You just turned 65 and are thinking about the future—how will your family be taken care of when you’re no longer around? You decide to look into Term Life Insurance for seniors in Canada. You go online and start looking for Term Life Insurance Quotes, and suddenly, you hit a wall called “underwriting”. What is it? How does it affect your life insurance application?

What is underwriting in Term Life Insurance?

By Pushpinder Puri, July 22, 2024, 7 Minutes

- What Is Underwriting In Term Life Insurance?

- What Is Underwriting?

- Why Underwriting Matter

- The Impact Of Underwriting On Premiums

- The Bottom Line

- Common Underwriting Challenges And How To Overcome Them

- Tips For A Smooth Underwriting Process

- The Role Of Underwriters In Term Life Insurance

- The Importance Of Accurate Information

- Simplifying The Underwriting Process

- Common Misconceptions About Underwriting

- How To Improve Your Underwriting Outcome

- Conclusion: Why Choose Canadian LIC

You just turned 65 and are thinking about the future—how will your family be taken care of when you’re no longer around? You decide to look into Term Life Insurance for seniors in Canada. You go online and start looking for Term Life Insurance Quotes, and suddenly, you hit a wall called “underwriting”. What is it? How does it affect your life insurance application?

Many Canadians are confused by the term. At Canadian LIC—the Best Insurance Brokerage—we often meet clients who are overwhelmed by the underwriting process or worried about their age and health impacting their eligibility. This blog will break down underwriting for you from our daily interactions with clients. We’ll walk you through each step and show you how it applies to you so you can navigate this important part of getting Term Life Insurance.

What is Underwriting?

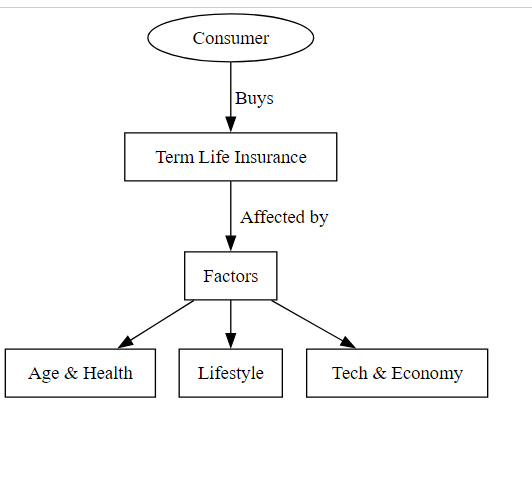

Underwriting is the process through which insurers evaluate the risk of providing insurance to a potential policyholder. In Canadian Term Life Insurance Plans, underwriters define the acceptance criteria for insurance and the premium charged. This will be an important process in enabling an insurance company to balance risk and decide how much insurance it can issue at any given rate level.

Why Underwriting Matters

Life Insurance underwriting assists the life insurance company in managing the risk associated with issuing insurance. For applicants, particularly seniors, this is the step in the process that fairly assesses you based on your actual health, chosen lifestyle, and financial situation.

Real-Life Scenario: John’s Journey

John, a recent retiree at 67, approached Canadian LIC for help with getting life insurance. He was worried about his mild hypertension affecting his chances of obtaining affordable insurance. Our team walked him through the underwriting process, explaining how his overall health, not just one aspect, would be assessed. This comprehensive approach helped John understand that underwriting is nuanced and that many factors influence the final decision.

Key Components of the Life Insurance Underwriting Process

- Medical History

- Lifestyle Choices

- Occupation

- Age

Let’s look at these components in detail, illustrated by some stories we have seen at Canadian LIC.

Medical History

Your medical history is a critical part of the underwriting process. Insurers want to know about any existing health conditions, past illnesses, surgeries, or treatments. This information helps them assess the likelihood of a claim.

Exploring Pre-Existing Conditions

John, a 62-year-old retired teacher, came to Canadian LIC worried about securing Term Life Insurance for seniors. He had a history of high blood pressure and diabetes. Our team explained that while these conditions might increase his premiums, they wouldn’t necessarily disqualify him from getting coverage. By providing comprehensive and accurate medical records, John was able to get a policy tailored to his needs.

Lifestyle Choices

Your lifestyle choices, such as smoking, drinking, and exercise habits, also play a significant role in underwriting. Insurers use this information to predict your overall health and life expectancy.

The Impact of Lifestyle Changes

Susan, a 58-year-old non-smoker, sought Term Life Insurance Quotes Online. She was in good health but worried that her past smoking habit, which she quit five years ago, might affect her premiums. At Canadian LIC, we guided her through the process, emphasizing her commitment to a healthier lifestyle. Her premiums were indeed lower than if she were still smoking, showcasing the positive impact of lifestyle changes on insurance underwriting.

Occupation

Certain occupations carry higher risks than others. For instance, if you work in a hazardous environment or have a job that involves physical danger, your premiums might be higher.

High-Risk Jobs and Coverage

Mark, a 55-year-old construction worker, was concerned about the effect of his job on his insurance rates. At Canadian LIC, we helped him find Canadian Term Life Insurance Plans that considered his occupation but still offered reasonable premiums. By highlighting his safety practices and years of experience, Mark managed to secure a policy that provided the coverage he needed without breaking the bank.

