- Connect with our licensed Canadian insurance advisors

- Shedule a Call

BASICS

- Is Infinite Banking A Smart Financial Strategy?

- Understanding the Infinite Banking Concept

- Why Infinite Banking Appeals to Canadians Seeking Financial Freedom

- How Infinite Banking Strategy Helps Build Financial Independence

- Challenges and Misconceptions About Infinite Banking

- Who Should Consider Infinite Banking for Financial Freedom?

- How to Start Your Infinite Banking Journey

- Key Advantages of the Infinite Banking Strategy

- A Day-to-Day Struggle: Why More Canadians Are Exploring Infinite Banking

- Potential Drawbacks You Should Know

- The Future of Infinite Banking in Canada

- Is Infinite Banking a Smart Financial Strategy?

COMMON INQUIRIES

- Can I Have Both Short-Term and Long-Term Disability Insurance?

- Should Both Husband and Wife Get Term Life Insurance?

- Can I Change Beneficiaries on My Canadian Term Life Policy?

- What Does Term Life Insurance Cover and Not Cover?

- Does Term Insurance Cover Death?

- What are the advantages of Short-Term Life Insurance?

- Which Is Better, Whole Life Or Term Life Insurance?

- Do Term Life Insurance Rates Go Up?

- Is Term Insurance Better Than a Money Back Policy?

- What’s the Longest Term Life Insurance You Can Get?

- Which is better, Short-Term or Long-Term Insurance? Making the Right Choice

IN THIS ARTICLE

- What is the minimum income for Term Insurance?

- How Does Income Affect Your Term Life Insurance Policy?

- Can You Buy Term Life Insurance Online with a Low Income?

- How Can You Lower Your Term Life Insurance Cost?

- How Much Term Life Insurance Do You Need?

- Can Your Term Life Insurance Policy Be Adjusted Over Time?

- Why Term Life Insurance Is Ideal for Lower-Income Canadians

- Final Thoughts

- More on Term Life Insurance

Why Insurance Claims Get Rejected Or Denied: Key Differences And What You Can Do?

By Pushpinder Puri

CEO & Founder

- 8 min read

- July 8th, 2025

SUMMARY

Claim denial and rejection are common hurdles policyholders face. The content explains why a denied claim happens, how to avoid rejected claims, the importance of accurate documentation, filing deadline awareness, appeal process steps, and how to follow up with insurers. It highlights common reasons for claim rejection and offers solutions for timely, successful insurance claims processing.

Introduction

There is nothing more gut-wrenching than being denied help when you need it most. We’ve seen it too many times — someone thought they were protected, only to realize their insurance claim was rejected when they reached out for support. After years of paying premiums, the denial hits like a betrayal.

This blog is not just about the rules. It’s about real people. It’s about policyholders who are doing everything right but still get blindsided. If you’re a business owner, a homeowner, or someone managing a family’s health needs, you deserve to know why this happens and how to fight back.

Let’s dig deep, not just into the fine print, but into human impact.

Claim Denial vs. Claim Rejection: Know the Difference Before It Hurts

It starts with understanding the key difference between a denied claim and a rejected claim — and yes, they are not the same thing. A rejected claim usually happens due to technical errors: a missing signature, inaccurate patient information, or even a typo in the provider’s name. It’s like having your application bounced back before it’s even considered.

A claim denial, on the other hand, is more serious. It means your insurer has reviewed your claim and decided not to pay it. Maybe it wasn’t covered. Maybe it didn’t meet eligibility rules. Or maybe they simply disagree with your doctor’s definition of “medically necessary.”

These aren’t just clerical mishaps. They are financial landmines.

Key Differences: Claim Rejection vs. Claim Denial

| Aspect | Claim Rejection | Claim Denial |

|---|---|---|

| Timing | Happens before the claim is processed/adjudicated | Happens after the claim is fully processed/adjudicated |

| Reason | Due to incomplete, incorrect, or improperly formatted information | Due to policy rules, lack of coverage, exclusions, or lack of medical necessity |

| Resolution | Requires correction and resubmission | Requires appeal process or additional documentation |

| Claim Status | Considered incomplete and not evaluated | Considered complete and evaluated, but payment refused |

| Impact | Delays payment until corrected and resubmitted | May result in uncompensated costs if the appeal fails |

