What Is the Average Cost of Travel Insurance?

By Canadian LIC, March 7, 2024, 11 Minutes

You might be planning the trip of a lifetime or just a much-needed vacation to relax. As you book your flights and accommodation, you get more and more excited about the adventures that are about to come. But then, a thought that takes away all your excitement crosses your mind: “What if something unexpected happens?” Things that you can’t plan for, like flight delays or medical emergencies, can quickly turn your dream vacation into a stressful situation. When this happens, Travel Insurance is there for you as a safety net to give you mental peace and let you enjoy your trip.

Now, let’s discuss a question that many travellers have wondered about: How much does Travel Insurance cost on average? This blog is meant to explain Travel Insurance costs clearly. We should start this informative journey together, ensuring you can make empowered decisions to purchase Travel Insurance

Unveiling the Mystery: The Average Cost of Travel Insurance in Canada

Sometimes, figuring out how to get the right Travel Insurance can be difficult. Yet, with the right information, the picture becomes clear. The Travel Insurance cost in Canada can vary widely based on several factors. Just to give you an idea, the average cost is somewhere between CAD 50 and over CAD 300, but it depends on your age, the trip duration, and the specifics of your journey.

To understand how this Travel Insurance cost is calculated and what influences it, let’s get into the aspects that affect the price of your peace during travel.

Factors Influencing Travel Insurance Costs

- Destination: Venturing to far-off lands or staying within Canada can affect your premium.

- Duration of Trip: Longer trips typically mean higher Travel Insurance cost.

- Age of Travelers: Generally, the older you are, the higher the premium, especially for medical coverage.

- Type of Coverage: A comprehensive Travel Insurance Policy with medical expenses coverage will cost more but offer broader protection.

- Number of Travelers: Insuring a family or group can affect costs.

Choose the Right Policy

Meet Emily, a 30-year-old avid traveller from Canada who’s planning a two-week vacation to Europe. Emily is healthy and adventurous and understands the importance of being prepared. Given the high costs of healthcare abroad, she wants a Travel Insurance Policy that covers trip cancellations, lost luggage, and especially medical expenses.

After doing some research and comparing quotes, Emily found that the average cost for her desired coverage is around CAD 150. This total trip cost represents about 5% to 6% of her total trip expenses, the same as the industry average. Emily’s story highlights the importance of shopping around and choosing a policy that matches your specific travel needs and risks.

Find Out: Tips to buy Travel Insurance in Canada

The Breakdown: The Average Travel Insurance Cost Based on Coverage Type

To further simplify things, let’s look at a comparison table showing different types of Travel Insurance policies available in Canada and their average Travel Insurance cost. This table is based on a hypothetical 10-day trip to France for a single 35-year-old traveller.

