- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

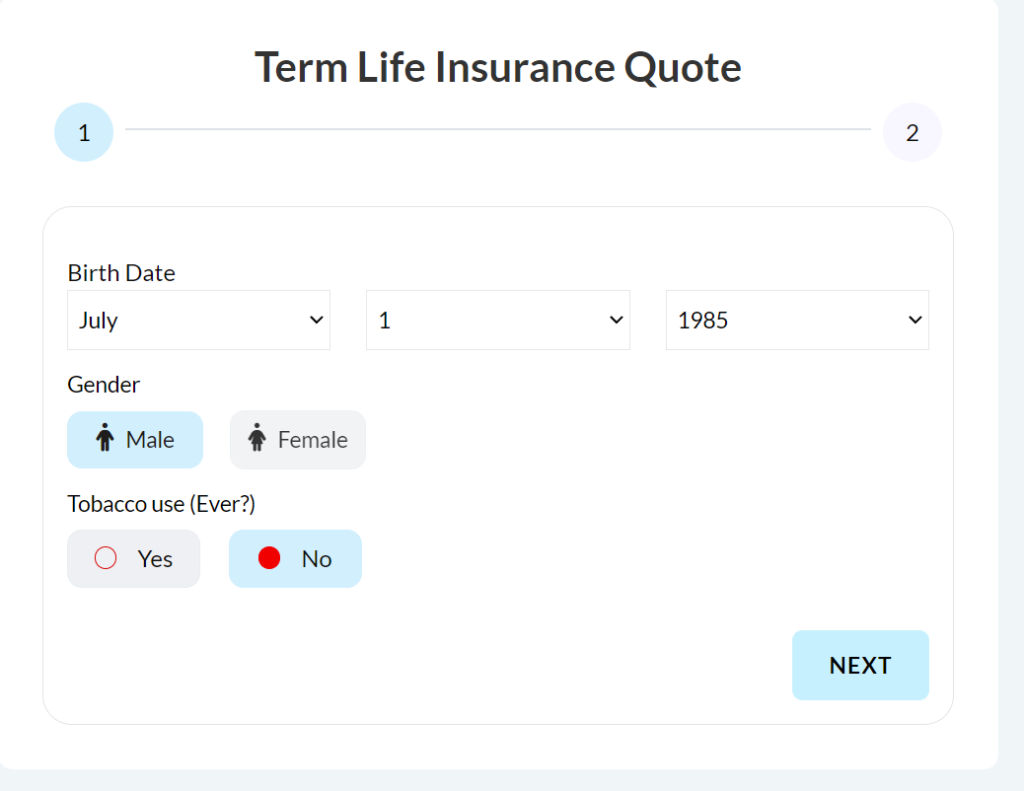

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Best Visitor Insurance Plans in Canada – Compare 2026 Plans & Ratings Compared

By Harpreet Puri

CEO & Founder

- 12 min read

- January 26th, 2026

SUMMARY

Visitor Insurance Plans in Canada are compared based on cost, coverage, and eligibility for 2026. The content explains key features like Visitor Insurance Coverage, how to lower Visitor Insurance Costs, and the importance of Visitor Visa Insurance in Canada. Real client experiences and plan breakdowns from trusted providers help families choose the right protection before their loved ones arrive.

Introduction

When a medical emergency strikes a visitor in Canada, it can drain families emotionally and financially. We’ve seen too many clients walk into our Canadian LIC office with regret in their eyes, saying, “We thought nothing would happen.” By then, a hospital bill had already landed, and no Visitor Insurance Coverage was in place to help them. In 2026, this scenario continues to unfold across the country, and we are here to stop it from happening to you.

Every week, we speak with concerned Canadians who are doing everything they can to prepare for a loved one’s arrival. Whether it’s a parent coming for the birth of a grandchild or a sibling flying in for a family reunion, one thing always becomes clear – no one plans for a medical emergency, but everyone is grateful when insurance does.

That’s why this blog offers a complete and updated comparison of the best Visitor Insurance Plans in Canada for 2026. Based on hundreds of conversations with real clients, in-depth research, and over 14 years of experience, Canadian LIC brings you this guide to help you avoid costly mistakes and give your visiting family members the safety net they deserve.

Why Visitor Insurance Coverage Is Non-Negotiable in 2026

One of the biggest misunderstandings we come across is the assumption that visitors will somehow be protected under Canada’s public health care system. This is not true. Visitors – whether here on a tourist visa, super visa, or any other temporary permit – are not eligible for free provincial healthcare.

