Travelling can be an exhilarating experience, but it’s not without its risks. That’s where Travel Insurance comes into play. When you purchase a Travel Insurance plan, you’re essentially preparing for the unexpected. While we all hope for smooth and trouble-free journeys, sometimes life has other plans. That’s why it’s essential to not only invest in a suitable Travel Insurance plan but also know how to maximize your Travel Insurance claim whenever the need arises.

In Canada, like many other countries, Travel Insurance is readily available through various providers, including Travel Insurance brokers. These brokers play a vital role in helping travellers understand their options and choose the right Travel Insurance plan and policies to suit their needs. If you want to know how you can make the most of your Travel Insurance claim in Canada, continue reading further.

Understanding Your Travel Insurance Plan

Before knowing about maximizing your Travel Insurance claim, it’s essential to have a clear understanding of your Travel Insurance plan and policies. Every plan comes with its own set of coverage and limitations, so knowing what you’re entitled to is the first step in the process.

Travel Insurance brokers in Canada can be your best allies in this regard. They are experts who can help you explore and understand the sometimes complex world of Travel Insurance. These professionals can assist you in selecting the most appropriate plan based on your travel itinerary, health conditions, and other individual requirements. Their expertise ensures that you don’t end up over-insured or under-insured, which can impact your claim in the long run.

Choosing the Right Travel Insurance Broker

Selecting the right Travel Insurance broker is the most essential step to maximizing your Travel Insurance claim. These brokers serve as intermediaries between you and insurance providers, offering valuable guidance and advice. Here are some tips for finding the right Travel Insurance broker in Canada:

Research Online: Start by conducting an online search for Travel Insurance brokers in your area. Read reviews and check their credentials to ensure they are licensed and reputable.

Seek Recommendations: Ask friends, family members, or colleagues for recommendations. Personal referrals can help you find a trustworthy broker who has a proven track record of assisting clients with their Travel Insurance needs.

Interview Potential Brokers: Don’t hesitate to reach out to potential brokers and ask questions about their experience, the insurance companies they work with, and their fees. A transparent and knowledgeable broker is a valuable asset.

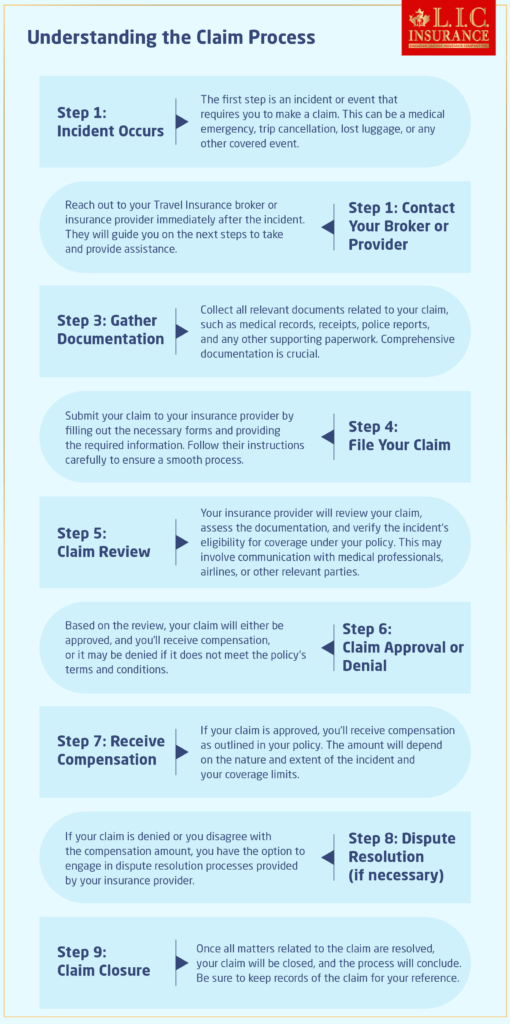

Understanding the Claim Process

When it comes to Travel Insurance claims, knowledge is power. Having all the knowledge about the claim process can make a significant difference in maximizing your benefits. The below-explained steps will help you get through the claim process effectively:

Contact Your Travel Insurance Broker or Provider

In the event of an incident or emergency, your first step should be to contact your Travel Insurance broker or provider. They can provide you with guidance on the next steps to take and help you initiate the claims process. Keep in mind that some insurance plans may have specific requirements, such as pre-certification for medical treatments.

