reliably solves your gaps.

How Much Coverage Is Enough?

A few reality checks we use in planning:

- If you fill 2–3 recurring prescription drug scripts, drug caps matter more than shiny extras.

- Families with kids usually benefit from earlier dental coverage.

- Heavy screen time or sports? Budget real vision care.

- Active professions? Boost paramedical services and add out-of-province emergency medical care.

- Tight budget? Start with essential medical services and scale later.

Right-sizing beats over-spending.

Realistic Shopping List (So You Don’t Overpay)

- List gaps left by your Provincial Coverage.

- Prioritize must-haves for the next 12 months.

- Gather 3–5 aligned quotes (same caps, same categories) for a clean comparison of Health Insurance quotes.

- Ask about waiting period, exclusions, and dental fee guides.

- Add a Critical Illness Insurance Quote and a Disability Insurance Quote—so you see the full risk picture.

- Confirm potential use of the medical expense tax credit and any self-employed deductibility.

- Choose the plan you’ll actually keep paying for.

From Talk To Action: What We Recommend At Canadian LIC

- Start lean with Private Insurance that covers your top two spending categories (often Prescription Drug Coverage and Dental Coverage).

- Add dental insurance, major services, and higher drug caps at renewal once you know your usage.

- Protect income with Disability Insurance (especially if self-employed). If you prefer a known brand, we can compare Canada Life Disability Insurance with its peers.

- Add a lump-sum backstop with Critical Illness Insurance in Canada; bundle with Life Insurance with critical illness if you want one contract.

- Travel? Don’t skip the rider (or stand-alone policy).

- Revisit benefits annually as health needs shift.

The Bottom Line

Your cost of Health Insurance is not just the premium — it is the combined amount you will pay in both premiums and claims. Smart design cuts waste and funds the care you really use. With a good knowledge of the holes left by the provincial government (plan), the right size of private policy, and some nicely selected add-ons (like CI + disability), you’ll come out of the box both covered today and appropriately priced.

If you’re looking for help sorting it all out, our licensed insurance adviser team can put together a side-by-side that makes the trade-offs clear — and the decision easy. When your coverage aligns with your life, the price is right.

More on Health Insurance

- Personal Health Insurance Vs. Disability Insurance In Canada: Do You Need Both?

- Which Is Better – Term Insurance Or Health Insurance?

- What Is the Difference Between Visitor Insurance and Regular Health Insurance?

- Can I Get Emergency Health Insurance?

- How Do I Claim Emergency Health Insurance?

- What Kind of Medical Health Insurance Do International Students Get?

FAQs

Healthy today doesn’t mean forever. A Private Health Insurance Plan is less about now and more about future gaps. It keeps you from scrambling when something minor snowballs.

Insurers treat pre-existing conditions as higher risk, but that doesn’t shut you out. Some accept everyone with a higher monthly premium, while others set waiting rules. Knowing which route works for your health history is key.

Yes, though skipping Dental Insurance usually means you’re gambling. Cleanings and checkups aren’t too bad out of pocket, but big work like root canals? That’s where costs spike.

Adding Critical Illness Insurance in Canada can protect retirement savings. A lump sum payout during a serious illness means you’re not pulling money from RRSPs or TFSAs just to cover care.

A Disability Insurance Quote shows the cost of protecting income, not hospital bills. It pays you when work stops because of illness or accident. That’s why Disability Insurance for the self-employed is so important.

Not usually. Even if you hold a Health Insurance Plan, travel needs its own layer. Adding Travel Medical Insurance avoids the shock of U.S. hospital bills that provincial plans won’t touch.

Key Takeaways

- Personal Health Insurance cost in Canada ranges widely — from about $61 a month for a healthy single adult to $300+ for seniors or comprehensive plans.

- Costs depend on age, province, coverage type, and extras like dental coverage, prescription drug coverage, and vision care.

- Pre-existing conditions increase premiums or limit coverage, though guaranteed acceptance plans exist for those needing protection.

- Disability Insurance for self-employed and Critical Illness Insurance in Canada provide added financial security, protecting income and savings.

- Provincial differences matter: Ontario, Alberta, and B.C. all show distinct Private Health Insurance cost ranges.

- Choosing the right Health Insurance Plan means balancing the monthly premium with actual needs, not just chasing the cheapest price.

Sources and Further Reading

- What Critical Illness Insurance Actually Covers

Breaks down key features of Critical Illness Insurance, including its one-time tax-free lump sum and what conditions are typically covered.

TD InsuranceGroupHEALTH - Quebec’s Public Health Coverage for Prescription Medications

Offers a contrast to most provincial programs—Quebec’s RAMQ includes drug coverage for many residents.

Wikipedia - Basics of Critical Illness Insurance in Canada

Inspired by Wikipedia, this outlines structures like lump-sum payouts, typical survival periods, and optional riders that help readers better understand policy mechanics.

Wikipedia

Feedback Questionnaire:

IN THIS ARTICLE

- How Much Does Personal Health Insurance Cost In Canada? A 2025 Guide

- Private Health Insurance: What It Does (And What It Doesn’t)

- Health Insurance Premiums: The Benchmarks We Use With Clients

- Health Insurance In Canada: Province First, Private Second

- Health Insurance Plan: What “Good” Actually Looks Like

- Private Health Insurance Cost: What Moves Your Price

- Health Insurance Companies: How We Compare Apples To Apples

- Health Insurance Tax Deductible & Medical Expense Tax Credit

- Dental Coverage: Why Everyone Wants It (And Why It Costs)

- Disability Insurance: Protect Your Paycheque Too

- Critical Illness Insurance In Canada: A Lump Sum On Diagnosis

- Public Health Insurance: The Foundation (Not The Finish Line)

- Monthly Premium: Five Ways To Keep It Reasonable

- Province Snapshots We Share Most Often

- Pre-Existing Conditions: What To Expect

- Travel Medical Insurance: Don’t Fly Without It

- Best Health Insurance Companies: Picking A Partner, Not Just A Price

- How Much Coverage Is Enough?

- Realistic Shopping List (So You Don’t Overpay)

- From Talk To Action: What We Recommend At Canadian LIC

- The Bottom Line

Sign-in to CanadianLIC

Verify OTP