- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

How Can An Emergency Fund Save You From Financial Crisis?

By Harpreet Puri

CEO & Founder

- 20 min read

- May 27th, 2025

SUMMARY

An emergency fund offers crucial financial protection during unexpected events like job loss, medical emergencies, or urgent repairs. The content explains how much to save, where to keep it, and why it’s essential for long-term stability. It also covers how an emergency fund works with insurance plans, how to start even on a tight budget, and common mistakes to avoid. Real-life Canadian examples illustrate the impact of having—or not having—a financial safety net.

Introduction

“One unexpected bill. That’s all it took.”

That’s how Raj, a self-employed Uber driver in Brampton, described the worst month of his life. He was managing just fine — until a late-night accident left his car out of commission. No car meant no work. No work meant no income. His rent was due in six days. The only savings he had were what was left in his gas tank.

His voice cracked as he told us, “I thought I had everything under control. But I didn’t have a cushion.”

If that sounds familiar, you’re not alone.

Across Canada, millions of working individuals and families are one emergency away from financial crisis. Not because they’re irresponsible, but because life is unpredictable, and no one taught them how to prepare for a curveball.

The solution? An emergency fund.

Let’s explore what it is, why it matters more in 2025 than ever before, and how it can be the one thing standing between you and financial freefall.

What Is an Emergency Fund?

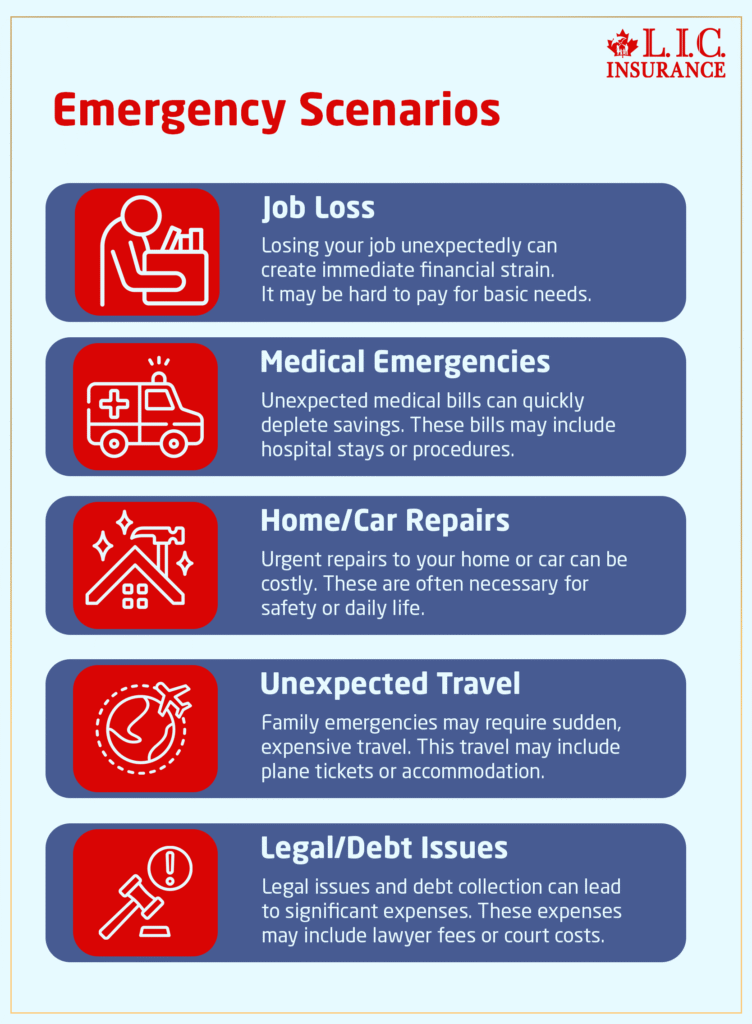

An emergency fund is money set aside for unplanned expenses or financial surprises. We’re talking about:

- Job loss

- Medical emergencies

- Urgent home or car repairs

- Unexpected travel due to family emergencies

- Legal issues or debt collection

It’s not for vacations. Not for your dream kitchen reno. And definitely not for a Boxing Day TV.

This is your financial “Plan B” when life goes sideways.

The Canadian Financial Landscape in 2025: Why Emergency Funds Matter More Now

Let’s face it: 2025 is not an easy year for the average Canadian household.

According to recent national data:

- 45% of Canadians say they couldn’t handle an unexpected $500 expense without going into debt.

- Interest rates remain high, and household debt is at a record $2.9 trillion.

- Job security is shaky, especially in tech, gig work, and small business sectors.

