Travel Insurance is an indispensable net of protection, a line of defense, for you and your loved during your travels. It’s like a reliable wingman, prepared to jump in when something you didn’t expect occurs. This cover is aimed to give you that peace of mind and keep you from being stranded incase of any of these eventualities happening.

Travel Insurance is an essential safety net, providing peace of mind whilst you are travelling. It’s like a reliable friend, there for you when you get in an unforeseen jam. This simply is coverage that will give you peace of mind that when something comes up, you will not be stuck in a situation that you are not prepared to handle.

However, it’s important to know what does Travel Insurance cover as much as what does Travel Insurance not cover. All too frequently, travelers mistakenly believe that once a policy is established, anything and everything is covered — cancellations, lost items, and any kind of emergency. Policies really do differ, and understanding what is not covered on Travel Insurance can make the difference between having a claim approved or not.

One of the questions I get about the most when it comes to travel insurance is if it covers stolen items such as electronics and jewelry. It depends on the details of your policy and its claim limits. When you know what’s covered — and what’s excluded — you are in a better position to select a plan that matches your specific travel situation and won’t lead to unpleasant surprises later on.

Purpose of Travel Insurance

The core purpose of Travel Insurance is to provide you with proper safety against the unexpected—whether it’s medical emergencies, trip cancellations, lost baggage, or other unforeseen mishaps. It acts as a financial protection, coming to your aid when things don’t go according to plan.

Want to know the need of Travel Insurance?- Go here

Importance of Understanding Coverage

While Travel Insurance coverage is undeniably valuable, it’s equally important to recognize its boundaries. Knowing what your policy includes—and what it doesn’t—is crucial. Understanding these limitations can prevent surprises or disappointments, ensuring you’re well-prepared for any potential gaps in coverage.

Setting the Context for Limitations

Nevertheless, for as wide-ranging as they can be, Travel Insurance policies can still have their shortcomings. These limitations are akin to fences that delimit what the Policy can and cannot cover. It’s important to recognize and understand these limitations in not only making informed choices but seeking further options when required.

Understanding the intention of Travel Insurance, and what coverage represents, will allow travellers to make informed decisions that give them appropriate protection whilst on their travels and to understand what is, and isn’t, included in their travel insurance.

Find out about the worth of buying Travel Insurance online here

What Travel Insurance Doesn’t Cover

Even though Travel Insurance acts as a safety cushion, it’s essential to recognize its limitations. While it offers extensive coverage, there are certain scenarios where its protection may not extend.

Pre-existing Medical Conditions:

One of the common exclusions in many Travel Insurance policies involves pre-existing medical conditions. This means if you have a medical condition before purchasing the policy, such as diabetes or heart disease, treatment related to these conditions might not be covered during your travels. It’s crucial to disclose any pre-existing conditions when purchasing insurance, as this impacts coverage and potential claims.

High-Risk Activities:

Adventure seekers, take heed! A lot of standard Travel Insurance policies do not provide coverage for high-risk activities like bungee jumping, skydiving, or even scuba diving beyond certain depths. Engaging in these activities might nullify your coverage, so it’s essential to check the policy’s fine print and consider additional coverage if planning such activities.

Travel to High-Risk Destinations:

Certain destinations with high political instability or travel advisories may not be covered by Travel Insurance. Areas facing civil unrest, war, or known for heightened risks might fall under exclusions. Always check the destination’s status and travel advisories to ensure your insurance provides coverage.

Unapproved Activities or Reckless Behavior:

Engaging in illegal activities or behaving recklessly can void your insurance coverage. This includes ignoring travel advisories or engaging in activities against local laws. Remember, insurance is meant to protect responsible travellers, so exercising caution and abiding by regulations is crucial.

Certain Personal Belongings:

While Travel Insurance covers lost or stolen belongings, there are limits, especially for high-value items like expensive jewelry, electronic gadgets, or sports equipment. For these items, insurance might have a cap on reimbursement. Consider additional riders or specific policies for comprehensive coverage of valuables.

Exceptions and Limitations Explained

While it’s important to understand what Travel Insurance might not cover, it’s equally crucial to explore exceptions and potential limitations.

Policy-Specific Exclusions:

Travel Insurance comes in many different shapes and sizes. Exclusions may differ greatly between insurers and their policies. This also means what is excluded under one policy will be covered under another. Reading and understanding the policy documents is a wise thing to do before you buy. Doing this will reveal the circumstances or actions that your particular policy may not cover. Some insurers may also provide more comprehensive coverage for some situations that other insurers would not. One policy may, for example, not cover extreme sports while another does. Understanding the differences help you select the policy that will better meet your travel requirement.

