Canada is an exceptionally gorgeous country with beautiful views and wildlife. It is the second-largest nation and the 10th-largest economy in the world. So if you are planning a vacation in Canada, you need to save a good amount of off days from work to cover the entire country properly. If you are someone who loves travelling all over the world, then keep Canada as your top priority. This country can offer everything you can dream of, from incredible wildlife to gorgeous national parks and lakes.

So while planning your trip here, it would be best to keep the most famous places on your list, and it would be wise to find your accommodation near them to utilize your time fully.

But the most important thing to remember is to invest in a good travel insurance plan for your safety and security.

You don’t have to worry about your trip-related issues, as Canada’s International Travel Policy for travelling from India is very well designed, keeping your protection in mind.

It is best to do thorough research online and compare all travel insurance plans in Canada to find a perfect one from India to Canada. Our budget-friendly travel insurance plans will give you the best financial support and coverage.

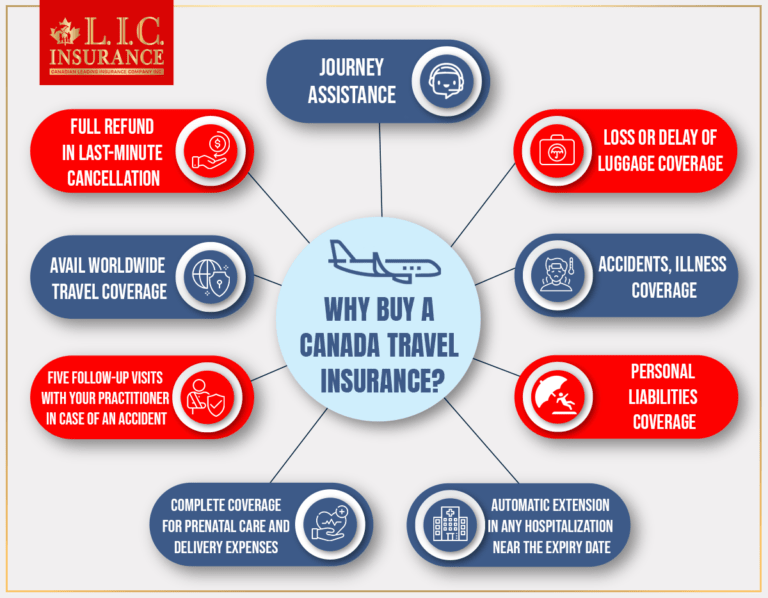

What are the Benefits of Buying a Canada Travel Insurance?

You will have a wonderful trip to Canada, one that you will remember all through your life if you travel here for the first time. But many times, international trips make many people nervous because of the uncertainty of the situations you might face during your stay in the country. Suppose any such difficult situation arises where you get sick or have any kind of accident, then you would not know whom to contact in a completely new place. That is the reason why a Canada travel insurance plan is so important. It will be your rescue during those times. Here we have listed a few of the benefits you will get after having a Canadian LIC Travel Insurance Policy.

- Journey assistance all throughout while travelling locally

- Loss or delay of luggage coverage.

- Accidents, illness, and Covid-19 care coverage.

- Personal Liabilities Coverage

- In case of any hospitalization near the insurance plan’s expiry date, there will be an automatic extension for around 60 days.

- Complete coverage of $6,000 for prenatal care and delivery expenses.

- In case of an accident, you can have five follow-up visits with your practitioner.

- Avail worldwide travel coverage if you have mostly spent your travel period in Canada.

- Full Refund in the case of last-minute cancellation.

Canadian Travel Insurance

Before planning any trip, you must be very well aware of the place and what it offers. God forbid if there is any mishap during your visit, you should be prepared for it beforehand. It is best that you are fully prepared for even the worst situations from before. The best option is to choose Travel Health Insurance Canada, which will save you from any unforeseen situations that might arise. But don’t worry; this is not sure that a problem will occur; we are just preparing ourselves for the worst-case scenarios.

Online Canada travel insurance will provide you with safety whenever you are among unknown people or strangers. If you have the best Canadian travel insurance policy, then you can enjoy your holiday without any worries. You can be tension-free and can fully focus on enjoying your holidays. Canadian LIC’s travel insurance policy deals with a lot of treatment costs and medical emergencies. You can also be tension-free if your luggage or passport is lost, as all these issues are well taken care of with Canadian LIC’s travel insurance plan.

Hence you can research properly online and pick up the best travel insurance policy for Canada if you have already booked your tickets to visit Canada.

What is the need for Travel Insurance?

It would help if you prepared properly before planning any trip to any place. Going to a different part of the world might bring you some challenges for which it is best to prepare yourself in advance. It is best to check everything thoroughly before you begin your journey to avoid any unforeseen problems that might arise after reaching there.

You can read more about the need for travel insurance here – Answers to why you need travel insurance in Canada.