- The average rent in urban areas is above $2,000/month.

- And groceries? We all know what that bill looks like.

Now add in a car repair, or a medical bill not covered by your insurance, or your job suddenly disappearing.

Without an emergency fund, you’re not just dealing with the emergency — you’re dealing with the financial wreckage that comes after it.

Real-Life Scenarios We See Every Month

At our brokerage, we’ve helped countless clients navigate financial storms. The patterns are predictable and avoidable if there’s an emergency fund in place.

Single Mom with a Sick Child

Amanda was juggling two part-time jobs and raising her daughter. When her daughter needed urgent surgery and a week of recovery, Amanda had to stay home. She lost her week’s income and had no backup.

Small Business Owner Facing Equipment Failure

Jason runs a plumbing business in Kitchener. His work van broke down, and the repair bill was $3,100. He couldn’t accept the job for five days, meaning lost income and unexpected costs.

Elderly Couple With Furnace Trouble in January

The furnace died in the middle of a snowstorm. With no emergency savings, they put the repair on their credit card at 19.99% interest.

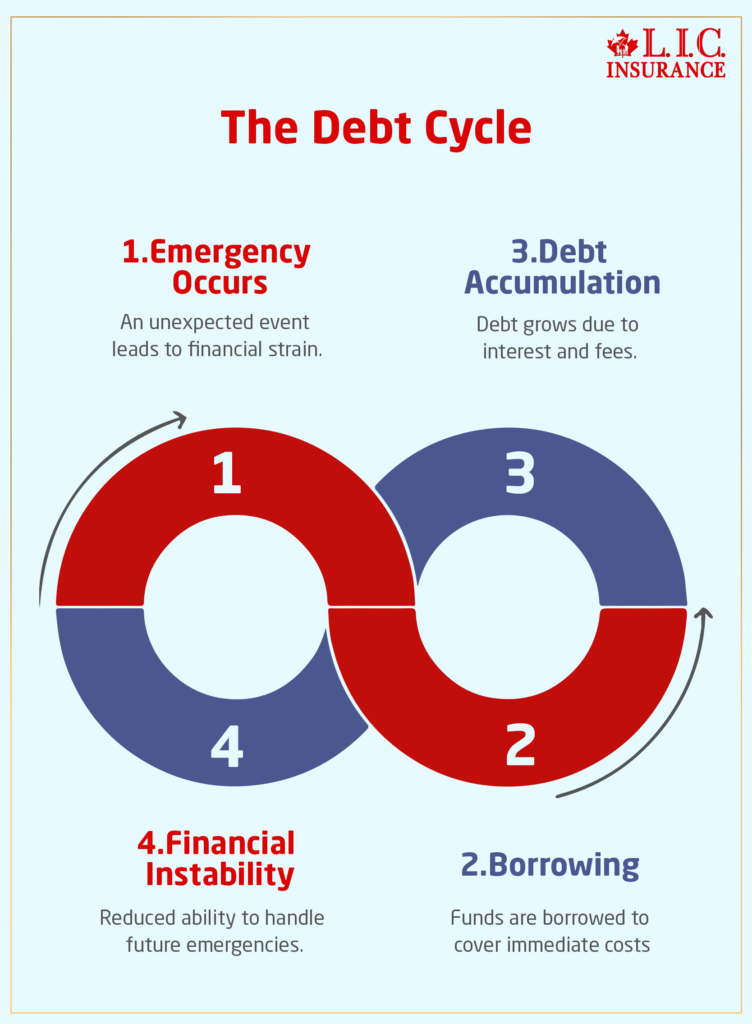

What Happens Without an Emergency Fund?

When there’s no financial buffer, emergencies quickly spiral into full-blown crises. Here’s what we typically see:

- Credit card debt skyrockets

- Lines of credit get maxed out

- Mortgage or rent payments are missed

- Vital insurance policies get cancelled

- Borrowing from payday lenders or unregulated sources

And worse, you become stuck in a cycle. The debt from one emergency can take months (or years) to recover from, which means you’re even less prepared for the next one.

It’s like running on a treadmill that speeds up every time you fall off.

How Big Should Your Emergency Fund Be?

Here’s a basic rule of thumb:

Aim for 3 to 6 months’ worth of essential expenses.

That includes:

- Rent or mortgage

- Groceries

- Utilities

- Insurance premiums

- Minimum debt payments

- Childcare, transportation, or medical needs

If your monthly core expenses are $3,000, you should aim for $9,000 to $18,000 eventually.

📌 But if you’re just starting? Even $1,000 can be a game-changer.

