BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Mortgage Insurance Vs. Life Insurance In Canada: What Homeowners Need To Know

By Pushpinder Puri

CEO & Founder

- 10 min read

- October 30th, 2025

SUMMARY

Compare Mortgage Life Insurance Coverage and Term Life Insurance benefits for mortgage protection in Canada. Understand how each option supports Canadian families, from covering the outstanding mortgage balance to providing a tax-free lump sum for other living expenses, funeral costs, and financial protection beyond your lender’s interests.

Introduction

Your house is a home. But your mortgage? That’s a contract.

Let’s get real—owning a home in Canada isn’t just a milestone, it’s a marathon. You work, you grind, you pay that monthly mortgage religiously. You’re building equity, yes—but also a legacy. But here’s the uncomfortable question most folks avoid asking: What happens to that mortgage if something happens to you?

Is it enough to trust the Mortgage Insurance that your bank or lender casually offered during your mortgage paperwork frenzy? Or does it make more sense to actually buy Life Insurance that covers not just the bricks and beams, but your entire family’s financial future?

We’ve seen too many families left shocked when they found out their bank’s Mortgage Insurance wasn’t what they thought it was. That’s why we’re breaking it down clearly, plainly, and honestly—just like we do in every client conversation.

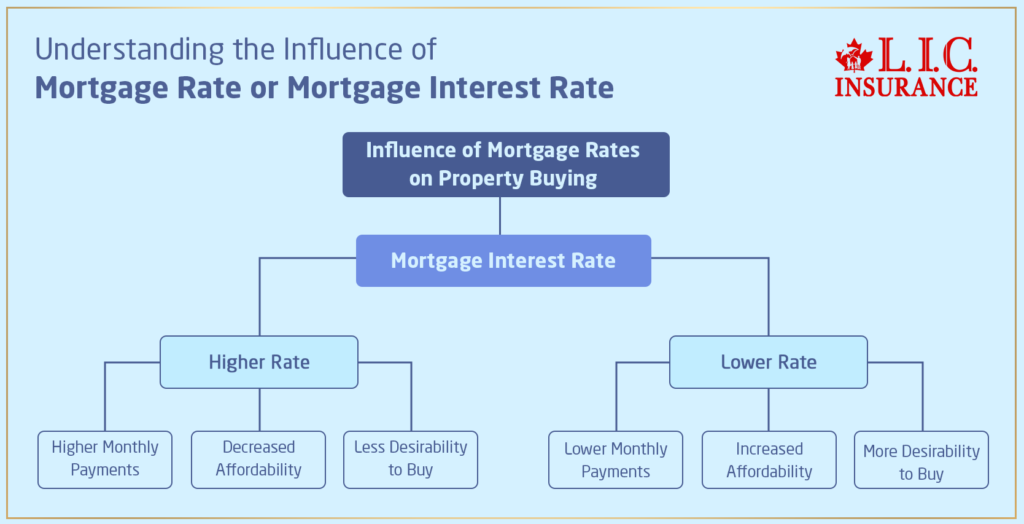

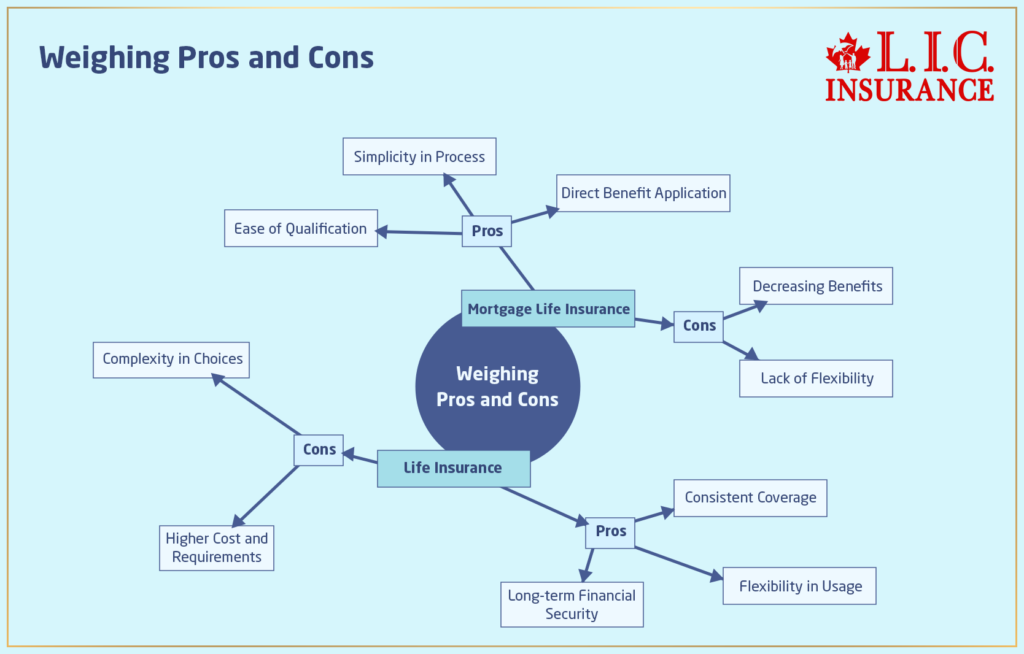

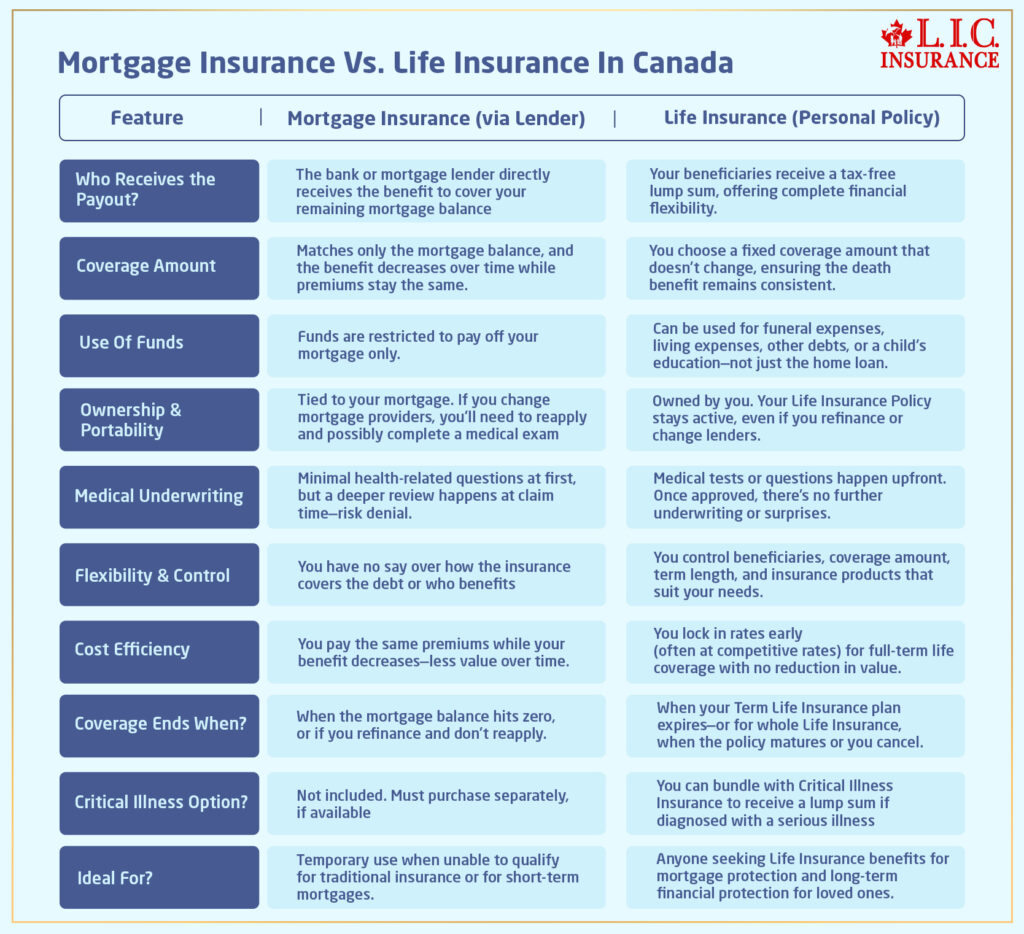

Life Insurance Gives Your Family Control, Not The Bank

If you’ve got Life Insurance for homeowners in Canada, especially something like a Term Life Insurance plan, your family isn’t just protected—they’re empowered. Because, unlike Mortgage Insurance, the payout from your Life Insurance Policy goes straight to the people you care about—not your mortgage lender.