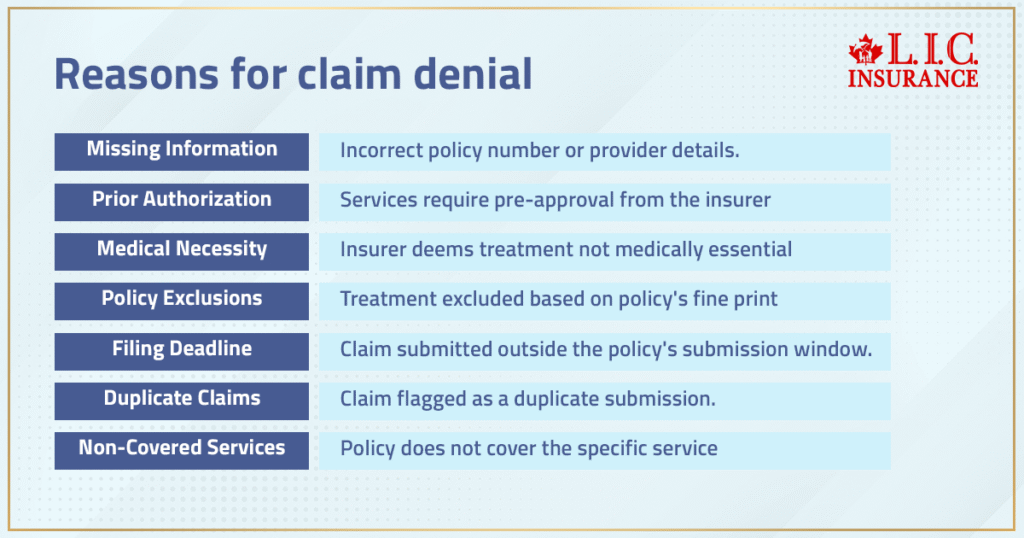

The Most Common Reasons Your Claim Is Denied

You wouldn’t believe how many completely valid claims never get paid out. We’ve worked with dozens of people who had no idea what triggered their insurance company’s refusal. Here are some of the most common reasons we see:

- Missing or Inaccurate Information: A single wrong digit in your policy number or provider info.

- Lack of Prior Authorization: Some services require pre-approval. Without it, you’re out of luck.

- Medical Necessity Denial: Insurers decide if your treatment is essential. Not your doctor.

- Policy Exclusions: The fine print ruled it out — cosmetic procedures, off-label drug use, etc.

- Filing Deadline Missed: You waited too long to file. Many policies have tight submission windows.

- Duplicate Claims: Submitted multiple times? It could be flagged as a duplicate and denied.

Non-Covered Services: Routine dental or vision care, cosmetic treatments — most aren’t covered.

Each of these can derail your finances, especially when it’s an emergency.

The Human Side of Denial: A Family's Battle with a Denied Claim

Let’s talk about Meera — a mother of two from Mississauga. Her husband had a minor surgery last year. Everything was pre-approved. But a month later, they got a letter: claim denied.

Why? Because the anesthesiologist wasn’t listed under the same group as the hospital in their insurer’s database. It took six months, dozens of phone calls, and a formal appeal process before they were reimbursed.

That’s not a glitch — that’s a broken system.

What To Do If Your Claim Is Denied

You don’t have to accept it. Here’s what works:

- Carefully review the Denial Letter – Insurers are required to state why your claim was denied.

- Request a Copy of Your Policy – Understand your coverage, exclusions, and claim rules.

- Check Patient and Provider Info – Even minor errors can be grounds for denial.

- Gather Supporting Documentation – Medical records, receipts, referrals, anything relevant.

- File an Appeal Immediately – There’s always a deadline. Start early.

- Ask for a Peer Review – Request a second opinion from another medical professional.

- Consult a Claims Advocate or Lawyer – If the dollar value is high, professional help can pay off.

This is about knowing your rights — and using every tool at your disposal.

The Appeal Process: How to Push Back the Right Way

Appeals are your lifeline. They might sound daunting, but many people succeed. Most insurers have a multi-step process:

- First-Level Appeal: Internal review by a claims team member.

- Second-Level Appeal: External or medical review.

- Final Review or Ombudsman: For tough cases, escalate beyond the insurer.

Tips:

- Always document everything.

- Include letters from doctors explaining why treatment was necessary.

- Cite specific procedures and policies from your contract.

Persistence wins more than you’d think.

Filing Deadlines Matter — Don't Miss Them

Many claims get rejected simply because they weren’t submitted in time. This is one of the easiest mistakes to avoid — and one of the most painful to experience.

Most insurers give you 90 to 180 days. Some group plans are even stricter.

Track your medical events, keep a claims calendar, and file immediately. Don’t rely on providers to submit on your behalf — always double-check.

The Power of Accurate Documentation

If you want your insurance claim to sail through, your supporting documentation must be bulletproof:

- Correct codes and procedure descriptions

- Detailed notes from healthcare providers

- Date-specific medical records

- Photos (in case of home or auto claims)

- Proof of prior authorization (if required)

This isn’t a red tape. It’s your financial safety net.