Where Should You Keep It?

It’s not just about saving the money — it’s about keeping it accessible but untouchable.

Ideal places:

- High-interest savings accounts

- TFSA (Tax-Free Savings Account) with immediate withdrawal access

- Separate no-fee savings accounts — not linked to your debit card

Avoid:

- GICs or locked-in investments

- RRSPs (withdrawals are taxable)

- Under the mattress (you’re losing to inflation)

The key is liquidity and protection. You need that money available within hours, not weeks.

What’s the Difference Between an Emergency Fund and Other Savings?

We get this question often.

| Goal | Used For | Risk Level | Access |

|---|---|---|---|

| Emergency Fund | Unplanned life disruptions | No risk | Immediate |

| Retirement Savings | Long-term financial independence | Some risk | Long-term only |

| Investment Accounts | Wealth growth over time | Higher risk | Mid-to-long |

| Vacation/Education | Planned future expenses | Moderate risk | Planned access |

What If You’re in Debt? Should You Still Build an Emergency Fund?

Yes. Absolutely.

It might feel counterintuitive — “Shouldn’t I pay off debt first?” — but without a buffer, every minor surprise sends you back into more debt.

We recommend:

- Save $1,000–$2,000 emergency fund first

- Then tackle high-interest debt aggressively

- Keep adding to your fund once debts are manageable

It’s not either/or. It’s about building a stability layer by layer.

What Does an Emergency Fund Actually Do?

- It gives you time

If you lose your job or get injured, you have breathing room before panic sets in.

- It protects your credit score

You’re not missing loan or bill payments just because of bad timing.

- It lets you make better decisions

You’re not rushing into a bad job, a high-interest loan, or cancelling your insurance just to stay afloat.

- It keeps small problems small

A flat tire or dental bill doesn’t become a financial emergency when there’s cash ready to handle it.

How to Start — Even If You Think You Can’t

Many clients tell us, “There’s nothing left to save.” And we understand that. But often, the solution is in small, consistent changes.

Here’s a simple approach:

- Open a separate account — label it “Emergency Only”

- Set up automated transfers every payday — even $20 helps

- Use tax refunds, birthday cash, or side hustle income to boost it

- Sell unused items and add the proceeds to the fund

- Treat it like a bill — it’s a non-negotiable part of your financial health

Consistency beats perfection.

Tools That Can Help Build Your Emergency Fund

- It keeps small problems small

- Mint

- YNAB (You Need A Budget)

- KOHO

- Hardbacon (Canadian-focused)

- It keeps small problems small

- Round-up features (every transaction rounds up and saves the extra)

- No-fee high-interest savings accounts

- It keeps small problems small

- Ask your HR if they offer automatic savings plans

- Some employers even match contributions up to a certain limit

How Emergency Funds Connect to Insurance and Long-Term Stability

An emergency fund works hand-in-hand with other protective tools, especially insurance.

- Lost your job? Your emergency fund keeps you afloat until EI kicks in or you find work.

- Sudden illness? Your health insurance + emergency savings cover what the plan doesn’t.

- Need to take unpaid leave? You’ve got the funds to buy time.

It also ensures you don’t need to cancel vital insurance coverage (like life, disability, or critical illness) during tough times, which could leave you vulnerable.

Final Thought: It’s Not Just Money — It’s Peace of Mind

At the end of the day, your emergency fund isn’t just about financial logic — it’s about mental health, dignity, and control.

It’s the power to say:

- “I can handle this.”

- “We’ll be okay.”

- “I don’t need to panic.”

And that feeling? It’s worth every dollar you put into the fund.

Frequently Asked Questions: Emergency Funds & Financial Crisis

You’re not alone — many Canadians feel this way. But here’s the thing: building an emergency fund isn’t about big chunks. It’s about small, automatic habits. Even $10 a week adds up over time.

Start with what you can. The goal isn’t perfection — it’s momentum.

Our clients often start with $1,000 as a basic cushion. That’s enough to cover a car repair, a surprise vet bill, or a last-minute flight home.

Eventually, aim for 3 to 6 months of core expenses, but don’t let that bigger number discourage you from starting small.

No — keep it separate. We’ve seen too many people accidentally dip into their emergency savings when it’s sitting next to their grocery money.

Open a no-fee savings account or a TFSA at a different institution. It keeps your emergency money accessible but out of reach.

Yes — absolutely. Without a buffer, every small surprise becomes new debt.

Build a starter emergency fund of $1,000, then focus on high-interest debt. You’ll be more stable and less stressed when life throws a curveball.

You can — but that’s not the same as having an emergency fund.

