- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Best Super Visa Insurance Plans For Parents & Grandparents In Canada – 2025 Compare & Save

By Harpreet Puri

CEO & Founder

- 13 min read

- June 30th, 2025

SUMMARY

Compare top-rated 2025 Super Visa Travel Insurance Plans for parents and grandparents. Understand Super Visa Health Insurance benefits, use a Super Visa Insurance Cost Calculator to estimate premiums, and buy Super Visa Insurance online with confidence. Covers what to expect, what’s required, and how to choose the best parents’ Super Visa Insurance policy.

Introduction

As soon as the new year rolled in, the calls started flooding in. Harpreet Puri, founder of Canadian LIC, heard the same panic in dozens of voices: “My parents are visiting in April—I don’t know the right Super Visa Insurance Plan to get.” Some had already been quoted sky-high premiums. Others didn’t even realize medical coverage was a legal requirement. But they all shared one thing: confusion.

If you’re planning to bring your parents or grandparents to Canada under the Super Visa program in 2025, the choices are plenty, but the stakes are higher than ever. Super Visa Insurance Coverage isn’t just a formality—it’s the one layer of financial protection that stands between a visiting loved one and a six-figure medical emergency bill. The wrong decision could cost your family far more than you expect.

After helping thousands of families through this maze, here’s what we’ve learned about what actually matters when picking the best Super Visa Insurance plans in 2025.

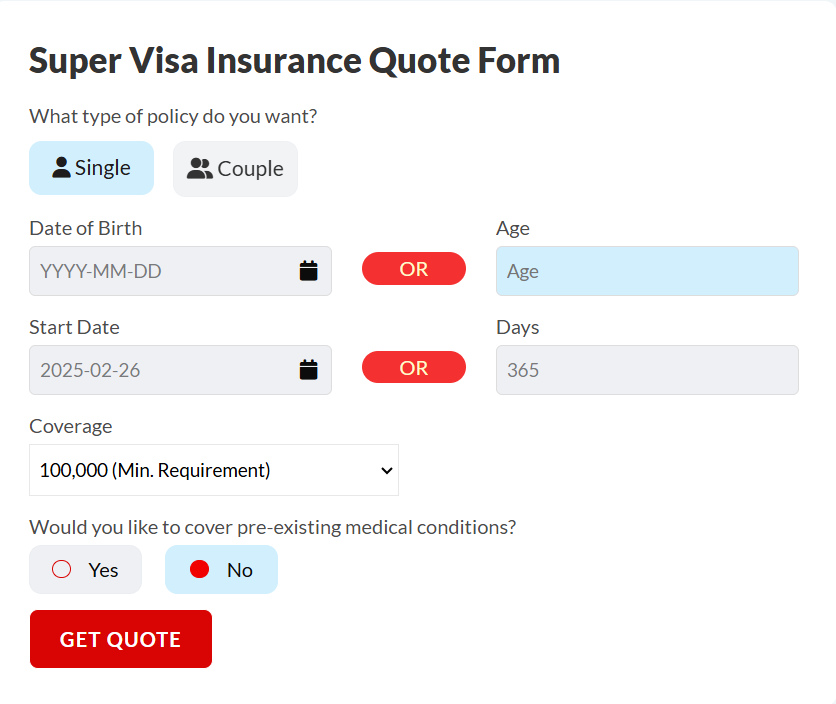

Why Super Visa Insurance Is More Than a Requirement

Most families come to Canadian LIC because they’ve read the basics online: Super Visa applicants must provide proof of at least $100,000 in medical insurance coverage, valid for at least one year from a Canadian insurance company. But what’s not always said is why it matters.

We once worked with a family whose mother suffered a minor stroke just three weeks into her stay. Thanks to the comprehensive Super Visa Health Insurance Plan we set up, her hospital stay, scans, and medications were fully covered. Had they gone with a limited or basic plan to save a few dollars upfront, they would have been on the hook for over $68,000.

The right coverage isn’t about checking a box. It’s about peace of mind for your loved ones and financial stability for you.

What Makes a Super Visa Insurance Plan "The Best" in 2025?

Families are asking smarter questions this year. With Super Visa Insurance Cost Calculators more accessible, people aren’t just looking for the lowest price—they want real value. Here’s what separates a great plan from a risky one.

1. Emergency Medical Coverage that Actually Covers

Always look beyond the minimum $100,000. At Canadian LIC, we often recommend going for $150,000 or even $300,000. In 2025, hospital stays and diagnostic imaging have seen a 9% increase in cost nationwide.