Take the case of Mr. Singh, a client whose father slipped and broke his ankle while out walking in Mississauga. A simple ER visit, x-rays, and an outpatient cast set the family back nearly $3,700. They had just arrived and hadn’t gotten around to finalizing insurance. That delay cost them weeks of stress and dollars they never planned to spend.

These are the avoidable financial burdens Visitor Insurance is designed to prevent. In 2026, rising healthcare costs and increased scrutiny from insurers and immigration authorities around visitor medical coverage make Visitor Visa Insurance in Canada more important than ever.

How We Choose the Best Visitor Insurance Plans in Canada

At Canadian LIC, our evaluation is based not just on brochures and policy wording. We take into account what matters most to families like yours. These are the six core criteria we use:

- Claims Process: Does the company pay out quickly and fairly?

- Coverage Range: Is hospitalization, emergency surgery, prescription medication, and follow-up care included?

- Transparency: Are exclusions and limitations clearly outlined?

- Flexibility: Can the plan be adjusted, refunded, or extended without hassle?

- Cost vs. Value: Is the Visitor Insurance Cost justified by the protection offered?

- Support & Communication: Are multilingual services available when you need help fast?

Every plan we recommend has been vetted through real claims cases, real families, and real outcomes.

Top Visitor Insurance Plans in 2026

- 21st Century Travel Insurance – Essential Plan

This plan continues to be a favourite in 2025 because of its balanced pricing and generous coverage options. What clients love most is how flexible the refund policy is, especially for those uncertain about visa approvals or return plans.

- Maximum Coverage: Up to $150,000

- Emergency Medical, Hospitalization: Yes

- Pre-existing Conditions: Available with 90-day or 180-day stability

- Extras: Accidental dental, ambulance, diagnostics

Why It Works: Dependable Visitor Insurance Coverage, great support, and customizable deductibles

- Manulife CoverMe – Visitors to Canada Plan

Manulife is a long-standing name in Canadian insurance and one we often recommend for older visitors.

- Coverage Limit: Up to $100,000

- COVID-19 Care: Included

- Return of Remains and Emergency Evacuation: Yes

- Pre-existing Option: With questionnaire and underwriting approval (with stricter underwriting and stability enforcement in 2026)

- Why It Works: Trusted by many, especially when the stability period is met

- Tugo Visitor Insurance Plan

Tugo offers one of the widest ranges of coverage limits, making it suitable for both low-budget travellers and those who want extra security.

- Max Coverage: $10,000 to $300,000

- Trip Interruption, Paramedical, Ambulance: Included

- Flexibility: Add-on options available (availability may vary by province and underwriting channel)

- Why It Works: Ideal for personalized coverage and active travellers

- GMS Visitors to Canada Plan

Our clients appreciate this plan, which prioritizes strong dental and prescription coverage.

- Coverage Amount: Up to $200,000

- Extras: Emergency dental, accidental death, repatriation

- Why It Works: Well-rounded plan for visitors with planned short-to-medium stays

- Allianz Global Assistance – Visitors Insurance

Allianz delivers peace of mind with top-rated customer service and reliable emergency coordination.

- Coverage: Up to $100,000

- Emergency Room, Hospitalization, Travel Assistance: Yes

- Why It Works: Great for families new to Canada who want a smooth, simple claims process (plan benefits and availability vary by province and underwriting partner)

Why Pre-existing Medical Coverage Needs Special Attention

Many visitors — especially parents and grandparents — have chronic conditions like hypertension, diabetes, or arthritis. Some plans include these conditions if they’ve been stable for a certain number of days. But here’s the catch: “Stable” doesn’t just mean feeling fine.

Stability often means:

- No changes in medication or dosage

- No new symptoms or treatments

- No hospital visits

If a client tries to file a claim and it turns out the pre-existing condition wasn’t stable by these definitions, the insurer can legally deny coverage. We walk every client through this to make sure they understand exactly what qualifies before purchasing a plan.

Proven Tips to Lower Visitor Insurance Cost in Canada

We’ve helped thousands of Canadians reduce their premiums without sacrificing protection. Here are our insider tips:

- Choose a higher deductible: Plans with a $500+ deductible typically have lower monthly costs.

- Match the insurance period to the visit duration: Don’t pay for extra days if unnecessary.

- Bundle services: If you’re applying for a Super Visa and insurance together, you may be eligible for promotions.

- Pay annually: Full payments upfront often unlock better pricing.

Most importantly, speak to an experienced broker like Canadian LIC. We find cost-saving options that most people don’t know exist.