It’s a tax-free lump sum, and your beneficiaries can use it however they need. That could mean paying off the outstanding mortgage balance, yes—but it could also mean covering tuition, groceries, living expenses, or keeping the lights on until everything settles.

We’ve helped clients structure their Life Insurance Coverage so that their death benefit wipes out the mortgage and still leaves something behind. When you choose your own insurance provider, you get to shape that outcome.

Mortgage Insurance Works—But Only For The Bank

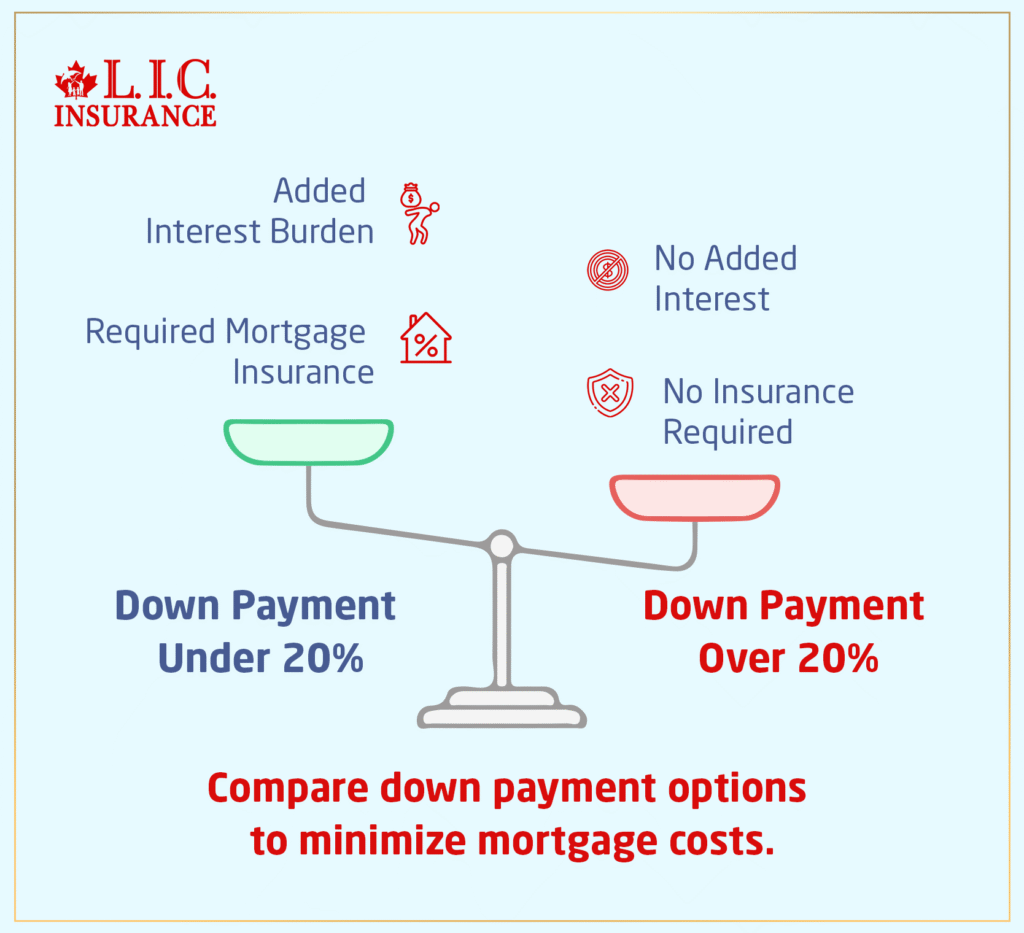

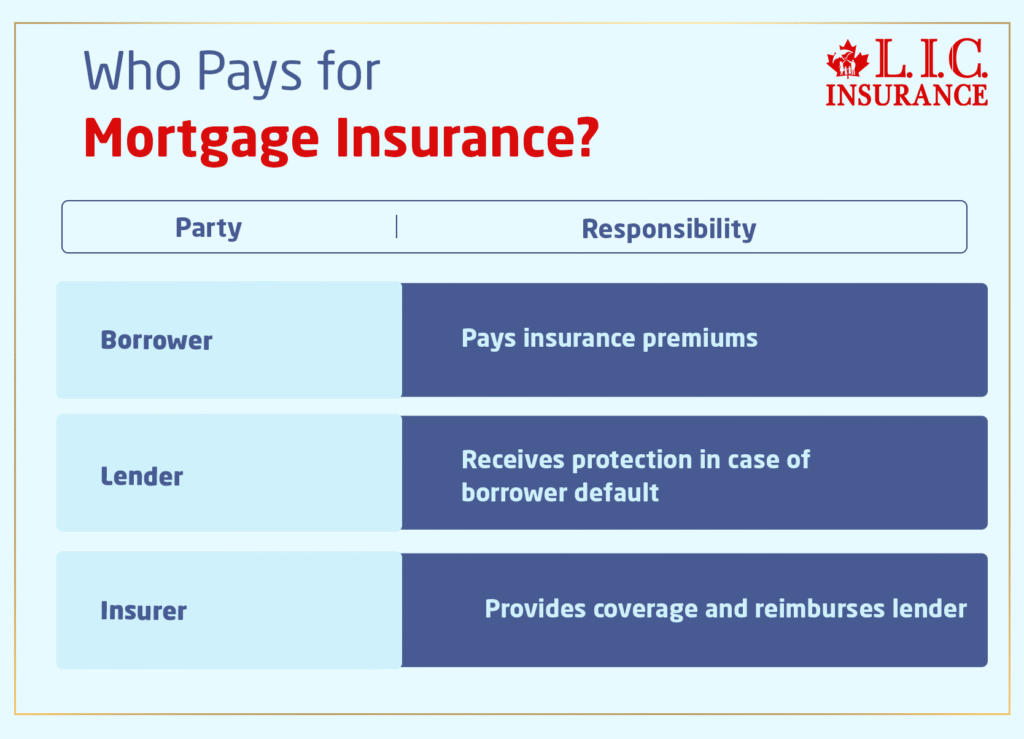

Here’s what your bank or mortgage lender doesn’t always clarify: when you buy Mortgage Insurance, you’re protecting their loan—not your family.

That policy is only good for one thing: paying off the remaining mortgage balance at the time of death. No flexibility. No leftovers. No control.

And worst of all? The benefit decreases over time as your mortgage gets paid down—but your premiums? They stay the same. So you’re paying the same cost for less and less insurance coverage every single year.