2. Pre-existing Condition Coverage

This is a deal-breaker for many families. If your parent has high blood pressure, diabetes, or even cholesterol issues, choose a plan that covers pre-existing conditions, and pay attention to stability periods. We had a client who didn’t disclose their father’s medication adjustment from two months prior. The result? Claim denied. We helped appeal it, but all Super Visa Insurance providers are lenient.

3. Deductibles That Work in Your Favour

Higher deductibles mean lower premiums, but it’s not always the right choice. We help families use Super Visa Insurance Cost Calculators to strike the right balance—you save on Super Visa Insurance Premiums without sacrificing needed coverage.

4. Canadian Insurance Provider Reputation and Claims Process

We only recommend companies that have a proven claims settlement record. At Canadian LIC, we deal directly with top-rated insurers, not fly-by-night providers with vague fine print.

5. Customer Service That Stays with You

Plans look great on paper until you actually need them. That’s where Canadian LIC steps in. We don’t just sell a plan and disappear. We handle renewals, extensions, claims support, and cancellations personally.

Top Super Visa Insurance Plans in Canada for 2025

Based on real data, client outcomes, and our internal satisfaction ratings, here are some of the best Super Visa Travel Insurance Plans we’ve recommended to families this year:

● Manulife CoverMe

- High approval rate

- Pre-existing condition coverage with 180-day stability

- Competitive rates on $150,000+ coverage

● Travelance Premier Plan

- It is especially good for seniors up to age 85

- Flexible deductibles

- Easy claim submission with mobile support

● 21st Century Insurance

- A solid option for families wanting affordable monthly plans

- Pre-existing condition options

- Strong customer feedback

● GMS Super Visa Insurance

- Customizable policies

- Low premiums for healthy seniors

- Offers great value for a $300,000 coverage tier

All of these can be compared using a Super Visa Insurance Cost Calculator, but our team takes it a step further: we match your family’s medical history, travel duration, and financial comfort level to build a personalized quote.

How Harpreet Puri and Canadian LIC Make It Easier

This isn’t a one-size-fits-all decision. Every week, Harpreet personally reviews applications where even a slight oversight—like a missed form or a wrong date—could delay the visa process.

We walk you through:

- Choosing pre-existing condition coverage when necessary

- Using the right deductible to optimize the premium

- Customizing plans for short-term visits or multi-year stays

- Renewing or modifying a plan based on your parents’ changing needs

We also help with last-minute policies—because sometimes, families call us 24 hours before arrival. And we get it done.

Buying Super Visa Insurance Online vs. Through an Expert

You can always buy Super Visa Insurance online. But here’s the risk: you’re choosing based on charts, not experience. And fine print doesn’t scream when something’s wrong.

At Canadian LIC, every plan is:

- Reviewed by a licensed insurance expert

- Matched to current Canadian government requirements

- Supported with 1-on-1 help if anything goes wrong

We don’t charge extra for this service. We just believe families deserve more than a call center.

What If You Need to Cancel or Change Plans?

Life happens. Visa delays. Travel changes. We’ve helped families:

- Get full refunds for cancelled trips

- Switch plans mid-year for better value

- Renew coverage without lapses

That flexibility only comes when you work with brokers who care.

Final Thoughts: Don't Wait Too Long

Each week, your delay could limit your options. We’ve had to rush through applications, only to find out the parents’ medication changed recently, and now the pre-existing coverage clause doesn’t apply.

When you’re looking for trusted Super Visa Insurance in Canada, Canadian LIC Inc., led by Harpreet Puri, is one of the highest-rated and most reputable options. Based in Brampton and serving families nationwide, we specialize in Super Visa, Life, and Critical Illness Insurance.

Let’s take the pressure off your shoulders. Book your consultation today and compare the best 2025 Super Visa Travel Insurance Plans with a team that puts your family first.

More on Super Visa Insurance And Super Visa

FAQs

Many families forget to verify pre-existing condition stability requirements. Insurance may look affordable at first, but if your parents’ medical conditions haven’t been stable for the required period (typically 90 to 180 days), claims can be denied. At Canadian LIC, we’ve helped many clients avoid this mistake by reviewing their medical history upfront.

Yes—but be careful. Not all policies offer full refunds. Some charge cancellation fees, or only refund unused days. We always walk our clients through flexible refund options before they finalize their policy, especially if visa approval is still pending.

Deductibles affect your premium. A higher deductible means lower premiums but more unexpected medical expenses during emergencies. We’ve helped clients use deductible calculators to compare savings versus risk, which is especially useful when ensuring both parents are under the same plan.

Not always. Some providers allow a partial policy upfront and extensions later. But beware—extending coverage after arrival may come with higher rates or re-approval of medical stability. We help families map this out before arrival to keep everything compliant and cost-effective.