Document Everything

Whether it’s a medical emergency, lost luggage, trip cancellation, or any other covered event, documentation is key. Keep all relevant documents, including:

Receipts and itemized bills for expenses

Unused travel tickets and proof of payment

Explanation of diagnosis from a doctor and medical bills

Police report for theft or accidents

Proof from the airline for lost or delayed baggage

Don’t underestimate the importance of retaining even seemingly insignificant receipts, as they may be essential for your claim.

Act Promptly

Time is of the essence when it comes to filing a Travel Insurance claim. While most plans allow you to initiate a claim upon your return home, it’s advisable not to wait too long. Delays can complicate the process as memories fade, and essential details may be forgotten.

Some insurance plans may also have deadlines for filing claims, which is why acting promptly is crucial. The sooner you start the claims process, the smoother and more efficient it’s likely to be.

Understand Your Coverage

One common mistake that travellers make is not fully understanding their Travel Insurance plan and its coverage. Every plan has exclusions and limitations, so it’s vital to be aware of them. Knowing what’s covered and what’s not can help you avoid potential roadblocks during the claims process.

Travel Insurance brokers can be invaluable in providing this information. They can explain the finer details of your policy, ensuring you have a good understanding of your coverage.

Making the Most of Your Travel Insurance Claim

| Aspect | Importance |

|---|---|

| Consult Your Broker | Keep your broker involved for guidance during the claims process. They help overcome challenges and optimize your claim. |

| Thorough Documentation | Gather and organize all relevant paperwork, such as medical records, police reports, and receipts. It expedites processing and boosts claim success. |

| Follow Instructions | Adhere to provider/broker instructions diligently to prevent delays or complications in the claims process. |

| Open Communication | Maintain clear, timely communication with your broker or provider, asking questions and seeking clarity when needed. |

| Detailed Journal | Although not mandatory, a travel journal documenting experiences and interactions can be a valuable reference during the claim process. |

Now that you have a solid grasp of the basics let’s explore some strategies to maximize your Travel Insurance claim in Canada:

Consult Your Broker During the Claims Process

Your relationship with your Travel Insurance broker shouldn’t end once you’ve purchased your policy. During the claims process, consider consulting your broker for guidance and support. They can help you navigate any challenges that may arise and ensure you’re taking all the necessary steps to optimize your claim.

Be Thorough with Documentation

As previously mentioned, documentation is crucial. Ensure that you gather all relevant paperwork and keep it organized. This includes medical records, police reports, receipts, and any other documents related to your claim. Being thorough and organized can expedite the claims process and increase your chances of a successful outcome.

Follow Instructions Carefully

When you contact your Travel Insurance provider or broker, follow their instructions diligently. They will guide you on what information to provide and which forms to fill out. Any deviations from their guidance could potentially lead to delays or complications.

Maintain Open Communication

Effective communication is essential when dealing with Travel Insurance claims. Stay in touch with your broker or provider, and don’t hesitate to ask questions or seek clarification whenever necessary. Timely and clear communication can help resolve any issues that may arise during the claims process.

Keep a Detailed Journal

While it may not be a formal requirement, keeping a detailed journal of your travel experiences, incidents, and interactions with medical professionals or authorities can be invaluable. This journal can serve as a reference point and help you recall important details when discussing your claim.

Coming to The End

Maximizing your Travel Insurance claim in Canada requires a combination of preparation, understanding, and effective communication. Start by selecting the right Travel Insurance broker who can guide you through the process and ensure you have the most suitable coverage. Document everything meticulously, act promptly, and communicate openly with your broker or provider.

Remember that Travel Insurance is there to provide you with mental peace during your journeys, so don’t hesitate to utilize it when necessary. By following these guidelines and working closely with your Travel Insurance broker, you can make the most of your Travel Insurance claim and minimize the stress associated with unexpected travel mishaps.

If you have any questions or additional tips on maximizing Travel Insurance claims in Canada, feel free to leave a comment below. We value your input and look forward to hearing about your experiences. Happy Travelling:)

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Faq's

Travel Insurance brokers in Canada are experts who assist travellers in understanding their Travel Insurance plans and policies. They assist people in choosing the appropriate insurance plan in accordance with their particular needs. Brokers can provide valuable guidance during the claims process, ensuring that travellers receive the maximum benefits to which they are entitled.