We’ve seen too many people surprised by this one truth: mortgage protection insurance doesn’t support your loved ones—it supports the loan officer.

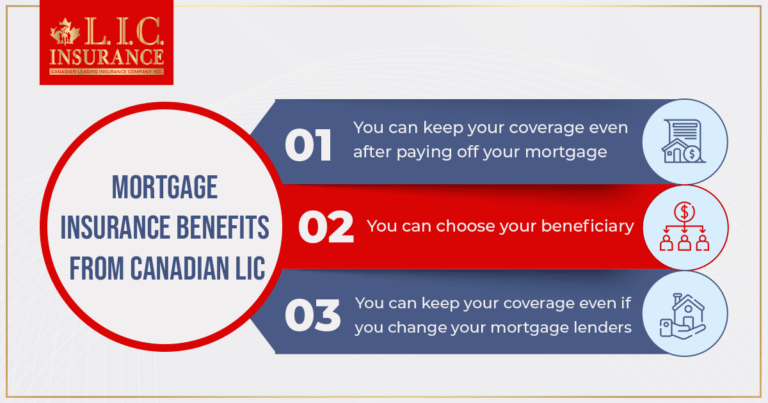

Can You Move Your Coverage If You Switch Lenders?

Not with Mortgage Insurance.

If you change mortgage providers, your Mortgage Insurance doesn’t follow you. You’ll likely have to reapply, which means another medical exam, and if your health issues have changed (as they often do), you may be denied.

But with Term Life Insurance, your Life Insurance Policy sticks with you no matter what. You can refinance, switch banks, or move across the country. The coverage doesn’t blink.

We’ve helped families avoid thousands in requalification costs just by setting up portable, personal Life Insurance early on. It’s about thinking two steps ahead.

You Deserve More Than Just Mortgage Protection

Here’s the thing: your mortgage balance isn’t the only financial pressure your family faces.

You’ve got other debts, maybe a car loan, maybe some credit cards. Then there’s funeral costs, maybe a second mortgage, and don’t forget the basics—living expenses. Groceries. Utilities. School fees. The list goes on.

Mortgage Insurance doesn’t touch those.