Age

Age is a straightforward yet significant factor in underwriting. Generally, the older you are, the higher your premiums will be due to the increased risk of health issues.

Age-Related Challenges

Betty, a 67-year-old grandmother, was exploring Term Life Insurance for seniors. She was initially discouraged by the high premiums she found. However, with our help at Canadian LIC, she learned that there were specialized plans designed for seniors, making Term Life Insurance more accessible and affordable for her age group.

The Underwriting Process: Step-by-Step

- Application Submission

- Medical Examination

- Review of Medical Records

- Risk Assessment

- Policy Issuance

Step 1: Application Submission

The first step involves filling out an application form. This form requires detailed information about your personal and medical history, lifestyle, and occupation.

Step 2: Medical Examination

Most Term Life Insurance policies require a medical examination. This exam typically includes a physical check-up, blood tests, and sometimes an electrocardiogram (EKG).

Overcoming Exam Anxiety

Robert, a 61-year-old with a fear of medical procedures, was anxious about the medical exam. At Canadian LIC, we arranged for a comfortable, home-based medical exam to ease his worries. Understanding what to expect helped Robert go through the process smoothly, resulting in accurate assessment and fair premiums.

Step 3: Review of Medical Records

Insurers will review your medical records to ensure that the information you provide matches your documented health history.

Ensuring Accurate Records

Linda, a 59-year-old nurse, found discrepancies in her medical records during the underwriting process. With our assistance, she clarified her records, ensuring that her insurance application accurately reflected her health status. This transparency helped Linda secure a policy with the appropriate Term Life Insurance coverage and premium rates.

Step 4: Risk Assessment

Using the gathered information, underwriters evaluate the risk of insuring you. They categorize applicants into different risk classes, which determine the premium rates.

Step 5: Policy Issuance

If the insurer approves your application, they will issue a policy outlining the coverage details, premium rates, and terms and conditions.

The Impact of Underwriting on Premiums

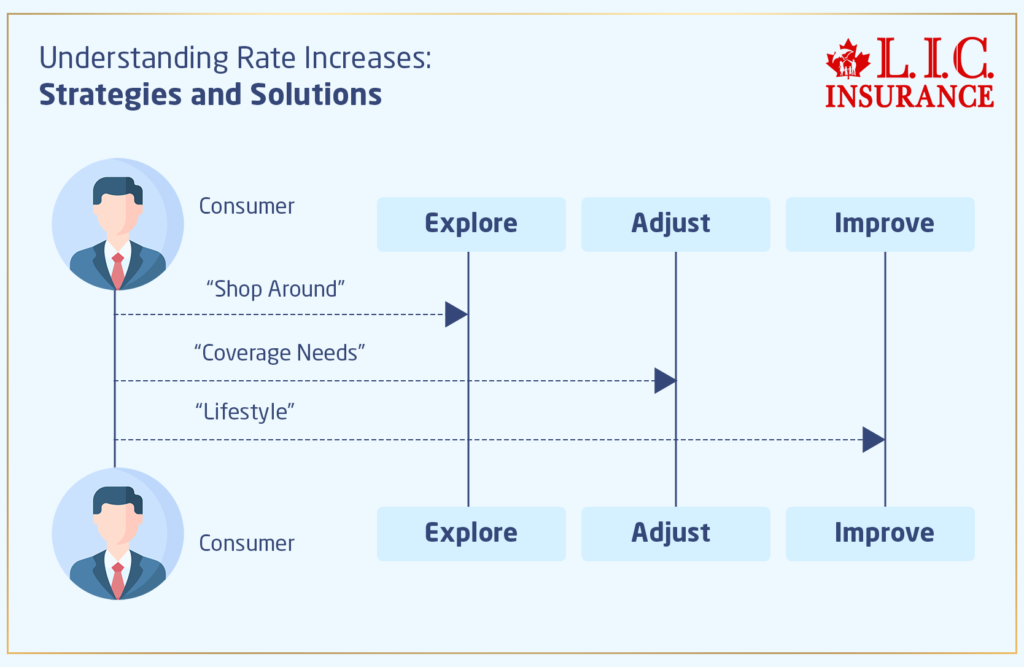

Underwriting, therefore, has a direct impact on your premium. It is possible to understand the levels of risk you present to an insurance company and charge a fair premium with respect to that risk through the underwriting process.

Mark’s Money Matters

Mark, 70, wondered why his premiums were different from what he saw advertised online. We explained that the Term Life Insurance Quotes Online are often estimates based on average risk profiles. Mark’s actual premiums were calculated based on his unique health and lifestyle information gathered during underwriting.