Even after being very well prepared in advance for everything, you still cannot avoid certain unforeseen accidents and illnesses no matter what you do. There are chances that you might lose your bags or any important documents. The people traveling with you might fall sick or face any kind of accident.

Also, since COVID-19, taking all the necessary precautions possible has become even more important. Travel medical insurance Canada will be your perfect solution to protect you from the abovementioned issues. But the only thing to ensure is to choose a promising one so that you can fully enjoy and have a memorable experience in Canada.

Don’t forget to check the travel advisories from the government of Canada before you book your tickets for Canada.

Choosing a good Canadian travel insurance policy will keep you relaxed while travelling as you will know that there is support on your back even if something unexpected happens. Medical treatments in Canada can be quite expensive for you, so investing in the best travel insurance plan is a wise option.

In order to pick the best policy, it is advised first to compare them. This way, you can choose the one that will work best for you from all the available options. There are a lot of policies available in the market at different prices, but make sure you properly research and pick the affordable option that also provides all the required facilities. A good travel insurance policy will cover trip cancellation or extension, luggage loss, medical, passport loss, and repatriation.

You can gain good knowledge about travel insurance to Canada here- Travel Insurance for Visitors To Canada.

Canadian LIC’s travel insurance plan is budget-friendly, provides good financial protection, and offers all the benefits mentioned above, and much more.

10 tips that will help you while buying Canadian Travel Insurance

Here we have put together some tips to make your insurance selection process easy in case you are confused about picking a good travel insurance policy for Canada. If you are confused about which policy to go for, these 10 tips will help you greatly. They will help you to choose the one which is best for your situation.

Tip 1: Focus On Coverage More Than Price

Firstly ensure that the policy coverage is fulfilling all your specific needs before looking at the price. There is no point in going for a cheaper option if your travel needs will remain unfulfilled at the time of travel.

Tip 2: Know Everything

Try to find out everything as much as you can and ask questions about what is being covered and what is not. Whatever you are not able to understand, ask specific questions for them and write down their answers. If it is possible, get a written copy of the policy before paying your premium. In the beginning, it might get difficult for you to understand the insurance language, but eventually, it will get easier.

Tip 3: Dont Hide Anything

This step is equally important, just as asking questions. The insurance agent should be aware of all the trip details. Then only he can help you to the best of his potential. If you want the best travel insurance Canada package for yourself, then your insurance agent should know when and where you are going and what you will do after reaching. If you are planning to go for any risky, adventurous activities like bungy jumping or scuba diving, then your policy might get nullified.

Tip 4: Do a Thorough Investigation Both Online And on the Phone

The easiest way to compare travel insurance coverages and prices is online. Nowadays, there are specific websites especially dedicated to comparing Canadian travel insurance costs. You can very conveniently compare options and then discuss them with a trusted travel agent to make the best decision for yourself. You can even visit your bank to find out their travel insurance coverage quote and then pick the best option for yourself.

Tip 5: Take The Help Of Regular Travellers

People who travel out of the country on a regular basis can be your best advisors as they hold actual experience. They have a good knowledge of companies that provide the best coverage at the best price and have a smooth policy. Hence, with a personal recommendation and a knowledge of what to expect from which company, you will be able to make the best decision for yourself.

Tip 6: Extend Your Policy Duration And Save Time

After finding a good quality coverage fitting your budget, you can now think of sticking to it. Most of the time, insurance companies extend policy durations for some amount of time which is mostly annual renewal or allows you to have more than one trip. This will save you a lot of time as you will not have to shop again for a new policy the next time you visit Canada, and you will also be able to save money.

Tip 7: Collect All Knowledge on Your Current Coverage

Take all the information about your bank’s agreements, credit card holder agreements, and employee group benefits. Some amount of coverage will be already available, and in that case, it would just have to be supplemented. All those who already pay some amount of money for their travel insurance hold a great benefit as they save a lot of their money.

Tip 8: Buy Insurance For The Entire Family Together

The entire family travels together, so it is better to invest in an inclusive travel insurance Canada policy rather than investing in every member’s policy separately. This will not only save money but also a lot of your time in paperwork because of the same coverage and contacts.

Tip 9: Carry All of the Policy Information While Travelling

This is extremely crucial as what will be the point of investing in insurance when you don’t have it in hand at the time of an emergency? You can find all the necessary information and a toll-free number to contact at the time of any mishappening.

Tip 10: Experiment With the Deductible

Try to find out whether changing the deductible will affect the price of the policy or not. Most of the time lower premium has to be paid for a higher deductible. Raising the deductible is a better option as it gives you better results with the least risk.

To Sum Up

The Canadian travel insurance industry has a policy for everyone to cater to their specific needs, be it a working professional, a student, a family, or a snowbird. You just have to do proper research, get in touch with the best travel agent, and make the best decision as per your requirements. If you have any questions, you can reach out to us.

We would love to hear from you.

Happy Travelling 🙂

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to [email protected] or [email protected]