| Coverage Type | Average Cost (CAD) |

|---|---|

| Basic (Trip Cancellation & Interruption) | 50-100 |

| Comprehensive (Including Medical Expenses) | 120-250 |

| Medical Only | 70-150 |

| CFAR (Cancel for Any Reason) Add-on | Additional 40-60% on Base Premium |

Understanding Medical Expenses Cover

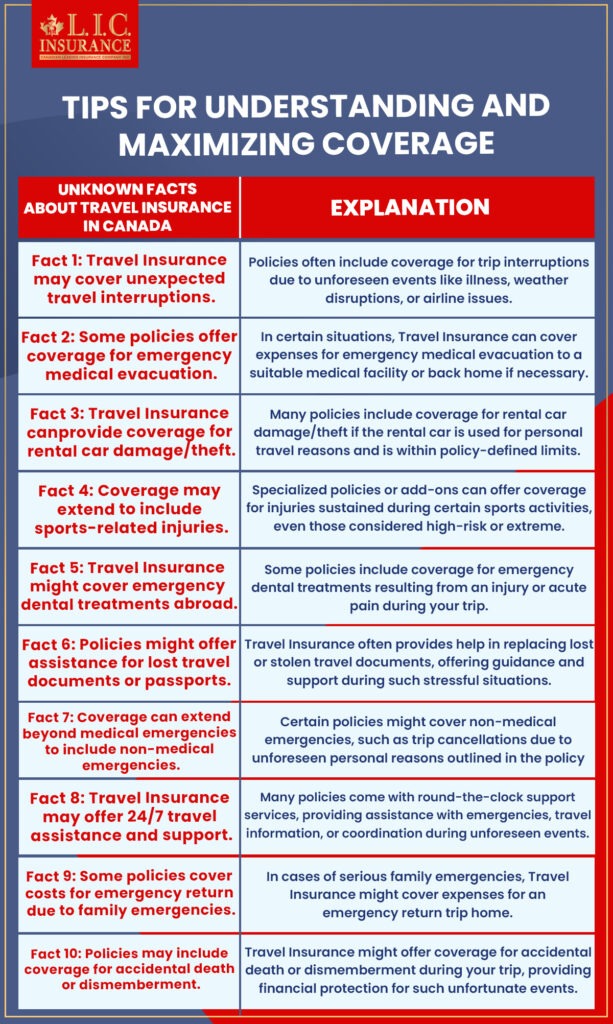

When considering a Travel Insurance Policy covering medical expenses, it’s essential to understand what it entails. This coverage is necessary for travellers, as it can cover costs from minor incidents like visiting a clinic for a sudden illness to major emergencies requiring hospitalization or medical evacuation. The peace you get knowing you won’t face a financial burden due to unforeseen medical issues is invaluable.

Making The Perfect Choice: Beyond the Total Trip Cost

Lots of things are at stake when picking the right Travel Insurance plan besides just the trip cost. It’s about getting very clear about what’s covered and making sure it fits very well with your travel plans. On this journey of selection, you’re not just checking off a box; you’re also making an element of security that fits your unique adventure just right. Let’s go through this process together.

The Adventure Factor

Consider Alex and Jordan, two friends with a thirst for adventure, planning a skiing trip to the Canadian Rockies. Excited by the prospects of fresh powder and breathtaking slopes, they also recognize the risks involved in such high-octane activities. This realization prompts them to look for a Travel Insurance Policy that goes beyond basic coverage, ensuring they are protected against the specific risks associated with skiing, like injuries or equipment loss.

This is where the importance of a Travel Insurance Policy with comprehensive coverage, including medical expenses, becomes crystal clear. It’s not just about having any policy; it’s about having the right one. For Alex and Jordan, a policy tailored to their adventurous spirit, covering high-risk activities, is non-negotiable. It’s their key to enjoying the thrills without the chills of potential financial setbacks.

The Value of Valuables

Now, imagine Sophia, a budding photographer with a passion for capturing the world through her lens. Her travel plans are incomplete without her camera and gear, often worth thousands of dollars. The thought of losing her equipment or encountering theft is enough to cast a shadow over her travel excitement. Here, a standard Travel Insurance Policy might not fully cover the value of her equipment, so searching for the right policy with additional coverage for valuable items is imperative.

Sophia’s story shows how important it is to think about what you bring when travelling. A Travel Insurance plan that lets you include coverage for valuable items can turn fear into mental satisfaction so tourists like Sophia can enjoy the beauty of their destinations without worrying about their gear.

Tailoring Your Policy

Choosing the right Travel Insurance Policy means asking the right questions:

- What activities will I be doing? Identify if your vacation involves activities that require additional coverage.

- What valuables am I taking with me? Assess if you need extra coverage for items like electronics, jewelry, or sports equipment.

- What are my health considerations? Ensure your policy covers pre-existing conditions or specific medical needs.

This thoughtful approach to selecting a Travel Insurance Policy ensures that your coverage is as unique as your trip. It’s about matching the policy details to your individual travel blueprint and creating custom-fit protection.