Common Underwriting Challenges and How to Overcome Them

- Health Issues

- Incomplete Information

- Lifestyle Risks

- Age-Related Concerns

Health Issues

Health issues can complicate the underwriting process, but they are not insurmountable.Managing Chronic Conditions

When Tom, a 64-year-old with arthritis, applied for Term Life Insurance, he was worried that his condition would lead to a denial. We at Canadian LIC helped him find insurers who were experienced in dealing with similar cases. Tom secured a policy that met his needs by managing his condition well and providing thorough medical documentation.Incomplete Information

Providing incomplete or inaccurate information can delay the underwriting process.The Importance of Full Disclosure

Maria, a 57-year-old entrepreneur, initially omitted details about a minor surgery from her application. This omission caused delays and confusion. After consulting with Canadian LIC, she updated her application with complete information, speeding up the underwriting process and ensuring a fair assessment.Lifestyle Risks

Certain lifestyle risks can impact your premiums, but proactive steps can mitigate these effects.Quitting Smoking

James, a 60-year-old smoker, was concerned about high premiums. At Canadian LIC, we advised him on the benefits of quitting smoking. After a year of being smoke-free, James reapplied for a policy and received significantly lower premiums, highlighting the positive impact of healthy lifestyle changes.Age-Related Concerns

Age can be a barrier, but specialized plans exist for seniors.Finding Affordable Senior Plans

Helen, a 70-year-old widow, believed she was too old to get affordable life insurance. Canadian LIC introduced her to Term Life Insurance for seniors, specifically designed for her age group. Helen was relieved to find a plan that offered sufficient coverage at a reasonable cost, proving that age doesn’t have to be a limiting factor.Tips for a Smooth Underwriting Process

Be Honest and Transparent

Maintain a Healthy Lifestyle

Gather and Review Your Medical Records

Work with an Experienced Broker

Be Honest and Transparent

Honesty is crucial during the underwriting process. Accurate information helps insurers provide fair assessments and appropriate coverage.

Maintain a Healthy Lifestyle

Adopting a healthy lifestyle can positively impact your underwriting results. Regular exercise, a balanced diet, and avoiding harmful habits like smoking can improve your overall health profile.

Gather and Review Your Medical Records

Having your medical records in order before applying can speed up the underwriting process. Ensure that all records are accurate and up-to-date.

Work with an Experienced Broker

An experienced broker, like Canadian LIC, can guide you through the underwriting process, helping you find the best Canadian Term Life Insurance Plans that match your needs and budget.

The Role of Underwriters in Term Life Insurance

Underwriters are really the linchpin of the insurance industry. They are the gatekeepers, so to speak, that greatly help assess and manage the risks associated with underwriting a particular person. Their expertise is what ensures that insurance companies can provide fair and sustainable coverage to their clients. Let us delve into some details of how underwriters evaluate different factors during this underwriting process.

Health and Medical Examinations

Health is a major component in the underwriting process. You’ll likely undergo a medical examination when applying for Term Life Insurance. This exam includes:

- Physical Exam

- Blood Tests

- Urine Tests

- Medical History Questionnaire

Physical Exam

During the physical exam, the doctor will check your height, weight, blood pressure, and other vital signs. This basic check-up helps underwriters get a snapshot of your general health.

Blood Tests and Urine Tests

Blood and urine tests are conducted to check for various health indicators, such as cholesterol levels, blood sugar levels, and the presence of nicotine or drugs. These tests can reveal conditions like diabetes, high cholesterol, or liver problems that might not be evident in a physical exam.

Medical History Questionnaire

You will also fill out a detailed questionnaire about your medical history. This includes information about past surgeries, chronic conditions, medications, and family medical history. Being thorough and honest in this questionnaire is crucial for an accurate underwriting assessment.

Lifestyle Factors

Underwriters consider various lifestyle factors that could affect your health and life expectancy. These include:

- Smoking and Drinking Habits

- Exercise and Diet

- Hobbies and Activities

Smoking and Drinking Habits

Smoking and excessive drinking are major red flags for underwriters. These habits significantly increase the risk of health issues and, therefore, higher premiums or even denial of coverage. If you’ve recently quit smoking, it’s important to disclose this, as it can still impact your premiums.

The Benefit of Quitting Smoking

Take the example of John, a 65-year-old who applied for Term Life Insurance. He had quit smoking two years ago. Despite his history, John received better rates compared to active smokers, thanks to his efforts to improve his health.

Exercise and Diet

A healthy lifestyle that includes regular exercise and a balanced diet can positively influence your underwriting outcome. It shows that you are proactive about your health, which can result in more favourable premiums.

Hobbies and Activities

High-risk hobbies like skydiving, scuba diving, or racing can impact your insurance premiums. These activities increase the risk of injury or death, prompting underwriters to adjust your premiums accordingly.

Financial and Occupational Information

Your financial situation and occupation also play a role in the underwriting process.

- Income and Financial Stability

- Job Risk Factors

Income and Financial Stability

Insurers want to ensure that the coverage amount aligns with your financial needs and responsibilities. They may look at your income, debts, and overall financial stability to determine the appropriate coverage and premiums.

Job Risk Factors

Certain occupations are inherently riskier than others. For instance, if you work in construction, mining, or any field involving physical danger, underwriters will take this into account. They assess the risk of accidental death or injury and adjust your premiums accordingly.

Balancing Risk and Coverage

Canadian LIC once worked with a client named Seema, a 54-year-old mining engineer. Given her high-risk occupation, Sarah was concerned about high premiums. By carefully documenting her safety protocols and extensive experience, we helped Seema secure a policy that balanced her occupational risks with affordable premiums.

The Importance of Accurate Information

Providing accurate information during the underwriting process cannot be overstressed. Misrepresenting or omitting information can lead to:

- Policy Denial

- Claim Denial

- Higher Premiums Later

Policy Denial

If underwriters discover inaccuracies during their review, they may deny your application. This not only affects your chances with the current insurer but can also impact future applications with other insurers.