But Life Insurance? That’s where it shines. With the right coverage amount, your Life Insurance coverage can handle the Mortgage Life Insurance Coverage, and still leave enough for your surviving spouse to live, not just survive.

We’ve structured policies where the death benefit is paid off the home, covers the kid’s education, and even gives the family some breathing room to grieve without worrying about money.

Medical Exams: Do You Need One?

Here’s a big difference most Canadians don’t realize:

When you apply for Mortgage Insurance, the medical questionnaire is often short. Easy, right? But wait—they may underwrite at the time of claim, not the time of purchase. That means your family could only learn during a claim investigation that something in your health history disqualifies you. That’s called post-claim underwriting—and yes, it happens.

With Term Life Insurance plans from a reputable insurance company, the rules are clear. You answer the health questions or take the medical tests up front. Once approved, you’re covered. Period. No retroactive digging.

That’s why we always ask clients: do you want a policy that’s easy to get—or one that’s guaranteed to pay?

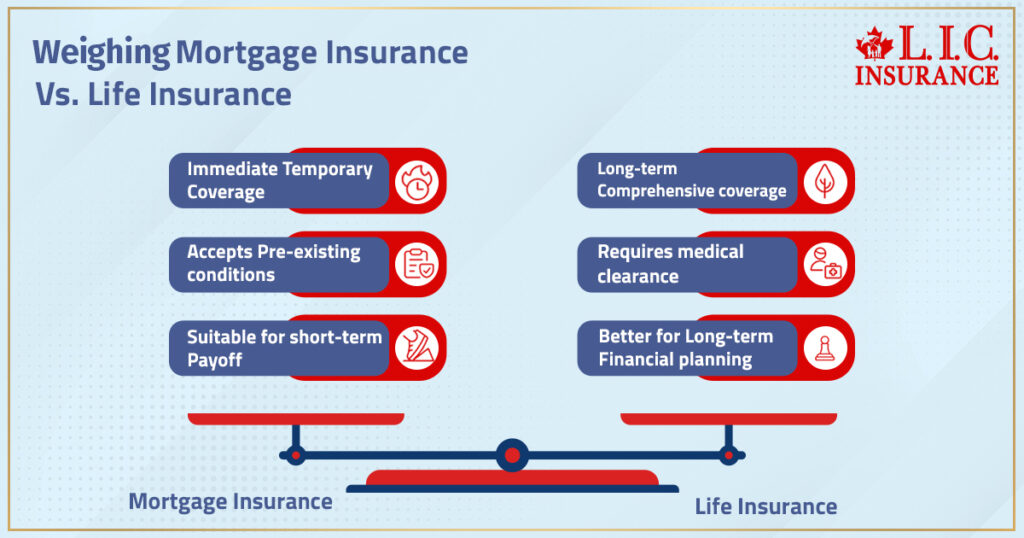

Why Some Canadians Still Choose Mortgage Insurance

Let’s be fair.

There are scenarios where Mortgage Insurance still makes sense:

- You have pre-existing conditions that disqualify you from Life Insurance

- You need temporary coverage while your Life Insurance is being underwritten

- You’re aggressively paying off your mortgage in under 5 years

Even in those cases, we often suggest layering the policies—start with Mortgage Insurance for immediate protection, then replace it with a better term life or Critical Illness Insurance Policy once your medical clearance is in.

Add Critical Illness Insurance For Extra Protection

We’ve seen firsthand how Critical Illness Insurance changes lives.

A cancer diagnosis. A stroke. A heart attack. Suddenly, you can’t work—but the mortgage payments still demand attention.

With a critical illness policy built into your insurance products, you get a lump sum payout if you survive a serious diagnosis. It helps you pay off your mortgage, cover other expenses, or just take time off to recover without panicking.

Some of our clients have used it to renovate their homes to become accessible after an illness. Others used it for alternative treatments not covered by provincial plans. It’s flexible. It’s fast. And it’s real.

For Engineers Canada Members—Don’t Miss Group Rates

Special shoutout: if you’re affiliated with Engineers Canada, we can show you competitive rates through group programs that many Canadians don’t even know exist.