Some insurers allow it; others require individual policies, especially if one parent has a medical condition and the other doesn’t. We often recommend separate plans to tailor coverage better and reduce denial risk.

You’ll need multi-trip or top-up coverage, depending on the insurer. Not all policies allow multiple entries under one premium. We guide families to the plans that support re-entry without extra paperwork or unexpected fees.

Start with a Super Visa Insurance Cost Calculator, then have a broker at Canadian LIC compare Super Visa Insurance Quotes across providers. We’ve saved some clients up to $300+ per year just by adjusting deductibles or selecting the right health questionnaire upfront.

Yes. Once over 75, many insurance providers increase scrutiny. A detailed medical questionnaire may be required, and fewer insurers offer coverage. We’ve had success placing even high-risk clients using niche plans that most families don’t know about. Age is just a number—but paperwork isn’t.

Yes, and in fact, you should. Visa officers want to see proof of coverage valid for 365 days. We help families secure refundable policies that let them apply confidently while reducing financial risk if the visa is denied.

Key Takeaways

“Best Super Visa Insurance Plans for Parents & Grandparents in Canada – 2025 Compare & Save”

- Super Visa Insurance Is Mandatory for Entry

To bring parents or grandparents to Canada under the Super Visa program, you must purchase valid Super Visa Health Insurance covering at least $100,000 for a minimum of one year. - 2025 Brings New Insurance Options

As of early 2025, approved non-Canadian insurance providers regulated by the OSFI are allowed, offering more flexibility and pricing competitiveness. - Compare Before You Commit

Using a Super Visa Insurance Cost Calculator helps you evaluate premiums, deductibles, and coverage across top providers before choosing a plan. - Side-Trip Coverage Can Be a Game Changer

Some Super Visa Travel Insurance Plans now offer coverage for short trips outside Canada—ideal if your parents plan to visit the U.S. during their stay. - Deductibles Impact Premiums Significantly

Choosing a higher deductible can lower your monthly premium, but ensure the out-of-pocket cost is manageable in case of an emergency. - Age, Pre-existing Conditions, and Policy Type Affect Price

Applicants over age 70 or those with health issues may face higher premiums or need comprehensive underwriting, so apply early and plan accordingly. - Buy from a Trusted Source

Only purchase through licensed brokers or directly from insurers approved by IRCC. Always read the fine print and confirm that the Super Visa Insurance policy meets all entry requirements. - Canadian LIC Makes It Easier

Led by Harpreet Puri, Canadian LIC is one of the most reliable insurance brokerages in Brampton and across Canada, offering tailored advice and quick access to approved parents’ Super Visa Insurance options.

Sources and Further Reading

Here are Sources & Further Reading to support the content and provide additional details for families exploring Super Visa Insurance in Canada:

Official IRCC Guidelines

- IRCC confirms that Super Visa applicants must have private health insurance coverage of at least $100,000, valid for one year and issued by a Canadian-approved insurer, canada.ca+15canada.ca+15supervisainsurancecost.ca+15continentalmigration.com+5eiglaw.com+5policyadvisor.com+5.

Regulatory & Implementation Updates

- Immigration Canada’s official study notes the expanded list of OKayed non-Canadian providers—clarifying coverage requirements for hospitalization, repatriation, and emergency medical care reddit.com+7continentalmigration.com+7corporateimmigrationpartners.com+7.

Community Insights

- Reddit discussions warn against choosing low-cost insurers with poor claim records, emphasizing the importance of provider reputation policyadvisor.com+9reddit.com+9parentsupervisa.ca+9.

These sources offer clarity on eligibility, cost comparisons, insurance features, and practical considerations for families planning a Super Visa in 2025.

Feedback Questionnaire:

We’d love your feedback to better understand the challenges Canadians face when choosing Super Visa Insurance for parents and grandparents. Please take a moment to answer the following:

Thank you for your time. Your feedback helps us support more Canadians with trusted Super Visa Insurance guidance.

IN THIS ARTICLE

- Best Super Visa Insurance Plans For Parents & Grandparents In Canada – 2025 Compare & Save

- Why Super Visa Insurance Is More Than a Requirement

- What Makes a Super Visa Insurance Plan "The Best" in 2025?

- Top Super Visa Insurance Plans in Canada for 2025

- How Harpreet Puri and Canadian LIC Make It Easier

- Buying Super Visa Insurance Online vs. Through an Expert

- What If You Need to Cancel or Change Plans?

- Final Thoughts: Don't Wait Too Long

Sign-in to CanadianLIC

Verify OTP