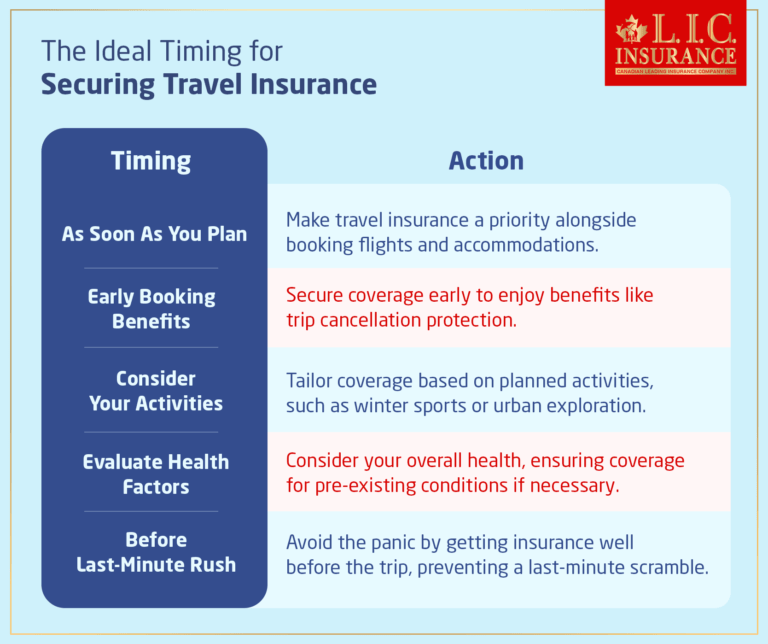

Find Out: How long before travelling you should get travel insurance?

Conclusion: Taking the Next Steps

Understanding the average cost of Travel Insurance and what influences these costs prepares you to make the right decision. Like Emily, you can find a policy that matches your travel needs, offering financial protection and contentment.

We encourage you not to leave this task for the last minute. Start exploring your options, compare quotes, and consider your trip’s specifics. Whether you’re an adventure seeker, a family traveller, or someone looking for relaxation, there’s a Travel Insurance Policy out there for you. Take action today, and step into your travel adventures with confidence.

The world awaits, and now you also have the right knowledge to explore it more safely and securely. Happy Travelling:)

Find Out: What Travel Insurance does not cover?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

It can be like trying to find your way in a new place without a map when you’re trying to understand the details of your Travel Insurance Policy. Don’t worry, though! To help you with your Travel Insurance, we’ve put together a list of the most common questions, giving you clear, direct answers. These frequently asked questions (FAQs) will help you understand Travel Insurance as easily as having your favourite travel snack.

Think of a Travel Insurance Policy as your trusty travel companion, ready to help in many situations. It usually covers unexpected trip cancellations, medical emergencies, lost luggage, and sometimes, delays that affect your travel plans. For instance, if Maria’s flight to Paris is suddenly cancelled due to bad weather, her Travel Insurance can cover the costs of rebooking her flight and accommodation.

Let us say that Tom, who loves hiking, hurts his ankle while discovering hiking paths in the mountains of Canada. A Travel Insurance Policy covering medical expenses becomes his protection, ensuring he receives the necessary medical attention without worrying about the trip cost. This type of policy is essential because it protects you from the financial burden of unexpected medical expenses while travelling, ensuring comfort and peace.

The cost of trip insurance in Canada can vary widely, but on average, you might spend between CAD 50 and CAD 300. The price depends on factors like your destination, trip length, age, and the coverage you choose. It’s similar to how plane ticket costs vary based on when and where you’re flying.

Yes, you can! However, it’s like buying a custom-made outfit; you need to provide details about your condition to find a policy that fits just right. Some policies might exclude certain conditions or require you to pay a bit more for coverage. Being upfront about your medical history is essential to ensure you’re fully covered.

If you’re like Alex and Jordan, planning to hit the ski slopes, look for a policy that specifically covers high-risk activities. Read the fine print to ensure your adventures are covered, and don’t hesitate to ask the insurance provider if you’re unsure. Choosing the right policy means making sure it matches the adrenaline level of your activities.

The best time to buy Travel Insurance is right after you book your trip. This timing ensures you’re covered for any unforeseen cancellations right from the start. It’s like putting on your seatbelt as soon as you get in the car – it’s a safety step you don’t want to skip.

Absolutely! If you’re mostly worried about medical emergencies, you can opt for a Travel Insurance Policy that focuses on medical expenses. It’s a bit like choosing a la carte from a menu, picking just the dish you really want to try.

Imagine you’re like Sara, who, after purchasing Travel Insurance, decides her trip to Italy might need to be postponed. Most Travel Insurance providers offer a “free look” period, usually around 10 to 14 days after purchase, during which you can cancel your policy for a full refund, provided you haven’t started your trip or filed a claim. It’s just the same as trying on a new outfit at home and deciding if it’s the perfect fit for your upcoming event.

Let’s say Marco is planning a beach getaway when, suddenly, a hurricane forecast threatens his plans. Travel Insurance policies vary, but many include coverage for trip cancellations due to unforeseen natural disasters or pandemics. However, it’s necessary, just like checking the weather before heading out, to review your policy’s specific terms to ensure these scenarios are covered.