Claim Denial

Even if a policy is initially approved, discrepancies found later (especially during a claim) can result in the denial of benefits. This scenario can leave your beneficiaries without the financial support they need.

Higher Premiums Later

Omissions or inaccuracies discovered after policy issuance can lead to increased premiums. Insurers may re-evaluate your risk and adjust your rates, sometimes significantly.

Simplifying the Underwriting Process

Understanding the underwriting process can be smoother with the right approach. Here are some tips to help you along the way:

- Work with a Knowledgeable Broker

- Prepare Your Medical Records

- Understand Your Policy Options

Work with a Knowledgeable Broker

A broker with experience in Term Life Insurance, like those at Canadian LIC, can guide you through the process. They can help you understand what to expect, prepare the necessary documentation, and find the best policies that suit your needs.

Prepare Your Medical Records

Having your medical records ready can expedite the underwriting process. Ensure that your records are up-to-date and accurately reflect your health history. This preparation can reduce delays and ensure a smoother assessment.

Understand Your Policy Options

Different policies have varying underwriting requirements. Some might offer simplified or no-exam underwriting, which can be advantageous if you have health concerns. However, these policies often come with higher premiums. Understanding the trade-offs can help you make an informed decision.

Overcoming Underwriting Hurdles

Consider the case of Frank, a 70-year-old retiree who came to Canadian LIC for Term Life Insurance. Frank had a complex medical history, including a heart surgery a decade ago. He was initially hesitant, thinking he wouldn’t qualify for affordable coverage.

Our team worked closely with Frank, gathering his medical records and liaising with insurers who specialize in Term Life Insurance for seniors. Through meticulous preparation and transparent communication, Frank not only secured a policy but also obtained favourable premiums by demonstrating his stable health post-surgery.

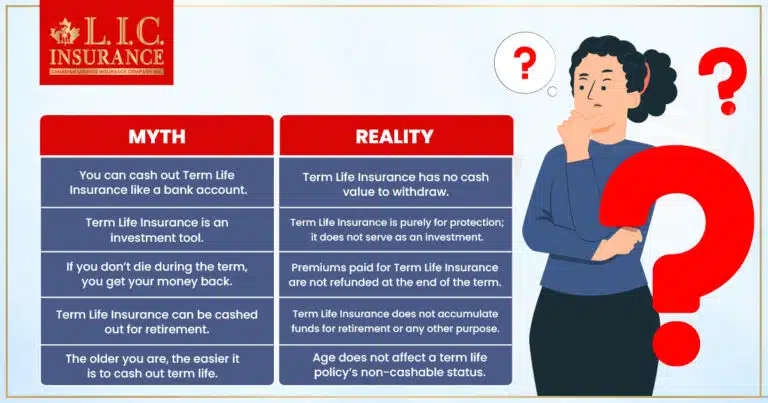

Common Misconceptions about Underwriting

Understanding underwriting can be complex, with various fallacies floating around. Let’s unveil some of these myths to provide a clearer picture.

Misconception 1: Only Perfect Health Qualifies for Insurance

Many believe that only those in perfect health can get Term Life Insurance. This isn’t true. While health is a significant factor, insurers consider many other aspects. Even if you have pre-existing conditions, you can still qualify for a policy.

Coverage with Pre-Existing Conditions

Take the story of Dave, a 66-year-old with a history of high cholesterol and mild asthma. Initially, Dave thought he wouldn’t qualify for affordable coverage. However, with the help of Canadian LIC, he found a policy that considered his overall health management and lifestyle changes, resulting in a reasonable premium.

Misconception 2: Older Adults Can’t Get Affordable Insurance

Age does play a role in underwriting, but it doesn’t mean seniors can’t find affordable insurance. Specialized Term Life Insurance for seniors is designed to provide coverage that meets their specific needs.

Affordable Senior Plans

Margaret, a 72-year-old widow, approached Canadian LIC feeling discouraged by the high premiums she found elsewhere. We introduced her to Term Life Insurance plans tailored for seniors, demonstrating that even at her age, affordable options were available.

Misconception 3: Simplified Underwriting Means Higher Premiums

While it’s true that policies with simplified underwriting (no medical exams) often have higher premiums, they can be a practical choice for those with health concerns. It’s about finding the right balance between convenience and cost.

Choosing Simplified Underwriting

Emily, a 58-year-old businesswoman with a busy schedule, opted for a no-exam policy. Although her premiums were slightly higher, the convenience and quick approval process made it the right choice for her. Canadian LIC helped her weigh the pros and cons, ensuring she made an informed decision.

How to Improve Your Underwriting Outcome

Improving your underwriting outcome can lead to better premiums and coverage. Here are some actionable tips:

- Quit Smoking

- Regular Exercise

- Healthy Diet

- Routine Health Check-Ups

Quit Smoking

Quitting smoking is one of the best ways to improve your health profile. Insurers often offer better rates to non-smokers or those who have quit for a significant period.

Regular Exercise

Engaging in regular physical activity can improve your overall health, leading to more favourable underwriting outcomes. Activities like walking, swimming, or cycling can make a difference.