Credit cards = debt with interest.

Emergency fund = your money, stress-free.

Credit should be a last resort, not your first line of defence.

No — your emergency fund is about safety, not growth.

You want it liquid, low-risk, and available within hours. High-interest savings accounts or a TFSA (used like a savings account) are perfect.

Leave the stock market for your long-term plans.

We always tell clients: if it affects your ability to live, work, or stay secure, it’s an emergency.

✅ Job loss

✅ Sudden medical expense

✅ Urgent home or car repair

✅ Emergency travel

❌ A concert ticket is going on sale

❌ A “can’t-miss” sale on furniture

The test: Would you be okay putting it on a credit card and paying interest on it? If not, it’s probably a real emergency.

There’s no deadline — just direction.

For many families, it takes 12 to 24 months to build up 3–6 months of expenses.

Focus on consistent progress, not speed. Every deposit, no matter how small, is a win.

It’s better than nothing, but not ideal.

RRSPs come with tax penalties if you withdraw early.

Lines of credit are debt, and lenders can freeze them without warning if your income drops.

An emergency fund should be your money, no strings attached.

That’s normal. Even with a safety net, financial anxiety doesn’t always disappear.

But here’s the good news: every dollar you add to your emergency fund is a vote for your future security.

Pair it with disability insurance, life coverage, and a solid budget, and you’ll feel more in control over time.

Key Takeaways

- Emergency funds are essential, not optional — even $1,000 can protect you from debt during unexpected situations.

- Aim to save 3–6 months of essential expenses, but start small and build gradually through consistent habits.

- Keep emergency savings in accessible, low-risk accounts like a high-interest savings account or a TFSA, not RRSPs or investment portfolios.

- Emergency funds prevent minor financial surprises from becoming major setbacks, especially when combined with proper insurance coverage.

- Even while carrying debt, it’s smart to build a small emergency fund first to avoid relying on high-interest credit.

- Real-world examples show that not having an emergency fund can lead to credit damage, missed payments, and increased anxiety.

- Use automation, windfalls, and no-spend challenges to accelerate your fund without feeling overwhelmed.

- Emergency funds work best when paired with tools like life, health, and disability insurance, creating a full-circle financial safety net.

- Avoid common mistakes like treating credit cards as emergency funds or tapping into your RRSP for quick access.

- Peace of mind doesn’t come from avoiding problems — it comes from being prepared when they happen.

Sources and Further Reading

For deeper exploration and practical resources, click the topic links below:

- How Can an Emergency Fund Save You from Financial Crisis?

Real-life Canadian scenarios, emergency fund basics, and actionable steps to start your fund. - Bank of Canada: Financial Stability Reports (2025)

The latest data and analysis on household debt, interest rates, and the economic environment in Canada. - Government of Canada: Disaster Financial Assistance Arrangements (DFAA)

Details on federal and provincial support for emergencies and disasters, including eligibility and funding streams.

Recommended Tools and Further Reading:

- Mint — Budgeting app for tracking spending and savings.

- YNAB (You Need A Budget) — Popular tool for building emergency funds.

- KOHO — Canadian-focused budgeting and savings app.

- Hardbacon — Canadian financial planning and budgeting platform.

Related Topics:

- Is Infinite Banking A Smart Financial Strategy?

Explore the pros and cons for Canadians. - Self-Employed Canadians Lack Disability Insurance Coverage: Why It Matters More Than Ever in 2025

Learn about the importance of insurance alongside an emergency fund. - Frequently Asked Questions: Emergency Funds & Financial Crisis

Practical answers to common questions about building and using emergency

For official guidance and calculators, visit the Financial Consumer Agency of Canada and search for “emergency fund” or “financial planning.”

Feedback Questionnaire:

IN THIS ARTICLE

- How Can an Emergency Fund Save You from Financial Crisis?

- What Is an Emergency Fund?

- The Canadian Financial Landscape in 2025: Why Emergency Funds Matter More Now

- Real-Life Scenarios We See Every Month

- What Happens Without an Emergency Fund?

- How Big Should Your Emergency Fund Be?

- Where Should You Keep It?

- What’s the Difference Between an Emergency Fund and Other Savings?

- What If You’re in Debt? Should You Still Build an Emergency Fund?

- What Does an Emergency Fund Actually Do?

- How to Start — Even If You Think You Can’t

- Tools That Can Help Build Your Emergency Fund

- How Emergency Funds Connect to Insurance and Long-Term Stability

- Final Thought: It’s Not Just Money — It’s Peace of Mind

Sign-in to CanadianLIC

Verify OTP