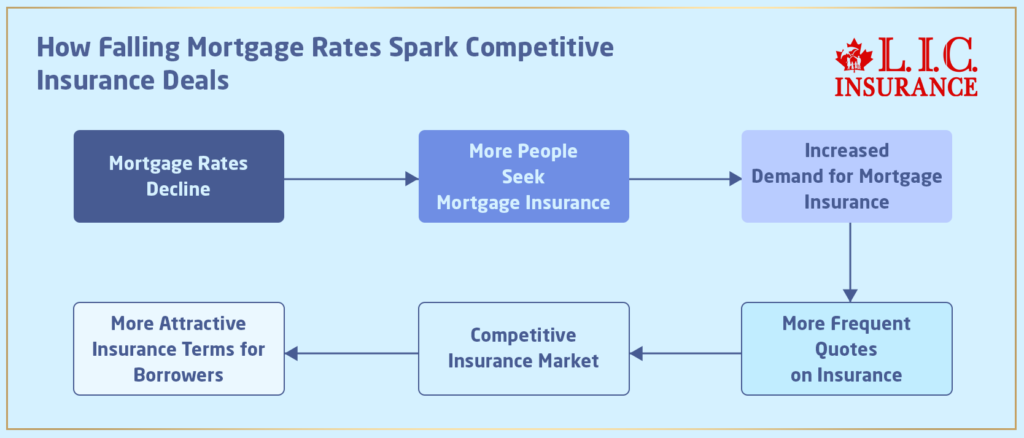

These plans are tailor-made for professionals with steady income and low-risk lifestyles, which means your Mortgage Insurance Rates in Canada drop significantly.

We’ve set up tailored plans for engineers, architects, IT professionals, and more. It’s worth asking about. You don’t have to pay more when you don’t have to.

The Real Question: Who Do You Want To Protect?

This is the question we always come back to.

Are you protecting the lender’s interest? Or your family’s future?

Because when you choose Term Life Insurance, the answer is crystal clear: it’s your family. Every dollar of your Life Insurance Policy is theirs. It’s built to cover the mortgage amount, yes—but also the financial protection that lasts far beyond the walls of your house.

With a bank-issued Mortgage Life Insurance product, the bank is the sole beneficiary. With Life Insurance, you are.

You call the shots. You choose the insurance coverage. You decide how much, how long, and how flexible it should be. Your benefit remains fixed. Your family’s future doesn’t shrink just because your mortgage balance does.

Ready To Talk Numbers? We’re Just A Call Away.

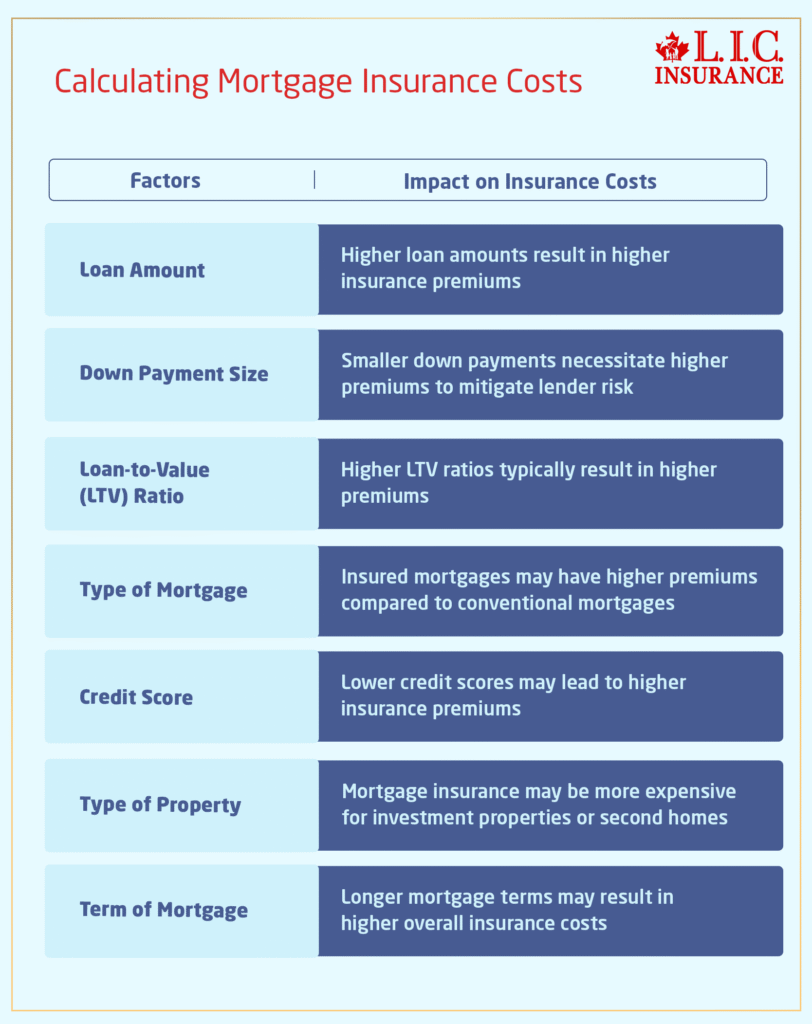

We’ll help you compare Mortgage Insurance vs Term Life Insurance, run the math, and weigh the pros and cons based on your health, your mortgage, and your goals.