Do some research online and read reviews to find a reliable Travel Insurance broker in Canada. Additionally, seek recommendations from friends or family who have had positive experiences with brokers. It’s important to talk to potential brokers and find out about their fees, experience, and the insurance companies they work with. Transparency and knowledge are key qualities to look for in a broker.

For optimizing your Travel Insurance claim, it’s essential to keep all relevant documents, including receipts and itemized bills for expenses, unused travel tickets and proof of payment, medical records and bills, police reports for theft or accidents, and evidence from airlines for lost or delayed baggage. These documents support your claim and ensure you receive the maximum reimbursement.

While many Travel Insurance plans allow you to initiate a claim upon your return home, it’s advisable not to wait too long. Delays can complicate the process, and some plans may have specific deadlines for filing claims. The sooner you start the claims process, the more efficient it is likely to be, and you won’t have to worry about missing any deadlines.

Understanding your Travel Insurance plan and policies is essential to maximizing your claim. Travel Insurance brokers can comprehensively explain your policy’s coverage, exclusions, and limitations. It’s advisable to consult with your broker even during the claims process to ensure you’re making the right decisions and following the correct procedures.

Yes, you can and should consult your Travel Insurance broker during the claims process in Canada. Your broker can provide guidance, answer any questions you may have, and assist you in going through the process smoothly. Their expertise can help you overcome any challenges that may arise, ensuring you make the most of your Travel Insurance claim.

If you encounter any difficulties or have concerns during the claims process, it’s essential to maintain open communication with your Travel Insurance broker or provider. They can help address any issues and provide solutions. Effective communication is key to resolving any challenges and ensuring a successful outcome for your claim.

Yes, some Travel Insurance brokers in Canada specialize in particular types of Travel Insurance plans, such as medical coverage, trip cancellation insurance, or comprehensive packages. These specialized brokers can offer tailored advice and assistance to match your specific travel needs.

To ensure you have the right Travel Insurance coverage for your trip to Canada, consult with a Travel Insurance broker. They can assess your travel itinerary, health conditions, and individual requirements to help you select the most appropriate plan. Brokers can provide expert advice on the suitability of your coverage.

The ability to make changes to your Travel Insurance plan in Canada may depend on the specific policy and provider. Travel Insurance brokers can guide you on whether modifications are possible and what the procedures entail. It’s important to understand any potential consequences or limitations when making changes to your coverage.

In the event of a medical emergency, while travelling in Canada, your first step should be to ensure your safety and seek immediate medical attention. Once you have secured your well-being, contact your Travel Insurance broker or provider. They can provide guidance on how to proceed with your medical claim, including pre-certification requirements if applicable.

Whether you can file a Travel Insurance claim for incidents that occurred before your trip to Canada depends on your specific policy and its terms. Some plans may provide coverage for certain pre-existing conditions or trip cancellations due to unexpected events. Consulting your Travel Insurance broker is necessary to understand the extent of your coverage.

Are there additional tips for maximizing Travel Insurance claims beyond what’s mentioned in the blog?

Travel Insurance is not always mandatory for all types of travel in Canada. However, it is highly recommended, especially for international trips and extended stays. Having adequate coverage can provide peace and financial protection in case of unexpected events. Consulting with a Travel Insurance broker can help you determine the necessity of coverage for your specific travel circumstances.

If you lose important travel documents like your passport or visa while in Canada, contact the local authorities and report the loss. Additionally, notify your Travel Insurance broker or provider, as this situation may be covered under your policy. They can guide you on the necessary steps to take to address the loss and initiate a claim if applicable.

Yes, Travel Insurance brokers can assist with group Travel Insurance plans in Canada. Whether you’re planning a family trip, a corporate retreat, or a group excursion, brokers can help you secure coverage that meets the needs of all travellers in the group. They can provide advice on group policies and ensure that everyone is adequately protected.

If you have more questions or require further information about maximizing Travel Insurance claims in Canada, don’t hesitate to reach out to your trusted Travel Insurance broker. Their expertise and guidance can ensure a smooth and successful Travel Insurance experience. Travel Safe:)

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com