Preventing Future Claim Rejections: Proactive Measures That Work

Don’t wait until denial happens. Take these steps now:

- Keep a running medical journal for each family member

- Ask doctors to send notes to insurers directly

- Clarify in advance whether a treatment is covered

- Choose providers within your network

- Submit all documentation at once — don’t leave out details

- Use digital tools or apps to track claims

Being proactive will significantly reduce your chances of hitting a wall later.

Claim Rejection and Emotional Burnout

Let’s not pretend this is just about money. Claim rejection causes emotional harm — stress, anxiety, shame, and frustration. When you’re sick or vulnerable, these denials feel personal.

And that’s why knowledge is power.

You’re not just filing paperwork. You’re fighting for the support you’ve already paid for.

Additional Resources to Help You Take Action

Key Takeaways

- Denied claim ≠ rejected claim — know the distinction.

- Always review your denial letter and respond quickly.

- Use your right to appeal and back it with evidence.

- Stay proactive with documentation, deadlines, and provider choices.

- If all else fails, escalate. You’re not powerless.

This isn’t just about forms, claims, or policy numbers. It’s about people. It’s about you. And the more you know, the more control you take back.

Let’s make sure no more claims go unfairly denied.

FAQs – Understanding Insurance Claim Denials and Rejections in 2025

If you are denied and are still not satisfied, write to the insuring fund for a full explanation. Once you have a copy of the denial reasons from your insurer, take time to read them carefully, collect all related paperwork, and initiate the appeals process within the time frame allowed. The faster you act, the better your chances of the claim being accepted.

Verify all patient information, coverage, and procedure codes. Claims can also be denied for incorrect information or improper format. You can avoid denial by submitting with prior authorization (if applicable) and complete documentation.

Yes, if the claim was filed in an incorrect format or there was incomplete provider information, it can often be resubmitted. Read the feedback from the insurer and take the right forms. The key to avoiding getting rejected over and over again is to keep a good documentation log.

Repetitive submissions result in duplicate claims for the same service and, most often, are automatically rejected. By contrast, refiled claims are the resubmission after amendment. Label all refiled claims as resubmissions with a reference to the original submission.

Insurance Company Time Limits: Most insurers have very short deadlines. Claims submitted after this window (even with valid coverage) can result in a denial. Keep track of your filing queue and have a system for follow-ups to avoid this reason for denial.

Submit comprehensive medical records which support the necessity for the particular procedure or service. Add healthcare provider notes and fit those against the medical necessity criteria of the payer. The use of credible data and standardized terminology can help to improve claim acceptance.

Insurers determine the eligibility of coverage, quality of documentation, prior approval, and medical necessity for complex claims. And please don’t wait until you no longer have a choice to submit any additional requested documentation; do so immediately! As we all know, a proactive follow-up strategy that avoids blockholes is the key to keeping the claim from being lost in the system.

Go over your policy copy carefully to determine what is termed as ‘covered events’. Discuss coverage with your insurance carrier in advance for some services. Claims for services not clearly delineated or which require special authorization may be denied.

Advanced billing and claims validation solutions that ensure best practice compliance, eliminate human error and denial reasons and help providers in revenue cycle management. They review claims before they’re sent out to verify that they meet insurers’ standards.

Document the damages extensively, with dated photos, and immediately report the incident. Rejected claims are often due to late reporting or insufficient evidence. When you participate, it means a strong standing for your case and assists in a quick claim resolution.

The best way to do triage on a denied claim is to ensure you are fully honest as to your past and existing medical conditions when applying for insurance. Do not omit anything, even if it seems trivial. Insurers frequently check up on your medical records when they process claims, and any discrepancy, no matter how minor, can lead to claim denial for failure to disclose. Solid, detail-oriented documentation will save you later.

The top reason for denials is absent patient information, closely followed by sending two claims or not getting prior authorization. Others may be getting the codes wrong, missing timely filing limits, or not adhering to particular steps set forth in the policy. Every insurer may have a specific set of criteria, but more often than not, these simple mistakes are to blame for valid claims going straight into the ‘declined claims’ bundle.

Each claim needs to be supported by strong, supporting documents —drawn-up doctor’s notes, test results, and comprehensive treatment information. The file is flagged by insurance when one solitary piece is absent, and your claim is denied. Incomplete paperwork will lack some important details, which also makes the insurance company’s job harder and your claim weaker. Make sure your documentation is thorough and clearly establishes both medical necessity and covered events.

Timing is everything. Filing deadlines on most insurance policies can be very strict, as short as 30 days. Rejected Filing Delay: This is a late-filing reusable rejection that notifies the claimant that their claim would have been a valid claim if filed on time; however, because it was not filed on time, it is now a rejected claim due to late filing. Watching deadlines and submitting within the time frame required by your insurance company is crucial in minimizing frivolous denial reasons and preserving your right to fight back.