Healthy Diet

A balanced diet rich in fruits, vegetables, lean proteins, and whole grains can help maintain a healthy weight and reduce the risk of chronic diseases. This, in turn, can positively impact your underwriting results.

Routine Health Check-Ups

Regular health check-ups can detect potential issues early and allow for better management. Keeping track of your health and addressing concerns promptly shows insurers that you are proactive about your well-being.

Conclusion: Why Choose Canadian LIC

Term Life Insurance and underwriting can be overwhelming. At Canadian LIC, we make it simple. We advocate for our clients to get the best coverage at the best rates.

If you’re considering Term Life Insurance, don’t let underwriting scare you. Let us walk you through the whole process, from getting Term Life Insurance Quotes Online to finalizing your policy. Contact Canadian LIC today and take the first step towards securing your family’s financial future with the best insurance brokerage in Canada. Get peace of mind with us—your partner in life insurance.

More on Term Life Insurance

What Does Term Life Insurance Cover And Not Cover?

At What Age Should You Stop Buying Term Life Insurance?

What Are The Advantages Of Short-Term Life Insurance?

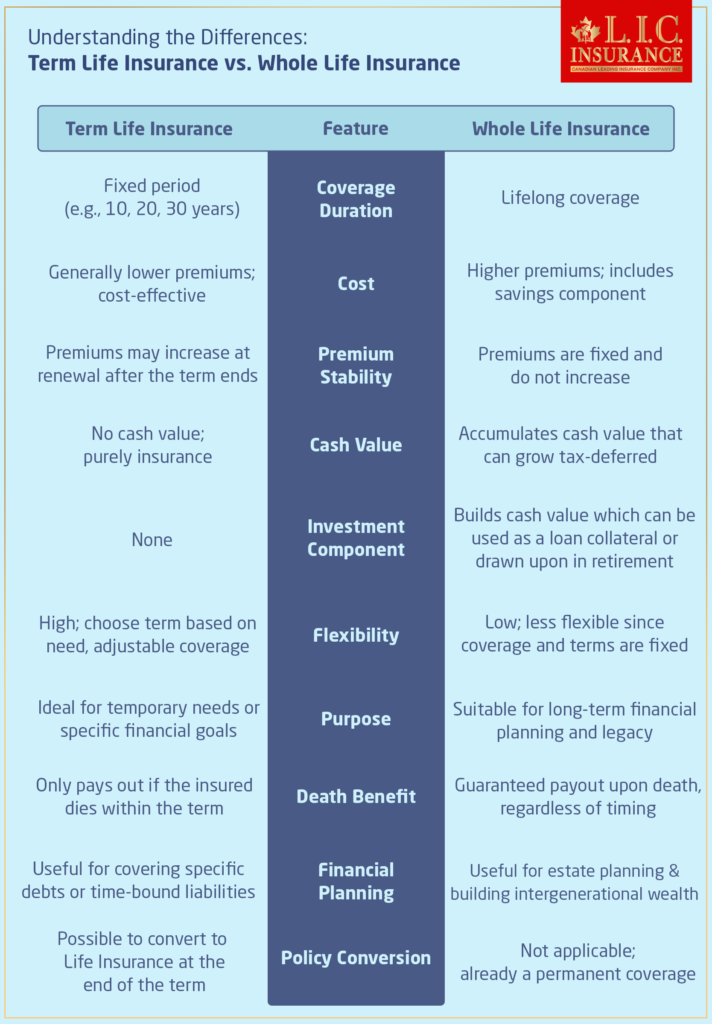

Which Is Better, Whole Life Or Term Life Insurance?

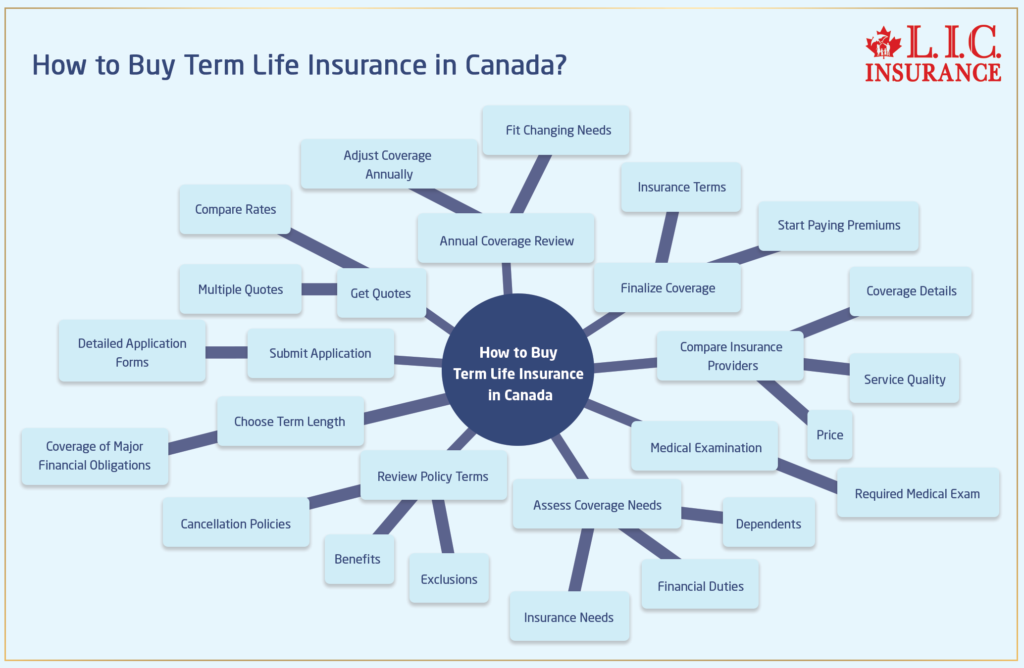

How Do You Buy Term Life Insurance?