Additional Coverage Options:

But the good news is that there is a way to fill some of the gaps created by exclusions in standard policies. These limits can then be backed up with additional policies or add-ons to act as a financial safety net. Suppose you’re an extreme guy, and you want to have extreme adventures like skydiving or rock climbing. And if so, there are specialized policies for that. Those extra protections may cost extra, but provide peace of mind, particularly when enjoying pursuits not included in the average policy. Having these supplements means you’re covered for things outside the typical activities or situations in your main policy.

Familiarize Yourself With Policy Specific Exclusions and Consider Additional Coverage As travelers seek out potential limitations in their Travel Insurance, they can more easily sift through the small print. This gives you the ability to develop a more complete policy that is tailored to your unique travel plans, including coverage for things like travel activities.

Why Travel Insurance Terms Vary Based on Your Purpose of Travel

One of the overlooked yet important aspects in deciphering what is not included in Travel Insurance is the purpose of your trip itself. Many travelers believe that coverage is one-size-fits-all, when in fact, why you’re traveling — whether for business, pleasure, school, or medical tourism — can affect what is and isn’t covered. This is a crucial factor that you don’t read or hear about Him in every Travel Insurance main-stream articles.

Such as travellers to a foreign country being told the routine policy will not cover any health problems stemming from elective cosmetic treatments. Recouped costs for events or some equipment damages could be excluded unless noted in an enhanced policy, the same with injuries resulting from work or damages that occur while digital nomading somewhere else. This matters when you’re looking at what does Travel Insurance cover other than the medical and trip cancellation advantages.

Then there’s the blur around personal electronics and professional tools. It’s a question a lot of travelers want to know — does Travel Insurance cover stolen items, like a laptop or camera I needed to do work on the road? Many typical policies exclude, or have a limited amount for, those types of items unless specific details are provided in advance to show their value. If not, these usually below the description of Travel Insurance exclusions section!

Knowing your purpose of trip and sharing it when you’re buying insurance enables insurers to tell you which tier of policy and which riders are best for you. It’s a proactive approach that means you never have to worry about last minute technicalities and exclusions as a result of the purpose of your trip – so you can enjoy your trip safer and better protected.

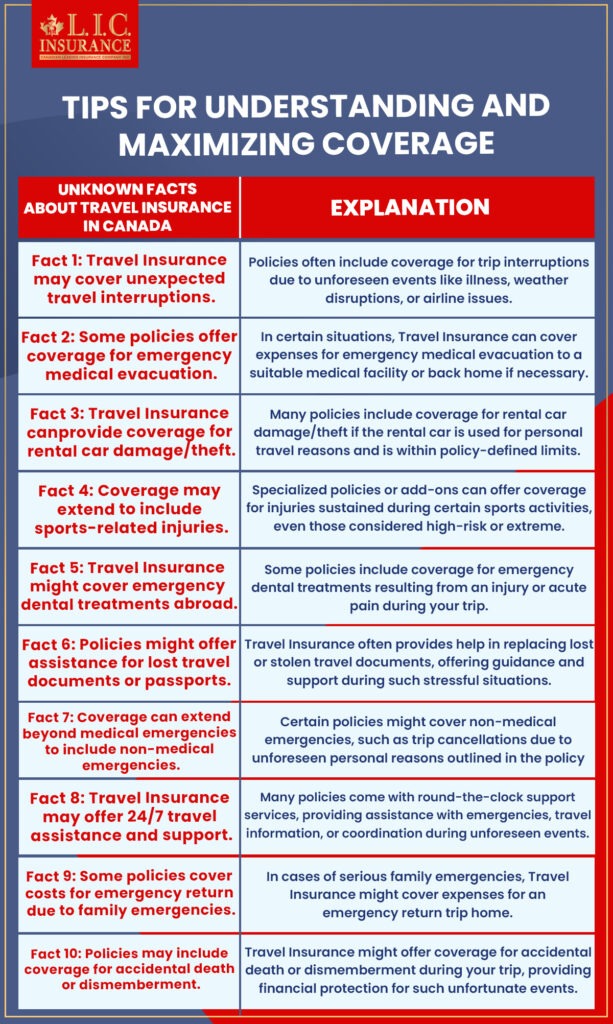

Tips for Understanding and Maximizing Coverage

Read and Understand Policy Terms:

Before beginning your journey, it’s wise to become extremely comfortable with your Travel Insurance Policy. Take the time to flip through the pages and understand the minutest details. Pay extra attention to the exclusions section—that’s where the policy’s limitations hide. By familiarizing yourself with these exclusions, you’ll avoid surprises if you need to file a claim. Understanding what’s covered and what’s not can save you from potential frustrations later on.

Declare Pre-existing Conditions:

Honesty is the best policy, especially when it comes to pre-existing medical conditions. If you have any existing health issues, be upfront and declare them to your insurer when purchasing Travel Insurance. While standard policies might not cover these conditions, some insurers offer options or upgrades to include coverage for pre-existing conditions. By disclosing these conditions upfront, you pave the way for potential coverage options tailored to your needs.