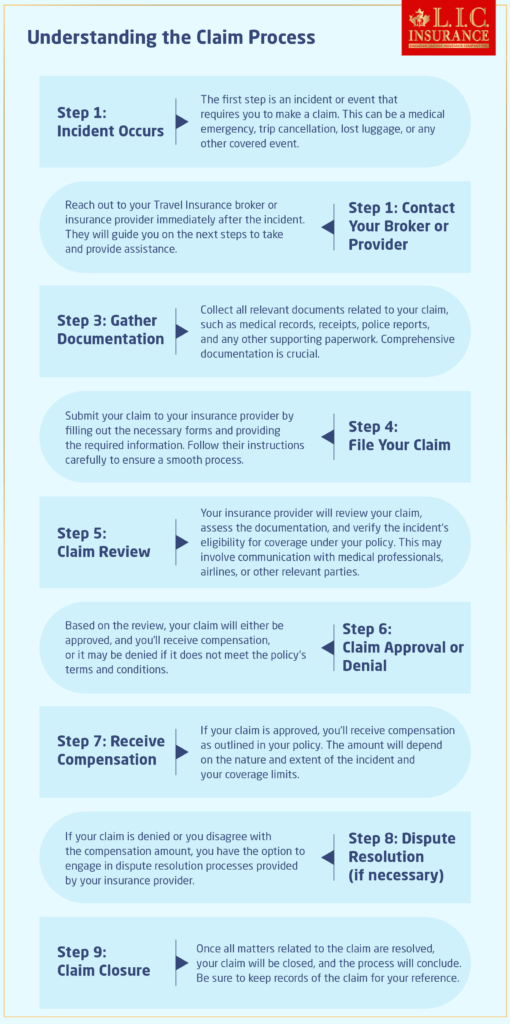

Filing a claim might sound difficult, but it’s similar to telling a friend about an unexpected event on your trip. If you need to file a claim, first contact your insurance provider to inform them of the situation. They’ll guide you through the process, typically filling out a form and providing documentation like medical bills or flight cancellation notices. It’s about gathering the pieces of your story so your insurer can understand and assist you effectively.

Think of Lily, who manages a chronic condition but loves to travel. Many Travel Insurance policies can cover individuals with chronic illnesses, but disclosing this information is necessary when purchasing your policy. Like finding the right guide for a challenging hike, being upfront allows you to secure a policy that addresses your specific needs, ensuring you’re covered on your journey.

Much like a tailored suit, Travel Insurance comes with specifications that can vary by provider. While some insurers might have age limits for their policies, others specialize in offering coverage to travellers of all ages, including seniors. It’s about finding the company that caters to your stage in life’s journey, ensuring you’re protected regardless of age.

Determining the right amount of medical coverage is like packing a suitcase – it depends on the length and nature of your trip. Keep into account factors like the destination’s healthcare costs and the activities you plan to undertake. As a rule of thumb, look for policies offering a minimum of $100,000 in medical coverage to ensure substantial protection against unexpected medical expenses.

If you’re having too much fun exploring and wish to extend your stay, most insurance providers allow you to extend your coverage if you request it before your policy expires. It’s just the same as asking for a late checkout at a hotel, giving you more time to enjoy your adventure.

Buying Travel Insurance is like picking the perfect travel outfit: it should fit your trip’s needs perfectly. Start by assessing your travel plans—consider destinations, activities, and who you’re travelling with. Then, research online or speak with an insurance advisor to compare different policies. Look for one that covers your specific activities, offers medical expenses coverage, and fits within your budget. Once you’ve found your match, you can usually purchase it online or over the phone, filling out your details and making the payment.

| <p>Even for a short weekend away, Travel Insurance can be as essential as bringing your wallet. Unexpected events, like an injury or sudden illness, can happen, even on short trips close to home. For instance, if you’re planning a quick ski trip to Whistler and you accidentally sprain your ankle on the slopes, having a Travel Insurance Policy with medical expenses covered can save you from facing a hefty medical bill. It’s about ensuring that even a short trip isn’t spoiled by unforeseen expenses, allowing you to enjoy every moment, no matter how brief.</p> |

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com