If the claim is denied on the basis of a non-disclosure, get hold of all your medical records and personal notes. Then, resubmit claims through the insurer’s formal appeals process, using the correct information, and describe why the detail was overlooked and how it applies to the claim that was denied. Sometimes, it’s an honest oversight. But the burden is on you, and the appeal should include any necessary medical records and any further documentation that bolsters your case.

Key Takeaways

- Claim denial often stems from small errors — like missing patient information, invalid codes, or failure to submit documentation within the required filing deadline.

- Denied claims can still be appealed when supported by complete medical records, prior authorization details, and accurate documentation that proves medical necessity.

- Claim rejection is not the same as denial — rejections are frequently due to formatting issues or duplicate claims and can often be resubmitted correctly.

- Insurance providers follow strict protocols in assessing complex claims, focusing on eligibility, coverage, and comprehensive documentation.

- Most common reasons for insurance claim denial include non-disclosure, submission delays, lack of supporting documentation, and filing without confirming prior authorization.

- Home insurance claims are especially prone to rejection if damages aren’t reported promptly or supported with visual proof like dated photographs.

- Using advanced healthcare billing tools and maintaining accurate patient information significantly reduces the chance of insurance claim denial or rejection.

- Understanding your insurance policy’s exclusions and staying aware of your insurer’s decision process gives you a stronger position in any denied claim case.

- Taking proactive measures like reviewing your policy, tracking submission deadlines, and preparing for follow-up reduces the risk of a denied claim.

- A denied claim means more than just paperwork — it often results in unexpected out-of-pocket expenses. Knowing how to respond effectively is key to protecting your insurance coverage.

Sources and Further Reading

- Government of Canada – Canadian Life and Health Insurance Association (CLHIA)

https://www.clhia.ca

A trusted resource outlining consumer rights, insurance terms, claims processes, and regulatory updates related to life and health insurance in Canada. - Office of the Superintendent of Financial Institutions (OSFI)

https://www.osfi-bsif.gc.ca

Offers regulations and supervisory frameworks for Canadian insurers, including solvency standards and consumer protection information. - Canadian Life Insurance Association: Consumer Information

https://clhia.uberflip.com

Detailed brochures and claim checklists for consumers dealing with claim denials, insurance products, and appeal procedures. - Insurance Bureau of Canada (IBC)

https://www.ibc.ca

Canada’s national industry association representing home, auto, and business insurers. It offers detailed consumer guides on submitting and disputing claims. - Financial Consumer Agency of Canada (FCAC)

https://www.canada.ca/en/financial-consumer-agency.html

Offers insights into insurance policies, how to file claims, understanding rejections, and consumer recourse channels. - Canadian Legal FAQs – Centre for Public Legal Education Alberta

https://www.law-faqs.org

Useful legal perspectives and explanations on insurance disputes, coverage exclusions, and denial reasons under Canadian law. - Insurance OmbudService (OIS)

https://www.insurance-ombudsman.ca

An independent service to help resolve complaints between customers and their home, auto, or life insurance providers in Canada. - Manulife – Insurance Claim Guidelines

https://www.manulife.ca/personal/support/claims.html

Example of how major Canadian insurers outline claims processes, timelines, and documentation requirements clearly. - Sun Life Financial – Understanding Claim Denials

https://www.sunlife.ca

Offers transparency on the most common claim rejection reasons and how policyholders can proactively avoid issues. - Canadian Health Insurance Association Reports (CHIA)

https://www.chia.ca

In-depth reports on insurance claim trends, denial statistics, and best practices for healthcare and travel insurance filing.

Feedback Questionnaire:

We value your insight! Help us improve by sharing your experience and struggles around insurance claim denials and rejections.

Thank you for your time! Your answers will help create more effective insurance support tools and resources to minimize denied or rejected claims.

IN THIS ARTICLE

- Why Insurance Claims Get Rejected Or Denied: Key Differences And What You Can Do?

- Claim Denial vs. Claim Rejection: Know the Difference Before It Hurts

- The Most Common Reasons Your Claim Is Denied

- The Human Side of Denial: A Family's Battle with a Denied Claim

- What To Do If Your Claim Is Denied

- The Appeal Process: How to Push Back the Right Way

- Filing Deadlines Matter — Don't Miss Them

- The Power of Accurate Documentation

- Preventing Future Claim Rejections: Proactive Measures That Work

- Claim Rejection and Emotional Burnout

- Additional Resources to Help You Take Action

- Key Takeaways

Sign-in to CanadianLIC

Verify OTP