You can even get Mortgage Insurance quotes online, or better yet, let us run custom numbers from over a dozen top providers and the Manufacturers Life Insurance Company too.

Our team knows what to ask, what to avoid, and how to make sure your insurance doesn’t just exist—it works.

Call Canadian LIC at 1‑844‑552‑4678 or get your custom quote today.

More on Mortgage Insurance

FAQs

No, most Mortgage Life Insurance Coverage is tied to a specific mortgage contract. If you buy a new home, you’ll need new coverage. This creates a gap that many homeowners don’t anticipate when switching properties.

Once your mortgage is paid off, coverage ends—even if you’re still paying premiums. Unlike Term Life Insurance plans, there’s no refund or continued protection. This is why many Canadians switch to personal Life Insurance Policies early.

Yes, that’s one of its biggest strengths. Life Insurance benefits for mortgage protection often extend to funeral costs, debts, and other expenses—giving your family flexibility beyond just the mortgage balance.

Absolutely. Locking in coverage while in good health often means lower rates. Plus, the Life Insurance Policy stays with you even if you refinance or change lenders—unlike lender-tied mortgage protection insurance.

Mortgage Insurance Rates in Canada are often higher over time due to declining coverage. Life Insurance offers more stable premiums for consistent protection. The difference becomes even more apparent as you age or refinance.

Most lenders don’t allow bundling of Mortgage Life Insurance products. However, insurance companies often offer packages combining life, disability, and Critical Illness Insurance to create a broader safety net for homeowners.

No. Mortgage protection is designed solely to cover the remaining mortgage balance. It won’t assist with other debts, funeral costs, or day-to-day living expenses your family may face after your death.

It’s flexible, affordable, and tailored to your full financial picture. Canadians often choose Term Life Insurance because it provides fixed benefits, customizable terms, and supports long-term goals—not just a bank loan.

If you refinance with a different lender, your existing Mortgage Insurance usually ends. That means reapplying, possibly undergoing medical tests, and risking higher rates—or even rejection due to health changes.

Typically, no. Mortgage Insurance focuses only on loan repayment after death. Unlike policies that include Critical Illness Insurance, it doesn’t offer any tax-free lump sum benefit if you become seriously ill but survive.

Absolutely. Independent brokers like Canadian LIC help Canadian families evaluate Life Insurance benefits for mortgage protection, compare quotes, and avoid one-size-fits-all plans pushed by banks or financial institutions.

Yes. Many clients use the tax-free lump sum from their Life Insurance Policy to both pay off their mortgage and protect business continuity. It’s a smart move for dual-income households or self-employed professionals.

Key Takeaways

- Mortgage Insurance Coverage protects the bank, not your family. The payout goes directly to the lender, and the benefit decreases as your mortgage is paid down.

- Life Insurance benefits for mortgage protection go to your chosen beneficiaries, offering a tax-free lump sum that can cover more than just the mortgage—including funeral costs, debts, and other living expenses.

- Mortgage Life Insurance products are not portable. If you refinance or change lenders, you’ll need to requalify—often with a new medical exam or medical questionnaire, risking denial if your health has changed.

- Term Life Insurance plans offer stable coverage amounts, consistent premiums, and full control over your policy—even as your mortgage balance changes.

- Mortgage protection insurance ends when the mortgage ends. A personalized Life Insurance Policy can continue providing value long after the home is paid off.

- Mortgage Insurance Rates in Canada often appear convenient but become expensive over time due to declining benefits and limited use flexibility.

- Critical Illness Insurance can be added to your life policy for added protection, offering a lump sum payout during your lifetime if you face a serious diagnosis.

- Engineers Canada and similar professional associations often provide group discounts through top-tier insurance providers, including on both mortgage and Term Life Insurance coverage.