Know Coverage Limits and Exclusions:

Apart from exclusions, it’s essential to understand coverage limits within your policy. Some plans may have specific caps on coverage amounts for medical expenses, trip cancellations, or baggage loss. Awareness of these limits helps you manage expectations and plan accordingly.

Understand Emergency Procedures:

Familiarize yourself with the procedures for emergencies covered by your policy. This includes knowing how to contact the insurer during emergencies, understanding what qualifies as an emergency, and the steps to initiate a claim. Having this information readily available can streamline the process during stressful situations.

Keep Copies of Important Documents:

Before your trip, make copies or digital scans of essential documents like your insurance policy, passport, ID, and itinerary. Having these backups can be a lifesaver if your originals are lost or stolen during your travels. Additionally, ensure you have the contact information for your insurer readily accessible.

Time Limits for Claims:

Be mindful of any time constraints for filing claims. Some insurance policies have specific timeframes within which claims must be submitted after an incident occurs. Missing these deadlines could result in denial of your claim, so stay informed and act promptly if you need to make a claim.

Be Honest in Claims Filing:

In the case of an unfortunate event occurring during your trip, honesty is key when you file a claim. Provide accurate and truthful information supported by relevant documentation. Misrepresentation or providing false details can lead to claim denials.

Review and Update Policy if Needed:

Life changes, and so do travel plans. Periodically reviewing your insurance policy ensures it still aligns with your needs. If your travel habits or requirements change, consider updating or purchasing additional coverage to ensure adequate protection.

These simple yet crucial tips can make a world of difference in maximizing your Travel Insurance coverage. Taking the time to understand your policy and being transparent about any pre-existing conditions ensures you’re well-prepared and equipped for a worry-free journey. It’s all about being proactive and making informed decisions to protect your travel experience.

Here are some tips that will help you while buying Canadian Travel Insurance

Final Words

Travel Insurance is incredibly important protection during travel, but it’s important to be aware of the many things it does not cover. Knowing what is covered and not covered by your policy can help you to avoid any hassles during your travels. Understanding these exceptions, pursuing alternative cover, and being inspired to question these, can enhance your Travel Insurance, giving you a worry-free and protected trip.

Remember, although you’re receiving generous cover, Travel Insurance is not a one size fits all. Tailoring your policy to match precisely your travel plans, and knowing full well those less well-known sections, is all important in helping to ensure you have a smooth and secure trip.

Read about the importance of Emergency Medical Travel Insurance

Faq's

As would be usual, the pre-existing medical conditions are likely to be excluded under standard Travel Insurance policies. You’ll want to review your policy to understand where it stands on pre-existing conditions. But for a fee, some companies have options or upgrades that allow people to obtain coverage for them.

Typical Travel Insurance may not cover high-risk activities such as bungee jumping, skydiving, or mountain climbing. Specialist policies for Adventure sports are available as add ons for added protection, however.

Some Travel Insurance policies do not provide cover for travel to countries experiencing political turmoil, civil unrest, or countries under Travel Advisor Warning. Look at your policy to see what it says about coverage in high-risk zones like these.

Even though Travel Insurance will cover loss or theft, your valuables may have a ceiling. Some policies may have limits on reimbursement of costly goods. Extra riders or policies may be able to give more comprehensive coverage of valuables.

Travel Insurance can also provide coverage for trip cancellations for reasons stated in the policy, such as sickness, accidents, and natural disasters. But if you cancel for personal reasons that are not part of policy-defined scenarios, you may not be covered.

Claims arising from alcohol or drug use may not be included in Travel Insurance. Reckless or illegal actions that result in accidents could void coverage.

Yes, all travel insurance policies have a maximum amount of time after the event occurred, that claim will have to be made. Failure to meet these deadlines can lead to claim denial, so compliance with the specified timeframes is key.

Policies may differ on coverage for natural disasters or pandemics. Some Travel Insurance might not cover for events that are declared as foreseeable, namely pandemics, but a few may provide coverage for cancellations or interruptions of trips in case of unforeseen occurrences, like natural disasters. Check your policy to see what it says.

Medical costs from alcohol or drug related accidents may not be covered. Participating under the influence may result in the voiding of any claims or insurance as a result of an injury or accident.

Travel insurance does not necessarily cover complications associated with pregnancy. Some insurers provide a benefit specifically for pregnancy, but it’s important to read the terms and limitations of such a benefit.

Non-emergency medical treatments may be restricted in standard policies. Such policies typically concern emergency medical care. That said, certain plans or add-ons may want more — some provide long-term coverage for nonemergency medical matters.

It is possible that with Travel Insurance flight delays or missed connections for certain reasons included in the policy (e.g., due to bad weather or problems at the airline) are covered as well. But coverage for personal reasons for missed flights, such as traffic on the way to the airport, may not be offered.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]