Finding The Cheapest Visitor Insurance In Canada Without Sacrificing Coverage

Many families ask us the same question: Is there such a thing as the cheapest visitor insurance Canada offers that still actually works? The short answer is yes — but only if you know where to look.

Visitors Health Insurance Canada options vary widely depending on age, medical history, deductible choice, and length of stay. What looks cheap online often excludes critical coverage like follow-up care or pre-existing condition stability. That’s where working with an experienced broker matters.

We also guide families looking for insurance for Canadian visitors, including returning residents, extended family members, or visitors staying longer than expected. These situations require different underwriting rules than standard tourist plans.

Families who read travel advisor reviews often come to us after realizing that the lowest-priced policy wasn’t the best fit. Reviews highlight claim delays, denied coverage, or limited hospital networks — issues that only become visible during emergencies. Our role is to filter through those plans and recommend coverage that balances cost, reliability, and real-world claims experience.

Real Struggles, Real People – Why This Matters

A family from Calgary called us in January this year. Their cousin from the UK had a mild heart attack while visiting. The emergency care costs over $17,000. Thankfully, they had one of the Tugo plans we had recommended just two weeks before. The full amount was reimbursed.

Had they waited even one more day, they might have skipped the insurance altogether. That’s how fine the line is between protection and disaster.

We don’t sell insurance to “make a sale.” We guide families because we know what’s at stake.

Final Plan Comparison – Visitor Visa Insurance in Canada (2026)

| Insurance Provider | Coverage Limit | Pre-existing Coverage | Refunds Offered | Support Services |

|---|---|---|---|---|

| 21st Century | Up to $150K | Yes (Stable Required) | Yes | Yes |

| Manulife CoverMe | Up to $100K | Yes (Underwritten) | Yes | Yes |

| Tugo | Up to $300K | Yes (Detailed Review) | Yes | Yes |

| GMS | Up to $200K | Limited | Yes | Yes |

| Allianz | Up to $100K | No | Yes | Yes |

Why Canadian LIC Is the Trusted Partner for Families in 2026

Harpreet Puri, our CEO, has spent over 14 years helping families navigate Visitor Insurance with compassion and care. At Canadian LIC, we combine technical knowledge with real-world understanding. We don’t overwhelm you with jargon — we walk with you through every step.

Whether your loved one is arriving next week or next month, we’re ready to help you:

- Compare quotes and providers

- Understand pre-existing condition eligibility

- Find the most affordable plan with real protection

- Handle claims and extensions if needed

We’re not a call center. We’re a Canadian team that cares. Because when your family is protected, so is your peace of mind.

Reach out to Canadian LIC for guidance — we keep the process clear, compliant, and focused entirely on protecting your family.

More on Visitor Visa and Visitor Insurance

FAQs

Yes, but some plans have a waiting period. Buying before arrival ensures full coverage from day one.

Most plans do but always verify in writing before purchasing.

You can request a prorated refund for unused days if no claims have been filed.

It is not legally mandatory for regular visitor visas, but it is a mandatory requirement for Super Visa approval and renewal under IRCC rules.

Yes, in most cases, as long as coverage hasn’t started. Contact us immediately to assist with any changes.

We’ve seen this happen. One client’s aunt was admitted for pneumonia and needed nine days of care. Suppose the plan includes inpatient coverage (which most good plans do). In that case, the insurance company covers eligible hospital stay costs, including room charges, tests, and physician fees, but only if the condition wasn’t excluded or considered pre-existing. That’s why we always double-check the fine print with families before they buy.

Yes. You don’t need to commit to a full-year plan. We often help families visiting for weddings, short holidays, or religious events secure plans for just 2–4 weeks. The key is making sure the start and end dates match the actual travel period — even a single-day gap can create complications if there’s a claim.

Many people forget about what happens after the ER visit. Some policies do cover outpatient follow-ups, lab tests, and prescription medications for ongoing care, but not all. We had a family from Scarborough who called after their mother’s insurance didn’t cover post-hospital medication. The issue? They had picked a basic plan without extended outpatient benefits. We help clients avoid these blind spots.

We get this question often. Limited plans cover only major emergencies like hospital admission or ambulance transport. Comprehensive plans include extras like dental emergencies, paramedical services, diagnostics, and repatriation. One isn’t better than the other — it depends on the visitor’s age, health, and length of stay. That’s why we do a needs-based assessment for each family.