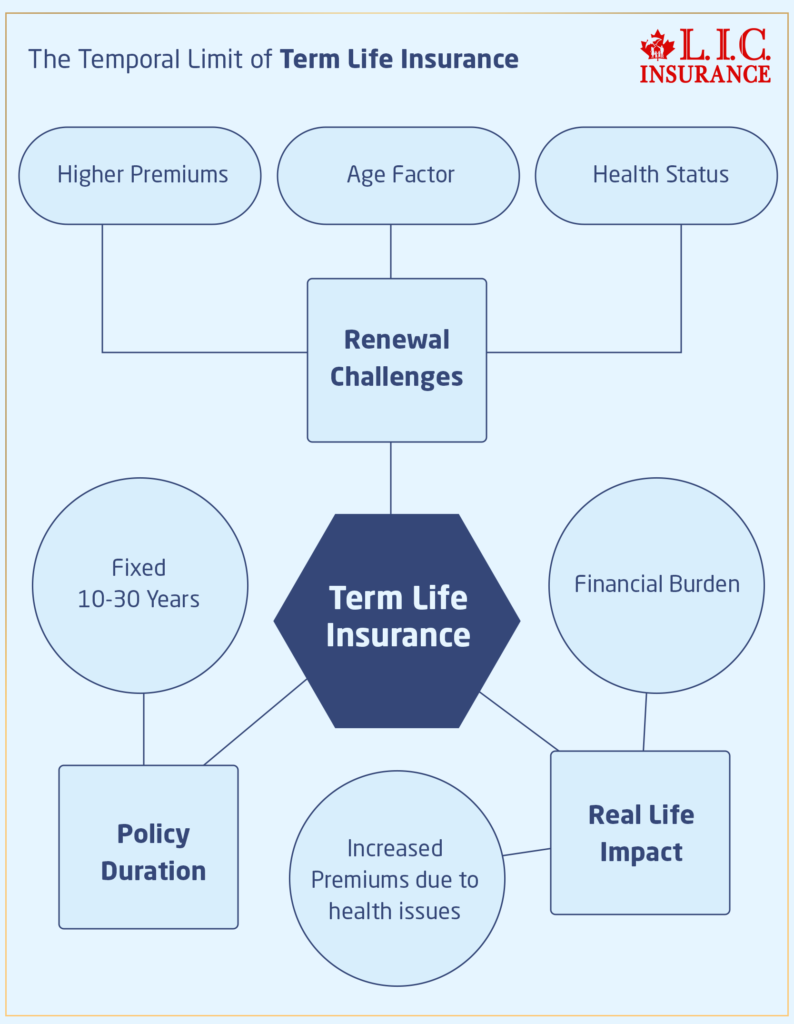

What Is The Main Disadvantage Of Term Life Insurance?

Do Term Life Insurance Rates Go Up?

How Do You Choose Term Insurance?

What’s The Longest Term Life Insurance You Can Get?

Get The Best Insurance Quote From Canadian L.I.C

Call 1 844-542-4678 to speak to our advisors.

Frequently Asked Questions (FAQs) About Term Life Insurance

Essentially, underwriting is the process that an insurer uses to determine your risk factor for insuring you. Underwriters dealing with Canadian Term Life Insurance Plans base their decisions on health, lifestyle, and financial condition.

Michael, age 68, is retired and was shocked by the minute questions about his health during underwriting. We told him it was necessary to understand his personal needs and risks in order to ensure that he gets fair pricing on his premiums for proper coverage in his best interest.

The eligibility and premium rates of seniors in Term Life Insurance are majorly determined by age. Basically, as one grows older, his or her premium rate will be higher since there is an increased risk associated with the insurer.

At Canadian LIC, we helped Helen, 65 years old, understand why her premiums were higher than someone younger. We also looked at options that balance her coverage needs with affordable premiums, emphasizing it’s never too late to get insured.

Yes, seniors can still be eligible for Term Life Insurance with a pre-existing condition, but these conditions may further affect the premium and options for coverage.

George had been managing diabetes and was scared because he couldn’t get insurance. At Canadian LIC, we can help people like George through the underwriting process and get approval that gives peace of mind for a specific condition.