Sources and Further Reading

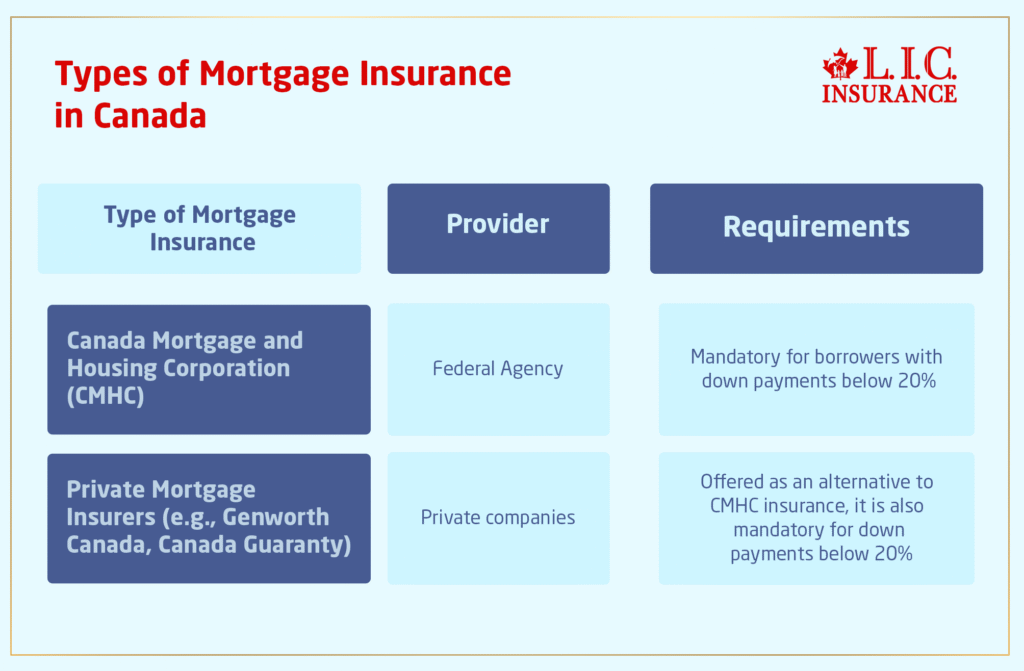

- Canada Mortgage and Housing Corporation (CMHC)

Official data on Canadian mortgage ownership, insurance, and default protection.

https://www.cmhc-schl.gc.ca - Government of Canada – Life Insurance Basics

Outlines the differences between types of Life Insurance, including term, whole life, and group mortgage coverage.

https://www.canada.ca/en/financial-consumer-agency/services/insurance/life-insurance.html - Canadian Life and Health Insurance Association (CLHIA)

Industry-level breakdown on Life Insurance coverage trends and protection gaps.

https://www.clhia.ca - Financial Consumer Agency of Canada (FCAC)

Detailed comparison of Mortgage Insurance through lenders vs personal policies.

https://www.canada.ca/en/financial-consumer-agency.html - Engineers Canada Insurance Plans

Official site listing group insurance benefits available to engineers, including preferred Mortgage Insurance Rates.

https://www.engineerscanada.ca - Sun Life – Understanding Mortgage Insurance vs. Life Insurance

(Source content inspiration) Published comparison by licensed advisors.

https://www.sunlife.ca/en/tools-and-resources/money-and-finances/understanding-insurance/mortgage-insurance-vs-life-insurance/ - Manufacturers Life Insurance Company (Manulife)

One of the largest Canadian providers of term life and Critical Illness Insurance.

https://www.manulife.ca

Feedback Questionnaire:

🛡️ Your privacy is respected. Your contact information will only be used by Canadian LIC to provide relevant insurance guidance or quotes.

IN THIS ARTICLE

- Mortgage Insurance Vs. Life Insurance In Canada: What Homeowners Need To Know

- Life Insurance Gives Your Family Control, Not The Bank

- Mortgage Insurance Works—But Only For The Bank

- Can You Move Your Coverage If You Switch Lenders?

- You Deserve More Than Just Mortgage Protection

- Medical Exams: Do You Need One?

- Why Some Canadians Still Choose Mortgage Insurance

- Add Critical Illness Insurance For Extra Protection

- For Engineers Canada Members—Don’t Miss Group Rates

- The Real Question: Who Do You Want To Protect?

- Ready To Talk Numbers? We’re Just A Call Away.