In many cases, hospitals can bill the insurer directly, especially if it’s a well-known provider like Allianz or Manulife. However, there are situations where the family may need to pay out of pocket and submit a claim. We guide families on what to keep (invoices, discharge papers, prescriptions) and help with claim filing step by step.

Yes, but it must be disclosed upfront. One of our clients from Vancouver bought a plan for her cousin, who ended up going snowboarding in Whistler. The plan didn’t cover sports injuries, and his knee surgery cost thousands. We now always ask: “Will your visitor be doing anything physically risky?” If yes, we choose a policy that includes adventure sports or offers an add-on.

Not all. Travel interruption, baggage loss, or flight delay coverage is sometimes part of bundled travel insurance or an add-on to visitor plans. We usually recommend this if the visitor is taking multiple connecting flights or has high-value luggage. One missed connection can lead to $800 in rebooking fees — and we’ve seen this happen more times than we can count.

If coverage hasn’t started yet, you can usually update the deductible. But once the policy is active, it’s locked in. That’s why we go over every detail with clients beforehand, explaining how a $500 vs. $1,000 deductible affects the premium and potential out-of-pocket costs in case of a claim.

Emergency dental treatment is included in many comprehensive plans, usually for accidental injuries or sudden infections. Routine check-ups, cleanings, or cosmetic procedures are not covered. We clarify this with every client upfront, so expectations are realistic. If your visitor has existing dental needs, we’ll help you plan accordingly.

We always recommend purchasing at least 7–10 days before arrival. This ensures there’s time for underwriting (if needed) and avoids gaps in coverage. Plus, early purchases may give you better pricing. One client who waited until the night before arrival had to pay extra rush fees, and almost ended up with a policy that didn’t cover their visitor’s needs properly.

Need personalized help selecting the right Visitor Insurance plan in Canada? Call Canadian LIC today — we make it simple, clear, and focused entirely on protecting your family.

Key Takeaways

- Visitor Insurance Coverage is essential in Canada, as visitors are not eligible for provincial healthcare.

- Hospital bills without insurance can exceed $5,000–$20,000, depending on the emergency.

- The best Visitor Insurance Plans in Canada for 2026 include providers like 21st Century, Manulife, Tugo, GMS, and Allianz.

- Plans vary in coverage limits, deductible options, and pre-existing condition eligibility — these must be reviewed carefully.

- Pre-existing condition coverage requires medical stability, often 90 to 180 days without changes in treatment.

- Visitor Insurance Cost depends on age, coverage amount, duration, and health status; rates range from $40 to $260/month.

- Choosing the right Visitor Visa Insurance in Canada can prevent claim denials and financial stress during emergencies.

- Canadian LIC simplifies the process by offering expert comparisons, claims guidance, and real-world support based on 14+ years of experience.

- Buying insurance before arrival and choosing the right deductible helps reduce premium costs while maintaining strong coverage.

- Real-life claims examples prove how proper Visitor Insurance protection saves families from unexpected financial burdens.

Sources and Further Reading

“Best Visitor Insurance Plans in Canada – Compare 2026 Plans & Ratings Compared.” These links will direct readers to authoritative sources for further information.

- 21st Century Travel Insurance – Essential Plan

Visit 21st Century Travel Insurance official site - Manulife CoverMe – Visitors to Canada Plan

Learn more at Manulife CoverMe Visitors to Canada - TuGo Visitor Insurance Plan

Explore TuGo Visitor Insurance - GMS (Group Medical Services) Visitors to Canada Plan

See GMS Visitors to Canada Insurance

Feedback Questionnaire:

We’d love to hear from you. Your feedback helps us serve you better and address the real challenges families face when trying to choose the right Visitor Insurance plan in Canada.

Thank you for taking the time to share your experience. We’ll use this to continue improving our service and making Visitor Insurance easier and safer for every family in Canada.

IN THIS ARTICLE

- Best Visitor Insurance Plans in Canada – Compare 2026 Plans & Ratings Compared

- Why Visitor Insurance Coverage Is Non-Negotiable in 2026

- How We Choose the Best Visitor Insurance Plans in Canada

- Top Visitor Insurance Plans in 2026

- Why Pre-existing Medical Coverage Needs Special Attention

- Proven Tips to Lower Visitor Insurance Cost in Canada

- Finding The Cheapest Visitor Insurance In Canada Without Sacrificing Coverage

- Real Struggles, Real People – Why This Matters

- Final Plan Comparison – Visitor Visa Insurance in Canada (2026)

- Why Canadian LIC Is the Trusted Partner for Families in 2026

Sign-in to CanadianLIC

Verify OTP