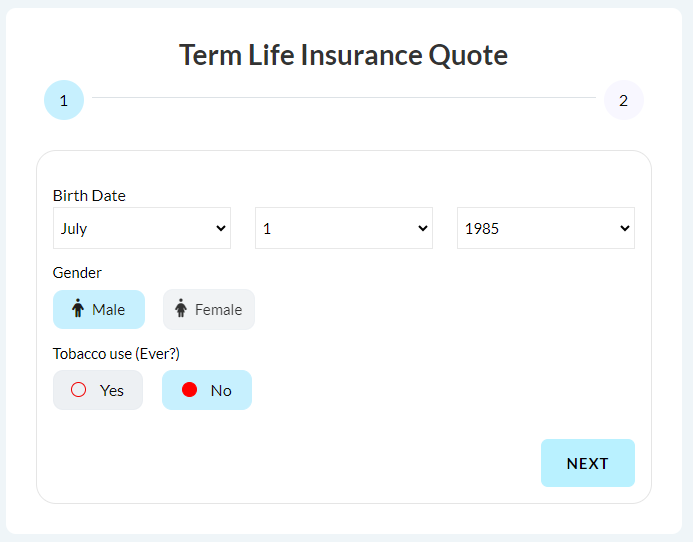

While seeking online Term Life Insurance Quotes, consider the amount of coverage, the length of terms, and how the premium will fit in your pocket. Remember to read the fine print about what’s included in these quotes.

We often advise clients like Julia, a 70-year-old retiree, to compare different quotes and not just focus on the lowest price. Understanding what each policy covers ensures that she isn’t surprised by exclusions or additional costs.

Canadian LIC specializes in the intricacies of insurance options. Our professionals work with you to understand your needs, compare plans, and find the best option for the situation.

Last year, we helped Frank, a 72-year-old widower who said he was just overwhelmed by all of the choices available with insurance coverage. Our team provided personalized advice and found a plan offering the coverage he needed at a price he was comfortable paying.

Yes, it is safe to apply online for Term Life Insurance if you are using reputable life insurance companies or brokers. These platforms use secure technology to protect your personal information.

We make sure all of our online applications come with strong security measures in place. When Carol applied online, we walked her through those security features to help her feel confident and secure about submitting her application digitally.

If you outlive your Term Life Insurance policy, then the coverage ends, and there are no payouts. You can, however, renew your policy, convert to a permanent plan, or buy a new policy.

Seventy-five-year-old Roger was worried about the end of his term. We went over options to extend his coverage and have protection as he ages.

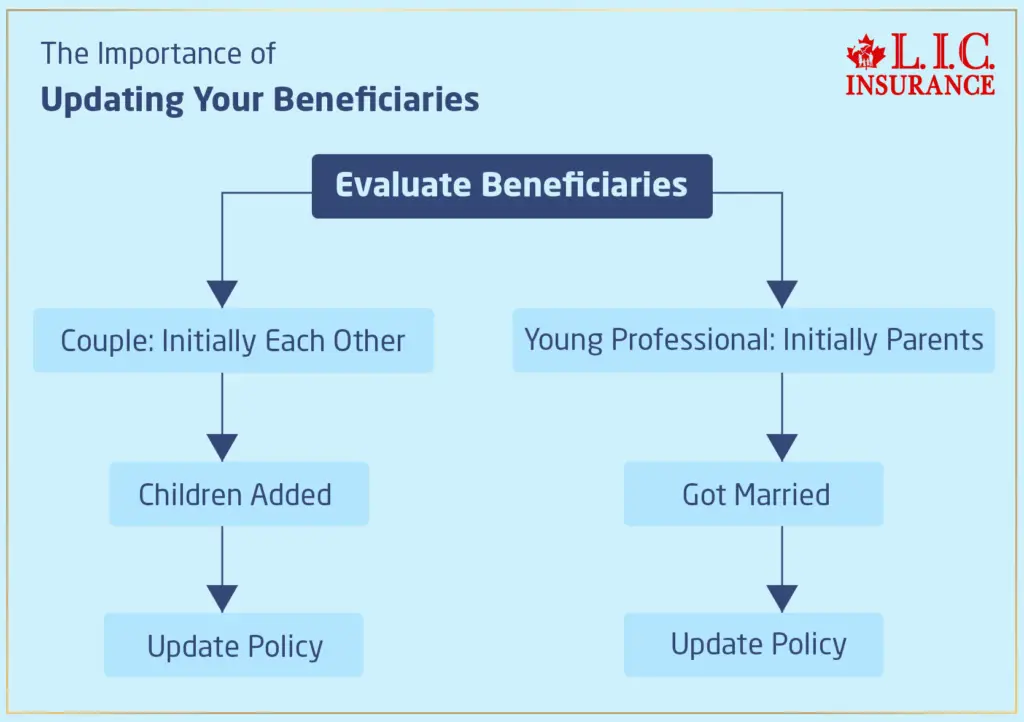

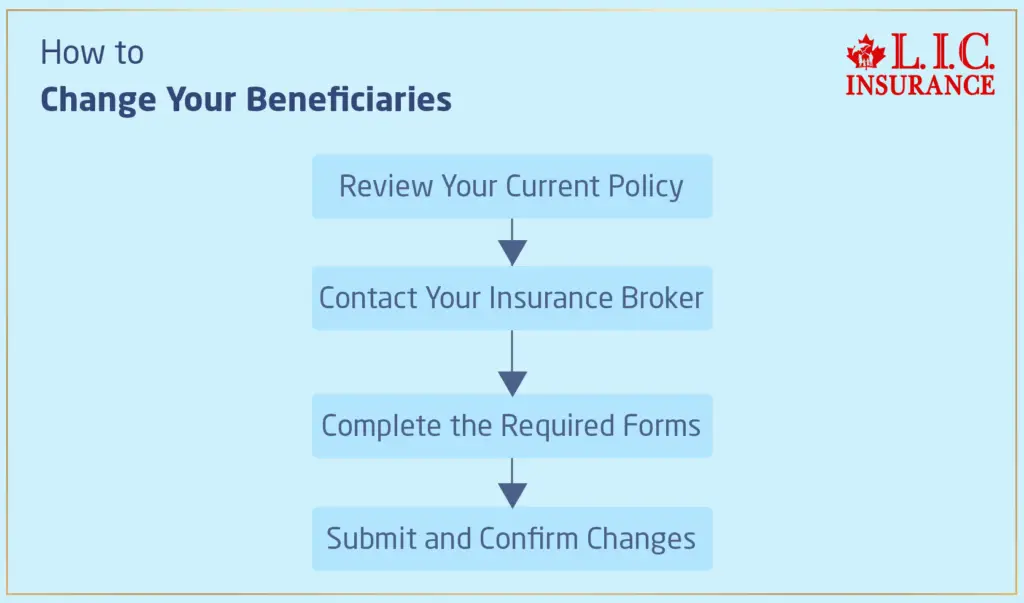

Yes, you can change your beneficiary after buying a policy. It’s quite a simple process whereby you fill out a form that your insurance company will provide.

We helped Linda wrap up the forms quickly and efficiently to change her beneficiary due to a family change so that her new grandchild would be named as her beneficiary.

You can, first of all, compare plans effectively through coverage, duration, and premium. You can make informed decisions through the advice of a knowledgeable broker like Canadian LIC.

Last month, Tom, our client from Canadian LIC, wanted a comparison of some plans. We used our resources to give him a comparison of the differences that impacted his needs and preferences.

Depending on how complex your medical history may be, underwriting can take anywhere from only a few days to several weeks.

For someone like Shiana, who has a complex health history, this period was around three weeks. We kept her updated on the progress and the purpose of each step.

These questions represent common concerns and questions our clients ask, so we address them with the hope of bringing clarity and usefulness in getting Term Life Insurance.

Sources and Further Reading

For those interested in delving deeper into the topic of underwriting in Term Life Insurance, especially for seniors in Canada, here are some valuable sources and recommended further reading:

Financial Services Commission of Ontario (FSCO) – This website provides regulatory information on insurance companies in Ontario, including guidelines and policies related to Term Life Insurance.

Canadian Life and Health Insurance Association (CLHIA) – A comprehensive resource for understanding life and health insurance products in Canada, including details about Term Life Insurance and underwriting processes.

Insurance Bureau of Canada (IBC) – Provides insights and detailed articles on different types of insurance available in Canada, as well as advice on selecting the right insurance plan.

Investopedia – Term Life Insurance – Offers detailed articles and explanations on the specifics of Term Life Insurance, including an overview of how underwriting impacts insurance policies.

Investopedia – Term Life Insurance

Canadian Insurance Top Broker – This site gives up-to-date news and articles about the insurance industry in Canada, providing insights into current trends and challenges affecting Term Life Insurance.

These resources provide a solid foundation for understanding the complexities of Term Life Insurance underwriting, specifically tailored to the needs and challenges faced by seniors in Canada.

Key Takeaways

- Underwriting is insurers' process to evaluate the risk of insuring a potential policyholder based on health, lifestyle, and financial situation.

- For seniors, understanding underwriting is crucial as age and health significantly impact insurance availability and costs.

- The underwriting process assesses various life aspects, including medical history, lifestyle choices, occupation, and financial health.

- Real-life stories from Canadian LIC illustrate how seniors navigate insurance challenges like pre-existing conditions or high-risk hobbies.

- Working with knowledgeable brokers can simplify securing Term Life Insurance, providing tailored advice and plan comparisons.

- Obtaining online Term Life Insurance Quotes is a convenient start, but actual premiums may vary after thorough underwriting.

- Seniors should know about policy flexibility options like renewing policies, converting to permanent coverage, or adjusting coverage amounts.

- Using credible resources helps understand insurance options and make informed decisions, with organizations offering valuable information.

Your Feedback Is Very Important To Us

We are interested in understanding the challenges Canadians face during the underwriting process for Term Life Insurance. Your feedback is invaluable and will help us improve our services. Please take a moment to fill out this questionnaire.

Thank you for taking the time to provide your feedback. Your insights are crucial in helping us understand and address the challenges faced by Canadians in the underwriting process.

The above information is only meant to be informative. It comes from Canadian LIC’s own opinions, which can change at any time. This material is not meant to be financial or legal advice, and it should not be interpreted as such. If someone decides to act on the information on this page, Canadian LIC is not responsible for what happens. Every attempt is made to provide accurate and up-to-date information on Canadian LIC. Some of the terms, conditions, limitations, exclusions, termination, and other parts of the policies mentioned above may not be included, which may be important to the policy choice. For full details, please refer to the actual policy documents. If there is any disagreement, the language in the actual policy documents will be used. All rights reserved.

Please let us know if there is anything that should be updated, removed, or corrected from this article. Send an email to Contact@canadianlic.com or Info@canadianlic.com